DNKN - SWING ANALYSISDNKN - Good buyers momentum is there now on the daily chart, it is expected to go up from the current levels but it's a buy only above 104.87, Don't buy here at current price buy above the mentioned range

Maintain stop loss around 98.60

Potential upside target 112-120

Hit the like button to get more such signals

DNKN

$DNKN 'Merica Runs on Dunkin$DNKN Dunkin Brands finally seeing some daylight above resistance around $72. Support retest appears successful.

Combine that with a Golden Cross on the Daily Chart and it's looking near term bullish in my opinion.

Also, with many schools starting back up, parents electing to drive kids vs bus, more people out in their cars, etc...I think demand should really start to pickup - to at or near pre-COVID levels.

Targeting an approximate 10% move to the $79-$80 area by early Sept.

Looking longer term, I can easily see this back at its 52 week high ~$85 by early Oct.

Sbux LongAccording to Bloomberg, The Fed Is Entrenched in the Repo Market.

"Since the rate on overnight repo spiked to 10% on Sept. 17 from around 2%, the central bank has been conducting overnight and term repo operations to help rebuild banking reserves, adding $237 billion of liquidity. It’s also prepared to inject up to $490 billion around Dec. 31."

Since, the market is held up by the fed, I looked around for some safe stocks to go long on and Sbux seems like a good safe bet.

if we get a pullback to $88 today, i would get an entry and see if we could potentially reclaim ATH at $99.72 in the next two weeks.

especially since majority of the white girl index is hitting All Time Highs, Why can't Starbucks?

Stoploss around $86

Take profit $91

max target 99

Strong Buy - TA and FundamentalsDNKN has been dedicated to improving quality of their food and beverage options and I believe it will show in revenue in the next year or two as improvements continue. DNKN is an extremely strong buy here imo and I don't see it falling below it's channel. Instead, I see it bouncing right off the bottom of its channel here up to new highs. I could see DNKN nearing 200 by 221. Long-term calls in play here.

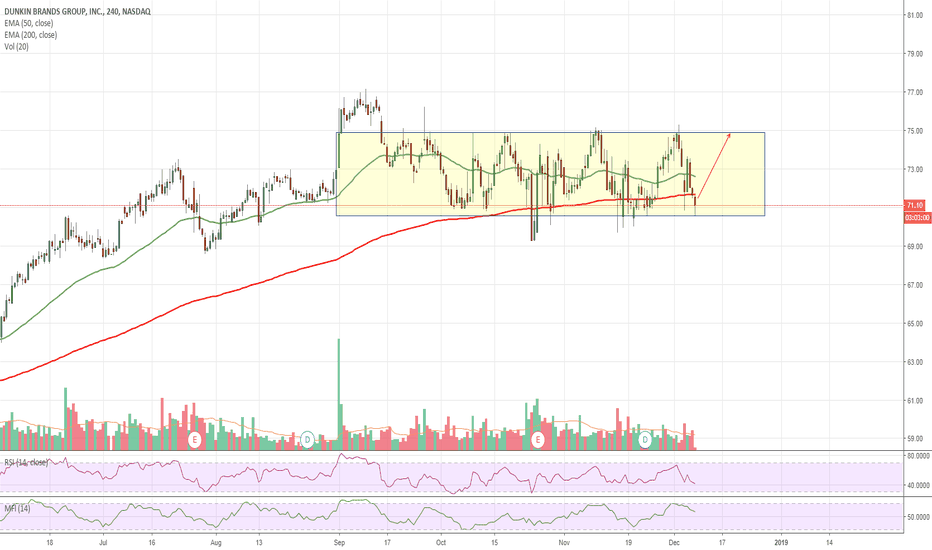

$DNKN Bullish Hammer - Short Term Trade$DNKN Bullish hammer forming today at the bottom of the recent trading range. Playing for a move back to ~$75 level in the near term.

Near term target - $75.00 by Christmas

Note: Informational analysis, not investment advice.

$DNKN Long-term Bullish Channel$DNKN appears to be holding the lower trendline of a bullish channel it's been in since earlier this year. Assuming this rebound continues, targeting 5-10% return by next ER late October.

Note: Informational analysis, not investment advice.

Some money for pink donutsnot much to say, trend up, rebounding from base, and set to get to that past selling ressitance of 68.36, good volume my get on way to break out, still this candle W candle not to be wasted.

(D) Strong. With the market taking a breather, may findresistance here near R1 Pivot. Has also held support in EMA50 & EMA200 cloud. If looking for an entry, be patient.

Obey your rules.

$DNKN continue upward marchFolk love their coffee and doughnuts. This has been a buy from the beginning. Price continue to rise.

Dunkin Donuts Higher..Constantly appalled by the customer service, I wanted to short the stock... Unfortunately it's a buy at market and anywhere in pink.

$DNKN Bearish Cypher$DNKN clear bearish cypher on today's chart. Slightly stretched, but recommend shorting and picking up again later this week.

DNKN- Short from 45.87 to 35.37DNKN broken down most recently formed upward channel. It also had a rising wedge formation which also broken down.

It also has longer term channel formation & downtrend support where it can come down. So we are looking for a longer term target of 35.37

On the option side we would $45 March puts

You can check our detailed analysis on DNKN in the trading room/ Executive summary link here-

www.youtube.com

Time Span: 10:40"

Trade Status: Pending

DNKN Dunkin Brands accumulation prior to April earningsI am scaling in a small position in $DNKN Dunkin Brands. I initiated the position the morning of 2015.03.10. My strategy: "#3 Supply Headwind" from early December 2014 flipped to "#3 Demand Tailwind" in early January at the same time "2 Demand" kicked in. In retrospect, hat was the time to buy! However, the next best thing happened. DNKN made its first pull back in a probable uptrend after pushing above the support / resistance level of 44.50 - 44.75. The "Tailwind" is still in play and the "#2 Supply" from 2015.02.06 has flipped back to "#2 Demand" on 2015.02.25 followed by lower level demand signals on 2015.03.05 & 10. Note... my Cyclical Support and Resistance Levels" code needs a lot of data. It cannot calculate any s/r level above L5 in DNKN so far. This is because the issue date is to new. L5 s/r needs almost 3 years of data to make the call. My program has six levels of support and resistance higher. Fundamentally, the earnings bar was lowered this coming quarter. I believe the Street will want to position this up near the highs to take advantage of a short squeeze on a whisper beat. The pro desks have been accumulating under $44 in anticipation of a move higher. This is also a domestic tilt and does not come with the currency issues facing mult-nationals in the space.

DNKN, I hope history does repeat itself.It might have mini run-up to 47 - 48, if it got rejected, short it.