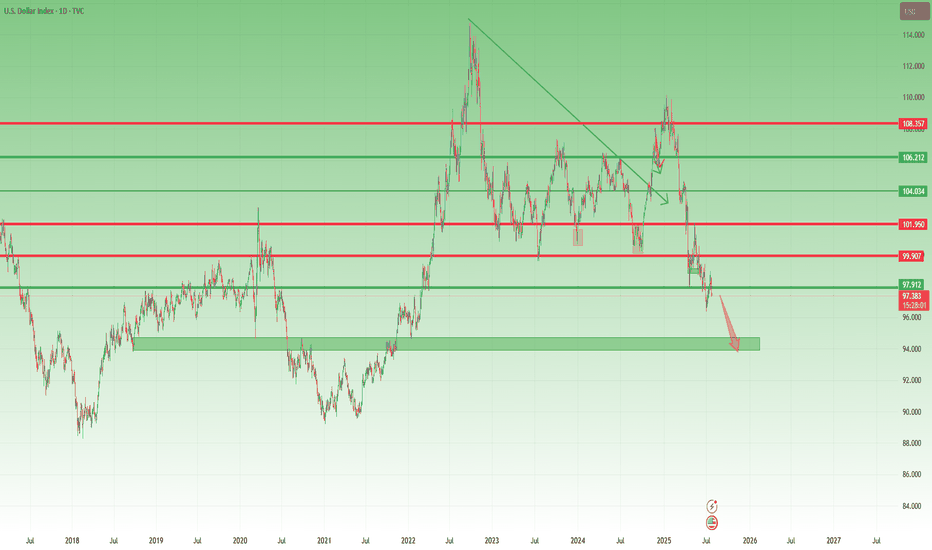

US Dollar Breakdown – Don’t Fight the FloodSince the start of the year, after forming a small double top around the 110 zone, the US Dollar Index (DXY) has followed only one direction: down.

So far, we’re seeing a decline that’s approaching 15%, with the index breaking multiple major support levels along the way. And judging by the current structure, there’s little reason to believe this trend will reverse any time soon.

________________________________________

🔍 Short-Term View – Flag Break, More Losses Ahead

Zooming in, we can observe that the last rally was purely corrective — a typical bear flag formation. That flag is now broken to the downside, which confirms renewed bearish pressure and suggests that further losses are likely even in the short term.

________________________________________

🎯 What’s Next?

The next major support zone sits around 95, a level that should act as a magnet if the current trend continues.

As long as price stays under 100 ZONE, the outlook remains bearish and the strategy should align with that bias.

________________________________________

✅ Strategy Going Forward

The safe and logical approach now is to buy dips on major USD pairs:

EURUSD, GBPUSD, AUDUSD, and NZDUSD

________________________________________

📌 Final Thought

The structure is clear, momentum favors the downside, and the market is offering clean setups across multiple USD pairs.

Don’t fight the trend — follow the flow. 🟢

Dxysetup

"DXY Bullish Setup – High Probability Trade!"🚨 "DXY DOLLAR BANK HEIST" – THIEF TRADING STYLE MASTER PLAN (HIGH-IMPACT TRADE ALERT!)

🔥 "Steal the Market Like a Pro – This DXY Heist Could Print Serious Cash!" 🔥

🌍 Greetings, Market Pirates & Profit Raiders! 🌍

🤑 "Money isn’t made… it’s TAKEN!" 💰💸

Based on the 🔥 Thief Trading Style 🔥 (a lethal mix of technical + fundamental + psychological warfare), we're executing a DXY Dollar Index Bank Heist—a high-stakes robbery where YOU get to keep the loot!

📜 THE HEIST BLUEPRINT (TRADE PLAN)

🎯 ENTRY ZONE – "BREAK THE VAULT DOOR!"

📍Key Trigger: Wait for price to SMASH through the Moving Average Wall (97.700) – then STRIKE!

🔪 Thief’s Entry Trick:

Buy Stop Orders above MA (aggressive)

Buy Limit Orders near recent swing low (smart pullback play)

DCA/Layering Strategy for max profit extraction (real robbers scale in!)

