[ TimeLine ] Gold 31 March - 1 April 2025Hello everyone,

Today is Thursday, March 27, 2025.

I will be using the high and low price levels formed on the following dates as entry points for my trades:

March 31, 2025 (Monday), or

March 31 & April 1, 2025 (Monday & Tuesday)

Trading Plan:

✅ Wait for the price range from these candles to form (indicated by the green lines).

✅ Trade entry will be triggered if the price breaks out of this range, with a 60-pip buffer.

✅ If the price moves against the initial position and hits the stop loss (SL), we will cut/switch the trade and double the position size to recover losses.

📉📈 Below is the chart with the estimated Hi-Lo range of March 31 & April 1, 2025.

You can copy the unique code and add it to the TradingView URL.

🔗 TV/x/IaLLLLcp/

Economic Cycles

DXY | Major Cycle Peak – Is the Dollar Losing Its Grip?The U.S. Dollar Index (DXY) appears to be following a well-defined historical cycle, marking major peaks approximately every 15–20 years. If history repeats, the 2022 peak near 114 could signal the beginning of a multi-year dollar decline, impacting global markets, commodities, and currency pairs like EUR/USD.

Historical Peaks & Reversals

Examining past DXY cycles, we see:

969 Peak (~120): Followed by a prolonged decline into the 1970s.

1985 Peak (~165): Marked by the Plaza Accord, triggering a sharp dollar downtrend.

2001 Peak (~120): Led to a multi-year decline as the Fed shifted policies.

2022 Peak (~114): The most recent high—could it mark the next major reversal?

Each peak historically aligns with aggressive Fed tightening cycles, followed by a shift towards easing policies, leading to a weaker dollar. With U.S. interest rates expected to plateau or decline, this pattern suggests a potential long-term bearish trend for the dollar.

Implications of a Weaker Dollar

Bullish for EUR/USD – A declining DXY typically strengthens the euro.

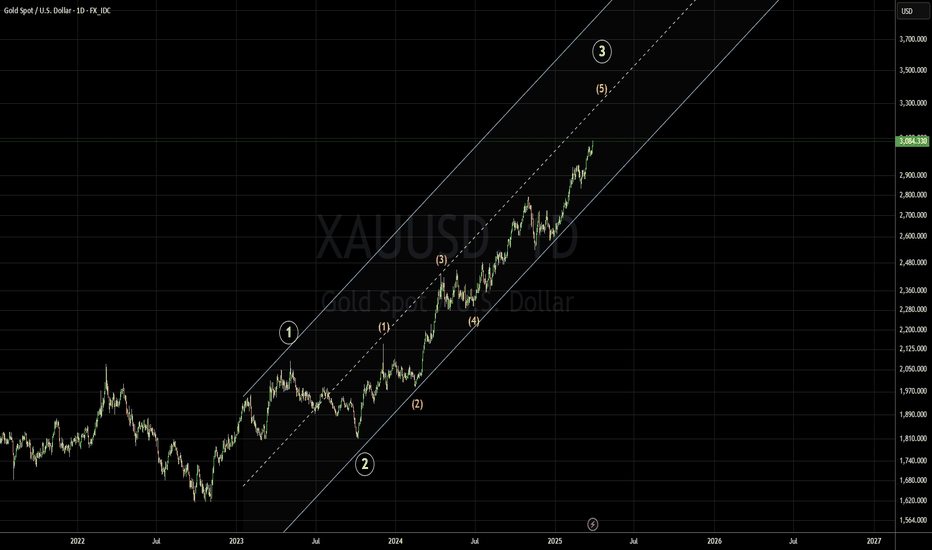

Boost for Commodities – Gold, oil, and other dollar-denominated assets could rally.

Stronger Emerging Markets – A softer dollar eases financial conditions globally.

With DXY showing signs of a historical cycle peak, investors and traders should watch for confirmation of a multi-year downtrend, potentially reshaping global markets.

