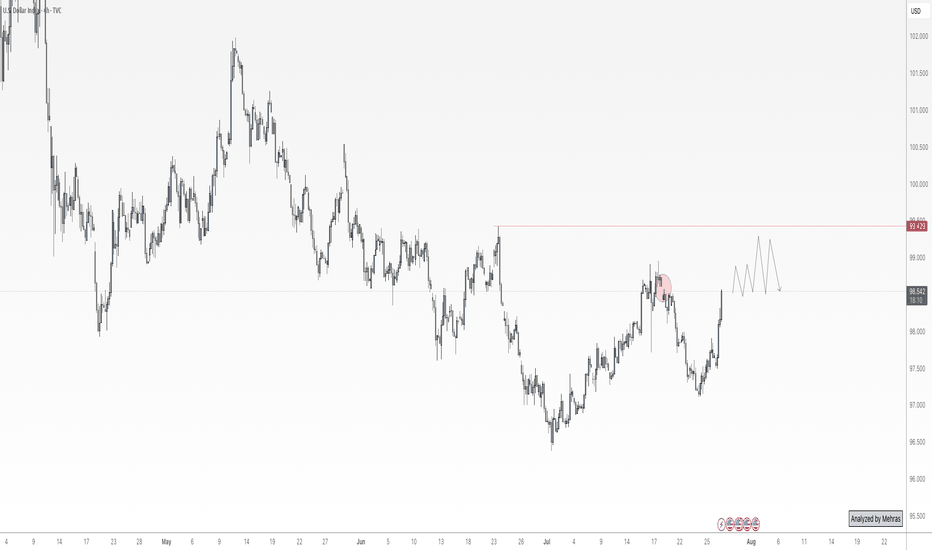

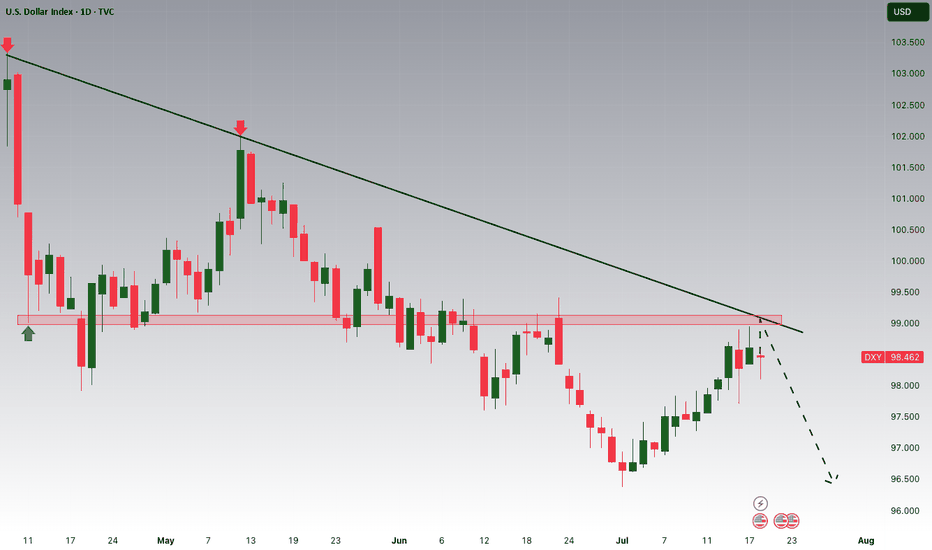

DXY at Its Most Critical Level of 2025 — Will the 100 Bank LevelThe Dollar Index (DXY), just like several other majors, is approaching a very important level. We’re now near the 100 mark, which is not only a psychological level — but also a key institutional (bank) level.

There’s also a gap zone left behind that price is about to fill. I believe the index will stay in a range over the next 1–2 days as it waits for critical data later this week — especially Wednesday’s announcements and Friday’s NFP report, which could set the tone for what’s next.

Based on current market sentiment, Trump’s remarks, Powell’s upcoming speech, and broader macro factors, I believe DXY has the potential to break above 100 and move toward 102–104, if that level is broken cleanly.

Let’s also not forget — price bounced from a monthly demand block near 96, and we’re seeing weak support across majors like EUR and Gold. That adds confluence for potential dollar strength.

📌 What do you think — is dollar strength just around the corner?

