Economic Cycles

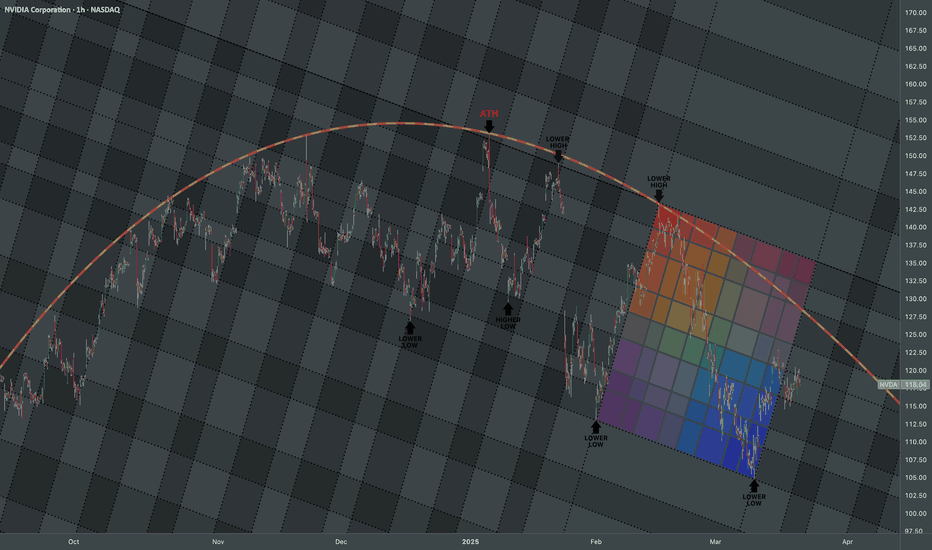

NVIDIA Rounding Top: Bearish Swings Q1 2025TA

Nvidia demonstrated strong growth throughout 2024. However, this year, it has shown rather a poor performance. When an uptrend started to weaken, it gave off subtle signals before a full reversal happened on the horizon. One of the first clues is that the highs collectively begin to appear curved compared with initial rough growth. This reflects the loss of aggressive bullish intent, showing hesitation and vulnerability to a reversal.

The price still makes higher highs, but the incremental gain between each peak shrinks. This declining magnitude in price advancement suggests that buyers are gradually losing strength with each move. These shallow bullish waves often get sold into quickly, showing early distribution behavior.

Simultaneously, it takes longer time for price to reach each successive high . When higher highs occur at reduced frequency, the rally phases become stretched out. This indicates buyers are struggling, and sellers are gaining time-based control.

Extended Rounding Top Pattern

Price crosses above the rounding top

Indicates a failed reversal and potential bullish breakout. Suggests renewed buying strength and possible trend continuation. I'd recommend using confirmation tools like volume spikes and momentum indicators which are essential to validate the breakout.

Price reaches the rounding top and stalls or reverses

Confirms the bearish reversal signal of the pattern. Acts as a strong resistance zone, often leading to a downtrend. Alongside with fibs, it can be used as a cue to take profits, exit long trades, or enter short positions.

FUNDAMENTALS

Catalysts of Bearish Swings

A transition phase characterized by a series of sharp bearish swings, marked by a sequence of Lower Highs and Lower Lows, shaping a well-defined downward channel.

Drop #1: ATH → Higher Low

(Early January 2025)

After Nvidia’s euphoric 2024 AI hype rally, it was a matter of time as some institutional Investors locked in profits, causing initial drop.

Valuation metrics (P/E; P/S) reached extremes creating grounds for a correction.

The Fed’s January meeting hinted at fewer rate cuts than the market expected. Rising Treasury yields pressured tech stocks.

The U.S. government has imposed strict export controls on advanced semiconductors, AI chips and related technology to China.

Drop #2: Lower High → Lower Low

(Late January to February 2025)

While Nvidia beat Q4 earnings expectations, its forward guidance disappointed. Management cited softening data center orders and consumer GPU inventory corrections.

Concerns about potential erosion in gross margins due to increasing costs and competitive pricing pressure from AMD and Intel.

AI infrastructure spending was plateauing faster than expected, leading to re-ratings across the sector.

