Doge

DOGE close to parabolic moveCrypto never sleepin’.

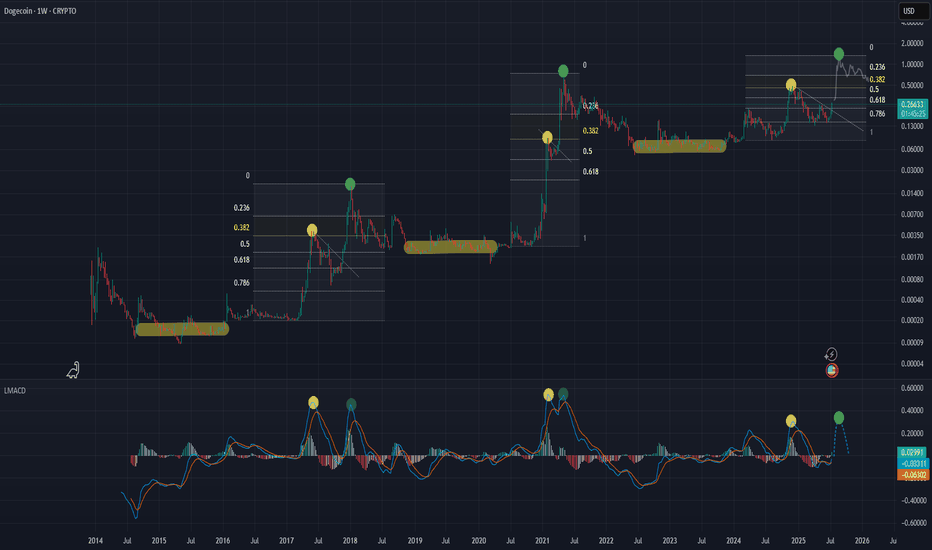

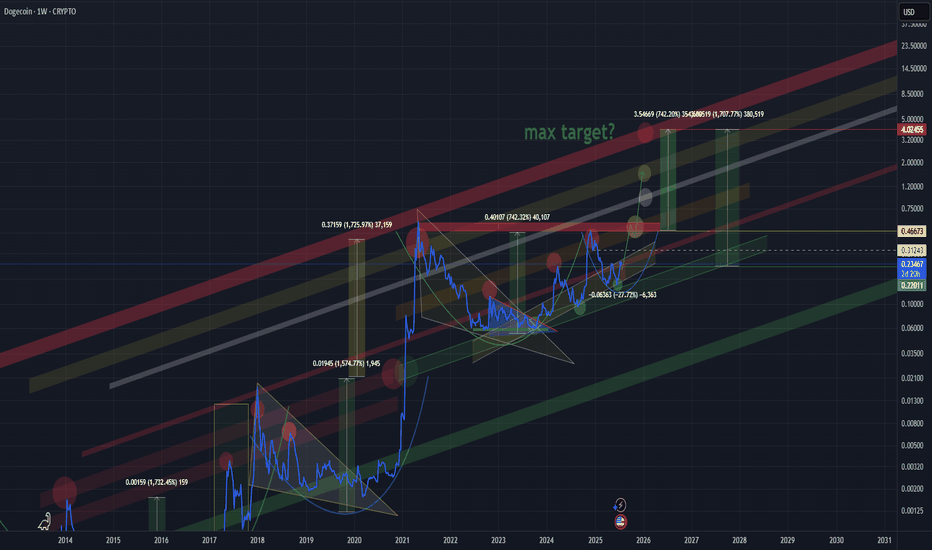

I drew this arc a long time ago for fun just in comparison to the last DOGE cycles back in 2023. It has been surreal to see it somewhat follow the curve just coming down to tag it in recent weeks. The entire history of this asset just looks like a cup n’ handle leading into another cup n’ handle to now another cup that might break out soon

