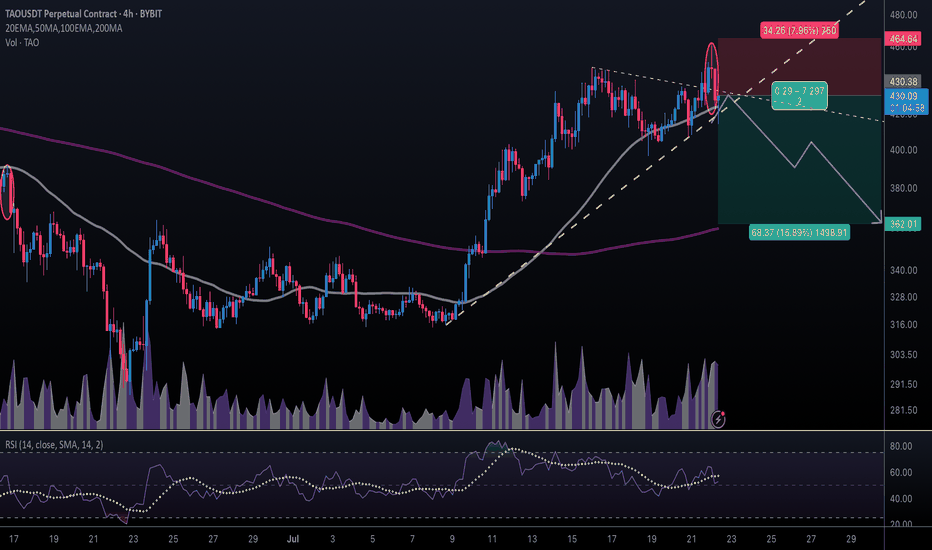

#TAOUSDT #4h (ByBit) Ascending trendline near breakdownBittensor printed an evening doji star deviation, a retracement down to 200 MA support seems next.

⚡️⚡️ #TAO/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.0%

Entry Targets:

1) 430.38

Take-Profit Targets:

1) 362.01

Stop Targets:

1) 464.64

Published By: @Zblaba

GETTEX:TAO BYBIT:TAOUSDT.P #4h #Bittensor #AI #DePIN bittensor.com

Risk/Reward= 1:2.0

Expected Profit= +79.4%

Possible Loss= -39.8%

Estimated Gaintime= 1 week

Doji

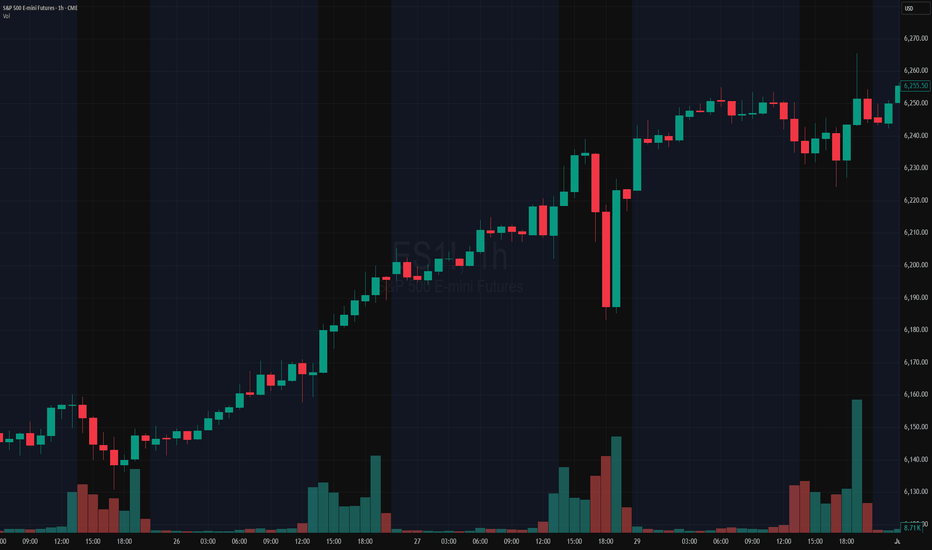

How to Trade Doji Candles on TradingViewLearn to identify and trade doji candlestick patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Doji candles are among the most significant candlestick formations because they signal market indecision and can help you spot potential trend reversal opportunities.