Drop #3: Second Lower High → Second Lower Low

(Mid to Late February through Early March 2025)

Several investment banks downgraded semiconductor stocks, including Nvidia, amid fears of a cyclical slowdown and oversupply risks in H2 2025.

In early March, broader indices dropped due to hot inflation prints in February. Fed’s stance during testimony to Congress indicated a higher interest rate outlook.

Reports emerged about delays in next-gen chip production due to yield issues at TSMC and logistics constraints, fueling investor anxiety.

Renewed export control tightening and U.S.-China friction were again cited as major concerns earlier this year. These concerns were part of the bearish narrative during Nvidia’s downward structure, especially during Drop #1 and Drop #2 where investors began pricing in geopolitical and regulatory headwinds.

Events & Economic catalysts to monitor (before buying heavy):

Nvidia Earnings Q1 2025 Mid to Late May 2025

Why it matters: Forward guidance, Data Center/AI segment growth, margin updates, and China sales commentary will heavily impact sentiment and trend direction.

U.S. CPI (Inflation) Reports April 10, 2025 (March CPI)

Remember: Hot inflation = higher rate expectations → tech sector sell-off. Watch for YoY core CPI trends.

U.S. Jobs Report (NFP) April 4, 2025

Keep in mind: Strong labor = sticky inflation = Fed hawkishness → higher discount rates on growth stocks.

Semiconductor Industry Conferences

・NVIDIA GTC (GPU Technology Conference) – usually held Spring or Fall

・Semicon West 2025 – typically July

Track the progress: Product launches, AI roadmaps, new partnerships, and forward tech strategy updates often revealed.

What factors could drive Bitcoin(BTC/USD) to reach the $68KGiven the current market conditions, Bitcoin has not managed to establish a new high in its recent upward movement. Various factors, including uncertainty regarding upcoming economic changes, reduced liquidity, the focus of financial institutions on the decline of stock markets, and the market's inability to react to sudden shifts, have contributed to the lack of a clear directional trend.

However, based on the presented analysis and chart review, it is anticipated that Bitcoin will reach the level of $68,000 in the coming weeks, paving the way for the initiation of a strong bullish trend. This upward movement is expected to first drive Bitcoin's price to approximately $130,000, and after a brief correction, the upward momentum may continue, potentially pushing the price to levels as high as $179,000.

GLD/SPX as a risk-off signal for BTC/SPXFor all the "Bitcoin will follow gold" crowd...

This chart tells a very different story.

Every time we’ve seen GLD/SPX rally sharply, BTC/SPX has underperformed for months afterward.

📉 See the shaded red zones – they highlight periods when:

GLD/SPX (gold line) made strong relative moves,

BTC/SPX (aqua line) lagged or outright dropped.

We're in another one of those zones right now.

Unless you’ve got a strong reason why "this time is different," the base case is clear:

BTC/SPX likely underperforms for another 3–6 months.

If you're positioning long BTC expecting it to mimic gold's run, be aware — that hasn't played out well historically.

🧭 Trade Idea:

Patience: Don't rush the BTC long. Let the GLD/SPX spike play out.

Timeframe: Revisit BTC/SPX for potential re-entry mid-to-late 2025.

$ETH = Silver and $BTC = Gold Means WHAT!?They say Ethereum is the Silver to ₿itcoin being Gold.

If that's the case, does that mean that the ceiling for CRYPTOCAP:ETH will forever be stuck at $4,800

just like TVC:SILVER being capped at $48 for the past 45 years?

Does anyone really think ETH will be higher than $4,800 in 45 years???😆

A true store of value 💯

Bitcoin - 2025After a long consolidation around $100,000, and a correction of ~32% from the top, it seems we are preparing for a new move.

In the previous idea, I mentioned that there could be either consolidation or a healthy correction, but both happened.

I will describe several scenarios that I see.

I will describe only positive, super-positive and ultra-positive ones.

Since the negative sounds like this - we have already reached the peak, there will be a small over-high, and we will go bearish.

