GBPUSD is Forming a Weekly Double Top!!!Hey Traders!

In today's session, we're closely watching GBPUSD for a potential short setup around the 1.34200 level.

The pair is currently forming a double top pattern on the weekly timeframe, a classic reversal signal. Price action is showing signs of rejection at the neckline, suggesting possible downside momentum from this key resistance zone.

Trade safe, Joe.

Double Top

SHORT ON AUD/USDAUD/USD has given us a double top at a major resistance area/zone.

It has currently formed a lower high after giving us a change of character (choc) to the downside.

I expect price to drop to the next demand level for 200-300 pips.

Dxy News for the rest of the week should help fuel the move if positive for the dollar.

XRP/USDT I Reverse Short Squeeze Alert! Resistance at 2 USDTHey Traders after the success of my Previous trade this month on NASDAQ:HOOD hitting Target 1 & 2 in 2 days more than 16%+

With a Similar Trade setup But Crypto I bring you today

BINANCE:XRPUSDT

Short opportunity

- Market structure

- Head and shoulder pattern

- Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal which is taking place as we speak- 4 Hour TF.

- Breakdown and retest

- Risk Aversion Dynamics in Cryptocurrency Markets

PROTIP/-

Entry on Bearish candle stick pattern on Current Levels

Stop Loss : 2.2292

Target 1 : 1.4707

Target 2 : 1.0507

Technical View

The orange circle marks a double top within the supply zone, acting as the shoulders of a larger head and shoulders pattern, suggesting strong resistance.

Bearish Trendline

breakdown + Retest

Risk Aversion Dynamics in Cryptocurrency Markets

Fundamental View - How Current Affairs can effect this pair!

The proposed imposition of significant tariffs, such as the 60% levy on Chinese imports suggested by former U.S. President Donald Trump, could trigger a chain reaction across global markets. This scenario would likely amplify risk aversion among investors, potentially catalyzing a sell-off in risk-sensitive assets like XRP (Ripple) in favor of perceived safe havens such as the U.S. dollar (and by extension, Tether/USDT). Below, we analyze the mechanics of this relationship and its implications for the XRP/USDT trading pair.

1. Tariff Escalation and Its Macroeconomic Consequences

1.1 Direct Impact on China’s Economy

A 60% tariff on Chinese exports to the U.S. would directly reduce China’s export competitiveness, potentially lowering its GDP growth by 1.5–2.5 percentage points annually, according to UBS economists. This slowdown would exacerbate existing vulnerabilities in China’s economy, including a property market crisis, weak domestic demand, and deflationary pressures (June 2024 CPI: 0.2% YoY). Reduced economic activity in China—the world’s second-largest economy—could dampen global trade volumes and commodity prices, indirectly affecting risk sentiment in financial markets.

1.2 Global Spillover Effects

The UBS analysis highlights that retaliatory measures by China or other nations could amplify trade fragmentation, further destabilizing supply chains and corporate earnings. For example, the April 2025 announcement of 25% U.S. tariffs on automotive imports triggered a 2.9% drop in the S&P 500 and a 5–7% decline in major Asian equity indices. Such volatility often precedes broader risk aversion, as investors reassess exposure to growth-dependent assets.

2. Risk Aversion Dynamics in Cryptocurrency Markets

2.1 Flight to Safety and USD Appreciation

During periods of economic uncertainty, capital typically flows into safe-haven assets like U.S. Treasuries and the dollar. Tether (USDT), a stable coin pegged 1:1 to the USD, often benefits from this dynamic as crypto traders seek stability. For instance, Bitcoin’s role as a “weak safe haven” for the USD in acute crises suggests that stable coins like USDT could see increased demand during tariff-induced turmoil, while altcoins like XRP face selling pressure.

2.2 XRP’s Sensitivity to Risk Sentiment

XRP, unlike Bitcoin, lacks established safe-haven credentials. Its price action in Q2 2025 exemplifies this vulnerability: a 7.5% decline over 30 days (peaking at 2.57 USDT on March 19 and bottoming at 1.64 USDT on April 7). This volatility aligns with broader patterns where altcoins underperform during risk-off periods. A global slowdown would likely intensify this trend, as retail and institutional investors reduce exposure to speculative crypto assets.

3. Mechanism: From Tariffs to XRP/USDT Price Decline

3.1 Investor Behavior in Risk-Off Environments

Tariff Announcements → Equity Market Sell-Off: The April 2025 auto tariffs caused a 6–7% drop in Asian equities, signaling growing risk aversion.

Liquidity Reallocation: Investors exit equities and crypto (including XRP) to hold cash or cash equivalents like USDT.

USD/USDT Demand Surge: Increased demand for USD lifts USDT’s relative value, pressuring XRP/USDT downward.

3.2 Technical and Fundamental Pressure on XRP

Supply-Demand Imbalance: As sellers dominate XRP markets, the token’s price in USDT terms declines. The 14.56% 90-day volatility in XRP/USDT suggests heightened sensitivity to macroeconomic shocks.

Liquidity Crunch: A broader crypto market downturn could reduce trading volumes, exacerbating price swings.

