Incoming breakout for $MaticSo from my charts in the 15min & hourly time frames I do see a breakout to the upside possibly coming sooner then later. If you are thinking of investing into $MATIC then I would say now is a good time to buy before the breakout. But if you want to be on the safe side of things just wait for confirmation but in my own honest opinion I do believe after the last 2 days of hell the major corrections are over with and $MATIC is going to continue it's uptrend most likely challenging the recent (ATH) and possibly going back into (price discovery)

If you like my TA then drop a like / follow I appreciate the support from my followers!! I will be starting LIVE TA during the week once I have achieved 100+ Followers.

This is not financial advice this is my own humble opinion of what I have learned over the years of trading. I never claim to be 100% accurate but I will say I am a pretty profitable day trader so stick around and you might learn some things if you are a noob. If you are a seasoned vet then please drop some comments down below and I will happily get back to you when I can.

As always,

Happy Trading Traders & Never Trade Leverage!!

Educational

HOLLYWOOD meets WALL STREET- Top 10 movies

In this post I will introduce you to 10 stock market films and documentaries about trading and the financial markets that will both entertain and motivate you, some are real, others just funny or very critical

WALL STREET 1 and 2 1987 u 2010 DRAMA whit Michael Dougles

Rogue Trader- The Nick LEESON Story 1999 REALLITY whit Ewan McGregor

INSIDE JOB 2010 DOKU whit Matt Damon

The Wolf of Wall Street 2013 TRUE STORY whit Leonardo Di Caprio

Money Monster 2016 ACTION whit Georg Clooney

The big Short 2015 BIOGRAFY whit Christian Bale

To Big to Fail 2011 DRAMA whit William Hurt

Boiler Room 2010 DRAMA whit Giovanni Ribisi

Margin Call 2011 DRAMA whit Kevin Space

The Corporation 2003 DOKU independent

Tell me about your favorite financial films and determine the rating

If you like the post,smash the like button,follow me, and comment Thanks

ADA UPDATE TREND ANALYSIS!! <LONG><TERM>So from what I can see on the 15min time frame we are indeed going to go up for a bit I think we may reach the 78.6% resistance line before another short pull back occurs but anything can happen with all of the instability going on with Bitcoin and all of the scarcitty in the markets right now in general. Proceed w/ Caution and take profits accordingly because you never know when a reversal is coming considering ADA did sell off past the 61.8% support on the daily chart which is usually a #1 indicator the trend is over.

This is not financial advice only my humble opinion on what I see with the tools that I know for trading.

I have been trading for a few years and I do like to think I am pretty profitable at it. I learned from a lot of BIG losses and never aloud the losses to discourage me from learning more and more. I still study everyday on new strategies , new indicators & ALWAYS pay attention to the fundamentals of today's world it effects the markets more then anything if you ask me.

As always,

Happy Trading & Never Trade Leverage!!

BTC nearly in Bear Market? or already in?As you can see this is the last major support for the BTC, and if will close this week below this

line, you can be sure we are on the Bear Market

already since from 13 May.

The chances are high if will continue in this way, to avoid that BTC needs a major investment, but i think will never come now becouse the whales have been taked the profits somewhere betwen 60-63k.

Anyway this is only my opinion, and i belive the Bear Market have been start already from 13 May, but for the people its hard to belive that or dont want to belive and hope BTC will rise again.

Bitcoin schematic formationWatching the recent BTC moves, we have overlaid both Wyckoff & Elliott to highlight the current situation.

Talking our community through the process - we thought this was interesting and worth sharing here. The example using Bitcoin has been near enough textbook to here.

There are several crosses of interest currently using SPX, DJI & Gold, but the Grayscale pattern clearly shows a bias. Watching closely.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Daily Char for $ADASo I don't think we are going to get to much more downward pressure, we may see some struggle to start moving back up but I am almost positive we will gain traction and that this bull market is not coming to a end. There is alot of negativity towards Bitcoin right now and that my friends is just bad for the markets when you are the main dominance over the markets. Once Bitcoin finds stability we should see a nice alt season and most likely a very nice cardano push back up to retest the all time highs and then go back into price disovery mode but you must be patient in crypto and never underestimate the power of fundamentals and scarcity. When everyone's selling if you're in a fundamentally strong cryptocurrency project then chances are you should be buying the dip and HDLE for the next bull cycle which always comes around in crypto land. Buy the dip, sell the high! Not as complicated as some of you think just learn, observe, educate yourself before throwing money in this highly volatile market. And always DYOR before investing.

This is not financial advice, This is only my humble opinion after a few years of trading cryptocurrencies.

As always,

Happy Trading & Never trade leverage!

-Like me if you Like it, Comment you're opinions down below I will always enjoy good feedback / advice!

