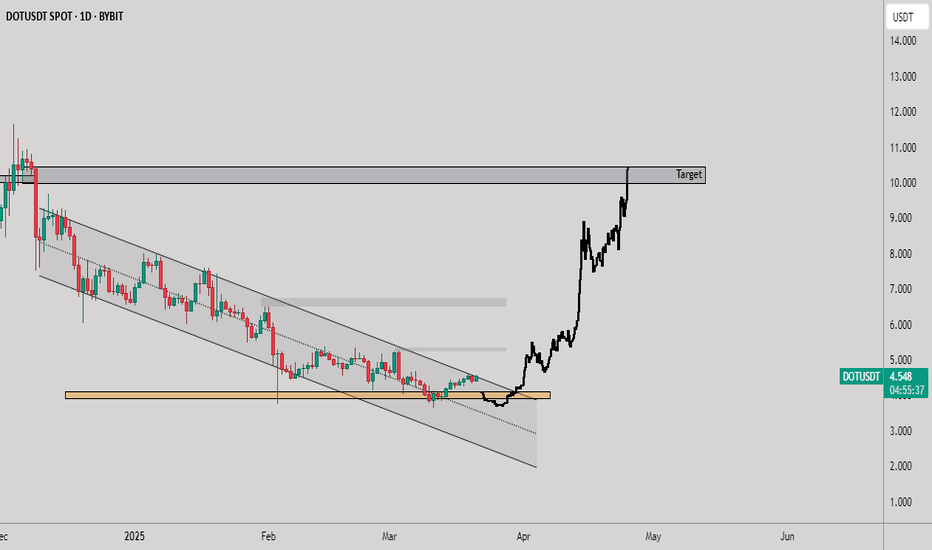

DOT/USDT (Bybit - 1D Chart)📍 Timeframe: 1D (Bybit Exchange)

📈 Current Price: $4.550 (+3.43%)

Key Technical Insights:

Descending Channel Breakout:

DOT had been trading in a descending channel since late 2024.

A successful breakout from the channel indicates a trend reversal.

Strong Support Retest & Bounce:

The price found support at the $4.00 region (marked in yellow).

Multiple tests of this level suggest strong demand and potential accumulation.

Major Resistance & Upside Target:

The next key resistance zone is around $10.00 (marked as "Target").

If momentum continues, a move towards $12.00–$14.00 is possible.

Possible Price Path:

The projected price movement (black line) suggests a retest of support before a rally.

If price holds above $4.20–$4.30, further bullish continuation is expected.

Trading Strategy:

Bullish Entry: Consider long positions on a retest of $4.20–$4.30 with a stop below $4.00.

Breakout Confirmation: A daily close above $5.00 strengthens the case for an upward push.

Profit Targets: $7.00, then $10.00, and extended targets at $12.00–$14.00.

DOT

PolkaDot DOT Has Just Confirmed The Huge Reversal!Hello, Skyrexians!

Recently we made analysis on BINANCE:DOTUSDT where pointed out that the reversal is likely, but not confirmed. Now we have the reversal signal even on weekly. Moreover, we know that you don't like DOT and argue when we draw the unbelievable targets. Toady we will show you the realistic one.

Let's take a look at the weekly chart. We can see two confirmed green dots on the Bullish/Bearish Reversal Bar Indicator . Moreover there bars have the great angle with the Williams Alligator. Even if we will not count Elliott waves it's enough to have an idea that bull run is starting now. The realistic target is located at 0.61 Fibonacci zone approximately at $30-$35.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

#DOT/USDT#DOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 4.22.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.30

First target: 4.37

Second target: 4.46

Third target: 4.57

Be careful with DOT !!!the price can form a head and shoulders pattern. If that is happen, expect a significant price increase.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