What You'll Learn:

• Understanding doji candlestick patterns and their significance in market analysis

• How to identify valid doji formations

• The psychology behind doji candles: when buyers and sellers fight to a draw

• Using volume analysis to confirm doji pattern validity

• Finding meaningful doji patterns at trend highs and lows for reversal setups

• Timeframe considerations for doji analysis on any chart period

• Step-by-step trading strategy for doji reversal setups

• How to set stop losses and profit targets

• Real example using E-Mini S&P 500 futures on 60-minute charts

This tutorial may help futures traders and technical analysts who want to use candlestick patterns to identify potential trend reversals. The strategies covered could assist you in creating straightforward reversal setups when market indecision appears at key price levels.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

GBPUSD ANALYSISThe weekly candle rejected weekly resistance and closed as a doji for consecutive weeks, which could mean price could be transitioning to a bearish market. Overall price is still bullish, but it did form an H4 LH so I'd look for price to retrace to the H4 support. If price breaks & retest minor M15 support around 1.32970, I'd start looking for sells with my TP being 1.32100.

Daily and weekly poised for a bull run, BULL FLAG $SKLZPersonally see 6.89-7.33 in the coming weeks potentially 9$-10$ by summer with momentum and positive ER. SKLZ is a sleeping giant

Many analyst say its a buy and the chart is bullish for a 6month swing trade easy or a great long term position. Final time we see south of 5$ !?

We shall see, in time

$GLD - bullish momentum soon to stallHello, I was bullish on AMEX:GLD for a bit and now examining the charts, multiple frames, this may be setting up for a good short. If geopolitics and tariff talks deescalate then this should cool off. The Elliot wave placed indicates some time for a correction/pull back on this hot commodity and the candle on the Daily from Friday is a spinning stop doji which can indicate reversal in an uptrend. Also, we have so many gaps up that happened in 3 day span, crazy actually. I labeled areas of targets to fill these gaps. Expecting a retracement to $280.

WSL.

Mastering Candlestick Patterns for better trades!Candlestick patterns are a powerful tool for identifying market sentiment and potential reversals. Let's break down some key single and double candlestick formations seen in this chart:

🕯️Single Candlestick Patterns:

- Doji – Represents indecision in the market, signaling a potential reversal.

- Inverted Hammer – A bullish reversal pattern after a downtrend, indicating buyers are stepping in.

- Long-Legged Doji – Suggests market uncertainty; watch for confirmation before taking a position.

- Bearish Closing Marubozu – A strong bearish signal showing sellers' dominance, with no upper wick.

- Bullish Opening Marubozu – A strong bullish candle with no lower wick, signaling a potential uptrend.

🕯️Double Candlestick Patterns:

- Bullish Engulfing – A strong bullish reversal pattern where the green candle fully engulfs the previous red candle, signaling buying pressure.

- Bullish Harami – A potential trend reversal where a small green candle is "inside" the previous large red candle, indicating a slowdown in selling.

- Cross Doji – Suggests hesitation between buyers and sellers, often appearing before a reversal.

How to Use Them in Trading?

✔️ Combine candlestick patterns with indicators like RSI, MACD, or Moving Averages for stronger confirmations.

✔️ Look for patterns near key support and resistance levels to increase reliability.

✔️ Always wait for confirmation before entering a trade!

Mastering Candlestick Patterns: Visual Guide for Traders

🔵 Introduction

Candlestick charts are among the most popular tools used by traders to analyze price movements. Each candlestick represents price action over a specific time period and provides valuable insights into market sentiment. By recognizing and understanding candlestick patterns, traders can anticipate potential price reversals or continuations, improving their trading decisions. This article explains the most common candlestick patterns with visual examples and practical Pine Script code for detection.

