Double Top

EUR/JPY – Double Top with RSI Divergence (Bearish Setup)Technical Analysis (Short Trade Idea)

EUR/JPY is forming a textbook double top pattern with notable bearish signals:

First top: 173.242

S econd top: 173.111 (lower high, indicating weakening bullish pressure)

Neckline: 171.650 – key support level, potential breakdown trigger

RSI divergence: Bearish divergence observed as RSI prints lower highs while price forms nearly equal tops, signaling momentum loss

This structure suggests a potential reversal from recent highs. A short opportunity may arise if price breaks below the neckline at 171.650 with confirmation.

Trade Setup

Sell Stop: 171.650

Stop Loss: 173.148

Take Profit 1: 170.180

Take Profit 2: 168.642

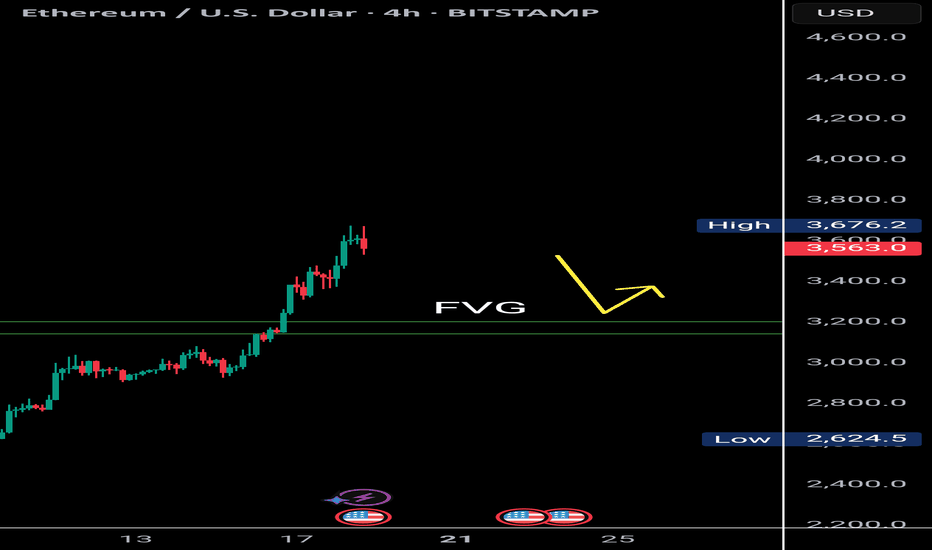

$Eth Faces Double Top Resistance with Bearish RSI DivergenceETH/USDT | 4H Analysis

Ethereum is currently showing signs of weakness on the 4H chart, forming a potential double top pattern around the $3,700-$3,680 range.

Adding to this, the RSI is exhibiting bearish divergence, suggesting that bullish momentum is fading. There's a visible liquidity gap between $3,200–$3,180, which might act as a magnet in the short term. A retest of this zone is likely before ETH attempts to resume its upward move.

Key Observations:

🟠 Double top structure on 4H chart

🔻 Bearish RSI divergence

🕳️ Favorable gap: $3,200 – $3,180

🔁 Watch for price reaction after retest

⚠️ If ETH holds the $3,180 support after filling the gap, a bullish bounce toward higher levels could follow.

📌 This idea is for educational purposes. Trade wisely with proper risk management.

Ethereum - This structure decides everything!Ethereum - CRYPTO:ETHUSD - trades at a key structure:

(click chart above to see the in depth analysis👆🏻)

After Ethereum retested the previous all time high in the end of 2024, we saw quite a harsh move lower. This move was followed by an expected recovery, however Ethereum is still trading below a key structure. Either move is still possible and will shape the future of Ethereum.

Levels to watch: $2.500, $4.000

Keep your long term vision!

Philip (BasicTrading)

How to Trade Double Tops & Bottoms in TradingViewLearn how to identify, validate, and trade double top and double bottom reversal patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Understanding these classic chart formations can help you spot potential trend reversals and capitalize on contrarian trading opportunities in the futures markets.

