SHORT GDX or LONG DUST // Swing TradingAfter correction of Gold (GLD) day before yesterday.

A equity market open for a risk-on scenario, maybe cooldown the gold rally for a while.

Today GDX filled the gap of the yesterday decline stopin at $50 (yellow mark).

Target $44-$45. First level of Fibonacci.

DUST

Silver Miners pop, down and then launchI feel a flash crash coming on, similar to Covid - wouldn't surprise me if Birdflu was the catalyst (see my NASDAQ:GILD idea). The patterns line up exactly the same. You can't see it with this picture, but tons of my indicators are going off -which I will post below. Silver Miners will exit the ascending triangle this go around as the commodity supercycle takes off. Could silver miners go a little more up then down? Absolutely, but miners are sensitive to market rallys and poundings like other stocks (see the pandemic in March 2020 on the chart).

2XBEAR JUNIOR MINERS LOOKING GOOD FROM HERE!It's time for precious metals to take a cooler.

I noticed AMEX:JDST 's options for $5 is off the chart compared to other months. I bought calls for .20 for $5 strike price in September. I anticipating these going to 2.00 by then which is 1000% return.

I also think AMEX:DUST is worthy of buying at these levels too - except they don't have miners, but I see a 500% return for this stock by the fall.

I will also link to some supportive ideas following this post.

2XBEAR MINERS LOOKING GOOD FROM HERE!It's time for precious metals to take a cooler.

I noticed JDST's options for $5 is off the chart compared to other months. I bought calls for .20 for $5 strike price in September. I anticipating these going to 2.00 by then which is 1000% return.

I also think DUST is worthy of buying at these levels too - except they don't have miners, but I see a 500% return for this stock by the fall.

I will also link to some supportive ideas following this post.

DUST Is Stuck between a Bearish & Bullish Trend!DUST is in a Symmetrical Triangle which means the Price has the chance to be Both Bullish and Bearish. No break out Has Happened yet So We Can not Determine the Trend Yet But It should Happen Soon. price in Bullish Scenario will be Reach around 0.27 and in the Bearish Scenario It will reach 0.13.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

🌍Thank you for seeing idea .

Have a nice day and Good luck.

Are miners about to crash? Looks like it to meDust looks like it's putting in a bottom to me. Also, there's a big falling wedge forming.

If we see a breakout of this pattern (which I think will materialize over the next week or so), I think we'll see a sharp move higher in $DUST and miners should fall quickly.

I'd be targeting the $17 resistance level as the target. Let's see what happens over the next few weeks.

Buy Dust to Short gold opportunity soon?If you belive gold will correct and the dollar will go up first half of 2023.

Buying dust might be a opportunity. The setup and cyles looks nice.

I am waiting for volume and a swing low with short term avrages

and oscilators confirming the move. Also the dollar must show strength.

Last COT data must show signs that the smart money is flipping the trade.

For more simple great ideas fallow and like. I have had alot of sucsess

in markets for many years and want to share my simple approch trough

my ideas. NO BS, No selling you course and stuff like most of tradingview.

My style is based on cycles of diffrent authors, like bressert, gan and so on.

Also the investing case must have fundamentals to support it.

Lets invest not gamble.

monitoring 2hr bull flag set up notice the 2 previous bearish cypher patterns. The 1st pattern of the (X) leg appears to be acting as support. I'm looking for gold to get above the 2nd bearish cypher pattern, and Test its X leg for support. If it hold then Im looking for gold to breakout again above $1800 and retest $1840-$1850 area

The AD earlier this morning showed me an ascending triangle to $1840 area. I'm monitoring and do a position

The AD is showing me a bullish butterfly pattern 2hrThe weekly price action of the S&P 500 is also showing a bullish butterfly pattern. however, for this price action to continue, the lower time frame also must establish the same pattern. In addition, naturally a rejection from B leg, forms a base, and potentially leading us into a high probably cup and handle breakout.

I like to trade the money flow, as it first gives me pattern recognition which I have to later confirm w/ price action ...

not trading or financial advice.

Disclosure im long spxl

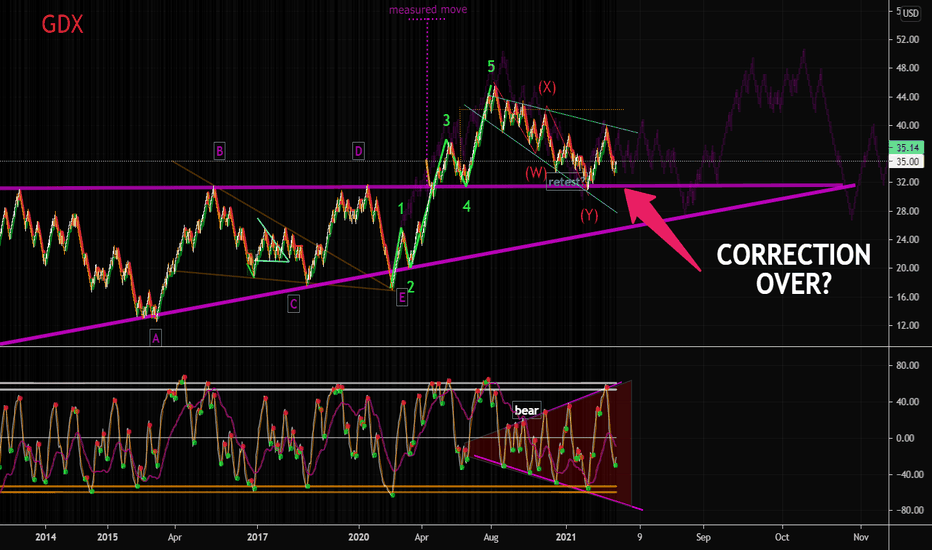

GDX HAS COILED ENERGYThe metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden bearish pattern that will eventually break. When it breaks, GDX is likely to move up incredibly strong. Perhaps one more push lower? I don't know... But I'll be ready if it drops again.

For me, I have some medium-longer term targets over 55-60.

GOLD - WHAT IS THE DEAL WITH NOVEMBER?Gold has entered the pivot zone. The hard metal is always a hold to me personally, but it helps to study the charts to get an idea of the algorithmic driving forces and other oddities. In this case, I couldn't help but see this Nov Nov Nov trend and the math behind the madness. The pattern suggests it'll be supportive. Watch it closely the next few weeks. We need to see strength come in to confirm support and upward continuation. Do not dismiss the possibility of a deeper correction.. There's no such thing as "impossible" when in comes to financial assets.. especially in 2020-after all, we did see oil trade MINUS $37 this year. Keep an open mind while in wonderland.

Gold and the next leg upGold looks like it's about to make a new leg higher but will it also drop 5-7% first? The dollar and gold tend to create very distinctive price cycles if you know how to look for them. Renko helps to see these price cycles and time seems irrelevant to them. I am seeing a cycle low in the works now but I'm not sure if it's complete yet. I will venture to say it's going to drop down into the 1700's before the next leg up but I'm not sure if we'll get that lucky. See my forecast on GDX (gold miners) and how this analysis could agree with that one. Smart money likes to flush the boys out so I am just expecting a wild ride here soon.