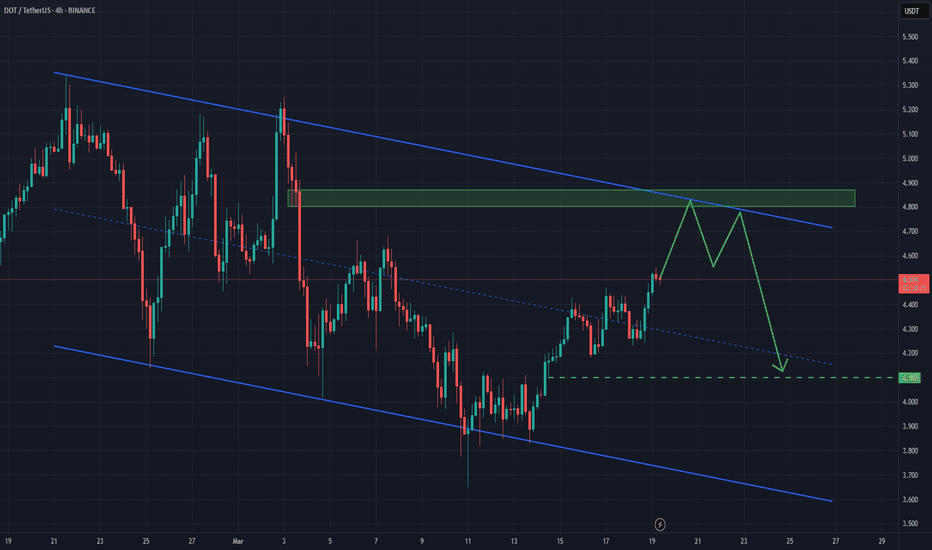

DOT/USDT: Consolidation Expected After Recent Bounce The DOT/USThe DOT/USDT market has recently rebounded from a previously tested level from November. Following this bounce, the price appears to be forming an ABC pullback, moving towards the channel boundary.

Historical price action shows that the market has consistently respected the resistance zone, reinforcing the prevailing bearish trend. Given this setup, the market is likely to enter a consolidation phase, with price stabilizing within the 4.88 to 4.00 range. The next key target lies at the support zone around 4.100

PolkaDot DOT Has a Chance, But Still In Danger!Hello, Skyrexians!

Recently we have already made analysis on BINANCE:DOTUSDT before the dump, where pointed out that wave 5 to the downside ahead. Asset has finally reached the minimal target at $3.8 and now we have a question if it's going to reverse or $2 is next.

Let's take a look at the daily time frame. We can see the Elliott waves structure and wave 5 can be finished anytime now. Our best practice to find the reversals is the green dot on the Bullish/Bearish Reversal Bar Indicator and the divergence with Awesome Oscillator. Now we can see all these conditions, but bullish reversal bar is still unconfirmed, while it's high is going to be broken, the danger will be melted, but now we still have a chance to go down.

Also wanna notice the false signals on the indicator. All of them are placed inside the range and cannot be counted as valid. Take it into account when use it.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

DOTUSDT at a Make-or-Break Level – Big Move Incoming?Yello, Paradisers! Is DOTUSDT on the verge of a breakout, or will the bears crush the momentum? Read on this is a critical moment!

💎#DOTUSDT is showing strong bullish momentum, bouncing off the demand zone above $4.582, signaling that buyers are stepping in and defending key levels. The market structure remains favorable for the bulls, but a crucial test is ahead.

💎The price is trading above both the 50 EMA and the 200 EMA, which is a strong indication that the uptrend is intact. Volume is increasing near demand zones, suggesting that buyers are actively supporting the price. This reinforces the strength of the trend, with green candles showing a strong buying push and minimal wicks, indicating low selling pressure.

💎If POLKADOT successfully breaks and holds above $5.00 with strong volume, the next upside target is $5.30, a major resistance zone. A decisive breakout here could open the door for an even stronger rally. However, if DOT fails to break $5.00 and retraces, the lower demand zone at $4.465 will be a key area to watch for a potential bullish rebound. A close below $4.215 would invalidate the bullish setup and shift momentum in favor of the bears.

Patience is key, Paradisers! If we see a confirmed breakout, we act. If not, we wait. Discipline is what separates traders from gamblers. Stay sharp and trade smart! 🎖

MyCryptoParadise

iFeel the success 🌴

Polkadot 8X Trade-Numbers (6,280% Potential)One is theory, the other one is practice.

