Educational

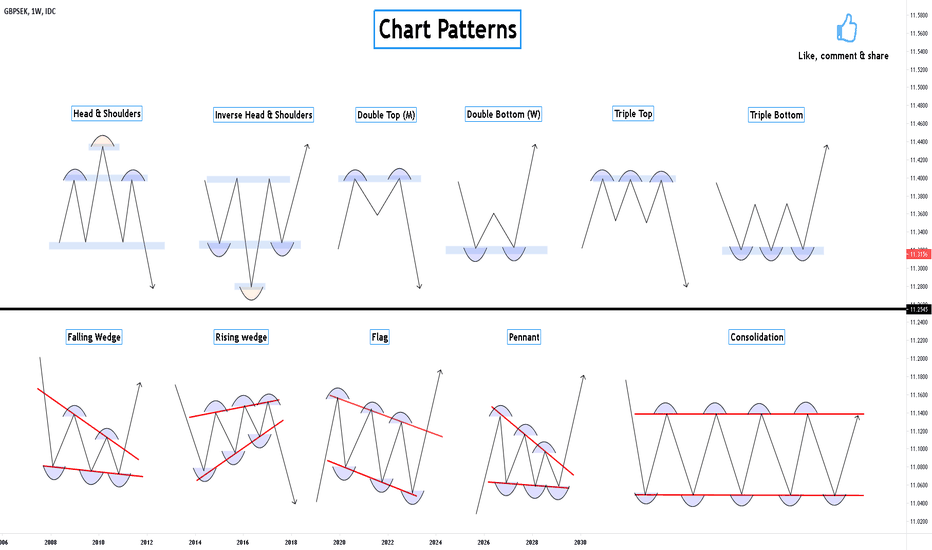

11 Chart Patterns you need to know in 2021Hello Traders,

Here is some Educational Chart Patterns that you should know in 2021.

Most of these patterns are seen daily in Stocks, Forex and different markets across the globe.

I hope you will find this information educational & informative.

Your support is appreciated with a like & Comment

Head and Shoulders Pattern

A head and shoulders pattern is a chart formation that appears as a baseline with three peaks, the outside two are close in height and the middle is highest.

In technical analysis, a head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal.

Inverse Head and Shoulders Pattern

An inverse head and shoulders is similar to the standard head and shoulders pattern, but inverted: with the head and shoulders top used to predict reversals in downtrends

An inverse head and shoulders pattern, upon completion, signals a bull market

Investors typically enter into a long position when the price rises above the resistance of the neckline.

Double Top (M) Pattern

A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs.

It is confirmed once the asset's price falls below a support level equal to the low between the two prior highs.

Double Bottom (W) Pattern

The double bottom looks like the letter "W". The twice-touched low is considered a support level.

The advance of the first bottom should be a drop of 10% to 20%, then the second bottom should form within 3% to 4% of the previous low, and volume on the ensuing advance should increase.

The double bottom pattern always follows a major or minor downtrend in a particular security, and signals the reversal and the beginning of a potential uptrend.

Tripple Top Pattern

A triple top is formed by three peaks moving into the same area, with pullbacks in between.

A triple top is considered complete, indicating a further price slide, once the price moves below pattern support.

A trader exits longs or enters shorts when the triple top completes.

If trading the pattern, a stop loss can be placed above resistance (peaks).

The estimated downside target for the pattern is the height of the pattern subtracted from the breakout point.

Triple Bottom Pattern

A triple bottom is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears).

A triple bottom is generally seen as three roughly equal lows bouncing off support followed by the price action breaching resistance.

The formation of triple bottom is seen as an opportunity to enter a bullish position.

Falling Wedge Pattern

When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move.

The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline.

Before the lines converge, price may breakout above the upper trend line. When price breaks the upper trend line the security is expected to reverse and trend higher.

Traders identifying bullish reversal signals would want to look for trades that benefit from the security’s rise in price.

Rising Wedge Pattern

This usually occurs when a security’s price has been rising over time, but it can also occur in the midst of a downward trend as well.

The trend lines drawn above and below the price chart pattern can converge to help a trader or analyst anticipate a breakout reversal.

While price can be out of either trend line, wedge patterns have a tendency to break in the opposite direction from the trend lines.

Therefore, rising wedge patterns indicate the more likely potential of falling prices after a breakout of the lower trend line.

Traders can make bearish trades after the breakout by selling the security short or using derivatives such as futures or options, depending on the security being charted.

These trades would seek to profit on the potential that prices will fall.

Flag Pattern

A flag pattern, in technical analysis, is a price chart characterized by a sharp countertrend (the flag) succeeding a short-lived trend (the flag pole).

Flag patterns are accompanied by representative volume indicators as well as price action.

Flag patterns signify trend reversals or breakouts after a period of consolidation.

Pennant Pattern

Pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis.

It's important to look at the volume in a pennant—the period of consolidation should have lower volume and the breakouts should occur on higher volume.

Most traders use pennants in conjunction with other forms of technical analysis that act as confirmation.

Consolidation Pattern

Consolidation is a technical analysis term used to describe a stock's price movement within a given support and resistance range for a period of time. It is generally caused due to trader indecisiveness.

Consolidated financial statements are used by analysts to evaluate parent and subsidiary companies as a single company.