Research: Interconnected Scalable ComplexitiesIntegrating another fibonacci channel into a formerly discovered interconnected structure:

Direction defined by HH's: Mar '24 & Dec '24; Mapping to LL Nov '22 Price breaking over this channel is a signal of continuation of bullrun in a bigger scale (like 2016 BR).

Interconnected Fractals in respect to Phi:

My work revolves around understanding and interconnecting scalable complexities, forming the foundation for a probabilistic framework that accurately models the underlying patterns and relationships driving price movements over time. Achieving this requires analyzing how price historically reacts to key levels and projecting this consistency for a future price coverage. This research will be used to build an indicator that automatically generates these levels in Pine Script.

Please, confirm in comment section if you would like me to do traditional subjective TA over objective Fractal Analysis. I highly appreciate your involvement!

EUR/HUF: Positioning for a Probable Bullish Trend ShiftBig Picture Context

Currencies, like any market, move in cycles driven by macroeconomic forces, capital flows, and investor psychology. The EUR/HUF exchange rate has been in an uptrend since mid-2023, reflecting a broader structural shift. The key question now is whether this trend continues or if we see a meaningful reversal.

Looking at the data, we see that price has pulled back to a critical support zone (396-402 HUF). This is where buyers previously stepped in, making it a high-probability area for renewed strength. Meanwhile, resistance levels exist at 409.5 HUF, 411.75 HUF, and 420.53 HUF, with an ultimate target near 434.45 HUF.

What the Market Is Telling Us

Liquidity & Positioning: A volume spike signals increased market activity. This is often a sign that larger players are repositioning.

Momentum & Trend: Higher lows and price support at moving averages indicate that bullish sentiment remains intact.

Sentiment & Reflexivity: If buyers step in at support, it could reinforce the uptrend, drawing in more participants and accelerating price movement.

Game Plan: Managing Risk & Reward

Entry Zone: 396-402 HUF (buy into strength if support holds).

Profit Targets:

First milestone: 409.5 HUF (short-term test of resistance).

Second milestone: 420.5 HUF (trend continuation).

Final milestone: 434.5 HUF (full breakout scenario).

Stop-Loss: Below 382 HUF, where the bullish thesis breaks down.

Principles Applied

Markets are a function of supply and demand, shaped by human behavior. We’re looking at probabilities, not certainties. The key is risk-adjusted decision-making—placing asymmetric bets where upside outweighs downside. If the support holds, the next move up is likely. If it fails, we step aside and reassess.

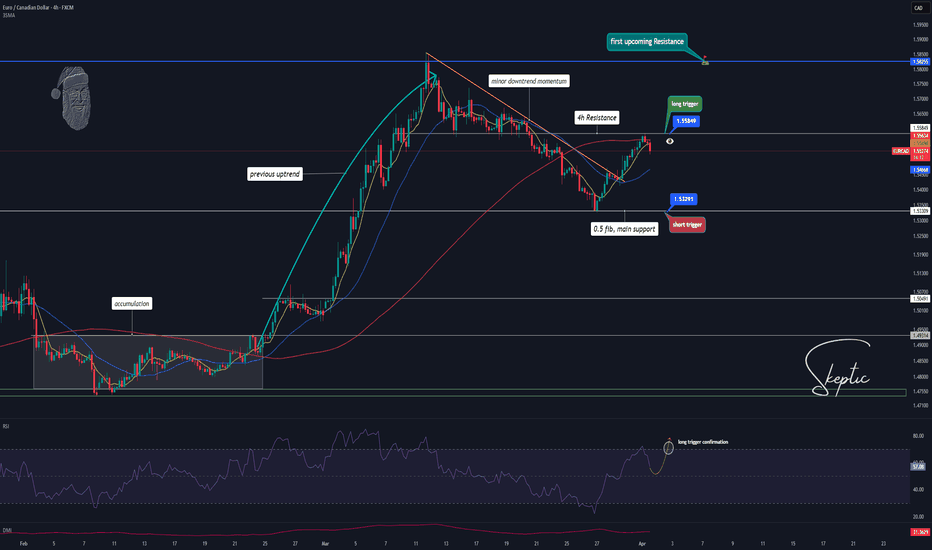

Skeptic | EUR/CAD at Crossroads: 1.55849 vs. 1.53291Welcome back, guys! 👋 I'm Skeptic.

