Gbp/Usd Consolidation 06-May-25Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Easymarkets

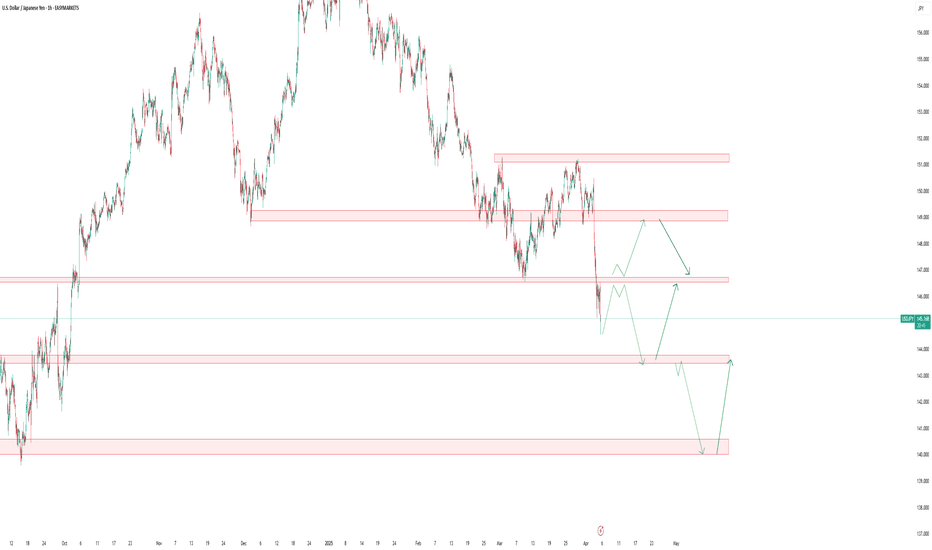

Usd/Jpy 02-May-2025 AnalysisDisclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBP/JPY Analysis 28-Apr-2025GBP/JPY Analysis 28-Apr-2025

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

S&P 500 Intra-day Analysis 25-Apr 2025The markets currently are showing some relief after China's decision to exempt certain U.S. goods from tariffs.

Potential scenarios for intra-day moves:

• Price recently touched the lower end of the range around $5,520 and then moved up. If this upward move continues, it could test the top of the range near $5,550. If that level is passed, the next area to keep an eye on might be around $5,660.

• If the price drops below $5,500, it could mean sellers are gaining strength, and the next level to watch could be around $5,360.

• If the price also goes below $5,320, then the $5,200 level might become the next important zone to monitor.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

WTI Crude 23-Apr 2025WTI showed some move up after some headlines related to sanctions imposed by the US on Iran.

Potential scenarios to monitor:

• The inability to sustain a move above the $65 level may suggest that bullish momentum remains limited, which could potentially open the door for a revisit of the previous support area near $55.

• A confirmed move and stabilization above the $65 mark may indicate scope for a continued recovery toward the $72 area.

• Around the $72 level, price action may face a decision point — a lack of further upward momentum could see a pullback toward $65, while sustained buying interest might support a move toward the $80 area.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Eur/Usd 16-Apr 2025EUR/USD remains supported, largely due to continued USD softness, with the Dollar Index (DXY) currently holding below the 100 mark.

Potential scenarios to monitor include:

• A move towards the 1.148 area, where a pause or pullback could lead to a return toward the 1.12 region.

• A confirmed break and retest of the 1.15 level may suggest increased momentum toward the 1.165 area.

• A sustained move below 1.12 could open the way toward 1.114, where renewed interest may begin to emerge.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Silver Market Analysis 14-Apr-2025 (15m & 1Hr timeframe)Possible scenarios that could takes place on Silver

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gbp/Usd 11-Apr 2025The GBP/USD currency pair has recently shown signs of strength, trading above the 1.30 level. This movement appears to be influenced by a weaker US dollar, which may be attributed to ongoing trade tensions and lower-than-expected US inflation data released yesterday. Additionally, UK GDP figures came in above market forecasts, potentially supporting the pound.

Looking ahead, upcoming US data releases—including PPI, Consumer Sentiment, and Inflation Expectations—may introduce market volatility and impact USD-related pairs.

Possible Price Scenarios (Not Financial Advice):

• If the price revisits the 1.30 level and shows signs of support, this may indicate reduced selling pressure, with a potential move toward the 1.32 level if buying interest returns.

• A move above 1.325—possibly supported by lower-than-expected PPI data—could open the door for a continuation toward the 1.343 region.

• Conversely, if the price breaks below the 1.30 level, the 1.277 area may serve as the next level of interest, where buying activity could potentially emerge.

