EDGE

📖 STEP 3 to MASTER TRADING: WHAT’S YOUR TRADING EDGE? 📖The topic of trading edge in the market is highly underrated, in my opinion. That’s why today I propose to discuss it, and I hope it can help you to shift your perspective on this matter. So let’s think about this together. What parts does your trading edge consist of?

🟩 THE BIG FILTER

For me, the first part of any trading edge is its filter. So your trading system tells you very clearly when you should NOT be in the market. It protects your capital - both $ capital and emotional capital - from poor market conditions, and low-quality and low-probability setups. And what it actually means when you execute your edge is that most of the time, you will stay out of the market.

🟩 YOU WILL “MISS” THE MOVES

That’s really tough topic for many of us, me included because very often you’re looking to enter the zone, but the price can either turn right before tapping into it or tap and doesn’t give any confirmation for entry. And that could be very emotional. However, the fact is simple - such “missed” moves are also part of our edge. Why? Because if you tested one set up, one pattern, and you know it’s profitable the way it is, then you need to execute it the way it is. Keep in mind, when I say profitable, I don’t mean crazy profitable. Today, with access to prop firms, we need a very low % of profitability to earn for living. We can scale the $ amount relatively easily if we are profitable consistently.

So again, we don’t need every move, and we don’t need the whole move. We just need some part of some moves - and a good edge will make consistent profits out of this.

And only then, if you want, you can tweak, refine and step by step make your system even more profitable.

🟩 THE PATTERN

This part is actually your entry pattern. Notice again, this is just a part of your system, not the whole system. If you really understand this, you’ll be much more relaxed in the market. This part should include a written checklist for your entry - just like a pilot has a checklist before his flight. A checklist, in its turn - is a part of your trading plan, it’s the essence of your trading plan. You will refer to it before every trade.

🟩 MANAGEMENT, LOSERS AND BREAKEVENS

When you executed your edge in the market, now you need to manage the trade accordingly, based on your checklist. So take partials, accept breakevens and losers. If you entered into a high-quality setup, which turned into a BE or a loser - it’s the part of your system, and usually, it doesn’t make sense to overthink it and try to find flaws in your system. But that’s flexible, and of course, you can analyze what happened, and maybe even find something to tweak, but very often a loser is just a normal loser, and breakeven is just a normal breakeven.

📖To recap, any edge will include:

🔹“missed” trades

🔹trades, where price didn’t tap into your entry order just a bit

🔹trades where you were stopped out for several pips and price then went to profit (if it repeats constantly, maybe consider having a bigger stop loss)

🔹full TP

🔹partials

🔹losers

🔹breakevens

🎁If you’re still here, here’s a BONUS trading hack for you. Ask yourself and try to answer honestly this question: “During all the time I’m trading, what is the maximum amount of days in a row, when I followed my rules to the T, honestly?” You will be surprised, but the usual answer is 3-10 days. Yes, people can trade for 2-3 years, but never manage to follow their rules (whatever they have at the moment) for at least a month in a row. It all leads to catastrophe, of course.

Thank you for your time! If you want to see more educational materials, please hit the BOOST button and leave your comments below.

Dima

STEP 1 to MASTER TRADING: Hindsight trading. Train your eyes.A common mistake that traders make after learning any kind of trading setup is jumping into backtesting using a replay tool, or even live trading.

However, if you think about it, trading is very much about pattern recognition. And when you force yourself into live trading without a proper understanding of what your patterns look like, most likely you’ll need much more time to succeed.

A different approach and much more effective would be using hindsight, that’s when you see what actually happened.

During this process, try to find at least 50 high-quality setups, that represent your trading system. So you actually see everything that happened and find situations, where your edge played out, document it in your journal. That’s great training for your eyes and brain.

You don’t need to guess, you will not feel anything, because you already see what happened, you’ll notice that sometimes your edge, your system doesn’t give you entries and price goes without you, sometimes, you’ll see a loser or a breakeven after your entry, start to get used to this, as it’s all part of your system.

After that, you'll have a much better understanding and vision for your setup - and that could be the time to try some backtesting and forwardtesting.

I’ll talk more about a different kind of backtesting in future posts. Meanwhile, take care, send your questions, and comments, will be glad to chat with you.

Dima

nas100 analysis (28 june-01 july)here we go!

the reasons behind my bearish bias are as follows:

1. on monday we tested a key market level which is our current resistance level and closed bearish with bearish momentum as seen by the wick on top of the candlestick

2. market came and tested the downward trendline and closed below the trendline

3. on lower timeframes a head and shoulder pattern formed at the key market level

so there is a decent probability of market pushing down in the coming days and i'll take trades only when my edges occur

Education: Why your trading strategy win rate doesn't matter!What makes a profitable automated strategy?

Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable.

