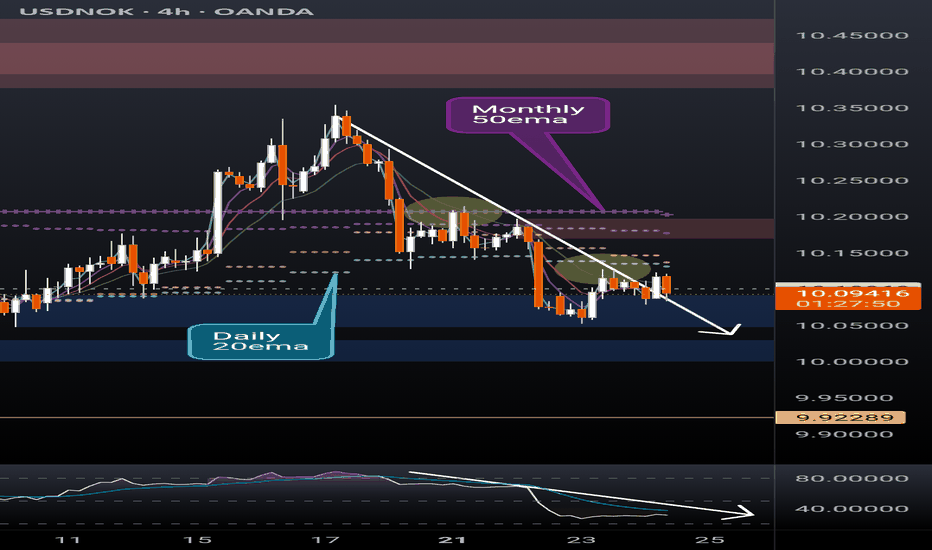

Downtrend

USDNOK short potential setupUSDNOK recently broke down below the monthly 50ema (overlayed on this 4h chart) and has rejected off the daily 20ema (overlayed) twice this week. RSI is showing bearish momentum after a brief overbought period while the PA has remained in a strong downtrend. Short setup potential is evident but not certain.

I'm a cat not a financial advisor.

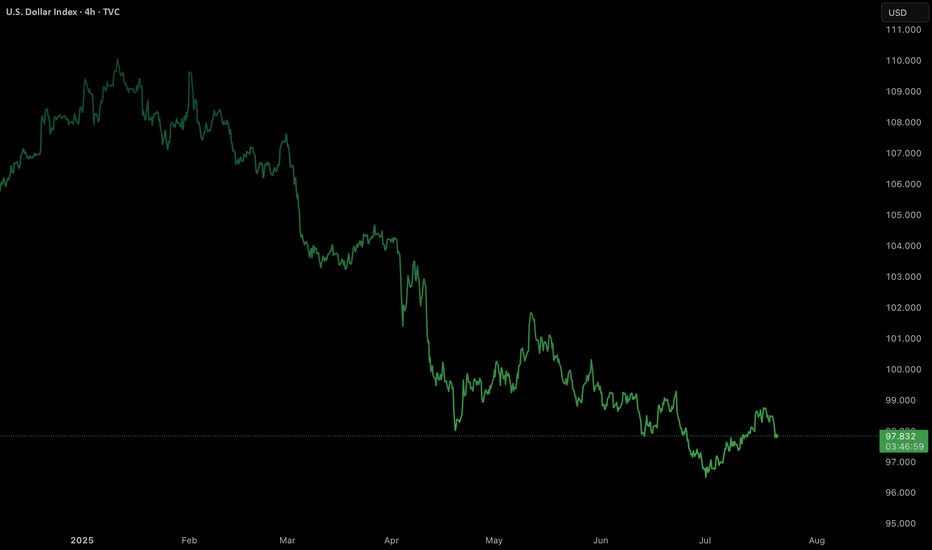

U.S. Dollar (DXY) bearish?Will dollar continue its bearish momentum or will it reverse?

