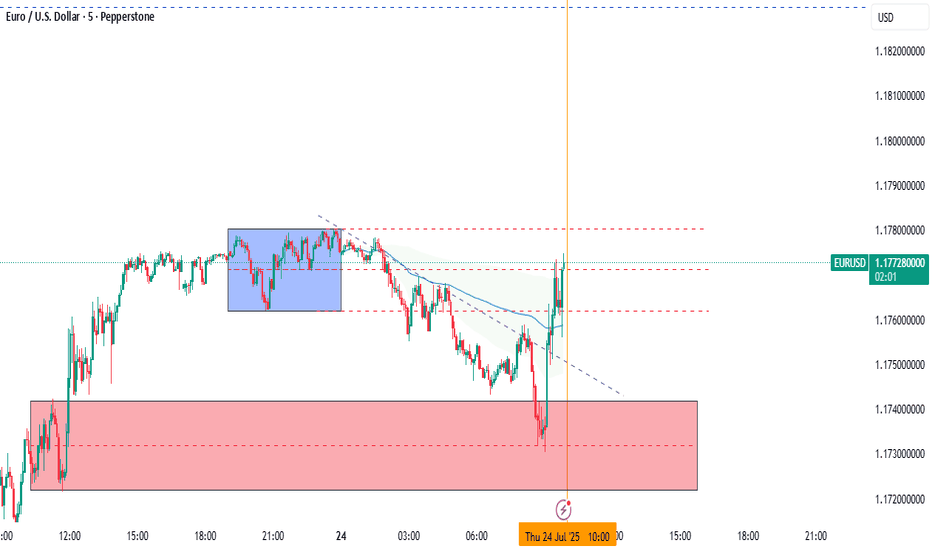

EURUSD LIVE TRADE 65PIPS 5K PROFITEUR/USD stays defensive below 1.1800 ahead of ECB decision

EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

Ecbnews

ECB Interest Rate Decision: What to Expect and How Could React📊 ECB Interest Rate Decision: What to Expect and How EURUSD Could React

This week’s spotlight is on the European Central Bank (ECB) Interest Rate Decision — a key market driver that could shape the near-term direction of the euro and broader European markets. Here's what to expect. 👇

🔔 Key Event to Watch

📅 ECB Interest Rate Decision

🕐 Date: July 24

⏰ Time: 12:15 p.m. UTC

📉 Forecast: Hold at 2.15%

📌 Economic Context

The European Central Bank is expected to hold interest rates steady on Thursday, likely marking the end of its current easing cycle after eight consecutive cuts that brought borrowing costs to their lowest levels since November 2022.

🔒 Main refinancing rate: 2.15%

💰 Deposit facility rate: 2.00%

Policymakers are likely to adopt a wait-and-see approach as they monitor the impact of persistent trade uncertaintyand potential U.S. tariffs on economic growth and inflation.

Adding to the cautious stance, inflation finally reached the ECB’s 2% target in June, and is now forecast to dip belowthat level later this year. This drop is expected to be sustained over the next 18 months, driven by:

A strong euro 💶

Falling energy prices 🛢️

Cheaper imports from China 🇨🇳

Markets are currently pricing in just one more rate cut by December, with around a 50% probability of that happening in September, before a possible tightening cycle resumes in late 2026.