🔵 Anatomy of a Candlestick

Before diving into patterns, it's essential to understand the components of a candlestick:

Body: The area between the open and close prices.

Upper Wick (Shadow): The line above the body showing the highest price.

Lower Wick (Shadow): The line below the body showing the lowest price.

Color: Indicates whether the price closed higher (bullish) or lower (bearish) than it opened.

An illustrative image showing the anatomy of a candlestick.

🔵 Types of Candlestick Patterns

1. Reversal Patterns

Hammer and Hanging Man: These single-candle patterns signal potential reversals. A Hammer appears at the bottom of a downtrend, while a Hanging Man appears at the top of an uptrend.

Engulfing Patterns:

- Bullish Engulfing: A small bearish candle followed by a larger bullish candle engulfing the previous one.

- Bearish Engulfing: A small bullish candle followed by a larger bearish candle engulfing it.

Morning Star and Evening Star: These are three-candle reversal patterns that signal a shift in market direction.

Morning Star: Occurs at the bottom of a downtrend, indicating a potential bullish reversal. It consists of:

- A long bearish (red) candlestick showing strong selling pressure.

- A small-bodied candlestick (bullish or bearish) indicating indecision or a pause in selling. This candle often gaps down from the previous close.

- A long bullish (green) candlestick that closes well into the body of the first candle, confirming the reversal.

Evening Star: Appears at the top of an uptrend, signaling a potential bearish reversal. It consists of:

- A long bullish (green) candlestick showing strong buying pressure.

- A small-bodied candlestick (bullish or bearish) indicating indecision, often gapping up from the previous candle.

- A long bearish (red) candlestick that closes well into the body of the first candle, confirming the reversal.

2. Continuation Patterns

Doji Patterns: Candles with very small bodies, indicating market indecision. Variations include Long-Legged Doji, Dragonfly Doji, and Gravestone Doji.

Rising and Falling Three Methods: These are five-candle continuation patterns indicating the resumption of the prevailing trend after a brief consolidation.

Rising Three Methods: Occurs during an uptrend, signaling a continuation of bullish momentum. It consists of:

- A long bullish (green) candlestick showing strong buying pressure.

- Three (or more) small-bodied bearish (red) candlesticks that stay within the range of the first bullish candle, indicating a temporary pullback without breaking the overall uptrend.

- A final long bullish (green) candlestick that closes above the high of the first candle, confirming the continuation of the uptrend.

Falling Three Methods: Appears during a downtrend, indicating a continuation of bearish momentum. It consists of:

- A long bearish (red) candlestick showing strong selling pressure.

- Three (or more) small-bodied bullish (green) candlesticks contained within the range of the first bearish candle, reflecting a weak upward retracement.

- A final long bearish (red) candlestick that closes below the low of the first candle, confirming the continuation of the downtrend.

🔵 Coding Candlestick Pattern Detection in Pine Script

Detecting patterns programmatically can improve trading strategies. Below are Pine Script examples for detecting common patterns.

Hammer Detection Code

//@version=6

indicator("Hammer Pattern Detector", overlay=true)

body = abs(close - open)

upper_wick = high - math.max(close, open)

lower_wick = math.min(close, open) - low

is_hammer = lower_wick > 2 * body and upper_wick < body

plotshape(is_hammer, title="Hammer", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

Bullish Engulfing Detection Code

//@version=6

indicator("Bullish Engulfing Detector", overlay=true)

bullish_engulfing = close < open and close > open and close > open and open < close

plotshape(bullish_engulfing, title="Bullish Engulfing", style=shape.arrowup, location=location.belowbar, color=color.blue, size=size.small)

🔵 Practical Applications

Trend Reversal Identification: Use reversal patterns to anticipate changes in market direction.

Confirmation Signals: Combine candlestick patterns with indicators like RSI or Moving Averages for stronger signals.

Risk Management: Employ patterns to set stop-loss and take-profit levels.

🔵 Conclusion

Candlestick patterns are powerful tools that provide insights into market sentiment and potential price movements. By combining visual recognition with automated detection using Pine Script, traders can enhance their decision-making process. Practice spotting these patterns in real-time charts and backtest their effectiveness to build confidence in your trading strategy.