What You'll Learn:

• Understanding contrarian vs. continuation trading strategies and when to use each approach

• The psychology behind buying low and selling high through reversal pattern trading

• How to identify double top and double bottom formations on any timeframe

• Key characteristics of valid double tops and bottoms, including volume confirmation

• Using TradingView's XABCD pattern tool to validate potential double top/bottom setups

• Real-world example analysis using crude oil futures charts

• Risk management techniques for trading reversal patterns

• How to calculate appropriate entry points, stop losses, and profit targets

• Setting up 1:1 risk-reward ratios for mathematical trading edge

• Understanding win rate requirements for profitable pattern trading

• How double bottom patterns work as the inverse of double top formations

This tutorial may benefit futures traders, swing traders, and technical analysts interested in contrarian trading strategies and reversal pattern recognition. The concepts covered could help you identify potential turning points in market trends and develop systematic approaches to trading these classic chart formations.

Visit Optimus Futures to learn more about trading futures with TradingView: optimusfutures.com/Platforms/TradingView.php

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

BTC Pullback or Breakout? Key Levels to Watch Around 110KBitcoin is showing repeated rejections from the $110K and $108K zones. Currently, it's moving upward from the $98K area toward resistance, but price action remains compressed between the major trendline support and resistance.

This range-bound structure suggests that a pullback may be imminent, especially as RSI is forming consistent bearish divergence and the MACD is signaling weakness. A liquidity sweep to the downside could occur before a decisive move.

However, if BTC manages to break above the converging trendlines with strong volume, we may see a move toward $110K again for a retest. Watch $106K as an intermediate support. If that fails, further downside may follow.

📌 Trading Insight: Wait for confirmation before entering — don’t jump in without a clear signal.

Bitcoin - We have to see new highs now!Bitcoin - CRYPTO:BTCUSD - is now at the previous highs:

(click chart above to see the in depth analysis👆🏻)

It could really not be more exciting on Bitcoin at the moment. With the current "all or nothing" potential breakout or double top creation, we will either see a bullrun or a bear market. So far, bulls are still strong, so the chances of a breakout luckily remain higher.

Levels to watch: $100.000

Keep your long term vision!

Philip (BasicTrading)

#Btc Breakdown Begins: Double Top + Iran-Israel Tensions = CrBitcoin has clearly formed a double top pattern and is currently hanging near the critical 100K support. If this level breaks, we may first see a fall to 90K, followed by a deeper decline toward 73.5K. If that too fails to hold, the market could slide drastically to 64K–45K zones. The pattern indicates Bitcoin is exiting the distribution phase, with profit booking at aggressive levels.

The Iran-Israel conflict, intensified by U.S. involvement, has triggered panic and short positions across the market. This is a high-risk environment, and long entries could be dangerous right now. Caution is advised — we are entering a potentially sharp correction phase.

IHSG / COMPOSITE (IDX) DAILY CHART DOUBLE TOP DETECTEDIHSG going to close the gap at 65xx.. (first gap).

the worst case IHSG will close the 2nd gap (61xx) << Mostly happened.

after that we hope IHSG will start to Bullish once more.

so just wait n see for now. After IHSG closing all the gap, we can start buying all the bluchip stock like banking sector (BBRI, BBCA, BMRI, BBNI).

SHOT ON EUR/USDEUR/USD Has given us a nice double top at a major resistance level.

Since then it has broken the neckline of that double bottom, creating a new low, engineering liquidity, sweeping it and now getting ready to tap into supply before it should fall.

The Dxy is also getting ready to rise from a demand level so this should also aid in pushing EU down.

Looking to catch over 200 pips.

#BTC Double Top Breakdown? Key Levels to Watch: 100K, 92K, 74Bitcoin has recently formed a double top pattern near its all-time high at $112K–$110K, signaling potential exhaustion in the bullish momentum. After a strong rejection from the $106K resistance — a critical zone that has historically failed to close above on the daily timeframe — BTC is showing increasing bearish pressure.

All major indicators — RSI, MACD, and Stochastic RSI — are aligning to confirm this potential downtrend.

Here’s the projected bearish scenario if key supports break:

A break below $100K could trigger a fall to $97K, followed by a bounce and retest.

Rejection from $100K again may lead to a drop toward $92K.

Failure to reclaim $95K–$90K could send BTC directly down to $88K.

Another failed attempt near $90K might push Bitcoin to crash toward $74K, echoing the 2024 summer correction pattern.

