Dow30

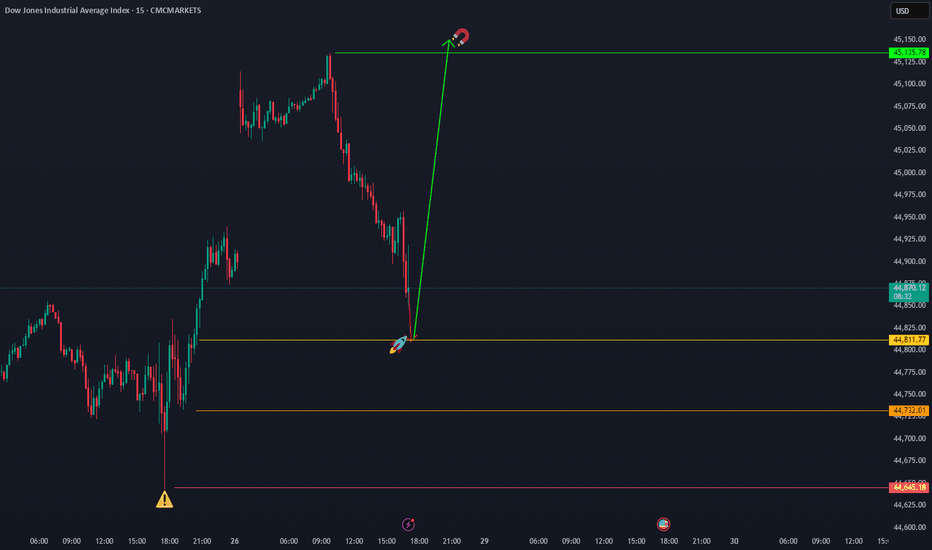

DOW Jones go upCMCMARKETS:US30

Reaching the price level of 45,082.74 is inevitable. From the current closing price, there is a high probability of continuation toward the ATH.

However, the price levels 44,440 and 44,344.95 are also acceptable zones from which the move toward 45,082.74 may begin.

At the start of the upcoming week, as soon as the market opens, we are likely to move toward the ATH from one of these three levels.

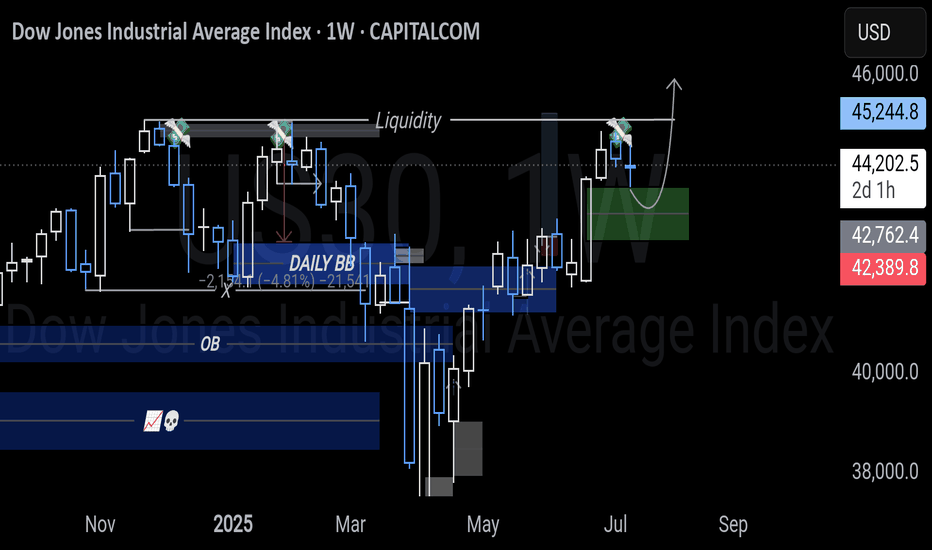

US30 Under Pressure: Possible Short Setup Brewing on the 4HI'm currently eyeing the US30 (Dow Jones Index) for a potential short opportunity based on multi-timeframe structure 📊.

🔍 Weekly Overview:

The weekly chart continues to show sustained pressure, with this week and last week both closing bearish. The sellers are clearly in control at the macro level. 🔻

📆 Daily & 4H Structure:

Drilling down to the daily and 4-hour charts, we can clearly see a break of structure (BOS). The 4H specifically is showing textbook signs of a bearish trend with lower highs and lower lows forming consecutively 🪜🔽.