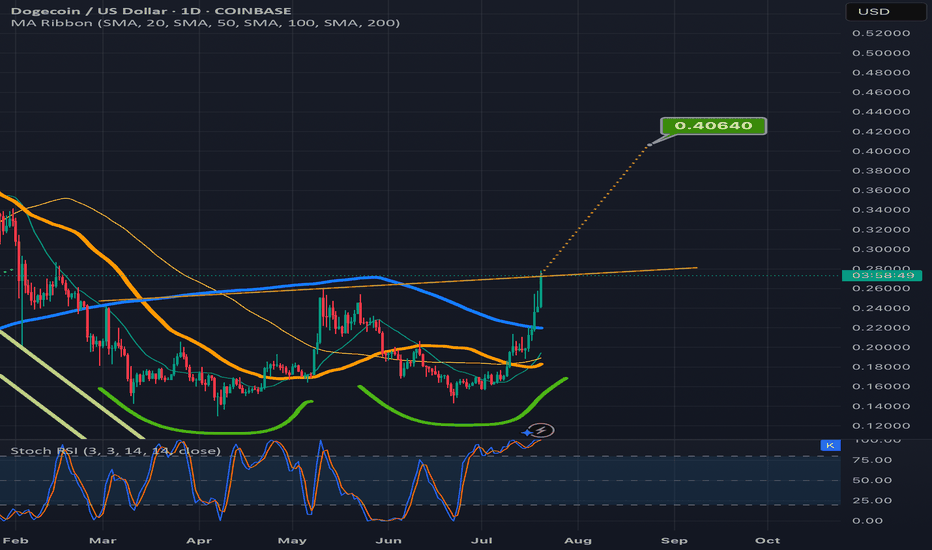

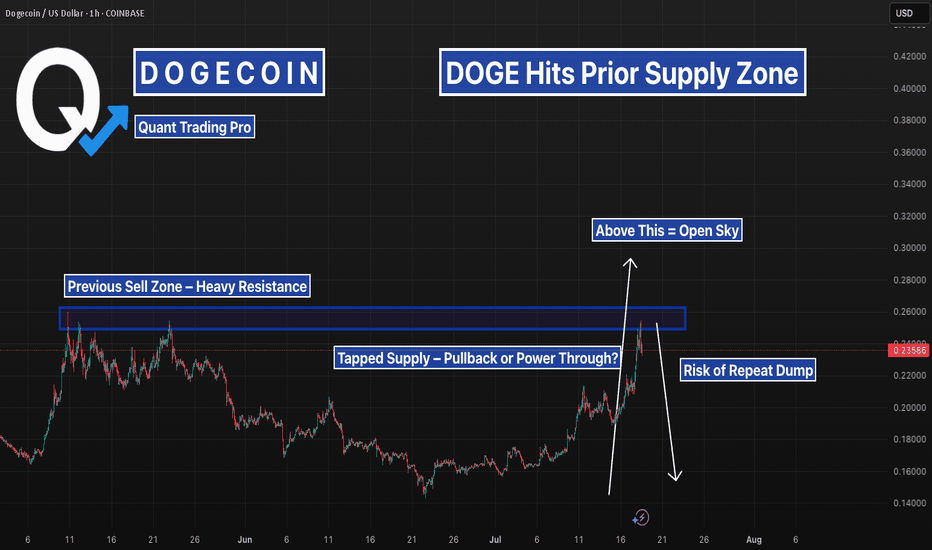

DOGE Coiling Below Resistance — Liquidity Tracker Already TriggeDOGE broke structure last week and pushed into a key resistance zone — but now price is going flat, consolidating just below breakout territory. This type of pause can either lead to continuation or a trap, and that’s exactly what we’re watching for.

The MACD Liquidity Tracker Strategy already triggered long earlier in the move, right around the $0.226 reclaim — a clean entry confirmed by bullish histogram shift, crossover, and trend alignment.

Since then, price has respected the EMA and gradually built up pressure just under the $0.257–0.270 zone.

The strength of this strategy is in combining MACD compression/expansion with trend filters, so it avoids whipsaw entries and only triggers when momentum AND structure align. This helps traders catch the beginning of a move — not the middle or end.

Right now, momentum is compressing again on lower timeframes, which often leads to a volatility expansion. The strategy is quiet for now, but the earlier long is still holding and valid.

We’re watching closely for a clean breakout above resistance — or signs of weakness that invalidate the move.