This setup mirrors past seasonal moves and could mark a significant shift in market structure if confirmed.

📉 Watch these key zones:

$106K – Major resistance

$100K – Psychological and structural support

$92K / $88K / $74K – Potential targets if bearish continuation plays out

⚠️ Stay alert for retests and confirmations before entries.

A Follow up to: “Adjustments for Better Readings & VSA vs BTC"When a trend approaches its end, we typically observe the formation of a buying or selling climax. That was certainly the case during Wyckoff’s era. Everything he described—market manipulation, signals, footprints—remains relevant today. But you know what that also means: if it's out there, it’s old news.

Yes, this is still happening, but we need to acknowledge that this information is no longer exclusive. And when a method becomes well-known—especially among retail traders—it can be used against them. Wyckoff himself hinted at this: the manipulators can and do use these same technical patterns to deceive. His real message?

“Keep an open mind.”

📉 In our current BTC chart, we’re seeing a textbook example of potential manipulation. A selling climax is visible—normally a sign of trend exhaustion and a bullish reversal. But is that really the case here? Did the downtrend truly end?

On the 1-Hour timeframe, both the RSI and volume indicators suggest otherwise: a bearish continuation seems more likely.

🧱 We're also witnessing a real-time formation of a Double Top pattern, taking shape since June 6. Measured by body candle spreads (excluding wicks), we observe four touches within a key price rectangle. These align with a known candlestick pattern: the Tweezer Top, commonly associated with bearish reversals.

What’s more, all of this is happening within a supply zone—actually three marked zones on the chart. The most recent zone shows signs of offloading pressure, amplified by both the Double Top and bearish candlestick formations.

And I haven’t even touched on the rejection wicks or how bearish volume spikes are gaining strength. That’s where the principle of Effort vs. Result comes in—remember, nothing in the market is free.

📊 In line with our past two posts, note how price action (PA) shows equal highs while RSI diverges, reinforcing earlier signals. The signs are stacking up.

So, the critical question now is:

Are we heading below the $100.718 level for a confirmed Head & Shoulders pattern?

Or is this just a retest before another move?

If this way of reading the market resonates with you and you want to go deeper—whether it’s building confidence or spotting signals before they play out—I work with a small circle of traders sharing TA privately on a daily basis. Feel free to reach out.

Till next time be well and trade wisely!

Double Reject @ March Resistance Spells Good News For GJ BearsOANDA:GBPJPY struggles to reach Higher Prices then that of the High created on March 27th and leads me to believe we could see a Double Top Pattern in the making!

Confirmation of the Pattern will come when:

1) Price declines back to 191.877

&

2) Makes a Breakout of the Confirmation

Once the Pattern is Confirmed and Breakout is Validated:

- This should deliver great Short opportunities as a Double Top Breakout & Retest Set-up!

Silver Double Top at Major Resistance – Bearish Breakdown📌 Overview:

This chart shows a classic Double Top Pattern forming on the weekly timeframe for Silver (XAG/USD). Price has reached a multi-year resistance zone and failed to break above it twice, signaling potential exhaustion of bullish momentum and the possibility of a larger trend reversal.

🧩 Detailed Pattern Breakdown:

🔹 1. Double Top Pattern

The double top is one of the most reliable bearish reversal patterns, formed when the market tests a resistance level twice and fails to break it, creating two rounded or sharp peaks. In this case:

Top 1 and Top 2 occurred near the $35–36 zone, clearly marked as a major resistance level.

This indicates strong selling pressure from that zone.

🔹 2. Major Resistance Zone

The $35–36 price range has historically acted as a ceiling for Silver prices. It rejected price several times between 2021 and 2025. When this kind of level holds, it often precedes sharp corrections, especially when volume begins to drop and momentum weakens.

🔹 3. Rising Trendline Break

After forming the double top, price broke down through a key ascending trendline, a sign that the bulls are losing control. The breakdown is further confirmed by a strong bearish candle, closing below both the trendline and a critical SR (Support-Resistance) Interchange zone.

🔹 4. Retesting in Progress

Post-breakdown, the price action is now retesting the broken trendline and horizontal zone (~$28). This is a crucial moment:

If Silver gets rejected here, it confirms the bearish breakout and signals entry for sellers.