🚨 ALERT SETUP: "Don’t miss the breakout – set an ALARM!" ⏰

🛑 STOP LOSS – "DON’T GET CAUGHT!"

"Yo, rookie! If you’re entering on a breakout, WAIT for confirmation before placing SL!"

📍Thief’s SL Zone: 97.400 (30min swing low – adjust based on your risk appetite!)

⚠️ WARNING: "Place it wrong, and the cops (market) will lock YOU up!" 🚔

🎯 TARGET – "ESCAPE WITH THE LOOT!"

🏆 Primary Target: 98.350 (Take profits before the resistance police show up!)

🔄 Scalper’s Bonus: "Trail your SL, squeeze every pip!"

💡 Pro Tip: "If you’re underfunded, ride with the swing traders – teamwork makes the dream work!"

💣 WHY THIS HEIST WILL WORK (MARKET DYNAMICS)

✅ Bullish Momentum Building (DXY showing strength!)

✅ Overbought? Maybe… but thieves don’t wait for permission!

✅ Trend Reversal Potential (Big money shifting!)

✅ Police (Resistance) Trap Ahead (Escape before they catch you!)

📡 NEWS & RISK MANAGEMENT (DON’T GET BUSTED!)

🚨 High-Impact News? AVOID new trades! (Use trailing stops to lock profits!)

📊 Check COT Reports, Macro Data, Geopolitics (Smart thieves do their homework!)

💥 BOOST THIS HEIST – LET’S GET RICH TOGETHER!

👊 "Hit the LIKE & BOOST button to fuel our next heist!"

💖 "More boosts = More robberies = More FREE money for YOU!" 🚀

⚠️ DISCLAIMER (LEGAL SPEAK)

"This ain’t financial advice – just a damn good robbery plan. Trade at your own risk, and don’t cry if you ignore the SL!" 😎

🔔 Stay tuned for the next heist… The market’s our playground! 🏴☠️💰

🚀 "See you at the next breakout, thief!" 🚀

🔥 #DXY #Forex #Trading #BankHeist #ThiefTrading #ProfitPirates #MakeMoney #TradingView #SmartMoney 🔥

“The Dollar Job: Break-In Strategy for 99+ Profits”💸 “DXY Heist Blueprint: Thieves’ Bullish Breakout Play” 🏴☠️

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome, Money Makers & Silent Robbers 🕶️💼✨

This is our next big Thief Trading Heist Plan targeting the 💵 DXY Dollar Index Vault. Armed with both technical precision 🔍 and fundamental insight 📊, we're ready to strike smart — not just fast.

🎯 THE MASTER HEIST PLAN:

🟢 ENTRY POINT – “Heist Entry Protocol”

🎯 Wait for price to break above Resistance @ 99.000 and candle to close ✅

💥 Plan A: Place Buy Stop Orders just above breakout

📥 Plan B: For Pullback Pros, use Buy Limit at recent swing low/high (15m–30m TF)

📌 Tip: Set alerts — don’t get caught napping while the vault opens! ⏰🔔

🛑 STOP LOSS – “Thief’s Escape Hatch”

🧠 Use 4H swing low at 98.100 as SL

⚖️ Adjust based on your lot size and number of open positions

🚨 Don't rush to set SL for Buy Stop entries before confirmation! Patience is part of the plan. 😎

🎯 TARGET – “Mission Objective”

💰 First Exit Target: 100.000

🏃♂️ Optional: Escape earlier near high-risk zones (Blue MA Line Trap Area)

⚔️ SCALPERS' CODE – Stay Sharp!

Only scalp on the Long side.

🔐 Use Trailing SL to guard your loot!

💸 Big wallets? Jump early.

🧠 Smaller stack? Follow the swing crew for coordinated execution.

🌐 MARKET OUTLOOK: WHY THE VAULT’S OPENING

💡 Currently seeing bullish momentum in the DXY

📈 Driven by macroeconomics, sentiment shifts, and intermarket pressure

📰 Want the full debrief? Check our analysis across:

COT Data

Geopolitics & News

Macro Trends & Sentiment

Fundamental Forces

📎🔗 See full breakdown

⚠️ TRADE MANAGEMENT ALERT

🚫 Avoid opening new trades during high-impact news

🔁 Always use Trailing Stops to lock in profits

❤️ Support The Heist – Boost the Plan!

