Dxysignals

DXY - Outlook 17 October 2020 - bullish **short term**Hi all traders,

This is a video analysis for dxy.

As always, i have informed some of the levels that are important towards your trading for dxy.

Hope it helps in your trading.

***Follow me on tradingview****

****Like and share this video analysis with all your friends***

Thank you and cheers to a great day!

Has Us dollar(dxy) strength Resumed?We are currently analyzing a possible inverted head and shoulder which shows a reversal chart pattern that the previous downtrend might has ended and the the former uptrend may resume.

We expect a retracement to the neckline and a candlestick confirmation to trigger the buy order. Target is as shown on the chart and the ideal stop loss should be set below the right shoulder.

DXY- more and more bullishTwo days ago I said that Dollar Index is bullish in my opinion and the recent drop is just a correction before a new leg up.

The marked has confirmed this outlook and now the index is above short-term support.

Sell rallies on EurUsd, AudUsd, NzdUsd and GbpUsd is my strategy for next week

DXY - Outlook 8 October 2020 - Complicating USDHi all traders,

This is a video analysis for dxy.

DXY is gonna be volatile as the US election nears.

but we are also at an important levels where traders could make some pips trading it.

So take note of those levels i have explained in the chart.

hopefully you will take some trade off it and make some pips.

As always, do like and share this video analysis with all your friends.

Follow me on tradingview and leave a comment if u have any questions pertaining to this video analysis.

Cheers and thank you!

DXY (USINDEX) buying from Support Level !!!!Hello traders as we know the DXY has move toward testing a strong support on this retrace after a successful breakout from consolidations mode

bulls are doing great for moving DXY more upside so we decided we will enter on buying orders from the given support level on confirmation and

aiming for higher rewards with low risk push like if you like our idea

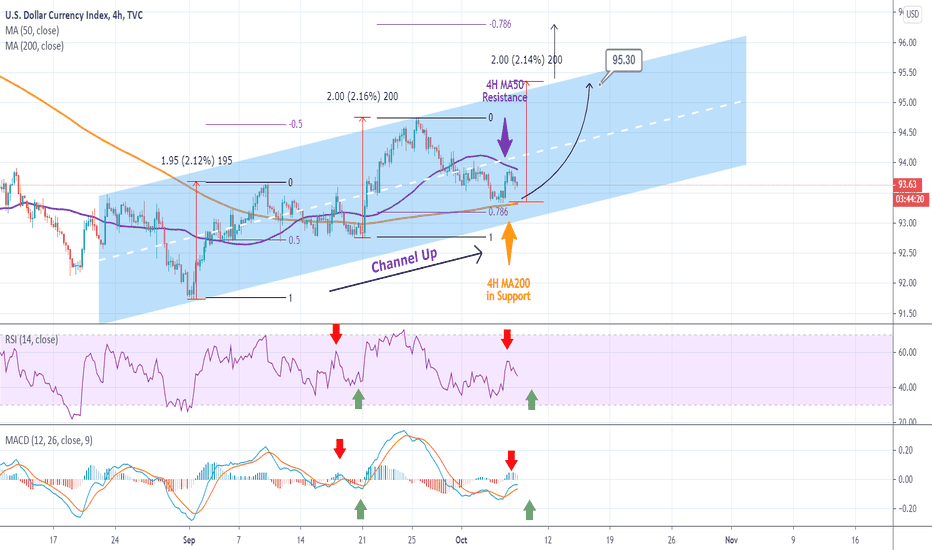

DOLLAR INDEX Stuck within the MA200 / MA50. Is this the bottom?Pattern: Channel Up on 4H.

Signal: Buy once the 4H MA50 (which is acting as Resistance) breaks.

Target: 95.30 (the Higher High trend-line of the Channel Up).

Most recent DXY signal:

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> Hunchocrypto1

--------------------------------------------------------------------------------------------------------

US DOLLAR (dxy) to fall to 92.00 region and beyondBased on my Elliot wave count, I started shorting the dollar since 94.70 price region. because it is evident that a new impulse wave as resumed towards the downside.

I am expecting more downpour ahead to a minimum of 92.00.

If you find this analysis useful kindly like and share.