Today, we’re diving deep into EUR/CAD, analyzing key levels and potential triggers. 🔍

Market Structure & Current Outlook

Looking at the 4H time frame , we initially saw an accumulation phase from February 3rd to February 24th. After breaking out from the accumulation range, price rallied strongly, continuing the major uptrend until 1.58552 .

Following this peak, EUR/CAD entered a corrective phase, forming a secondary downtrend that retraced to the 0.5 Fibonacci level.

Now, the minor downtrend has broken , signaling a potential continuation of the major 4H uptrend. With strong confluence for a bullish move, we’ll be looking for a long setup, but we’ll also prepare for a potential short trigger in case price reverses. Remember, as traders, we analyze the market from both perspectives and execute based on confirmations—skeptical eyes always! 🔮👽

📈 Bullish Scenario (Long Setup):

🔹 Trigger: Break & close above 1.55849

🔹 Confirmation: 7 SMA below the breakout candle

RSI entering overbought zone

🔹 Invalidation: Rejection & close back below 1.54325

📉 Bearish Scenario (Short Setup):

🔹 Trigger: Drop below 1.53291

🔹 Confirmation: RSI entering oversold zone

⚠️ Key Notes & Risk Management

🔹 Fundamentals:

This Friday is NFP day, a crucial event that could create volatility in the market.

Always consider fundamental catalysts when executing trades.

🔹 Risk Management:

Avoid overleveraging.

Wait for confirmed breaks before entering positions.

Stick to your trading plan and stop-loss strategy.

Stay sharp, and I’ll see you in the next analysis! 🚀

CHZ/BTC about to score a goal?Welcome back dearest reader,

If you have been following me you're quite aware i'm very bullish on this project. Fundamentals aside the charts look amazing. And CHZ/BTC is no exception to this!

Deeper dive:

~Trendlines --> As you can see at trendline ''1'' chz has found support going way back to 2021, you can see what happened next. The bars pattern from 2021 has been copied and shows a strong impulsive move going into june. Trendline ''2'' just shows the downtrend we've been in in relation to BTC, i don't expect this to fall below legacy support ''1''.

~MFI --> The Money Flow Index (MFI) is a technical indicator used in financial analysis to measure the strength and momentum of money flowing in and out of a security, typically on a scale from 0 to 100. It combines price and volume data to help traders identify overbought or oversold conditions, often signaling potential reversals in the market. As we can see it's massively oversold and yearning for a reversal ''3''.

~Stochastic RSI --> The Stochastic RSI (Stoch RSI) is a momentum oscillator that combines the Stochastic indicator and the Relative Strength Index (RSI) to measure the RSI's position relative to its recent high-low range. It ranges from 0 to 1 (or 0 to 100 when scaled), helping traders spot overbought or oversold conditions and potential trend shifts with greater sensitivity than the RSI alone. For CHZ also in a massive oversold condition ''4''.

Summary:

~Trend has bottomed and could provide a strong move for CHZ

~MFI and stoch RSI are massively oversold.

Note: This is the CHZ versus BTC chart, this means that even if BTC trades sideways or bottoms CHZ could do well. This would coincide with BTC.D dropping.

Any questions? Ask.

~Rustle

SAR Be the Next MEME Stock?Chart Outlook: Bullish Structure on 12M

Key Resistance: $40.50

Current Price: ~$25.20

Dividend Yield: 11.79% 😳

Speculation meets fundamentals.