Technical Summary

DXY remains in a firm bearish trend, having dropped around 11% this year. The setup is formed by a chain of lower highs and lower lows, confirming an unrelenting downtrend.

Support Level: ~97.70

Resistance Zone: 98.55–98.80

Long-Term Outlook: Bearish, unless a clear break and close over the resistance zone on the daily or weekly timeframe.

Technically, the momentum indicators remain weak, and the failure to sustain rallies above the 99.00 level also contributes to downward pressure further. The market is now consolidating within a narrow range after steep selling, which suggests probable continuation if macro catalysts are favourable.

Fundamental and Sentiment Drivers

Several macroeconomic and geopolitical drivers are underpinning the weakening of the U.S. dollar:

Federal Reserve Uncertainty:

Speculation over the ultimate fate of Federal Reserve Chairman Jerome Powell under political pressure from the executive branch has severely undermined investor confidence in the central bank’s independence. This has been manifested in increased volatility and bearish pressure on the dollar.

Trade Policy and Tariff Risks:

Ongoing trade tensions, including the possibility of sweeping tariffs (15–20%) on Chinese and European Union goods, have created a risk premium on valuations of the U.S. dollar. Market players still fear retaliation and its effects on trade stability in the world.

Fiscal Position and Credit Ratings:

The US fiscal deficit, which is approaching 7% of GDP, and recent credit rating downgrades to its outlook, have set alarms ringing regarding the structure. These fiscal developments have eroded the popularity of the US dollar as a safe-haven asset, particularly with foreign investors.

Global Monetary Landscape:

With European Central Bank and Bank of Japan maintaining policy guidance tight, and Federal Reserve already indicating that direction for a rate cut in Q4 2025 is being eyed, the falling rate differentials still maintain pressure on the dollar.

Market Outlook: Week of July 21–25, 2025

Major Geopolitical and Economic Events:

DATE : Ongoing

EVENT : U.S.- EU & U.S. — China Trade Negotiations.

MARKET RELEVANCE : High

Resolution or escalation will directly impact USD demand.

DATE : Mid-week

EVENT : Federal Reserve Speeches (including Powell)

MARKET RELEVANCE : High

Monetary policy guidance and institutional stability.

DATE : July 24–25

EVENT : Jobless Claims, Flash PMIs, New Home Sales, Durable Goods Orders

MARKET RELEVANCE : Medium–High

Labour market data, housing data, and production activity have the potential to shift rate expectations and dollar sentiment ahead of the FOMC and PCE releases.

Strategic Implications

Outlook: DXY remains structurally bearish in the short to medium term. Additional weakness below 98.80 and sustained closes below 97.70 would reassert downward momentum, risking a further retracement to the 96.00-95.50 region.

Possible Bullish Reversal Triggers:

A conclusive resolution to U.S. trade negotiations.

Unexpectedly solid economic data (particularly core inflation or employment).

Hawkish Fed commentary supporting policy tightening expectations.

Last thoughts

The U.S. Dollar Index is currently at structurally weak technical and fundamental foundations. Absent a sudden reversal of the monetary policy message or geopolitical resolution, the path of least resistance appears to remain to the lower side. Market participants need to pay special attention to upcoming economic data releases, central bank rhetoric, and trading news because any one of them could be a pivotal driver of near-term dollar behavior.

GBPUSD Week 30 Swing Zone/LevelsPEPPERSTONE:GBPUSD is expected to trend upward from the 1.34032 level towards the resistance zone. Whether it breaks through or reverses downward will ultimately depend on market players.

This projection is based on a forward-looking metric analysis, which explains why the zones are not derived from historical price action on the left side of the chart, as is common in traditional technical analysis. However, the daily candles from previous weeks still contribute meaningfully to this outlook.

RCI, Bear Flag On The Daily As Well As The 4hr Analyzing both the daily and 4-hour charts reveals a very prominent bear flag, which has formed following a steep decline. This pattern is often indicative of further downward movement, and it's hard to ignore the implications.

