😱Types of Fears in Trading😱Hello! There are several types of fears at the market!

There are several main types of fear:

💡- fear of losing all capital in the account. One of the most common fears. The trader clearly understands that the numbers in the terminal are his money, and their reduction limits his financial capabilities in the future. Under fear of losing an even larger sum, a market participant does even more stupid things or even refuses to trade;

💡- fear of losing money in a losing position. Similar concerns arise during the transaction period under the influence of strong market volatility . This kind of fear is easily correctable;

💡- fear in time not to see a signal to enter or exit the market. More often it's faced by newcomers, who will not imagine what risks are in the trader’s deals and how to protect themselves from them;

💡- general fear of working on the market. It can act as a negative background and prevent you from making the right decision. Often, such fears are eliminated by gaining certain knowledge and experience on the exchange;

💡- fear of receiving another disadvantageous deal. Such fear leads to the appearance of excess fuss. As a result, the trader misses a really good deal;

💡- fear of early fixation of income (fear of loss profit). The position could still be kept open, but the trader reduces his risks, closes the deal and receives less profit. For many market participants, the fear of making such a “mistake” is even stronger than the fear of losing trades.

Guys, it's ok to feel all types of fears ! Especially for those , who new at the market !

Everyone went through that. Someone overcame own fears, someone is trying to overcome, but someone hasn't gotten along with emotions and left the market!

Remember, if you have a goal - go forward!💪🏻 Look only ahead and listen only yourself !🙏🏻

If you wanna become successful - you'll surely become that!!!🚀🚀🚀

Let's become better together ♥️

Stay tuned by Rocket Bomb 🚀💣

Educational

Maybe it's time to get out of comfort zone?🧐

Have you noticed, that one of the most comfortable sleeping positions is curled up in a ball. The legs are pulled up to the stomach, the head is lowered, the arms are hidden on the chest, the back is slightly arched. Cover yourself with a blanket and sleep. Warm, dark and calm. A sense of safety arises.

And the secret of this protective posture is in subconscious imitation of the fetus in the mother's womb.

There, in the warmth of the mother's womb, is the first comfort zone, that a person leaves when he is born. Subconscious memories of how comfortable, calm and good it was, remain with us for life.

If you wanna live, you have to be born.

For a baby, this jerk is extremely uncomfortable. You find yourself in a cold and unfamiliar place, and some monster slaps on your 🌰🌰 🤣🤣

After a while you want to eat and drink, and you have to do it yourself, and everything around is so huge, loud...really don't wanna repeat that.

Therefore, subconsciously, we always resist leaving our comfort zone. The experience has already been. Didn't like it!

But the stress mechanism, that is triggered during childbirth (and then every time you leave your comfort zone) is a protective function of the body. Stress activates the reserves of the body and brain, forces us to act more actively, to fight the aggressive world.

However, nature also took care of the reward.

If stress doesn't become constant, but is a one-time surge, that activates forces, relaxation and satisfaction follow.

So, we figured out the physiology of the comfort zone. Why going beyond it guarantees stress is understandable. Now the question is: <>

The birth of a trader

In fact, everything new, unknown and unusual is outside the comfort zone. Even if we go to the store in a new way - that's a mini-stress for our brain, forced to work out a different route instead of saving resources while the body is moving on autopilot. Any change of scenery, new job means going beyond the familiar world. And the higher the unknown, the more uncomfortable the path.

For most people, trading is terra incognita. Trading isn't taught at school, it's not taught at universities. Trading forces you to take responsibility. Most importantly, trading is always associated with risk.

Risk is danger and uncertainty, and the brain reacts accordingly. He begins to ask insistently: "Do you really need this? No, are you sure?"

Leaving the comfort zone and becoming a trader is also hindered by social stereotypes. First, society reacts negatively to any attempts to break the system, that is, to do something that goes beyond the standard life path: creativity, politics, business. Secondly, trading is one of the areas, that make most people wary (and statistics, according to which only 5% of traders achieve success, reinforce this feeling). So if you want to become a trader, you are already challenging society.

That's why the birth of a trader so often becomes a struggle with the usual way of life, basic attitudes, other people's opinions and yourself.

What happens, when you become a trader ?

