Dragonpattern

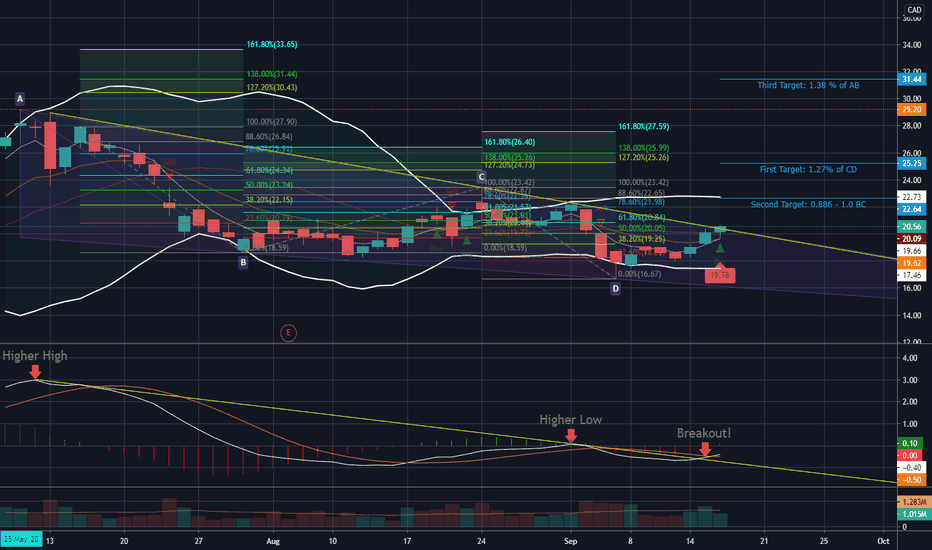

BLDP - Long with multiple confirmationsTSX:BLDP breaking out with 2 patterns and one strategy.

Firstly, a dragon pattern broke out today with three possible targets: Target 1 = 1.27% of CD, Target 2 = 0.886% - 1.0% of BC, Target 3 = 1.38% of AB. I really love this pattern and it works so well.

Secondly and coincidentally, a descending triangle pattern broke out which reveals the dragon pattern. Target here is the same height as the the triangle itself, showing around 52% profit which coincides closely with target 3 of the dragon pattern.

Lastly, a strategy I am very fond of is the MACD Trend Strategy. This strategy has done well for me in the past and I like that we have multiple confirmations. We have two swing highs forming the trendline on the MACD and a breakout above this trendline signals a buy.

I am Long @ $20/share

Nzdjpy DAILY ANALYSISDear traders

NZDJPY has reject from SMA 200 on daily timeframe and we have POINT D completed at this level of the harmonic pattern Dragon

what we should do ?

This is a long term trade wait to price go above 70.15

Preffred entry at 70.20

on daily we have a pin bar wich have been formed after rejection on SMA 200 wich made a solid support

You can wait on monday to see the price movement then wait for tuesday to take entry above the pin bar

this pair is for watching right now and not for direct entry

If you like My analysis please follow us and share our charts and links

We would be also happy if you Donate some coins for us as a support to keep our paid subscription active

BAT / USDT. Potentially Forming a Dragon Pattern. BAT/USDT may be forming a Dragon Formation , provided that the price breaks the downtrend line (red line) and fixes above it.

If the price cannot overcome the downtrend line, then the downtrend will start with the target zone being the local low.

The points of observation are showed on the graph.

ENTRANCE

1) Entrance on a breakthrough or pullback after breaking a trend resistance line (red resistance line).

2) Entry from the previous price lows when confirming support, if in this situation the price can not overcome the downtrend line.

TARGET

1) If the price overcomes the trend resistance line and fixes above it, then the Dragon Formation will be confirmed.

The entire length of the "Dragon's tail" is the target zone of this figure.

The potential is from +19% (hump level) to +128% (head level).

2) If the price does not overcome the downtrend line, then after the downtrend, the entrance is from support (around. 0.145-0.15) the first target being the downtrend line.

Stop Loss

Under key support levels during your entry into the market.

I learnt this formation from "SpartaBTC" so if it works out, he deserves the credit.

USDCHF: BreakdownWe have previously caught some decent swings on this pair! Make sure you check the related ideas below.

We have a Double Bottom formation on the daily timeframe.

The 113% expansion is crucial in a Harmonic Shark Pattern or the Harmonic 5-0 Pattern. Considering the 113% expansion, this set-up could potentially be leading to a bearish shark or bullish 5-0 pattern in the nearest future, while the Double Bottom allows for an aggressive ''C'' point entry.

A break above the descending trendline indicates bullish momentum, with the initial confirmation point above the previous high at aprox. 38% retracements.

Please dont forget to leave a like and make sure to leave any idea regarding USD/CHF in the comments below

Thank you for reading

God bless and happy trading!

Harmonic Dragon Pattern + C&H (NZDUSD)Dragon patterns are mentioned by Surri Dudella in his 2007 book ''trade chart patterns like the pros''. One of his reviews says: Dont read this book - make money with it!

