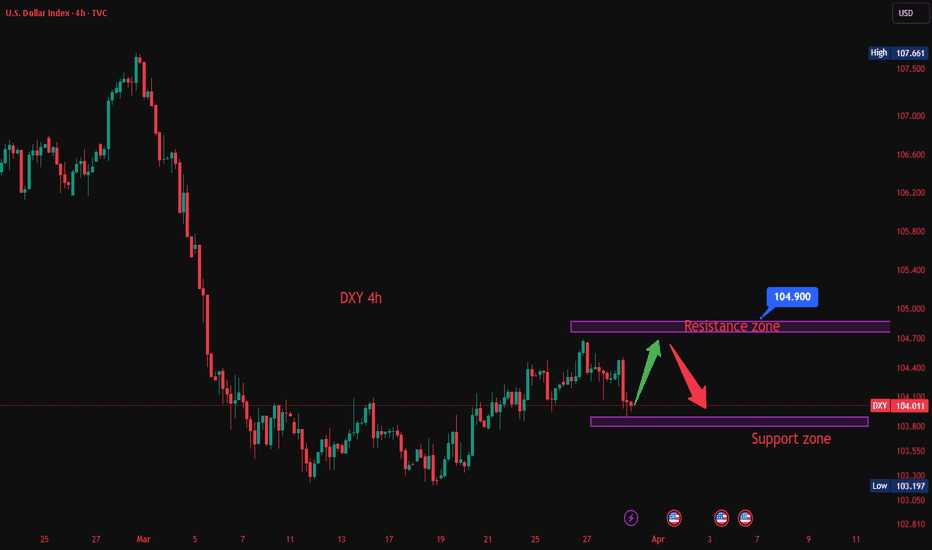

Dollar Index at Risk: Key Support Holds the Fate of the TrendThe U.S. Dollar Index (DXY) has broken down from a Head & Shoulders pattern, confirming a bearish reversal after a successful retest of the neckline. The price is currently near a key support area, and if it fails to hold, a drop toward the lower strong support zone is likely.

Additionally, RSI is showing bearish divergence and is below the neutral 50 level, indicating weakening momentum.

DYOR, NFA

Dxyanalysis

4.4 Gold is low and long, wait for non-agricultureYesterday, the gold market opened at 3134.1 in the morning. The market first fell back to 3122.6 and then rose strongly. After breaking the previous high, it reached a high of 2167.9. After that, the market began to fall under the cooperation of fundamentals and technical profit-taking. The intraday low was 3053.6. After that, the market rose strongly and reached 3135.8 before consolidating. The daily line finally closed at 3114.1. The daily line closed in a spindle shape with a very long lower shadow. After this shape ended, after the break of 2940 and 2958, the long positions were reduced, and the stop loss was followed up at 3050. If it falls back to 3082 first today, the long stop loss is 3075. The target is 3115 and 3132. If it breaks, the target is 3140 and 3150.

4.4 Analysis of gold short-term operation strategy!!!On Thursday (April 3), spot gold experienced a surprising volatility, with a single-day fluctuation of nearly $114, and the price of gold finally closed down.

Analyze the technical outlook of gold intraday.

The 4-hour chart of gold shows that the price of gold is trading below the currently flat 20-period SMA, but it is still well above the bullish 100-period SMA, which provides support near $3040/oz. At the same time, technical indicators have recovered from near oversold readings and stabilized within negative levels. If the price of gold falls below the above-mentioned $3040/oz area, the price of gold may fall sharply.

Support: $3086.70/oz; $3073.90/oz; $3061.10/oz

Resistance: $3123.10/oz; $3136.70/oz; $3150.00/oz

"DXY/Dollar Index" Bull Money Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "DXY/Dollar Index" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (104.100) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (103.500) Scalping/Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"DXY/Dollar Index" Indices Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY:Expect an uptrend based on the daily chart supportOn Tuesday, the price of the U.S. Dollar Index generally fluctuated in a range. The price reached a daily high of 104.345, a low of 103.99, and closed at 104.19.