Think your comfort zone problems will end? Nothing like this. Two ambushes await the trader. The first is the inability to cope with responsibility for your life.

The second ambush is stagnation. After overcoming difficulties, learning to trade and starting to receive a stable profit, the trader finds himself ... Right, in a new comfort zone!

After all, what is it? The comfort zone is above all stability.

But the calmness puts you to sleep. Periods of economic stability in history often turn into a stage of stagnation and stagnation. The same in human life. Psychologists Robert M. Yerkes and John D. Dodson established as early as 1908 that performance doesn't improve in a state of comfort. Motivation falls asleep.

In order to become a successful trader, it is not enough to leave your comfort zone. You may have to struggle with its attraction more than once.

Therefore, leaving your comfort zone, take care of your psyche:

✔️Pump up motivation. Be clear about why you are breaking the wall and whether you need it.

✔️Work through your fears so that the body does not engage in self-sabotage mode.

✔️Develop resistance to stress and brain flexibility. Choose non-standard routes more often - in the broadest sense of the word.

✔️Take care of insurance, think over different scenarios for the development of the situation.

If you feel that getting out of your comfort zone is difficult for you, do not take a running ram. Take small steps.

Have you ever tried to leave your comfort zone?

Stay tuned by Rocket Bomb🚀 💣

BTCUSD Price Action AnalysisThis is not a Financial Advice.

Hi guys i hope you are having wonderful trades , plz let me know your idea about this vision ?

Possible support lines and future resistance are shown according to divergence of parallel channels and Fibonacci channels .

Description is in the Screenshot.

Tips And Tricks To Be A Pro TraderThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

Harmonic Patterns With Advanced Explanations Check It Out Harmonic price patterns are those that take geometric price patterns to the next level by utilizing Fibonacci numbers to define precise turning points. Unlike other more common trading methods, harmonic trading attempts to predict future movements.

Let's look at some examples of how harmonic price patterns are used to trade currencies in the forex market.

-----------

KEY TAKEAWAYS

Harmonic trading refers to the idea that trends are harmonic phenomena, meaning they can subdivided into smaller or larger waves that may predict price direction.

Harmonic trading relies on Fibonacci numbers, which are used to create technical indicators.

The Fibonacci sequence of numbers, starting with zero and one, is created by adding the previous two numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc.

This sequence can then be broken down into ratios which some believe provide clues as to where a given financial market will move to.

The Gartley , bat, and crab are among the most popular harmonic patterns available to technical traders.

----------

Geometry and Fibonacci Numbers

Harmonic trading combines patterns and math into a trading method that is precise and based on the premise that patterns repeat themselves. At the root of the methodology is the primary ratio, or some derivative of it (0.618 or 1.618). Complementing ratios include: 0.382, 0.50, 1.41, 2.0, 2.24, 2.618, 3.14 and 3.618. The primary ratio is found in almost all natural and environmental structures and events; it is also found in man-made structures. Since the pattern repeats throughout nature and within society, the ratio is also seen in the financial markets

By finding patterns of varying lengths and magnitudes, the trader can then apply Fibonacci ratios to the patterns and try to predict future movements. The trading method is largely attributed to Scott Carney

although others have contributed or found patterns and levels that enhance performance.

Issues with Harmonics

Harmonic price patterns are precise, requiring the pattern to show movements of a particular magnitude in order for the unfolding of the pattern to provide an accurate reversal point. A trader may often see a pattern that looks like a harmonic pattern , but the Fibonacci levels will not align in the pattern, thus rendering the pattern unreliable in terms of the harmonic approach. This can be an advantage, as it requires the trader to be patient and wait for ideal set-ups.

Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points. The danger occurs when a trader takes a position in the reversal area and the pattern fails. When this happens, the trader can be caught in a trade where the trend rapidly extends against him. Therefore, as with all trading strategies, risk must be controlled.

It is important to note that patterns may exist within other patterns, and it is also possible that non-harmonic patterns may (and likely will) exist within the context of harmonic patterns . These can be used to aid in the effectiveness of the harmonic pattern and enhance entry and exit performance. Several price waves may also exist within a single harmonic wave (for instance, a CD wave or AB wave). Prices are constantly gyrating; therefore, it is important to focus on the bigger picture of the time frame being traded. The fractal nature of the markets allows the theory to be applied from the smallest to largest time frames.