Word on the street is that they're currently in dire straits. Since the Shaw acquisition, they've hemorrhaged 11 billion in valuation. The situation is exacerbated by declining revenues and missed growth targets. In short, it's not looking promising.

If the trend continues downward, we might see the price testing the $19 USD mark sooner rather than later.

For those who are currently long on this or have any vested interest, it might be prudent to reconsider your position and cut your losses before it's too late.

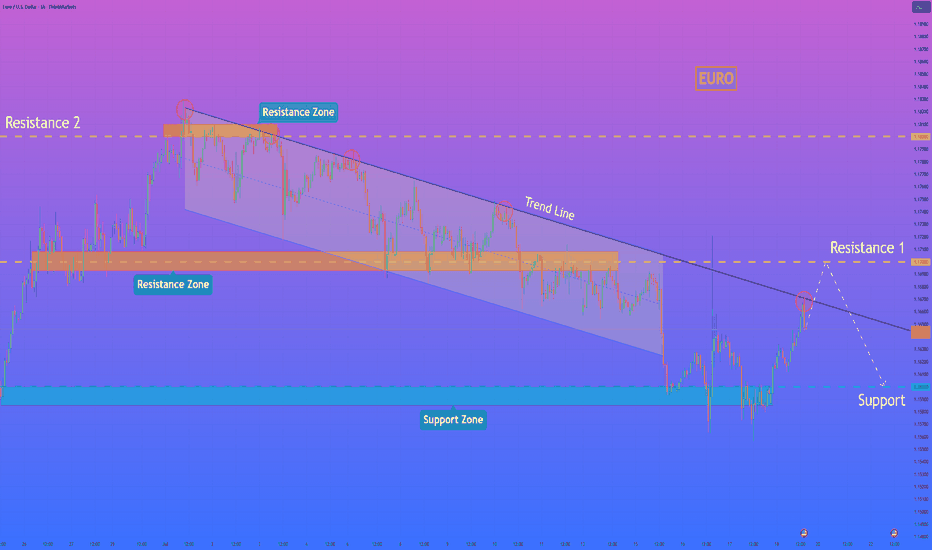

HelenP. I Euro will reach resistance level and then start fallHi folks today I'm prepared for you Euro analytics. For an extended period, the euro was trading within a clearly defined downward channel, consistently respecting its boundaries and moving under bearish pressure. Recently, however, the price staged an aggressive breakout from this structure, pushing above the upper trend line with a strong impulse. This move signaled a potential shift in momentum, as buyers appeared to take control and drive the price away from the major support zone near the 1.1600 level. Currently, following this upward breakout, the price is approaching a critical test at resistance 1. This area, centered around the 1.1700 level, is significant as it previously acted as a key pivot point and support inside the downward channel. The current price action is a classic scenario where old support is being retested as new resistance, which will determine the validity of the recent bullish move. Despite the recent breakout, I expect the upward momentum to fail as the price challenges the resistance zone 1 around 1.1700. I anticipate a rejection from this level, which would confirm the breakout as a false move and re-establish the dominant bearish trend. The primary target for the subsequent decline is the major support level at 1.1600. For this reason, my goal is set at the 1.1600 level. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

HelenP. I Gold may retest resistance before dropping to $3230Hi folks today I'm prepared for you Gold analytics. If we look at the chart, we can see that after a period of sideways consolidation, gold started to form lower highs under a descending trend line. Each time the price approached this trend line, it was rejected, confirming strong bearish pressure. Most recently, XAUUSD broke below the support-turned-resistance level around 3295, entering the lower resistance zone. Now, the price is trading just under this area, which has acted as a strong supply zone in the past. Given the current technical setup, I expect that gold may show a minor upward move to retest the resistance zone between 3285 - 3295. However, this retest is likely to act as a trigger for sellers to step back in. The prevailing downtrend and repeated failures to break the trend line suggest further weakness ahead. That’s why I’ve placed my target at 3230 points - a level that aligns with the next major support on the chart. This area could provide the next bounce opportunity, but for now, the bearish structure remains dominant. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

INJ Breakdown in Play Eyeing the Neckline for Precision ShortsINJ/USDT Analysis

〽️ The Head and Shoulders pattern has broken down successfully, confirming a bearish structure.