🎯 Trade Plan:

I'm watching for a pullback into equilibrium, ideally near the 50% level of the recent Fibonacci range. If price revisits that zone, I’ll be looking for short confirmations to ride the momentum back toward the previous lows, as marked on the chart. 🧠💸.

Bearish Forecast for the Dow Jones Starting May 15, 2025Bearish Forecast for the Dow Jones Starting May 15, 2025

The Dow Jones Industrial Average is poised to begin a significant decline, potentially as early as today, May 15, 2025, targeting a retest of the price low from April 7, 2025 (~36,611.78), and possibly lower. This movement is driven by renewed trade tensions, disappointing economic data, and bearish market sentiment.

1. Fundamental Factors Driving Potential Decline

Fundamental factors provide the macroeconomic and policy-driven rationale for the anticipated downturn in the Dow Jones.

1.1. Renewed Uncertainty in Trade Policy

The Dow’s rally on May 12–13, 2025, was fueled by optimism over a temporary U.S.-China tariff reduction agreement (90-day truce) announced after talks in Switzerland on May 11, 2025. However, as of May 15, 2025, investor confidence is faltering due to a lack of progress in ongoing U.S.-China trade negotiations.

Trigger for May 15: A Reuters report from May 14, 2025, notes that U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent are meeting with Chinese officials, but no new agreements have been confirmed. If today’s talks fail to deliver positive outcomes or if President Trump escalates tariff rhetoric, the Dow could plummet, as seen in early April when tariffs triggered a 5.5% single-day drop. The Dow, with its heavy weighting of multinational corporations, is particularly vulnerable to trade war fears, which could drive it toward the April 7 low as investors price in higher costs and slower global growth.

1.2. Disappointments in Economic Data

CPI Reaction: The April 2025 Consumer Price Index (CPI), released on May 14, 2025, showed inflation at 2.3% annually, below the expected 2.4%. However, the Dow’s decline (-0.6%) on May 14 suggests investors expected a lower figure to support Federal Reserve rate cuts, reflecting skepticism about inflation cooling further.

Producer Price Index (PPI) Release on May 15: The PPI for April 2025, due at 8:30 AM ET (2:30 PM CEST) on May 15, 2025, is critical. A higher-than-expected PPI, potentially driven by tariff-related cost pressures, could signal rising consumer prices, reducing hopes for Fed easing and triggering a sell-off. Consensus expects a 0.2% monthly increase; a reading above 0.3% could echo the April market reaction when GDP contraction fears pushed the Dow to 36,611.78.

Consumer Sentiment: The University of Michigan Consumer Sentiment Index for May 2025, released on May 14, likely showed continued weakness (April: 52.2, a multi-year low). A further decline could heighten concerns about reduced consumer spending, impacting Dow components like Walmart and Home Depot.

1.3. Concerns Over Federal Reserve Policy

On May 7, 2025, Fed Chair Jerome Powell cited “elevated uncertainty” due to trade policies, with markets expecting 75 basis points of rate cuts in 2025, starting in July. If today’s PPI or Initial Jobless Claims (8:30 AM ET) indicate persistent inflation or economic weakness, rate cut expectations could fade, increasing borrowing costs and pressuring Dow valuations, mirroring the April 7 recession fears.

2. Technical Analysis

The Dow’s initial decline in April was approximately -19.00%, with a second impulse of similar magnitude. Technical indicators suggest a bearish setup for May 15, 2025:

Current Level: The Dow closed at 42,051.06 on May 14, 2025, down 0.6%, testing support at 42,000.

Bearish Signals: A 12-hour timeframe analysis indicates alignment for a decline, with potential bearish candlestick patterns (e.g., bearish engulfing) and overbought RSI (70). A break below 42,000 could target the 200-day moving average (40,500) and the April 7 low of 36,611.78.

Price Targets:

Retest of April 7, 2025, low: ~36,611.78

Secondary target: ~35,970.70 (based on Fibonacci extensions and prior support zones).