To use the method, a trader will benefit from a chart platform that allows him to plot multiple Fibonacci retracements to measure each wave.

Types of Harmonic Patterns

There is quite an assortment of harmonic patterns , although there are four that seem most popular. These are the Gartley , butterfly , bat, and crab patterns.

BACKTESTING EDUCATION | How the market behavesThe market ALWAYS looks for liquidity and is magnetized by it. That is why there is a manipulation of trendlines , then bounces at the consolidations POC (Point Of Control) levels where it finds liquidity.<

Imbalance is where price has shown very little volume , and you can expect liquidity to be sitting there because price has not had a chance to trade at that level.

RSI divergence is where the strength of the market is going one way, and price is going the other way.

In this case, price was forming higher highs and the RSI (strength index) was showing lower highs; so it's a divergence from the strength of the market and what the price is telling us.

A Spring is when price is preparing for an aggressive move by multiple means: either by manipulating levels, retesting an accumulation or distribution; But in most cases, it's creating fear in one side in order to push price in the opposite way.

For example, the distribution on the top right shows euphoria because everyone is buying for a breakout of the longer-term trendline. Therefore, because everyone is only thinking that the market will go up, the complete opposite actually happens. This takes out a lot of people, and in the meantime takes their liquidity (their stop losses).

Fibonacci is a retracement tool to determine the most optimal level where the price is likely to continue its trend based on the length of an initial aggression move.

Ripple - XRPUSD ANALYSIS STRUCTURE CTRL[HIDDEN STRATEGY REVEAL] Hello dear traders and followers.

I wanted to reveal one of the most useful and lesser known strategy special on the XRP case day as it was asked for me to analyze today at most.

I have clearly wrote everything you need to learn in the boxes and highlighted the important parts for you to simplify and understand it easier. The structure control strategy is used by %1 of the traders at most and it is underestimated.

In this method the most important part is to draw the structure level and identify it very clearly with an expert way. The second most important part is to balance the previous low and high spots and identify them in the edge of the balanced areas. Be careful, many traders will look for bearish double top chart patterns here and go for short and intra sell it. It may happen but this method will benefit and profit you more as you do your trades near structure with the informations given on the tutorial.

It will help identify your swings and long positions given you more profit chance, help your scalps to see quick opportunities and help with your day trading.

Ask me if you have any questions on TradingView messaging me or commenting to this post!

BTCUSD Bearish AndrewTheSage reporting to you live. My charts are colorful. I am not a financial advisor I use arrows and different types of fib levels to show what's going on.. I will not put up an essay. I feel if you can read a chart you can understand what's going on with price by showing you a visual effect. Bitcoin is correcting at one of the green levels i have marked below and it is heading higher.

Break support/Resistance , give confirmation?Break support/Resistance , give confirmation?

- We usually trade base on S/R to find the entry point, exit or to predict the trend.

- One of an effective and simple way in trading is to trade when price breakout from a S/R level

- However, to identify an area or a point of good S/R in trading is mostly based on trading style, knowledge and trading experiences from each individual.

Today I would like to talk about Breakout in trading. When it is breakout, when it is failed breakout.

Before talking about breakout, we need to identify price closes above a S/R level or below a S/R level . Examine the below chart:

However, in the chart we also find the situations that market didn't follow the mentioned rule.

In the above case, if we carefully examine, we would see a pair of candle close below a resistance zone and make price go down. And price is still following rule of breakout and give confirmation as usual.

There are a lot of S/R appear in trading market. So, we have to choose by our own which is the S/R zone to play in each situation depending on our own experiences. No situation is exactly the same with each other! In the same above situation, at the same S/R level that we identified and used before, prices move differently (at that points, mostly our stoploss is hunted)

Here, experienced traders would easily recognize failed breakout based on trend analysis, or the way prices breaks, or at least don't follow the breakout.

We can analyze in a simple way as follow:

And then price continues its trend

I have presented some simple cases of successful breakout, failed breakout or fake breakout in the above chart.

I would like to receive the contributions from the community to learn from each other. Noone is right or wrong all the time. Every wrong or right cases have its own price. Hope that people would not keep silence instread of telling what you know or learned. Nothing has its own value unless it spent some prices. I hope that people would give a way their knowledge, don't try to hide for your own if not we are all failed to this market.

