OGEN Long into and past earnings! Starting Today!AMEX:OGEN is going to rip into earnings then pull back right before then pop for 100% or more post earnings. Here are my price targets placed for the next week every few days starting with next Monday.

DD:

OGEN has

*1 drug for Oral Mucosis just finished Phase 2 trial, FULL data will be release on earnings call and ironically at the same time they have $15 Million worth of Warrants that will expire the day before. :) Also OGEN as obtained FDA Fast Track approval for this drug and marketing agreements completed in Europe to put it on the shelves immediately if Phase 2 data is good.

*1 drug for lowering cholesterol by 70% currently in Phase 1trial, expect results and Ph2 announcement mid/early summer.

*$21 Million cash on hand with burn rate of less than 10 Million per year.

*This Monday OGEN bought a COVID19 trial drug company with 4,000,000 shares or roughly $1 Million.

Trading in a channel, well established bases in this range over the last year or two, no need for extra funding for at least 1 year.

Drugs

VBI vaccines $4 EOY Target Successful completion of the pivotal Phase 3 program for Sci-B-Vac®, on-track for submission of regulatory approval applications in the U.S., Europe, and Canada expected to begin in Q4 2020

Announcement of pan-coronavirus vaccine candidate targeting COVID-19, SARS, and MERS – human clinical study material expected to be available in Q4 2020

Expanded immunologic, tumor, and clinical data from recurrent GBM Phase 2a clinical study of VBI-1901 expected mid-year and Q4 2020

Human proof-of-concept data from Phase 1b/2a study of hepatitis B immunotherapeutic, VBI-2601, expected H2 2020

Net cash proceeds of approximately $54 million added to balance sheet from underwritten public offering in April 2020

11 Million shares bought by insider www.sec.gov

CVS PHARMACY IS FILLING SCRIPTS FOR PALFORZIA - STRONG BUYWe just checked pharmacies around the North East

PALFORZIA peanut allergy drug is available at CVS Pharmacy and is being filled at CVS Pharmacy

CVS Pharmacy is currently the largest pharmacy chain in the United States by number of locations with over 9,600 pharmacies throughout the United States.

Its parent company ranks as the 7th largest U.S. corporation by FY2017 revenues in the Fortune 500.

The parent company of CVS Pharmacy's leading competitor (Walgreens) ranked 19th for the same time period.

The stupid brokerage firms that just downgraded the stock price today because of a "so called slow roll-out" have no clue what they're doing or saying anymore.

All these analysts had to do is pickup the phone and call around like we did! They're lazy!!!

ANyone on this board wondering how easy it is to find out, call a CVS Pharmacy and ask them if they can fill a script for PALFORZIA, they will tell you YES,,, it is in the database for them to order..!!!

We are passing along our research to some major brokerage firms so they will get behind the stock and push it up

Palforzia Peanut Allergy Drug is available at CVS Pharmacy and soon to be available at Walgreens and other pharmacies throughout the USA

This stock could blast off any day folks!

We do not buy drug stocks so we are sitting on the sidelines just passing along solid and reliable information

Factual information for this board is always a good thing to post especially since you don't get it from dumb analysts!