• Should bearish momentum continue past 1.272, the 1.25 level might become the next key area to monitor for possible price reactions.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Eur/Usd Analysis 10-Apr 2025The euro continues to show relative stability, with some market participants attributing this to broader trends such as capital flows away from the US dollar amidst ongoing trade tensions and economic uncertainty surrounding the US.

In terms of price action and general market sentiment, a few technical levels are currently drawing interest:

• The pair remains above the 1.09 level, and some observers are monitoring whether it might approach the 1.11 area again. Should momentum continue to build, the 1.12 zone—where past reactions and selling interest were noted—could come into focus.

• A move below the 1.09 level on an intraday hourly or 4-hour timeframe may be interpreted by some traders as a sign of increasing selling pressure, potentially bringing the 1.075 level into consideration.

• If the price were to extend below 1.075, attention could shift toward the 1.06 level as a possible area of interest.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD/JPY Market Update – 04 April 2025The USD/JPY pair has been trending lower, reflecting recent weakness in the US dollar and renewed strength in the Japanese yen, which is often viewed as a safe-haven asset in times of uncertainty.

In addition, markets appear to be pricing in potential policy divergence between the Bank of Japan (BOJ) and the US Federal Reserve, contributing to recent moves.

It’s worth noting that upcoming US employment data may have a significant impact on this pair, potentially increasing market volatility.

From a technical standpoint, several scenarios may unfold:

• The pair could approach the 146.5 area, where signs of resistance have previously emerged. If bearish momentum continues, it may revisit the 143.5 region. A break below this level could see the pair testing the psychological 140 mark – a zone that, historically, has attracted buyer interest.

• Alternatively, if the price moves above the 143.7 level and establishes support, it could indicate a shift in short-term sentiment. In such a case, a potential move towards the 150 level may be observed, particularly if supported by stronger-than-expected US employment figures.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Eur/Usd 4H Market Update – 03 Apr 2025Following recent tariff-related developments in the US, broad dollar softness contributed to EUR/USD moving above the 1.095 level — a zone that had held since November 2024.

From a technical perspective, a few scenarios may unfold depending on broader market sentiment and price action:

• The pair may approach the 1.12 region, where previous price action showed signs of slowing momentum, potentially leading to a move back toward 1.10.

• If current dollar softness persists, a sustained break above 1.12 could open the path toward the 1.145 area.

• Alternatively, the pair could revisit the 1.09 region, which has acted as a significant level in the past, before any renewed upward movement occurs.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Brent Analysis 02-Apr-2025Possible scenarios on Brent amid the ongoing supply worries and sanctions.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold Hits New Highs Amid Rising Uncertainty – 31 March 2025 MarkGold Market Overview – 31 March 2025

Gold ended last week at historic levels, closing near $3,085 per ounce, amid rising economic uncertainty and renewed tariff-related rhetoric from the U.S. President, particularly concerning the automotive sector.

During late trading hours yesterday, fresh developments regarding trade tensions—along with references to potential geopolitical escalation—were noted. These factors appeared to contribute to a gap-up opening for gold, which reached a new all-time high of $3,125 per ounce.

While future price movements remain uncertain, market participants may monitor the following levels:

* The $3,125 high could serve as a key reference point; any revisit to this level may draw attention to the $3,150 area.

* A moderation in momentum near $3,125 might result in a revisit to the $3,112 level.

* Should prices fall below $3,110 , the $3,100 area—commonly observed as a psychological benchmark—may become relevant.

* A continuation below $3,100 might bring the previous high of $3,085 back into focus.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Oil Market Update – 28 March 2025Oil Market Update – 28 March 2025

Oil prices continue to move within a volatile range, influenced by competing fundamental factors. On one hand, geopolitical developments — such as potential sanctions on oil-producing nations and newly announced U.S. tariffs on Venezuelan oil — have contributed to recent upward pressure. On the other hand, market participants remain cautious due to broader macroeconomic uncertainties.

Key Levels Observed by Market Participants:

• The $71.50 level has previously acted as a point of interest; some analysts are watching to see how price behaves around this area.

• In the event of downward movement, the $66.00–$66.50 range has historically attracted attention during past price consolidations.

• Should the price establish itself above $72.00 with supportive developments, attention may turn toward the $75.00 region, which has been highlighted in prior analyses.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bitcoin Market Update – 26 March 2025Bitcoin Market Update – 26 March 2025

After reaching an all-time high near $110,000 earlier in 2025, Bitcoin experienced a notable correction and is currently trading around the $88,000 level.