4. Historical Precedents and Limitations

4.1 Bitcoin’s Mixed Performance as a Hedge

While Bitcoin has shown limited safe-haven properties for the USD in short-term crises, its decoupling from altcoins like XRP during stress periods is well-documented. For example, Bitcoin’s 40% rebound post-COVID crash contrasted with XRP’s prolonged slump in 2020–2021.

4.2 Mitigating Factors

Stimulus Measures: If China implements aggressive fiscal stimulus, as UBS posits, a partial recovery in risk appetite could cushion XRP’s decline.

Crypto-Specific Catalysts: Regulatory clarity or Ripple-related developments (e.g., SEC case resolutions) could counteract macro-driven selling.

5. Conclusion: Bearish Outlook for XRP/USDT in Tariff Scenario

In a tariff-driven slowdown, the XRP/USDT pair faces downward pressure due to:

Risk Aversion: Capital rotation from crypto to stable coins.

USD Strength: USDT demand surges as a proxy for dollar safety.

Altcoin Underperformance: Historical precedent of XRP lagging during macro stress.

People interested should monitor China’s policy response and U.S. tariff implementation timelines, as these factors will determine the severity of XRP/USDT’s downside. A breach below the April 7 low of 1.64 USDT could signal prolonged bearish momentum.

This analysis synthesizes macroeconomic triggers, market psychology, and cryptocurrency-specific dynamics to outline a plausible pathway for XRP/USDT depreciation amid escalating trade tensions.

Not An Investment Advise

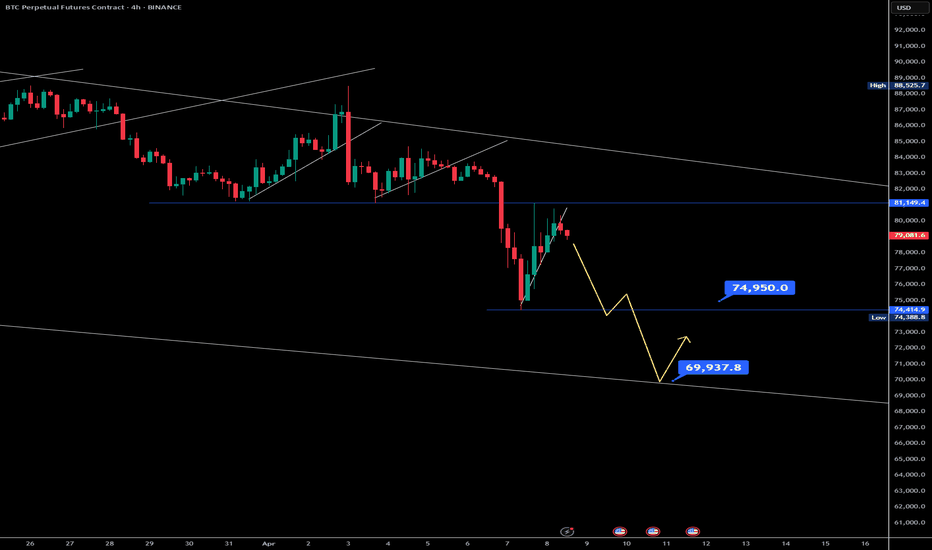

Bitcoin Double Top Signals Caution: Key Support Zones to WatchCRYPTOCAP:BTC previously formed a strong double bottom around the $74,500 level, which led to a bullish rally pushing the price up to a saturation zone near $86,000. However, current price action suggests a double top formation — a classic bearish reversal pattern. This aligns with RSI trendline rejection and signs of bearish divergence, reinforcing the bearish sentiment.

The key question: Is this a correction or the start of a deeper dump?

If BTC holds above $79,000, it may just be a healthy correction.

A breakdown below $79,000 brings the next support near $76,000 into focus.

If that fails, Bitcoin could revisit the $69,000 zone, which aligns with earlier consolidation.

Traders should monitor RSI closely and watch for reaction at the support zones. Opportunities exist for both short-term scalps and long-term positions near key levels.

Volume fades, double top forms – is Bitcoin headed to 70k?CRYPTOCAP:BTC is showing signs of exhaustion near the $83,500–$84,000 zone, with repeated rejections indicating weakening bullish momentum. Volume is steadily declining, which typically signals a lack of conviction from buyers.

We may be witnessing the formation of a potential double top – a bearish reversal pattern. If confirmed, this could trigger a correction toward $78K, $74K, or even the $70K–$68K zone.

Key Levels to Watch:

Resistance: $83,500–$84,000

Support: $78,000 → $74,000 → $70,000 → $68,000

This corrective move could be healthy for the market, potentially flushing out weak hands and injecting fresh liquidity for a stronger upward rally in the coming weeks.

''Altseason 2025''Welcome back dearest reader,

I will probably get alot of backlash from bitcoin maxi's for writing this post, i have read and heard it all by now. I'm not disregarding their opinion on bitcoin and i think it will do well, but not as well as some altcoins which i have monitored.

First the technical part:

~Bitcoin has seemingly formed a double top pattern with now on the weekly a gravestone doji (confirming this sunday). Looking at previous action from 2019 and 2020, these have been topping indicators and indicate a bearish reversal which in turn will be bullish for altcoins.

~ MFI --> massively overbought.