3. Market Sentiment and Behavioral Factors

Fragile Optimism: The Dow’s 15% recovery from April lows was driven by trade truce hopes and select stock strength. Bloomberg’s May 14, 2025, report notes Wall Street’s rebound is “showing signs of exhaustion” due to trade risks. The Dow’s May 14 weakness, led by an 18% UnitedHealth drop, could spread if negative news emerges today.

Global Correlation: Mixed Asian market performance on May 14 (e.g., Nikkei up 1.43%, India’s Nifty 50 down 1.27%) suggests vulnerability. A lower Asian open on May 15, driven by U.S. declines or trade news, could amplify selling pressure on the Dow.

4. Evidence-Based Framework for the Forecast

4.1. Catalysts for Today’s Decline (May 15, 2025)

PPI Data (8:30 AM ET): A PPI reading above 0.3% could signal sticky inflation, reducing Fed rate cut odds and sparking a sell-off.

Trade Talk Updates: Negative U.S.-China trade comments (e.g., no Geneva deal) could reignite fears, mirroring April 7.

Initial Jobless Claims (8:30 AM ET): Claims above 220,000 (vs. prior 211,000) could signal labor market weakness, fueling recession concerns.

4.2. Dow Scenario

Expect a wave-like decline with corrections. The Dow could fall below 36,611.78, potentially reaching ~35,970.70 if trade and economic pressures intensify. Extreme caution is advised in 2025.

4.3. Global Scenario for S&P 500

I anticipate a wave-like decline with intermittent corrections. I wouldn’t be surprised if the S&P 500 falls below 4,700, potentially reaching 4,200. Extreme caution is warranted this year. There’s even a theory that, starting in 2025, the U.S. dollar could lose 50% of its purchasing power.

Idea:

New Screenshot:

4.4. Oil and Geopolitical Outlook

I expect oil (Brent) to decline to the $50+/- range, from which an upward trend may begin, potentially tied to future military conflicts:

· Europe vs. Russia

· India vs. Pakistan

· Iran vs. Israel

Brent (UKOIL):

Natural Gas:

Dow Jones Correction in May 2025: Key DriversDow Jones Correction in May 2025: Key Drivers

Summary: The Dow Jones Industrial Average (DIA) is under pressure and likely headed for a correction due to the Federal Reserve’s tight monetary policy, trade uncertainty from Trump’s tariffs, and weak economic data.

Key Drivers:

➖ Federal Reserve Policy: At the May 6–7 meeting, the Fed is expected to maintain the 4.25–4.5% interest rate due to persistent inflation (2.7% forecast for 2025) and a robust labor market (+177K jobs in April). This dampens hopes for rate cuts, pressuring stocks.

➖ Trump’s Tariffs: New tariffs raise inflation risks and recession fears, reducing the appeal of Dow Jones constituents like Caterpillar and Walmart.

➖ Weak GDP and Global Volatility: A 0.3% GDP contraction in Q1 2025 and declines in Asian markets (1.6–1.8%) signal global instability.

➖ Technical Indicators: DIA trades below its 200-day moving average (~420 USD), with fewer stocks above this level (down from 76% to 55% since January), indicating market weakness.

➖ Outlook: Analysts (Long Forecast) predict volatility, with a potential drop to 38,958 in May, despite an average forecast of 43,370 by month-end. Historically, corrections occur every 1.88 years, and current conditions (tariffs, inflation, GDP) heighten the likelihood of a 10–15% decline.

Target: My downside target for the Dow Jones is 38,555.00.

Current factors and historical trends strongly suggest a near-term correction.

Idea for S&P 500:

Dow Jones US30: Spotting a Potential Pullback Opportunity!📉 The Dow Jones US 30 is currently in a dominant bearish trend on the higher timeframes, but 📈 the 1-hour chart reveals a shift in structure with bullish momentum emerging. This could signal a potential short-term retracement back into the previous range, aligning with the 50% Fibonacci retracement zone. 🔄 There’s also a bearish imbalance overhead that may attract price action for rebalancing. While this setup offers a possible buying opportunity, ⚠️ it carries significant risk given the prevailing bearish sentiment. Stay sharp and manage your risk! 🛡️

Disclaimer

⚠️ This is not financial advice. Trading involves substantial risk, and you should only trade with capital you can afford to lose. Always conduct your own analysis or consult a professional before making decisions. 💡

Dow Jones Testing Key Support – Bounce or Crash Ahead?The Dow Jones Industrial Average (DJIA) is currently testing a key rising trendline support, which has been a strong foundation for its uptrend since 2023. Holding this level could signal a continuation of the bullish momentum, while a breakdown may lead to a deeper correction. If the price fails to hold above this trendline, the next significant support lies around 41,000-40,000, a zone that previously acted as resistance and is now a psychological support level. In case of further weakness, the long-term trendline support around 38,000-39,000 could come into play, aligning with the Ichimoku cloud support.