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

Dollar

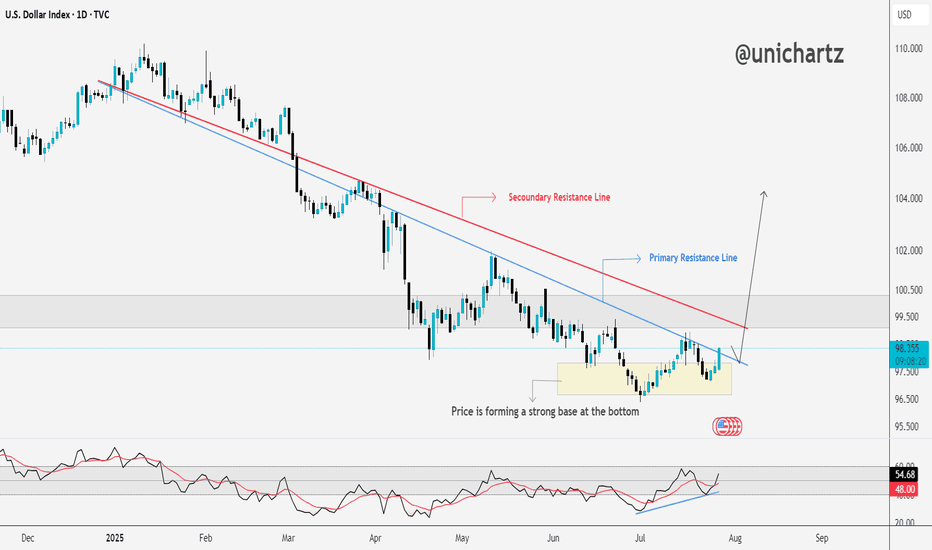

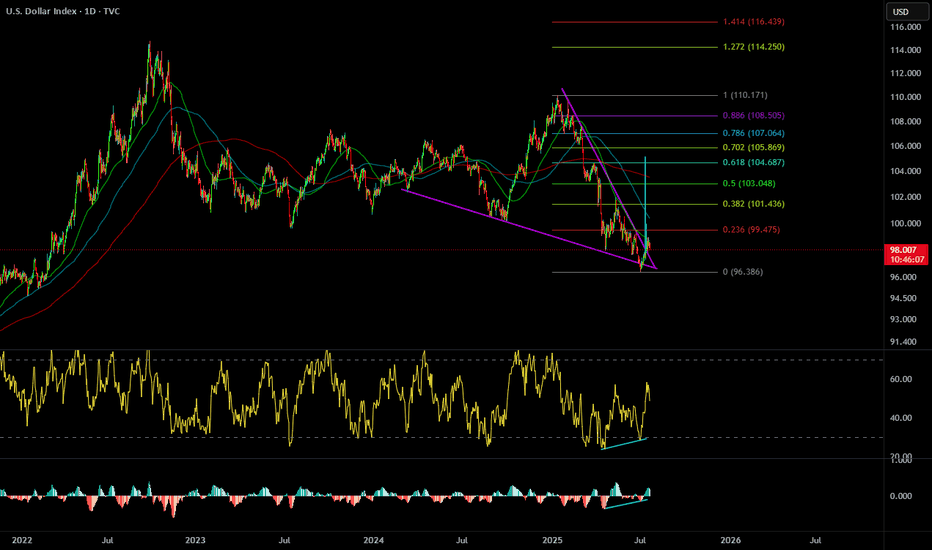

DXY Approaching Key Resistance — Trend Reversal Ahead?The DXY is forming a strong base at the bottom, showing clear signs of accumulation after a long downtrend.

Price has started pushing upward and is now approaching the secondary resistance line. A breakout here could open the path toward the primary resistance zone, which has capped rallies in the past.

The RSI is also trending higher, supporting this potential move.

If bulls clear the red resistance line, momentum could accelerate quickly.

DYOR, NFA

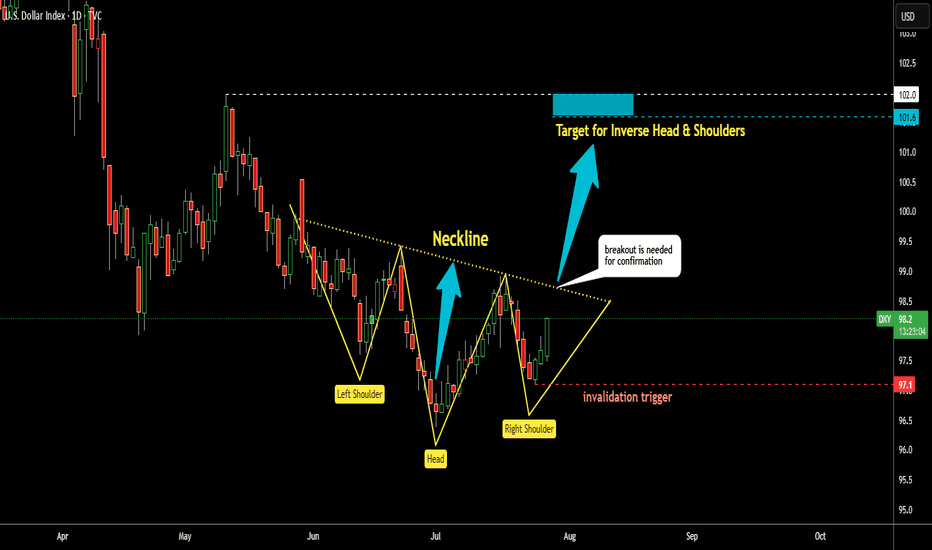

Dollar Index (DXY): Possible Reversal | Inverse Head & ShouldersThe dollar has had a tough year, but that might be changing.

I’ve spotted a well-known reversal pattern: an Inverse Head & Shoulders.

This pattern features three dips, with the middle one—the "head"—being the deepest.

Now, the price has rebounded from the Right Shoulder and is heading higher.

It’s approaching the Neckline at $98.7, which needs to be broken for a bullish confirmation.

If that happens, the projected target is around $101.6, based on the depth of the pattern.

This lines up closely with the previous high of $102 from May. The target area is highlighted in the blue box.

However, if the price falls below the Right Shoulder’s low at $97.1, the pattern would be invalidated.

Anyone else see this pattern?

Could this be the bottom for the dollar?