Looking back at the performance of the U.S. Dollar Index on Tuesday, after the morning opening, the price initially fell under short-term pressure. Subsequently, it halted its decline and resumed its upward movement above the daily support level, but the overall range was limited. The price rose in a volatile manner, and finally closed with a bullish doji.

From a weekly perspective, continue to focus on the 106.60 level, which is a key level for the medium-term trend. Below this level, the medium-term trend is bearish, and the price increase is temporarily regarded as a correction within the medium-term decline.

Meanwhile, from a daily perspective, temporarily pay attention to the 103.90 level, which is crucial for the wave trend. Above this level, adopt a bullish stance for the wave trend. Also, on the four-hour chart, temporarily focus on the support at the 104.10 area. Therefore, before the price breaks below the low of Monday, bet on an upward movement based on the daily support. Only after a downward break will the trend turn bearish.

Currently, there is a lot of news, so everyone must be cautious of market risks.

Trading Strategy:

buy@103.90-104

TP:104.50-104.80

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

DeGRAM | DXY continued growthThe DXY is in an ascending channel between the trend lines.

The price is moving from the support level, the lower boundary of the channel and the lower trend line, which has already acted as a rebound point.

The chart has formed a harmonic pattern and successfully held the 50% retracement level.

We expect the growth to continue.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DXY Bounces Back: I’m Staying BullishAfter breaking below the 104 support and hitting a low of 103.75, TVC:DXY staged a strong recovery, reclaiming support and signaling a potential false breakout.

The overnight retest of 104 established a higher low, suggesting further upside potential.

As long as 104 holds, I remain bullish and will look to sell EUR/USD and GBP/USD.

Monthly line saturated big positive line, gold and silver swordsYesterday, the gold market opened slightly higher at 3088 in the morning, and then fell back. The daily line reached a low of 3076.5, and then the market rose strongly. After breaking the 3100 integer mark, the daily line rose strongly. The daily line reached a high of 3128, and then the market consolidated widely. The daily line finally closed at 3123.8, and then the market closed with a long lower shadow. After this pattern ended, today's market still has technical bullish demand. In terms of points, after the breakout of 2940 and 2958, the stop loss followed up at 2990. Today, the stop loss of 3110 is 3105, and the target is 3128 and 3132. The breakout is 3140 and 3150-3152.

We will update regularly every day to introduce how we manage active ideas and settings. Thank you for your likes, comments and attention. Thank you very much

4.1 Analysis of gold intraday short-term trendFrom the daily chart, the gold price fell slightly after breaking through the previous high of $3127.76, but it is still in a strong upward channel overall. The current price has been stable above the 5-week moving average for many consecutive weeks, indicating that the medium-term trend is still healthy. It is worth noting that from the low of $2536.68 to date, gold has risen by more than 23%, and it is necessary to be vigilant about the risk of short-term adjustments. The next target will point to the psychological level of $3200. Factors supporting this view include rising global uncertainty, increased expectations of interest rate cuts by the Federal Reserve, and continued gold purchases by the central bank. In addition, the closing price needs to stabilize above $3135 to confirm the effectiveness of the long-term breakthrough. In this case, the price may accelerate upward, with a target of $3170.

Short-term resistance: 3130 3150 3170

The market is changing with the trend, and it is recommended to adjust the strategy in combination with real-time data!

4.1 Technical analysis of short-term gold trading BUYGold is currently temporarily maintaining a high range oscillation in the 4-hour level trend, but the short-term moving average continues to maintain a strong trend, and a wave of bottoming rebound in the 4-hour level trend has basically completed the repair of the technical pattern. Pay attention to the secondary pull-up trend after the high-level oscillation repair is completed. The hourly level trend is currently temporarily maintained in a high-level oscillation, but the strength and continuity of the US market's retracement are not particularly large. The technical pattern of the small-level cycle trend has also been gradually adjusted and completed, and it tends to be able to continue to rise in the late trading.