SAR is not your typical meme stock candidate. It’s a high-yielding, income-generating BDC (Business Development Company) with solid fundamentals, strong net margins, and steady dividend payouts. But lately… the internet’s been talking 👀

🚀 Meme Fuel?

Viral images and tweets of Saratoga water are starting to circulate.

The name “Saratoga” is catching on thanks to the crossover between the Primo Brands hype and fitness culture.

Social sentiment is up, and chatter is growing louder in meme stock circles.

🧾 Fundamentals Still Matter:

Steady upward trend from all-time lows around $6.

Key level at $40.50 remains a major psychological and technical resistance.

Payout ratio is high (~118%), meaning dividends may be pressuring earnings—but the yield is very attractive to long-term holders.

📈 Technical Perspective:

12-month chart shows a clear uptrend off the bottom.

Accumulation appears to be happening just under resistance, forming higher lows.

A breakout above $26.50 could set the stage for a momentum move toward $30+.

🎯 Conclusion

While SAR isn’t a meme stock by definition, the perfect storm of meme potential + real fundamentals could push it into the spotlight. Volume will be key—watch for a surge in retail interest and a break above previous highs.

Will SAR go viral next? Or is this a slow climb for patient income investors? Either way… eyes on $40.50.

🧠 This is not financial advice. Just sharing what I see in the charts—do your own research before entering any position.

#SAR #DividendStocks #MemeStocks #BDC #TechnicalAnalysis #Robinhood

Is a TON Pump Coming?Is a TON Pump Coming? 🚀

TON, the blockchain developed by Telegram’s team, has gained significant attention due to its low transaction fees and strong connection with Telegram. Recent increases in liquidity and demand indicate growing investor interest in this cryptocurrency.

🔹 Technical Analysis:

TON is currently in a short-term uptrend, with $4 acting as a key resistance level. A confirmed breakout above this level could push the price towards $7. However, failure to break this resistance may lead to a price correction toward lower support levels.

🔹 Potential Risks:

A significant portion of TON tokens is held by whales, which could lead to high volatility. Additionally, its unlimited supply poses long-term inflation risks if not managed properly.

🔹 Growth Catalysts:

Recent positive news, such as Telegram’s potential partnership with AI (Grok) and the release of key updates, could drive further demand. If TON sustains its momentum and breaks key resistance levels, it may enter a stronger bullish phase.

📌 Conclusion:

While TON has strong fundamentals and market interest, its long-term stability depends on supply management and investor behavior. Entry at key levels with proper risk management is essential for those looking to trade or invest. 🚀

Us100 Upward or downward?In the 5-minute timeframe, you can sell at the top of the trading range and buy at the bottom of the trading range (by observing reversal candles and patterns).

Alternatively, you can wait for a breakout and enter in the direction of the breakout.

Be mindful of fake breakouts.

SUPERUSDT P: Analyzing the Pattern of Explosive GainsAnalyzing SUPERUSDT P's historical cycles with gains ranging from 236% to 361% over consistent time intervals. Key support and resistance zones identified for potential entries and exits:

Entry Strategy: Accumulate near strong support zones ($0.50 - $0.53) after correction phases.

Exit Strategy: Target resistance levels between $1.20 - $1.75 for potential profits based on previous price action.

Tracking volume surges and cyclical trends for optimal timing.

BTC- Weekly Analysis: Elliott Wave ProjectionThis analysis applies Elliott Wave Theory using ghost candles to project potential future price movement for BTC/USDT Perpetual on Pionex.

Wave Structure: Completed (W)-(X)-(Y) correction followed by a speculative (A)-(B)-(C) correction using ghost candles.

Key Levels: Support at $110,791.5 (trendline), Resistance at $140,454.5.

Volume Confirmation: Low volume (154.4K) confirms the projected wave is speculative.

Forecast: If price respects the trendline, the next impulse wave could reach $140,454.5. A breakdown could target $73,238.2.