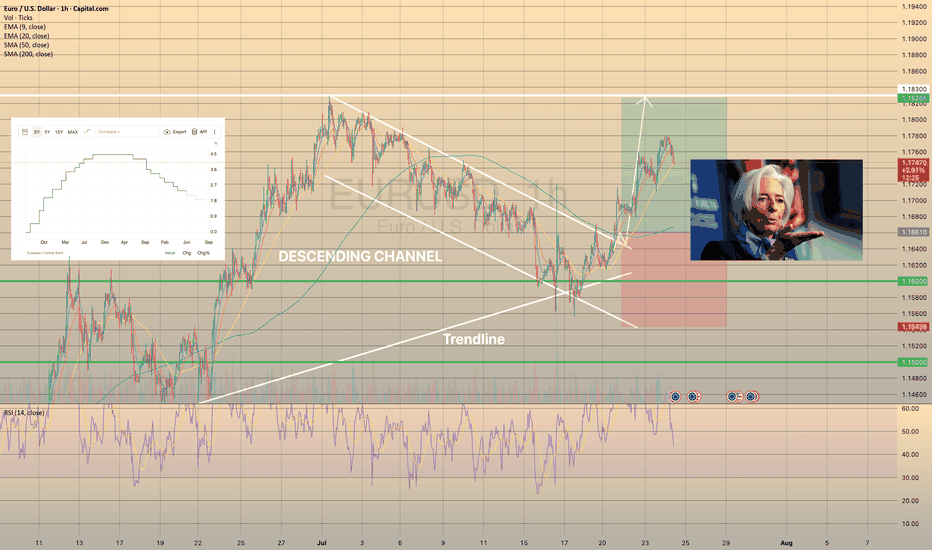

📈 EURUSD Technical Outlook

EURUSD has been trading within a descending channel since early July. However, it recently rebounded from trendline support, backed by bullish RSI divergence. The pair is approaching a breakout above the 1-hour SMA200, signaling a potential continuation of the uptrend. 🔼

A minor pullback is possible before a stronger move

Bullish momentum may continue if resistance is cleared

🎯 Target range: 1.18250 – 1.18300

🧩 Summary

The ECB is likely to keep rates unchanged at 2.15%, adopting a cautious tone amid easing inflation and global trade risks. This outcome could support the euro, particularly if U.S. rate expectations soften.

With technical indicators aligning with fundamental stability, EURUSD may be setting up for a bullish continuationin the coming sessions. 📊💶

EURUSD on the riseYesterday, EURUSD broke through the 1,1720 resistance level with strong momentum.

This confirms the uptrend and opens up opportunities for buying.

The ECB is set to announce interest rates tomorrow, which could trigger increased market volatility.

Keep an eye out for higher lows and signs of the uptrend continuing.

Stock Markets Consolidate Ahead of the HolidaysStock Markets Consolidate Ahead of the Holidays

A lull is expected on the financial markets today due to a shortened trading week related to the Easter holiday celebrations.

It is reasonable to assume that traders will get a “breather” after a news-heavy April, which caused a volatile “shakeout” in the stock markets.

US Stock Markets

On Wednesday, Federal Reserve Chair Jerome Powell was both cautious and somewhat aggressive in his forecasts regarding US monetary policy, stating that Trump’s tariffs could delay the achievement of inflation targets.

In response, US President Donald Trump accused Powell of “playing politics”, hinting at his possible dismissal.

European Stock Markets

On Thursday, the ECB cut interest rates for the seventh time in the past 12 months, and European Central Bank President Christine Lagarde left the door open for further easing.

Analysts had expected a rate cut from 2.65% to 2.40%, so the financial markets reacted relatively calmly to the ECB’s decision.

Technical Analysis of the S&P 500 Chart (US SPX 500 mini on FXOpen)

On the charts of European and US stock indices today, a narrowing triangle pattern is forming, indicating a balance between supply and demand — in other words, price is more efficiently factoring in all influencing elements.

On the S&P 500 chart (US SPX 500 mini on FXOpen), the triangle is highlighted in grey. The ADX and ATR indicators are trending downwards, which underlines signs of consolidation.

From a bearish perspective, the market is in a downtrend (marked by the red trend channel) — but from a bullish point of view, price is in the upper half of the channel.

Although the situation appears “reassuring”, the long weekend may bring a string of high-impact statements from the White House, which could disrupt the balance and lead to a breakout from the triangle.

It is not out of the question that the bulls may seize the initiative and challenge the upper boundary of the channel in an attempt to lay the groundwork for an upward trend (shown in blue lines).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