Whether this consolidates further or explodes from here, the setup has already shown how effective good filtering and timing can be.

$SHIB Ready to Move?CRYPTOCAP:SHIB has printed confirmed weekly bullish divergence in RSI and is now attempting to overcome the weekly 200EMA resistance.

A High Volume Node lies just above but a close above this will signal a bullish trend ready to move the initial target of the weekly pivot point followed by the 0.0003579 High Volume Node.

Price completed its retracement to the 'alt-coin' golden pocket 0.786 Fibonacci retracement.

Bearish divergence is currently growing on the weekly RSI but will be diverted with a thrust high!

Is it MEME season? CRYPTOCAP:DOGE also looks ready to go!

Safe trading

$DOGE Flipping to Bullish Structure!CRYPTOCAP:DOGE is coming to life after a second test of the weekly 200EMA as support and about to make a higher high, cementing in that higher low and flipping the macro structure bullish!

If the count is correct wave 3 of (III) should be powerful! The weekly pivot should put up a challenge as the first resistance before the High Volume Node at $0.45

Safe Trading

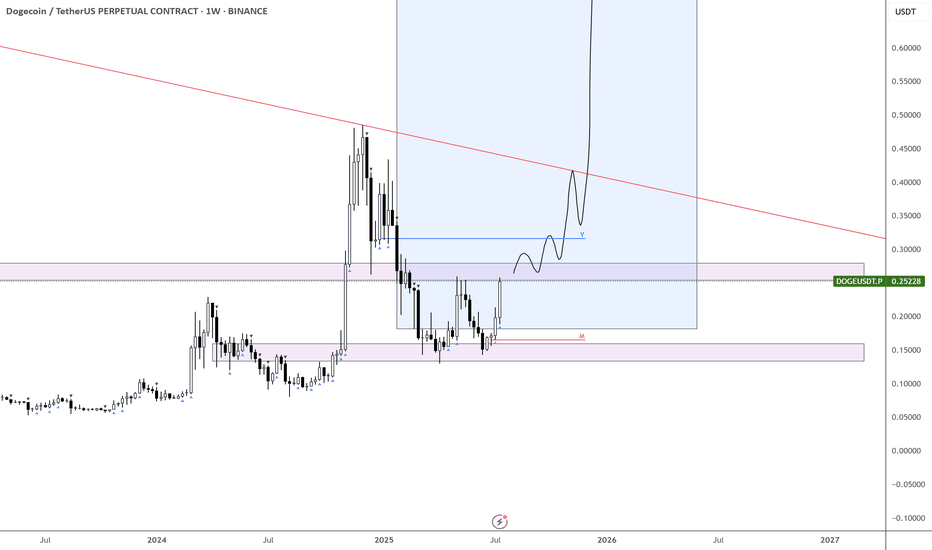

$1 in the Horizon for $DOGE!We’ve got something interesting brewing on CRYPTOCAP:DOGE right now:

Monthly trend is active

Uptrend in place for over a year (not relying on that timeline, but historically, targets hit within it)

If we can get above $0.30 and hold, the path to $1 opens up for the first time.

Other similar charts are also aligning for exponential moves, setting up to break out of multi-year consolidation patterns.

Keep a close eye on CRYPTOCAP:XLM as well — it’s shaping up with a very similar structure.