~ Stoch RSI --> nearly at 100! Screaming for a reversal.

Over the past months everyone seemed to think ''this is the top, only to see dominance rise further and alts bleeding''. It is possible that BTC.D doesn't correct immediately, but i do suspect an altseason to be really close.

Sentiment: When everyone... i mean EVERYONE is bearish. ''Alts to zero'', ''bitcoin is the only good coin'', ''Ethereum is dead''. This has historically been the perfect time to buy. And that time is now.

''But, there are over 13 million altcoins now!''

Yes this is true, i don't think all of them are going to do well, stick to the ones available on big exchanges. Those have 400 different ones on average. From those i have covered some allready which i think are going to do well, it's worth your time to look at those ideas.

Any questions?

Ask.

~Rustle

Bitcoin Bubble at $70K? Prepare for ImpactBitcoin recently faced strong rejection near the $81,000 level, forming a potential double top pattern on the higher timeframes. This classic bearish reversal setup is now playing out, as price action has begun to decline from the second peak.

Adding to the bearish confluence, the MACD has confirmed a bearish crossover, signaling weakening momentum and a potential trend reversal. The rejection at $81K aligns with historical resistance, and price has failed to break above it despite multiple attempts.

Going forward, there are two key scenarios to watch:

Retest of the $76,700 zone – A minor support area that could offer a bounce or consolidation before the next move.

Deeper pullback towards $70,000 – If bearish pressure continues, CRYPTOCAP:BTC could head lower to test this psychological and technical support level.

Dow Jones - Pivotal moment for the bulls and bears!The Dow Jones Industrial Average is currently approaching a critical juncture, as it risks breaking below and staying under the neckline of a potential double top pattern. A double top formation is typically a bearish signal, indicating a potential trend reversal after the price tests a key resistance level twice, failing to break higher. The neckline, which forms the base of this pattern, is the level that traders will be watching closely to determine the strength of this bearish signal.

If the Dow breaks below and stays under the neckline, it could trigger further downside momentum as liquidity is swept from the market. However, it's essential to note that this initial breakdown could just be a "liquidity sweep," a move designed to trigger stop-loss orders and shake out weaker hands. For the Dow to maintain its bullish potential, it must quickly recover and hold above the neckline after this sweep. If it can do so, the market may find stability and begin to look for higher prices again, as the double top formation would then be invalidated, and a more bullish outlook could emerge.

In summary, while the Dow Jones is at a pivotal moment, the key to higher prices will be whether it can hold above the neckline after sweeping liquidity. A failure to do so could signal further downside, but a strong recovery above the neckline would leave the door open for a potential rally.

For now the Dow jones swept the liquidity under the neckline. However, it needs a quick recovery to maintain and find support on the neckline again. The risk that it now faces is the resistance of the 50, 100 and 200-day MA. Staying above the neckline and reclaiming these MA could be a massive bullish signal on the Dow Jones.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Lets chat in the comment section. See you there :)

XAGUSD Weekly Analysis – Double Top Formation & Breakdown🧱 Chart Pattern Identified: Double Top Formation

The chart displays a classic Double Top pattern, a bearish reversal structure typically found at the end of an uptrend. This pattern forms when price reaches a resistance level twice, fails to break above it both times, and eventually breaks the neckline/support level, confirming a shift in market sentiment.

🔍 Key Components of the Chart:

1. Resistance Level (Tops) – ~$34.25

The market formed two significant peaks around the same level — labeled Top 1 and Top 2.

This level has proven strong resistance, as price was rejected both times after testing this zone.

This zone is marked with a light orange rectangle and a horizontal blue line labeled "Resistance Level".

2. Support Level (Neckline) – ~$28.80

This level served as the neckline of the Double Top.

After the second top, the price sharply declined and is currently approaching this key support zone, highlighted again in light orange.

A clean break and close below this zone on the weekly timeframe will be a strong confirmation of the bearish reversal.

3. Trendline Break – Bearish Shift in Momentum

A rising black dashed trendline supported the prior uptrend.

Price action has now broken below this trendline with strong bearish momentum, indicating that buyers have lost control.

This trendline break adds confluence to the bearish setup, supporting the validity of the pattern.

4. Bearish Projection Target – ~$22.47

The target is projected using the height of the Double Top pattern.

Measured from the resistance level ($34.25) to the support ($28.80), the vertical distance is ~5.45 USD.

Subtracting this from the neckline gives us a projected target:

28.80 - 5.45 = ~23.35 (rounded down to ~22.47 for technical cluster support).

This target area is marked with a blue arrow and labeled "Target" near the horizontal support at $22.47.

5. Stop Loss – ~$34.25

The logical invalidation point is placed just above the resistance zone and the second top.

A move above this level would invalidate the double top pattern, signaling that bulls have regained control.

📈 Price Action and Candlestick Behavior

The strong bearish weekly candle that broke below the trendline shows a decisive shift in sentiment.

The candle's large body and long range confirm institutional selling interest.

Volume (if shown) would likely support the move, but even price structure alone is highly telling here.