Follow me on twitter @NPCBuilds

ADA falling to $1.74 - $1.55 levels.From what I can see on the daily chart, the hourly charts, the 15min chart $ADA is looking to fall back down to around $1.74 - $1.55 area for the short-term pull back I expect a very large pump back up to challenge the $2.49 ATH once we hit the bottom of this downward pressure. But if you have any opinions please leave you're comments down below and I will get back to you as soon as I can.

ADA trend is now over it sold pass the 61.8 supportThe ADA Trend is over it now has be over sold and this is a indicator that there has been too much selling and ended the trend. If you are long-term then just HDLE but if you're day trading I would watch very close and may need to buy back at a lower price.

The Golden Rule of TradingOne of the fundamentals that every trader must know is how to evaluate the effectiveness of his trading methodology. In this article, we will explore core trading fundamentals that you must follow in order to survive and thrive in this business.

1. Never open a position without knowing the initial risk that you are willing to take. The initial risk is the point at which you will get out of the position to preserve your capital.

Very few people have the psychological makeup to keep a mental stop loss and respect it 100%, that’s why for the rest of us, there is the stop-loss that will automatically close our trade for us at a certain level.

2. Define your profit and loss in your trades as multiples of your initial risk.

These are the R multiples. If your risk is $1000 and you make $3000, you have a 3R win. If your risk is $1000 and you lose $1200, then you have a 1.2R loss. You must start to think in terms of risk/reward.

3. Limit your losses to 1R or less. If you don’t respect the stop loss that you have set and let a losing trade run then you are in real trouble.

This mechanism produces 4R losses or larger and can turn your great system into a losing system very easily.

4. Make sure that your profits, on average, are larger than 1R. Let’s say you have one 5R profit and four 1R losses.

If you add those up you have 5R in profit and 4R in losses, a net gain of 1R. Even though you lost money 80% of your trades, you still made money overall because your average gain was big. This is the power of having an average gain larger than 1R.

What is typically known as the golden rule of trading is a summary of these 4 rules:

“Cut your losses short and let your profits run.”

Here we are talking about doing your best to make sure your losses are 1R or less and that your profits are much bigger than 1R. In 2002, the Nobel prize for Economics was awarded to Daniel Kahneman, a psychologist and economist Amos Tversky for their development of “prospect theory”. This theory when applied to trading/investing showed that people have a natural bias to cut profit short and let their losses run, exactly opposite to the golden rule.

5. Understand your trading system in terms of mean (the average R) and the standard deviation (variability in the results) of your R multiples.

Your system, when you trade it, will generate a number of trades. The result of those trades can be expressed as a multiple of your initial risk or a set of R-multiples. You should know the properties of that distribution for any system that you plan to trade. And the majority of the people who trade the markets never know this. If you spend some time and calculate the mean and the standard deviation of your R multiples, you’ll know a lot about your system and what can you expect from it in the long run.

Trade with care.

If you like our content, please feel free to support our page with a like, comment & subscribe for future educational ideas and trading setups.

Is the trend really your friend?This is a short take. I'm showing a 30 min ATR trend line.

Loads of traders know that ' the trend is their friend ', but do they truly exploit it? I don't think so.

There were three main opportunities to exploit this trend. The problem is - now you see it but when it's developing you can't. But at each of two points where price hit the 30 min ATR line, it was worth a short, with a very tight stop loss.

Trend following is a very difficult strategy, but rewards can well exceed other methods of trading. It makes sense to explore it, and develop the skill (safely on paper trading accounts).

Disclaimer: This is not advice or encouragement to trade securities or any asset class. This is not investment advice. Chart positions shown are not suggestions and not intended to assure you of an advantage. No predictions and no guarantees are supplied or implied. The author trades mostly trend following set ups which has a low win rate of approximately 40%. Heavy losses can be expected if trading live accounts or investing in any asset class. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on opinion expressed here or on my profile and you lose your money, kindly sue yourself.

ADA ON TRACK FOR 50-60% RECOVERYFrom what I can see on my chart in the 15min time frame and the hourly time frames we are looking at a 50 - 60% recovery before another short-term position takes place.

This is not financial advice please DYOR before investing into cryptocurrencies this is my personal opinion on my own Technical Analysis and I never claim to be 100% accurate I only use the tools I have learned over the years of trading to try and get a good analysis.

As always,

Happy Trading & Never trade leverage!!

Currently on the 61.8 support BUY NOWThis is the lowest ADA can go without ending the TREND if we go below the 61.8 support then the trend is over but this is definitely a great ENTRY position so please DYOR and this is not financial advice however if you're looking to ENTER ADA this is a great area.