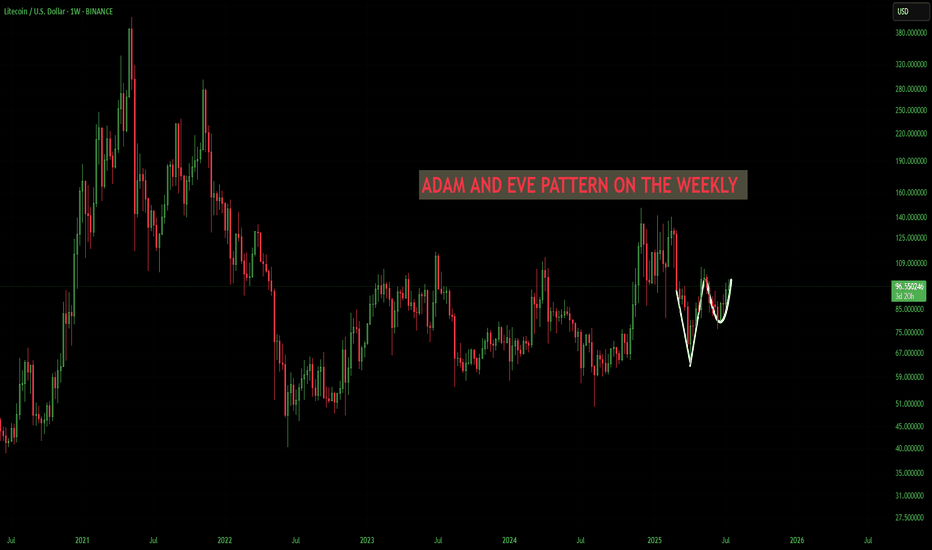

LTC/USD LITECOIN Adam & Eve Pattern On WeeklyThe Adam and Eve pattern is quite effective and usually signals a trend change to bullish. Once this pattern breaks the neckline I think its straight to $200 before any sort of pullback.

Haven't done a chart in a while cause its been the same old stuff, sideways. We are starting to ignite now. Silver is running which means something is breaking in the background financial system. I see the biggest blow off top you've ever seen coming, its the only way out of this, print print print until it doesn't work anymore.

Also I was reading that Bitcoin is removing its cap for spam in each block in October? This could spell disaster for fees and congestion. Litecoin will skyrocket during that time I believe because the fees will be so high it will price out the little guy trying to send a grand or two. I see an influx of people coming to Litecoin. Good luck , none of this is financial advice just my opinion

Bitcoin Interesting Fractal And Timing! GOING STRAIGHT UP!I noticed that the timing and pattern of how this is playing out in 2025 in Bitcoin is very similar to that of 2017. This fractal is not identical but its damn close. In 2017 there were approximately 15 million people in crypto, very few leverage exchanges, and trading was no where near what it is today. Now we have exchanges everywhere, hundreds of them most with leverage which we didn't really have before. Also not to mention that now we have big players getting in and they aren't buying and selling on the daily, they are buying it all and holding it, hence why we aren't seeing the typical "Alt season". The sloshing effect we had in the early days when traders would rotate out of Bitcoin into alts is not happening as it used to.

In 2017 Trump took office and in the end of March the bull run started in full swing. Something very similar is also happening now that we are in March and these fractals are lining up. Let see how this plays out. I think we are on the cusp of a giant mega bull run like you've seen before.

Crypto traders last year made mega profits cashing out multiple billions in capital gains. Once the selling stops around the end of March and beginning of April from people selling to pay taxes I think its on. This is not financial advice this is just my opinion. Lets see how this chart ages. Thank you for reading.

