Dollarindex

Dollar index (DXY) Analysis DXY Analysis – General Outlook

This week’s analysis is more of a general overview, and it closely aligns with my view on EUR/USD. While I don’t trade DXY directly, I use it heavily as a confluence tool, so marking out its likely direction is key for aligning trades across other USD-related pairs.

At the moment, I’m favouring Scenario A, where I expect DXY to move a bit lower, accumulate, and then react from the 2-day demand zone. If that happens, we could see a bullish move on DXY, which would naturally result in bearish pressure for other pairs like EU and GU.

However, if price decides to retrace upwards first, there’s a clean supply zone that still needs to be mitigated. If that zone holds, DXY could continue its bearish structure for longer—meaning more bullish momentum across other major pairs.

DXY / Dollar Index Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY / Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (103.300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (101.700) Day / Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.000 (or) Escape Before the Target

💰💸💵DXY / Dollar Index Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY / Dollar Index Market Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY / Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (104.550) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (103.800) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

DXY / Dollar Index Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY The Fake Dance- One of the most important barometers for global currencies and markets in the world.

- Most of the time DXY is a well used machine to supress markets (forex, stocks, cryptos, etc..)

- When they don't start the printing machine, DXY keeps is strength.

- When they start to print DXY starts to dip and markets boom up.

- it's really basic and based on "BRRR Machine".

- i had a hard time to decrypt this fake peace of resilience.

- actually there's none visible divergences on the 1M or 3M Timeframes.

- So i decided to push my analysis to 6M Timeframe and noticed few things :

- You can notice that from 2008 ( Post crises ), DXY was in a perma bullish trend.

- So now check MACD and will notice this fake move on January 2021 ( in graph the red ? )

- MACD was about to cross down, columns smaller and smaller, then a Pump from nowhere lol.

- i rarely saw that in my trading life on a 6M Timeframe.

- So to understand more this trend, i used ADX (Average Directional Index)

- ADX is used to determine when the price is trending strongly.

- In many cases, it is the ultimate trend indicator.

- So if you look well ADX columns, you will notice that a strong divergence is on the way.

- First check the Yellow Doted Line in July 2022 when DXY reached 115ish and look the size of the green columns.

- Now check today (red doted Line), and look again the ADX green columns is higher, but DXY diped to 105ish.

- So like always, i can be wrong, but i bet on a fast DXY dip soon or later.

- it's possible to fake pumps, but it's harder to fake traders.

Happy Tr4Ding !

GOLD v DXY in breakout move --- HVF hunt volatility funnelAlways good to measure against the DXY not just the USD value

Not perfect of course as it is mainly the Euro and Yen but still insightful.

Been watching the relationship for a while

currently breaking out to the upside

HVF theory means this should be a violent expansion

Target 1 coming up.

Euro Stablecoin BOOMS: Bye, USD?The Euro Stablecoin Ascends: EURC Hits Record High as Traders Eye Dollar Alternatives Amid Global Uncertainty

For years, the digital asset landscape has been dominated by the US dollar, not just in trading volume but fundamentally through the ubiquity of USD-pegged stablecoins. Tokens like Tether (USDT) and Circle's own USD Coin (USDC) have become the bedrock of the crypto economy, acting as crucial bridges between volatile cryptocurrencies and traditional fiat, facilitating trading, lending, and yield generation within decentralized finance (DeFi). However, the winds of change may be subtly shifting. Amidst a backdrop of persistent global trade tensions, geopolitical maneuvering, and questions surrounding the long-term trajectory of the US dollar, alternative fiat-backed stablecoins are gaining traction. Leading this nascent charge is the Euro Coin (EURC), Circle's Euro-backed offering, which recently surged to a record market capitalization exceeding $246 million.

This milestone, while still dwarfed by its multi-billion dollar USD counterparts, is significant. It signals a growing appetite among traders, investors, and institutions for stable digital assets pegged to currencies other than the greenback. The rise of EURC isn't happening in a vacuum; it reflects a confluence of factors challenging the dollar's undisputed reign in the digital sphere and highlighting the strategic appeal of diversification.