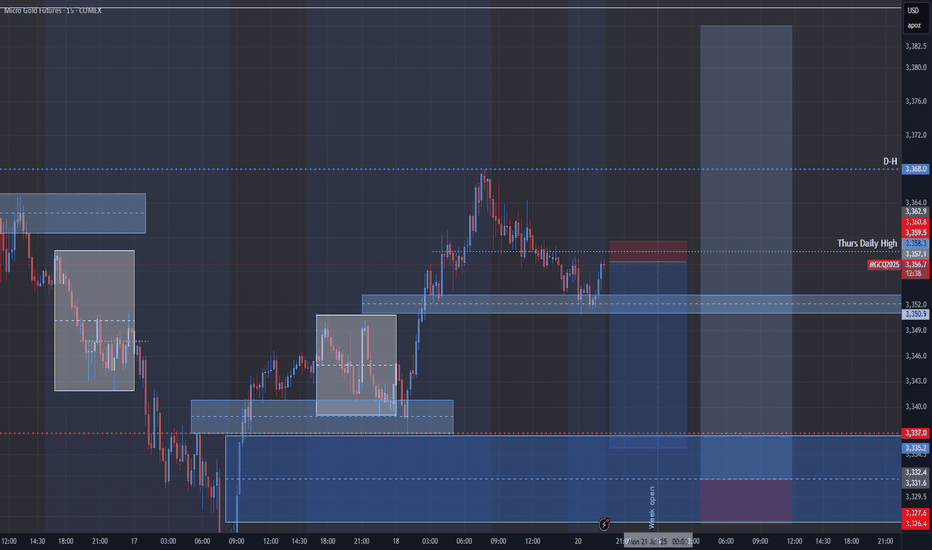

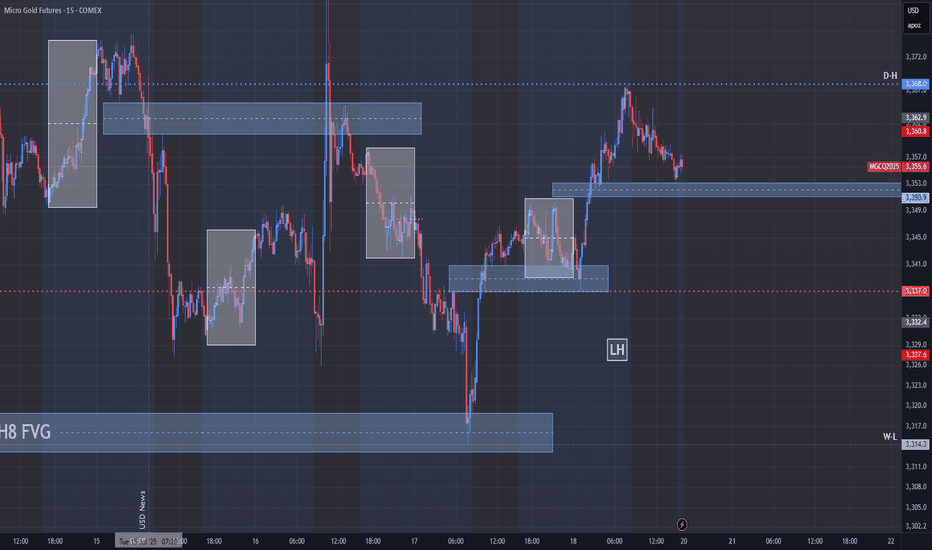

New Week...New Bullishness on Gold???Sorry my post have not been showing up. I have mistakenly been posting them as private! lol. But new week on gold looking to see some good bullish action this week but it also is the end of the month and price could stall till we get some news to move it. I need more confirmation before taking any moves so we are watching for now.

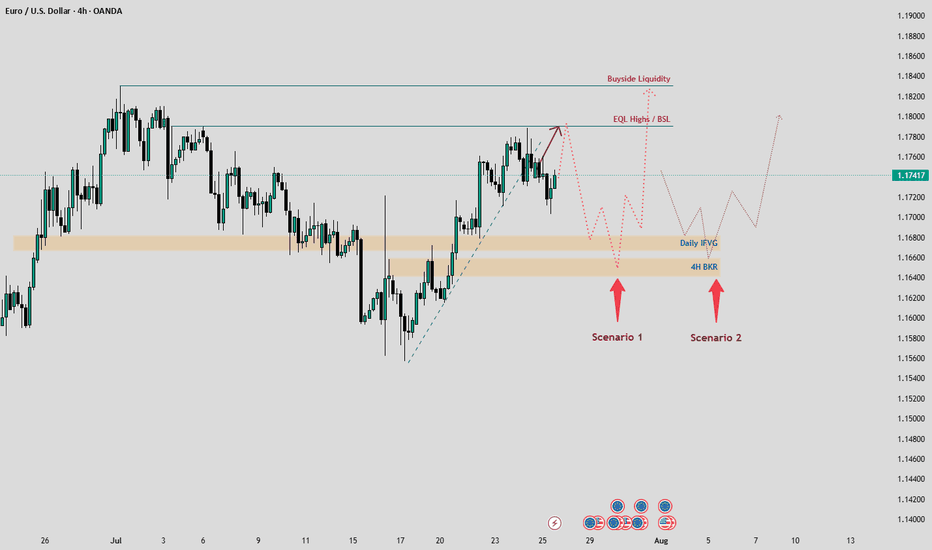

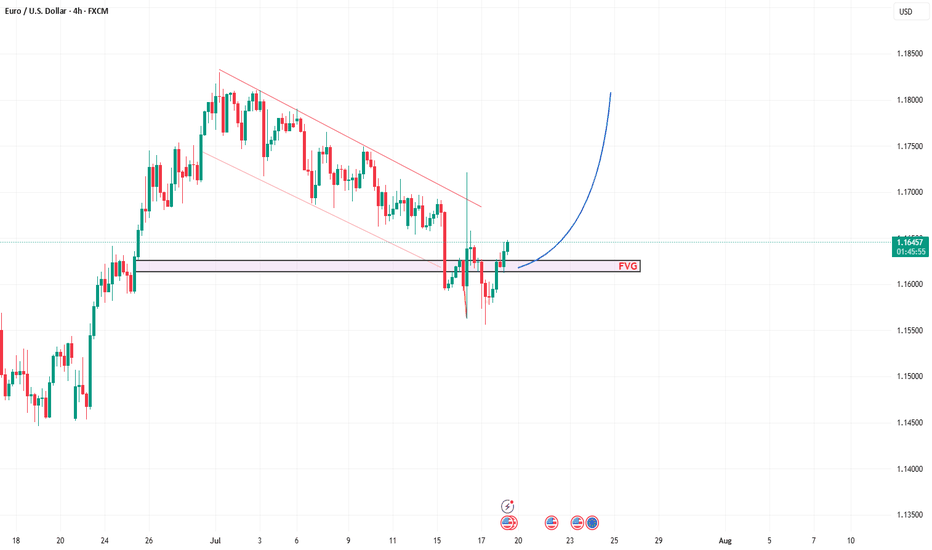

EURUSD Weekly Analysis: Key Levels and Scenarios to WatchHello, TradingView Community! 👋

Following our last EURUSD analysis, where we accurately predicted a bullish pullback from a key area within a descending channel, the price reacted as expected, delivering a solid move upward. Now, let’s dive into this week’s outlook, focusing on critical levels and two potential scenarios, keeping in mind the major economic events on the horizon. 📊

Current Market Context

EURUSD has recently reacted from a weekly Fair Value Gap (FVG) and is currently navigating the mid-range, with its sights set on Buyside Liquidity at the top. However, reaching this liquidity pool won’t be straightforward, as the price is likely to collect liquidity from lower Premium/Discount Arrays (PD Arrays) before making a significant move.

We’ve identified key levels to watch:

Daily Imbalance FVG (IFVG): A critical support zone where price could find buying interest.

4H Breaker Block: A high-probability reversal zone on the 4-hour chart.

