Double Top or Bottom

Dow Jones: A Make-or-Break Buy Setup with Smart Money BackingDow Jones Industrial Average - Buy Setup

Technical: U.S. markets have struggled recently due to uncertainty over tariffs imposed by President Trump. While the S&P 500 and NASDAQ have broken key support levels, the Dow remains resilient, holding the critical 41,648 support. A break below would confirm a large double-top pattern, signaling a bearish outlook. This is a pivotal moment. The rebound from overnight lows is encouraging, but with the U.S. CPI release tomorrow, caution is warranted. While speculative, COT and seasonal data favour a short-term move higher.

Fundamental: The latest Commitment of Traders (COT) Report shows increasing long interest in the Dow, suggesting "smart money" accumulation.

Seasonal: Historically, from March 12 – May 2, the Dow has posted gains 84% of the time, averaging +3.68% over the past 25 years.

Setup:

Entry: 41,800 – 42,000

Stop Loss: 41,285 (below the Nov 2024 low at 41,648)

Target: 44,290

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The golden counterattack is coming!As expected, gold rebounded with the support of 2880-2870 area, and has now rebounded to above 2893. Don't worry for now, gold still has room to rise. Don't be anxious for now, gold still has room to continue to rise. We insisted on buying gold on dips yesterday and have accumulated a lot of cheap chips. Now it seems to be a wise choice.

I clearly pointed out yesterday that the decline of gold this time is only to cooperate with the recent low of 2830 and successfully build a "W" double bottom structure. After confirming the support and building the "W" double bottom structure successfully, gold will continue to rise. Through the candle chart, we can clearly see that in the process of seeking support this time, gold just fell back to the 50% retracement level (50% retracement level from 2830 to 2930). At present, gold has confirmed the support and successfully built the "W" double bottom structure, which will support the rise of gold and provide good conditions for gold to break through the resistance near 2930 above, and even hope to try to hit the previous high near 2955.

Bros, I am glad that we are holding a lot of cheap chips now. These will be the chips that will bring us huge profits. Let us hold them together.Did you join me in taking the opportunity and going long gold?Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Gold Breakdown – Bearish Momentum Taking Over?Gold (XAUUSD) has shown clear signs of weakness after multiple failed attempts to break above resistance. The descending trendline acted as a strong dynamic resistance, leading to a sharp sell-off. The projected path suggests further downside movement, with increasing bearish momentum.

📊 Technical Breakdown:

✅ Rejection at Resistance: Price failed to break above the key resistance area, confirming a bearish structure.

✅ Lower Highs Formation: A series of lower highs indicate sellers are gaining control.

✅ Trendline Holding Strong: The curved descending trendline has successfully rejected price action multiple times.

✅ Breakdown Underway: The recent drop confirms sellers stepping in aggressively.

📉 Possible Targets:

1️⃣ Next Key Support: $2,850 - $2,820 zone could act as a short-term demand area.

2️⃣ Deeper Selloff: If momentum persists, a drop toward $2,780 is on the table.

📢 Trading Plan:

🔹 Bearish Bias: Look for pullbacks toward resistance for potential short entries.

🔹 Bullish Reversal? Only a sustained break above $2,910 would shift the bias.

⚡ Do you see Gold dropping further or reversing soon? Comment below!

#XAUUSD #Gold #Trading #TechnicalAnalysis #Forex #Metals

Double Bottom pattern: A bullish reversal signal The Double Bottom pattern is a classic reversal formation that signals a potential trend change from bearish to bullish. It occurs after a prolonged downtrend when price forms two distinct lows at a similar level, indicating strong support.

How to Identify:

✔️ Two Lows: Price touches the same support level twice, forming a "W" shape.

✔️ Resistance Breakout: The neckline (resistance level) marks the breakout zone.

✔️ Trend Reversal Confirmation: Once price breaks above resistance, momentum shifts bullish.

Interpretation:

In this chart, we see a clear bearish trend, followed by two attempts to break below the same support level.

After failing to break lower, buyers regained strength, pushing price above resistance, confirming the bullish reversal.

Once resistance turns into support, traders often enter long positions, targeting higher levels.

What’s Next?

A sustained breakout could fuel further upside momentum. However, watch for potential false breakouts and retracements back to support before continuation.

