NOKDKK - What to expect on 4hr - NORWEGIAN DANISH KRONE - FOREXWe can see that its clearly in a decisions making zone. Will it go up or will it go down? This is a NO TRADE ZONE FOR ME. I wait for it to signal by closing on one side of these lines to signal continuation or reversal BUT WE DONT BUY OR SELL THAT BREAK OUT. We wait for the pullback and get in or ladder in there. This makes your stop loss a no brainer and you didn't have to try and catch the knife. Instead you let if fall and you picked it up off the damn floor. NOT FINANCIAL ADVICE. TRADE SAFE.

Dkk

USD/DKK 1:4 Risk Reward Short? Long Term OutlookUSD

- Quant Scores shifted against USD by 10 points

- Building permits less than forecast showing a potential slowdown in approved housing

- Supported by a negative result in housing starts which can affect many other factors of growth such as jobs and money supply

- Consumer Confidence heavily lower than forecast suggesting the US consumers are less confident in the outlook, this can mean consumers keep their pockets tight and don't spend as much in the economy

- Manufacturing index suggesting a big slowdown in manufacturing after missing forecast by 2

DKKJPY: Sell opportunity on 1W.The pair is on a long term 1M Channel Down (RSI = 46.346, MACD = -0.067, Highs/Lows = -0.0252), which is trading on its inner resisting trend line. This 1W Resistance is waving a short flag (RSI = 47.484, MACD = -0.125, Highs/Lows = 0.0000) here and we are taking this long term short with TP = 16.420.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDDKK: Double buy opportunity on 1D/1W.The pair is on a strong long term Channel Up on 1W (RSI = 56.469, MACD = 0.047) trading on its Higher Low zone (Highs/Lows = 0.0000). Naturally, 1D is now neutral (RSI = 51.144, Highs/Lows = 0.0000), trading on its own Channel Up Higher Low, pricing a break upwards. The latter gives a buy signal with TP = 6.7000 (Higher High). The 1W Channel Up gives a buy signal if the H/H sequence on the lower resisting trend line (~6.72100) breaks upwards (TP = 6.87400).

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

GBPDKK: Long term correction ahead. Sell opportunity on 1W.GBPDKK has been trading on a long term 1W Channel Up (RSI = 64.794, MACD = 0.060, Highs/Lows = 0.1840, B/BP = 0.2987) that is close to making a Higher High. According to the monthly Higher High trend line since Sept 2017, the price should pull back towards the median of the Channel. We are therefore shorting with TP = 8.5500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURDKK: Rising Wedge targeting 7.46300.The pair is trading on a 1D Rising Wedge evident on the mix of neutral (RSI = 48.902, CCI = -27.6714, Highs/Lows = 0.0000) and bullish (STOCH = 57.149, Willams = -42.264, Ultimate Oscillator = 53.080) indicators. This indicates a bullish price action but on a narrow space. Long, TP = 7.46300.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