Relative Equal Highs / Previous Week High (PWH) : Acting as a magnet for price action, especially early in the week.

With major economic events like the FED meeting and Non-Farm Payrolls (NFP) looming, volatility is expected. Let’s break down the two potential scenarios for EURUSD this week.

Scenario 1: Price Targets Equal Highs / PWH First 📈

In this scenario, we expect EURUSD to be drawn toward the relative equal highs or previous week’s high (PWH) early in the week, potentially on Monday, forming the high of the week. These levels act as a magnet for price due to trapped liquidity and stop orders.

What to Watch:

Price Action at Equal Highs / PWH: Look for rejection signals (e.g., bearish candlestick patterns, divergence, or liquidity sweeps) indicating a potential reversal.

Confirmation for Shorts: If the price reaches these highs and shows a strong bearish reaction, this could signal a drop toward the Daily IFVG or 4H Breaker Block.

Trading Plan:

Entry: Consider short positions if price rejects at equal highs or PWH with clear bearish confirmation.

Target: Aim for the Daily IFVG or 4H Breaker Block as initial downside targets.

Stop Loss: Place above the equal highs/PWH to protect against a breakout.

This scenario is more likely given the magnetic nature of equal highs and the upcoming economic catalysts driving volatility.

Scenario 2: Price Drops to Daily IFVG / 4H Breaker First 📉

Alternatively, EURUSD could move lower first, targeting the Daily IFVG and potentially the 4H Breaker Block. If the price fails to break above the equal highs and instead drops toward these lower PD Arrays, we could see the low of the week form by Monday or Tuesday.

What to Watch:

Price Action at PD Arrays: Monitor for bullish reversal signals (e.g., absorption, bullish engulfing, or liquidity grabs) at the Daily IFVG or 4H Breaker Block.

Confirmation for Longs: A strong bullish reaction at these levels could signal a move toward the Buyside Liquidity at the top.

Trading Plan:

Entry: Look for long positions if price reaches the Daily IFVG or 4H Breaker Block and shows bullish confirmation.

Target: Target the Buyside Liquidity or intermediate resistance levels.

Stop Loss: Place below the IFVG or Breaker Block to manage risk.

Risk Management: Stay Disciplined! ⚠️

With major economic events like the FED meeting and NFP this week, volatility could spike. Always prioritize risk management:

Position Sizing: Risk no more than 1-2% of your account per trade.

Stop Losses: Always use a stop loss to protect your capital.

Trade Confirmation: Wait for clear price action signals before entering trades.

Avoid Overtrading: Stick to high-probability setups and avoid chasing the market.

Call to Action (CTA) 📢

What do you think about these scenarios? Are you leaning toward Scenario 1 or Scenario 2? Drop your thoughts in the comments below, give this post a LIKE if you found it helpful, and FOLLOW for more weekly analyses! Let’s discuss and trade smarter together! 💬

Stay sharp, manage your risk, and let’s conquer the markets! 🚀

#EURUSD #Forex #TechnicalAnalysis #TradingView

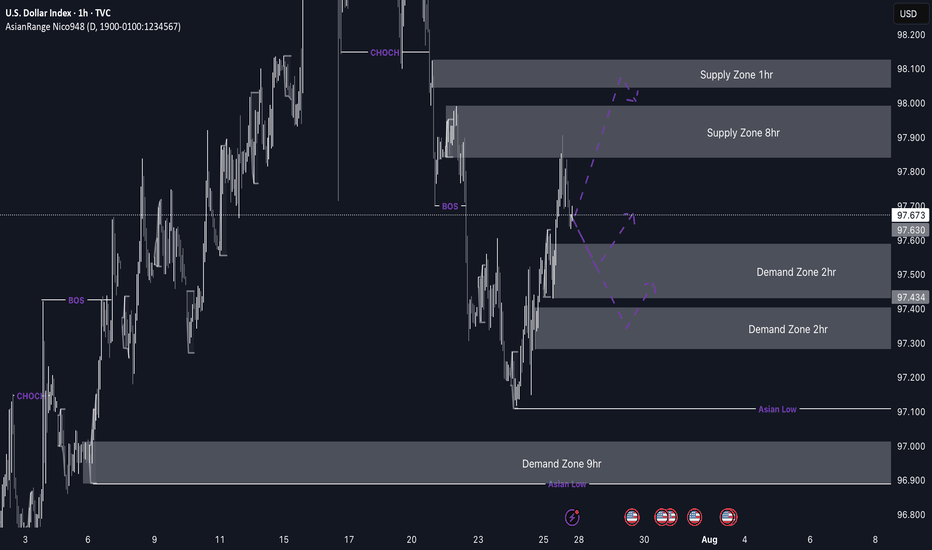

DXY weekly outlookDXY Weekly Outlook

This week, I’m watching to see if the dollar continues its bearish trend or breaks above the current supply zone. We've already seen a strong reaction from the 8hr supply, but price could still tap into the 1hr supply before making its next move.

If price drops from here, I’ll be looking at the 2hr demand zone below for a possible bullish reaction. If DXY pushes up from that zone, pairs like EU and GU could drop — which lines up with my overall short bias on those.

Gold may not always move in sync with the dollar, but DXY still gives a good idea of market sentiment.

Let’s see how it plays out and stay reactive.

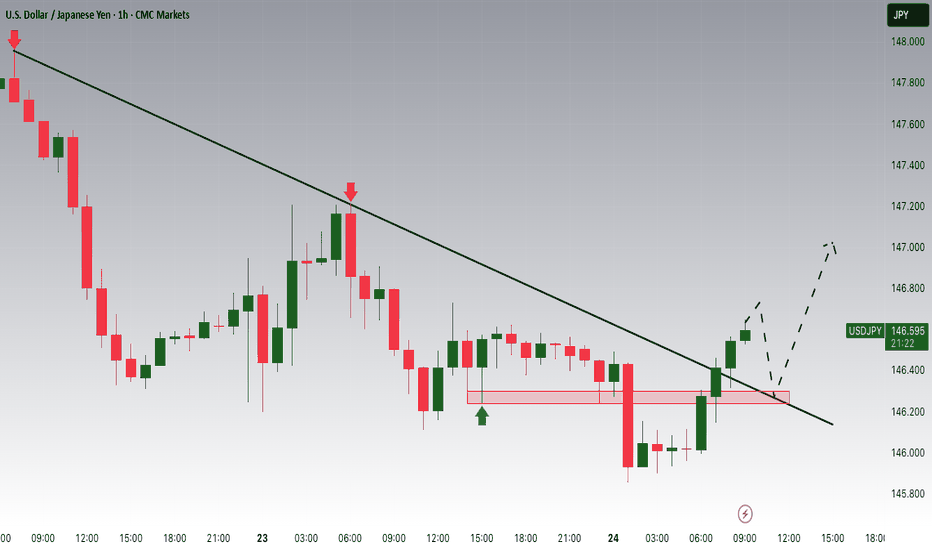

USDJPY Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDJPY for a buying opportunity around 146.300 zone, USDJPY was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 146.300 support and resistance area.