His book consists of hundreds of trading techniques and one of those are the harmonic dragon pattern which is shown here.

There are alot of ways to trade this pattern, but it is mainly defined as a double top or double bottom pattern. It consists of a neckline, head, two legs and a hump. If you want to get more into this pattern make sure to read his book and perhaps do some research if you have not heard about Surri Dudella.

There are 3 potential profit targets in this set-up:

Fibonacci retracements from head to second leg

62% 0.657xx

100% 0.679xx

127-162% 0.695xx-0.715xx

Now the same setup happens to be forming a potential Cup & Handle pattern.. What do you guys think?

Please dont forget to leave a like and make sure to leave any ideas regarding NZDUSD in the comments below!

God bless and happy new year!

Soon pump season altcoins? Head and shoulders. Inverted Dragon.Bitcoin dominance chart by market capitalization. You probably noticed that over the past month, many violas went to growth by a large percentage. This can be seen in my trading ideas for some altcoins. Maybe it's not casual?

At the moment, we see that the dominance of bitcoin over other assets is still in an uptrend. % BTC dominance came very close to the uptrend line.

At the top of the uptrend, the "Head and Shoulders" figure has formed. Breaking the Neck line will mean a 9.3% decrease in dominance. And this is already below the line of the upward trend of BTC dominance. Perhaps we will see a change in the trend of bitcoin dominance in the market.

Breaking the uptrend line will mean that we will confirm the final formation of such a complex, long-forming and rare formation on the market as the “Inverted Dragon” . Which in turn can consist of many small figures.

Confirmation of this figur provides an understanding of the direction of the trend in price movement in the long term. At the moment, we already see all the components of this formation formed: the head of a dragon, the first paw of a dragon, the hump of a dragon, the second paw of a dragon. Everything is there, except for the “Dragon Tail”, which in turn is the target the figure.

But you need to remember that only a breakthrough of the uptrend line (Dragon Range) gives confirmation of the figure.

This will mark the beginning of a full-fledged pump season of long-suffering altcoins. Consequently, a new hype, the arrival of new people and new "stupid money" to the market.

If we break the uptrend line and the percentage of Bitcoin dominance is fixed under it, this will mean the opening of a full pump of the altcoin season!

But we must not forget that if the uptrend is not breaking through and the dominance of bitcoin will increase, this will mean the death of most altcoins, except TOP.

But I am more inclined to believe that the uptrend line will break and the long-awaited season of pumping altcoins will begin.

You can read about the Inverted Dragon formation in this educational trading idea:

BTC Inverted Dragon The tragedy of faith Important areas FiguresBTC - potential shapes of technical analysis figures depending on the breakout / price retention levels. A huge symmetrical triangle - a bear measured move - Triple top - Inverted Dragon.

BTC / USD 1 week. I will write the zone algorithm and what will be drawn on the chart depending on the retention / penetration of a certain zone and levels.

________________________________________________

A very important area of $ 7,000, all hopes for it. From it, there can be a movement up and the symmetrical HUGE TRIANGLE is drawn. It will be our victory and hope! As working up / down -50/50.

As you can see, from the very beginning of Bitcoin trading, this has already happened more than once.

If we assume that we will not hold this zone - as a result the residual confirmation of the “Bear measured move”.

In 2014-2015, this formation - “Bear measured move” was formed and worked out.

BTC important areas on which further movement depends

The breaking of this zone will also mean - the break of the "Dragon Ridge" (uptrend line) Figures "Inverted Dragon" The first goal for the "Inverted Dragon" is the zone of his "Hump" - the region of $ 3200.

Inverted Dragon. The figure is rare. But almost always fulfills.

CONFIRMATION OF THE FIGURE WILL HAPPEN WHEN:

The uptrend will break. This is the yellow line on the chart (Dragon Ridge)!

____________________________________________________________

If we hold the zone of $ 3200 and the price goes up, the "Triple Top" will be drawn - the target is around $ 7000.

Then you need to observe how the price will continue to behave. Or work out a fall from the "Triple Top" or conquer new heights of price.

__________________________________________________

The opposite situation, if God forbid, we will not hold the zone of $ 3200 (squeezes and takeaways do not count), I mean if the price fixes for a long time below this zone.

Most traders will see which figure is drawn and what is confirmed.

This will be a complete confirmation of the “Inverted Dragon”. And the second goal (the first area of the "Hump") is "Dragon Tail."

Price will fall in an avalanche. How fantastic are the goals for developing shapes.

As an option, we can’t stop at the last high of the 2014 pump ($ 1,100). It’s even hard to imagine the residual target of Dragon Tail - this is an area of $ 200- 70-80. I do not know what will happen for this, probably the event is equal - to the third world war.

__________________________________________________

I’ll write a couple of lines about the “Inverted Dragon” figure.

“Inverted Dragon” is a reversal pattern that indicates almost the very beginning of a trend reversal. The formation of the “Inverted Dragon” tells the trader that the mood in the market may change soon and the current trend will unfold.

The figure is a more modified version of the “Double Peak” figure, while signaling a change in the bull market to the bear market. But there is one fundamental difference from the “Double Peaks” figure.

