DXY

Dollar Index Tests Key Demand Zone: What's Next?The Dollar Index is currently testing a major demand zone between 99.50 and 101. This area has marked the end of downward moves and the beginning of dollar rallies five times since early 2023.

The recent downward pressure is largely driven by rising expectations of an economic slowdown and a strengthening euro.

At this point, several possible scenarios could unfold, depending on how the market reacts to this key support zone:

Repeat of the Past: Just like the previous five instances, the Dollar Index rebounds sharply from the zone and starts a strong upward move.

Trendline Test: The Dollar Index breaks below this zone and moves toward testing the long-term uptrend line that originated in 2011.

Fakeouts and Reversal: The Dollar Index briefly falls below the demand zone, approaches the long-term trendline, and then stages a false recovery above the zone. After trapping both bulls and bears and creating a fake breakout signal, it dips below the trendline before reversing and beginning a new medium-term uptrend that ultimately aligns above the long-term trend.

Given the high level of global economic uncertainty and recent sharp reversals in financial markets, the third scenario may carry slightly higher probability. A similar pattern played out in 2017, when both the 200-week moving average and the demand zone were broken. The key difference this time is that TVC:DXY is much closer to the long-term trendline.

DeGRAM | DXY broke the triangle downwardDXY is in a descending channel under a triangle.

The price is moving from the upper boundary of the channel, resistance level and upper trendline, which previously acted as a pullback point.

The chart failed to form an ascending structure, but it formed a harmonic pattern and broke down the mirror support level, which now acts as resistance.

On the main timeframes, the relative strength index is below 50 points.

We expect the decline to continue.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

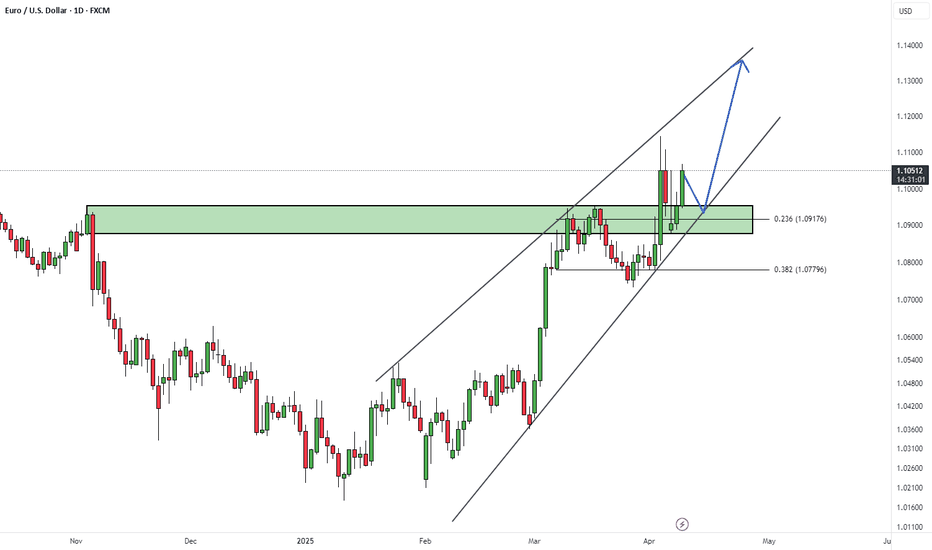

EURUSDHello Traders! 👋

What are your thoughts on EUR/USD?

EUR/USD has broken above the resistance zone and is currently trading above the breakout level.

A pullback to the broken level is expected before the next bullish move.

Once the pullback is complete, we anticipate a continuation of the uptrend toward the specified target. Holding above the broken resistance would reinforce the bullish outlook.

Will EUR/USD maintain momentum after the pullback? Share your views below!

Don’t forget to like and share your thoughts in the comments! ❤️

DXY Support Ahead! Buy!

Hello,Traders!

DXY keeps falling down

In a downtrend but the

Index will soon hit a

Horizontal support

Of 100.200 and after

The retest a bullish rebound

Is to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US DOLLAR at Key Support: Will Price Rebound to 103.000TVC:DXY is currently approaching an important support zone, an area where the price has previously shown bullish reactions. This level aligns closely with the psychological $100 , which tends to have strong market attention.

The recent momentum suggests that buyers could step in and drive the price higher. A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a bounce from this level. If I'm right and buyers regain control, the price could move toward the 103.00 level.

