#DYM/USDT Dymension's Falling Wedge#DYM

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.2550.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.2583, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2730.

First target: 0.2771.

Second target: 0.2832.

Third target: 0.2909.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Dymension

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.2795.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.2746, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2860.

First target: 0.2923.

Second target: 0.2976.

Third target: 0.3060.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

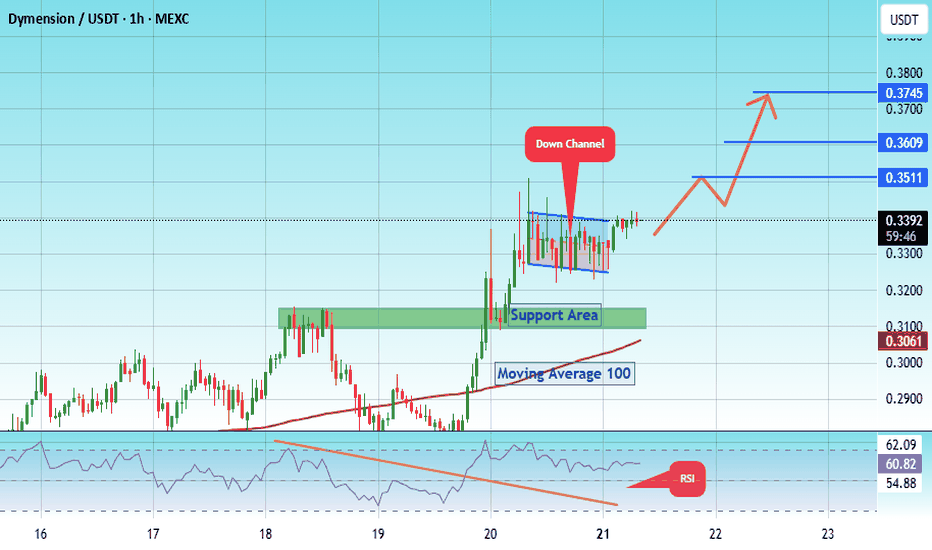

#DYM/USDT Dymension's Falling Wedge #DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.3250.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.3113, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3396

First target: 0.3511

Second target: 0.3610

Third target: 0.3745

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

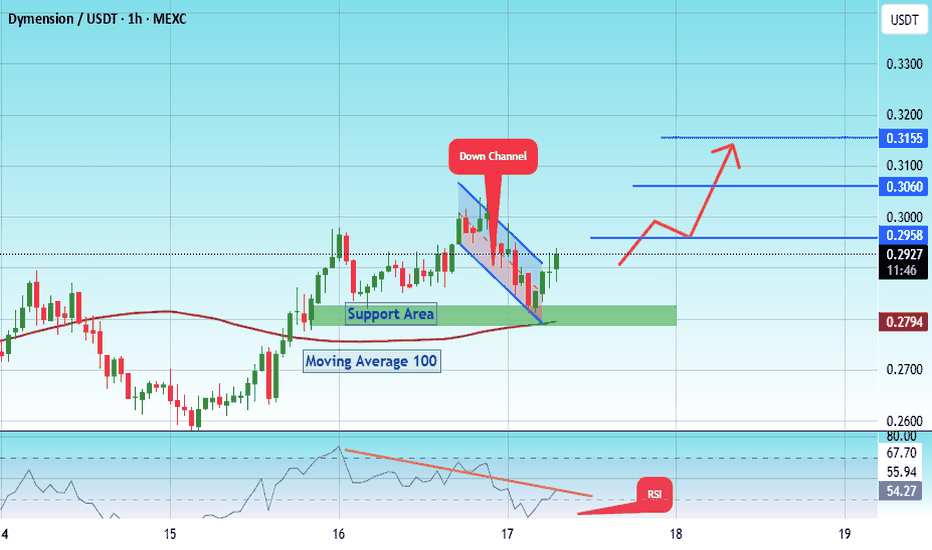

#DYM/USDT Dymension's Falling Wedge#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.2750.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.2800, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of consolidation above the 100 Moving Average.

Entry price: 0.2920

First target: 0.2958

Second target: 0.3060

Third target: 0.3155

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DYM/USDT (DYM) - A quick 20 % return#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 2730.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.2700, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 Moving Average.

Entry price: 0.2828

First target: 0.2889

Second target: 0.2954

Third target: 0.3045

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DYM/USDT DYM’s Comeback ?#DYM

The price is moving within a descending channel on the 15-minute frame and is expected to break it and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.2940, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.2847.