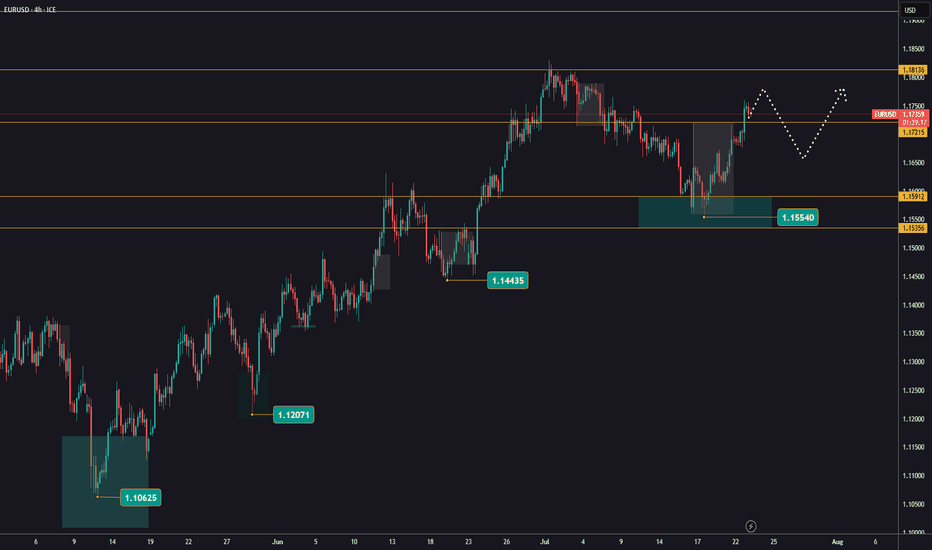

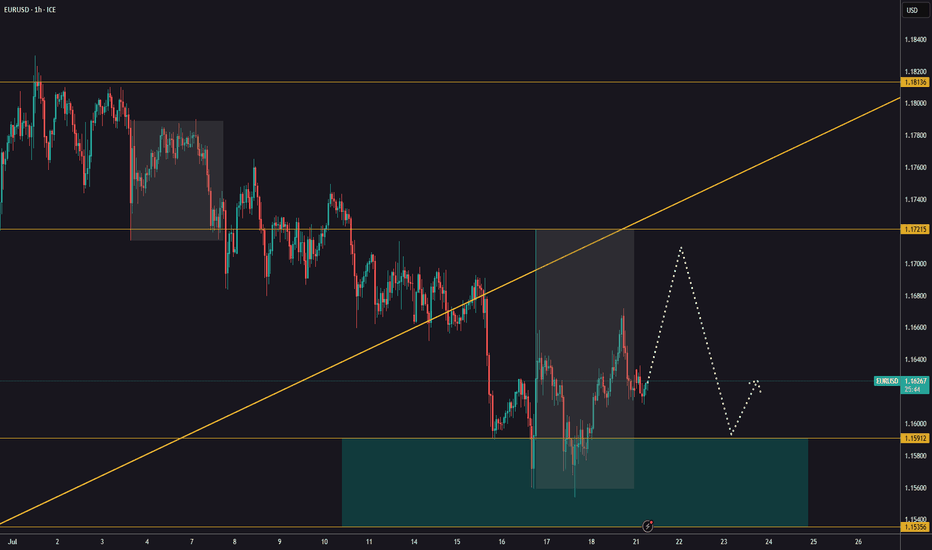

SWING TRADE SETUP ON EURUSD We had a nice move to the upside yesterday following a shift on the 1H timeframe, Hope some of you were able to catch the move to the upside.

If not there is another setup that I am looking at. This is a swing setup and if played out I expect for TP to be hit within the week.

The main thing to keep in mind is that we have interest rate decisions for both the FED and ECB.

Depending on how the numbers come out this setup will stay valid or EURUSD will break below the invalidation point and continue it's move to the down side. Good risk management is key with these news events.

ECB Rate Cut Sparks Uncertainty: Bitcoin as a Safe Haven The European Central Bank (ECB) has decided to cut interest rates by 0.25% unanimously, reflecting growing concerns about the economic health of the Eurozone. With inflation expected to slow to 1.9% by 2026 and GDP growth projected at 0.9% in 2024 and 1.6% in 2026, the ECB aims to stimulate borrowing and investment to drive economic growth. However, many investors express doubt and uncertainty about these future projections and feel a high degree of uncertainty in the markets.

Doubts about the ECB's ability to achieve these goals persist amid ongoing economic challenges and increasing global pressures. This doubt and uncertainty drive the search for more stable investment alternatives, making digital currencies, especially Bitcoin, an attractive option for investors seeking to hedge against economic and political volatility.

The ECB's interest rate cut could lead to a weaker Euro, making dollar-denominated assets like Bitcoin more attractive to investors. When interest rates drop, borrowing becomes cheaper, encouraging individuals and businesses to borrow and invest. This increases market liquidity, which can boost demand for digital assets like Bitcoin.