However, a breakout below this support would invalidate the bullish outlook, potentially leading to more even more downside.

This is not financial advice!

DeGRAM | DXY seeks to close the gapDXY is in a descending channel between trend lines.

The price is moving from the support level, which has already acted as a reversal point twice.

During the decline, the chart formed a gap and afterwards formed an inverted hammer and a harmonic pattern.

On the 1H Timeframe, the Relative Strength Index is in the oversold zone and indicates bullish convergence.

We expect the index to head towards the gap after breaking the 38.2% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

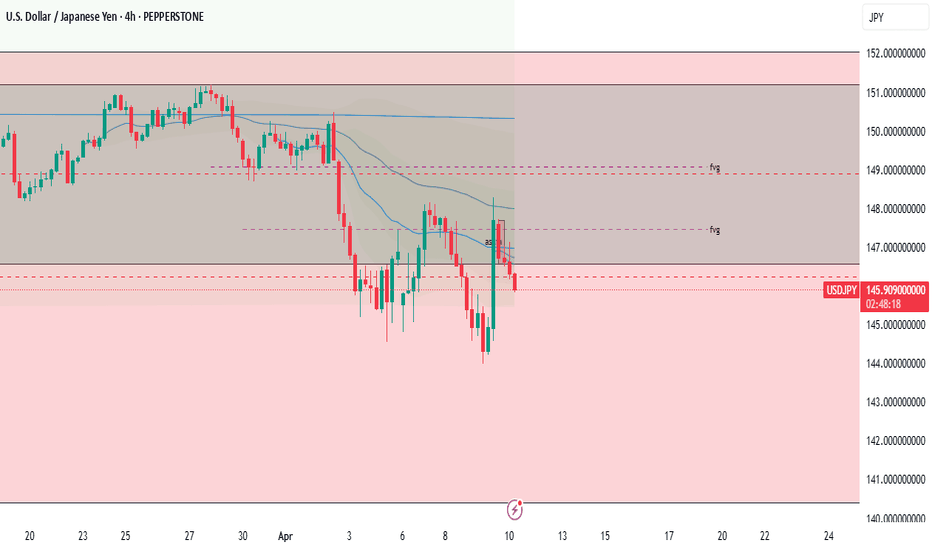

USDJPY SHORT LIVE TRADE AND EDUCATIONAL BREAKDOWNUSD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

DXY Will Move Higher! Long!

Take a look at our analysis for DXY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 102.170.

Taking into consideration the structure & trend analysis, I believe that the market will reach 102.904 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCAD → Weak dollar provokes continuation of downtrendFX:USDCAD under the pressure of a weak dollar and downtrend may renew its lows. The fundamental background for the dollar is weak, the market reacts accordingly.

The dollar continues to fall - a reaction to the tariff war. Besides, additional pressure is created by the issue of interest rates reduction.

The currency pair is under the pressure of the downtrend. After a false resistance breakout, the price is consolidating in the selling zone. The trend change is confirmed by the cascade of resistances. Emphasis on the local range 1.4245 - 1.42018. The price exit from the consolidation will provoke the continuation of the fall

Resistance levels: 1.4245, trend boundary

Support levels: 1.4202, 1.415

Possible retest of resistance before further decline. But the price exit from the current range and consolidation of the price below 1.4202 - 1.4205 will provoke the growth of sales and further fall to 1.405 (zone of interest).

Regards R. Linda!

Gold continues to rise and break through!Gold was driven by risk aversion news, and soared more than $100 in a single day yesterday, with a huge positive line on the daily line! At present, it has broken through the 3100 mark. It is difficult for gold to continue to be long and short. The next step is more of a big sweep!

At present, the 3100 mark will be the key to the next long and short positions. It is under pressure to continue to be bearish. The key 3055-50 area below is the long breakthrough point, which is also the support area for the two declines in the US market. Once it breaks down, it indicates that the rise started at 2970 yesterday has ended and returned to the short position.

If gold breaks upward and stands above the 3100 mark with the help of news, the long position will gradually rise to 3115-20 and 3135-40 (last Friday's high point) and even test the historical high of 3167 to build a daily double top!

Intraday operation:

The 3100 mark is used as a long-short boundary. If it breaks through, you can consider short-term long positions. After pulling up, refer to the above target position, which is also a resistance position, and arrange short positions again.