BTC/USD Key SupportBTC is hitting key support at just under $80,000

This is a good opportunity to expect a rebound back up to $100,000. Double bottom formation coming in nicely. Currently entering into my position and watching for a break under. Will keep stop tight as there is a fear of an extreme trend and sell off taking hold. Economic uncertainty and emotional buying and selling in today’s market can drive price in either direction HEAVILY. This being said i am currently looking for entries at major buy/sell areas and keep stops tighter than I normally would while also leaving room to leverage deeper into a trade under trending conditions.

Best of luck to you all and trade safe!

Gold is about to take off like a rocket, boldly go long gold!Bros, don't have any doubts about the rise of gold. Gold is just accumulating upward momentum during the shock process. Once the shock ends, gold will take off like a rocket.

In the short term, gold has tested the support of the 2900-2890 area many times and has never fallen below, confirming that the support in this area is effective. In addition, the candle chart forms multiple long lower shadows in the short period, indicating that the gold price refuses to fall, which will attract more off-market funds to buy gold. In this market, the longer the gold shock time, the higher the increase, so please relax and let us look forward to the gold rocket taking off! The first target in the short term is 2920. Once gold stands above 2920, gold is bound to reach 2930, and it is even expected to continue to rise to 2955

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

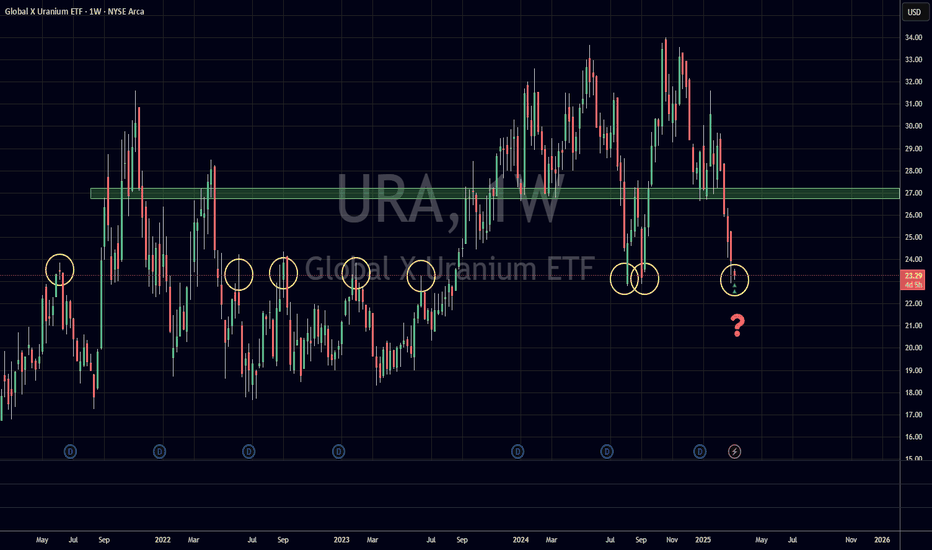

URA at historic Support/Resistance level on WeeklyURA has hit the ~23.00 level. Since June 2021, the 23.00 level has provided resistance or support to URA 7 times, as shown by the yellow circles on the Weekly chart.

Entering a Long position with a upside target to another area of previous support and resistance at the ~27.00 area (green rectangle).

Price Stop: $22.00

Time Stop: 3 months.

Bitcoin Approaches Strong Support ZoneA double top has been confirmed on a daily chart with a downside target around 74550. This corresponds nicely with previous resistance turning potential support (73794-71958) and an upward sloping trend line. Below this zone are two overlapping volume profile ledges (70721-57340). I expect buyers to enter and hold 65k+. However, if 56k is taken out significant chart damage will be done for bulls.

Solona Pattern: The price action is forming a "W" pattern (double-bottom reversal), signaling potential bullish momentum in the near term.

Near-Term Target: The formation is expected to test 180 (Est. 180) as an initial upside objective.

Resistance Level: A key hurdle lies at 228.62; a breakout above this level could confirm stronger bullish continuation.

Support Level: Critical downside protection is seen at 127, which must hold to maintain the bullish structure.

Triple Top on Cumberland Pharmaceuticals. CPIXPlus a reversal signal on the 1.618 vWAP Fibonacci cloud exit. Its a risky reversal take, so a stop loss goes right where the cloud starts up again. We can enter the cloud, but cannot exit in it without calling quits. None of the lagging indicators have fired off yet, which is common on pivot/reversal takes.