A weaker Euro means investors look for safe and stable alternatives to protect their money from inflation and currency depreciation. Bitcoin, which has a reputation as a safe haven and a high-performing investment despite the risks, may become a preferred choice for these investors.

Therefore, this move could lead to higher Bitcoin prices as investors seek to capitalize on changing financial conditions and invest in assets that are considered safer and more valuable in the long term.

Diversification is key to managing risk in your investment portfolio. Do not put all your investments in Bitcoin alone; diversify your portfolio across various digital and traditional assets. Diversification can help reduce overall risk and improve potential returns by leveraging the performance of different assets at different times.

Only invest what you can afford to lose due to the high volatility in the cryptocurrency market. Investing in Bitcoin or any other digital currency should be part of a comprehensive financial plan that considers the ability to bear risks and potential loss of value. With these tips, investors can take advantage of opportunities in the digital currency market while minimizing risks and achieving their financial goals in the long term.

Looking at EURGBP ahead of ECB Rate Decision TomorrowAhead of the ECB rate decision tomorrow, the futures markets see almost zero chance we get anything other than a hold at 4.50%. This falls in line with other economies including the Bank of Canada which held rates earlier today.

From a technical perspective the Daily chart is back above the wedge breakout level. I took a Long this morning from 0.87140 after a nice rejection candle close yesterday, but price moved sideways and failed to push higher. This continues the pairs lack of conviction above 0.8700 which starts to make it more and more difficult to see price making a clean break higher.

So 0.8700 is the line in the sand tomorrow, if we see buyers really step up and drive price higher I'll be looking for more Longs, but if we fall back inside 0.8700 I'll flip my bias short, specially if we fall back inside after the rates have been announced.

Best of luck out there and I'll see you tomorrow.

EURUSD The movement after the breakoutHello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

on Aug 31 I talked about the EURUSD market and how it's moving Bullish after a Breakout in the trend, Today we see that the market moved exactly like we thought it would.

EUR/USD is trading flat in a quiet start to the week with North America out for the day on holiday. The EUR/USD pair rallied higher all of last week to reach the end of July high at 1.1909. and now trending near the resistance line at 1.19010.

Possible Scenarios for the market movement for the new period of time :

Scenario 1:

The market is nearing the resistance zone between 1.1889 - 1.1892 after a great week of Bullish movement the Bulls does seem to have enough power to breakout that zone and if that happens we will be seeing the price going up near the June Resistance zone at 1.19312

Scenario 2:

when the market reaches the resistance zone between 1.1889 - 1.1892 a battle will happen between the Bears and Bulls, IF the Bears were able to gain control back over the market then the price will drop down and it will go near the first support zone 1.18172 where the Bulls will gather whatever power they may have to gain Bullish momentum and control the trend and push it back up.

Technical indicators show :

The market is above the 5 10 20 50 MA and EMA, But still below the 100 and 200 MA & EMA ( this indicates that the short-term trend for now seems Bullish but for the long-term trend of the market is still looking Bearish).

The MACD is above the 0 line showing that the market is in a Bullish state with a positive crossover between the MACD line and the Signal line.

The RSI is at 60.00 showing great strength in the market with no divergences found on the daily chart yet.

Daily Support & Resistance points :

support Resistance

1) 1.1881 1) 1.1889

2) 1.1876 2) 1.1892

3) 1.1874 3) 1.1897

Fundamental point of view :

As the market shifts its attention to the ECB meeting on Thursday, ‘buy the rumor, sell the fact’ is an apt strategy that springs to mind, according to economists at Société Générale. The EUR/USD pair should head higher towards the 1.1910 resistance on a hawkish message from the European Central Bank.

The ECB ( European Central Bank) hawks are spooked by the recent rising inflation numbers but the doves are firmly in control right now and so the policy is likely to remain loose for the time being.

However, certain members of the central banks are less dovish, including Governing Council member Francois Villeroy who said the bank should consider more favorable financing conditions in the eurozone in deciding on the pace of PEPP this week. According to Fxstreet

This is my personal opinion done with technical analysis of the market price and research online from fundamental analysts for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

Euro is bullish about the ECB news!!!This is what I say you yesterday at night that as European Central Bank meeting's today, the Euro is up today and waoh, that is a great sentiment of what investors buy and buy Euro, also we reach the 100 pips and left 40 pips to complete 140 pips, So guys, the moment to put break even is right now to protect your long position until is complete your earnings.!!!