Thank you

DXY to pull back based on the 1D MACD.This is a simple illustration of how the MACD on the 1D chart can give a good signal, at least on the short-term.

As you see on the chart, at least since March 2018, every time the MACD is trading towards 0 following a trend, the price makes a short-term directional change. I.e. when the price is rising and the and the MACD hits 0.00, then the price temporarily pulls back lower. Similarly when the price is falling and the MACD hits 0.00, then the price temporarily pulls back higher.

This is a very reliable indicator as it has only failed to deliver once on March 2020 (when COVID naturally invalidated all technicals).

Are you selling, at least on the short-term, based on this?

P.S. For those who recognize the analysis, this is a repost of the idea below which I published on September 24 and got deleted:

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> billstenzel

--------------------------------------------------------------------------------------------------------

DXY - Outlook 30 Sept 2020 - Bears or bulls? You decide! =)Hi all traders,

This is a video analysis on dxy.

Currently bears are making some short term waves but do take note of some levels as explain in the video for you.

Click on the video and you will be made known of these levels..

Cheers and thank you!

****Follow me on tradingview****

***Do like and share this video analysis so that they can be updated of such analysis done by me****

Have a nice day!

DXY - outlook 23 Sept 2020 - Buy biased but be wary!!!HI all traders.

This is a video analysis on dxy.

DXY is actually on the upside for now, but be wary that dxy is still a downtrend for now.

There are a few levels that i have pre-warn within the video for traders to take extra note on it.

Do take extra note on this because dxy usually will affect most of the usd pairs movement. Especially for EURUSD.

As always, hope you like this video analysis.

***Follow me on tradingview for more video analysis***

***Like and share this tradingview idea with your friends***

Thank you and cheers!

DXY is out of the ranging territory USD buyers will be happyDXY manage to break the losing streak from March to August end. From this month DXY has broke the resistance level 94.00 which is comes around .382 Fibonacci retracement level

Broke and retest was happened today This will give some conviction to buy the USD. As EURUSD and DXY tend to move in a opposite direction and today EURUSD is also makes some lower correction

DXY passed some major psychological hurdles such as 92,93,94 and next near-term target would be 95.00. After touching the 92.75 level strong bullish candle was formed. 92.75 level acted as a resistance for the bearish trend

On Elliot wave principal the wave 02 was completed and the 03 wave was underway. Before this impulse wave correction we can see the Elliot triangle waves from A to E

The swing target would be 96.40 which will act as major resistance for the bull. Buyers of the US dollar will be happy enough as DXY manage to move above the ranging territory

------------------------------------------------------------------------------------------------------------------------------------------

If you like our work give us as like and follow our profile

You will get regular updates and ideas about the market

Leave your valuable comments below

DXY Trading PlanPattern: Channel Up on 4H.

Signal: (A) Sell as it approaches the Higher High trend-line of the pattern, (B) Buy when it approaches the Higher Low trend-line.

Target: (A) 93.70 (potential -1.10% drop from the symmetrical Higher High), (B) 95.00 (just below the Higher High trend-line).

Most recent DXY signal:

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

Shout-out to TradingShot's top TradingView Coin donor this week ==> billstenzel

DOLLAR INDEX Trading plan on Fed DayPattern: Potential Channel Up on 4H.

Signal: (A) Buy as long as the Support is intact (B) Sell if the Support breaks.

Target: (A) 93.90 (right below the Resistance) (B) 91.85 (right above the Support).

*note: Tight SL needed on both ends as the volatility around and after the Fed Rate Decision will most likely be high. We want the price action to stabilize and then comfortably trade to the direction of the Fed aftermath trend.

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

Shout-out to TradingShot's top TradingView Coin donor this week ==> CITIZENCAINE

dxy - possible upside to continue Hi all traders.

Please take note for dxy.

Currently dxy has slightly broken the trend line but still trading below the 200ma.

On the h1, we are seeing dxy with structure still intact.

As such, as long as structure holds, we should be expecting the 200ma to be broken next week on h4 for more upside confirmation.

However, if h1 structure doesn't hold, we should see dxy continue going downwards.

It remains to be seen, but be prepared of how dxy gonna move next week..

Cheers!