🎯 Trading Strategy & Setup

Component Details

Entry On a confirmed break and retest of $28.80 support (neckline)

Stop Loss Above $34.25 (Top 2)

Target $22.47

Risk/Reward ~1:2 or better

Timeframe Weekly (Swing Trade)

Bias Bearish

🧠 Concluding Notes

This chart provides a high-probability bearish setup rooted in classical charting principles. The Double Top is one of the most reliable reversal patterns, especially when:

Formed after a prolonged uptrend (as seen here),

Confirmed with a trendline break,

Followed by strong bearish momentum toward the neckline.

Traders should monitor the support zone around $28.80 closely for a potential breakdown. If confirmed, the target near $22.47 becomes a realistic medium-term objective.

How to Identify Double Top Formation - A Long-Haul Bear?How to identify double top formation?

Is the US market still forming this double top formation, or has the pattern already completed, signaling a deeper correction to come?

In this discussion, we will focus on the latter question: whether this bear is going to be a long-haul bear.

3 parts of today tutorial:

1. How to Identify Double Top Formation is completed technically?

2. How to cross reference to its related markets?

3. How do the fundamental developments confirm these technical studies?

E-mini Dow Jones Index Futures & Options

Ticker: YM

Minimum fluctuation:

1.00 index point = $5.00

Micro E-mini Dow Jones Index Futures

Ticker: MYM

Minimum fluctuation:

1.0 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

Detailed Analysis of Silver (XAG/USD) – Double Top BreakoutThe chart represents a technical analysis of Silver (XAG/USD) on the daily timeframe (1D). A Double Top pattern, one of the most reliable bearish reversal formations, is developing. This signals a potential downtrend, with key price levels and trendlines confirming weakness in bullish momentum. Below is a full breakdown of the pattern, price action, and trading setup.

1️⃣ Pattern Formation: Double Top – Bearish Reversal

A Double Top pattern occurs when the price reaches a resistance level twice, failing to break higher. It indicates a shift from a bullish trend to a bearish one.

🔹 Characteristics of the Double Top in This Chart:

First Peak (Top 1 - Resistance at ~$34.57):

The price made a strong move upward, reaching a high near $34.57.

Selling pressure at this level pushed the price downward, forming a support level near $30 (Neckline).

Pullback & Temporary Support (~$30 Neckline):

Buyers stepped in at the support zone, causing a bounce back towards resistance.

This level acted as strong demand, preventing further decline temporarily.

Second Peak (Top 2 - Rejection at Resistance Again):

Price attempted to break above the previous peak but failed.

This failure to form a higher high confirms the presence of strong sellers.

The second rejection strengthens the resistance level at $34.57, signaling exhaustion in buying momentum.

Break of the Trendline Support (Bearish Shift):

A previously ascending trendline (black dashed line) was providing support for the uptrend.

Price broke below this trendline, indicating a possible trend reversal from bullish to bearish.

2️⃣ Key Technical Levels & Trading Setup

🔸 Resistance Zone (~$34.57 - Stop Loss Area)

This is the major resistance level, tested twice and confirmed as a supply zone.

A move above $34.57 would invalidate the bearish pattern, making this an ideal stop-loss level.

🔹 Support Level / Neckline (~$30 - Breakdown Confirmation)

The neckline acts as a critical level. If the price breaks below $30, the Double Top formation is confirmed.

If the price retests this level from below and rejects (fails to reclaim it as support), it becomes a strong short entry signal.

🔻 Target Price (Projected Move - $23.01)

The target is based on the measured move rule of a Double Top:

Distance from resistance ($34.57) to neckline ($30) ≈ $4.57.

Projecting this same distance downward gives a target of ~$23.01.

This aligns with historical demand zones, increasing the probability of price reaching this level.

3️⃣ Trading Plan: Short Setup Execution

🔽 Short Entry (Breakdown Confirmation Below $30)

Ideal entry point is after the neckline breaks and confirms resistance upon a retest.

A breakdown with strong volume enhances the validity of the setup.

🚨 Stop Loss Placement (Above $34.57 Resistance Level)

Placing a stop above the second peak ($34.57) ensures protection against invalidation.

If price moves back above this level, the pattern fails, indicating a potential return to bullish momentum.

🎯 Target Price ($23.01) – Measured Move Projection

The price target aligns with the pattern structure and historical support levels.

Traders can take partial profits at intermediary levels ($27–$26) before full target realization.

4️⃣ Additional Confirmation Factors – Confluence for Bearish Bias

1️⃣ Momentum Indicators: RSI & MACD Bearish Signals

If RSI (Relative Strength Index) drops below 50, it confirms weakening bullish momentum.

A MACD bearish crossover (signal line crossing below the MACD line) would further validate the downtrend.

2️⃣ Volume Analysis – Breakout Confirmation

A high volume breakout below $30 confirms selling pressure.

Low-volume breakdowns can lead to false breakouts, making volume a crucial factor to watch.

3️⃣ Fundamental Factors – Macro Outlook on Silver (XAG/USD)

Silver prices are influenced by interest rates, inflation, and USD strength.

If USD strengthens, silver could face more selling pressure, aligning with this bearish technical setup.

Any hawkish monetary policy statements could accelerate the downside movement.