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from

negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

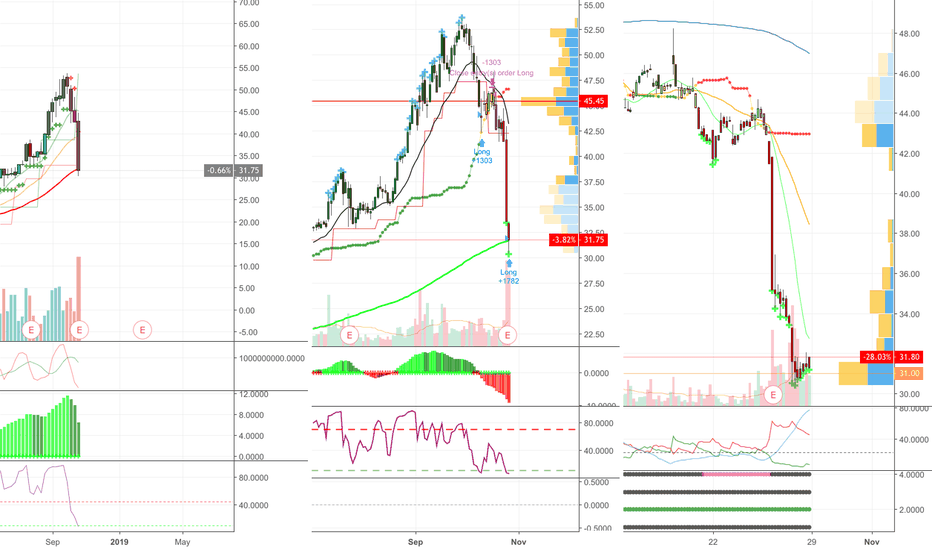

ACB July 30th 2019

Just my prediction on ACB.

Looks like it's going up. Could keep climbing until around the time of the earnings report.

Earnings report on September 9/23.

Quick TLRY updateHello all,

We bounced off of the line as I suspected might happen. I am expecting TLRY to at least retest the $180 dollar region if not make new all time highs. I would not put it past the market.

Would not recommend a short right now, confirmation is needed.

Good luck.

-YoungShkreli

BLRX - BioLine RX - Promising Biotech with Big upside - LongBLRX

BL-8040 Overview

BL-8040 is a novel, short peptide that functions as a high-affinity antagonist for CXCR4, which BioLineRx is developing for the treatment of solid tumors, acute myeloid leukemia, or AML, and stem-cell mobilization for bone-marrow transplantation.

Solid Tumors:

In January 2016, BioLineRx entered into a collaboration with MSD, known as Merck in the U.S. and Canada, in the field of cancer immunotherapy. Based on this collaboration, in September 2016 BioLineRx initiated a Phase 2a study, known as the COMBAT study, focusing on evaluating the safety and efficacy of BL-8040 in combination with KEYTRUDA® (pembrolizumab), MSD’s anti-PD-1 therapy, in up to 30 patients with metastatic pancreatic adenocarcinoma. The study is an open-label, multicenter, single-arm trial designed to evaluate the clinical response, safety and tolerability of the combination of these therapies as well as multiple pharmacodynamic parameters, including the ability to improve infiltration of T cells into the tumor and their reactivity. Partial results will be presented at the 2018 ASCO Gastrointestinal Cancers Symposium (ASCO GI) in January 2018, with top-line results expected in the second half of 2018.

September 2016, BioLineRx entered into a collaboration with Genentech , Inc., a member of the Roche Group , in the framework of which both companies would carry out Phase 1b/2 studies investigating BL-8040 in combination with atezolizumab (TECENTRIQ®), Genentech’s anti-PDL1 cancer immunotherapy, in various solid tumors and hematologic malignancies. Genentech commenced a Phase 1b/2 study for the treatment of pancreatic cancer in July 2017, as well as a Phase 1b/2 study in gastric cancer in October 2017. Genentech expects to commence an additional Phase 1b/2 study in lung cancer by early 2018. In September 2017, BioLineRx initiated a Phase 1b/2 study under this collaboration in acute myeloid leukemia (AML). These studies will evaluate the clinical response, safety and tolerability of the combination of these therapies, as well as multiple pharmacodynamic parameters.

n March 2015, BioLineRx reported successful top-line safety and efficacy results from a Phase 1 safety and efficacy trial for the use of BL-8040 as a novel stem-cell mobilization treatment for allogeneic bone marrow transplantation at Hadassah Medical Center in Jerusalem.

In March 2016, BioLineRx initiated a Phase 2 trial for BL-8040 for allogeneic stem-cell transplantation, conducted in collaboration with the Washington University School of Medicine, Division of Oncology and Hematology. Initial results of this study announced in March 2017 show that a single injection of BL-8040 mobilized sufficient amounts of cells required for transplantation at a level of efficacy similar to that achieved by using 4-6 injections of G-CSF, the current standard of care. Topline results of this study are now expected in mid-2018, as a result of certain delays in study recruitment in connection with the addition of two sites to the study and the regulatory filings associated therewith.