Entry price: 0.3060.

First target: 0.3122.

Second target: 0.3206.

Third target: 0.3317.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2729.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.3390

First target: 0.3056

Second target: 0.3210

Third target: 0.3390

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.2480.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 0.2537

First target: 0.2640

Second target: 0.2713

Third target: 0.2800

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.2232, acting as strong support from which the price can rebound.

Entry price: 0.2316

First target: 0.2384

Second target: 0.2461

Third target: 0.2532

#DYM Dymension's Falling Wedge#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 2180.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.2160, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2240

First target: 0.2296

Second target: 0.2374

Third target: 0.2462

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DYM Dymension's Falling Wedge#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.2130.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.2100, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2220

First target: 0.2276

Second target: 0.2340

Third target: 0.2427

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2020.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2059

First target: 0.2113

Second target: 0.2184

Third target: 0.2273

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.2552.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.2576

First target: 0.2642

Second target: 0.2714

Third target: 0.2808

DYM’s Comeback: Storm Over or More Clouds Ahead?After breaking down from that lovely pattern, DYM is finally showing some strength—pushing above the moving average at last! Not gonna lie, there’s still plenty of resistance on the way up, but the volume on that breakout gave me a bit of hope for a trend reversal. Now, it’s retesting the MA, and fingers crossed it flips to support. Of course, we’ve still got that big red cloud ahead before we can enjoy clear green skies. Hopefully, the worst of the storm is behind us, and we can all sit back and watch the northern lights! 🌌 Targets: $1 & $1.40. Let’s see what happens! 🚀

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.368, acting as strong support from which the price can rebound.

Entry price: 0.382

First target: 0.395

Second target: 0.413

Third target: 0.434

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.454.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.462

First target: 0.482

Second target: 0.503

Third target: 0.527

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.380.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.410

First target: 0.430

Second target: 0.445

Third target: 0.461

Dymension —Technical Analysis Works, We Can Time The MarketOnce a recovery is confirmed there is no going back. Technical analysis works, it is an amazing tool and this tool can help us time the market. It can help us know in advance where the market is headed next. Here we have a great example with this DYMUSDT chart.

Once a recovery is confirmed, there is no going back. Here the recovery is the inverted triangle pattern coupled with volume.

On 17-March, a three days session, DYMUSDT (Dymension) produced the highest volume ever. This was a strong green candle but there was a rejection.

This rejection led to a lower low and new All-Time Low. Here is the thing, there was a recovery just a few weeks later.

The last active session, 7-May, produced a full green candle after a higher low. This candle erased all the bearish action after the lower low.

The current 3D session is now full green and trades above the 17-March candle close. This is a complete recovery of the rejection from mid-March.

This recovery reveals two things: (1) The downtrend is over and (2) DYMUSDT is now green.

This chart pattern and price dynamic, reveals what will happen next. Notice that this information is nowhere written on the chart, you have to know where to look and what to look for to be able to extract this information, but the information is present to those that know how to interpret the data.

The chart doesn't predict any specific event. The candles can't be right or wrong, that part is on us. But it is clear that after such behavior by the buyers and sellers of this project their next action will be a wave of buying. This will push prices up. Technical analysis works .

What I like about this chart setup, it is so easy and so simple, yet it has huge potential for growth. With this tool, we can time the market . Being able to time the market successfully calls for a new strategy for those investing and thinking that the way to riches is allocating money into bonds and index funds.

Imagine the same investing strategy, monthly compounding, while at the same time choosing smart.

Buy when prices are low, sell when prices are high while choosing the best possible projects when they are about to blow up.

The end result can be a "Billionaire Teacher," the "Millionaire Teacher" will sound like a bad joke.

10% in the era of Crypto? Bitcoin alone outperforms these numbers already a hundred fold.

Namaste.

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 1.76.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.276

First target: 0.288

Second target: 0.303

Third target: 0.318

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.288, acting as strong support from which the price can rebound.

Entry price: 0.296

First target: 0.301

Second target: 0.311

Third target: 0.321

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.255.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.257

First target: 0.263

Second target: 0.273

Third target: 0.283

#DYM/USDT#DYM

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward trend with a break above it.

We have a support area at the upper limit of the channel at 0.330.

Entry price: 0.328

First target: 0.325

Second target: 0.317

Third target: 0.310