Every boost powers our underground crew 🐱👤.

We rob the markets, not the people. 💼💰

Like & Boost to help grow the Thief Trading Gang 👊💥

Stay tuned, robbers – more heist plans dropping soon.

💸🚀📈🤑

DXY Under Pressure: Breakdown Incoming Below 99.00?After testing the 102 resistance zone in mid-May, the TVC:DXY resumed its downward move, dropping back into the 98.50–99.00 support zone.

The brief spike above the psychological 100 was quickly rejected, and price has since rolled over — currently trading around 99.27 at the time of posting.

🔻 The downside pressure is strong, and a break below support looks imminent.

If that break occurs:

🎯 Short-term target: 98 (approx. 1% drop)

📉 Medium-term potential: A deeper decline toward 95

"DXY Dollar Index" Market Bullish Heist Plan (Day/Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "DXY Dollar Index" Bank Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Line Zone. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Crossing previous high (100.400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 2H timeframe (99.000) Day/swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 102.300

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"DXY Dollar Index" Bank Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY / Dollar Index Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY / Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (103.300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (101.700) Day / Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.000 (or) Escape Before the Target

💰💸💵DXY / Dollar Index Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY / Dollar Index Market Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY / Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (104.550) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (103.800) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

DXY / Dollar Index Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY Dollar Index Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (37800) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 38500 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 36500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

DXY Dollar Index Market is currently experiencing a Bearish trend., driven by several key factors.

⚡Fundamental Analysis

Fundamental factors driving DXY focus on U.S. economic conditions, Fed policy, and global currency dynamics.

Interest Rates:

U.S. Federal Reserve: Rates steady at 3-3.5%, down from 2024’s 4.5-5%. Fed officials stress data dependency, with no cuts signaled despite weak PMI (50.4) and jobless claims (219,000 vs. 215,000 forecast). Real yields (10-year Treasury at 3.8%, ~1% inflation-adjusted) support USD.

Other Countries: ECB at 2.5%, BoJ at 0.25-0.5%, BoE at 4-4.5%—U.S. yield advantage persists, though narrowing.

Impact: Bullish for DXY, tempered by global easing.

Inflation:

U.S.: PCE at 2.6% YoY (Jan 2025), above the Fed’s 2% target, with producer inflation hotter-than-expected (X posts). Inflation fears linger, supporting USD.

Other Countries: Eurozone at 2.8%, Japan at 2.5%, UK at 2.5-3%—global inflation pressures USD rivals less.

Impact: Bullish, as U.S. inflation sustains Fed hawkishness.

Economic Growth:

U.S.: Mixed signals—PMI at 50.4 (near stagnation), jobless claims up, but ADP jobs beat at 183,000 (Jan 2025). Tariffs add uncertainty.

Other Countries: China at 4.5% (slowing), Eurozone at 1.2%, Japan at 1%—U.S. outperforms peers.

Impact: Mildly bullish, U.S. resilience aids USD.

Safe-Haven Flows:

USD competes with JPY and CHF amid tariff risks and geopolitical flare-ups (Russia-Ukraine, Middle East). Recent yen strength (X posts) pressures DXY.

Impact: Mildly bearish, global risk-off challenges USD dominance.

Trade Balance:

U.S. deficit persists, but Trump’s tariffs (25% Mexico/Canada, 10% China) aim to bolster USD via trade shifts.

Impact: Bullish long-term, short-term neutral.

⚡Macroeconomic Factors

U.S.-focused with global context:

U.S. Policy: Fed’s tighter stance vs. global easing (ECB, BoJ) favors USD. Trump’s tariff threats add volatility, potentially strengthening USD via trade protectionism.

Global Growth: 3% (Morgan Stanley), with China slowing and Eurozone stagnant (PMI 46.2). U.S. relative strength supports DXY.

Commodity Prices: Oil at $70.44 pressures import-heavy peers (Japan), mildly weakening JPY vs. USD.

