What happened to Amazon today?Today, after the market closed, Amazon released its Q3 earnings and revenue, as well as other financials. It outperformed earnings per share by a significant margin, so why did Amazon drop 14% in after-hours trading? Well, the answer lies in a few things which I will cover today.

1. Amazon Web Services (Includes cloud computing, a major component of Amazon's revenue) only brought in 20.5 Bil, compared to forecast of 21 BIl.

2. Due to the above reason, Amazon's revenue was lower than expectations of 127.63 Bil, only achieving 127.1 Bil, with much, much slower growth compared to the previous quarterly earnings and revenue.

3. Amazons sluggish growth in revenue can only mean one thing -- A weaking Consumer. And as the Fed hikes interest rates quickly, Amazon's revenue may go down along with inflation.

4. Guidance from Amazon shows a weak Holiday quarter (weak sales and revenue)

So, this is just an update on the latest news to keep you updated. If you want me to continue this type of posts, please comment!

Earningsnews

BAH LONG SETUP SIGNIFICANT PULL BACK AFTER REVENUES MISSED , UP UNTIL THAT WAS DISCLOSED THE STOCK WAS CLIMBING INSIDE OF A ASCENDING CHANNEL MAKING HIGHER LOWS AND HIGHER HIGHS WITH A FRESH ATH PRINTED .

CURRENTLY WE ARE SITTING AT THE BOTTOM OF THE CHANNEL AND FOR THE MEANTIME HOLDING , THE STOCK IS OVERSOLD AND PRESENTS A GREAT OPPERTUNITY TO FILL LONGS WITH A TIGHT STOP .

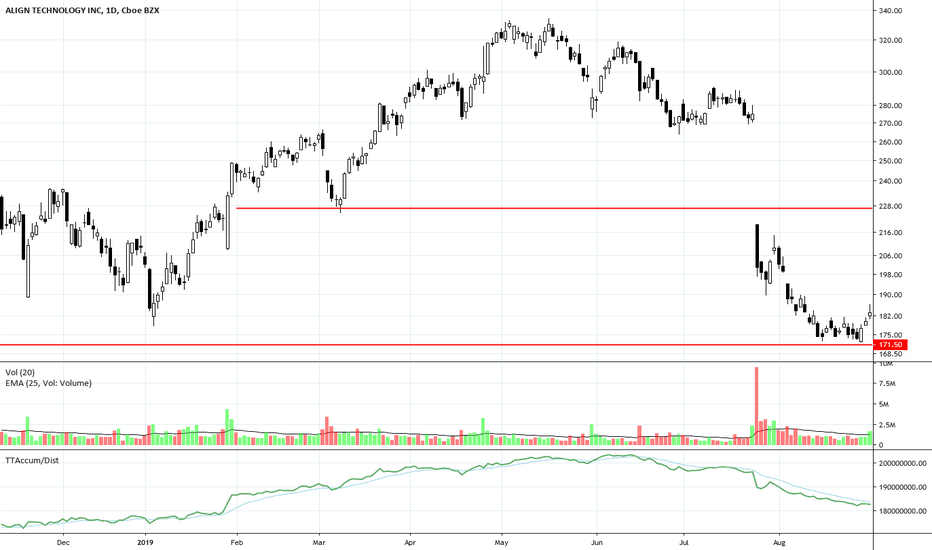

ALGN at Long-Term Support LevelALGN gapped down at the end of July on weak earnings news. It has now collapsed to a strong long-term support level. The final capitulation by Smaller Funds managers has ended. The consistency of the candlestick pattern with closely aligned lows and an early Shift of Sentiment™ pattern on the Balance of Power Indicator reveals some Dark Pool Quiet Rotation™ at this level.