For the bullish scenario to remain valid, DJIA needs to sustain above the rising trendline and reclaim recent highs. However, if sellers gain control and push prices lower, a broader pullback could unfold. Overall, the market remains in an uptrend as long as key support levels hold, but price action in the coming weeks will determine whether the index continues upward or undergoes a deeper correction.

Do like, comment and follow

Why does hegemony andsupremacy work? Trumpian economics ushers…Why does hegemony and supremacy work? Trumpian economics ushers The Neo Titanic era of late-stage capitalism.

Blessings. Good? I’m just easing back into the site myself.

An easy basic plain chart for your head tops!! you’re welcome.

entered the premarket with the hands-off approach and a wide stop.

Targeting 250 points of the US 3 to close out and historic week

I may also use a scalping strategy between the LSE and NYE opens

The pips are falling out of the sky. The bulls 🦬can smell the blood. Even the bears 🐻 like me can't resist the fresh meat in the woods tonight.

As always on the menu is the working class, as the new deconstructionists position their chairs on the reality TV show Neo-Titanic.

It’s a good year to get rich.

What do DJI, SPX and NDX have in common?Well the obvious answer is that they are Major USA indices and they also share some of the big players as stocks which make up their composite Indices.

My answer the Question...

The beauty of Trading View is the ability to combine all sorts of aspects of trading information together, whether it be writing new scripts, combining indicators or in my case combing major indices together in Logarithmic view to get a new way of future price discovery (for SPX & NDX) by looking backwards or left at price structure on the next highest valued Indice.

As we know A.T.M all 3 Indices are at A.T.H's so at some point in the near future there will be a move higher into new price territory. The question then is where is the price target? Where is the next resistance level when there is no price structure to the left on that Indice?

What I noticed historically about these Indices is that past price structure (major highs and lows) from the higher valued Indice (Mostly DJI) is horizontally plotted forward into the future onto the lesser valued Indice. Like looking left historically at an instrument with a lot of data for support and resistance levels.

Obviously with DJI being the highest dollar value Indice and it also moving higher past its all time high at some point into unknown price territory, we will have to rely on its own price structure for support levels or Fibonacci levels for clues about were price will find resistance levels in the future.

On SPX and NDX though we have a different story. As these 2 Indices move higher into unknown price territory with no price structure of their own to the left looking back, we can use the past price structure of the higher dollar valued Indice (DJI) market highs and lows to assess future levels of resistance or to find future price targets.

With SPX we will be able to use NDX and also DJI to find future higher price targets and resistance.

With NDX we will be able to use DJI to find future higher price targets and resistance.

Some examples,

If you pull up these 3 indices on a line chart yourself you will find that with NDX and SPX the support levels for the Dotcom and GFC crash's were DJI's historical price structure levels from 1961-1981. $731-$965.

If you look at SPX the present high and previous equal high on 01/2022 you will find it is mirrored in price structure on NDX 2015-2016 period and that the 2000 Dotcom peak is acting as a support level $4380 for present SPX price structure. NDX 01/2022

If you go way back in time to the 1930's Great depression market crash you will find the Aug 1929 SPX high $32.50 was in fact a resistance level which became support level for DJI back in 1898 and 1903 respectively.

The major past Cycle Highs on the higher valued Indice prior to recession tend to be the resistance levels for for future highs on the lower valued Indices. Or resistance levels that were broken and became support on DJI became resistance dollar value levels for SPX and NDX.

It is obvious that vertically this 3 indices would show similar reactions to market shocks but I'm not quite sure why horizontally there are so many matching price support and resistance levels.

This is a Monthly Chart over a 130 year period so the levels are harder to see and not precisely dollar accurate but if you use a weekly or daily chart you will see the levels line up very well.