Currency Dynamics: Yen strength and EUR softness (EUR/USD below 1.0500) drag DXY lower recently,

⚡Commitments of Traders (COT) Data

Hypothetical COT (mid-Feb 2025, CME):

Large Speculators: Net long USD ~70,000 contracts (down from 80,000 post-110 peak), cooling after profit-taking.

Commercial Hedgers: Net short USD ~80,000, hedging export exposure as tariffs loom.

Open Interest: ~150,000 contracts, stable, reflecting U.S. trader engagement.

Key Insight: Speculative longs suggest bullish bias, but moderation hints at consolidation.

⚡Market Sentiment Analysis

Includes retail, institutional, and corporate traders:

Retail Sentiment: U.S. retail traders likely 60% short DXY at 106.000 (hypothetical broker data), betting on yen/CHF gains. Contrarian upside risk if shorts unwind.

Institutional Traders: U.S. funds (e.g., Citi, HSBC) mixed—bearish short-term (DXY to 96.87, Citi Hong Kong), bullish long-term (WalletInvestor to 119.193). Sentiment leans cautious.

Corporate Traders: U.S. exporters hedge at 106.50-107.00, neutral as tariffs loom; European firms favor EUR weakness.

Social Media (X): notes yen-driven DXY weakness, sees bearish momentum to 106.15—trending bearish.

Broker Data: U.S. IG sentiment ~55% long—balanced positioning.

⚡Quantitative Analysis

Moving Averages: 50-day SMA (106.30), 200-day SMA (105.50)—price below 50-day, above 200-day, neutral signal.

RSI: 45 (daily), bearish momentum fading, room for reversal.

Bollinger Bands: 105.80-106.80 range, 106.000 at midpoint—consolidation likely.

Fibonacci: 38.2% retracement from 110.00-102.50 at 105.62—key support holds.

Volatility Model: Implied volatility (1-month) at 7%, suggesting 0.75-point monthly range (±0.7%).

⚡Intermarket Analysis

USD/JPY: At 150.00, yen strength pressures DXY; drop to 145 could accelerate declines.

EUR/USD: Below 1.0500, EUR weakness supports DXY mildly.

Gold: XAU/USD at 2940 (risk-off proxy) inversely pressures USD.

Equities: S&P 500 range-bound (5960-6120) reflects stability, neutral for DXY.

Bonds: U.S. 10-year yield at 3.8% vs. JGB at 0.9%—yield gap aids USD.

⚡News and Events Analysis

Recent: Trump’s tariff threats (25% Mexico/Canada, 10% China, Feb 23-25) fuel risk-off, pressuring DXY via yen strength (X posts). Weak U.S. PMI and jobless claims offset by PCE at 2.6% (Jan 2025).

Upcoming: U.S. PCE data (Feb 28) critical—hotter data could lift DXY, softer data bearish. Fed rhetoric pending.

Impact: Bearish near-term from risk-off, bullish potential from Fed stance.

⚡Overall Summary Outlook

DXY at 106.000 balances U.S. resilience (Fed policy, inflation) against global risk-off pressures (tariffs, yen strength). Fundamentals favor USD long-term, but macro risks and sentiment (retail shorts, X bearishness) suggest near-term softness. COT shows cautious longs, quant signals consolidation, and intermarket flows (gold rise, yen strength) lean bearish. Short-term dip to 105.50-105.91 likely, medium-term range-bound with a bullish tilt if Fed holds firm.

⚡Future Prediction

Bullish Case: DXY to 108.00-110.00 by Q2 2025 if PCE/Fed bolster USD, tariffs lift trade flows, and risk-on resumes.

Bearish Case: Drop to 103.50-105.00 if yen/CHF surge, tariffs falter, or Fed dovishness emerges.

Prediction: Mildly bearish short-term to 105.50, then bullish to 108.00 by mid-2025, driven by Fed policy divergence.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY US Dollar Index Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY US Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑: Thief SL placed at 108.500 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 106.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

DXY US Dollar Index Market is currently experiencing a Bearish trend., driven by several key factors.