AES Corporation - Short term view with strong supportSo first of all both price and indicators are confirming the downtrend.

Today NYSE:AES opened with a gap succeeding yesterday's equilibrium in price with doji candles.

The price is still in the middle of the regression line and in the next few days the price don't seems to be close to upper 2 SD.

In the print above the yellow line shows the support at $11.43. The image's time horizon starts at the end of 2006.

Furthermore looking at short ratio available online the value is about 2,7 from mid October as well as more than 22M short interest

Short term trading : Be carreful of this candlestick config !!!You can acknowledge with me the absolutely astonishing XRP perf but when it's too nice to be true, a pull back does occur at some point. Please consider this not as a financial advice but educational content

Take care _

Do sport _

Take profit _

Top 3 Must-Know Candlestick Patterns for BeginnersGet your cup of coffee or tea ready we are doing a crash course on Candlesticks today

I’m walking you through three candlestick patterns every beginner trader should know—Doji, Engulfing Candles, and Hammers (including the Inverted Hammer). These patterns are super helpful when you’re trying to spot market reversals or continuations. I’ll show you how to easily recognize them and use them in your own trades. Let’s keep it simple and effective.

Key Takeaways:

Doji: Indicates indecision, potential reversals.

Engulfing Candles: Bullish or bearish reversal signals.

Hammer & Inverted Hammer: Bullish reversal after a downtrend.

Trade what you see and let’s get started!

Mindbloome Trader

SPY LOVERS ! NEW ALL TIME HIGHS But be very careful ! Check hereFINALLY HERE ! NEW ALL TIME HIGHS !

But wait!!! do you really Trust those 2 last Dojis ?

Here are 2 quick scenarios to analyze for the week:

Scenario #1 (Green Line): The price may pull back to bounce off the order block zone I have marked in white, which we know as the institutional block where there was a lot of liquidity.

I call this pattern in my trading system "N3" as it consists of 1 breakout + 1 pullback + 1 trend decision.

Scenario #2 (Red Line): Always considering our active order block zone, the price may break through the block with strong momentum, confirming another pullback or bearish market for several days. In this case, AGAIN, the price could fall back to our buyer pressure zone (blue zone), where higher buying pressure volume has been shown. NOTE: All of this depends on the bearish strength the market carries; we can tell if the market will break downward by simply observing bearish volumetric candles or seeing a lot of active bearish volume.

But for now, we can't do anything as long as the price remains within our bullish channel, which we'll keep monitoring throughout the week!

The decision will become very clear once the price makes the choice to break out of my bullish channel.

Best regards, and a million thanks for supporting my analysis!

The Art of Candlestick Trading: How to Spot Market Turns EarlyBuckle up, TradingViewers! It's time to unravel the ancient secrets of candlestick patterns. Originating from an 18th-century Japanese rice trader, these patterns aren't simply red and green elements on your trading charts—they are the Rosetta Stone of market sentiment, offering insights into the highs and lows and the middle ground of buyers and sellers’ dealmaking.

If you’re ready to crack the code of the market from a technical standpoint and go inside the minds of bulls and bears, let’s light this candle!

Understanding the Basics: The Candlestick Construction

First things first, let’s get the basics hammered out. A candlestick (or Candle in your TradingView Supercharts panel) displays four key pieces of information: the open, close, high, and low prices for a particular trading period. It might be 1 minute, 4 hours, a day or a week — candlesticks are available on every time frame. Here’s the breakdown:

The Body : This is the chunky part of the candle. If the close is above the open, the body is usually colored in white or green, representing a bullish session. If the close is below the open, the color is usually black or red, indicating a bearish session.

The Wicks (or Shadows) : These are the thin lines poking out of the body, showing the high and low prices during the session. They tell tales of price extremes and rejections.

Understanding the interplay between the body and the wicks will give you insight into market dynamics. It’s like watching a mini-drama play out over the trading day.