Trade safe, Joe.

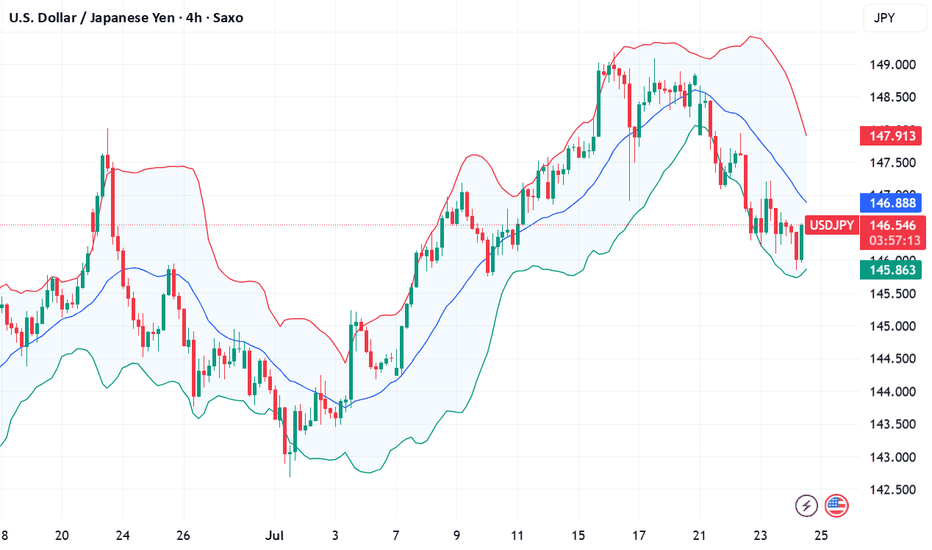

Fundamental Market Analysis for July 24, 2025 USDJPYThe Japanese yen (JPY) strengthened against its US counterpart for the fourth consecutive day and reached a nearly three-week high during Asian trading on Thursday. The recently announced trade deal between Japan and the US reduces economic uncertainty and increases the likelihood that the Bank of Japan (BoJ) will resume its tightening cycle at the end of this year, which in turn is seen as a key factor continuing to support the JPY. The US dollar (USD), on the other hand, is languishing near two-and-a-half-week lows and is putting additional pressure on the USD/JPY pair.

However, domestic political uncertainty and disappointing data on Japan's manufacturing PMI may keep yen bulls from aggressive bets. Moreover, the optimistic market sentiment should help limit the safe-haven yen's gains and further losses for the USD/JPY pair. Traders are now eagerly awaiting the release of US flash PMI indices to take advantage of short-term opportunities later in the North American session. However, the mixed fundamental backdrop calls for caution before making aggressive directional bets.

Trade recommendation: SELL 146.00, SL 147.10, TP 145.00

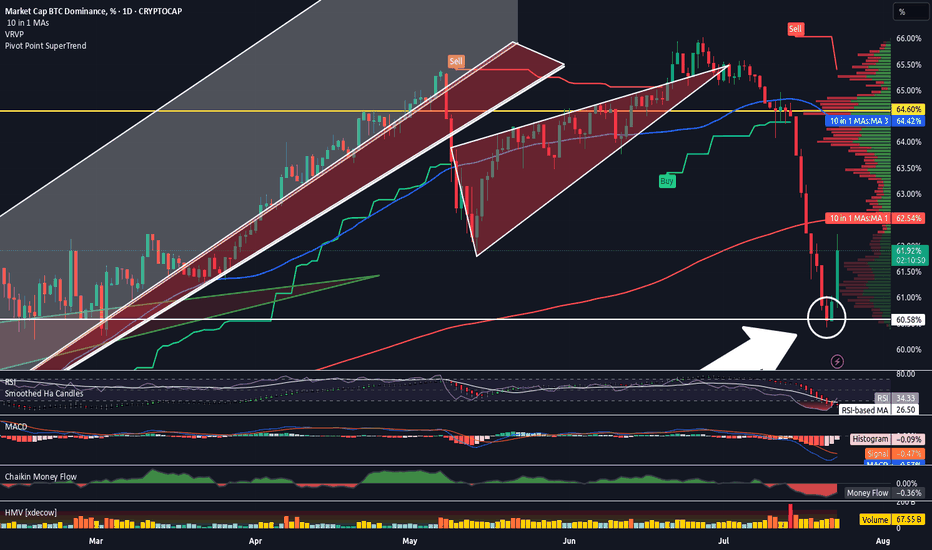

Altcoin Season Has Started. And A Quick Look At The Stock MarketHey Traders,

Time for me to catch you up on the latest price action in both the stock market and crypto as well as touch upon a few changes on my platform and subscription services and what I plan for the future.

Timestamps:

00:00 | Housekeeping - site changes, etc

04:35 | BTC Dominance

06:45 | DXY Dollar Chart

10:00 | SPY

14:25 | BTC Bitcoin Chart

15:45 | Bitcoin Liquidity Heatmap

17:30 | Solana

19:05 | Ethereum

20:20 | Crypto & Stock Trackers

24:25 | My Indicator

26:10 | Where I Went Wrong & How I Plan To Course Correct

✌️ Stew

Kiwi climbs on risk-on flow – chart says more to come? The New Zealand dollar strengthened to around 0.6045, its highest level in over a week, supported by improved global risk sentiment following a breakthrough U.S.–Japan trade agreement.