If it reclaims this level, the bearish setup could fail, and price might consolidate or resume uptrend.

🔹 5. SR - Interchange Zone

This zone is marked because it acted as resistance during the 2022-2023 period, and then flipped into support in 2024. Currently, it’s being tested from below, making it an SR flip retest. These zones often become inflection points.

🔹 6. Black Mind Curve Support

An important and unique addition is the “Black Mind Curve Support” – a curved dynamic trendline that has historically aligned with price retracements. The projected path shows that the curve and horizontal support (~$22.68) intersect, strengthening the significance of that level.

🔹 7. Measured Move & Target

Based on the height of the Double Top pattern (approx. $10 range from top to neckline), the measured move places the target near $22.68, which matches both:

Historical demand zone

Curve support

This alignment makes $22.68 a realistic and strong downside target.

🧭 Strategic Summary:

Pattern Type: Double Top (Bearish Reversal)

Key Resistance: $35–36 (Multi-year rejection level)

Trendline: Broken (Bearish confirmation)

Retesting Area: $28–29 zone (Watch for rejection)

Downside Target: $22.68 (Confluence of support zones)

Invalidation: Clean weekly close above $35

🔍 What Traders Should Watch:

✅ Bearish Candlestick Confirmation at the retest zone (e.g. bearish engulfing, shooting star).

✅ Increased volume on drop, confirming participation by larger players.

🚫 Invalidation signal would be a sustained move and close back above the resistance zone.

⚖️ Risk Management Tip:

This pattern offers a high risk-to-reward ratio trade setup. Short entries on the retest with stop loss above $36 can provide substantial downside potential toward $22–23, especially in a commodity market prone to sharp retracements.

📌 Final Thoughts:

Silver appears to be forming a clean double top reversal at a long-term resistance. If the current retest fails, a significant correction may follow, targeting the $22.68 level. This pattern, combined with key support-resistance dynamics and psychological zones, makes this setup worth monitoring for medium- to long-term traders.

BTC/USD Bearish Setup – Trendline Retest Before the Fall?🔍 Technical Breakdown – BTC/USD 3H Timeframe

Bitcoin is displaying a textbook Double Top pattern formation on the 3-hour chart, signaling a potential bearish reversal after a strong bullish run. This classic pattern suggests buyer exhaustion and sets the stage for a downward move. Let's break down the analysis:

🧠 Pattern Insight: Double Top Reversal

A Double Top is one of the most reliable trend reversal patterns, especially when it forms after a sustained uptrend — just like we're seeing here.

Top 1 and Top 2 both formed inside a strong Resistance Zone between $106,500 and $107,000, showing repeated rejection from buyers to push price higher.

The formation of lower highs and long wicks near Top 2 further reinforce the weakening bullish momentum.

💥 Neckline Breakdown & Bearish Trigger

The Neckline, aligned with a horizontal Support Zone (~$103,300–$103,800), was decisively broken, confirming the pattern.

This breakdown acts as the trigger for bearish entries, and we are now in the "Retest Phase", where price often pulls back to the neckline or a nearby trendline before continuing lower.

📐 Trendline Confluence – Retest Opportunity

A short-term descending trendline drawn from Top 2 intersects near the neckline zone.

Price is now approaching this confluence area, offering a potential high-probability short entry if bearish price action confirms (e.g., a rejection candle like a bearish engulfing or pin bar).

🎯 Price Targets & Trade Setup

Parameter Value

📍 Entry On bearish confirmation near neckline/trendline retest (~$105,300)

❌ Stop Loss (SL) Above recent swing high / Top 2 (~$107,100)

🎯 Target ~$97,126 (based on measured move from top to neckline projection)

⚖️ Risk:Reward Approx. 1:3 or better (depending on entry timing)

Measured Target Calculation:

Height from neckline to peak (~$107,000 - $103,500 = $3,500)

Target = Neckline break - height = ~$103,500 - $3,500 = $97,000–$97,100

🔥 Market Context & Psychological Edge

This chart structure reflects a shift in market sentiment. What was once strong bullish momentum is now hesitating — with buyers failing to make higher highs and sellers stepping in aggressively. The double top is not just a pattern, it's a narrative of exhaustion and reversal.