This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly by forex and stock market gurus.

By the end of this article, I hope to dispel these myths and aim to shed some truths on how to assess a profitable strategy.

Why your win rate doesn't matter:

Let's simplify this down using an example. Consider the following two strategies. Which one would you rather trade?

Strategy A: 50% win rate - When you win you make 2 dollars, but when you lose, you lose 1 dollar

Strategy B: 50% win rate - When you win you make 5 dollars, but when you lose, you lose 1 dollar

This one was a very obvious case of choosing Strategy B. In this case, both strategies have the same win rate, but Strategy B nets you 5 dollars per win, whereas Strategy A only makes you 2.

Let's take another example. A little less obvious this time. Which one would you rather trade here?

Strategy A: 90% win rate - When you win you make 1 dollar, but when you lose you lose 50 dollars

Strategy B: 10% win rate - When you win you make 200 dollars, but when you lose, you lose 1 dollar

Now the 90% win rate strategy may look attractive on the surface, but when you dig into it, you realise that you could get a massive 50 dollar loss in the 10% of times you do lose! For those of you who chose strategy B, this is the correct answer.

One way we can assess the above strategies is using Expectancy . The formula for Expectancy is as follows:

(Win % x Average Win Size) – (Loss % x Average Loss Size)

We can calculate the expectancies of the strategy below:

Strategy A:

(0.9 * 1) - (0.1 * 50) = -4.1

Meaning you are expected to lose an average of $4.10 per trade using strategy A. Not a good sign.

Strategy B:

(0.1 * 200) - (0.9*1) = 19.1

Meaning you are expected to win an average of $19.10 per trade using strategy B. This is a major winner here!

As you've probably realised. It is possible to have a profitable strategy using a low win rate. Many trend trading/breakout strategies tend to have lower win rates, but with larger rewards to risk, whilst mean-reversion strategies tend to have higher win rates with less frequent but larger drawdowns.

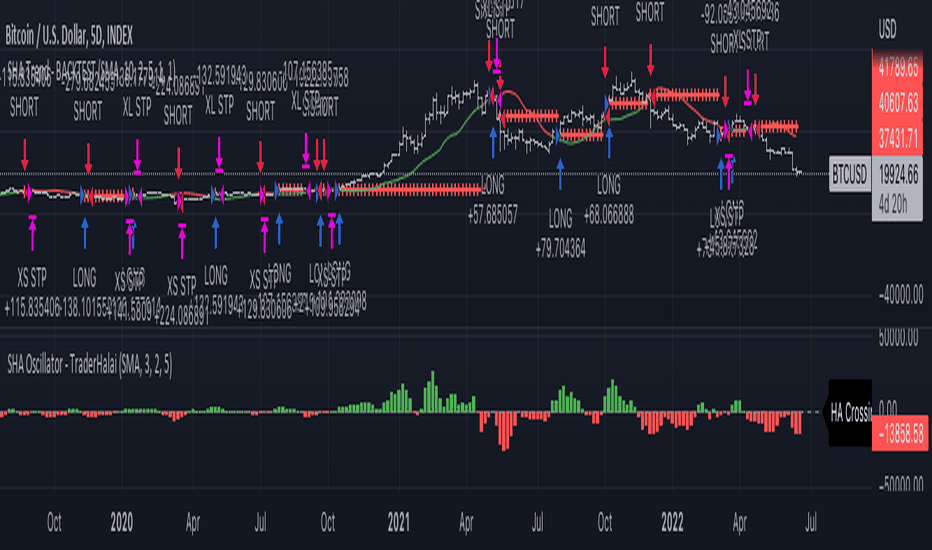

The backtest shown in this post shows an example of a low win rate, and high win amount strategy using the Smoothed Heikin Ashi Trend on Chart indicator which I have developed, with an overall positive expectancy, backtest (note, no strategy is perfect, should not just blindly trust backtest data).

Why you may still choose to define a risk/reward

Better consistency of your strategy

Psychological factor of knowing that you can be expected to lose only x amount (assuming no slippage etc)

As an aside, note that defining a fixed risk-reward may hurt your win rate (which could impact your expectancy) so it's important to backtest to see if you get better results with defined risk-reward parameters. This is beyond the scope of the current article, but an important consideration.

Why do traders gravitate toward a higher win rate?

The simple answer here is that everyone wants to be a winner! It's human nature to want to be right, whether this be about a market direction or when to open or close a trade. It's often easier to brag about how much you win whether that be on social media or just feeling good about yourself.

For algorithmic traders, having a higher win rate may also provide psychological benefits, as losing 20 times in a row can sometimes be very daunting for traders and can throw doubt into the efficacy of your system.

I hope that through this article, I have managed to convey that it may be prudent consider strategies with low win rates also, as these can be very profitable in their own right.