More information

www.investopedia.com

Break support/Resistance , give confirmation?Break support/Resistance , give confirmation?

- We usually trade base on S/R to find the entry point, exit or to predict the trend.

- One of an effective and simple way in trading is to trade when price breakout from a S/R level

- However, to identify an area or a point of good S/R in trading is mostly based on trading style, knowledge and trading experiences from each individual.

Today I would like to talk about Breakout in trading. When it is breakout, when it is failed breakout.

Before talking about breakout, we need to identify price closes above a S/R level or below a S/R level . Examine the below chart:

However, in the chart we also find the situations that market didn't follow the mentioned rule.

In the above case, if we carefully examine, we would see a pair of candle close below a resistance zone and make price go down. And price is still following rule of breakout and give confirmation as usual.

There are a lot of S/R appear in trading market. So, we have to choose by our own which is the S/R zone to play in each situation depending on our own experiences. No situation is exactly the same with each other! In the same above situation, at the same S/R level that we identified and used before, prices move differently (at that points, mostly our stoploss is hunted)

Here, experienced traders would easily recognize failed breakout based on trend analysis, or the way prices breaks, or at least don't follow the breakout.

We can analyze in a simple way as follow:

And then price continues its trend

I have presented some simple cases of successful breakout, failed breakout or fake breakout in the above chart.

I would like to receive the contributions from the community to learn from each other. Noone is right or wrong all the time. Every wrong or right cases have its own price. Hope that people would not keep silence instread of telling what you know or learned. Nothing has its own value unless it spent some prices. I hope that people would give a way their knowledge, don't try to hide for your own if not we are all failed to this market.

More information

www.investopedia.com

Support and Resistance, A way to draw a horizontal line !Support and Resistance, A way to draw a horizontal line !

Support, S and Resistance, R

1. Definition

1.1. Support is a zone where price moves up.

1.2. Resistance is a zone where price moves down.

- Support and Resistance can interchange when that zone is overcome by price

2. Support and Resistance levels

2.1. Horizontal line

2.2. Trendline

2.3. Moving averages

2.4. A Fibonancci level that you often use (Fibo 61.8)

2.5. A ratio of pattern AB=CD , or a Fibo derived from Harmonic pattern

….

Support and Resistance level are mostly depending on the trading skills and experiences of individuals

You and me would discuss a way to draw a horizinteal line

- S1: Change the chart to Line chart (because I prefer Closed price)

- S2: Choose zones where price is mostly reacting to that zone, then draw a horizontal line at those zones

- S3: Change back chart to candle chart of bar chart and adjust the horizontal line to make it look approriate

Just only 3 steps for us to draw a support/resistance line

o Attention:

- I emphasis that Support/Resistance is a zone, not a line. We usually based on historical data to plot the horizontal support/resistance zone. There fore, the close of candle or the shadow of it getting over that zone are quite common

- Because we base on historical data to plot it, so it doesn't have significant value in some specific cases. Not every time that price approaches that zone and bounce back. And not all the bouncing back case meet our expectation.

- All should depend on the surrounding theme of market, we have to look careful on specific cases to consider applying the Support/Resistance zone logically.

- All market are freely traded so there is always a chance to form a brand new Support/Resistance .

Good luck !

Support and Resistance, A way to draw a horizontal line !Support and Resistance, A way to draw a horizontal line !

Support, S and Resistance, R

1. Definition

1.1. Support is a zone where price moves up.

1.2. Resistance is a zone where price moves down.

- Support and Resistance can interchange when that zone is overcome by price

2. Support and Resistance levels

2.1. Horizontal line

2.2. Trendline

2.3. Moving averages

2.4. A Fibonancci level that you often use (Fibo 61.8)

2.5. A ratio of pattern AB=CD , or a Fibo derived from Harmonic pattern

….