So, obviously in my head I'm wondering what the heck is happening here exactly?

Some of these older levels have played out over 50-60 years into the future on DJI to the SPX and NDX, more recently the time frame is reducing to around 10-20 years.

Fibonacci levels also work on this chart going from lowest value Indice at a recession low to next business cycle high on highest value Indice.

Maybe W.D Gann could explain this accurately for me....Like is there some sort of Fractal playing out here or do the Wall street crew already use this method or is it the madness of the crowd echoing forward through time unwittingly expressing human emotion into charts of financial greed and fear? Who knows? I'd like to hear Traders ideas about this phenomena.

Dow 30 Tanks! Short Trade Hits First Target – More Downside?The Dow 30 (DJIA) has shown significant bearish momentum, with the short trade reaching Take Profit 1 (TP1) at 42855.11.

Key Levels

Entry: 42975.00 – The short position was entered as the price broke below this level, indicating bearish sentiment.

Stop-Loss (SL): 43072.00 – Placed above recent resistance to protect against a potential price reversal.

Take Profit 1 (TP1): 42855.11 – The first target has already been reached, confirming the downward move.

Take Profit 2 (TP2): 42661.11 – The next target as the bearish trend continues.

Take Profit 3 (TP3): 42467.11 – A further target if selling pressure persists.

Take Profit 4 (TP4): 42347.22 – The ultimate profit target signaling a continued decline.

Trend Analysis

The price has dropped below the Risological Dotted trendline, confirming the strength of the bearish trend. With TP1 already hit, further downside potential is in play, with the price likely to test TP2 and beyond.

The short trade on the Dow 30 has successfully hit its first profit target, with further targets likely if the current bearish trend holds. The strong downward move suggests that TP2 and TP3 could be reached in the near term.

New Technologies Can Push Stocks to New HighsNYSE:CAT easily moved above the resistance highs from March and out of its sideways trading range, making new highs. The white candle on lower volume was interesting: intraday showed pro traders in control toward the end of the day as retail traders and smaller funds started selling prematurely. A resting pattern would be a lower-risk entry to prepare for the breakout.

Caterpillar, Inc. has new technologies coming to market. The company unveiled its new technologies for mining on Sept 24, 2024. It reports earnings on October 29th. If you are trading or holding this stock, check support levels but be patient.

US30 (DowJones) - Daily Bearish SetupThe BLACKBULL:US30 index experienced a bullish spike, followed by a period of consolidation within a bullish channel. However, after a fake breakout above the upper boundary of this channel, it appears that the index could be poised for a downward correction. Based on the technical analysis, a fall toward the lower boundary of the channel is expected, providing traders with potential shorting opportunities in the near term.

Fundamentally, stock market volatility tends to rise during September, a historically weak month for stocks. This pattern is often attributed to traders returning from summer vacations, rebalancing portfolios, and increased bond offerings, which divert capital away from equities. In 2024, this volatility is further exacerbated by uncertainty around the Federal Reserve’s rate decisions and the upcoming U.S. presidential election. Investors are closely watching labor market data, inflation trends, and the Fed’s stance on potential rate cuts, all of which could impact market sentiment and drive further fluctuations in stock prices.

With the TVC:DJI at the top of the bullish channel and signs of weakness after the fake breakout, a pullback to the lower end of the channel seems likely. Traders should stay cautious and monitor key economic events and technical signals for opportunities to re-enter positions at more favorable levels.

US30/DOW30 - Preparing stageTeam, we are preparing to short US30 once the price set up confirm at 41035-50. However if the price continue to pass the above price 41150 then we need to review again. Please do not enter yet. We would prefer to trade during US marketing opening.

if it go according to our plan, Short will be place around 41035-50, with stop loss at 41232.40

TARGET 1 - 40898.40

TARGET 2 - 40603.10

TARGET 3 - 40297.70

We will update once we are in the market, please check our update comment below the chart. Thank you

Dow30 - US30 Faces DownturnBLACKBULL:US30 has returned to a crucial resistance zone, which aligns with a bearish technical setup. After the recent decline, this move back to the resistance suggests that a further drop may be imminent, especially if the index fails to break above this zone. The pattern indicates that TVC:DJI could start its downward trend again following a retest of this level, where sellers are likely to re-enter the market.