Positive scenario - parabolic growth, with a new peak in the region of $150,000-$200,000

Super-positive scenario - parabolic growth, with a new peak in the region of $200,000-$300,000

Ultra-positive scenario - parabolic growth, with a new peak in the region of $300,000-$400,000

Now you must ask - can we really reach $400,000, how is this possible, with the current price of $84,000, and April outside the window?

I will tell you that there is nothing complicated or incredible here, that is why it is ultra-positive.

But you should focus only on positive and negative scenarios, and not float in the clouds hoping for a miracle.

As for altcoins, in this scenario, I don't think Bitcoin dominance will last long, so high, in any case, soon there will either be an overflow and altcoins will start shooting, or we will all die from the paws of bears

HOLD YOUR BEARS, IT'S NOT OVER

Bitcoin Dominance Ascending Channel and Altseason (1W Log)CRYPTOCAP:BTC.D has been in a clean uptrend inside an ascending channel for over 2 years.

• The midline has consistently acted as a magnet, but BTC.D has recently detached from it and might be headed for another retest of the upper boundary.

• Unless major macro catalysts intervene, I expect no notable changes until the 72-73% key area, the same zone that triggered 2021's altseason.

Regarding altseason, this cycle isn't like previous ones. With millions of tokens today, dilution is real, and a full-blown altseason where everything pumps seems unlikely.

Instead, I expect selective rotation into quality projects, and that might actually make it easier to find real outperformance.

SUPER/USDT Technical Breakdown – Historical Cycle Repeating?🟢 Current Price: $0.5645

📊 Historical Moves (from chart):

🔹 Cycle 1:

🔹 Entry: ~$0.475

🔹 Peak: $1.5192

🔹 % Gain: +236.92%

🔹 Duration: 97 days

🔹 Cycle 2:

🔹 Entry: ~$0.387

🔹 Peak: $2.2603

🔹 % Gain: +361.63%

🔹 Duration: 133 days

🔹 Projected Cycle 3:

🔹 Entry: ~$0.5648

🔹 Peak: $1.6985 - $2.2667

🔹 % Gain: +267.04%

🔹 Duration: 102 days

🔹 Forecasted Move (Based on Pattern Repeat):

🔹 Projection: From current base (~$0.5031) → Target Range: $1.5332–$2.2666

🔹 Potential Max Gain: ~+386.94% (historical highest pattern)

🎯 Target Zones:

🎯 Target Price Level From $0.5645 Approx. ROI

Target 1 $0.8632 Resistance & fib zone +53%

Target 2 $1.2535 Previous rejection point +122%

Target 3 $1.5244 Historical fib resistance +170%

Final Stretch $2.2666 Last bull cycle top +301%

🟨 Suggested Entry Zone:

Between $0.50 – $0.56

Matches historical bottoms from each prior cycle

Strong support with triple bottom structure

🛑 Stop Loss Consideration:

Below $0.5031 support line

Break of structure would invalidate current cycle repeat

🧠 Strategy:

✅ Accumulate slowly within support range

🧾 Set sell targets at fib zones or previous tops

🔍 Monitor for breakout volume or EMA crossovers

Disclaimer...a portion of this was generated using AI to help me clearly get my idea across.

[ TimeLine ] Gold 4 April 2025Hello everyone,

📅 Today is Wednesday, April 2, 2025.

I will be using the high and low price levels formed on the following dates as key entry points for my trades:

📌 April 4, 2025 (Friday), or

📌 April 4 & April 7, 2025 (Friday & Monday).

Trading Plan:

✅ Wait for the price range from these candles to form (indicated by the green lines).

✅ Trade entry will be triggered if the price breaks out of this range , with a 60-pip buffer .

✅ If the price moves against the initial position and hits the stop loss (SL) , we will cut/switch the trade and double the position size to recover losses.

📉📈 Below is the chart with the estimated Hi-Lo range of April 4 & 7, 2025.

You can copy the unique code and add it to the TradingView URL .

🔗 TV/x/ikMJV8NH/

Bitcoin Cyclical Pattern Analysis: 2017 vs 2025-2026The charts provide compelling evidence of fractal patterns between Bitcoin's 2017 bull run and the current 2025 cycle, revealing both striking similarities and meaningful differences in market behavior.