Digging further:

This article is only just scratching the surface of how to create and validate if a strategy is something that you should consider trading. There are many aspects of backtesting including Monte Carlo simulation, understanding standard deviation of returns and risk, Sharpe ratio, Sortino ratio, walk-forward analysis, and out-of-sample analysis to name a few that you should conduct before you evaluate a strategy as suitable for live trading.

If you've made it this far, thanks for reading. If you like the content, feel free to like and share, as well as check out some of the free scripts, strategies and indicators that I have published under the scripts tab.

Thank you!

Disclaimer: Not to be taken as financial advice, anything published by me is purely for education and entertainment purposes

nas100 analysis (07 june - 10 june)hope you lot are blessed and are having a great day where ever you are!

so my current take on nas100 is as follows :

1. about two weeks back we broke through the neckline of the daily double bottom and we have been in a range for the whole of last week as seen by the rectangle

2. at yesterdays new york open the market showed signs of being strongly bearish because of the large bearish candlesticks on higher timeframes and a breakout on an upward trendline

3. another confluence is that a head and shoulder pattern formed on the H4 and it's neckline has been broken so there is a high probability that market will tank down

4. entry will be at the retest of the range/head and shoulders and stop loss a few pips higher than the recently broken structure and lastly take profits at the level which was previously used as support

those were my reasons of confluence so there is a high probability of my analysis playing out but i will make sure to update my analysis if need be, God bless!!

Sunday afternoon backtesting sessionToday I am backtesting trades on EURUSD to further improve my strategy and my ability to apply my strategy. It is important to keep your tools, and mind, sharp so that you can execute your trades in a live market that has major market players, news events, volatility, liquidity with experienced traders with high end technology with a high end education trading these markets. This means you must find your edge and constantly practice it to refine it, improve it, and remember it anywhere, any place, any time.

🎯 HISTORICAL EDGE - 77.50% WIN RATE - 08APR22PRO TRADER : Do you see the HISTORICAL EDGE?

NEWBIE : silence ...

PRO TRADER : Ok, we got a 10day low yesterday. Today the SPY gaps up and closes positive on the day. This close is above the 200MA.

⬇️ ⬇️ ⬇️ RESULT ⬇️ ⬇️ ⬇️

🔱 This setup has occurred 40 times since 2007! 💎

🔱 The 1 day move from here has had 77.5% chance of being bullish 🟢 ( aka higher for the cash session 08APR)

🔱 The average move up has been 0.8%!

👉 Aka we predict that on the 08APR22 the general market (SPX) has 77.5% chance of closing 0.8% here from here!

🎯 HISTORICAL EDGE - 01APR22PRO TRADER: Do you see the HISTORICAL EDGE?

PRO TRADER: Yesterday was the last trading day of the month. We closed above the 200D Moving Average.

NEWBIE:... silence ....

PRO TRADER: We also closed for a second day down and we closed in the lower range of the intraday.

NEWBIE: And?!

PRO TRADER: This has a significant edge for market. We backtested it since 1996!!! And we see an oportunity you can take advantage of.

⬇️ ⬇️ ⬇️ RESULT ⬇️ ⬇️ ⬇️

This setup has occurred 28 times since 1993 ! 💎

The 1 day move has had 85% chance of being bullish 🟢 on the next day ( aka market session on 01APR)

The average winner has been 2 times larger than the average loser!!

🎯 HISTORICAL EDGE - 🟢 RESULT FOR 15FEB💁♂️ TRADER: Did you take the signal, Newbie?

👶 NEWBIE: No, what happened?

💁♂️ TRADER: We anticipated a move to the upside ⬆️ on the 15FEB since we had a rare historical setup on the 14FEB.

👶 NEWBIE: And...?

💁♂️ TRADER: SPX posted a move to the upside with 1.5%🟢 AND given this an estimate for the general market, the move to the upside dragged many names up (NEW+5.5%, OXY+5.6%, CTRA+4.87%, PSX+4.18% etc etc.). These setups move the whole market - pay attention next time, Newbie.

🎯 HISTORICAL EDGE - MORE TO DROPHey guys!

Todays Historical edge comes from an interesting pattern.

📈 The Pattern: SPX closes down over 2% and above 5day low, but yesterday it closed at 5day high.

We backtested and saw strong edge.

⬇️ ⬇️ RESULT ⬇️ ⬇️

📍 Edge: 🔴 Bearish

🔄 Occurrence since 1990: 25x (frequent)

🏔 Highest edge: 4days later

🎲 Probability of bullish move: 28% - aka this suggest a bearish move over the next 4days.

POSSIBLE 600 PIP DROP Keep it simple ... Always.