Double Bottom / Buy after confirmationSo it looks like the right shoulder didn't have enough gas to go back up so we are forming a double bottom but don't worry the entire market is down because BTC is falling from the energy consumption bad reputation Bitcoin is currently earning from all of the Mining going on in china that is producing to many fossil fuels for our Planet to deal with. If everyone keeps mining bitcoin like they are now then the temperature if the earth will be raised by 2 degrees by 2025, So if you are looking to get into Cardano which is the Largest proof-of-stake platform in the world I would suggest DYOR and then refer back to this chart for you're entry point which I would say NOW is a great time to buy and HDLE. Cardano in my strongest opinion will be worth $10 - $20 by end of 4th quarter of 2021.

Thank you & happy trading!

This is not financial advice! Please DYOR before investing into anything in the crypto space & never trade leverage!!

Buy & Sell areas for noobies to learn entry & exit strategies.So I did a quick run down of where you should be buying & selling for those of you that are unaware of how to do you're own TA I hope it is useful for you to somewhat learn how the entry / exit strategies work for a day trader. If you are a long-term hdle trader then disregard this because this strategy is not for you. This is more aim'd towards people who want to make money on a daily basis and maximize there profits / accumulate more tokens. When you see the green bars going up up up up *This is buying buying buying buying* note: never go against the buyers you always want to wait for a pull back this is why it is important to learn support / resistance levels using the fibonacci retracement tool & the macD / RSI indicators. I hope that this chart give's you some guidance and if you have any questions feel free to DM me or leave you're comments down below & I will get back to you as soon as I can.

If you like the charting feel free to drop a like!

As always Happy Trading & Don't Trade Leverage.

"This is not Financial Advice, This is my own experiences from trading in the crypto space for a few years now I genuinely want to help others achieve financial freedom away from the traditional system that is so badly broken".

ADA analysis for noobies!So I recently posted a analysis which showed the last short term price pump before ADA came back down to retest the 50% fib level which is incredibly bullish for this on going uptrend. I believe with in the neXt few days we should be seeing a new ATH now that we have retested the 50% level we can safely head back up to retest the previous ATH & most likely go back into price discovery / new ATH for the 2ND quarter of 2021. If you are not aware ADA is currently the largest most widely adopted proof-of-stake platform in the entire crypto space on a global level. ADA / Cardano will in my opinion replace cryptocurrencies that are currently on the old proof-of-work algorithm due to high energy consumption and global warming from the warehouses upon warehouses of mining rigs! SOOOOOO if you have yet to pick a project to truley believe in then I would look into CARDANO for it's bleeding edge blockchain technology that is actually going to make a difference in the world today!

THIS IS NOT FINANCIAL ADVICE PLEASE DYOR WHEN INVESTING IN ANYTHING IN THE CRYPTO SPACE!!!

HAPPY TRADING EVERYONE <3

Drop a like & hmu in the comment section below if you have any opinions or questions related to the topic!

Thank you & have a great trading day!!

Using the Relative Strength Index (RSI)Using the Relative Strength Index

The Relative Strength Index (RSI) is a very popular and often used indicator that can be used effectively in many different ways. My personal favorite two are:

1. As a tool to indicate a reversal. This is the most popular way.

2. As a momentum indicator. This is what it was designed for.

Below we will discuss how to read the RSI, and how to set it properly depending on market conditions.

What the numbers mean

Before we discuss what to do with the information that the RSI gives us, we should learn what the numbers mean.

The RSI is a line graph that moves from 0 to 100. When the RSI is 70 or over, we consider our crypto to be overbought (people bidding up the price). Then when the RSI is 30 or below, we consider our crypto to be oversold (people bidding down the price).

Overbought means that the crypto might be overvalued.

Oversold is the reverse. The crypto might be undervalued.

The actual number is calculated using the average gain or loss over a set period of time. The default time period is 14 (minutes, hours, days, based on how the chart you are currently looking at is set).

You could also set your period length to a lower number, I use 10 sometimes, so that the RSI is more sensitive to recent moves. This is good to do in markets that are highly volatile (crypto for example).

The actual RSI number will increase as there are more and more positive closes within your time period, and will fall as there are more and more negative closes within your time period.

As with every trading indicator, the RSI should not be used as the sole reason for a trading decision. It helps paint a picture of the market of the particular crypto you’re looking at.

Nor are the default values always to be used. We’ve discussed time changes, but you could also change the upper and lower bands.

In a bull market you may want to change the upper band to reflect the general trend of the market (more on that later).

Trend Reversal

Now, let’s about how to actually use the RSI. The first way to use it is as a way to spot a possible trend reversal.

Put simply, the RSI can help us see if we have, in the last few candles, changed from an up-trend to a down-trend, or from a down-trend to an up-trend.

When the RSI is below 30 and crosses up, we consider this a bullish move.

When the RSI is above 70 and crosses down, we consider this a bearish move.