💠We anticipate a potential relief bounce towards the $11 region which aligns closely with the neckline retest zone. This area is likely to act as a liquidity trap, where institutional sellers may re-enter aggressively 👀.

🎯 Key downside targets remain at

1. $8.98

2. $8.03

3. $6.92

Strategic Plan 🎖️

Look to initiate short positions around the neckline retest near $11, as the risk-reward becomes increasingly favorable from that level.

Trade with discipline. Let the structure lead the execution. 🫡🧠

DOW30/US30 - ACTIVE TRADE - PROFITABLE SET UP TRADETeam,

today I have provide LIVE trading today provide you i did a good trade for

NAS100, DOW30 AND DAX30 - in real LIVE trading

OK, I prefer to SET UP my limit order today only. Remember, the market will be very volatile in the next 4 hours.

I expect the RATE should cut 25 points at least. Why

the employment data come out remain the same

inflation last week look under control

Retails is poorly come out today

The FED does not care about the America, they just care about taking advantage of America.

Lets now focus on the SETTING BUY LIMIT ORDER

I order small volume at 41975-42075

However I will double up at LIMIT BUY ORDER

The 1st target are looking at 4227542300

Target 2 - 42575-42675

REMEMBER - IF IT DOES NOT HIT YOUR ENTRY, JUST WALK AWAY.

The Fundamental Truths About a Trending MarketBefore you can trade successfully, you must first understand what defines a market trend.

🔼 What is an Uptrend?

An uptrend is characterised by a series of Higher Highs (HH) and Higher Lows (HL). This signals that buyers are in control and price is climbing steadily.

🔽 What is a Downtrend?

A downtrend is identified by a series of Lower Lows (LL) and Lower Highs (LH). This indicates that sellers are dominant and price is consistently falling.

📌 Important Facts About a Trending Market

Trends don’t change easily. Once a trend is established, it tends to persist.

A trend reversal takes time and effort. It doesn't happen abruptly — the market needs a strong reason to change direction.

There are always warning signs. Before a trend changes, there’s usually a pattern or shift in behaviour that acts as a clue.

The bigger the trend, the longer it takes to reverse. A well-established trend will require more time and evidence before it breaks.

🎯 Keys to Trading Any Market Successfully

Identify the market condition.

Is the market trending upwards, downwards, or moving sideways (consolidating)?

Study price behaviour at key levels.

Understand how price reacts at significant highs and lows.

Learn the anatomy of price waves.

Recognise wave structure — how price expands and contracts in trends.

Align your trades with the market condition.

Your entry and exit strategies should fit the current phase of the market.

🔚 Summary

Mastering trends is one of the most important skills in trading. When you understand what defines an uptrend or downtrend, recognise when a trend may be ending, and align your strategy with the market condition, you set yourself up for consistent success. Patience, observation, and timing are key — because the market always leaves clues, but only for those who are prepared to see them.

USD-CHF Bearish Bias! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend and the pair

Is making a local bullish

Pullback but will soon

Hit a horizontal resistance

Level around 0.8185

So we are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

PolkaDot (DOT) Structure Analysis (1D)BITGET:DOTUSDT is showing signs of strength after a deviation below the long-standing $3.70–$4.10 demand zone.

Key Levels

• 🟢 Demand Zone: $3.70–$4.10, respected since October 2023

• 🟡 Broken downtrend resistance, retested as support

• ⚪ Current falling channel (compression) following range high retest

• 🟥 Sell Order Block: $5.10–$5.40

• 🟧 Range Resistance: $5.40

• 🎯 Target on breakout: ~$7.00, potential extension to ~$7.50

Thesis

• The recent breakdown was quickly reclaimed, hinting at a possible spring/fakeout. After retesting the range high, price is now compressing within a descending channel, building energy just above demand.