Key Candlestick Patterns and What They Mean

Now onto the fun part — candlestick formations and patterns may help you spot market turns (or continuations) early in the cycle.

The Doji : This little guy is like the market’s way of throwing up its hands and declaring a truce between buyers and sellers. The open and close are virtually the same, painting a cross or plus sign shape. It signals indecision, which could mean a reversal or a continuation, depending on the context. See a Doji after a long uptrend? Might be time to brace for a downturn.

The Hammer and the Hanging Man : These candles have small bodies, little to no upper wick, and long lower wicks. A Hammer usually forms during a downtrend, suggesting a potential reversal to the upside. The Hanging Man, its evil twin, appears during an uptrend and warns of a potential drop.

Bullish and Bearish Engulfing: These are the bullies of candlestick patterns. A Bullish Engulfing pattern happens when a small bearish candle is followed by a large bullish candle that completely engulfs the prior candle's body — suggesting a strong turn to the bulls. Bearish Engulfing is the opposite, with a small bullish candle followed by a big bearish one, hinting that bears might be taking control of the wheel.

The Morning Star and the Evening Star : These are three-candle patterns signaling major shifts. The Morning Star — a bullish reversal pattern — consists of a bearish candle, a small-bodied middle candle, and a long bullish candle. Think the dawn of new bullish momentum. The Evening Star, the bearish counterpart, indicates the onset of bearish momentum, as if the sun is setting on bullish prices.

The Shooting Star and the Inverted Hammer : Last but not least, these candles indicate rejection of higher prices (Shooting Star) or lower prices (Inverted Hammer). Both feature small bodies, long upper wicks, and little to no lower wick. They flag price exhaustion and potential reversals.

Trading Candlestick Patterns: Tips for Profitable Entries

Context is King : Always interpret candlestick patterns within the larger market context. A Bullish Engulfing pattern at a key support level is more likely to pan out than one in no-man’s-land.

Volume Validates : A candlestick pattern with high trading volume gives a stronger signal. It’s like the market shouting, “Hey, I really mean this move!”

Confirm with Other Indicators : Don’t rely solely on candlesticks, though. Use them in conjunction with other technical tools like RSI, MACD, or moving averages to confirm signals.

Wrapping It Up

Candlestick patterns give you a sense for the market’s pulse and offer insights into its moment-to-moment sentiment — is it overreacting or staying too tight-lipped. Mastering candlesticks can elevate your trading by helping you spot trend reversals and continuations. These patterns aren’t foolproof — they are powerful tools in your trading toolkit but require additional work, knowledge and context to give them a higher probability of confirmation.

It’s time to light up those charts and let the candlesticks illuminate your trading path to some good profits!

Bitcoin at Crucial Resistance Level with Doji Candle FormationDaily Chart Overview: $Bitcoin is currently facing strong resistance around the $65,000 level, as indicated by the formation of a Doji candle on the daily chart. This pattern often signals market indecision and suggests that the recent bullish momentum may be weakening.

Technical Indicators:

Relative Strength Index (RSI): 57.25 – While buying pressure has moderated, it remains at a healthy level.

Supply Dynamics: With 19.75 million BTC in circulation out of the 21 million maximum supply, Bitcoin is testing a crucial price point.

Market Outlook: How Bitcoin reacts to this $65,000 level will be pivotal in determining its short-term direction:

Bullish Scenario: A breakout above this resistance could signal further gains.

Bearish Scenario: A rejection could lead to a potential pullback.

Trading Strategy: Traders should monitor this level closely for a decisive move, which will provide clarity on the next phase of Bitcoin's price action.

#Bitcoin #BTC #Crypto #MarketAnalysis #TechnicalAnalysis #Cryptocurrency #Resistance #DojiCandle #RSI #SupplyDynamics #PriceAction

SWING IDEA - ROSSARI BIOTECHConsider a compelling swing trade opportunity in Rossari Biotech , a leading specialty chemicals manufacturer in India, renowned for its innovative and sustainable solutions across various industries.