Just to reiterate: A bullish cross up is not an automatic buy, just as a bearish cross down is not an automatic sell. As you can see below.

But it is pretty accurate.

Nothing in TA is 100%, but the closer you get to 100% the better trader you will be.

One other thing to note based on the above picture is that there was no time that the RSI dipped below 30. In a crypto bull market (which we are currently in) it is more common to see cryptos that are overbought as opposed to oversold. You can compensate for this by changing the oversold line to 40.

Additionally, as the crypto moves up in price, you can see the RSI making consistent higher lows.

Divergence

One thing to look for when you are trying to spot trend reversals is what is called a Bullish Divergence.

This means that the price of your crypto is in a downtrend and making lower lows. At the same time, the RSI is oversold and is making higher lows.

When you spot this, it can be a very powerful indicator that the trend is reversing to the upside.

A bearish divergence is the same thing but in reverse. The price of the crypto is getting higher and higher while the RSI is overbought and making lower highs.

RSI as a momentum indicator

Another way to effectively use the RSI is by using it for its intended use as a momentum indicator.

As we talked about before, the RSI rises as we have more and more positive closes in our time window. It rises more (faster) when the price movements are more extreme to the upside. The reverse is true for the downside.

So, if we are oversold that means there is momentum to the upside, and if we are overbought that means there is momentum to the downside.

Generally, it is better to trade with the momentum than against it. Unless we spot the reversal signals that we discussed above; crossing back down, or crossing up.

It is also better to go long in bull-markets and short in bear markets when using the RSI in this way.

Let’s take a look at the chart below:

In a bull market the 50-60 range of the RSI acts as support and the RSI usually stays above 40.

I like to set my upper band to 60 in a bull market so I can trade with the bullish momentum and spot potential reversals in the 50-60 range.

As you can see it is necessary to use the RSI differently in different market conditions.

Final thoughts

As you can see there are different ways of successfully using the RSI. I hope I’ve made at least two of those ways clear in this beginner guide.

Please let me know if you have any questions and if you like it, please hit the thumbs up and be sure to follow for more!

Thanks for reading!

how to buy lower low ? visual guide there are multiple way to buy lower low but there is always a question how will you know it

sharp correction (one leg only )

single lower low

multiple lower low

lower lower low and double bottom

the lower you go in priority list more security you get as a trader. More discipline and patient you need as trader

(it looks like short read but it takes years and lots of money to learn it)

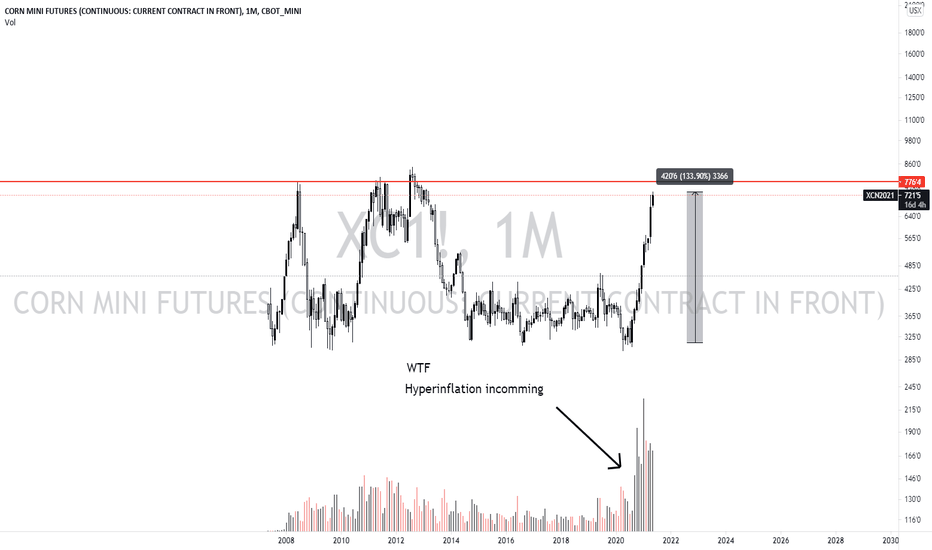

Buy anything callAm i looking at wrong, right? tell me i'm wrong..

We're in a really crazy world.

The Fed is announcing that there is no inflation yet, but this is bullshit. imo Crazy inflation is at the starting point.

If the price of raw materials goes up so rapidly, All prices are reflected in the market.

I don't know how much hamburgers will cost expensively in near future.

Seriously, consider investing in Bitcoin. It's okay if it's not Bitcoin.

Since it doesn't have to be Bitcoin, but buy an etf (qqq, tqqq, spy) instead.

I think it will be the last chance if the Fed gives the rate-raising card, and this will be the last dip to the market.

Fed cannot raise interest rates. Employment indicators are smashed. and This is a problem that cannot be solved forever.