5️⃣ Risk Management & Alternative Scenarios

✔️ Ideal Risk-Reward Ratio

Risk: Stop loss at $34.57 (~4.5% above entry)

Reward: Target at $23.01 (~23% move)

Risk-Reward Ratio: ~1:5 (highly favorable for short trades)

⚠️ Bullish Invalidations – When to Avoid the Trade?

If Silver reclaims $34.57 and holds above, the pattern fails.

A false breakout scenario could occur if price breaks below $30 but quickly moves back above.

Watching for bullish divergence on indicators like RSI before entering a short position is recommended.

Final Conclusion: Bearish Bias with Strong Downside Potential

📉 Summary of the Bearish Case:

✔️ Double Top pattern confirms a bearish reversal if the neckline breaks.

✔️ Break of ascending trendline signals increasing seller control.

✔️ Key levels: Stop-loss above $34.57 | Entry below $30 | Target $23.01.

✔️ Additional confluence: RSI, MACD, and volume confirmation strengthen the trade setup.

🚀 If price action aligns with this analysis, this setup presents a high-probability short opportunity.

Would you like any refinements or additional insights? 🔥

EURJPY Double Top - Bearish Reversal Ahead Toward Target!🔍 Chart Analysis: Identifying the Double Top Pattern

The EURJPY (Euro/Japanese Yen) 1-hour chart shows a classic Double Top pattern, which is a strong bearish reversal formation. This pattern occurs when the price reaches a significant resistance level twice but fails to break above it, indicating a potential shift from bullish momentum to bearish control.

1️⃣ Top 1: The first peak formed as buyers pushed the price higher, but strong resistance forced a pullback.

2️⃣ Top 2: The price attempted to break the same resistance level again but failed, forming a second peak at approximately 164.165, confirming that sellers are overpowering buyers.

3️⃣ Neckline (Support Level): The critical support level around 160.000 acted as a trigger for the bearish move. Once this level broke, the double top pattern was confirmed.

📌 Key Levels and Market Structure

🔹 Resistance (164.165): The highest level where sellers dominated, preventing further upward movement.

🔹 Support/Neckline (160.000): This level acted as a crucial pivot. Once broken, it signaled a trend reversal.

🔹 Take Profit Levels:

TP1 – 159.036: This serves as the first profit target, aligning with a prior demand zone.

TP2 – 157.200: The full projected downside move based on the double top pattern.

🔹 Stop Loss (SL): Above 164.165, ensuring a risk-managed approach in case of trend invalidation.

📉 Trading Strategy: How to Trade This Setup?

1️⃣ Entry Confirmation:

The ideal entry was after the price broke the neckline at 160.000 and retested it as resistance.

A breakdown candle with high volume confirmed seller dominance.

2️⃣ Stop-Loss Placement:

A stop-loss above 164.165 provides room for price fluctuations while protecting against false breakouts.

3️⃣ Profit Targets:

TP1: 159.036, securing partial profits.

TP2: 157.200, completing the double top measured move.

📊 Market Psychology & Price Action Insights

The double top pattern reflects a shift in market sentiment from bullish to bearish.

The repeated rejection at 164.165 signals a lack of buying strength, increasing the probability of a downward move.

The breakdown of the 160.000 neckline confirms that sellers have taken control.

The price action also shows a lower-high formation, reinforcing bearish momentum.

✅ Conclusion: Bearish Bias Until 157.200

This setup strongly favors short positions, as long as the price stays below 162.500.

A break above 164.165 invalidates the bearish setup, signaling a potential reversal.

Until then, the market remains bearish, with TP1 & TP2 as achievable downside targets.

💬 What’s your outlook on EURJPY? Drop your analysis below! 👇

EUR/USD Double Top Analysis - Bearish Reversal Trade Setup This analysis highlights a Double Top pattern forming on the EUR/USD 4-hour timeframe, which is a classic bearish reversal pattern. The pattern signals a potential shift from a bullish trend to a downtrend, providing traders with a well-defined entry, stop loss, and target levels.

1. Understanding the Double Top Pattern

A Double Top is a trend reversal pattern that forms after an extended uptrend. It consists of two peaks (Top 1 and Top 2) at approximately the same resistance level, followed by a break below the neckline (support level), confirming the pattern.

Pattern Breakdown:

Top 1 & Top 2: These peaks represent failed attempts to break higher, showing strong selling pressure at resistance.

Support (Neckline): The price found support at a key level, where buyers initially stepped in, but eventually, this level was broken, triggering a potential downtrend.

2. Key Levels & Trading Setup

📌 Resistance Level (Bearish Rejection Zone)

The resistance level is marked in the 1.09500 - 1.09600 range.

Price action tested this zone twice (Top 1 & Top 2) but failed to sustain above it.

The repeated rejection indicates that sellers are dominant in this zone.

📌 Support Level (Neckline Breakout Confirmation)

The support level is marked in the 1.07700 - 1.07800 zone.

The price bounced off this area initially, but later broke below it, confirming a bearish move.

The breakout suggests selling momentum is increasing.

3. Trading Strategy – Bearish Setup

🔴 Entry Point (Sell Trigger)

A short trade is confirmed when the price breaks below the neckline (support level) after forming the Double Top.

The breakout confirms seller dominance and signals potential downside movement.

🚨 Stop Loss Placement

Stop Loss is placed slightly above the resistance level at 1.09575.