Intraday short-term operation:

BUY: 3110 Stop loss: 3005-3100 Target 3125-3130

DXY:Seize the opportunity to sell short at high pricesThe situation in the Middle East is clearly deteriorating, which undoubtedly has a huge stimulating effect on the global risk aversion sentiment. More funds have started to seek safe havens. However, the best choice at present is not the US dollar. With the continuous rise of the East, more and more capital will favor this side of the East. Therefore, the pressure on the US dollar index is actually increasing, and it will be very difficult for it to rise.

Regarding the trend of the US dollar index today, although the current situation exerts great pressure, the actions to support the market of the US dollar index still take effect from time to time. So the price will not keep falling, and there will still be some oscillatory patterns. However, even if it moves in an oscillatory pattern, the upward pressure on the US dollar index will be significant. Therefore, when the price reaches the effective resistance level, it will be an excellent opportunity to short the US dollar index.

DXY Trading Strategy:

buy@104.500

TP:103.500

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

3.31 Gold US market operation analysis suggestions!Gold intraday analysis and operation: How to judge the next step after gold breaks through 3130!

Gold's strong rise in the Asian session has brought the price of gold close to 3130 and finally stagnated at 3127. The impact of the US market has not yet appeared, but with the current trend, the volatility of gold tonight will not be too small. The overall idea is to maintain the low north. The intraday volatility range is maintained within the range of 40 points between 3090 and 3130. The current increase has exceeded market expectations. Although there is selling pressure, it is all suppressed by the bulls!

US market pressure focus: 3130-3150 above and 3110-3095 below

The above analysis is a personal analysis suggestion, I hope it can bring some gains to everyone!

We will update regularly every day and introduce to you how we manage active ideas and settings. Thank you for your likes, comments and attention, we are very grateful

3.31 Gold officially breaks through 3100In the early Asian session on Monday (March 31), spot gold once again saw a surge in prices shortly after the opening. The most active gold futures contract in New York was traded in one minute from 10:22 to 10:23 Beijing time on March 31, with 890 lots traded, and the total value of the trading contracts was US$279 million. Affected by Trump's latest tariff news, spot gold maintained the current bull market trend. The gold price broke through the US$3,000 mark and broke through US$3,100 only half a month after breaking through the US$3,000 mark. As of 10:39 Beijing time, it was reported at US$3,105.23 per ounce.

Gold technical analysis: Gold closed higher with a big positive line last week, and after consolidating at a high level, it increased strongly and closed at a high level. The weekly K-line is still strong, with a big bald positive line. There will be further continuation this week. However, the monthly line closed today. After the volume is released, we must also be careful of the wash of the high and fall. The daily chart has continued to rise and set a new high. The Asian session is a slow consolidation and then a slow new high. The consolidation is not the high, and the volume is the top. At present, there is further rise in the short term. Gold was stimulated by risk aversion over the weekend. It opened high and fell back on Monday. However, gold fell back under pressure at 3100 in the short term. We must pay attention to adjustments. Then gold is just adjusting. Wait patiently for it to fall back before going long. The technical side of gold shows a strong upward trend. US$3070 has become a new short-term support level. The current upward momentum is sufficient and there is momentum for further rise. The influence of gold bulls on the current trend of gold has reached the highest level in history, but the trading scale and heat have not reached the most crowded range in history. There is still room for funds to further increase positions, which provides support for gold prices.

3.31 Gold Operation Strategy Reference:

Short Order Strategy:

Strategy 1: When gold rebounds around 3100-3103, short (buy short) in batches with 20% of the position, stop loss at 3110, target around 3085-3075, and look at 3070 if it breaks; (Strategy is time-sensitive, more real-time layout strategies are announced in the channel.)

Long Order Strategy:

Strategy 2: When gold pulls back around 3070-3073, long (buy long) in batches with 20% of the position, stop loss at 3060, target around 3085-3095, and look at 3105 if it breaks; (Strategy is time-sensitive, more real-time layout strategies are announced in the channel.)

DXY:It is about to witness a quarterly declineBecause concerns about tariffs causing a slowdown in U.S. economic growth have pushed down U.S. Treasury bond yields, the stock market, and the U.S. dollar exchange rate. The U.S. dollar is likely to experience a quarterly decline next week, and we can seize the opportunity to short on rebounds.