In August 2017, following a successful meeting with the FDA , BioLineRx announced the filing of regulatory submissions required to commence a randomized, controlled Phase 3 registrational trial of BL-8040 for the mobilization of hematopoietic stem cells, or HSCs, for autologous transplantation in patients with multiple myeloma. The trial is expected to commence by the end of 2017.

In November 2017, BioLineRx disclosed preclinical data supporting BL-8040 as robust mobilizer of hematopoietic stem cells, or HSCs, associated with long-term engraftment. The data will be presented as an oral presentation at the 59th American Society of Hematology (ASH) Annual Meeting and Exhibition in Atlanta, GA, taking place in December 2017.

Pre-Clinical Data

In vitro and in vivo data show that BL-8040 binds to CXCR4 at the low nanomolar range (1-10nM) and occupies it for prolonged periods of time (>24h). Characterization of the CXCR4 antagonism action of BL-8040 in comparison to other CXCR4 antagonists revealed that, unlike other compounds from the same class, BL-8040 acts as an antagonist as well as an inverse agonist. This activity leads to decreased autonomous signaling of CXCR4 and suggests activity against constitutively active variants.

BL-8040 inhibits the growth of various tumor types including multiple myeloma, non-Hodgkin’s lymphoma, leukemia, non-small cell lung carcinoma, neuroblastoma and melanoma. BL-8040 significantly and preferentially stimulated apoptotic cell death of malignant cells (multiple myeloma, non-Hodgkin’s lymphoma and leukemias). Significant synergistic and/or additive tumor cell killing activity has been observed in-vitro and in-vivo when tumor cells were treated with BL-8040 together with Rituximab, Bortezomib, Imatinib, Cytarbine, BCL-2 inhibitor ABT-199 and the FLT-3 inhibitor AC-220 (in NHL, MM, CML, AML, and AML-FLT3-ITD models, respectively). BL-8040 also mobilizes cancer cells as well as neutrophils and progenitor cells from the bone marrow to the peripheral blood.

The U.S. Food & Drug Administration (FDA) has granted an Orphan Drug Designation to BL-8040 as a therapeutic for the treatment of AML as well as for stem cell mobilization

BL-8040 is being developed by BioLineRx under a worldwide, exclusive license from Biokine Therapeutics.

1.

Conclusion: The current data demonstrate that BL-8040 induces mobilization of AML blasts from the BM and has sustained receptor occupancy. In addition, a direct effect on AML blast viability has been observed in samples obtained during BL-8040 monotherapy. Importantly, the data suggest a differential effect of BL-8040 monotherapy on AML blasts vs. normal progenitors. BL-8040 was found to be safe and well tolerated at all doses tested to date. The updated results of the dose escalation phase of this ongoing study will be presented.

Source: www.bloodjournal.org

2.

The FDA approved the first immunotherapy drug recently, but the field dates back to 1891, when William Coley, a physician and cancer researcher, observed that some cancer patients infected by Streptococcus bacteria experienced a dramatic and spontaneous improvement. He began injecting the bacteria into his patients, with mixed results.

The treatment was nearly abandoned amid skepticism from Coley’s peers and the advent of radiotherapy and improved surgical techniques.

Today, however, new avenues of immunotherapy research are underway, and the field is considered among the most promising new approaches to cancer treatment, according to Jill O’Donnell-Tormey, CEO and director of scientific affairs at CRI.

Source: www.jta.org

3.

"activated with human interleukin 2, or activated against patients own tumor cells in the laboratory, when such are available – have been extremely successful in killing every last cancer cell in the patients. The theory is the same, in that the cells are trained to act as honing devices."

“It’s fantastic because they all were expected to have been dead long ago,” Slavin told ISRAEL21c. “When the laboratory-treated and separated NK cells are infused into a patient, they go immediately to work because they were already trained in the laboratory to become professional killer cells capable of recognizing and destroying foreign cells.”