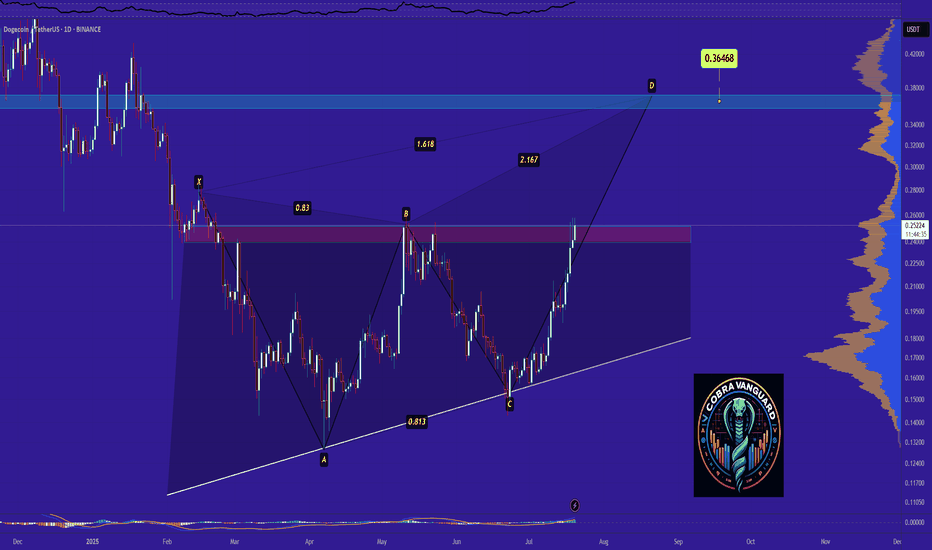

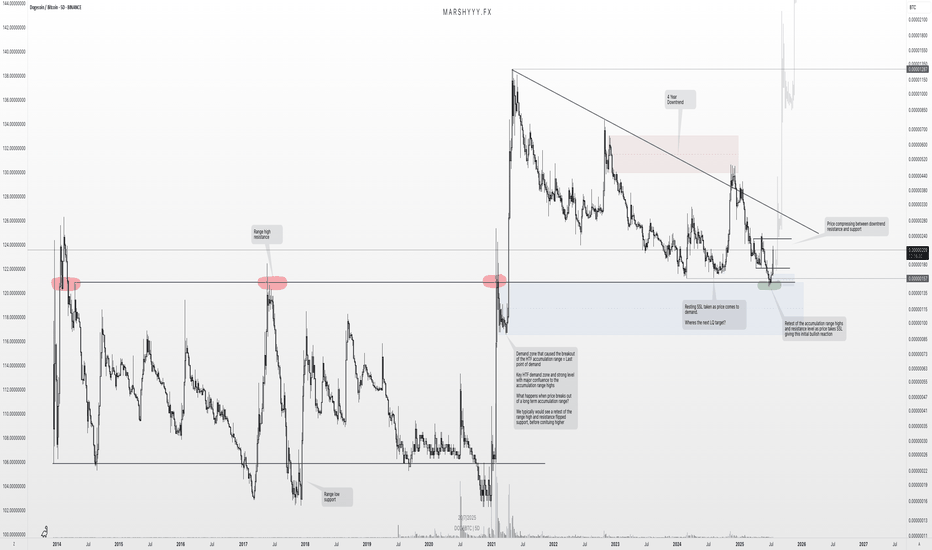

DOGE/BTC: HTF Retest Complete — Reversal BrewingDiving into DOGE/BTC, we’re seeing strong bullish confluences that align well with the DOGE/USDT structure and support the idea that the macro low is in.

Looking back across all available data, DOGE/BTC has traded within a clear 7-year accumulation range dating back to 2014, bounded by a defined range high resistance and range low support. This long period of consolidation enabled massive accumulation, ultimately leading to the first breakout in 2021, which rejected at the highs, pulled back, and then exploded into a cycle ATH.

Since that 2021 high, DOGE/BTC has been in a 4-year downtrend, retracing back into discount pricing, right into the range high of that original accumulation zone — which now acts as a major HTF demand level and last point of support before the original breakout.

📉 What’s happened recently?

- Price swept 2024 swing lows (SSL)

- Tagged the HTF demand zone

- Retested the 2021 breakout level (accumulation range high)

- Coiling inside a descending wedge with contracting volatility

This entire region is a key reversal zone from both a structural and psychological standpoint. It’s where we typically see major trend shifts form, and the structure suggests we’re forming a HTF swing low and bottom from this area.

🧠 Add this to the confluence from DOGE/USDT — which also appears to have printed its bottom — and the case for a macro reversal gets even stronger.

As this wedge tightens and price continues to compress against long-term support, I’m anticipating an explosive breakout that kickstarts the next leg of the HTF uptrend — effectively a continuation of the original breakout from the 7-year range.