A prerequisite for the formation of the Dragon is a trend line drawn through the head and hump of this model ("Dragon Ridge").

It is important that this trend line is clearly visible on the chart. The trend line plays an almost decisive role in the figure.

“Inverted Dragon” and “Dragon” are not very common on charts. With the correct identification and understanding of the work, you can get a good profit on various time frames.

The “Inverted Dragon” shape and its mirror image “Dragon” are very similar to the “Double Peak” and “Double Bottom” figures, however, they also have significant differences, which will be described below.

_________________________________________________________________

The potential profit corresponds to the length of the Dragon Tail, which, as a rule, is equal to the height from the point of occurrence of the trend line to the minimum point of its "Head". Simply put, the entire length of the Tail is your potential profit.

Objectives of working out the figure "Inverted Dragon":

The first goal will be at the level of the last minimum - the level of "Hump".

The second goal will be at the very minimum value of the figure - the level of the "Head" or from the breakdown of the level of the "Dragon Ridge" - all growth from the "Head" to the highest point of the "Paw" is superimposed.

__________________________________________________________________

Be smart, act on a situation, not faith. Faith - kills.

There should be a strategy and plan. At the same time, your strategy and plan should be plastic from market situations.

Count in trading all your and others' options for action in advance.

If you trade because of hopes and expectations, and not according to a trading plan, you follow a nervous and unprofitable crowd.

Dragon figure. Formation. Structure. Targets.“Dragon” is a reversal pattern that indicates almost the very beginning of a trend reversal. The formation of the Dragon tells the trader that market sentiment may change soon and the current trend will unfold.

The figure is a more modified version of the "Double bottom" or "W" shape, while it signals the change of the bear market to the bull market. But there is one fundamental difference from the “Double Bottom” figure.

A prerequisite for the formation of the Dragon is a trend line drawn through the head and hump of this model ("Dragon Ridge").

It is important that this trend line is clearly visible on the chart. The trend line plays an almost decisive role in the figure.

“Dragon” and “Inverted Dragon” with the correct identification and understanding of the work, you can get good profit on various time frames.

The figure “Dragon” and its mirror image “Inverted Dragon” are very similar to the figures “Double top” and “Double bottom”, however, they also have significant differences, which will be described below.

________________________________________________

There are two types of this figure, depending on the trend:

1) “Dragon” - is formed during a downtrend and signals a trend change to an uptrend;

2) “Inverted Dragon” - is formed during an uptrend and signals a trend change to a downtrend .

___________________________________________________

The figure "Dragon" got its name due to some similarities with the fairy-tale character: he also has a head, two legs, a tail and a hump on his back.

The figure "Dragon" consists of 5 parts, formed in the following order:

1) Dragon Head - the maximum price of all parts of the figure;

2) The first paw of the Dragon - a local minimum price;

3) The Hump of the Dragon - the maximum price between its paws;

4) The second paw of the Dragon is another minimum located slightly below / above the first paw, in rare cases equal to the minimum of the first paw;

5) Dragon Tail is the target price that should bring you revenue.

____________________________________________________

Additional signals that confirm the trend reversal and enhance the development of the "Dragon" figure:

1) The ratio of the length of the "dragon's paws" - if the "second paw" is longer, then there is more confidence in the upcoming turn.

2) When the level of the "second paw" coincides with some important level of support / resistance, already tested in the past, this also enhances the development of the figure.

3) Candles are strongly pronounced (large bodies with short shadows) that have gone in the opposite direction after the formation of the "second paw", the greater the likelihood of a change in the current trend.

4) The more a trend exists, the more likely it will end. The “Dragon” pattern is often in the 5th wave of the trend and in this case the reversal signal is very reliable.

5) An additional confirmation signal can be an increase in the indicators of the trading volume, which should increase during the break through the price of the downward trend line of the “Dragon” figure (resistance). This is the line drawn from the top of the Dragon Head to the bottom of the Dragon Hump.

__________________________________________

Setting goals when working with a figure.

There are two options for entering a deal:

1) Entrance when breaking the line of the "Dragon Range" of the downtrend (line- "Head" - "Hump").

2) Entrance when breaking through the "Hump of the Dragon" level.

__________________________________________

Now you need to decide on our targets:

The first targets will be at the level of the last maximum - the level of "Hump".

The second target will be at Head level

The third target is, in rare cases - the full length of the fall from the “Head” to the lowest “Paw” - then from the breakdown point of the downward trend line (“Dragon Ridge”) we set the entire length of the last price

See the chart above. The graph shows that it was the Third Goal that worked completely on the graph.

BCHABC is going to complete Dragon PatternIt is very similar to two bottom pattern, but i think it can be a dragon pattern, Descending trend line has been broken, now it is very safe to enter, according to the dragon pattern targets have been shown on the chart, and stop loss is under the first bottom (lower bottom), chart shows us a very R/R.

Note: Do not forget to set your Stop Loss.

Note: It is a long term position and takes time. if you are not a patient trader, do not enter to this position.

Targets:

TP1: 384.52

TP2: 521.84

TP3: 557.99

TP4: 672.48

SL: 256.71