Euro/ U.S. Dollar: Technical Analysis and ECB meeting!!!Hello traders, today Euro show a bull candlestick and we see a confirmation that Euro want to grow up, well, in H1 timeframe we see that the previously candlestick was a libelula doji and then, was the bull candlesticl of confirmation, that mean a long entry to find up pips to earn a lot. And also, we are into the confirmation of pull back in the bullish rising wedge.

And in H4 the structure is contiue bullish!!!

Well, my price entry was $1.1808 USD and my SL at 18 pips and the take profit is 140 pips, the risk/benefit relationship is near of 8, that mean what we get earning as Euro touch the objective that I find out.

Also, guys I reccomend when the market is volatil and touch the SL in the specualte news. As second option is to keep another second entry more below of the entry price when they say institutional's news, that order may be activated from long and then, that is in case the Euro is moving so volatil up and down so exagerated.

Now, basically, we believe that Euro is strongest and investor are keep in the European economy, if the thing is ok, the Euro it's could be to exploded to find out more higher's level.

Fundamentals Analysis taking in noticed it:

1. Lagarde has Euro-Fighting options from Rhetoric to rate cuts.

2. Euro turns positive, but expectations for dovish Europea Central Banks keeps traders on edge.

3. European Central Bank to take aim at strong Euro with hints of more stimulus.

So, in summary economist see the Euro as the single-currency as safe-haven assets, well as tjhe Euro is strong, I put in long!!!

Christine Lagarde just gave us a very good trade !!!Hello Traders !!! Hope you are doing well

I am listening live to the ECB press conference and one piece of information that traders apparently are ignoring for the moment is this direct quote from Lagarde :

" Based on the current price of oil and the future one, we believe that inflation will decrease in the future"

As we know, oil is the main driver of inflation. So if the ECB believes in the future inflation will decrease, it stands to reason also the price of oil to decrease.

other reasons for the potential down move:

* OPEC anounced that from August they will relax the production cuts. (so more oil pumped in the market)

* price action require a correction

* Melbourne shut down for 6 weeks and other big cities might follow

*the reopening in US are slowing down because of the increase in the number of cases

Let me know in the comments what you think. I would like to hear other ideas from you guys.

Let's grow together!!

_

EUR/USD has a possibility to reach at $1.15 USDHello guys and good morning. So, I have good news for EUR, because using the fundamentals as technical analysis, EUR is continue the rally bullish from May.

So, yesterday, EUR/USD is touch my SL and there, my technical analysis was good and continue bullish based in fundamentals, but in H1 timeframe, we see a bullish risign wedge and the par is slow in the European session a little at the $1.1248 USD, but no so bad, but, I recall for me as counsel that in H1 timeframe I should need to verify if H1 there are chartist pattern, because I make the technical analysis in H4 but not in H1.

So, in this technical analysis, I hope that EUR gain the US dollar in the days. So, EUR has bullish sentiment and so, it's one of the best par in the midterm of June to pick up earns. So, the EUR is continue upper.

Now, I hope that EUR is down the price a little and using the price action in H1 timeframe to entry in a short and following the trend to until to complete the elliot wave #5. There are 2 entry in long, in the 0.382% or 0.618% of Fibonacci, so for the next hours, we need to hope these levels to entry in longs.

So, I have a fundamentals that there are a deflation fears if ECB mean stimulus battles ahead for president Lagarte soon in the next meetings. So, this is very interesting because EUR/USD it's may be a bull run

EUR/GBP has same news of EUR/USDWell, in the morning, we see an another par what can up the next hours. So, in H4 basically we are in the Shoulder Head Shoulder bearish, but in H4 we see that institutinals going to up the price over 70 pips if the news of ECB can be a strong impact in the Eurozone.

This ia a scenario, so, if the institutionals make a drop a littel the price, it's can be a double bottom in H4 timefra,e but the more curious is in H1 timeframe, because I find up a chartist pattern bullish, this is here below in this technical analysis so I am concentraded here. And indicators in H1 are bullish and good health is EUR agains GBP is up.