Fundamentally, the rising unemployment claims in the U.S. have heightened fears of a recession. With more individuals out of work, consumer spending could slow down, which negatively impacts corporate earnings and the broader economy. This situation could exert additional downward pressure on the Dow Jones, making the possibility of a significant decline more likely as investors brace for potential economic contraction.

DowJones - 4H Bearish SetupBLACKBULL:US30 has been exhibiting signs of bearish pressure, despite recent upward movements. The chart shows a significant decline below the ascending trendline. The recent upward movement appears to be a pullback, potentially setting up for further declines. Two key resistance zones have been identified on the chart, where the index may face renewed selling pressure.

Fundamentally, the broader economic environment is contributing to the bearish outlook. The possibility of a recession looms large as the Federal Reserve has postponed rate cuts in response to persistently high inflation. Rising unemployment claims are another concern, signaling potential economic weakness. These factors are creating an environment where risk assets like the Dow Jones are likely to struggle, and any rallies may be short-lived.

The current pullback in the TVC:DJI could provide a better entry point for those looking to short the index. The key resistance levels identified on the chart could serve as optimal zones for initiating new short positions, with the expectation that the index will continue its downward trajectory.

Given the macroeconomic uncertainties and technical setup, traders should remain cautious and consider the potential for further declines in the Dow Jones Industrial Average. This cautious stance is supported by both the chart analysis and the broader economic fundamentals.

US30 - 4H DowJones is in a pullbackThe Dow Jones Industrial Average (DJIA) is currently facing significant bearish pressure, as indicated by recent market trends and technical analysis. The support trend line has broken, leading to a notable drop in the index. This break, coupled with a clear pullback, presents an opportune moment for traders to consider short positions with a logical stop loss.

From a fundamental perspective, the rising rate of unemployment and the postponement of interest rate cuts are increasing the chances of a recession. These economic indicators suggest that the market could experience further declines as investors react to the potential economic downturn.

US30 - 15m Buy scalpThe Dow Jones Industrial Average (US30) is currently on an upward trajectory, showing strong bullish momentum on the 15-minute chart. As it continues to rise, it is approaching a key resistance zone that has previously served as a turning point. Traders should watch this level closely, as the price may test and react to this resistance, potentially leading to a breakout or a consolidation phase. This anticipated rise towards the resistance zone signals a pivotal moment for US30's short-term direction, providing opportunities for strategic entries and exits based on price action around this area.

DowJones (US30) Bearish patterns and signsIn this 1-hour chart of DowJones (US30), we observe a significant bearish pattern forming after the price action. The market hunted the highs of both the Asia and Euro sessions during the NY session, which typically signals a liquidity grab. This maneuver often leads to a swift reversal, as is evident by the price dropping back down after touching the resistance zone.

The index has broken down from a rising wedge pattern, a bearish reversal signal. This suggests that after the false breakout to the upside, the DowJones is poised for a considerable decline. Traders should anticipate further bearish momentum, potentially leading the index down to lower levels. The break below the wedge confirms that the upward momentum has weakened, and sellers are likely to dominate, pushing the price down further.

Keep an eye on support levels for any potential slowdowns, but the overall trend appears to be bearish for the immediate future.

AMZN Under Pressure to Offer a DividendInventory adjustments are underway for $NASDAQ:AMZN. These adjustments are minor as Dark Pools are holding AMZN long-term, but there are other opportunities to boost ROI in younger companies.

AMZN needs to provide a dividend now that it is a Dow 30 stock. The mild rotation is a gentle reminder to the Board of Directors from their most critical and important investors, the Giant Buy Side Institutions. AMZN is the only fortune 500 company on the S&P500 that doesn't provide a dividend YET. The company's CEO is seasoned and aware that the Board must soon offer dividends, as it is no longer merely a "growth" company.

The pressure is increasing to force a dividend by the Giant investors. This should happen this year. There are no buybacks going on right now either. So the lowering of inventory is a warning to get this done. The Buy Side has the clout to influence the Board's decisions. This would benefit all investors big and small.

The support is at the lows of the red box on the chart, as indicated by the gap down white candle that quickly ended the previous selling by smaller funds.

WHEN, not if, AMZN announces a dividend, there is likely to be some brief momentum activity to the upside.