The agreement, which lowers tariffs and boosts bilateral investment, triggered a surge in Japanese markets. Japan’s Nikkei 225 index jumped more than 3%, hitting a one-year high.

The breakout in NZDUSD was accompanied by a series of bullish candles with little to no upper wicks, evidence of minimal rejection from sellers. The most recent candles are consolidating just below the 0.6055 zone, which aligns with minor resistance from July 4.

Rejection from this area—especially if it prints a bearish engulfing or shooting star pattern—could signal a short-term pullback. On the downside, immediate support is now at 0.6000. If broken, the next support potentially lies around 0.5980, which was the last major swing low before the breakout.

USD/JPY Possible Bear Scenario🔍 Analysis Summary:

USDJPY has failed to close above 146.1 on the weekly for the past 13 candles, showing clear signs of price exhaustion at this level. Price has also tapped into a marked 8HR bearish order block and printed a Daily Pin Bar — a strong reversal signal indicating potential downside.

📍Key Technicals:

• Resistance Holding: 146.1–146.6 zone

• Bearish Rejection: Pin Bar off resistance + order block

• Risk Area (Stop Zone): Above 147.16

• Target Zones: 144.2 (interim) → 142.4 (swing level)

🛠 Confluence:

• Order block rejection

• Multi-week resistance

• Clean structure with defined R:R

• Bearish candlestick confirmation

📊 Timeframe: 8HR

📉 Bias: Short

🔐 Risk Management: Proper stop loss in place above structure. Use personal risk limits.

⸻

⚠️ Disclaimer:

This setup is for educational and informational purposes only. It is not financial advice or a recommendation to trade. Always conduct your own analysis and use risk management based on your personal trading plan.

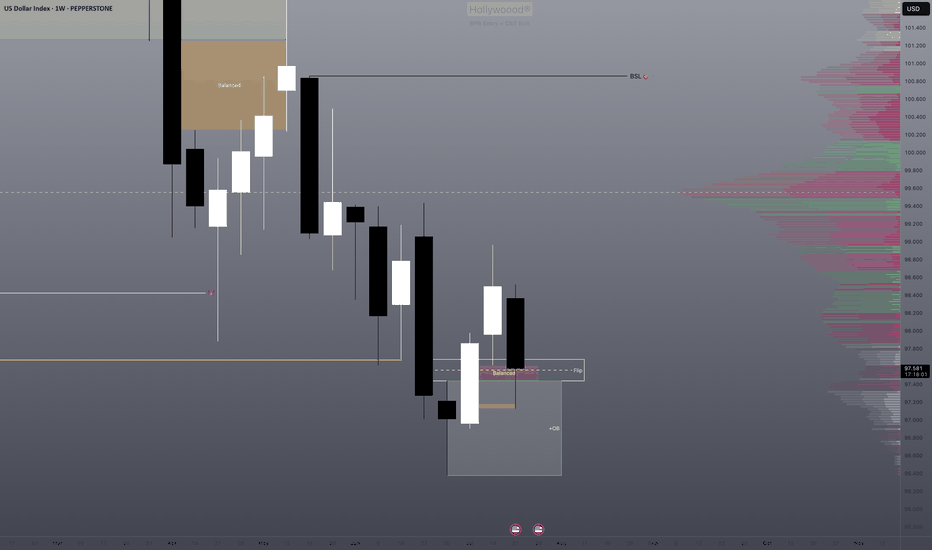

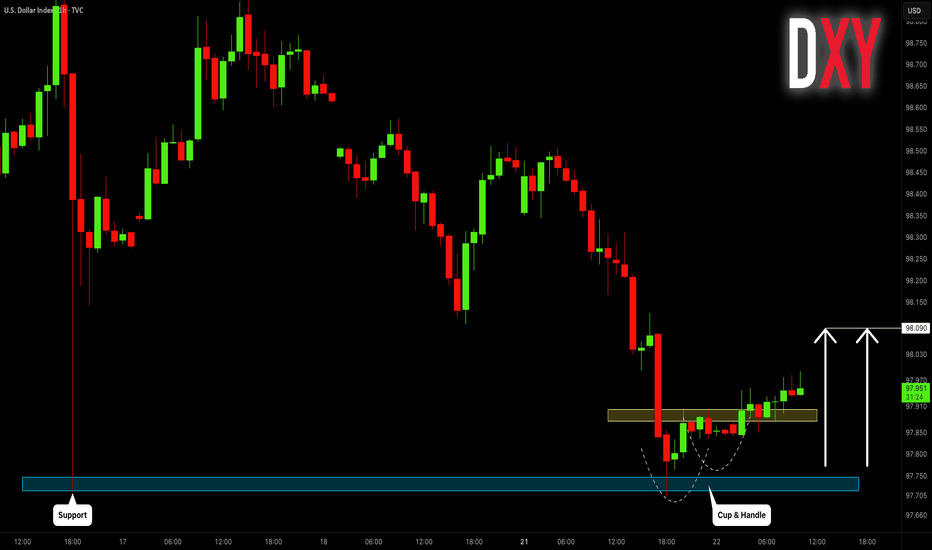

U.S. Dollar (DXY) bearish?Will dollar continue its bearish momentum or will it reverse?

Technical Summary

DXY remains in a firm bearish trend, having dropped around 11% this year. The setup is formed by a chain of lower highs and lower lows, confirming an unrelenting downtrend.

Support Level: ~97.70

Resistance Zone: 98.55–98.80

Long-Term Outlook: Bearish, unless a clear break and close over the resistance zone on the daily or weekly timeframe.

Technically, the momentum indicators remain weak, and the failure to sustain rallies above the 99.00 level also contributes to downward pressure further. The market is now consolidating within a narrow range after steep selling, which suggests probable continuation if macro catalysts are favourable.

Fundamental and Sentiment Drivers

Several macroeconomic and geopolitical drivers are underpinning the weakening of the U.S. dollar:

Federal Reserve Uncertainty:

Speculation over the ultimate fate of Federal Reserve Chairman Jerome Powell under political pressure from the executive branch has severely undermined investor confidence in the central bank’s independence. This has been manifested in increased volatility and bearish pressure on the dollar.

