TSLA trade of the weekThis idea is something new where I'm asking my HIGHLY EXPERIMENTAL dowsing work for a "best bang for your buck" trade at the beginning of the week. Last week was pretty good saying to short SPY on Wed., so I'm going to journal these and see if it can be consistent.

If this aligns with YOUR work, great.

The idea is TSLA has a spike up towards the upper gap around $326-28. My levels on TSLA often are overshot, but anyway. Then watch for it to head towards the lower gap in the $310-307 zone and possibly down to $302.

My work is INCONSISTENT. There's more going into this than just looking at an indicator. This is energy, intention, intuition and God knows what else and it's more for myself than you. But, if you're interested, I'm happy to answer questions and share as I hope it inspires your own sense of what is possible beyond just the physical world.

Dowsing

TLT long into Sept. 26th?I had TLT on my calendar (from the very EXPERIMENTAL dowsing work that I do) for yesterday and today from readings I did on 5/22 & 5/18.

Being that it was looking like a swing low in this date window, I checked this morning, & from the very experimental work that I do, I get that it's heading to around $100. I had a prior post suggesting a larger bottom in place, and this appears to have been accurate.

The date for exit (VERY EXPERIMENTAL & for journaling purposes) I get is Sept. 26th.

*** NOTE ***

I post things here as a method of journaling ideas. If it aligns with YOUR OWN WORK, great. I'm pretty sure everyone has their good and bad streaks no matter what method they use.

So, I had a rough patch after finding out my incredibly special companion kitty was dying. Did I know att this would affect my work? No! I tried to stay "normal" ( for me ;) ). Did I learn something? Of course, & in the future I will allow myself more downtime to come back to balance.

No one really knows what's going on in my life, but I guess this work is probably more subject than other methods to emotional or energetic disruptions. I always clear my energy, but in certain circumstances it may be better to just chill. I'm learning as I go. If you have any advice on making this work better, please lmk.

News sends SMCI down?I do dowsing for my information on stocks, & it came to my attention that SMCI may have some news around 9 am tomorrow that sends it down over 13% (taken from the Fri close).

It suggested just a daytrade - for reference last Thursday dowsing also said there was a short daytrade in TSLA & you probably know it was down 18+%.

Since I blew off the TSLA guidance, I don't want to miss this one! The idea is to short into the $35-36 area and buy it there.

I may be off on the timing. This morning I asked how many hours till this occurs & it was 20 or 20.4 from around 8:30 a.m. There is also something the 11th. Maybe that is when it really turns back upward?? Of course, it could be nothing too, but I'll check in on Wed.

It will be a "scene of the crime" trade at the target area, so this could be really nice catching both sides IF IT'S CORRECT. My work can be spot on at times & miss entirely others, but I did pull an oracle card from a website that has tons & tons of cards it "randomly" chooses from. I asked about this idea and it gave the YES card - your intuition is correct. We'll see.

Watching for pullback in METAMETA hit a target area I had on my dowsing work for the upside. Actually, it busted it by $10, but I get that it'll pullback to around the $610 area. There may be some kind of news. I'm unsure if it's specific to META, or the entire market. This would be happening soon. Like, tomorrow. BUT, I've been very wrong before... so if it triggers short, I'd expect it to be a decent move down (over 5%). We'll see.

Swing high on QQQ?My dowsing work is suggesting today is likely a swing high in indexes and there will be a few days down from around here. The level I expect on QQQ is just under 500. I've had some numbers as far as into the 80s as well, but not expecting that this go around.

I posted my roadmap for SPY as an idea for what to expect this week, and this is playing out so far. Today would be the "look above and fail", but we need to get the fail part! If it starts, then I think the target lower is valid.

I also will mention I get the number 6. That could be price or percent. If percent it's down to 495, which makes sense. In terms of price the last swing low was at 506.... idk we'll see.

SPY dowsing roadmap for this weekI've been posting the weekly readings my dowsing has given for SPY's potential price movement the past couple months and it's really interesting.

I go week by week, but am starting to include each day of the week looking forward. I left on the chart the prior notations from those ideas I've posted & you can reference what I had versus what actually occurred.

This week is quite negative. I've had the number around $562-62 coming up for a while, & beyond that, around the $542-48 area as I recall. I don't really get any positive gain over last week's close.

We'll see what happens.

SPY volatility this weekI'm posting the rest of the readings I did for each week this month on SPY. This week I'm expecting a drop into Wed. I get all my info from dowsing, btw.

I noticed all last week it kept suggesting to sell rallies, which makes me thing we're going to pull back. The weekly (done at the beginning of the month) did suggest over 5% down this week. But my dowsing now says to watch for a bounce Wed. with a look below & fail. Move up to some extent Wed. & reverse down Thursday (implies gap up or some up). Then Friday up. Short term watching the $575 area for the bounce or resumption of trend.