🟦Fundamental Analysis:

- The US Dollar Index (DXY) has been under pressure due to the contraction in JOLTS job openings, indicating a tightening job market

- The Federal Reserve's monetary policies, geopolitical stability, and global acceptance of the dollar as a reserve currency contribute to the dollar's strength

- A strong economy with high productivity, low unemployment, and stable inflation provides a foundation for strengthening the dollar's position

🟫Macro Analysis:

- The US economy is expected to remain strong, with low unemployment and stable inflation, supporting the dollar's value

- Global trade tensions and geopolitical instability may impact the dollar's value, but its status as a reserve currency provides stability

- Interest rate decisions by the Federal Reserve will influence the dollar's value, with potential rate cuts impacting its strength

🟪Sentimental Analysis:

- 60% of client accounts on IG are long on the US Dollar Index, indicating a bullish sentiment

- However, the recent contraction in JOLTS job openings and potential Fed rate cuts may lead to a bearish sentiment

🟧COT Analysis:

- The latest Commitment of Traders (COT) report shows that speculators are net long on the US Dollar Index, indicating a bullish sentiment

- However, the report also shows that commercial traders are net short, indicating a potential bearish sentiment

🟨Positioning:

- Corporate traders may consider hedging their exposure to the US Dollar Index due to potential volatility

- Investor and hedge fund traders may consider going long on the US Dollar Index due to its potential strength, but should be cautious of potential rate cuts and geopolitical instability

- Institutional traders may consider diversifying their portfolios to minimize exposure to the US Dollar Index

- Retail traders should exercise caution when trading the US Dollar Index due to its potential volatility and should consider using proper risk management strategies

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY "Dollar Index market" Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the DXY "Dollar Index" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a bull trade at any point,

however I advise placing Multiple Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low & high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low level.

Goal 🎯: 109.500

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Unmasking DXY's Bullish Potential with Volume ProfileH ello,

The unusually high market activity around the 100.5 level indicated strong bullish accumulation. The yellow ellipses highlight the volume and price levels. You can see that volume decreases both above and below this key level. This accumulation is evident because the price broke out of a bullish consolidation pattern, as shown in the left yellow circle, reaching a high of 103.9, indicated by the yellow line. This is the current level, where you may notice exceptionally high market activity. As the price remains above the green demand zone, the red supply zone may be tested, as suggested by the volume profile.

Regards,

Ely

Is a DXY Pullback on the Horizon? Key Price Action Signals Is a DXY Pullback on the Horizon? Key Price Action Signals to Keep an Eye On

👀👉 The DXY Dollar Index has shown robust bullish momentum recently—but is it overextended? A pullback at a major support level could offer a valuable entry opportunity. I’m watching this zone closely for a possible buy setup aligned with the key criteria covered in the video. In this analysis, we’ll explore essential price action signals to watch and discuss strategies for positioning in the next potential move. Disclaimer: This analysis is for informational purposes only and not financial advice.* 📊✅

DXY "DOLLAR INDEX" Bank Bullish Robbery Plan To Steal MoneyHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist DXY "DOLLAR INDEX" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

DXY Index at Critical Resistance: Possible Clues for USD Pairs👀👉 The US Dollar Index (DXY) is nearing a key resistance zone, repeatedly tested on both the monthly and weekly timeframes, which often signals a potential market reaction or rejection. While the US dollar has maintained a strong bullish trend, these factors suggest a possible near-term reversal, offering potential opportunities in both correlated and inversely correlated currency pairs. Disclaimer: This is not financial advice. Always do your own research and consult a licensed financial advisor before making any trading decisions.

📊✅

DXY (Dollar Index) Technical Analysis and Day Trade Idea👀 👉 The DXY (Dollar Index) recently shifted into a bullish structure on the 4H timeframe, with price now approaching a key resistance level. This could present a potential short day trade opportunity. In this video, we analyse the DXY in detail, reviewing the trend, market structure, and price action, while exploring a possible trade setup. Disclaimer: Forex trading carries significant risk, and market conditions can change rapidly. The information provided is for educational purposes only and does not constitute financial advice. 📉✅

DXY "Dollar Index" Bank Money Heist Plan on Bullish SideMy Dear Robbers / Money Makers & Newbies,

This is our master plan to Heist DXY "Dollar Index" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 30 mins timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.