What is Double Top or Double Bottom and how it works?Hello in this educational content we are talking about one of the major reversal pattern in market or maybe even the most important reversal pattern which is exist.

Double Top: Like the pattern mentioned on the chart now double Top is made by two reject from resistance but it is complete when the support or neckline of this two top break and then the pattern is complete and we can say this is a valid double Top and market now can get correction and get bearish.

here is chart & example take a look at Two kinds of Double Top available in my View:

As we can see sometimes price even made fake breakout to the upside or downside of the pattern and in these kinds of situation we can expect more fall if we had Advance Double Top because the liquidity was more at the beginning of second phase rejection.

We also have other Strong Reversal patterns like Head & shoulders and ... which you can mention them in comments or we may have another live post for them in next Educational posts.

most of You know about Regular Double top or Double Bottom and in this Educational post we mention some data about Advance form of it too and also so many know this form as regular form and consider this fake breakout a sign of good double Top and ....

Double Bottom is the same like the Double Top but reverse(This time support can not break two times and price after breaking neckline or resistance start to pump and bear market turn to bullish with Double Bottom).

DISCLAIMER: ((Always trade based on your own decision))-----this post is not signal content or analysis and just Try to talk about an important Reversal pattern with Example which happened also on Bitcoin in previous days in my Opinion.

<<press like👍 if you enjoy💚

$SOL Trying For W Patter ReversalTHE MARKET REALLY WANTS TO GO UP.

Stronger coins, such as CRYPTOCAP:SOL

keep putting in higher lows.

If we close above the EMA9 on the Daily that will be really telling.

A bit premature to call a reversal, but I’ve been speculating on this W reversal pattern forming since Trump announced the Crypto Strategic Reserve.

Perfect setup for that.

The lack of liquidity is the only thing holding back the reversal and reason for the pump n dumps on every bit of news.

BTCUSD – Descending Broadening Wedge With Key Buy ZonesBitcoin is trading within a Descending Broadening Wedge on the 6-hour timeframe, a pattern that typically signals increasing volatility before a potential breakout. The price is fluctuating between two diverging trendlines, with several critical buy levels forming along the structure.

Descending Broadening Wedge Resistance Breakout at 94,543

The upper boundary of the wedge, around 93,000 to 94,500, serves as dynamic resistance. If Bitcoin pushes through this level, it could trigger a breakout toward the first target at 108,000 and possibly extend to 124,407. Volume has been increasing near resistance, indicating strong market participation.

Ascending Trendline Rebound at 84,536

This level aligns with an ascending support trendline inside the wedge. Bitcoin has previously bounced from similar trend structures, making this an important zone to watch for a potential reaction.

Double Bottom Possibility at 79,006

The 79,000 level has acted as support in previous price movements, creating a possible double bottom scenario. If the price stabilizes here, it could be an early sign of trend reversal within the wedge.

Descending Broadening Wedge Support at 75,092

The lower boundary of the pattern, around 75,000, remains a major support level. This is where previous downward movements have found buying interest, making it a crucial point for potential price reversals.

Stop Loss at 69,000 to 68,000

A drop below this range would indicate that the wedge structure has failed, opening the possibility for further downside movement.

Bitcoin remains within a widening consolidation phase, with increasing volume showing heightened market activity. As long as the price respects the wedge boundaries, these key levels present potential opportunities for positioning ahead of a breakout.

Bitcoin: Mastering the Art of Resistance and SupportBitcoin recently broke below a 105‐day trading range, anchored by the critical 90K level. After the breakdown, it found support around 80K, prompting a sharp rebound back toward the previous range. This rebound, however, was short‐lived: BTC tested 95K, then quickly retraced, only to rally again toward 90K, where it trades at present.

Overview of BTC’s 105‐Day Range Break and Retest:

Yearly Open at $93,576: This is the single most important level to watch. Price currently sits below the yearly open, suggesting that, for now, bears hold the upper hand. If bulls cannot reclaim this threshold, the yearly candle remains vulnerable to turning red.

90K–95K Resistance Zone: With Bitcoin failing to sustain gains above 95K, this band becomes a natural focal point for potential short entries. Bears are expected to defend this region aggressively.

The question: Where do we go next? Let’s break down both the resistance (short setup) and an upcoming support zone (long setup), incorporating a variety of confluences—from volume profiles and trend lines to Fibonacci retracements and pitchfork alignments.