Next week's reading of down more is a bit of a head scratcher, so that's why I think things could just be really volatile.

Low on QQQ I'm looking for is 498.

GLD where to?My dowsing work suggested a high around $288 on GLD, which obviously worked out (see prior idea). There's often a decent reversal opportunity once levels are hit. This one was golden... Wah-wah.

I'm trying not to over ask on things because with my work, I think it opens the door for misleading information or confusion on my part.

Simply put, the guidance was to get a date from the past, which was Jan. 10th. Look to revisit that price, which happens to correlate with the area of the 200 sma. When I asked what price from the H/L of that day, I get $249.

I drew a line to show the reference candle from January.

I ask what date this may occur by & get May 15th, but another date came of July 26th. There's some big stuff I think happening in indexes too in June/July. Dates are often reversals, but can be nothing. You just never know, but odds are more often they are something.

GDXJ short to $44Using my dowsing readings on GDXJ as confirmation was helpful for the long GLD idea, so why not use it for the move down idea? Only this time, I'll post what I get :)

As I mentioned, I'm a dowser & all my ideas and levels come from that. There's not much to this idea other than it shouldn't go much above 54. I do have a bit higher on GLD, and then a significant correction, which on GDXJ gives me a target of $44.

Levels hit well before, so hopefully, we can get lucky again.

SPX potentials for resistance & lowsI do dowsing & that's where I get my information from. I am expecting a move up tomorrow and then a high Wed./Thurs. with a reversal back down.

I've had levels around the 5450 area even since September, as well as dates suggesting a return to prices even lower from around November/December 2023, which if you recall, was the start of this big run up. I'm only showing the more near term idea, because that's what seems more clear.

The areas at the top are likely resistance in the near term. I'm not sure on timing for lows, but suspect something big in June/July.

I have some potentially important dates including this Thursday, as well as April 18th, 23rd, June 2nd and twice I get July 14th as well.

Intuition stock: NOW shortI navigate markets by using my dowsing skills, and sometimes, intuitive hits. I actually have to sit still & ask for the intuitive stocks, however, & I don't often do it - even though I've had some remarkable results.

I did take a shot this morning though & heard or received, "NOW". Unsure if it was a suggestion to be more in the moment, I cleared my mind again & still got NOW & repeatedly the number 38. I pretty much left it at that, but took a look at the chart anyway, then went on with my day. It wasn't until I decided this afternoon to ask dowsing if there's anything to it that I got really intrigued...

I asked for the most important things to know about it, and got the "crash" option, followed by, "it's a big high". So I take another look at the chart to see what the hod might have been, & then I was blown away to see it is $1037.94. That's as good as 38 to me, & this is why I'm making this idea to journal what happens because it was very clear and repeating the number 38 in my mind this morning.

I used dowsing to try for the low. I think it's about 5.7% down this week. That'll be around 976-78. And the bigger low is around $947. I asked what date that low may hit by and got a date of June 16th, but I wouldn't put too much weight in that. I can't wait to see what happens with this one. We'll see!

USO long tgt $81I do dowsing & had a date to watch for on Monday 5/5 in USO from a reading I did on 3/25 & it even suggested a swing low! Yay! I don't always get the correct info going into these dates, so I'm hoping this will get more consistent.

Anyway, there may be a spike down in USO in the near future. If so, it's a buying opportunity as my work suggests this is a longer term low that's in place. I get a target of $81, but it also did give me 84, but that's the prior high & suspect. That's why I asked a second time & got 81.

When I ask what date we may hit this target by, I get the date of July 17th, so watch what happens there.

That's all for now!

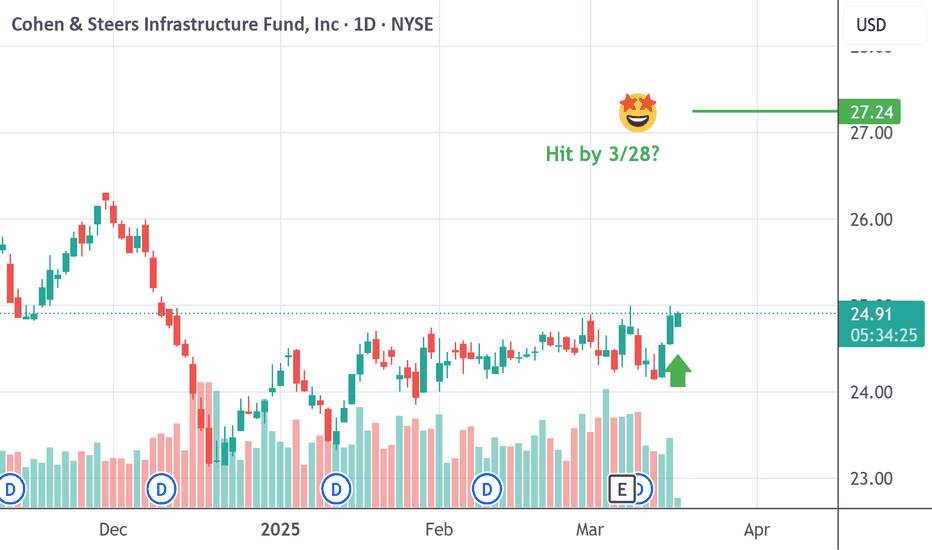

UTF up from here to 27.23ishMy dowsing suggested I ask for a stock from a screener I use. This list has many thousands of tickers & it's always interesting what I get.