5D:

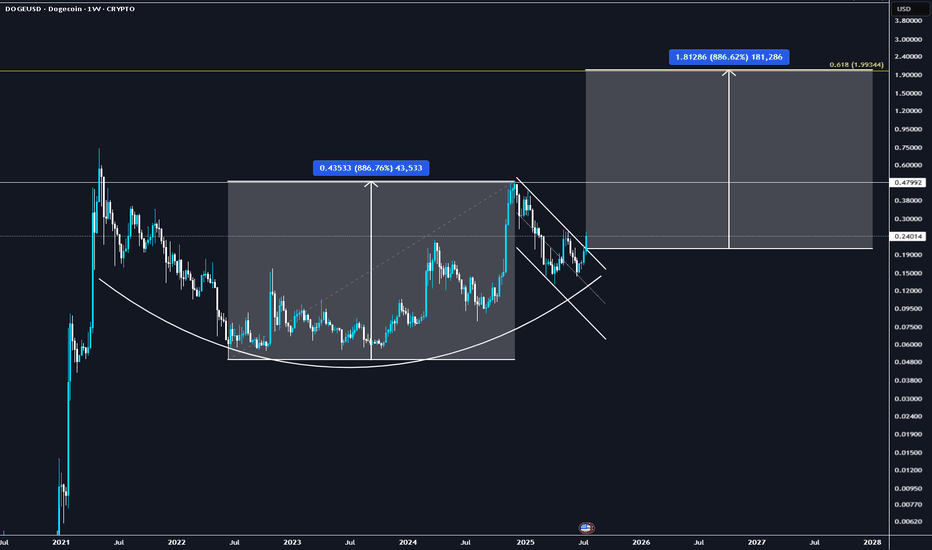

DOGE to $2 before EOYCUP & Handle type formation on DOGE, really believe this can run to $2 during alt season which has just started firing its engines ...

BTC.D finally looks toppy.

📈 1. Technical breakout & chart patterns

DOGE has recently broken out of a long-term descending channel, forming a classic double-bottom pattern—a strong reversal signal.

It also cleared the key $0.20–$0.21 resistance zone, with on‑chain data pointing to rising futures/open interest and reduced sell pressure

⚖️ 2. Macro & regulatory tailwinds

The passage of the Genius Act in the U.S. House brought “clear‑cut regulation” for crypto, boosting confidence and driving DOGE higher—rising ~8% on the news

Broader crypto bull sentiment—fueled by possible Fed rate cuts and favorable legislation—has pushed altcoins like DOGE ahead this week

🧠 3. On‑chain & investor activity

Charts show increasing futures & spot trading volumes, along with expanding whale activity and holders staying profitable—collectively suggesting strong demand and low sell pressure

Network usage is also up: wallet interactions and momentum have accelerated as DOGE crosses these technical thresholds

💬 4. Community & utility factors

Dogecoin maintains a vibrant community, boating meme-driven social capital, plus occasional celebrity mentions (e.g., Elon Musk), keeping public attention

Its growing real-world usage in tipping, payments (e.g., Shopify, AMC, Tesla merch), and even institutional products—like the Grayscale Dogecoin Trust—adds fundamental backing

DOGE - Another Perspective- DOGE is currently trading nearing the trendline resistance and pending breakout

- A clear breakout from this resistance line is a must to continue to bullish momentum.

- we will enter the trade after confirmed breakout

Entry: 0.221

SL at: 0.14103

TP1: 0.26035

TP2: 0.33892

TP3: 0.47751

Stay tuned for more updates.

Cheers

GreenCrypto

Will DOGE Hit $1? Ascending Broadening Wedge in PlayDogecoin is trading within a clear ascending broadening wedge on the weekly chart. The price has bounced strongly from wedge support and the 100 and 200 EMAs, now pushing upward with growing volume and bullish candles. If momentum sustains, DOGE could rally toward the $1 psychological target and broadening wedge resistance.