Key Similarities

Both periods display remarkably similar structural patterns with consistent sequence of movements:

Initial pulldowns (~34% in 2017 vs ~33% in 2025)

Series of uptrends followed by corrective pullbacks

Progressive upward momentum with higher highs and higher lows

Similar number of major price waves (four significant uptrends in each case)

Key Differences

Timeframe Extension: The 2025 cycle shows significantly extended durations compared to

2017

Initial pulldown: 3 weeks (2017) vs 21 weeks (2025) – 7x longer

First major uptrend: 12 weeks (2017) vs 11 weeks (2025) – similar duration

Second uptrend: 12 weeks (2017) vs 14 weeks (2025) – slightly longer

Overall cycle progression is approximately 2-3x longer

Magnitude Reduction: The 2025 cycle shows diminished percentage movements:

First major uptrend: 230% (2017) vs 120% (2025) – roughly half

Second uptrend: 172% (2017) vs 85% (2025) – roughly half

Final uptrend: 253% (2017) vs 125% (2025) – roughly half

Technical Analysis Support

This pattern correlation would likely be supported by other technical indicators:

Bollinger Bands would show:

Similar pattern of band expansion during strong directional moves

Band contraction during consolidation periods before breakouts

2025 likely exhibiting less volatility (narrower bands) but with similar repeating patterns of price touching upper bands during uptrends and lower bands during corrections

Ichimoku Cloud would demonstrate:

Similar cloud breakout patterns preceding major uptrends

Price respecting key Ichimoku components (Tenkan-sen, Kijun-sen) as support/resistance

2025 showing extended time within the cloud during longer consolidation periods

Similar bullish/bearish crossovers of the conversion and base lines, but occurring over longer timeframes

Predictive Value

This comparative lens offers valuable predictive power for several reasons:

Market Psychology Consistency: Despite Bitcoin's maturation, market psychology (fear, greed cycles) remains remarkably consistent, expressed through similar percentage retracements and fractal patterns.

Macro Context Integration: The longer durations and reduced volatility in 2025 reflect Bitcoin's increased market capitalization and institutional adoption, creating a logical evolution of the same underlying patterns.

Specific Forecasting Application: If the pattern correlation holds, we might anticipate:

The current cycle extending into mid-2026

One more major uptrend followed by a 30-40% correction

A final explosive move of approximately 125-150%

Total cycle appreciation significantly less than 2017 but still substantial

Risk Management Framework: These patterns provide clear pivot points for position sizing and risk management, with defined percentage targets and timeframes.

This analysis suggests we're witnessing an evolved expression of the same market dynamics that drove the 2017 cycle, with the extended timeframes and reduced percentage movements reflecting Bitcoin's maturation as an asset class while maintaining its fundamental cyclical character.RetryClaude can make mistakes. Please double-check responses.

BTC to the moonIs Bitcoin Just Getting Started? This Fib Zone Could Be the Ultimate Buy Signal!

Bitcoin is pulling back… but smart money is watching this golden zone.

After a strong rally, BTC is now retesting the 61.8%–78.6% Fib retracement zone—historically one of the highest-probability reversal areas in crypto. We’re not just guessing here… the chart is showing structure, confluence, and opportunity.

My Trade Plan (Weekly Chart)

- Entry Zone: FWB:83K – $85K

- Re-entry/DCA: $79K – $81K

- Stop Loss: $74K

- Take Profits:

- TP1: $95K

- TP2: $109K (previous high)

- TP3: $130K–$144K (extension zone)

Bullish bias unless we close below $78K on the weekly. A clean breakout above GETTEX:89K could send BTC into price discovery mode again.

Could this be the last big dip before a parabolic move? Time will tell, but this setup has everything we look for.

Agree? Disagree? Drop your thoughts below.

Follow for more swing setups & macro plays.

#BTC #Bitcoin #CryptoTrading #Fibonacci #PriceAction #SwingTrade #Bullish #CryptoAnalysis #BTCUSD #BitcoinHalving #BuyTheDip #AltseasonComing #TradingView

Ishares 20+ Treasury Bond | TLT | Long in the $90sIshares 20+ Treasury Bond NASDAQ:TLT are particularly sensitive to interest rates: the price moves up when they are lowered and down when they rise. Locally, I'm witnessing banks lower their interest rates for CDs and shorten the duration for those with high-yielding returns. The general political rhetoric, especially due to the election cycle, is a push for the Federal Reserve to drop them. Now, despite the possible negative economic implications of lowering interest rates too soon if inflation is high, there is a good probability they may be lowered (even slightly) in 2024... perhaps September?