Understanding the Stablecoin Status Quo and the Dollar's Dominance

Stablecoins are indispensable cogs in the crypto machine. They offer price stability relative to a specific asset (usually a major fiat currency), allowing market participants to park funds, calculate profits, pay for services, and interact with DeFi protocols without the wild price swings characteristic of Bitcoin or Ethereum. USDT and USDC have achieved massive network effects, integrated across countless exchanges, wallets, and DeFi applications, making them the default choice for liquidity and settlement.

Their success, however, inherently ties a vast swathe of the digital economy to the US dollar's fate and US monetary policy. For international users, particularly those operating primarily within the Eurozone or holding significant Euro-denominated assets or liabilities, relying solely on USD stablecoins introduces foreign exchange (FX) risk and potential conversion inefficiencies.

Enter EURC: A Regulated Euro On-Chain

Launched by Circle, the same regulated fintech firm behind the highly successful USDC, Euro Coin (EURC) aims to replicate the trust and utility of its dollar sibling, but pegged 1:1 to the Euro. Each EURC token is intended to be fully backed by Euros held in dedicated, segregated bank accounts under Circle's custody. This emphasis on transparency and regulatory compliance, mirroring the approach taken with USDC, is crucial for building trust, especially among institutional players wary of less transparent stablecoin issuers.

The recent surge in EURC's supply to over €246 million (equivalent to ~$246 million at the time of the record, assuming near parity for simplicity, though the exact USD value fluctuates) indicates accelerating adoption. This growth isn't just passive accumulation; it suggests active minting driven by real demand.

Why the Shift? Trade Uncertainty and the Allure of Diversification

The primary catalyst cited for this growing interest in non-USD stablecoins is the pervasive sense of uncertainty clouding the global trade environment and the US dollar's outlook. Several factors contribute to this:

1. Geopolitical Tensions & Deglobalization Trends: Ongoing conflicts, shifting alliances, and a move towards regional trading blocs can create volatility and potentially weaken dominant currencies like the dollar as nations explore alternative payment and reserve systems.

2. US Economic Concerns: Debates around US national debt levels, inflation trajectory, and the Federal Reserve's monetary policy decisions can lead some international investors and traders to hedge against potential dollar depreciation.

3. Desire for FX Hedging: Businesses and traders operating significantly within the Eurozone may prefer a Euro-native stablecoin to minimize the costs and risks associated with constantly converting between EUR and USD stablecoins. Holding EURC directly aligns their digital cash position with their operational currency.

4. European Regulatory Clarity (MiCA): The implementation of the Markets in Crypto-Assets (MiCA) regulation in the European Union provides a clearer framework for stablecoin issuers and users within the bloc, potentially boosting confidence in well-regulated Euro stablecoins like EURC.

5. DeFi Diversification: As the DeFi ecosystem matures, users are seeking more diverse collateral types and trading pairs. EURC allows for the creation of Euro-based liquidity pools and lending markets, catering to a specific user base and reducing systemic reliance on USD assets.

Traders aren't necessarily predicting an imminent dollar collapse, but rather strategically positioning themselves to mitigate risk. Holding a portion of their stable digital assets in EURC provides a hedge – if the dollar weakens against the Euro, the value of their EURC holdings, when measured in dollars, would increase, offsetting potential losses on USD-denominated assets.

Use Cases and Potential Beyond Hedging

While hedging FX risk is a significant driver, the utility of EURC extends further:

• Seamless Euro Transactions: Facilitates frictionless payments and settlements within the Eurozone using blockchain technology.

• European DeFi Growth: Enables the development of DeFi applications tailored to the European market, offering Euro-based borrowing, lending, and yield opportunities.

• Remittances: Potentially offers a more efficient channel for cross-border Euro transfers compared to traditional banking rails.

• Trading Pairs: Allows exchanges to offer direct EURC trading pairs against various cryptocurrencies, simplifying the process for Euro-based traders.