1. Resistance Analysis & Short Thesis

1.1. Double Top Target at $72,800

A double top pattern has formed, suggesting a measured‐move target near $72,800. While not a guaranteed endpoint, this target serves as an early directional clue. Price could still find support at higher levels, so we use this only as one piece of a larger puzzle.

Double Top Pattern with $72,800 Target:

1.2. The 105‐Day Trading Range & Retest

Bitcoin spent over 100 days ranging between roughly 90K and 105K. The downside break turned that prior range into a new resistance zone—specifically 90K–95K, with an even stronger cluster up to $96,418 (Point of Control from that range).

Fixed Range Volume Profile: The POC (Point of Control) from this 105‐day period lies at $96,418.05, further extending our resistance zone. Price retesting anywhere between 90K and the POC around 96K sets up potential short entries.

Fixed Range Volume Profile Showing POC at $96,418.05:

Stop Loss Guidance: Given the possibility of wicks or “stop hunts,” a safer invalidation point sits above 98K. That buffer allows the trade room to breathe without prematurely stopping out on minor spikes.

1.3. Daily & Weekly Moving Averages

In addition to the above factors, both the daily 21 EMA/SMA and the weekly 21 EMA/SMA are converging in the 90-92K region, acting as additional resistance.

1.4. Bearish Trend Line & Pitchfork Alignment

Bearish Trend Line: Connecting the all‐time high at $109,588 and the swing high at $106,457.44 yields a downward sloping line. This trend line has already acted as resistance near 100K on February 21.

Pitchfork (Modified Schiff): Anchoring from the all‐time high (109,588) to the swing low (97,777.77) and back up to 106,457.44 confirms the same bearish trajectory, aligning neatly with the trend line around 95K.

Bearish Trend Line & Pitchfork Convergence Around 95K:

1.5. Monthly Order Block & Fibonacci Confluence

Monthly Order Block: Spanning from the yearly open (93,576) up to the POC (~96,418), this monthly order block forms a substantial supply zone. Price often gravitates toward the median line of an order block, which sits near 94–95K.

Fibonacci Retracement (0.786): From the swing high at 99,475 (Feb 21) down to the low at 78,258.52, the 0.786 retracement is at 94,934.67—almost exactly the median line of the monthly order block.

Monthly Order Block, Median Line, and 0.786 Fib at ~94,934.67:

When price rallies swiftly to the 0.786 for the first time, it often presents an ideal short entry—especially under a confluence of bearish signals:

2. Short Trade Setup: Laddering In & Out

2.1. Scaling In (Entries)

We allocate $25,000 (from a $100,000 account) and ladder our entries from 89,736 up to 96,206:

Short Trade Laddered Entries:

Stop Loss: $97,560 (slightly below the higher “breathing room” area of 98K).

Max Risk: Approximately $1,028.16 (about 4.11% of the GETTEX:25K position, or 1.03% of the $100k account).

2.2. Scaling Out (Exits)

We plan to take profits in increments as price drops, aiming for an average exit around $79,822.10:

Potential Profit: Approximately $3,704.16 on a $25,000 position, which is +14.82% (or +3.70% of the $100k account).

Risk‐to‐Reward Ratio: 3.60, an attractive R:R for a swing trade.

3. Support Analysis & Long Thesis

Having addressed the downside retest and short scenario, let’s turn to potential support where Bitcoin might reverse for a long trade.

3.1. Double Top Target & 5‐Wave Structure

The double top projected target near $72,800 aligns with a broader Elliott Wave possibility, where BTC may have completed a 5‐wave structure from the low at $15,476 to the all‐time high at $109,588.

A typical Fibonacci retracement of this 5‐wave move suggests the 0.382 level at $73,637.22, which sits near a notable swing high of $73,777—coincidence?

5‐Wave Structure & 0.382 Fib Retracement at ~$73,637:

3.2. Monthly Bullish Order Block & Further Fib Confluence

Monthly Bullish Order Block: Located around $71,280, historically a place where buyers have stepped in.

Fib Retracement (49K to 109K): The 0.618 retracement lands at $72,144.62, adding further confluence around the 72–73K zone.

Taken together, we begin to see a support band forming between $73,777 and $71,280.

Monthly Bullish Order Block & 0.618 Fib ~$72,144.62:

3.3. Fib Speed Fan & Bullish Trend Line

Fib Speed Fan (0.7): On higher timeframes, the 0.7 fan lines up with the same 71–73K region if BTC dips this month.