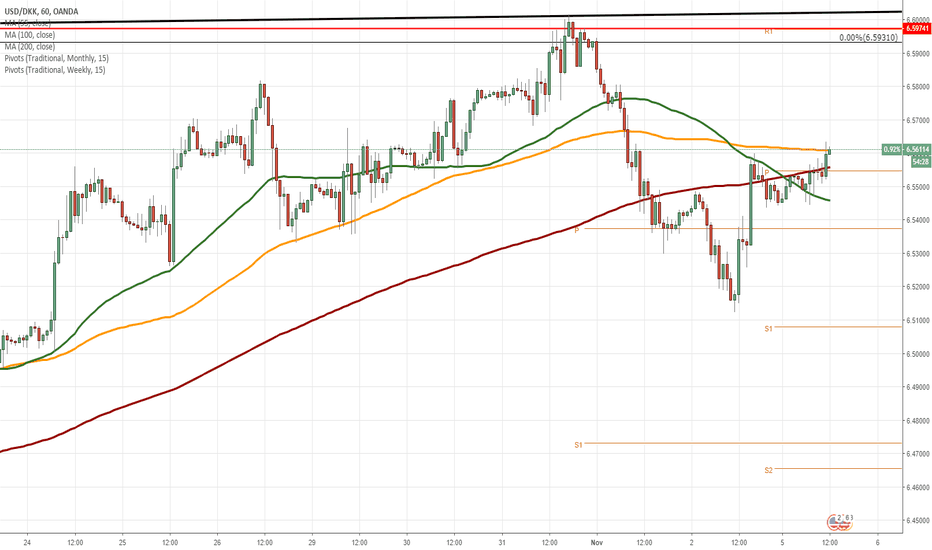

USD/DKK 1H Chart: Previous forecast at workThe previous forecast worked, and the USD/DKK currency pair has reached the upper boundary of a long-term ascending channel located circa 6.6000.

As apparent on the chart, the exchange rate reversed south from the upper channel line at the beginning of November. From a theoretical point of view, it is expected that the pair goes downwards. A potential target is the Fibonacci 23.60% retracement at 6.4443.

However, technical indicators for the long run suggest that bullish momentum should continue to prevail. In this case, it is likely that the pair re-tests the upper channel line in the nearest future. If given channel does not hold, a breakout north occurs within the following sessions.

USD/DKK 1H Chart: Bulls likely to prevailThe US Dollar has been appreciating against the Danish Krone after the currency pair reversed from the lower boundary of a long-term ascending channel at 6.3200.

Currently, the exchange rate is trading in a short-term ascending channel as well. It is expected that the pair will breach the junior trend and will aim for the upper boundary of the senior channel located circa 6.6000. An important level to look out for is the 2018 high at 6.5691.

It is the unlikely case that some bearish pressure still prevails in the market, the US Dollar should not exceed the 100– and 200-period SMAs (4H), currently located near 6.4140.

1W Rectangle. Sideways action.DKKJPY is trading sideways within a long term 1W Rectange (RSI = 48.280, ADX = 16.028, CCI = -1.8926, Highs/Lows = 0.0000) at 16.755 - 17.700. Our operating scalping zone is 17.000 - 17.480 but for those who seek more risk can engage as low as 16.845. If either the 16.755 Support or the 17.700 Resistance breaks, we will cease engaging.

USD/DKK 1H Chart: Bulls likely to prevailThe US Dollar is appreciating against the Danish Krone in a short term ascending channel. This gradual increase in price began when the rate reversed from the 6.3600 mark.

Currently, the rate is being supported by the 55– and 100-hour SMAs on the 1H time-frame. It is expected that the rate eventually gathers the necessary momentum to breach the junior channel.

However, it should be taken into account that the pair is pressured by the 200-hour SMA at 6.4126 and this advance might not be immediate.

An important level to look out for is the monthly R1 at 6.4312.

Channel Up on 1D. Long.EURDKK is trading within a 1D Channel Up (RSI = 63.378) and the neutral Highs/Lows = 0, MACD = 0.002, B/BP = 0.0036, indicate that pricing a Higher Low is near. The larger setting is also a 1W Channel Up (RSI = 62.486) so if the pair breaks 7.45720, the downside is still limited to a 7.4540 Higher Low. We are long with TP = 7.462 and 7.4640.

New bullish leg initiated. Long.USDDKK has preserved the long term Channel Up on 1W (RSI = 69.995, MACD = 0.069, Highs/Lows = 0.1019, B/BP = 0.3423) as it broke the previous consolidation on 1D to the upside. As you see on the chart there are recurring patterns on 1D (Channel Up after Rectangle) so the pair will now most likely print a Channel Up (RSI = 67.432, ADX = 34.541) on 1D towards the next Monthly Resistace = 6.69018. Our long's TP is 6.67021.

Lower Low rejection on 1W. Short to 1D Resistance.NZDDKK made a new Lower Low (4.2649) on the inner 1W Channel Down (RSI = 40.595, low pace still on MACD = -0.026, Highs/Lows = -0.0309, B/BP = -0.0786) and shoulde now give a minor bullish leg on 1D (already on neutral STOCH, STOCHRSI, Williams) to the previous 4.3524 High and Resistance. Our long's TP = 4.3500.