Challenges and the Road Ahead

Despite its record supply, EURC faces hurdles. Its market capitalization and liquidity remain a fraction of USDT's and USDC's. This lower liquidity can mean higher slippage on large trades and limits its immediate utility as deep collateral in major DeFi protocols, which thrive on multi-billion dollar liquidity pools. Building the network effect – getting listed on more exchanges, integrated into more wallets, and accepted by more DeFi platforms – takes time and concerted effort.

Furthermore, EURC's success is intrinsically linked to the stability and economic health of the Eurozone itself. It diversifies away from the dollar, but not away from fiat risk entirely. The regulatory landscape, while clarifying under MiCA, will continue to evolve and shape the operational environment.

Conclusion: A Sign of a Maturing Market

The surge in Circle's EURC supply to over $246 million is more than just a numerical milestone; it's a tangible indicator of a maturing stablecoin market seeking diversification beyond the US dollar. Driven by global trade uncertainties, geopolitical shifts, and a desire among European users and savvy traders to hedge FX risk, Euro-based stablecoins are carving out a growing niche. While the dollar-pegged giants still dominate, the ascent of well-regulated alternatives like EURC signifies a crucial step towards a potentially multi-polar stablecoin future. It underscores the demand for trusted, compliant digital representations of major world currencies, offering users greater choice and resilience in an increasingly complex global financial landscape. The journey for EURC and its Euro counterparts is still in its early stages, but the trend towards diversification is clear, promising a more varied and potentially more stable digital asset ecosystem ahead.

DXY: Summer CRASH but here is why it will SKYROCKET after.The U.S. Dollar Index is oversold on both its 1D and 1W technical outlooks but on the 1M it just turned bearish (RSI = 42.641, MACD = 0.810, ADX = 21.680). This is because it crossed under its 1M MA50 for the first time since January 2022. For more than 3 years the 1M MA50 has kept it on the upper side of the 2008 Channel Up but now the time has come for it to aim at its bottom as every time it broke under it, the pattern dropped more and made a bottom a few months later.

We anticipate a bottom around July, ideally with the 1M RSI inside our Target Zone, which consists of the last two lows. Then the new bullish wave of the pattern should begin, reaching the January 2025 High by the end of 2026.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Dollar Index Tests Key Demand Zone: What's Next?The Dollar Index is currently testing a major demand zone between 99.50 and 101. This area has marked the end of downward moves and the beginning of dollar rallies five times since early 2023.

The recent downward pressure is largely driven by rising expectations of an economic slowdown and a strengthening euro.

At this point, several possible scenarios could unfold, depending on how the market reacts to this key support zone:

Repeat of the Past: Just like the previous five instances, the Dollar Index rebounds sharply from the zone and starts a strong upward move.

Trendline Test: The Dollar Index breaks below this zone and moves toward testing the long-term uptrend line that originated in 2011.

Fakeouts and Reversal: The Dollar Index briefly falls below the demand zone, approaches the long-term trendline, and then stages a false recovery above the zone. After trapping both bulls and bears and creating a fake breakout signal, it dips below the trendline before reversing and beginning a new medium-term uptrend that ultimately aligns above the long-term trend.

Given the high level of global economic uncertainty and recent sharp reversals in financial markets, the third scenario may carry slightly higher probability. A similar pattern played out in 2017, when both the 200-week moving average and the demand zone were broken. The key difference this time is that TVC:DXY is much closer to the long-term trendline.

Eur/Usd sell setup update!!Good day traders, we back again we another beauty of a setup well Atleast I like to believe that😂.

Eur/Usd a set was posted here by me on TradingView before market opened on Monday and if you go look at that set up today’s move was seen before hand and now that price went higher, we can now expect to see price move lower for the rest of the week to our liquidity resting below(equal lows). On the 4 hour price just broke structure higher solidifying a low that we want to see get broken during today trading day.