“Let price confirm your bias. Don't just predict; react to structure and behavior.”

Being patient and letting the retest play out is crucial. Don’t rush in early — let the market give you a clean signal. This is where technical discipline pays off.

⚠️ Risk Management Notes

Crypto markets are highly volatile — avoid oversized positions.

A failed double top can lead to a bullish continuation, so SL discipline is key.

Wait for confirmation — candlestick patterns, momentum shifts, or bearish volume spikes can add confidence.

📌 Summary

✅ Pattern: Double Top

✅ Confirmation: Neckline Break

🔄 Current Phase: Retesting Neckline/Trendline

📉 Bias: Bearish

🎯 Target: ~$97,100

❗ SL: Above Top 2

💬 What do you think? Are we headed to GETTEX:97K or is this just a fakeout? Drop your thoughts below and don’t forget to like and follow for more trade setups!

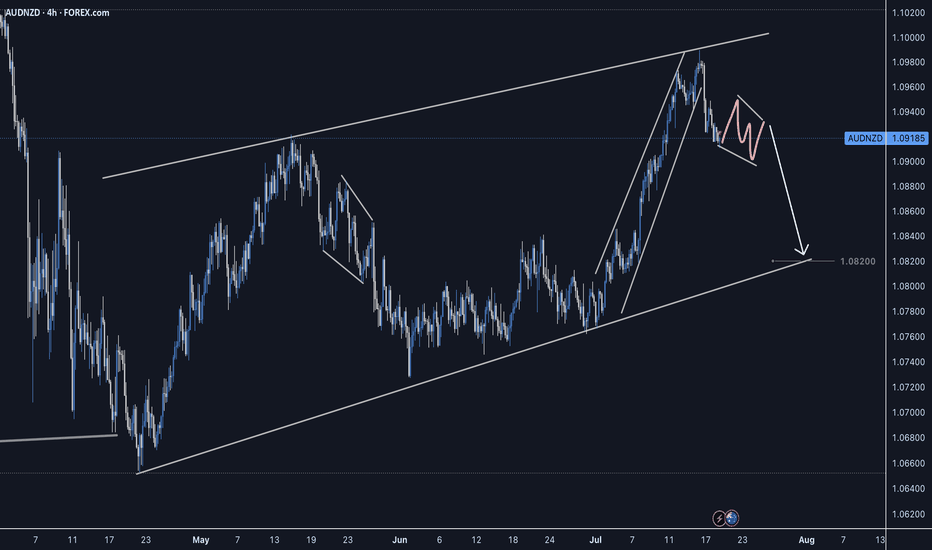

GBP-AUD Double Top Pattern! Sell!

Hello,Traders!

GBP-AUD made a retest

Of the horizontal resistance

Level of 2.0820, then

Established a double-top

Pattern and is now going

Down so we are locally

Bearish biased which

Means that we will be

Expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$BTC Double Top Pattern Forming – Is a Major Correction Bitcoin Double Top Formation Alert!

Currently, CRYPTOCAP:BTC appears to be forming a Double Top pattern on the 4H chart. If this candle closes as an Inverted Hammer, it may confirm a bearish reversal from the overbought zone.

Key Levels to Watch:

Immediate Support: $96,500 – $95,000

Critical Support: $94,000

Major Breakdown Levels:

If $94K breaks, next support is at $91,000

A deeper breakdown could target $80,000 or even $60,000

This correction could present a golden long opportunity for the next bullish leg. Stay patient, observe confirmations, and plan your entries wisely.

XAUUSD Double Top Breakdown & Target – Bearish Reversal in Play?In today’s analysis, we focus on Silver (XAG/USD) on the daily timeframe, which is currently presenting a high-probability bearish reversal setup. The price action has completed a Double Top pattern — a classic reversal formation — and has broken down below its neckline support, signaling a potential shift in momentum from bullish to bearish.

This chart setup is particularly valuable for swing traders, pattern traders, and anyone seeking to anticipate mid-term directional moves in the commodities market.

📐 Technical Breakdown:

🔷 1. Double Top Formation:

The Double Top pattern forms after a sustained uptrend and is identified by two peaks at nearly the same level.

In this case:

Top 1 formed near $35.5.