Support and Resistance level are mostly depending on the trading skills and experiences of individuals

You and me would discuss a way to draw a horizinteal line

- S1: Change the chart to Line chart (because I prefer Closed price)

- S2: Choose zones where price is mostly reacting to that zone, then draw a horizontal line at those zones

- S3: Change back chart to candle chart of bar chart and adjust the horizontal line to make it look approriate

Just only 3 steps for us to draw a support/resistance line

o Attention:

- I emphasis that Support/Resistance is a zone, not a line. We usually based on historical data to plot the horizontal support/resistance zone. There fore, the close of candle or the shadow of it getting over that zone are quite common

- Because we base on historical data to plot it, so it doesn't have significant value in some specific cases. Not every time that price approaches that zone and bounce back. And not all the bouncing back case meet our expectation.

- All should depend on the surrounding theme of market, we have to look careful on specific cases to consider applying the Support/Resistance zone logically.

- All market are freely traded so there is always a chance to form a brand new Support/Resistance .

Good luck !

The continuous feedback loop of a successful traderDo you know what’s more important than winning in trading? It is knowing exactly why you actually won . Why? So that you can do it constantly. Needless to say, it is equally important to know why you lost when you lost.

The successful trader is constantly winning money, no matter the conditions. The economy may be in recession … or not … Algorithmic trading may be accounted for most of the trading volume. The volatility may be over the edge or down to ridiculous levels due to the summer holidays. So what … these are all part of the job . You need to make money because this is your job and if you complain and blame external factors for your poor results then think about choosing another profession.

Many would ask how is that possible … to constantly make money in ever-changing markets? Among the other 999 little things, your overall strategy is built upon there is one directly linked to your consistency. That is the continuous feedback and adjustment loop of your trading approach . This is where your post-trade analysis takes place and where you should find out WHY you won or lost.

For a discretionary trader, this feedback loop is not an easy thing to put in place, but it’s crucially important to have it. Because, the more useful you want the feedback, the more accurate the analysis should be. The difficulty of building the whole feedback mechanism is finding a fine balance between the depth of the trading details you take into consideration and the time and effort needed for analyzing them. From personal experience, I can tell you that you may fail to have a useful mechanism if you are too superficial. You might as well get lost in “analysis paralysis” as well as if you go too deep. That level of needed compromise is somehow personal. You know you’ve reached it when it can answer the following questions:

1. Is your selection technique giving you enough opportunities per your time frame?

2. Are your entries able to give you the price moves you want?

3. Are your exit techniques able to cut your losers short and let the winners run?

If the answer is “No” to any of these questions then you need to ask the next question “Why?” and dissect the effectiveness of that particular technique. Be ready to do the required adjustments if necessary.

There is a point in a trader’s career when being able to answer these questions alone will be more useful than an advice from the mentor. From that point on you can be on your own.

How To Trade Bearish Pattern's like Professional🗒 Just browsing through my analysis means a lot to me.

➡️ Please follow the analysis very carefully and every detail of the chart means a lot. And always entry depends on many reasons carefully studied

Always enter into deals when there are more than 5 reasons

combined

-----------------------

How To Trade Bearish Pattern's like Professional

-------

1 ) Descending Triangle

What is Descending Triangle

---------

This Triangle Contain 3 lower Higher &

3 - 2 Same level - and that mean there is

Selling Pressure on this area

--------

Target will be The Same Distance From

B : C -

IF This Area 200 PIP Target will be

200 PIP --

Stop loss Above

Down Connected line B - D

------------------------------

2 ) Symmetrical Triangle

What is Symmetrical Triangle

---------

This Triangle Contain 3 Higher low's &

3 - 2 lower high - and that mean there is

buy'er & sell fight's in this area -

and the winner who will break that Triangle

Target will be The Same Distance From

B : C -

IF This Area 200 PIP Target will be

200 PIP --

Stop loss Above

Down Trend line B - D

-----------------

3 ) Triple Top Pattern

WHAT IS A TRIPLE TOP?