• A breakout from the channel followed by an S/R flip of the $4.40–$4.60 region could trigger a rally toward the upper range.

Watching for

• Channel breakout with volume

• Clean break above $5.40 to confirm range expansion

Invalidation

• Sustained break below the $3.70–$4.10 demand zone

Celestia (TIA) – Ascending Triangle Setup (4H)BINANCE:TIAUSDT is printing a clean ascending triangle on the 4H chart, signalling a potential reversal.

Key Levels

• Support: Ascending trendline

• Resistance: $2.30 – a key level that acted as support since early April

• Measured Target: $2.50–$2.55 – aligns with prior support area

• Watch out for the longer-term descending trendline, which could act as resistance on breakout around ~$2.40

Breakout Trigger

A solid 4H close above $2.30 with convincing volume could confirm the move

Invalidation

A sustained break below the ascending support would fully invalidate the setup and potentially lead to a drop to $1.70

Shoulder on Shoulder - Need a dump this Week😥 The past week was complicated, and I don't want to bore you with all the political goings-on, which I hope you're already aware of. I'm a bit short on time right now, but I still wanted to share this perspective with you all.

💁♂️ It is Shoulder on Shoulder H&S everywhere!

💡 My concept of a plan:

🧗 Let's climb the Pinky way down

3289 - Actual Price

3271 - 🏁 S1

3232 - 🚪 Pink Neckline entry

3245 - 🤞 S2 & Head of White reverse H&S

3204 - 👀 Pink Start from Left Shoulder

3184 - 🎯 TP 1 - Fibo 1.272

3163 - 🎯 TP 2 - Fibo 1.414 or 3166

3134 - 🎯 TP 3 - Fibo 1.618 or 3154

3120 - 👀 Head of Yellow reverse H&S

3079 - 🎯 TP 4 - Fibo 2

🗣️ Important: FED Chair Powell speaking June 02 Mon at 1 PM EDT

What are your toughts about this? Please write it in the comments.

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Understanding Market StructureIn this video, I break down market structure in a simple and easy-to-digest way, helping you understand how to identify whether the market is in an uptrend or downtrend.

Recognizing market direction is a key skill for any trader, it allows you to trade in alignment with price action and make more confident, higher-probability decisions.

✅ If you're new to trading or want to sharpen your edge, this video will give you the insights needed to read market trends more clearly.

📈 Hope you find value in this breakdown!

👉 Don’t forget to like, comment, and subscribe to support the channel and stay tuned for more educational content.

Euro may grow to resistance level and then drop to 1.1275 pointsHello traders, I want share with you my opinion about Euro. After forming a strong upward move from the buyer zone (1.11850–1.1210), the price rose sharply, broke the mid-range resistance, and entered the seller zone between 1.1380 and 1.1400. Once it reached the upper boundary of the broadening wedge, the price bounced down from resistance at 1.1380. Now the price is trading inside a broadening wedge, showing signs of a potential reversal. After failing to hold above resistance, the Euro started to decline from the seller zone, confirming selling pressure. The current movement points to a correction within the wedge structure. I expect the Euro will continue falling toward 1.1275, my TP 1, where the support line of the wedge coincides with the upper boundary of the previous buyer zone. This zone has already shown strong reactions before and could act as a short-term reversal area. Given the recent rejection from resistance, the broadening wedge formation, and return from the seller zone, I remain bearish and anticipate further decline. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

XAUUSD: Mid-Term Swing Sell OpportunityXAUUSD: Mid-Term Swing Sell Opportunity

While Gold's (XAUUSD) larger timeframe remains bullish, the intermediate trend has turned bearish. This shift is clearly signaled by a break below previous lows and the formation of a clean Head and Shoulders reversal pattern.