Trading strategy:

buy@104.500

TP:103.500

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

$DXY IdeaWhen analyzing the weekly DXY chart, we identify the presence of two CRTs: one bullish and one bearish. However, the bearish CRT has a low probability of success due to the candle formation and the fact that the price is still in a discounted region within the range.

Given this, our initial expectation is for the price to drop at the beginning of the week to seek liquidity in the equilibrium region of the daily range, which coincides with the 50% level of the bearish CRT. This movement may act as a correction within the predominant trend, pushing the price up toward the premium region of the weekly range. From that point, we will once again look for selling opportunities, as the market may resume its downward movement.

Based on this analysis, we initially seek selling opportunities down to the equilibrium region. Once this level is reached, we will wait for confirmation of a bullish reversal to look for buying opportunities up to the 50% mark of the bullish CRT.

Gold breaks new high again, the market waits for a pullback to gFundamentals: Gold hits a new record high today, and the market continues to hold a bullish view after the decline.

Gold is currently maintaining a relatively strong oscillating trend in the large-scale cycle trend, and the upward space in the large-scale cycle trend is likely to have not yet been completed. The daily level trend continues to maintain a relatively strong oscillating trend along the short-term moving average. The wave of decline before and after the European session has completed the repair of the technical form to a certain extent. The oscillating repair temporarily maintained at a high level in the hourly level trend currently has no particularly obvious trend. The range in the short-term trend may be compressed to the oscillating repair trend between 3060-85. Although there are some rebounds in the small-scale cycle trend, the strength and continuity are not too large. Pay attention to the short-term adjustment and repair.

Operation suggestions:

Short near 3080-7, stop loss 3085.2,

Long near 3059-60, stop loss 3053.1.

Real-time market intraday guidance.

3.28 Gold breaks new high again, holding on is the keyGold price hits a new record high of 3086, and today's low is the key

Gold price hits a new record high of 3086, which is in line with our bullish thinking of restarting strength since Tuesday

Now the price has also broken through the upper track of the green channel line. The next focus is on keeping low. Keeping low and breaking high will accelerate. Breaking the low point will easily return to sweeping

Today's low point defense position has two, the first is the early trading low of 3054, because it is a direct rise in the early trading to break the new high, and the afternoon continues to break the new high. In this case, it is particularly important to hold the early trading low ;

The second is the position along the green channel line, 3063-3061, which is also the position of the acceleration starting point

Then, next, hold the position along the green channel line, and switch upwards for at least 50-70 US dollars, corresponding to the resistance of the 3100-3115 area

The key point is to hold low, hold low and break high to see acceleration, and break the low point to turn to sweep

As shown in the figure, this wave of confirmed support began to rise, starting from breaking through the green dotted line suppression. After the breakthrough, repeatedly stepping back to confirm the 3015 upper and lower areas Support, then stand up and stabilize in the 3033-3030 area, and start an upward breakthrough

In the process, it is accompanied by a deep squat of 18-20 US dollars. After the leverage is completed, it will rise by more than 40 US dollars to break the new high

For the market that directly rose in the morning, there was a second sprint to break the high in the afternoon, so refer to 3068-3066 as support to continue to layout the bullish sprint to the 3080-3082 area

The price also accelerated the sprint and rose, and slightly exceeded the range of 3086

: Suppression line Under pressure, enter adjustment, squat 18-20 US dollars, confirm the support and continue to pull up more than 40 US dollars (what needs to be considered and verified at this moment)

For this pressure position, the focus is on the 3082-3085 area (now the excess range has reached 3086), using this as a suppression to find a space range of 18-20 US dollars, corresponding to the 3062-3060 range

The short position in the 3082 area fell to 3072-3070 as expected

Verify the conjecture step by step, time is the best verification tool!

Today is Friday, still the old rules, only provide information reminders for cooperative friends, if you need, you can find us, looking forward to the good news you have received!

3.28 Gold Breaks Point, Falls Back to Support Long PositionsOn Thursday (March 27), affected by the news that US President Donald Trump announced new tariffs on imported cars, global trade tensions further escalated, market risk aversion heated up, and gold prices once again approached the record high set last week.