One is the analysis and the other one the numbers.

Technical analysis and trading numbers.

Here we go again with Polkadot (DOTUSDT). This time around we are not focusing on the analysis but the full trade-numbers for a leveraged trade. Still, let's consider the chart briefly and what it has to say.

The black lines... Previously, the black lines showed the drop and the incoming bear-market. High prices and All-Time High = bearish. A long-term double-top, the highest ever, led to the strongest ever bear-market.

Now, the black lines signal support. The market bottom. All-Time Lows and bottom prices = bullish. A long-term accumulation phase with higher lows will kick off the next bullish market. We are in, we are live and we are green.

The market moves in cycles and within this cycles we have waves...

We are going from a neutral, sideways market to a bullish market. The neutral sideways market produces the same highs and the same lows. The bullish market will produce higher highs and higher lows. This is were we are going next.

Notice that we use lower targets for the leveraged trades compared to spot trades. This is because leverage carries higher risk. We are happy with a win and with big profits but not greedy. In this market, greed will get you killed. Financially speaking.

Full trade-numbers below:

____

LONG DOTUSDT

Leverage: 8X

Entry levels:

1) $4.60

2) $4.30

3) $4.40

Targets:

1) $4.92

2) $5.62

3) $6.77

4) $7.70

5) $8.63

6) $9.96

7) $11.6

8) $14.66

9) $16.52

10) $19.53

11) $21.68

12) $24.41

13) $32.30

14) $40.19

Stop-loss:

Close weekly below $4.00

Potential profits: 6280%

Capital allocation: 4%

____

Disclaimer: I love you and I am deeply grateful for your continued support.

You are a diving human being, you can do whatever you want.

It is your life, it is your body, it is your money, it is your soul.

Trade, drink, eat, sleep; it is your choice.

Namaste.

DOT in accumulation zone!Hello followers and haters,

I figured out that almost everyone here hates longterm analysis so I will post another one.

We can see DOT once again in beautiful accumulation zone , zone where I personally started accumulating tokens in previous cycle and in this one as well.

We are looking to take some profits on the FIRST TP where we can expect anywhere from 1 00% to 200% depending on our average buy price.

Second TP will bring us anywhere from 300% to 350%.

If we however drop even lower (WHICH WOULD BE AMAZING) there is an ALL-IN zone where I will be looking to put more money on my buys.

My accumulation is buying some DOT every 2-3 days while we are in the zone.

I marked only 2 TP zones for and as we will move UP in the BULL RUN I will post updates on where my next TP zones are.

Hope this helps, play it smart and stay patience!

#DOT/USDT#DOT

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 4.50

Entry price 4.60

First target 4.72

Second target 4.85

Third target 4.99

Polkadot: Now It’s Crunch TimePolkadot has been unable to resist the widespread downturn in the altcoin sector, giving up much of its recent gains after a solid performance in recent days. Our grayed-out Target Zone for the low of the green wave is coming back into focus – though under our primary scenario, DOT shouldn’t fall much lower in the short term. If the coin drops below the $3.80 support, however, a new bear market low in our orange Target Zone between $2.40 and $1.07 will be on the horizon. In this 39% probable alternative scenario, the coin would erase all gains since the low in October 2023, implying a new bottom for the magenta wave alt. . In our primary scenario, we expect renewed buying pressure soon, which should allow the green wave to surpass the resistance at $5.38.

Bitcoin Finds Support, Relation 2 Altcoins Market & Bullish TalkBitcoin is trading right now between the 0.5 and 0.382 Fib. retracement levels relative to the last bullish wave. Let's dissect what this means.

The main levels are always 0.382 and 0.618 when it comes to Fibonacci retracements. The 0.5 level is also relevant and pairs tend to find support around this line.

Bitcoin broke the 0.382 Fib. level decisively but on very low volume.

Bitcoin failed to test 0.5 Fib. retracement level as support.

The fact that volume is low and 0.5 wasn't pierced works in favors of the bulls.