So, guys, the only is we need to have confirmations specially of price action if EUR/USD it's want to up the price and we need to valid this shoulder head shoulder inverted, if it's inverted, so the target profit is $0.8957, so it's mean 70 pips, or included over of

+70 pips, and we can to see a retest on the resistance line and so, its a experiments in case if EUR/GBP is have a little force to continue and reach over +70 pips, so se can to pick up between 70-95 pips.

EURGBP short to .087431 135 PIP move! EG has been dipping lower since Friday afternoon EURO selloff into the weekend.

With more pressure upcoming from ECB and with final unemployment rate + GDP news for EURO tomorrow we could swing into this lower low.

Potential h & s on 4HR TF 1 confirmation

EXY and BXY both in bullish trends is a nullifier.

will need USD bulls to help out with this drop as well...

We are currently testing above the Support zone and 88750 has been tapped and bounced off so will tread lightly for another retest and break.

EUR Will hit 1.11500 ECB Meeting Tomorrow. But What's Next?EURUSD will make at least a 50% retracement at some point tomorrow 3/12/20. The ECB is expected to cut interest rates by .10% and possibly mention more stimulus. Look for EUR to tag 1.11500. The question is what will happen next? Price could bounce right back up in the descending channel and possibly break up past the channel and make another attempt at 1.15? or Will price head for the 61.8% retracement at 1.10500? Time will tell. The target for the short is 1.11500 (100+ pips).

I am not a financial advisor. This is not financial advice. This is for educational purposes only.

ridethepig | ECB Macro FlowsHere we go...Markets are not expecting a lot from the ECB fundamental front , rates will remain on hold with more focus on the hard macro data tomorrow. The only thing to 🔎today is for clues around duration of policy review.

On the technical side , jurisdictions are defined clearly on both sides as EUR is comfortably holding the 1.108/9x support. The initial targets are located at 1.125x resistance while stops can be kept comfortably below 1.103x. My feeling is that macro players betting on the topside are itching to get going as the board is setup in favour of EUR. Happy to hold longs for now.

In the Long-Term chart (see diagram below) buyers have broken out of the resistance channel; amongst other effects, this reduced the sellers in EURUSD to become a prisoner in their own camp. The main function of the breakout appears to be as a competent bi-product in the USD devaluation / 2020 reflationary theme.

The technicals for the long term are striving to reach 1.21xx and beyond. But the concept of "attacker" goes much further. You can also defend areas (for example the 1.108/9x today in ECB) or defend yourself against a breakout:

Buyers are securing a wide stretch of the swing territory. This could be considered as gaining momentum with green shoots appearing in Europe already. This means that macro recovery will be used as weapon of force:

Good luck all those in EURUSD, and trading ECB today. We can open the short-term flows if there is enough interest in the comments.. as usual thanks for keeping the support coming with likes, comments and etc!

EURUSD Bear signal down to 1.09, 20+Month bear channelEURUSD has been in a strong bear channel, nearly 2 years straight. A lot of its due to the ECB monetary policy that has an extremely dovish tone, which puts downside pressure on the Euro. On a technical basis on the weekly chart we got a really strong reversal at the top of the channel at 1.117 and a recent broken low that was tested and held really well by the bears at 1.109 with a long wicked candle that closed the week bearish and identified a higher probability short down to a new low.

The target to the downside is the GAP start from April 2017 at 1.073.

Disclaimer: This is not trading or investment advice, this is analysis used for educational purposes only.

Place buy under 1.11Markets pricing in dovish ECB due to poor economic data, so unless we see a real rate cut price should hold and get some relief rally towards 10 ema on daily chart likely around 1.11800-1.12000

I am looking for a spike down below 1.11 to place long entry, as the risk would minimize significantly if i can enter long at new lows of the year

EURGBP - Long on Hawkish DraghiWe have a lot of EUR news due out tomorrow together with a speech from Mario Draghi, the President of the European Central Bank.

His comments alone will move the market and we are hoping for an alignment with the PMI data due out later on in the morning. This will give us a great trading opportunity on the EUR throughout the rest of the week.

We are planning a long trade on the EURGBP should we see and hear hawkish sentiment from Draghi. The Euro has been the stronger of the two currencies over the past week, and over the past month, and is currently sitting at resistance. We would prefer to see this pair fall into a level of support before the news, giving us a better entry. We would also look to take a long on a breakout condition with a small position, adding to it as the bullish move is confirmed.