This was neat because I asked what price I'm looking for BEFORE looking at the stock & the pendulum went to $26-27. So when I found it trading under $25 if felt like some validation.

There was a mention of a spike down & reversal up. Idk if that means this morning it already happened, or is yet to, but I'm pretty confident we hit the target, which is $27.23.

It shouldn't go under $24 & I asked what date we meet the target by and got March 28th.

There's no options on this fyi. We'll see how it shakes out!

Pendulum pick MTRN to $83Last night my dowsing told me to get a pendulum pick from the stock scanner. I do this from my ipad & all levels & info is from dowsing.

Anyway, I'll mention the first thing it gave me was a stock TDEC. I'm only noting this for journaling purposes. It's a weird "buffer" etf for emerging markets. Not interested, but may imply something bigger picture.

The second stock, which I changed settings on the screener to "optionable", is this MTRN. I know nothing about this stock, & I kind of like it that way so I'm not biased.

First things I get that it was going down, but will make a reversal up with the number 83. I was happy to see a number relatively close to where it's actually trading, but is down hard this today & I'm looking at 72 for a buy area. I did get the number 69, but that also could be the % down for today... and it's the prior low. Down 7% should be around $72, so watch this for a reversal and the target is 83. That also would fill a gap on the daily.

On a SPY idea I did pull a tarot card to see what it offered & it was totally relevant. This one was also really positive for just sitting back, relaxing & letting the money come. 4 of swords & 10 of pentacles if you're into it.

That's all.

Bearish energy TSLA earningsEarnings are kinda hard to read, but I totally nailed TSLA last time, so practicing here again with my dowsing.

It's all really bearish. I've already had a number around $188 come up for it, and that comes along with 185. Seems my levels get blown out by about 20 pts on TSLA, but watch out in these zones.

I suspect down 8%, but dowsing says down 17%. Advice is new 52 week low.

That's it. We'll see.

Pendulum pick for KR - short tgt 44I have many tens of thousands of dollars worth of home renovations to do, so why not ask my dowsing/spirit team to help find me a stock that can help PAY for these expenses and then some?

I'm a dowser, btw, so all my ideas & levels come from this form of information gathering. So woo woo ;)

The pick is from all of NYSE, so it's a lot. I'll admit, when I've done this in the past I've seen stocks have way better moves faster & I'm like, "why didn't you give me THAT one?!"

Regardless, I'm not going to disrespect the guidance, but just try to be more pointed in my intention. I did ask for this one to be a quick move, but I don't think it will be.

I do, however, have good confidence the target will hit. I did not look at the chart before I finished the reading & had a target. It's a way to see how accurate the level & info might be, so I was definitely happy the chart & levels look reasonable. It's literally at a multi year high & the dowsing said it's at a swing high.

Out the gate on this reading, it was saying swing trade short, & soon. It might get up to 69.

Anyway, when I ask about the 44 level (tgt), twice I get that the "target is reached". I tried to get the amount of time this takes & got the months around May/June as an exit, but it could easily be a few months. It's a 36% drop from 69 if it reaches there.

I drew the trendlines just to see how it behaves there. Maybe that'll help as a confirmation/trigger to short since it has been relatively strong.

That's it. Hopefully, this can pay some bills!!