-------------------

The triple top pattern entails Three high points

within a market which signifies an impending

bearish reversal signal. A measured decline in

price will occur between the Three high points,

showing some resistance at the price highs

Stop loss Above

Half Distance From Top to Nick line

----------------

4 ) Head & Shoulder Pattern

Target Same Distance From

Head To Nick

---------

If The Distance From Head To Nick is

200 PIP -- So Our Target will be 200 PIP

-----------

And Stop loss Will be 32 %

Of the 200 PIP Distance

---

Or Will be above Down Trend

That Connected

From Head To Right Shoulder Line

Stop loss Above

Down Connected line

From Head To Shoulder

-----------------

5 ) Up Channel Pattern

Target Same Distance From

Upper line To lower line

-------------

IF The Distance From Upper line To

lower line 200 PIP -- So Our Target

will be 200 PIP

------

Stop loss will be 32 % of Our Target

or near From middle line Of Broken

Channel

Stop loss Will be Above

Broken Channel Lower Line

/ Near Fro Channel Middle line

Risk : Reward

1 : 2 / 1 : 3

--------------

6 ) Inverted

Cup & Handle Pattern

What is an ‘inverted cup and handle’?

If you look at the regular cup and handle

pattern, there is a distinct ‘u’ shape and

downward handle, which is followed by

a bullish continuation. This means the

inverted cup and handle is the opposite

of the regular cup and handle .

Instead of a ‘u’ shape,

it forms an ‘n’ shape, with the handle

bending slightly upwards on the chart.

Stop loss Will be Above

Broken Support

Near From Handle

Sell Here

-------

Risk : Reward

1 : 3 -

Same Distance From Cup

to nick

--------------------------

7) Bearish Flag Pattern

The bear flag formation is

------------

underlined from an initial strong directional

move down, followed by

a consolidation channel in an upwards

Target Will be same Distance From Upper

line of flag to lower line

Stop loss Above

Flag middle line ( Channel )

Sell Here

-------

Risk : Reward

1 : 3

--------------------

8 ) Double Top Pattern

WHAT IS A DOUBLE TOP?

-------------------

The double top pattern entails two high points

within a market which signifies an impending

bearish reversal signal. A measured decline in

price will occur between the two high points,

showing some resistance at the price highs

Stop loss Above

Half Distance From Top to Nick line

Sell Here

-------

Risk : Reward

1 : 3 - 1 : 2

--------------------

9 ) Bearish Rectangle Pattern

4. Bearish Rectangle

-------------

The bearish rectangle pattern

characterizes a

pause in trend whereby price

moves sideways

between a parallel support

and resistance

zone.

Stop loss Will be Above

Broken Rectangle

or Near to Middle line

Sell Here

-------

Risk : Reward

1 : 3 - 1 : 2

-----------------------------

Hope you Enjoy Guys with this content Tumps Up Please and Support me with like and Comment

AKRO is going to lift off hardHere I share you an idea about AKRO.

Its a lowcap, a bridge between Ethereum and Polkadot.

Defi project, one of the firsts to join the Polkadot ecosystem, and printing a beautiful reversal in both pairs, USD and BTC.

I expect at least a x2, and then a x4 would be around 600M mktcap. Nothing unseen.

Target around 0.2 dollar

Could go higher, but would be sweet to be there at least.

What do you think? Tell me in the commments your idea!

Cheers!

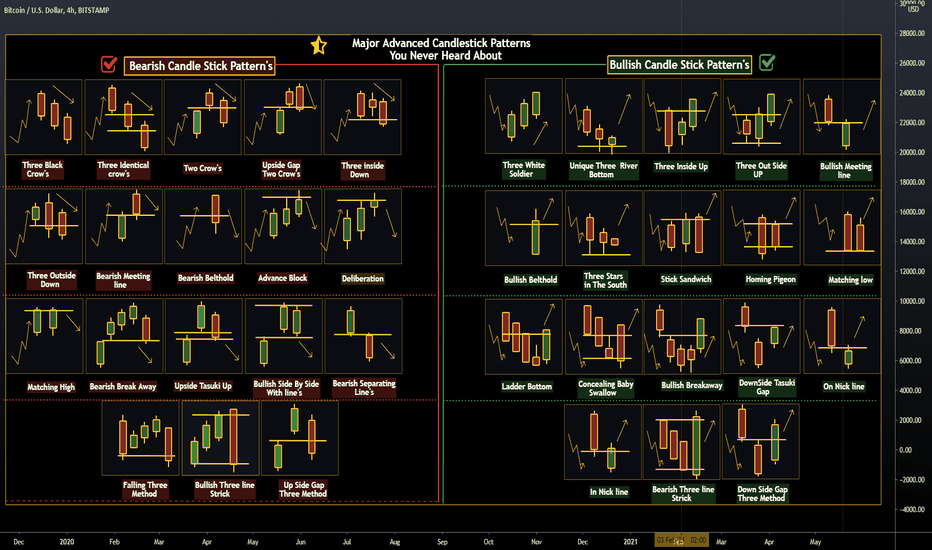

Major Advanced Candlestick Patterns You Never HeardCandlestick Definition

-----

What Is A Candlestick?