This ensures protection against false breakouts or price retracements.

🎯 Target (Take Profit Projection)

The price target is calculated based on the height of the Double Top pattern.

Target Level: 1.06639, aligning with the measured move from the resistance to the neckline.

4. Market Outlook & Risk Management

📉 Bearish Scenario (High Probability Move)

✔️ The market structure shows a strong bearish reversal with price failing to break above resistance.

✔️ The confirmed neckline break indicates sellers have taken control.

✔️ If the price continues lower, we can expect a move toward 1.06639.

📈 Bullish Scenario (Invalidation of Trade)

❌ If price closes back above resistance (1.09575), it would invalidate the bearish setup.

❌ This would indicate that buyers are regaining control, and the trade setup should be re-evaluated.

5. Final Thoughts & TradingView Tags

Summary of Trading Setup:

✅ Pattern: Double Top (Bearish Reversal)

✅ Sell Entry: Below the support neckline

✅ Stop Loss: Above 1.09575

✅ Target: 1.06639

✅ Risk-Reward Ratio: Favorable

📌 Tags for TradingView Idea:

#EURUSD #DoubleTop #ForexTrading #BearishReversal #SupportResistance #PriceAction #TechnicalAnalysis #ForexSetup #TradingStrategy

(XAG/USD) weekly Forcast – Double Top Breakdown & Bearish SetupThis detailed technical analysis of Silver (XAG/USD) on the daily timeframe highlights a potential bearish reversal forming through a Double Top pattern. This setup suggests that Silver could be gearing up for a major decline, provided key confirmation levels are met. Let’s break it down thoroughly.

📌 1. Understanding the Chart Pattern – Double Top Formation

A Double Top is a bearish reversal pattern that forms after an extended uptrend, signaling that buyers are losing strength and sellers are taking control.

🔹 Key Phases of the Double Top:

1️⃣ First Top (Top 1)

Silver initially rallied to a major resistance zone ($34.5 - $35).

The price failed to break higher, leading to a correction.

This rejection signals heavy selling pressure at this level.

2️⃣ Pullback to the Neckline ($28.5 - $29)

After the first peak, the price retraced to a critical support area known as the neckline.

This level acts as a decision point—either price bounces or breaks lower.

3️⃣ Second Top (Top 2) – Bull Trap?

Silver made another attempt to break through $34.5 - $35, but once again, sellers defended this level.

The failure to set a new higher high confirms weakness, forming the second peak.

This second rejection adds credibility to the Double Top pattern, increasing the likelihood of a bearish move.

4️⃣ The Crucial Neckline Test

The neckline around $28.5 - $29 is the most critical level to watch.

A clean daily close below this level would confirm the breakdown and trigger a strong bearish trend.

📍 2. Key Technical Levels & Market Structure

🔴 Resistance Level ($34.5 - $35) – Strong Selling Zone

This area has repeatedly rejected price advances, indicating high supply.

A breakout above this level would invalidate the bearish setup.

🔵 Support & Neckline ($28.5 - $29) – The Make-or-Break Zone

A break below this level would complete the Double Top pattern and confirm the bearish trend.

If buyers defend this area, Silver could see short-term consolidation before another breakout attempt.

🎯 Target Price ($22 - $23) – Where Silver Could Be Headed

The measured move (distance from top to neckline) suggests a potential drop to $22 - $23.

This aligns with historical support zones, making it a reasonable target.

🚨 Stop Loss Area ($35.2 - $35.5) – Risk Management

If Silver invalidates the pattern and closes above $35.2 - $35.5, the bearish setup is no longer valid.

Traders should cut losses early if price regains bullish momentum.

📊 3. Trading Setup & Execution Plan

🔻 Bearish Trading Plan (Short Entry):

✅ Entry Point:

Enter a short position after a confirmed neckline break below $28.5 - $29.

Wait for a break-and-retest of this level to confirm the bearish move.

✅ Stop Loss:

Place stop loss above $35.2 - $35.5, just beyond the resistance level.

This protects against false breakouts and sudden bullish reversals.

✅ Take Profit Targets:

Primary target: $24.5 - $25 (first support zone).

Final target: $22 - $23 (measured move completion).

📉 4. Market Sentiment & Technical Outlook

📌 Why This Setup is Important:

The Double Top pattern is a well-established bearish signal.

Price failed to create a new high, showing that buying momentum is fading.

The neckline breakdown will confirm that sellers are in control, pushing price lower.

📌 What Could Invalidate This Setup?

If Silver breaks and closes above $35.5, it would signal that bulls have regained strength.

A strong rally above this level could send Silver towards $37 - $38 instead.

🔎 Final Thoughts – Will Silver Collapse or Hold?

The chart suggests a bearish bias, but confirmation is key!

A breakdown below $28.5 - $29 would activate the Double Top pattern, leading to a potential drop.

If Silver bounces off the neckline, then we might see consolidation or a reversal instead.

🚀 What’s your view? Will Silver break down or bounce back? Share your thoughts below! 🚀

Gold (XAU/USD) Double Top Pattern – High Probability Trade Setup📌 Overview of the Chart:

This 4-hour timeframe chart of Gold Spot (XAU/USD) highlights a Double Top pattern, one of the most reliable bearish reversal signals in technical analysis. The price has tested a strong resistance zone twice (Top 1 & Top 2) but failed to break above, suggesting that bullish momentum is weakening and a possible trend reversal is imminent.