Key Technical Observations:

• The area near $91,300 may act as short-term resistance. If price action struggles to maintain momentum there, we may observe a retest of lower zones such as $80,000 or $78,000. A sustained move below $78,000 could bring the $72,000 demand region into focus.

• On the upside, a decisive 4-hour or 1-hour candle close above $93,000 could indicate strengthening bullish sentiment. Should that occur with supporting volume and positive market conditions, the $100,000 area may come back into view, followed by the previous high near $110,000 as a potential reference point.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold Consolidation or Secondary phase?Gold currently trading in consolidation phase, waiting for the next fundamental catalyst to make its move. This week we have the important GDP and PCE numbers which could be it.

Keeping in mind, we are approaching End of month and Quarter, and it's very common to see profit taking move and rebalance of flows.

Why is Gold hitting record highs while Silver lags behind?Silver 21-Mar-2025:

Many investors are wondering why Gold continues to reach new highs, while Silver remains below its 2011 all-time high of around $49.50.

It’s important to understand that Silver is not perceived as a safe-haven asset to the same extent as Gold. During times of uncertainty, capital tends to flow more aggressively into Gold as a hedge. While Silver may benefit from this momentum, its heavy use in industrial production makes a sharp rally less favorable for manufacturers—much like we see in oil markets.

As of now, Silver is trading around $33.

From a technical perspective, some traders are observing the following levels:

* A potential short-term move above $35 may open the way for a retest of the $37 area.

* Support was previously seen near $32.5.

* A sustained move below $32.5 might lead to a deeper correction, possibly toward the $30.8 support zone.

* If the $30 psychological level fails to hold, further downside toward $29 cannot be ruled out.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

S&P 500 Market Update – 20 March 2025Following a notable sell-off in US indices, the S&P 500 recently tested levels around 5500, marking its lowest point since September 2024.

Key Levels in Focus:

* Recent market activity has seen 5650 as an important level for traders.

* 5500 has previously been an area of increased investor interest.

* The 5680 level has played a role in past price movements, with some market participants monitoring its potential significance.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/USD on the Move: What’s Driving the Action?Eur/Usd 18-Mar-2025 :

Starting the year, Eur/Usd was expected to reach the parity point of 1/1. This was mainly supported by the US election results and tariffs policy which were expected to give strength to the US dollar against other currency pairs, in addition to the rate-cut expectations of the ECB.

The lowest point for Eur/Usd for this yes was in mid-Jan where it reached slightly lower than 1.02.

Currently with the depreciation of Usd due to the fear of recession, and the push in Eur supported by the German Fiscal policy which is expected to spend 500 billion on infra-structure and defense. Euro pair is trading at 1.09.

The below possible scenarios could take place:

• Breaking and retest above 1.095 could be the trigger to test the higher time-frame demand area at 1.12

• Breaking below 1.0925 could see a deeper pull-back to 1.08

• Breaking below 1.075 could lead to price retesting 1.063

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold at a Crossroads: Can It Hold Above $3,000 or Pull Back?Gold Update – 17 March 2025

Gold recently reached new all-time highs around $3,000 last week, encountering a reaction at this psychological level. Today, the latest Retail Sales data was released, coming in below expectations.

Potential market movements:

• Gold may revisit the previous high of $3,004.

• A move below $2,980 could lead to a test of the $2,955 area.

• A deeper retracement could bring prices toward the $2,930 level.

For Gold to sustain movement above $3,004, market participants may look for a series of confirmed intraday closes above this level.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold’s Record Run: Is 3000 the Next Battleground?Gold 14-Mar-2025:

During this week, Gold moved above the first consolidation area at 2930 following the CPI data release. The next day, price also surpassed previous highs at 2955, reaching a new record at 2993, amid lower inflation data (both CPI & PPI) and ongoing trade-war uncertainties.

As for potential scenarios:

• Gold may trade lower to retest the 2955 level, depending on market sentiment and liquidity.

• It is important to monitor the psychological 3000 level, as price action could experience increased volatility around this area.

• Price action could also see a deeper pullback to 2940 before potential buyers step in at better prices, though this remains subject to broader market conditions.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

ASX Extremely Oversold Friday Afternoon Short SqueezeLooking for sellers to take profit and bargain hunters to squeeze this heavily sold Australia stock index into the close Friday or for Pop higher Morning if US stocks can Bounce.

In large sell offs Friday are profit taking days for sellers and this naturally causing some buying as they close short positions and in the fallout there are some stocks that are bought on dips that help the whole index rally.

Some good news would help but technically its sets up some excellent 3-1 and 5-1 risk rewards.

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

“Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based o n a recommendation, forecast or any information supplied by any third-party."