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price (black/red if the stock closed lower, white/green if the stock closed higher).

KEY TAKEAWAYS

Candlestick charts display the high, low, open, and closing prices of a security for a specific period.

Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States.

Candlesticks can be used by traders looking for chart patterns.

The candlestick's shadows show the day's high and low and how they compare to the open and close. A candlestick's shape varies based on the relationship between the day's high, low, opening and closing prices.

Candlesticks reflect the impact of investor sentiment on security prices and are used by technical analysts to determine when to enter and exit trades. Candlestick charting is based on a technique developed in Japan in the 1700s for tracking the price of rice. Candlesticks are a suitable technique for trading any liquid financial asset such as stocks, foreign exchange and futures .

Long white/green candlesticks indicate there is strong buying pressure; this typically indicates price is bullish . However, they should be looked at in the context of the market structure as opposed to individually. For example, a long white candle is likely to have more significance if it forms at a major price support level . Long black/red candlesticks indicate there is significant selling pressure. This suggests the price is bearish . A common bullish candlestick reversal pattern, referred to as a hammer , forms when price moves substantially lower after the open, then rallies to close near the high. The equivalent bearish candlestick is known as a hanging man . These candlesticks have a similar appearance to a square lollipop, and are often used by traders attempting to pick a top or bottom in a market.

Traders can use candlestick signals to analyze any and all periods of trading including daily or hourly cycles—even for minute-long cycles of the trading day.

Two-Day Candlestick Trading Patterns

There are many short-term trading strategies based upon candlestick patterns. The engulfing pattern suggests a potential trend reversal; the first candlestick has a small body that is completely engulfed by the second candlestick . It is referred to as a bullish engulfing pattern when it appears at the end of a downtrend, and a bearish engulfing pattern at the conclusion of an uptrend. The harami is a reversal pattern where the second candlestick is entirely contained within the first candlestick and is opposite in color. A related pattern, the harami cross has a second candlestick that is a doji ; when the open and close are effectively equal.

Three-Day Candlestick Trading Patterns

An evening star is a bearish reversal pattern where the first candlestick continues the uptrend. The second candlestick gaps up and has a narrow body. The third candlestick closes below the midpoint of the first candlestick . A morning star is a bullish reversal pattern where the first candlestick is long and black/red-bodied, followed by short candlestick that has gapped lower; it is completed by a long-bodied white/green candlestick that closes above the midpoint of the first candlestick .

LETS TAKE EMOTIONS OF TRADING!This post is a piggy back of a detailed analysis i posted earlier, the purpose of this post is to show traders how banks manipulate harmonic patterns and other strategies like Elliot wave and wyckoff. If you agree with this market cycle like and leave some feedback, I'd appreciate it!

Manipulation Scenario :

1. Support was tested several times and finally (looks) a breakdown. Maybe some traders will sell on break support.

And put SL a little above the candle that breaks the support. But the price made a pinbar / hammer, went back up and touched SL.

2. After the SL is touched, the price finally breaks the trendline and closes above it.

Traders will think this is a false break with the trendline breakout confirmation and become a best time to buy with SL just below the previous low. However, prices fell back and touched SL for the second time.

3. After the SL has been touched, the price create a pinbar which is an indication of buyer's pressure.

Traders might think not to be fooled once again and think that the support is really broken and decide to sell in the SBR area with SL above the previous high. But again, the price was not friendly and touched SL once again.

4. The price finally made an upside impulse and formed a bullish pennant which became a continuation pattern.

With this pattern the trader should take a long position. However, due to doubt and don't want to become a victim of SL for another time, trader decided not to open a position. And the result is price actually goes up without being able to get some profit.

After being hit by SL several times it does disturb our emotions as traders, but if we have calculated each risk of SL before jump into trade and put SL which suitable with our risk tolerance, it shouldn't be a problem.

JUST ENJOY THIS PROCESS