This setup provides an excellent opportunity for a short (sell) trade, provided the price confirms the pattern by breaking below the neckline. The potential downside targets are marked as TP1 ($2,983) and TP2 ($2,938), with a stop loss placed above resistance ($3,056) to manage risk effectively.

📌 Key Chart Patterns & Market Dynamics

1️⃣ Double Top Pattern – The Bearish Reversal Signal

The Double Top pattern occurs when:

✅ The price reaches a resistance zone and gets rejected (Top 1).

✅ It then retraces downward to find support at the neckline.

✅ The price makes another attempt to push higher but fails at the same resistance level (Top 2).

✅ A break below the neckline confirms the bearish trend, as buyers lose strength and sellers take control.

🛑 Why is this pattern important?

The failure of buyers to push beyond resistance shows that sellers are dominating. This creates a psychological shift in the market, making traders and institutions more likely to sell aggressively once the neckline is broken.

2️⃣ Resistance Level – The Rejection Zone

🔵 Price Level: $3,050 – $3,056

🔵 Role: Key supply area where sellers are strong

🔵 Market Impact: Strong rejections at this level indicate that big players (institutions) are offloading positions, leading to bearish momentum.

Why Does This Matter?

📌 If the price breaks above this level, it would invalidate the bearish setup, leading to potential further upside.

📌 This is also why we place our Stop Loss above this level—to protect against unexpected bullish breakouts.

3️⃣ Neckline Support – The Breakout Zone

🔻 Price Level: Around $3,020

🔻 Role: The last line of defense for buyers before a bearish breakout

🔻 Market Impact: If this level is breached, it confirms the Double Top pattern, leading to a sharp decline.

📌 A confirmed break of the neckline is the ideal point for traders to enter a short (sell) position, targeting lower price levels.

4️⃣ Key Take Profit (TP) Targets – Where Price Might Drop

🎯 TP1 – $2,983:

This level is a minor support zone where price may temporarily pause before further decline.

Conservative traders may choose to secure profits here.

🎯 TP2 – $2,938:

A stronger historical support zone, making it a high-probability target for a full bearish move.

More aggressive traders may hold positions until this level.

📌 Why These Levels?

These targets align with Fibonacci retracement zones and previous market structure, increasing the likelihood of a reaction at these points.

5️⃣ Stop Loss – Managing Risk Like a Pro

Placement: Above the resistance zone at $3,056

Reason: If price breaks above resistance, it invalidates the bearish thesis, meaning we need to exit the trade.

Risk-Reward Ratio:

TP1: ~2:1

TP2: ~3.5:1

A good risk-reward setup, ensuring a profitable edge over multiple trades.

📌 Trading Strategy & Execution Plan

📉 Bearish (Sell) Setup:

1️⃣ Wait for confirmation – Price must break below the neckline ($3,020) before entering a short trade.

2️⃣ Sell Entry: On a confirmed break and retest of the neckline.

3️⃣ Stop Loss: Above the resistance zone ($3,056).

4️⃣ Take Profit Targets:

TP1 ($2,983) – First profit level.

TP2 ($2,938) – Secondary target for deeper decline.

📌 Optional Confirmation:

Look for bearish candlestick formations (e.g., Bearish Engulfing, Shooting Star, or Doji) near resistance or after a neckline breakout.

Monitor RSI/MACD for bearish divergence, confirming weakening momentum.

📌 Market Psychology Behind This Pattern

1️⃣ First Peak (Top 1): Buyers push the price up, but sellers step in at resistance and force a pullback.

2️⃣ Pullback to Neckline: Some buyers re-enter, believing the uptrend will continue.

3️⃣ Second Peak (Top 2): Price attempts another rally but fails at the same resistance, showing buyers' exhaustion.

4️⃣ Break of the Neckline: Sellers take full control, leading to a high-momentum sell-off.

📌 Key Takeaway:

💡 The Double Top is a trader’s favorite because it reflects a real psychological shift in market sentiment—from greed (buyers) to fear (sellers).

📌 Final Verdict – High Probability Trade Setup

✅ Double Top formation confirms a bearish trend reversal.

✅ Strong resistance & multiple rejections signal seller dominance.

✅ Clear risk management strategy (Stop Loss & TP Levels).

✅ Waiting for neckline break ensures a high-probability entry.

🚀 Watch this setup carefully! If the neckline breaks, GOLD could experience a sharp decline! 📉🔥

🔍 Pro Tips for Smart Traders

💡 Don’t rush into a trade! Wait for a solid break and retest of the neckline for confirmation.

💡 Monitor volume: A strong breakout should be accompanied by increasing volume for validation.

💡 Use confluence: Combine with other indicators (RSI, MACD, EMA) to increase accuracy.

🔥 What’s Your Take on This Setup? Will You Trade It? Let Me Know in the Comments! 🚀

$BTC double top pattern detected 1H timeframe.As shown on the chart, a double top has formed on the CRYPTOCAP:BTC chart.