Bullish Trend Line: Connecting the lows at 49K and 52,550 also aligns with this zone, reinforcing the idea that a cluster of support awaits if price slides that far.

Bullish Trend Line & Fib Speed Fan ~$71–73K:

3.4. Potential Long Trade Setup

Entry Range: Ladder in from 76K down to 71K (or adjust according to personal risk appetite within that 73–71K zone).

Stop Loss: Below 70K, providing sufficient buffer.

Target: At least the monthly open ($84,350), or higher if momentum supports a stronger bounce.

Risk‐to‐Reward (R:R): Aim for 2:1 or better, depending on exact entries and the final target.

4. Summary

Short Trade:

Resistance Zone: 90K–95K, extending up to $96,418 (POC) and with the daily/weekly 21 EMA/SMA acting as additional resistance in the 90-92K region, plus a stop‐hunt buffer above 98K.

Laddered Entry: GETTEX:25K allocated, averaging around $93,706, with a stop near $97,560.

Scaling Out: Average exit near $79,822, netting a +14.82% gain on the position (+3.70% on account).

R:R: 3.60—solid for a swing setup.

Long Trade:

Support Zone: Between $73,777 and $71,280, with multiple Fibonacci and structural confluences.

Laddered Entry: Potential DCA from around 76K down to 71K, with a stop under 70K.

Target: At least $84,350 (monthly open), likely offering a 2:1 or better risk‐to‐reward.

Sharp moves up or down have been the norm lately, often gravitating to the 0.786 fib retracement on each leg, so remain vigilant for sudden volatility.

Ultimately, flexibility is key. If Bitcoin reclaims the yearly open at $93,576 and pushes decisively above 95–98K, the bearish case weakens. Conversely, a significant drop below 80K brings the deeper support zone near 73–71K into sharper focus.

Always be prepared for shifts in market conditions—confirm each setup with multiple indicators and chart patterns before entering any trade. Stay up to date with evolving market dynamics and adjust your strategy accordingly.

Happy trading!

P.S. If you have any coin requests, feel free to share them in the comments. I will be selecting one or two for the next technical analysis.

BTCUSD – Head & Shoulders Confirmed?In my previous analysis ( ), I outlined a potential Head & Shoulders formation that could lead to a bearish move. So far, price action has followed this structure accurately.

Key Developments:

✅ The right shoulder seems to be forming as expected.

✅ Price grabbed liquidity above $92,500 before reacting downward.

✅ A double top has formed, adding further bearish confluence.

What’s Next?

If the market respects this pattern, a break below the neckline could confirm a continuation lower, with a potential target at $59,117 , aligning with the full Head & Shoulders projection.

Conclusion:

So far, this setup is playing out perfectly. If bearish pressure continues, we could see a deeper decline. However, a sustained move above $95,150 would invalidate this scenario.

🔔 Do you see BTC following this path, or do you expect a bullish surprise? Drop your thoughts below!

Unswervingly short goldRecently, gold was rejected at 2930, then rejected near 2925, and today gold was rejected again near 2920. From this point of view, the resistance area of gold moves down, and the high point drops accordingly. If gold is repeatedly rejected near 2915 next, then gold will have more room to fall.

This is also the reason why I advocate shorting gold recently. At present, I still hold a short position in gold and look forward to the performance of gold and its fall back to the 2880-2870 area, or even 2860.

Bros, only by following the right people can you execute the right transactions and master the skills to make money. If you want to master independent trading skills and thinking while copying trading signals and making stable profits, you can join the channel at the bottom of this article to liberate your trading talent!

USDJPY & NFP Preview: Key Levels & Market ImpactThe USDJPY has dropped more than expected since our last update, and now, with Non-Farm Payrolls (NFP) on the horizon, the pair is back in focus. A weak NFP report could push USDJPY lower, especially with Japan's tightening stance and global trade tensions weighing on the dollar. In this video, we break down key technical levels, fundamental drivers, and trading strategies. Watch now and leave your thoughts in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

ETHEREUM (ETHUSD): Bullish Continuation Confirmed

I think that ETHEREUM is going to rise.

A double bottom pattern formation on a key daily/intraday support

and a bullish breakout of its neckline show a strong buying interest.

The market is going to reach 2495 level soon.

❤️Please, support my work with like, thank you!❤️