As soon as price breaks structure lower on the LTF’s than we have a alert to enter our shorts, good luck and have a wonderful day✌️

My name is Teboho Matla but you don’t know me yet…

US DOLLAR at Key Support: Will Price Rebound to 103.350?TVC:DXY is currently testing a key support zone, an area where the price has previously shown strong bullish reactions. The recent price action suggests that buyers may step in and drive the price higher. A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a bounce from this level. If buyers regain control, the price could move toward the 103.350 level.

However, a breakout below this support would invalidate the bullish outlook, potentially opening the door for further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

crypto downtrend exhaustion indicatorsA couple facts:

1) usdt.d is above 5.60% for ~two days. This is a major fact. We have an early bull market end confirmation, or at least the end of an impulse structure of intermediate degree. There is a probability that the structure of the current bull market will be either extended or will end with the final diagonal.

2) usdt.d below 5.60% is confirmation of current dump exhaustion.

3) Crossing down one of the trend lines at BTC dominance chart will mean start of alt season. The target for the mini alt season is ~53% at BTC.D;

4) The terminal target for upcoming Dogecoin rally is range between 0.5 - 1.37 USD. Beware pullback, i look at whole crypto market structure and anticipate one.

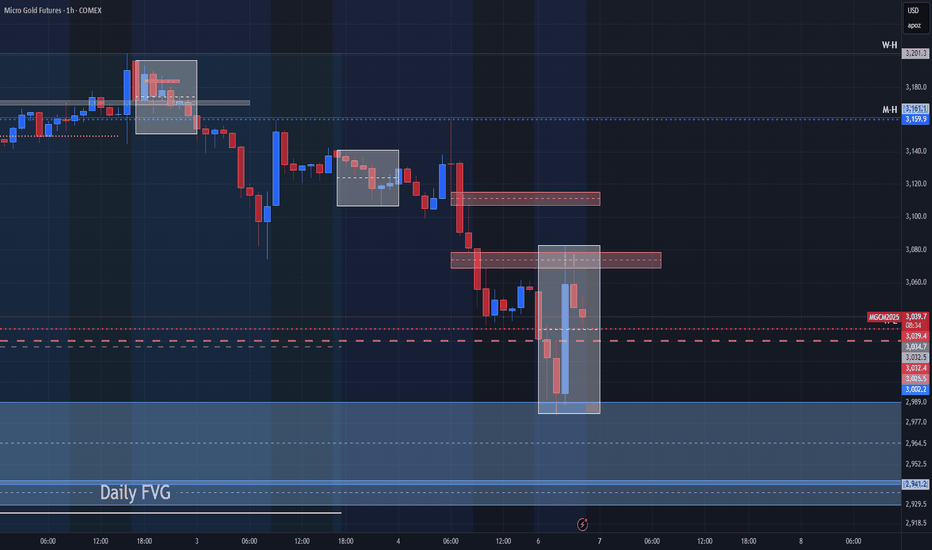

We might get a play on Gold soon! Been waiting for price to come for these levels for almost a month now. Now that we are finally here I'm just trying to keep my cool and wait for things to line up inside of the killzone. We could get a nice bullish swing here. We just have to wait for price to show us thats what it wants to do.

Zloty vs Euro 5.20 - timespan boundariesTwo years ago, I found the probability with the current zloty price of 4.15 PLN; and forecasted new extremum terminal point >6.5 zloty per single euro. The first part of the prediction has worked out, 4.15 was reached.

How i received the 6.50 PLN value? I got the value by applying the Elliott Wave Principle: this is the height of the first wave, primary degree. At the moment the chart is at the second wave end. I think so because there is an exit outside the channel, it is an indicator. According to the principle - the third wave cannot be the shortest in the impulse, so the target is above 6.5+.

Today, the time boundaries became obvious to me.

I think 5.20 PLN target per single EUR may be reached by the end of Trump presidency. Thus, by the end of 2028. This target will coincide with the upper trend channel and may match with the end of the first sub-wave of the minor degree of the primary third wave.

