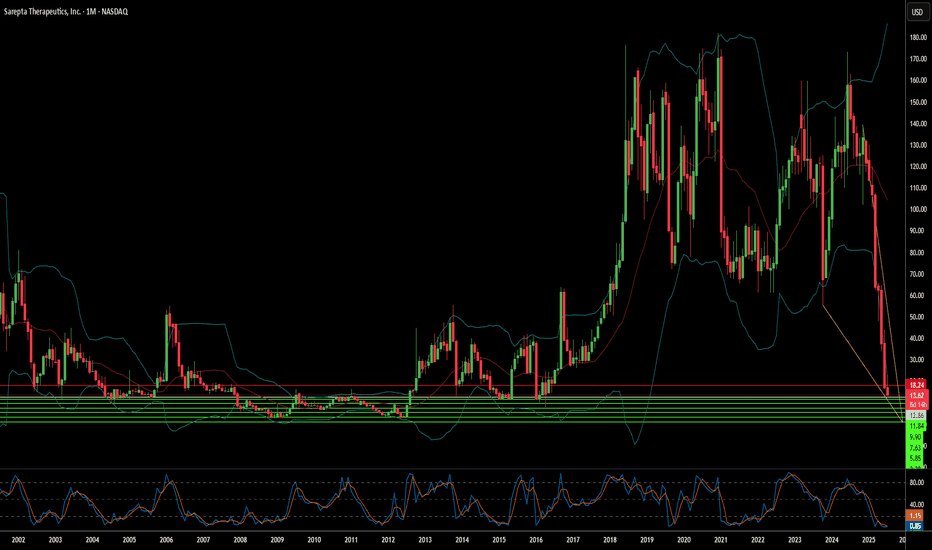

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

Drugdevelopment

Can Pain Be Managed Without Addiction?Vertex Pharmaceuticals has achieved a monumental breakthrough in pain management, securing FDA approval for Journavx, the first new class of painkiller in over 20 years. This non-opioid drug introduces a paradigm shift, targeting pain signals directly at the source without the addictive risks associated with traditional analgesics. The significance of this development cannot be overstated, as it promises a new era where acute pain can be treated effectively and safely, potentially altering the landscape of medical treatment for millions.

Journavx operates by selectively inhibiting NaV1.8, a sodium channel vital for pain signaling, thus preventing pain signals from reaching the brain. This mechanism not only offers relief but does so without the side effects that have long plagued opioid use. The implications for healthcare are profound, offering doctors and patients alike a tool that can redefine how we approach pain management in clinical settings. Vertex's success with Journavx showcases the company's commitment to pioneering treatments that address some of the most pressing needs in modern medicine.

Financially, this approval has bolstered Vertex's market position, evidenced by a significant uptick in stock performance following the announcement. With a revenue projection for 2025 set between $11.75 and $12.0 billion, Vertex is not just riding the wave of this single approval but is also expanding its therapeutic horizons. The strategic leadership transitions announced alongside this approval signal a robust plan for future innovation, challenging investors and healthcare professionals to think about the evolving landscape of drug development and patient care.

This moment invites us to ponder the future of pharmaceuticals - one where efficacy does not compromise safety, where innovation in treatment could lead to broader societal benefits by reducing dependency on addictive substances. Vertex's journey with Journavx might just be the beginning of a new chapter in medical science, urging us to envision a world where pain management is humane and humane-centered.

Can Duvakitug Redefine IBD Therapy?Teva Pharmaceuticals, in a groundbreaking collaboration with Sanofi, has unveiled results from the Phase 2b RELIEVE UCCD study that could potentially reshape the landscape of inflammatory bowel disease (IBD) treatment. The study's focus, duvakitug, a novel anti-TL1A monoclonal antibody, has shown remarkable efficacy in managing ulcerative colitis and Crohn's disease, positioning it as a potential best-in-class therapy. With clinical remission and endoscopic response rates significantly outpacing placebo, this development not only challenges existing treatment paradigms but also ignites a spark of hope for millions suffering from these chronic conditions.

The implications of duvakitug's success extend beyond immediate patient care; they invite a broader discussion on innovation in the pharmaceutical industry. Teva's strategic pivot towards growth through pioneering drug development efforts underscores a commitment to expanding its portfolio and accelerating access to life-altering treatments. This study's outcomes, showing a favorable safety profile alongside its efficacy, encourage reevaluating how we approach IBD, potentially leading to a future where patients can achieve remission with fewer side effects and less invasive interventions.

Moreover, the financial and strategic narrative surrounding Teva's performance in 2024 adds another layer of intrigue. With a notable increase in revenue driven by key products and a focus on both generics and innovative medicines, Teva is not just navigating but also setting the course for future healthcare advancements. The journey of duvakitug from clinical trials to potential Phase 3 trials exemplifies how scientific curiosity, when supported by strategic foresight, can lead to transformative outcomes in medical science, challenging us to imagine a new era in IBD management.