While the overall trend remains bullish, there is also a clear bearish divergence.

The question is — will CRYPTOCAP:BTC follow the technicals and see a short-term correction, or will it continue pumping as if nothing happened? Let’s wait and see!

DYOR

Silver (XAG/USD) Double Top Reversal – Bearish Trading SetupThe provided 1-hour chart for Silver (XAG/USD) presents a well-structured bearish trade setup, highlighting key price action patterns, technical indicators, and confluence factors that suggest a potential downside move. Let's analyze the chart step by step to understand the logic behind this bearish trade setup.

1. Market Structure & Trend Overview

Silver (XAG/USD) has been in a short-term uptrend, as indicated by the ascending trendline. However, the trend now shows signs of exhaustion, with a clear shift in market behavior. The price action reveals the formation of a double top at a strong resistance level, coupled with a Change of Character (CHOCH), which signals a possible reversal.

A break below the trendline suggests that the bullish momentum is losing strength, and sellers are beginning to dominate the market. The combination of these elements makes this setup a high-probability short trade opportunity.

2. Key Technical Levels & Zones

A. Resistance Zone ($33.96 - $34.20) – The Selling Pressure Area

The chart marks a clear resistance zone, where price has struggled to break higher.

Two price rejections from this level indicate that sellers are actively defending this region.

This zone serves as an ideal stop-loss area for short trades, as a breakout above this level would invalidate the bearish setup.

B. Double Top Formation – Reversal Pattern

The price tested the resistance zone twice and failed to establish new highs, forming a double top structure.

A double top is a well-known bearish reversal pattern, indicating a shift from bullish to bearish momentum.

The second top (Top 2) aligns with a downward trendline, further confirming that sellers are stepping in at lower levels.

C. Support Level ($32.60 - $32.80) – Initial Reaction Zone

This area has previously acted as a demand zone where buyers stepped in.

If the price breaks below this support, it would confirm further downside movement towards the final target.

D. Trendline Breakdown – Loss of Bullish Momentum

The dotted trendline represents the previous bullish trend, supporting price action for several days.

A break below this trendline suggests a structural shift in market dynamics, meaning buyers are losing control.

The failure to reclaim the trendline increases the probability of a deeper move downward.

E. Target Level ($32.11 - $32.20) – The Bearish Objective

The projected target is based on the double top’s measured move, which suggests a price drop to at least $32.11.

This level also coincides with previous historical price action, making it a strong confluence zone for profit-taking.

3. Trading Strategy & Execution Plan

📌 Entry Point:

Aggressive Entry: Short position around $33.40 - $33.50, near the second top where price rejected the trendline.

Conservative Entry: Wait for a confirmed break and retest of the support level at $32.80 before entering short.

📌 Stop-Loss Placement:

The stop-loss should be placed above the resistance zone at $33.96.

This level ensures that the trade is invalidated if the price breaks out higher.

📌 Take-Profit Target:

Primary Target: $32.60, which is the first support level where price may temporarily react.

Final Target: $32.11, aligning with the double top breakdown target and historical support.

📌 Risk-Reward Ratio:

A minimum 1:2 risk-reward ratio, meaning for every 1% risked, there is a potential 2%+ gain.

This makes the trade favorable in terms of risk management.

4. Confluence Factors Supporting the Bearish Outlook

✅ Double Top Formation – A classic bearish reversal pattern.

✅ Lower Highs Formation – Indicates increasing selling pressure.

✅ Trendline Breakdown – A significant loss of bullish momentum.

✅ Resistance Zone Rejection – Strong seller presence.

✅ CHOCH (Change of Character) – Confirms a shift in market sentiment.

5. Risk Management & Alternative Scenario

📌 What If Price Moves Against the Trade?

If the price breaks above $33.96, the bearish outlook becomes invalid, and a potential bullish continuation could follow. In this case:

Stop-loss is triggered, and the setup is considered invalid.

Traders should then wait for a new setup before re-entering the market.

📌 Market Conditions to Monitor:

Volatility: Ensure there is enough momentum in the market before entering.

Volume Confirmation: A break below support should have strong volume.

News Events: Watch out for fundamental catalysts, such as US Dollar strength, economic data, and geopolitical events, which could influence Silver’s price movement.

6. Final Thoughts & Summary

This chart setup provides a clear bearish trade opportunity based on technical analysis. The combination of double top formation, resistance rejection, trendline breakdown, and lower highs strongly supports the idea of further downside movement.

💡 Key Takeaways:

Bearish bias is valid as long as price stays below $33.96.

Target is set at $32.11, with an intermediate support at $32.60.

Risk-to-reward is favorable, making it an ideal short trade setup.

If the market follows this expected scenario, this trade has the potential to yield significant profit while maintaining disciplined risk management. However, always stay alert to market conditions and adjust strategies accordingly.

LOW RISK ETH SHORTSimply hopped into an ETH Short at around 11;15 pm EST

about a 40 pip SL @ $2,580

Looking for a 1:4 or 1:5

TP 1 : 2,487

TP 2 : 2,420

TP 3 : 2,355

If you can handle volatility hold till possible $2,100 or below!

Always good to scale in and out protecting your capital EFFICIENTLY!

Let's Get it PPFX Fam! Peace