In 2024 December i also made forecast for DXY dollar index: ~112% and ~85%. The first part of that prediction has already worked out at 110.217%. The second part of the probability may be more swift, thus we may see 94-85% DXY values during 2025. Which could lead to 5.20 at PLN already in 2025. We will know this soon...

Good luck with your investing strategy, have fat profits and remember - there are no guaranties on the markets, only probabilities.

We Have direction. We wait on confirmation! GOLD!Looking for price to give is a little more indication that it wants to continue bullish. We have areas to fill on larger time frames before it gives us a stronger play for bigger moves. Just have to be patient and wait for price to give us more solid indication. As Always #NOFOMO!

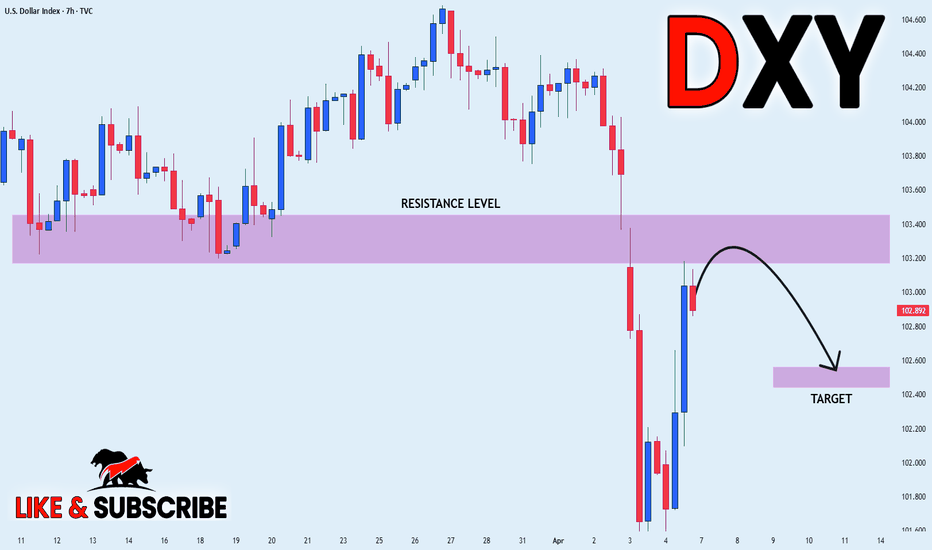

DXY PULLBACK EXPECTED|SHORT|

✅DXY surged again to retest the resistance of 103.400

But it is a strong key level

So I think that there is a high chance

That we will see a bearish pullback and a move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How Worrying is the Weakening Dollar? A Departure from TraditionThe value of a nation's currency is a critical barometer of its economic health and global standing.1 Typically, in times of international turmoil or economic uncertainty, the U.S. dollar, as the world's reserve currency, tends to strengthen.2 This "safe-haven" effect is driven by increased demand for the dollar as investors seek stability and liquidity. However, recent trends have seen the greenback exhibit a notable weakening, even amidst persistent global anxieties.3 This begs the crucial question: how worrying is this deviation from the norm, and what are the potential implications for the U.S. and the global economy?

To understand the significance of a weakening dollar, it's essential to first recognize the factors that typically influence its strength. These include interest rates set by the Federal Reserve, inflation levels, the overall performance of the U.S. economy relative to others, trade balances, and geopolitical stability.4 Higher interest rates tend to attract foreign investment, increasing demand for the dollar and thus its value.5 Strong economic growth similarly boosts confidence in the currency.6 Conversely, high inflation erodes the dollar's purchasing power, while a significant trade deficit (importing more than exporting) can indicate an oversupply of the currency in global markets, leading to depreciation.

Historically, during periods of global crisis, the dollar has often acted as a port in a storm. Events like geopolitical conflicts, financial market meltdowns in other regions, or global pandemics have typically triggered a "flight to safety," with investors flocking to the perceived security and liquidity of U.S. dollar-denominated assets, thereby strengthening the currency.7 This was evident during past crises, where the dollar often appreciated as investors sought refuge from volatility elsewhere.