Resistance 1: $0.35

Resistance 2: $0.60

Resistance 3: $1.00

Stop Loss: $0.14

Cheers

Hexa

COINBASE:DOGEUSD BINANCE:DOGEUSDT

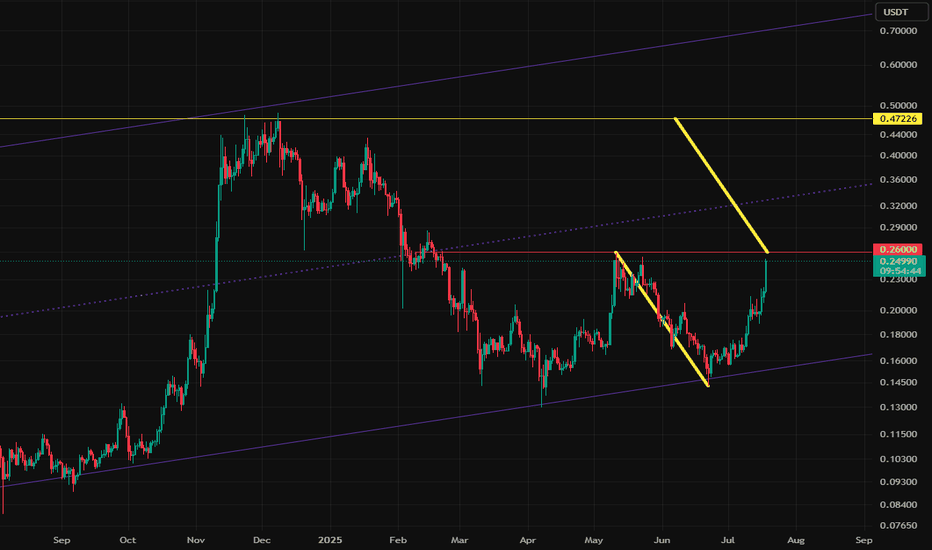

$DOGE Double Bottom TargetIf this double bottom "W" pattern on CRYPTOCAP:DOGE plays out, the target is $0.47.

Two notes:

1. The double-bottom pattern has a 60-65% success rate (no guarantees).

2. The Alt market has been very strong, with new dollars entering the market. If we close above $0.25-0.26 and retest, I think this target is likely as it returns to the high for this cycle.

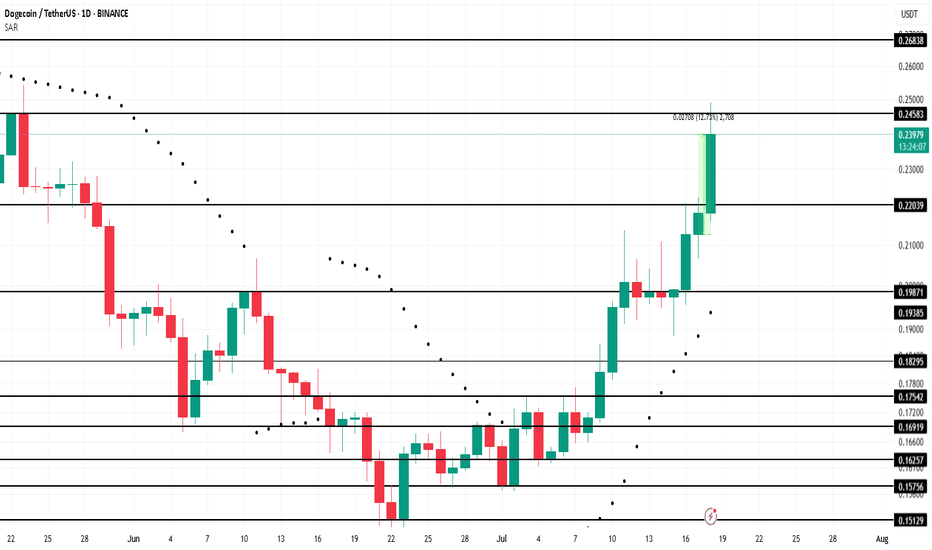

Dogecoin Leads Meme Coins With 12% Rally In 24 HoursBINANCE:DOGEUSDT , the leader of meme coins, surged 12% over the last 24 hours , reaching $0.239. This rally has positively impacted other meme tokens, showcasing DOGE’s influence within the market.

Currently facing resistance at $0.245, BINANCE:DOGEUSDT has reached a 2-month high . The Parabolic SAR below the candlesticks signals that DOGE is likely to maintain its upward trend in the coming days. If this support holds, the meme coin could continue pushing towards higher price levels, attracting more buyers and momentum.