Trade Policy and Tariff Risks:

Ongoing trade tensions, including the possibility of sweeping tariffs (15–20%) on Chinese and European Union goods, have created a risk premium on valuations of the U.S. dollar. Market players still fear retaliation and its effects on trade stability in the world.

Fiscal Position and Credit Ratings:

The US fiscal deficit, which is approaching 7% of GDP, and recent credit rating downgrades to its outlook, have set alarms ringing regarding the structure. These fiscal developments have eroded the popularity of the US dollar as a safe-haven asset, particularly with foreign investors.

Global Monetary Landscape:

With European Central Bank and Bank of Japan maintaining policy guidance tight, and Federal Reserve already indicating that direction for a rate cut in Q4 2025 is being eyed, the falling rate differentials still maintain pressure on the dollar.

Market Outlook: Week of July 21–25, 2025

Major Geopolitical and Economic Events:

DATE : Ongoing

EVENT : U.S.- EU & U.S. — China Trade Negotiations.

MARKET RELEVANCE : High

Resolution or escalation will directly impact USD demand.

DATE : Mid-week

EVENT : Federal Reserve Speeches (including Powell)

MARKET RELEVANCE : High

Monetary policy guidance and institutional stability.

DATE : July 24–25

EVENT : Jobless Claims, Flash PMIs, New Home Sales, Durable Goods Orders

MARKET RELEVANCE : Medium–High

Labour market data, housing data, and production activity have the potential to shift rate expectations and dollar sentiment ahead of the FOMC and PCE releases.

Strategic Implications

Outlook: DXY remains structurally bearish in the short to medium term. Additional weakness below 98.80 and sustained closes below 97.70 would reassert downward momentum, risking a further retracement to the 96.00-95.50 region.

Possible Bullish Reversal Triggers:

A conclusive resolution to U.S. trade negotiations.

Unexpectedly solid economic data (particularly core inflation or employment).

Hawkish Fed commentary supporting policy tightening expectations.

Last thoughts

The U.S. Dollar Index is currently at structurally weak technical and fundamental foundations. Absent a sudden reversal of the monetary policy message or geopolitical resolution, the path of least resistance appears to remain to the lower side. Market participants need to pay special attention to upcoming economic data releases, central bank rhetoric, and trading news because any one of them could be a pivotal driver of near-term dollar behavior.

GBPUSD: Bearish > Bullish Order FlowAlright, we are approaching some Higher Timeframe Points of Interests. We got a Potential Bullish Bat Pattern Pattern this align with this Bullish H4 Order Block, that's right in the middle of an whole number 1.34. We could expect some spikes around the area, some complex pullbacks, but we must remain steady.

Gold will make a Low for the Week before Pushing BullishOn my previous Update I mention that we should have support off this H4 Gap. My problem with it s it immediately reacted to it when the market opened back up. well before the killzone. So I feel like this is a fake out to go short for now. they will make a low for the week then we will see it set up for the bullish move.

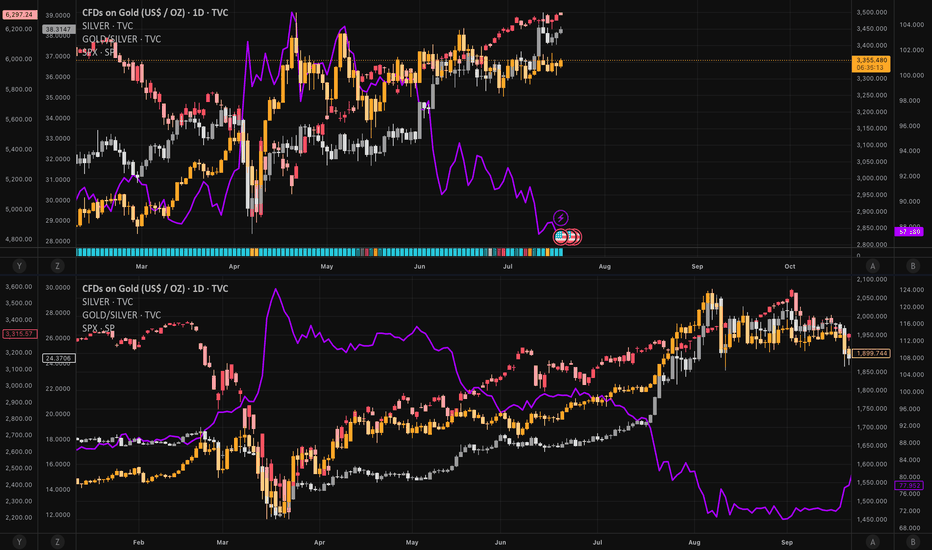

Bear-Trap armed: Gold ticks 4 / 5 boxes - waiting for the spark1️⃣ Why the 2020 déjà-vu is EVEN louder

2025 (now) 2020 (pre-rally)

TradingView ideas still bearish 💬

> 70 % 60 % bearish

Managed-money net-longs ≈ 115 k

-35 % from Apr. –25 % from peak

+ $741 m PM-ETF inflow Record IN-flows

G/S ratio 87 (< 90) Fell to 95

S&P keeps making highs Ditto

2️⃣ What’s still different

Real 10-y TIPS yield +0.7 % vs -1 % in 2020 → smaller monetary tail-wind.

Gold is already at an infl-adj. record – expect a short & sharp squeeze, not a fresh multi-year super-cycle (yet).

3️⃣ Checklist – updated

Signal Status 18 Jul Comment

———————————————————

Gold DAILY close ≥ $3 200–3 250 YES – $3 354 ✔

G/S ratio < 90 YES – 87 ✔

CFTC net-longs < 150 k YES – ~115 k ✔

ETF flows turn positive. YES – $741 m ✔

Equity stress (VIX > 25 or SPX −5 %) NOT YET – VIX 16.5 ✖

4 / 5 boxes = 99 % primed. One spark missing.

4️⃣ What could light the fuse

Date Potential trigger Why it matters

22 Jul Mega-tech Q2 earnings (NVDA/AMD) Any guidance miss → SPX wobble

30 Jul FOMC Fed holds but sounds dovish USD dump + yield spike risk

1 Aug Trump s “reciprocal” duties Imported-inflation scare → VIX pop

Early Aug. DXY crashes < 96 in < 5 days. Disorderly USD slide = funding stress

Hit ≥ 2 of: DXY < 96, VIX > 25, SPX -5 % or HY-spread +75 bp → final ✔.