Reasons are listed below :

Price at Support Zone : Rossari Biotech is trading at its support zone, where it was initially listed, indicating potential buying interest and stability at these levels.

Doji Candle Formation : A doji candlestick pattern has formed, confirming the bullish momentum indicated by the preceding marubozu candle. This suggests that the price is holding onto higher levels and may continue to move upward.

0.618 Fibonacci Support : Finding support at the 0.618 Fibonacci level strengthens the bullish case, providing a solid foundation for potential upward movement.

Initiation of Double Bottom Pattern : The beginning of the formation of a double bottom pattern suggests a potential trend reversal and bullish continuation, indicating a shift in market sentiment.

Increase in Volumes : An increase in trading volumes reflects growing market interest and potential accumulation by investors, adding confirmation to the bullish thesis for Rossari Biotech.

Target - 809 // 890

StopLoss - weekly close below 655

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

LONG! Bitcoins hit current support - BTC ready for up trendBTC has confirmed support on the daily, We have alot of market indecision and have had sideways price movement testing our bull market support.

As investors pre [are to liquidate and take up short positions BTC has failed to experience any confirmation, volume.

Without volume to confirm the price direction when the price has fallen below support the Price has recovered on all charts up to daily with backtest

We have the appearance of a Morning star Doji candle on the daily with the body above the star (rising) that should Boost Confidence and get us back above !68k

Watch for the daily close to close above open

I am getting in position with a long currently, and will maintain tight stops but am confident to trade at this level

NIFTY DAILY - 2/4/2024Nifty open flat and made days high 22497 level buy didn’t sustain that level.

Index has formed another Doji candle on the daily chart at the top of the market which indicates thug of war between buyers and sellers as today’s closing was near the opening levels.

So, further levels for nifty will be 22336 will work as support level and 22520 will work as resistance level.

Today’s Advance Decline ratio of NIFTY50

Advance - 28

Decline - 22

FII Sell – 1622.69 crore

DII Buy + 1952.72 crore.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy New Financial Year 🚀

Happy learning with trading. Cheers!🥂

NIFTY DAILY - 20/3/2024Nifty open higher but bulls didn’t survive into the market and traded range bound for entire session.

Nifty has formed Doji candle on a daily chart which indicates thug of war between buyers and sellers.

Double moving averages is giving cross down, we may see weakness into the market.

If the Nifty index is at a low point and if the market opens positively the next day and maintains stability at current levels, there's a chance that the downward trend could shift, and prices could start rising again.

Reason behind this is that when a Doji formation is happening at a Bottom level we may see trend reversal from there.

So, further levels for nifty will be 21667 will work as support level and 21906 will work as resistance level.

Today’s Advance Decline ratio of NIFTY50

Advance - 27

Decline - 23

FII Sell – 2599.19 crore

DII Buy + 2667.52 crore.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

NIFTY DAILY - 5/3/2024Nifty open with negative note and rangebound throughout the day.

Nifty has formed another Doji candle on daily chart, which indicate indecisiveness among bulls and bears.

Index find immediate support at 22303 level and resistance will be 22520 level.

This suggests caution and the need for careful decision-making in the current market environment.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

NIFTY DAILY - 4/3/2024Index open with positive note and made all time high that is 22440.

Index has formed Doji candle on the daily chart at the top of the market which indicates thug of war between buyers and sellers as the closing was near the opening levels.

We may see trend reversal in near future.

Next levels for nifty will be 22520 upsides and 22303 level downsides.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

Monthly on btcusd.January ended with a Doji candle, a symbol of uncertainty and often when seen on the tops a prelude to reversals. But for a reversal of the trend, confirmation will be needed and we know that the underlying trend is bullish, so in this context we can use the doji candle to understand whether it will make a retracement or not, using the highs and lows of the candle. For the February or March candles, a closing below the minimum should be seen as a retracement signal because to reverse the underlying trend, in addition to confirmation, time is also needed and on this we have seen that the trend has been bullish for more than a year . A close above the doji's high, however, would be a very strong bullish signal, consolidating a trend that for now seems to catch its breath in the short term and that's all.