DXY upmove will decide the top on stocksHello everyone,

Most important week of the year is here, the next upmove on the dollar will decide the top of stocks

Then the 2 wave will start the correction from the downmove on stocks and gold /silver

3 wave will be the impulsive which will crash stocks and send gold to 1400 target

This is my view, Good luck everyone

Dxysignals

U.S. DOLLAR INDEX Sell signalPattern: Channel Down on 1D.

Signal: Sell as the price not only got rejected today on the Channel's median but also on the 0.382 Fibonacci retracement level, potentially repeating the previous bearish leg of the Channel Down.

Target: 88.000 (the -0.236 Fibonacci extension).

*Reference* This scenario was captured on my last DXY idea, regarding the potential of the 1D time-frame. Take a look below:

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> TradingView

--------------------------------------------------------------------------------------------------------

US Dollar Index BULLS Into NON FARM PAYROLLS! Where to Next?Hi Everyone,

As you would be aware tonight is non farm payrolls and this means we are about to see the next movement for US dollar pairs and the index. Will the 20 moving average on the weekly hold it down similar to last time?

Good luck and see you all tonight live on You Tube!

Happy Trading,

Tom

DXY, Dollar SkyRocketing?As salam alaikum

DXY Trying to recover as Joe Biden and FED decisions

are manipulation market. Still NFP,ISM,PMI to come,

that depicts the sign of further incline.

T.A review:

Rising Wedge

Minor Ascending Channel

90 seems to be rejection zone

If breaks up and retest then DXY might

bring lots of pairs pretty down.

DXY / LONG IdeaFrom what i can see before we can look to go long on the DXY we must wait for price to reach this area which i have marked out as support

No significant moves happen unless this area is reached and we are probably a few weeks away from that as yet

This is just my opinion, let me know your thoughts

Judgement time for WTI Oil according to the DXY.Simple chart comparison on a +12 year time span. Oil on a Channel Down, DXY on a Channel Up. Every time DXY kept its Support (green zones), Oil failed to make a Higher High and break its Lower Highs trend-line.

Oil hasn't made a Higher High since July 2008 and the Sub-prime mortgage crisis. Is it time to do so, if DXY breaks its Support this time? Thoughts???

Most recent WTI idea:

Most recent DXY idea:

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> Astael

--------------------------------------------------------------------------------------------------------

DXY- To continue its correctionAs I expected, DXY broke above short term wedge resistance and reached my first target.

Now the index looks determined to continue its upward correction and 92 could be the target for such a correction.

In my opinion rallies in EurUsd, NzdUsd, AudUsd should be sold, and also a buy trade for UsdCad could be a good choice

DXY conflicting patterns on the 4H and 1D time-frames.The U.S. Dollar index is consolidating for the past 2 days within the MA50 and MA200 on the 4H time-frame (chart on the left). The RSI is indicating that such consolidating, within a Triangle pattern, is similar to the December 22-25 sequence, which after it broke ended lower with a new Lower Low on the long-term Channel Down pattern that DXY is in since late September.

On the 1D time-frame though (chart on the right), both the RSI and MACD indicators show that we could be repeating the September rise (which eventually led to the start of the Channel Down). Currently the 1D MA50 is the Resistance, but on the September rise it broke and peaked a few days later.

All the above suggest the DXY is still a sell but traders should reserve an additional sell for a potential peak near 92.000. Which pattern do you think will prevail?

Most recent DXY signal:

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> ProjectSyndicate

--------------------------------------------------------------------------------------------------------

DXY is bottomingWhat is clear is that USD is weak but also is clear that the market can't be unidirectional indefinitely.

Usd counterparts started the year strong but the new highs (and new lows for the index) are marginal and lacking power. So far all that USD could do was to have some intraday correction and I think this is about to change and we will have a lasting correction.

That being said I will look for opportunities of buying USD and my preferred pairs are EurUsd, AudUsd and NzdUsd for short and UsdJpy&UsdCad for long trades

DXY- Dollar bears should be very careful now!I was pretty bearish USD till now and I wasn't disappointed by now and although in the long run I maintain my bearish outlook on DXY, at this point a drastic correction can be just around the corner.

With DXY approaching a strong support and old congestion zone around 89, I think Dollar bears should be very careful.