Notice that 0.618, the golden ratio, is not even in question. This is because the market is ultra-bullish. When the market is bullish, a reversal tends to happen at 0.382 or above 0.618. The fact that Bitcoin stopped its fall above this major support is good news for the bulls. This is good for those that are trading Bitcoin LONG. Just hold patiently because prices will recover and Bitcoin will grow. Not only grow but massive growth.

Signals continue to develop from the Altcoins market, today is not the same as yesterday, today we have a continuation on many, many big and small pairs.

At first, it would be doubtful to trust the signals that I am showing because the action was young in some cases, in other cases it was weak and small. But this isn't the case anymore.

Very big projects such as Aptos, Bitcoin Cash, Litecoin, Polkadot, Zcash and Maker are only a few of the many examples I've been showing you. This is enough to know, confirm and trust that the bottom is already in, the Altcoins market is going up. The only way the Altcoins can grow is if Bitcoin is also going to grow. The Altcoins never move up while Bitcoin is bearish. Seeing an Altcoin growing 100%+ in a single day means that the bears are weak while the bulls are strong. We are experiencing the final-final flush before a major, massive, incredibly, hyper, uber-rich Cryptocurrency market bull-run.

So support is good and support is really strong. The 0.5 Fib. retracement level sits at $79,000 but this level wasn't hit. Bitcoin bottomed before hitting $82,000 but some people are saying lower and this is where confusion comes.

I understand that we have many great traders and market analysts. TradingView is truly the best place in the world (Internet) for trading, learning, growing and sharing about financial markets and charts. But these same markets and charts can't lie. We can interpret some signals in a way that is detached from reality but the market is never wrong. Whatever is about to happen, it is clearly revealed when we look at the charts.

FIOUSDT is another pair that is breaking up just too strong after a higher low. The low being 3-February and the higher low a few days ago (25-Feb). This is just another confirmation that the correction is over; we (Bitcoin) are going up next.

It is great to be part of this market and this community.

It is such a blessing to have access this kind of knowledge and information. Because I can read this now I can rest easy and be calm. I know that regardless of what happens, Bitcoin is going up.

Bitcoin isn't going up in years to come, nor in the future far away. Bitcoin is set to grow, together with the Altcoins market, in a matter of days.

Are you ready for the 2025 bull-market?

Thank you.

Your continued support is appreciated.

We are winners and will continue to win regardless of what is takes.

We will pour our hearts, our sweat and our blood into what we do and trust. If today I make the right decision, tomorrow I am taking a big bag of money home.

The Cryptocurrency market is changing (saving) the world.

The money monopoly is over.

Money used to mean bondage, now, money is freedom.

Namaste.

DOT/USDT Technical Analysis – Potential Breakout Ahead🔹 Asset: Polkadot (DOT/USDT)

🔹 Timeframe: 1D (Daily)

🔹 Exchange: Bybit

📊 Market Overview:

DOT/USDT has been trading within a well-defined descending parallel channel, indicating a prolonged downtrend. However, recent price action suggests a potential trend reversal fueled by bullish signals.

📈 Key Technical Factors:

✅ Break of Structure (BOS): The price has started to break key structural levels, signaling an early shift in momentum.

✅ Strong Hammer Candle Formation: A bullish hammer appeared at the lower boundary of the channel, indicating buying pressure and potential bottoming out.

✅ Mini & Major Change of Character (ChoCH): A breakout above the mini ChoCH ($6.00) would confirm an early bullish reversal, while a move above the major ChoCH ($7.00) would solidify the bullish trend.

🎯 Potential Trade Setup:

Bullish Scenario: If DOT/USDT breaks out of the descending channel and successfully flips resistance into support (~$6.00), it could push towards $7.00 - $9.00 in the coming weeks.

Bearish Scenario: If the price fails to break out and gets rejected at resistance, we may see a retest of the lower levels (~$4.00 - $4.50) before a stronger move.

🔥 Conclusion:

DOT/USDT is showing promising signs of a trend reversal, but confirmation is needed above key levels. Watch for breakout confirmation and volume surge to support the bullish momentum.