Can Market Turbulence Create Future Innovation?In a dramatic turn of events that sent shockwaves through the pharmaceutical industry, Novo Nordisk's recent setback with its experimental obesity drug CagriSema presents a fascinating case study in market resilience and scientific progress. The company's stock plummeted 24% after trial results showed a 22.7% weight reduction efficacy, falling short of the anticipated 25% target. Yet, beneath this apparent disappointment lies a deeper story of pharmaceutical innovation and market adaptation.

The obesity treatment landscape stands at a pivotal crossroads, with the market experiencing exponential growth from its modest beginnings to a staggering $24 billion industry in 2023. Novo Nordisk's journey, alongside competitor Eli Lilly, exemplifies how setbacks often catalyze breakthrough innovations. The CagriSema trial, involving 3,400 participants, represents a clinical study and a testament to the industry's commitment to addressing global health challenges.

Looking ahead, this moment of market recalibration might well be remembered as a turning point in the evolution of obesity treatment. With projections suggesting a potential $200 billion market by the early 2030s, the current turbulence could drive even greater innovation and competition. The fact that only 57% of trial participants reached the highest CagriSema dose points to untapped potential and future opportunities for optimization, suggesting that today's apparent setback might pave the way for tomorrow's breakthroughs.

Can a Pharmaceutical Giant Rewrite Its Own Destiny?In the complex world of global pharmaceuticals, Teva Pharmaceutical Industries Ltd. emerges as a compelling narrative of strategic reinvention. Under the leadership of CEO Richard Francis, the company has transformed from a struggling enterprise to a potential market leader, executing a bold "Pivot to Growth" strategy that has captured the attention of investors and industry experts alike. The company's remarkable journey reflects corporate resilience and a profound understanding of how strategic focus and innovative thinking can resurrect a seemingly faltering business.

Teva's renaissance is characterized by calculated moves that challenge traditional pharmaceutical business models. By strategically divesting its Japanese joint venture, selectively targeting high-potential generic markets, and developing promising drug candidates like Anti-TL1A, the company has demonstrated an extraordinary ability to reimagine its core strengths. The financial metrics tell a compelling story: a 66% market capitalization increase, double-digit revenue growth, and a strategic pipeline that promises future innovation in critical therapeutic areas such as neurology and digestive system treatments.

Beyond financial metrics, Teva represents a broader narrative of corporate transformation that extends beyond balance sheets. Its commitment to patient access programs, such as the recent inhaler donation initiative with Direct Relief, reveals a deeper organizational philosophy that intertwines strategic growth with social responsibility. This approach challenges the traditional perception of pharmaceutical companies as purely profit-driven entities, positioning Teva as a forward-thinking organization that understands its broader role in global healthcare ecosystems.

The company's journey poses a provocative question to business leaders and investors: Can strategic vision, relentless innovation, and a commitment to patient care truly redefine a corporation's trajectory? Teva's emerging story suggests that the answer is a resounding yes—a testament to the power of adaptive strategy, visionary leadership, and an unwavering commitment to pushing the boundaries of what's possible in the pharmaceutical landscape.

Can Pharma Innovation Rewrite Healthcare's Future?In the rapidly evolving landscape of medical technology, Eli Lilly emerges as a beacon of transformative potential, challenging conventional boundaries of pharmaceutical innovation. With a strategic masterstroke, the company has positioned itself at the forefront of medical breakthroughs, particularly in the revolutionary realm of weight loss and diabetes treatments. The remarkable Zepbound medication stands as a testament to this vision, demonstrating unprecedented efficacy by enabling patients to lose an average of 20.2% body weight - a figure that not only surpasses competitors but also represents a paradigm shift in medical intervention.

The company's financial architecture is equally compelling, reflecting a meticulously crafted approach to growth and shareholder value. With a staggering market capitalization of $722 billion, a 27.4% revenue growth, and an impressive 80.9% gross profit margin, Eli Lilly transcends the traditional pharmaceutical business model. Its recent $15 billion share buyback program and consistent 54-year dividend payment history underscore a strategic philosophy that balances aggressive innovation with prudent financial management, creating a blueprint for sustainable corporate success.

Beyond financial metrics and breakthrough medications, Eli Lilly represents something more profound: a vision of healthcare's future where technology, research, and human potential converge. The company's $3 billion manufacturing expansion, commitment to oncology research with drugs like Jaypirca, and continuous investment in cutting-edge medical solutions paint a picture of an organization that sees beyond immediate profit - an entity committed to reshaping human health through relentless innovation and scientific excellence. In an era of unprecedented medical challenges, Eli Lilly stands not just as a pharmaceutical company, but as a harbinger of hope, demonstrating how visionary thinking can transform global health landscapes.

Roivant Sciences (ROIV): A Multibagger Stock Opportunity

Roivant Sciences (ROIV) is poised for significant growth with a strong pipeline, including potential blockbusters like Batoclimab and Brepocitinib in the autoimmune space. Recent deals, including the $5.2B sale of Telavant, have strengthened their balance sheet and set the stage for future profitability. Upcoming Q4 catalysts, a $1.5B buyback program, and a solid focus on pulmonary hypertension therapies make ROIV an undervalued gem at its current price.

Personal Note: Hi, I'm sharing insights on stocks with strong catalysts like ROIV. Follow me for more deep dives and stock picks.