From the risk point of view also I can't see a favorable trade on the short side so, in my opinion, we should look to buy USD especially with NZD,AUD and CAD

Will the stock market decline if DXY holds this Support?This is a simple yet very informative study showing a comparison of Dow Jones against DXY (U.S. Dollar Index).

Since early 2015 the DXY has been ranging (wide range but still range) and especially after 2017 it established a clear Resistance (103.800 - 103.000) and Support (88.200 - 88.900) Zone. Every time it hit the Resistance and got rejected (Jan 2017, March 2020), Dow Jones started rising aggressively. Similarly when DXY hit the Support Zone (Feb 2018), Dow Jones (though volatile) made a new Low.

The DXY is currently very close to that Support Zone. Will another rebound here kick-start selling on the stock market? That chart certainly shows that. However we have to consider the (much longer) Cycles of DXY on a decade span (I posted that chart earlier today), which suggest that there are increased chances of breaking this Support.

Which scenario do you think will prevail? Will DXY hold this Support and cause selling on stocks or the opposite? Feel free to share your work and let me know in the comments section!

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> OCDJ

--------------------------------------------------------------------------------------------------------

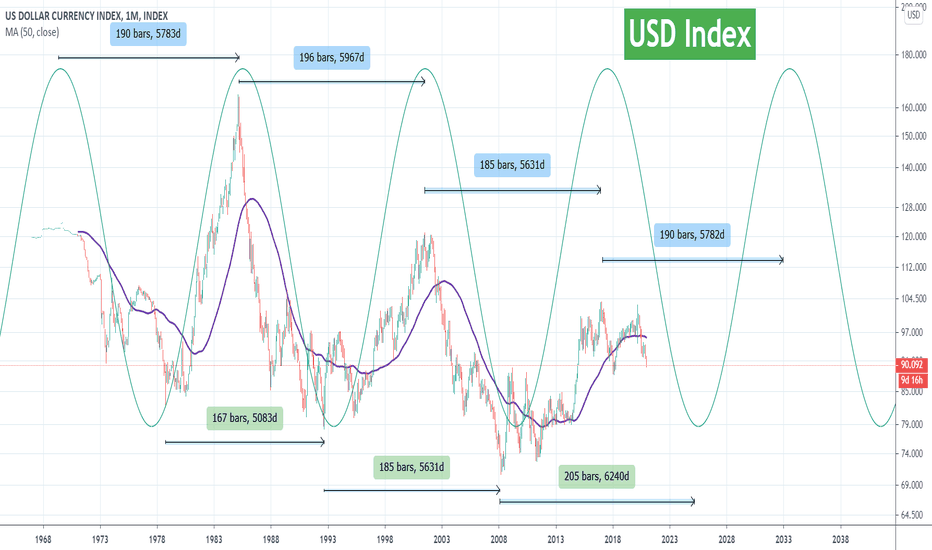

U.S. DOLLAR INDEX We haven't seen the cyclical bottom yetFollowing the stimulus news this week, there is a lot of talk around the USD and whether it will rise or fall as a result of the rescue package. I decided that it may be the perfect time to look at the (much) larger picture to see where we stand. This is a simple study on the DXY (U.S. Dollar Index) on the 1M time-frame, representing its Cycles in the span of decades.

As you see it is the perfect example of Sine Waves. There are very clear Cycle Tops and Bottoms since the 1960s. The Tops appear to be on average 190 months (almost 16 years), while the Bottoms 175 on avg so far, but based on the since waves they may follow a +20 bar sequence. As a result, while the next top for the DXY (which I have to add at this point that the sequence is Lower Highs) may be around 2032/33, the next Bottom (based on the waves) should be around 2025. That means that we are still a long way of seeing the cyclical bottom and the best course of action is to sell every rally.

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> OCDJ

--------------------------------------------------------------------------------------------------------

DXY- Correction underway?A great volatility day for USD Index yesterday and, after opening with a gap up, the index fell in the afternoon and from a technical point of view, just filled the gap.

Now it seems like we have a strong base on 90 and slightly under and I expect a correction to follow.

Pairs that I have in focus for selling are EurUsd, NzdUsd and AudUsd

DXY- Important breakAs I said before, I'm very bearish USD, and till now things worked that way.

Now, after breaking down the flag formation, we have another important break for USD index: the horizontal support and previous low.

In my opinion rallies on USD should be sold and we can soon have new local highs for EurUsd, AudUsd, GbpUsd and NzdUsd