The current weakening of the dollar, therefore, raises eyebrows precisely because it seemingly contradicts this established pattern. While global uncertainties persist – ranging from ongoing geopolitical tensions in various parts of the world to concerns about the pace of global economic growth – the dollar has not consistently exhibited its traditional strengthening behavior. This departure suggests that underlying factors might be at play, potentially signaling deeper concerns about the U.S. economic outlook or the dollar's long-term standing.

One potential reason for this weakening could be a shift in relative economic strength. If other major economies are perceived to be on a stronger growth trajectory or offering more attractive investment opportunities, capital might flow away from the dollar, putting downward pressure on its value. For instance, improvements in economic prospects in the Eurozone or emerging markets could lead investors to diversify their holdings, reducing their reliance on the dollar.

Furthermore, concerns about the U.S.'s fiscal health, including rising national debt and persistent budget deficits, could also contribute to dollar weakness. While the dollar's reserve currency status has historically provided a buffer, a sustained period of fiscal imbalance could eventually erode investor confidence in the long-term value of the currency.8

Another factor to consider is the Federal Reserve's monetary policy. While higher interest rates typically support a stronger dollar, expectations of future rate cuts or a more accommodative monetary stance could dampen investor enthusiasm for dollar-denominated assets. If the market anticipates that the Fed will need to lower rates to support economic growth or combat deflationary pressures, this could lead to a weakening of the dollar.9

The implications of a weakening dollar are multifaceted and can have both positive and negative consequences for the U.S. economy. On the positive side, a weaker dollar makes U.S. exports more competitive in international markets, as they become cheaper for foreign buyers.10 This could potentially boost U.S. manufacturing and help to narrow the trade deficit. Additionally, a weaker dollar can increase the value of earnings that U.S. multinational corporations generate in foreign currencies, as these earnings translate into more dollars when repatriated.

However, the downsides of a weakening dollar can be significant. Firstly, it makes imports more expensive for U.S. consumers and businesses.11 This can lead to higher prices for a wide range of goods, potentially fueling inflation.12 For businesses that rely on imported components or raw materials, a weaker dollar can increase their costs of production, which may eventually be passed on to consumers.

Secondly, a sustained weakening of the dollar could erode its status as the world's reserve currency. While this is a long-term prospect, a decline in the dollar's dominance could have significant implications for the U.S.'s ability to borrow cheaply and exert influence in the global financial system.13

Thirdly, a weakening dollar could lead to concerns among foreign investors holding U.S. assets, such as Treasury bonds. If they anticipate further depreciation of the dollar, they might become less inclined to hold these assets, potentially leading to higher U.S. borrowing costs in the future.

In conclusion, the current weakening of the dollar, particularly in the face of ongoing global uncertainties where it would typically strengthen, is a trend that warrants careful attention. While a moderate depreciation can have some benefits for U.S. exports, a sustained or significant weakening could signal underlying economic vulnerabilities or a shift in global investor sentiment towards the greenback. Factors such as relative economic performance, U.S. fiscal health, and the Federal Reserve's monetary policy will likely play a crucial role in determining the future trajectory of the dollar. The departure from its traditional safe-haven status serves as a reminder that the dollar's dominance is not immutable and underscores the importance of maintaining sound economic policies to underpin its long-term strength and stability. Monitoring these trends will be critical for understanding the evolving global economic landscape and its implications for the United States.

Dollar Index at Risk: Key Support Holds the Fate of the TrendThe U.S. Dollar Index (DXY) has broken down from a Head & Shoulders pattern, confirming a bearish reversal after a successful retest of the neckline. The price is currently near a key support area, and if it fails to hold, a drop toward the lower strong support zone is likely.

Additionally, RSI is showing bearish divergence and is below the neutral 50 level, indicating weakening momentum.

DYOR, NFA

"DXY/Dollar Index" Bull Money Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "DXY/Dollar Index" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (104.100) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (103.500) Scalping/Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"DXY/Dollar Index" Indices Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