Bottom line

The bear-trap thesis aged well: sentiment, positioning, ETFs, and G/S ratio have already clicked bullish.

Only equity-market stress is missing. A fast USD slide or a tariff shock right after a neutral Fed is the most likely detonator.

Stay nimble: Collect premium inside $3 250-3 400 while volatility sleeps – but keep alarms on VIX 25 and DXY 96. One red headline could still launch the squeeze.

Disclaimer: Educational opinion, not investment advice. Futures & CFD trading is risky – do your own research and consult a professional.

1 minute ago

EURUSD Buy Trade Idea: Reversal Rocket Ready to Launch!Hey Fellow Traders! 👋

The EURUSD (EU) is setting up for a massive reversal that’s got me hyped! 🚀 After nailing the lows of that descending channel like a pro, price has retraced to our expected zone and is now bouncing hard. It’s time to gear up for a potential buy trade targeting the Buyside Liquidity! Let’s break down this fire setup and get ready to ride the wave! 🌊

📈 The Setup: Reversal in the Making!

EU hit the descending channel lows as predicted, and now it’s showing some serious bullish vibes with a strong bounce off a key weekly trendline support. This isn’t just a random move—price is reacting to a weekly demand zone and a trendline that’s holding like a fortress. 🏰 I’m expecting a reversal to kick in, aiming for that juicy Buyside Liquidity up top. But hold up—don’t just dive in blindly! Let’s talk strategy. 😎

🎯 Trade Details: How to Play It Smart

Entry Zone: Look for a calculated entry in this bounce area. Key setups to watch for:

FVG (Fair Value Gap) or IFVG (Imbalance Fair Value Gap) for precision entries.

Order Blocks (OB) for high-probability setups.

Trendlines/Support Zones: Use these for confluence, as EU is respecting that weekly trendline support.

Target: We’re gunning for the Buyside Liquidity—a high-probability target where price loves to gravitate.

Stop Loss: Place your stops below the recent lows or your chosen setup (FVG/OB) to keep risk tight.

👀 Keep an Eye on DXY for Confluence

The Dollar Index (DXY) is a key player here. A weakening DXY could supercharge this EU reversal, so monitor it closely for extra confirmation. If DXY starts to roll over, it’s like pouring rocket fuel on this trade! 🚀

🧠 Why This Reversal Makes Sense

Weekly Trendline Support: Price kissed this level and is bouncing like it means business.

Weekly Demand Zone: This area has historical strength, making it a prime reversal spot.

Channel Lows Conquered: EU smashed through the descending channel lows and is now retracing for the next leg up.

⚠️ Risk Management Reminder

Don’t YOLO this one! Use proper risk management—calculate your position size, set tight stops, and only enter when your setup aligns. Whether you’re using FVGs, OBs, trendlines, or classic support/resistance, make sure your entry is calculated to avoid getting caught in a fakeout. 💪

💬 Let’s Talk Trades!

What’s your take on this EU reversal? Are you jumping in with an FVG, OB, or something else? Drop your thoughts, setups, or questions in the comments below! 👇 If this idea gets you pumped, smash that LIKE button ❤️, follow for more banger trade ideas, and share your charts with the community! Let’s keep the vibes high and the profits higher! 💰

#EURUSD #ForexTrading #BuyTrade #Reversal #TradingView

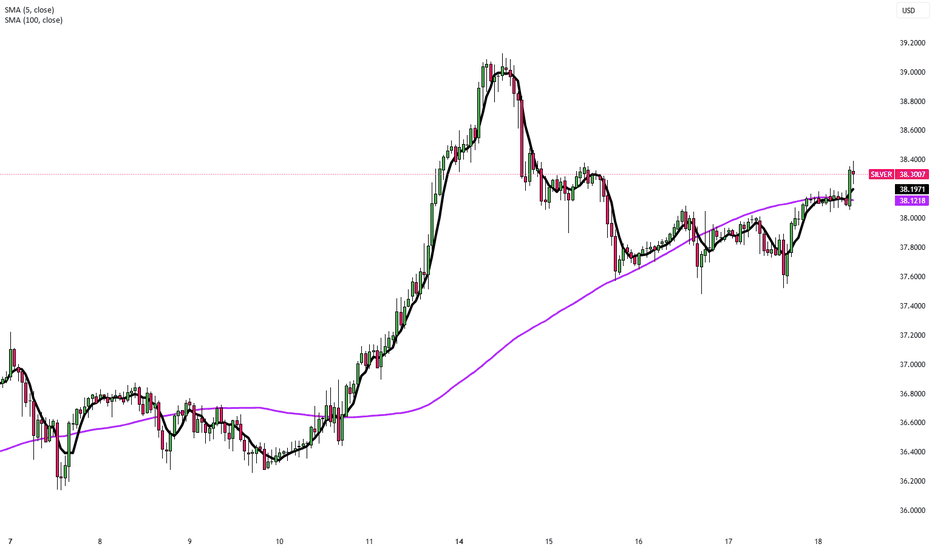

Silver Rebounds Toward $38 as Dollar EasesSilver rebounded toward $38 per ounce on Friday, recovering from a two-day decline as the U.S. dollar and Treasury yields eased. The move reflected shifting sentiment on Fed policy and trade conditions after earlier losses sparked by inflation data that reduced hopes for near-term rate cuts.

U.S. stock futures edged higher following record closes for the S&P 500 and Nasdaq, driven by strong retail sales, lower jobless claims, and optimism in AI-related tech stocks after Taiwan Semiconductor’s positive forecast. On monetary policy, Fed officials remain divided: Mary Daly expects two rate cuts this year, while Adriana Kugler urges caution due to tariff-driven inflation. President Trump reinforced trade tensions by sending letters to over 20 partners setting new tariffs between 20% and 40%.

In corporate updates, United Airlines expects stronger earnings in the second half of 2025, and Chevron signaled higher future cash flow as production in its top U.S. oil field nears a plateau.

Resistance is at 38.50, while support holds at 37.20.