Fundamentals: Gold fell from its pre-US high. The decline supports the long position view.

The new US tariffs have exacerbated market tensions, and PCE data will become the next focus of attention.

The current market is active, and both long and short sides are engaged in fierce competition around key resistance levels. The dual drive of technical and fundamental factors has significantly amplified the volatility of gold prices.

The cumulative net inflow of gold ETFs in the first quarter of 2025 has reached 155 tons, and the total holdings have climbed to the peak since September 2023. In the previous trading day alone, the scale of a single-day increase of 23 tons set a record since 2022. The unexpected growth of central bank demand for gold purchases and the continued inflow of ETF funds together constitute the "two-wheel drive" for gold's medium- and long-term bullishness. If this trend continues, it will provide sufficient liquidity support for gold prices to break through historical highs.

The current price is close to the historical high, and some long profit-taking pressure is gradually accumulating. If the PCE data released on Friday is stronger than expected, or the Federal Reserve releases hawkish signals, it may become the fuse to trigger a pullback

Trend: shock upward trend

Support: around 3033.00

Resistance: around 3055.50

DXY:Today's Trading StrategyTrump signed an executive order announcing a 25% tariff on all imported cars, aiming to force the return of many automotive manufacturing and related industries through the "tariff stick." However, the actual situation is more complex. Currently, there are significant issues within the US domestic industrial chain system, with declining quality and craftsmanship, failing to meet the needs of many automotive manufacturing enterprises. As a result, this measure is unlikely to achieve the desired effect and may even harm the US itself. The US Dollar Index is the first to bear the brunt. Upon the market's confirmation that Trump has officially signed the order and tariffs will be imposed, the pressure on the US Dollar Index suddenly emerged, squandering the hard-earned advantages accumulated yesterday. This led to a sharp decline in the US Dollar Index early today.

Regarding today's trading strategy, it is recommended to adopt a trading approach based on the market's oscillatory trend. One can seize the opportunity to sell the US Dollar Index short at highs and buy non-US currencies at lows, as the current market demand indicates that the US Dollar Index cannot truly rise, nor will it experience a significant decline for now. Therefore, it is advisable to find opportunities to sell the US Dollar Index short at highs during the market's oscillation.

Trading strategy:

buy@103.70-103.80

TP:104.50-105.00

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

DXY:Pay attention to the retest of the daily chart supportOn Tuesday, the price of the US Dollar Index generally declined. The intraday price peaked at 104.444, bottomed out at 103.917, and closed at 104.189.

From the perspective of the daily chart, the level of 103.80 below serves as a crucial watershed for the wave trend. As long as the price remains above this level, a short-term bullish position is advisable for the time being. Meanwhile, the short-term support of the four-hour chart is in the 104.10 area. Currently, the price in the short term is fluctuating and is likely to continue to retest the support area of the daily chart. Therefore, in trading operations, focus on the support of the daily chart and anticipate an upward movement.

Trading strategy:

buy@103.70-103.80

TP:104.50-105.00

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

3.26 Technical analysis suggestions for short-term gold operatioIn the early European trading on Wednesday (March 26), spot gold continued to rebound in the short term, and the current gold price is around $3027/ounce.

Gold technical analysis, how to operate in the evening? ——

The daily chart of gold shows that gold prices are rising above all bullish moving averages, while setting higher highs and higher lows. The 20-day simple moving average (SMA) has gained upward momentum and currently provides dynamic support around 2954.70. At the same time, after correcting the extreme overbought conditions, technical indicators resumed their upward trend within the positive level. From the 4-hour line, gold prices are fighting against the mildly bearish 20-period SMA, but are still well above the bullish 100-period SMA and 200-period SMA. At the same time, technical indicators are retreating from the midline and slightly lower within the neutral level. Overall, it is recommended to treat gold operations with a wide range of fluctuations today!

Gold operation strategy at night:

Short order strategy: short near 3031 above, stop loss 3040, target near 3010;

We will update regularly every day and introduce to you how we manage active ideas and settings. Thank you for your likes, comments and attention, we are very grateful