Currently, price is testing a strong support confluence at a Fair Value Gap (FVG) and a Demand Zone below.

Strategy: Bounce & Sell

Our strategy is to sell into bounces (short on rallies). Key resistance levels to watch for reversal

signals include:

3300: Coincides with the Range Volatile Day High.

3325 - 3350: This is a significant Supply Zone.

We will wait for bearish candlestick patterns and reversal patterns to confirm the move down at these resistance areas.

Downside Targets

Our primary downside targets are:

3150: Aligns with the Range Volatile Week Low.

3100: If this level breaks, we'll then look towards the final support at 3000, potentially forming a Triple Zigzag (WXYXZ) corrective structure.

From a time perspective, we anticipate this bearish phase to last approximately 13 days, in line with Fibonacci Time Cycle analysis.

Crucial Considerations

Effective Money Management is paramount. Ensure your position sizing is appropriate for the expected volatility range. Always be prepared to adapt your view when the price structure clearly invalidates the current bearish setup.

Trade carefully and profitably.

C.Goii Super Trader

Potential Head and Shoulders Pattern on XAUUSD (Gold)Chart: XAUUSD (Gold) on the 15-minute timeframe (based on "XAUUSD-15-OANDA" in the image).

Pattern: Possible Inverted Head and Shoulders. The image highlights what appears to be a developing head and shoulders pattern.

Key Observations:

Head and Shoulders Formation: The image indicates a possible left shoulder, a head, and what could become a right shoulder.

Fibonacci Retracement: There's a Fibonacci retracement level of 0.618 marked from the head to the potential right shoulder.

Trendline: A downward-sloping trendline connects the highs of the pattern.

Support/Resistance Levels: Horizontal yellow lines suggest potential support or resistance areas.

XAUUSD: Downtrend Channel - Potential Short OpportunityXAUUSD is currently trading within a well-defined descending channel on the 2-hour timeframe. Price action has been respecting the upper and lower trendlines, suggesting a continuation of the downtrend.

Given the overall downtrend, I'm seeing a potential short opportunity.

Entry: Look for a SELL signal near the upper trendline of the channel or within one of the resistance zones.

Stop Loss: Place a stop-loss order above the most recent swing high or above the resistance zone to limit potential losses, around $3,390.00.

Take Profit: Target a Take Profit (TP1) near the lower trendline of the channel. A potential TP level is around $3,250.00

Target a Take Profit (TP2) near the lower trendline of the channel. A potential TP level is around $3,150.00 (adjust based on your risk tolerance and analysis).

Confirmation:

Before entering the trade, seek confirmation from other indicators or chart patterns (e.g., bearish candlestick patterns), or wait for a sell signal from our indicator.

Consider the overall market sentiment and any upcoming news events that could affect the price of gold.

Risk Management:

This is just an idea, not a trading recommendation.

Trading involves risk, and you could lose money.

Always use proper risk management techniques, including stop-loss orders and appropriate position sizing.

Disclaimer:

I am not a financial advisor. This is just my personal analysis, and you should do your own research before making any trading decisions.

DOW/US30 - PERFECT TIME FOR LONG ENTRYTeam, i hope you all making millions on SHORT BOTH SETUP UK100 AND GER30 today

However there is no perfect time to entry LONG DOW/US30 now

please follow the guideline and entry..

target 1st is 150-200 points

2nd target between 300-500 points.

we expect this swing will take tomorrow and next day for the recovery.

DHANI SERVICES MAY GIVE BREAKOUT SOONDhani Services is an Indian consumer business that operates through its app, Dhani. It provides a range of services, including digital healthcare, financial services, e-commerce, UPI payments, stock trading, and bill payments. The company was originally founded as Indiabulls Ventures Limited in 1995 but was later renamed Dhani Services Limited in October 2020.

SHORT TERM MAY TOUCH 69 TO 72 MARK.