Top 2 retested the same zone but failed to break above.

The neckline support — drawn across the $28 zone — was eventually broken.

This price action confirms the classic M-shaped structure, signaling distribution and potential bearish continuation.

🔷 2. Neckline and Breakdown:

After failing at Top 2, price dropped below the neckline, breaking critical horizontal support.

This move completed the pattern, triggering many technical sell signals.

Price is now retesting the neckline zone, a common phenomenon where broken support becomes resistance (known as a "retest").

This retest offers a textbook short opportunity if bearish confirmation follows.

🔷 3. Curve Resistance:

The upper curved blue line represents dynamic resistance.

It has successfully capped price action across multiple attempts and aligns with the pattern's second top — enhancing the strength of this rejection area.

🧱 Support & Resistance Zones:

Resistance Zone: $34.50–$35.50

Strong resistance from both peaks (Top 1 & Top 2) and historical sellers.

Neckline / Retest Zone: ~$28.00

Now acting as resistance — this is the critical level to watch for rejection or breakout.

Support Zones / Take-Profit Levels:

TP1: ~$26.40 — aligns with recent horizontal structure and minor support.

TP2: ~$22.58 — matches major historical support and measured move projection from the Double Top pattern.

📉 Measured Move Target (Pattern Projection):

To calculate the target from a Double Top:

Measure the height from top to neckline.

Project that downward from the neckline’s breakout point.

In this case:

Height: ~$35.5 – $28 = $7.5

Breakdown point: $28 – $7.5 = Target near $20.5–22.5

The TP2 at $22.58 matches this logic — further validating the downside potential.

🔄 Market Psychology & Sentiment:

This pattern reflects a shift in sentiment:

Bulls tried and failed twice to push through resistance.

The eventual breakdown shows bearish conviction, and the ongoing retest represents a decision point.

If sellers hold this level, we could see a cascade of downside pressure as stops are triggered and momentum builds.

🛠️ Trade Setup & Scenarios:

📌 Scenario 1 – Bearish Continuation (High Probability):

If price fails to reclaim the neckline (now resistance) and forms bearish confirmation (e.g., engulfing candle, rejection wick, breakdown below $31), this confirms a likely move toward TP1 and TP2.

Entry Idea: Short on rejection from the $28–$29 zone

Stop-Loss: Above $30

TP1: $26.40

TP2: $22.58

📌 Scenario 2 – Invalidated Pattern:

If bulls push price back above the neckline ($29–$30 zone) with strong volume and daily close, this invalidates the setup and may lead to:

Bullish continuation toward $32–$34

Possible trend resumption if curve resistance breaks

🧠 Educational Notes:

Double Tops are most reliable when:

Formed at the top of strong uptrends.

Followed by a neckline break with volume.

Retested with rejection.

The retest phase is often the best risk/reward entry because:

It confirms resistance.

Offers clear invalidation levels.

Keeps your stop tight while targeting deeper moves.

📢 Final Thoughts:

Silver is currently at a critical technical juncture. The Double Top breakdown has played out, and now all eyes are on the retest. If bears defend the neckline, this setup provides a strong case for continued downside, offering a clean structure with well-defined targets.

⚠️ Risk Management is crucial — always manage your position size and respect invalidation zones.

GOLD → Correction ahead of news. Will the decline resume?FX:XAUUSD has been buying back all the losses from the Asian and Pacific sessions since the opening of the European session, but this looks more like a catapult being loaded...

GOLD broke through the global consolidation base of 3200, which only confirmed the bearish market structure. Investors are waiting for PPI and retail sales data in the US, as well as Fed Chair Powell's speech.

Expectations of fewer Fed rate cuts and optimism surrounding trade talks with China and South Korea continue to weigh on gold. However, weak macro data and a growing US budget deficit could revive interest in this safe-haven asset.

GOLD is in a correction phase and is heading towards the zone of interest: the liquidity zone and previously broken support of global consolidation.

Resistance levels: 3187-3190, 3200

Support levels: 3123, 3100

Gold may test the indicated resistance, but based on the nature of the market, this situation may end in a false breakout and a fall. Target 3123 - 3100.

However, unpredictable data may temporarily change the market, which could lead to momentum towards 3220-3230.

Best regards, R. Linda!