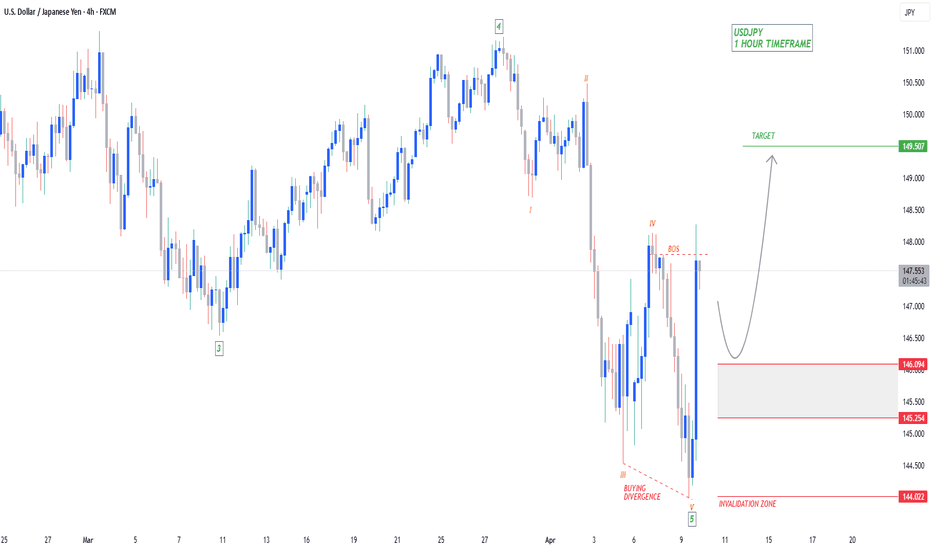

USDJPY Bullish to $149.500Rather than buying at the top of the ‘Impulse Wave’, wait for a ‘Wave 2’ or ‘Wave B’ correction towards the support zone, so you can buy back at a cheaper price.

⭕️5 Major Wave Bearish Move Complete.

⭕️5 Minor Waves Complete in Wave 5.

⭕️BOS Confirming Bullish Structure Now Valid.

Short XAU (Gold) Gold Futures are showing a very clean impulsive move through Elliot Wave TA. You can see the running flat on the 2nd wave leading to a very strong move on the Wave 3 major move. The Wave 5 is shorter than the Wave 3 to confirm the possible completion of this 5 Wave move up.

A weaker DXY (USD) is throwing an obstacle to this beautiful setup. Let's see some stability to the bonds market which should lead to stability in the equities market. This should help propel traders taking profits on this Gold rush.

DXY: Will Go Up! Long!

My dear friends,

Today we will analyse DXY together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 102.250 will confirm the new direction upwards with the target being the next key level of 102.798 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

NZDUSD - Golden Opportunity Alert This pair has been consistently breaking lows for a while — but things just got interesting. It’s now sitting at a key yearly support level, and we're still firmly within a large bullish range.

📈 Translation? Now is the time to buy.

This setup is looking like a textbook bounce opportunity. Not only is this one of the cheapest dollar pairs available right now, but with the dollar continuing its broader decline, this could be the best pair to capitalize on in the current market.

⚡ Don’t sleep on this move. Timing is everything.

Let me know what you think — and if this breakdown helped you, drop a comment or share it with someone who needs to see it!

Possible Battle Between USDJPY Bulls and Bears at TrendlineUSDJPY is currently testing its weekly trendline, but recent data from Japan may challenge the possibility of a downward break.

Market turmoil has increased demand for long-term U.S. bonds, and the resulting drop in the TVC:US10Y has kept the TVC:DXY under pressure, conditions that have supported Yen bulls. However, the latest wage data out of Japan may shift the short-term outlook just as the trendline is being tested.

Base full-time wage growth dropped to 1.9% year-over-year, down from 3%. This slowdown may give the Bank of Japan more justification to hold rates steady at its next meeting. If tariff-related panic subsides with any calming news from the White House, USDJPY could see renewed upside potential.

In the short term, two resistance levels are crucial: 146.50 and 147.50. The battle between bulls and bears is likely to play out between these resistance levels and the weekly trendline near 145.

XAUUSD/GOLD Possible Move 09.04.2025📊 Market Context

After a sharp selloff from the $3,160 region to sub-$2,980 levels, the market is now in recovery/consolidation mode.

Market currently hovers around $3,010 after bouncing from below $2,980, indicating buyer interest.