🔔 Stay updated & manage risk accordingly! 🚀

#DOT #Polkadot #Crypto #Trading #TechnicalAnalysis

DOT/USDT 4H chart reviewHello everyone, let's look at the 4H Dot chart to USDT, in this situation we can see how the price moves in the local growth trend channel. However, let's start by defining goals for the near future the price must face:

T1 = $ 4.93

T2 = $ 5.40

Т3 = $ 5.87

T4 = $ 6.18

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 4.65 $

SL2 = 4.19 $

SL3 = $ 3,74

SL4 = $ 3.39

Looking at the RSI indicator, you can see the traffic above the upper limit of the range in the place where the price relief could be observed earlier.

PolkaDot DOT Needs To Crash More Hello, Skyrexians!

As you know, globally we are very bullish on BINANCE:DOTUSDT and our previous analysis on the weekly time frame is still valid, but locally it still has not reached the bottom. Current value of fear and greed index is extreme fear and it will not allow DOT to drop immediately, some bounce is anticipated, but after that bears can take control again.

Let's take a look at the daily chart. We can suggest you this Elliott waves counting, may be it's not 100% correct, but the only one thing we need to know. The drop, which we have seen on February 3 was the wave 3 according to minimum Awesome Oscillator value. While it has not crossed zero line price is in wave 4. Yesterday we had a chance to finish this night mare, but price is pumping again and it looks like it's going to reach $5.50 max and then continue printing wave 5 to the final target $1.9-$3.2. The key points for reversal is the appearing of green dot on Bullihs/Bearish Reversal Bar Indicator and divergence on AO.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

DOT Eyes 170% Breakout as Nasdaq Sets to List Grayscale PolkadotPolkadot (DOT) is on the verge of a massive breakout as institutional interest in altcoin-based exchange-traded funds (ETFs) gains momentum. With Nasdaq officially submitting a filing to the U.S. Securities and Exchange Commission (SEC) to list and trade shares of the Grayscale Polkadot Trust (DOT), the stage is set for DOT to witness significant capital inflows, potentially driving a 170% rally.

Nasdaq Files to List Grayscale Polkadot ETF

The cryptocurrency investment landscape is undergoing a major shift as traditional financial institutions increasingly embrace digital assets. In a recent filing, Nasdaq submitted Form 19b-4 to the SEC, requesting approval to list and trade shares of the Grayscale Polkadot Trust. If approved, this move will provide investors with a regulated and institutional-grade avenue to gain exposure to DOT.

Grayscale Investments, the asset management firm behind the proposed ETF, has been aggressively expanding its crypto product offerings. Alongside the Polkadot ETF, the firm has filed for a spot Cardano ETF and an XRP Trust conversion. Other potential digital asset ETFs, including those tracking Solana (SOL), Dogecoin (DOGE), and Litecoin (LTC), are also being considered.

This filing follows a broader trend of growing institutional interest in crypto ETFs. In late January, asset manager 21Shares also applied for a spot Polkadot ETF, signaling heightened confidence in DOT’s long-term potential. The SEC now has 45 days to review Nasdaq’s application, after which it can approve, deny, or extend the decision-making process.

Technical Indicators Signal a 170% DOT Breakout

As of the time of writing, Polkadot is trading at $4.40, up 1.4% on the day. The technical outlook for DOT presents a highly bullish scenario, with the asset forming a textbook falling wedge pattern—a historically reliable setup that has preceded major upward price movements.

A closer examination of DOT’s price action reveals striking similarities to its March 2024 trading pattern, where the token surged 170% following a breakout from a similar wedge formation. Historically, DOT has exhibited a strong tendency to rally after breaking out of falling wedge patterns, making this a key inflection point for traders.

Momentum indicators further reinforce the bullish outlook. DOT’s Relative Strength Index (RSI) currently sits at 37, indicating that the asset remains in oversold territory with significant upside potential. With buyer accumulation increasing and selling pressure waning, DOT appears poised to capitalize on this dip before an explosive breakout takes place.