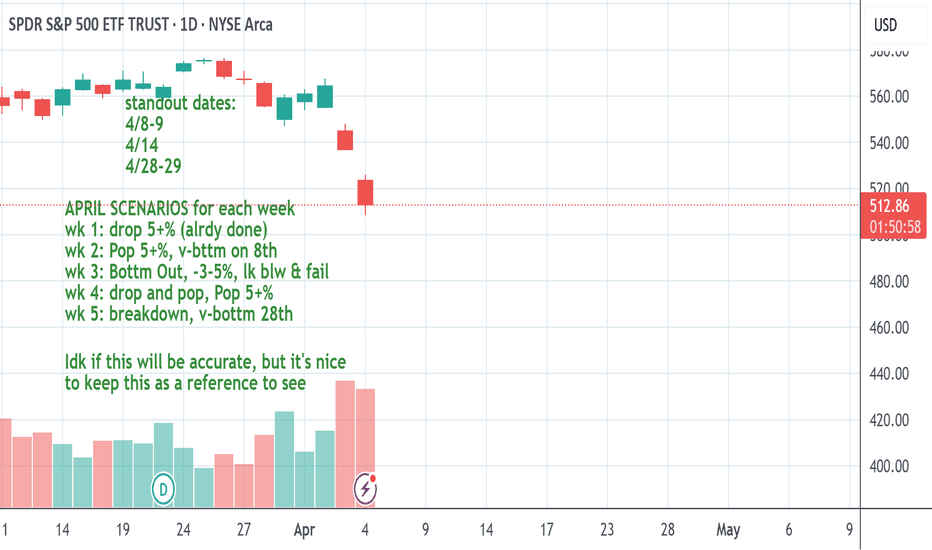

SPY short targets for this weekI expect this area to offer at least a bounce. There may be something like that on Thursday.

This is based on my dowsing work. I also left my prior idea, which was done at the beginning of the month to see how things shake out with projecting week by week with my work.

Obviously, the standout dates were very relevant. I don't get that there are any new dates to add.

Intuitively, I will say I heard the word, "floor". So where we land may be support for a bit?

We'll see. I'm still very new at intuitively hearing/receiving messages & things.

SPY April weekly forecasts - New stuff-This is an idea I've done in the past, but never posted on here. Sometimes it's pretty close to how things play out with variances on timing. Regardless, I want to see it as a journal entry for my dowsing work with all my notes with the chart.

It may be interesting to other people as well, so I'm posting it.

Dates are often reversals. I do think next Tuesday could be a bounce.

I'd like to get monthly highs/lows on SPY/QQQ, but that doesn't seem to be in the cards atm. :(

Downside tgt hit on USO. Bounce to $70?I've seen so many targets hit and reverse - especially GLD & GDXJ- I figured I may as well see if USO has a similar reversal since the downside target from my last USO idea is tagged & holding.

At the moment I get that it can get back up to the $70-71 area & it's a bull trap.

I also get the date of the 16th, so there's often reversals or interesting price action around dates. Oh, I do dowsing, btw, and that's where all my levels and information comes from. We'll see.

USO swing high- short tgt 65-66I asked my dowsing for the next trade to help reach my goal for the year, and it's oil/ USO. I do believe this will include oil stocks, so I may ask for dowsing to choose one from a list. If I do & get the reading done on it, I'll post it as another idea.

My latest work is pretty decent, but a work in progress. I'm really trying to determine time frames for when targets will hit so we can get the right options & mental expectation (i.e. patience) for things to develop.

The target is 65. In my mind I got 63, but I'm only sharing that because I'm also testing my own intuition more lately. The date we hit by is around April 28th.

I also have been guided to get dates from the past as an indication of what to expect, & the date given was 1/21, which was a gap down. I suspect there will be a gap down tomorrow, or at least the move down starts more aggressively. This has worked in prior ideas on TSLA & I think SPY... but can't remember.

I really am enjoying this method so far as my levels are often hit & I can just relax & allow things to happen with more faith they will. Of course, there's always the chance it's completely wrong & it is a smaller move, but we'll see.

TLT longer term high...I do dowsing and checked on TLT today. My work is suggesting this is a longer term high and that TLT will move down to around $85.

I'm not the best at getting time frames for things to occur, but I ask anyway. At a minimum dates more often than not signal some kind of reversal - though it may only be short term. Anyway, I get $85 in about 21 days, or 3/19. I like TLT options. They're cheap and if TLT can keep from any close higher than these highs, I think good odds for down.

MIRM expecting something bigThis stock was a pendulum pick (as in from dowsing) from around August. I posted an idea at the time, and it's gone up, but been consolidating. Last week or so, I decided to let my dowsing choose a stock from the fi viz screener from ALL exchanges.

There were over 9500 stock tickers & you know which one I landed on??? Yeah, MIRM again.

This is virtually impossible, & really got me fired up. I decided to check the option and that day (early last week I think) there were 1900 calls bought for next months $45 strike.

MIRM trades NO options, so this is extra interesting. And I happened to look on the day they were all purchase at once, or at least on the same day.

I will still expect the original target, though I do need to verify this still. I just can't help think something is brewing here.

NVDA support idea $108.90I do dowsing with a pendulum to get answers on what to expect in the market and stocks. I checked on NVDA today, and along with indexes soon (tomorrow) making a somewhat lasting (or longer term) low, I have a level for at least a bounce.

Tomorrow could be a big down day for stocks and indexes as I have timing for a low, but we have yet to reach targets. The $108 area has come before in NVDA, so I feel it really should be a spot to watch. The more refined level is $108.90, so it will be fun to see what happens here; and of course, I could be completely wrong & it does something else!