This analysis isn't to time the bottom perfectly, though. Instead, it's a probability assessment. Personally, TLT in the low $90s is in a long-term "buy-zone".

Target #1 = $104

Target #2 = $122

Target #3 = $170+ (very long-term view / economic crash... let's hope not, though)

iShares 20 Year Treasury Bond | TLT | Long in the $80sFor the patient, one of the "safest" investments is in long-term treasury bonds (specifically NASDAQ:TLT ). For those who may not understand why, bond prices move inversely to yields. If interest rates drop (which the Federal Reserve has stated is going to happen this year), NASDAQ:TLT will rise. If interest rates rise (like what happened in early 2022), NASDAQ:TLT will fall. But all information from the Federal Reserve points to interest rate cuts starting this year *or* in the near future.

As of April 1st, 2025, the dividend yield for NASDAQ:TLT is 4.52%. That interest rate beats the vast majority of savings accounts right now. I don't think we will see NASDAQ:TLT prices in the $80's longer than a year or two. A contrarian may argue "inflation is rising!", but the data continue to point to it actually stabilizing. Yes, prices are higher compared to 4-5 years ago for just about everything... but the higher prices are "stable". Tariffs may put a slight wrinkle in this stability in the near-term, but I think the economy is already slowing and the Federal Reserve will be pressured to start dropping interest rates sooner than later.

I believe a global economic bust is inevitable - but no one knows when. Anyone who says they can time it is a charlatan. If/when a global economic bust occurs, the Federal Reserve will drop interest rates (like what happened in 2020) to get the economy juiced up again. NASDAQ:TLT will double in price or go further.

My general point is I *believe* NASDAQ:TLT is nearing a low and any future declines (especially below $80) are personal opportunities for buy-and-hold. It's a solid hedge with a good dividend. Options don't give you that and timing events is a guessing game for every retail trader. So, as someone who tries to think beyond the "now", I am gathering shares, enjoying the dividend, and not touching them until a global economic bust occurs. Currently holding positions at $85, $86, $87, and $90.

Targets:

2027: $100.00

2028: $105.00

2029: $110.00

2030: $115.00

Bust (unknown timing): $170+

Gold Xau (tf1M) Last Phase AccumulationGold Xau Last Phase Accumulation incoming 👇

"Way from 1500 to 4100" (+175%)

OANDA:XAUUSD

⏰ TimeFrame 1 Month

👉 Go to last phase accumulation

👉 White Trace

👉 Green Trace

👉 EMA 200 1M (White)

👉 Fib Measure as pattern "ExPanding Triangle" ( blue stick )

👉 Potential +175%

✔️Logarithmic (Log) Chart & Fib

Gold touches all-time high. Overbought or poised for more upsideGold ( OANDA:XAUUSD ) has soared to a new all-time high, marking the launch of its next bullish phase. This powerful uptrend began on September 26, 2022, and is unfolding as a five-wave Elliott Wave pattern, a technical framework traders use to predict market movements. The first wave (I) climbed to 2081.82, showing strong momentum. Then, a corrective wave (II) pulled back to 1810.58, setting the stage for more gains. The third wave (III) was the most explosive, rocketing to 3167.74, driven by global demand for the safe-haven metal. Wave IV followed, forming a zigzag pattern—a typical correction where prices dip before resuming the trend. This correction found its low at 2954.62 after a structured decline.

Now, gold is advancing in wave V, the final leg of this impulse. The first sub-wave, wave (1), hit 3132.59, with smaller waves within it showing steady progress. A brief wave (2) dip ended at 3103.17, and now wave (3) is pushing prices higher. As long as the key support at 2954.6 holds, pullbacks should attract buyers, particularly in 3, 7, or 11 swings—technical levels where dips often reverse. This suggests more upside ahead for gold, appealing to both traders and investors watching this historic rally.