📏 Fibonacci + Support Confluence Zones

Price may pull back and give a buy-the-dip opportunity.

✅ Buy Zone 1 – $2,993–2,997

Reason: Retest of strong horizontal support, Fibonacci .5% area.

Signal to Enter Long: Bullish engulfing / hammer on M5/M15 + RSI divergence.

Target: $3,010 (first), $3,020+ (extended).

🔁 Retest Logic

Wait for price to retest any of these zones on low volume → watch for bullish candle close.

⚠️ Important Notes

Avoid entering mid-range trades at $3,010–$3,015 without pullback confirmation.

Aggressive buys can be scalped on momentum breakouts of $3,020 only if volume supports.

Always monitor for news or sudden volume spikes which can invalidate pullback zones.

Follow, comment, like and join for more like analysis.

Gold: Economic Risks May Drive Prices UpGold Surges Amid Global Uncertainty, Testing Key Resistance

Gold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless climb of US Treasury yields. With markets recalibrating their expectations around interest rate cuts by the Federal Reserve, investor appetite for safe-haven assets like gold has gained renewed strength.

At the heart of the current rally lies mounting geopolitical tension, particularly the intensifying trade standoff between the United States and China. Washington's proposal to impose 50% tariffs on a broad array of Chinese goods has rattled global markets. In response, Beijing is signaling potential retaliatory measures, further stoking fears of a prolonged economic conflict between the world's two largest economies. These developments are injecting volatility into risk assets and increasing demand for traditional hedges such as gold.

From a technical standpoint, the precious metal is currently grappling with a significant resistance level near $3,013. If the price manages to consolidate above this threshold following the current retracement, it could pave the way for a continued upward drive toward the next resistance zones at $3,033 and $3,057. These levels represent key pivot points that could dictate the short- to medium-term trajectory of gold.

On the downside, immediate support lies at $2,996, with stronger backing at $2,981. These levels may provide a cushion for any near-term pullbacks, especially as traders look for opportunities to re-enter the market during dips.

The broader narrative remains highly fluid, shaped by the ever-changing dynamics of global trade policy and monetary strategy. As the tug-of-war between Washington and Beijing intensifies, markets are left navigating a highly politicized and uncertain environment. With neither side showing signs of capitulation—China maintaining its firm stance, and the US administration likely to resist backing down—the potential for further escalation remains high.

In this context, gold’s appeal as a strategic asset grows stronger. The current setup suggests that the metal may gain additional bullish traction if it finds support around the 0.5 Fibonacci retracement level or holds above $3,013. Investors are keenly watching these technical and fundamental cues, weighing the growing economic risks that could propel gold into a sustained rally.

Weekly Market Analysis - 9th April 2025Here we are with another market analysis. This time, a bit late in the week on a Wednesday, but it is what it is! We have CPI today and PPI tomorrow, so this should be an interesting week. Overall, gut instinct tells me we would be pushing lower for the DXY, but again, i'm not betting anything on it. I trade the candles, I trade the structure, I don't trade guesses.

I hope you find the video analysis useful. Take care this week!

- R2F Trading

Trading Plan for DXY Elliott Wave View:

Large correction marked as Wave 4 in progress.

Inside it, a (A)-(B)-(C) zigzag structure is unfolding.

We’re currently in a sub-Wave B of C, expecting a short dip before a bullish move into the 104.80–105.60 supply zone (red box).

Invalidation level sits at 108.247, confirming the correction is valid below that.

2. Price Levels & Zones:

Strong support zone around 101.50–102.00, projected as a potential base for the next leg up (Wave C).

Resistance (target) is clearly the red supply zone near 105.

---

Correlation with EUR/USD Chart:

If DXY is expected to rise in its Wave C, then EUR/USD should fall (as seen in your earlier chart).

Your EUR/USD analysis targets the 1.06924 demand zone — this lines up perfectly with DXY's Wave C rise.

---

Trading Plan for DXY (or correlation play):

If trading DXY directly (if possible via CFDs):

Buy setup: Wait for minor correction (Wave B) to bottom around 101.80–102.00.

Entry: Near support with confirmation candle.

Target: Red zone 104.80–105.60.

SL: Below 101.50.

For EUR/USD traders:

Watch for EUR/USD Wave B to complete.

Once DXY starts impulsing up (Wave C), EUR/USD will likely drop hard.

That’s your sell opportunity on EUR/USD, aligned with DXY strength.