"The new procedure has little or no side effects, is done during fifteen-minute outpatient intravenous infusion and has already showed promising results in high risk patients with metastatic or resistant cancer."

"In order for the procedure to be government-approved, a much larger number of patients must successfully undergo treatment."

"The reason I am optimistic is because we use mother nature’s tool – immune-system-cells to fight off disease. Normally too, it is the immune system that can recognize cancer cells as undesirable, and under normal circumstances, it will go on an attack until the single abnormal cell, which can grow to a bitter enemy, is gone. In patients with cancer, the patient’s own immune system failed to recognize the enemy and this is why we use the immune system cells from another individual that can easily recognize and destroy such tumor cells escaping the attention of patient’s immune system,” said Slavin."

Summary Source: seekingalpha.com

In two January ASCO presentations, BL-8040 showed robust infiltration of anti-tumor T-cells into liver metastases in pancreatic cancer and primes the tumor micro-environment to enhance the effectiveness of immunotherapy agents.

New oncology asset AGI-134 induced complete tumor regression in 50% and 67% of two mice melanoma preclinical studies. The company plans to start Phase 1/2a clinical trials in 1H 2018.

BiolineRx is funded to 2020 with $55M in cash, no debt. However cash balance might be higher since it's likely company was selling against a $30M ATM since November.

The company has plans to deliver up to a dozen high-potential catalysts in 2018 following a busy January (4 conferences, and 4 clinical data).

Institutional ownership has increased from 20% to almost 60% in a year. Five analysts have a consensus Buy rating with $3.5/share price target.

Chart Screenshots:

screenshots.firefox.com

screenshots.firefox.com

screenshots.firefox.com

Will update.

-AB

ABBV - when having all your eggs in one basket works outAbbVie's bread winner is Humira - this drug accounts for the majority of their revenue. However, they did forecast that by 2020, revenue from Humira will be $21B - which is about 75% of their 2017 revenue of $28.22B.

Since AbbVie depends so heavily on their flagship, their stock is fairly volatile, giving this play more of a risk. Consider well-hedged positions (like married puts), or at least ITM leap calls.

INCY: sold ahead of earnings, looking 4 re-entry after reassessmNot sure if the BLUE support is gonna hold this time around. Might eventually sets on ~9yr-old support (note chart is in Log scale). Monthly chart also showing massive MACD divergence. As a result, sold my position to see how is gonna play out in the ST. Also binary outcome drug data expected this year, with unknown timing. However, INCY is top pick at Credit Suisse and has bear case scenarios (considering other banks too) in the $65-70 range. But the massive MACD divergence on the monthly (although not showing up on the weekly..uhm?) + very long bull run made me reconsider the position I opened at $94.5 a couple of weeks ago, so I'll just sit aside for the time being. The thing is, where's there risk, there is opportunity: I am cognizant that by sitting aside I might be missing out on some upside here. I'll wait for a reversal of the downtrend to jump on, obv missing out on the first bit (provided it doesn't coincide with a spike up 100% any positive drug data released later in the yr).

Teva Pharmaceutical industries. up or down? This is my first wave chart, so be gentle. :)

i have 2 scenario. One is that wave 5 have ended and we are ready to a correctional wave of A,B,C.

The other is that they will present bad revenue. And the price will continue the down trend, and stop at the support line at 6,49

where the 5th wave could end and start a correction of A,B,C.

Fundamental:

Teva have a great product portfolio, but have lost 64.46% decline year to date. and a 68.83% decline from 30/10/2016 to 30/10/2017

The decline have something to do with there stock pilling on debt that run along the loss in product sales.

The U.S. generics industry is facing significant competitive and pricing pressure, which have been affecting the company’s generic revenues. An increase in FDA generic drug approvals and ongoing customer consolidation are resulting in additional competitive pressure in the industry. earlier this month, in a major blow to Teva, Mylan MYL launched its generic version of the 40 mg formulation, much earlier than expected. Mylan also launched a second generic version of Copaxone 20 mg formulation (once-daily).