However, meme coins are volatile. If BINANCE:DOGEUSDT holders decide to cash out their profits, the price could drop back down to $0.220 . Losing this support would invalidate the bullish outlook, signaling a possible downturn for the altcoin in the short term.

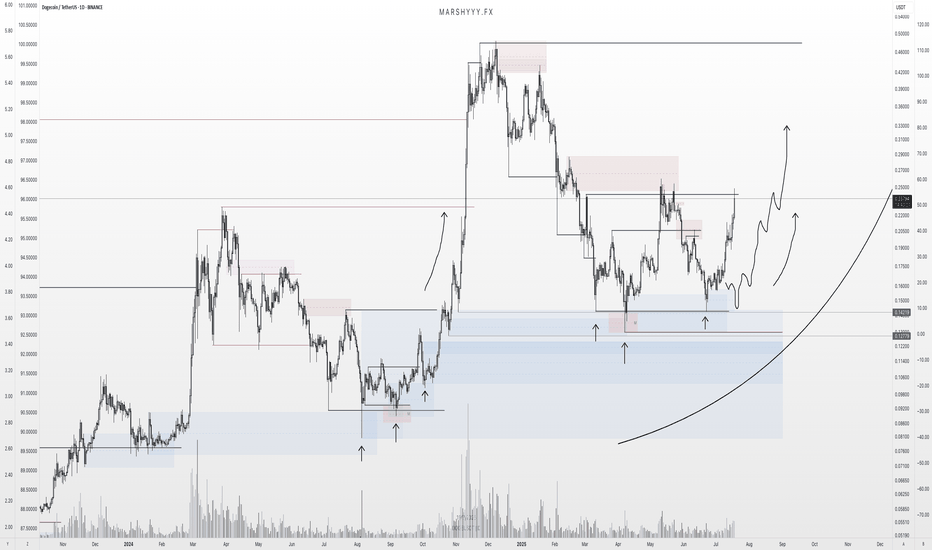

DOGE Update: Reversal Playing Out — $1+ in Sight?DOGE is playing out almost exactly as forecast back on June 14th, where I was monitoring for price to sweep the SSL and tap into range low demand within this larger HTF range.

Price did exactly that — pushing into discount, tagging the marked demand zone, and bottoming out right where I expected the reversal. I DCA’d hard at $0.165 after the initial low printed — just as planned.

Now sitting around +50% on those buys, and my plan remains to ride this out toward the ATH at $0.74 and potentially $1+.

The HTF closes forming here — across 3D, 4D, 5D, 6D candles — are showing clear strength. For me, the low is likely in, and I’m expecting new higher highs and ATHs from here. Now it’s just about letting the market do its thing, trailing stops, and taking profits into strength as alerts and targets get hit.

Zooming way out — I’m also watching DOGE’s 10-year uptrend channel. Price has once again tagged the lower bound of that channel, and historically, this has led to moves back to the channel highs.

🧠 Layer on a fib projection from the previous ATH to the bear market low, and we get:

1.272 Fib → ~$1.54

1.618 Fib → ~$3.92

Both of which align perfectly with the upper bounds of that long-term trend channel — giving us a key HTF reversal zone to monitor in the future.

In summary:

- Reversal from demand ✅

- DCA filled ✅

- HLs printing ✅

- Targets = ATH and beyond

- Watching HTF fibs + channel highs for eventual cycle top formation

DOGE is doing what DOGE does — don’t overcomplicate it.

1D:

3D:

1W:

1M:

DOGE DOGECOIN DOGEUSDT long/midium term☕ Cup and Handle Forming Again – Targeting $4!

Just like before — we are seeing a massive “Cup and Handle” pattern forming.

Last time, the exact same structure played out, and the price perfectly reached the previous high upon completion of the pattern.

📌 Current Setup

The cup is already formed, and now we are clearly drawing the handle

If history repeats — and it often does in crypto — the price should break out and target above the previous high

🎯 Projected Target:

Based on the structure, the full Cup & Handle breakout points toward a move up to $4.

⚠️ Things to watch

Fakeouts are possible, so use proper risk management

💬 "Patterns don’t repeat exactly — but they often rhyme."

Let the chart guide your plan, not emotions.