Risk : Reward

1 : 20

_______________________________

Moving Stoploss to break even if price gets to 1.8900

Manually closing order if price closes above 1.9015 (on the 4H timeframe)

Past Experience DOES NOT Determine Future Outcomes.

Past Experience DOES NOT Guarantee Future Outcomes.

Trade Safe 🥂✅

🎯 HISTORICAL EDGE - 🎾 BOUNCE?Today was interesting day since a few things have triggered:

✅. Yesterday we gapped up

✅. Today we closed at a 10d low

✅. Today we closed under 200MA

✅. Today we closed at 25% of the Daily Close Range (shame)

🦄. Some additional technical magic filters

We tested the times this has happened...since 1993📆 !

We saw a relatively bullish move. The 2DAY move on the spy has been bullish nearly 83% of time🟢 . This type of setup has occurred 1️⃣8️⃣x!

Average move up has been about 3% over a 2day period, which is positive🟢 .

However, if we do not observe strong bounce, probabilities stack strongly to the downside, so observe and evaluate 🔴 .

However, as our members hear me repeat over and over again patience is the name of the game!

Trade safe

🎯 HISTORICAL EDGE – RARE ANIMAL 🦖👋 HOLA team!

A very rare system has triggered in our studies. This is a 7️⃣ day higher close for the VIX.

We backtested the system since the initiation of the SPY (Only 11x, super rare 💎 ). What we see is that....(drum roll 🥁)

the 3 days move has yielded 100% bullish move. This is quite a tell. Average bullish move has been 1.7% for 3 days. 🟢

However, given the abnormal behaviour of this market, caution is advised.

If you like this idea and want similar like this click on the link below. ⬇️

POSSIBLE CRAZY FALL ON USDJPY ??!All through 2021, we've seen price rise steadily on USDJPY.

Right now, price is approaching a monthly resistance, from which a huge reaction could occur that could take price to 102.00

There's also a shark harmonic pattern in formation.

When the time is "right", we'll be looking to capitalize on this move with a 30 pip stoploss (max.)

Trade safe🥂

Keep it simple ✅

$SEDG: Time To Get $TAN?SEDG made a major break through the key 370 level we were watching on my Stocktwits page. TAN (Solar ETF) broke above 100 today as well and looks very strong against alternative energy plays. In fact if you look at $XLE vs $TAN you'll see that energy potentially has a long way to fall vs solar companies who are leading the pack today. Could be good to hold longer term until retail trends begin to develop in a more broad based way. Good luck!

AUDUSD long moving nicely We are using our trend following EDGE strategy for this trade.

Entry details are shown on the chart.

Working the 30M time frame on this strategy.

We're only looking for TP3.

The trade history can be seen at the foot of this trade idea too for full transparency.

Lets see how this trade ends up but it has started well.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren.

GBPJPY long valid ☝️ 👍Entry details are shown on the chart.

Working the H1 time frame on this strategy.

We're only looking for TP3.

Trade history can be seen below this trade idea too for full transparency.

Part of previous trade can be seen on the chart which was a successful short.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren.

CAD/JPY Short - 01 June 2021 | Hybrid Move Result: +3.00%Hey all,

Another quick breakdown of a Hybrid setup taken this month..

The trade initiated from a Sr. Daily Zone which was created all the way back in January 2018, where price showed a beautiful trendline break and a huge crash in price. Overall the monthly time-frame was sitting at major value as well together with the weekly chart being in need of a reversal after the strong 2020 and 2021 volatility in the markets.

The 4hour started to top out here after the daily showed a clearly over-extended run. When the double top formed at the 4hour chart, price confirmed the bearish bias with a clean 4hour star formation to the downside and a clean move later on. The orange candles at my chart are from our unique entry indicator developed to be optimal for our supply and demand zones.

If you have any questions, feel free to comment below!

Kind regards,

Max Nieveld

EURUSD sell in progress 👍Entry details are shown on the chart.

We're only looking for TP3.

Slight retrace on moment of posting this idea so lets see how this one plays out.

Trade history can be seen below this trade idea too for full transparency.

This strategy is a 1:5 RR but comes with a 28% win rate.

I trade a plan based on the available test data to me.

That data for this strategy tells me despite a 28% win rate I still have an edge as the strategy creates bigger wins than losses on average.

All the trades can be found by pressing the 'list of trades' tab at bottom of the idea.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren

BCTI think the triangle pattern is formed at the very important price edge.

Therefore, it is predicted that after breaking the upper side of the triangle and retreating, we will climb to the next edge of the price.

The reason for the importance of the price edge is that it has been touched many times in the past

Also the bottom diameter is a triangle

In addition, at this level we touched the moving average

NAKD Will Rise Again...The price has formed a triangle shape and is at the edge of breaking out. Price is expected to cross and test the 50EMA before trying to close the 200EMA gap.