Though these generic launches will not hurt Teva’s third-quarter sales and profits, Teva estimates that it will have a negative impact of at least 25 cents per share on fourth-quarter earnings.

Teva Pharmaceutical industries have a P/E Ratio (TTM)=-2,22

And a EPS(TTM)=-6,11

This means that the company is losing money.

besides that, investors now pay 2,22 Dollars less pr earned dollar

They still have a 1,20(8,07%) Forward Dividend and Yield

this means that the company is expecting a low grow rate because of the high yield

(if the Yield is low, a company is expecting high growth expectations and are more likely to give investors reward through out a rise in the stock price)

The Beta is low at 0,72. a Beta below 1 is a less volatile stock.

My target will be at 36.49$

where my stops loss will be at 6,18$

general 1y target estimate from other investors is at 20,02$

Profile:

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes generic medicines and a portfolio of specialty medicines worldwide. It operates through two segments, Generic Medicines and Specialty Medicines. The Generic Medicines segment offers sterile products, hormones, narcotics, high-potency drugs, and cytotoxic substances in various dosage forms, including tablets, capsules, injectables, inhalants, liquids, ointments, and creams. This segment also develops, manufactures, and sells active pharmaceutical ingredients. The Specialty Medicines segment provides branded specialty medicines for use in central nervous system and respiratory indications, as well as the womens health, oncology, and other specialty businesses. Its products in the central nervous system area comprise Copaxone for multiple sclerosis; Azilect for the treatment of Parkinsons disease; and Nuvigil for the treatment of excessive sleepiness associated with narcolepsy and certain other disorders. This segments products in the respiratory market include ProAir, ProAir Respiclick, QVAR, Duoresp Spiromax, Qnasl, Braltus, Cinqair/Cinqaero, and Aerivio Spiromax for the treatment of asthma and chronic obstructive pulmonary disease, as well as Treanda/Bendeka, Granix, Trisenox, Lonquex, and Tevagrastim/Ratiograstim products in the oncology market. This segment also offers a portfolio of products in the womens health category, which includes ParaGard, Plan B One-Step, and OTC/Rx, as well as other products. The company has collaboration arrangements with Attenukine, Procter & Gamble Company, and Regeneron Pharmaceuticals, Inc.

(source: finance.yahoo.com)

Good luck :)

junior drug above cloud 50 200 8ema and weekly cloudgood money flow use limit//stop top of cloud/macd crossed/cci and percent r in upper band/diversify with juniors/enter on good 21 minute bar re fib pullback/adx starting trend/next level 200 weekly.16

Gilead ready for Lift-Off Target1: 123.27 Target2: 140 Stop: 93Consistent outperformer with always an Ace up its sleeve. Expect at least a 30% increase in value in 2016. You will never see this stock at these prices ever again. Buy now and thank me Later. All bets are off if we have a financial collapse dragging the share price below 92.96.

HART: Going back up so soon?Harvard Apparatus Regentive Technology is a bioscience company working on more natural heart valve replacements and other pretty cool biotech stuff. However my interest is because the way they are ramping up for another go after moving from $0.60 to $3.25 in less than a month. This is shaping up to be your typical "head and shoulders" scenario. HART's 1day MACD only crossed into negative on 12/7, giving the appearance that they are ready to fall back down. However it bounced at the 50% mark ($1.90) and StochRSI is already showing a cross upward.

What makes it really interesting is if you check out the 4hour or 2 hour you can see the MACD already coming back to positive. (see bottom image)

The markets are rough given the fear of a rate hike along with some 'cooling off' given the build up of overheating from past 2-3 years. However, at such a low price HART could be a worthwhile option play at a $5 strike a few months out. The option route would allow a relatively low bet--I need to look at the chain but I'm guessing as little as $20 a contract---with a short-term opportunity if the 2hr/4hr MACDs stay positive and bring the 1 day up; and a medium term opportunity if the indicators and the stock can't handle the bear market---HART has enough room and volatility to pay off later as well.

Even at $2.35 a share it's a good, cheap play.