Thanks for Reading, ill see you in the next Educational Post

Global Fx Education

" INTRA-DAY PATTERNES " To Get 50-100 Pips Daily Hi Pro Trader's .. Hope You Be Fine ♥️

Today We Have New Education Lesson .. About INTRA-DAY PATTERNES

1- Ascending Triangle

2- Descending Triangle

3- Channel

4- Trends On 5 Minutes Frame

If you follow Those Pattern You Will Get Daily 50-100 Pips ✔️

Best Pairs : GBPUSD / EURAUD / EURNZD / Gold / Dawjones

Be Safe - Trade Safe ✔️✔️

GBPUSD PROFITABLE STRATEGY This idea is for educational purpose

Is trading easy ? Answer is simply No unless you don't know about trading , Most of the traders who start trading they lose their money in first three months and always blame them self.

Now how to be profitable in Fx Trading

Few Steps which are very important and every trader must follow

1. Trade plan : Always plan your trade and than trade your plan, mark your charts, tradingview is one of the best platform available which provides you all kind of tools which are very helpful in marking charts

Identify entry and exit points and mark them don't leave position open when you are uncertain of market. Don't enter the market without plan learn to wait let market reach your desired entry point

2. Trend is your friend identify the trend on monthly, weekly, daily and four hourly time frame look for support and resistance levels, mark demand and supply zone on your chart only enter when the market reaches your desired range.

3. Control your emotions don't get attracted by false move (breakouts) you will lose, Trust you analysis.

4. I will suggest select one currency pair and keep your self updated on all news economic data release, master that pair mark and remember all entry points by heart only possible if you have carried out proper planning.

5. RISK MANAGMENT . Risk management is key to success in trading. trade plan with proper risk management is always a winning trade let me explain it Take a pair GBPUSD as show on chart mark all resistance and supports demand and supply zone draw trend lines you will get some idea where the pair is going, read the news about dollar and GBP now picture will be clear to you for trading. Let suppose we get that trend is bullish identify buy and sell zones as marked on the chart. now when market reaches your buying point split your buy mean if you have 10000$ account use 1:5 maximum leverage not more than that. open first position in buy zone with minimum volume with stoploss 30 pips down and take profit at 90 pips (0.05 stoploss at 30 pips if hit you will lose 15$ and if TP hit you will get 45$) let suppose SL is hit now open another buy with double volume (.10 same stoploss at 30 pips and TP at 90 pips) i assure you in 90% cases this stoploss will not be hit and you wil end up in 90$ profit mean you lost 15$ but you secured 90$ which mean you have earned total 75$ profit. even if this stoploss is also hit open another buy with .15 volume and same stoploss and take profit the end result will be good profit.

6. If this is helpful please do like and follow for more updates i have selected only GBPUSD pair for trading. my buying points were 1.3580-60, 1.3624-1.3610 and same strategy as i have discussed in Risk Management and selling point i have marked already so far in this week secured 65 pips and right now one trade in profit floating 35 pips

Please Do Like & Comment and must follow if this is helpful

Short on USDCHF 1H Chart (Prepare to Sell) Analyzing USDCHF 1H chart.

Actual conditions:

1. Few days Range broken

2. Returning and touching S&R .

3. EMA in right position ( Using EMA like S&R ).

4. Bearish candles stronger than Bullish candles.

4. Waiting for Stoch and RSI to become OverSold .

Patiently waiting.

Do you have any other idea about it?

The Forex market can bring you freedom. Freedom of Time and Money. Study the markets, Study yourself. Believe .

Disclaimer: This analysis is just educational for me and others. If you take this trade, you're taking it at your own risk.

FX:USDCHF

AMT LONGNYSE:AMT

This is solely for educational purposes.

This is my first sharing. I am testing my strategy which is based on combination of fundamental and technical analysis. My objective is to find good investment opportunities.

Analysis

I notice the price is making a trend change upward after bouncing at FIbo 61.8. Do notice there is a strong resistance at the top @ 268.64. The potential reward is about 17-18%.

Strategy

I would place a LONG order at the high of the candle on 25 Jan 2021 @ 229. Stop loss ard 203. Profit taking ard the resistance which is 268.64.

What kind of Trader are YOU?🟢 A scalper , is a kind of trader that usually buys and sells an individual stock multiple times throughout the same day.

They hold a position for few seconds or few minutes, trading during the busiest and most liquid market hours.

Scalpers aim for very small profits on each trade, the large number of trades they open during a day can easily return significant profits by the end of the day.

Be a scalper is not that easy, if you can't keep focusing on your screen for hours each day, it probably won't suit your life style.

🟢 A day trader open and close substantially less setups compared with scalpers, normally one or few setup every day.

Although they both trade intraday, the day trader's strategy is to focus on the best opportunities of the day, and to hold on for a larger profit target.

Therefore, a day trader usually holds on to a trade for several hours but not more than one full trading day. Ultimately the goal of a day trader is to aim for a larger piece of the expected daily price movement within one trade

🟢 Swing traders normally trade on higher time frames, from H4 to daily charts, holding a position for few hours, days or sometimes weeks!

They always are looking for great opportunities that could give them more profits and large targets

Swing traders must familiarise themselves with technical analysis, using these techniques as a set of guiding principles for their decisions and also have an understanding of fundamental analysis, examining the asset’s fundamentals to support their technical evaluation.

🟢 Position traders usually hold a stock for an extended period of time, typically several weeks or years. A position trader generally does not let daily price motion or market news influence their trading strategies. Instead, they are focused on long-term outcomes and allow their particular holdings to fluctuate in sync with general market trends over the short-term.

They usually need to be really patient and wait several weeks before getting the perfect opportunity to get into a trade!

What kind of Trader are you?

Trade Safe and Responsibly ,

Gianni

Trading Errors / Trading Success In Market - 10 Golden Tips -Hi Trader's .. Hope You Be Fine .

Today We Have A New Education Lesson To How To Success In Trading --- And Golden Tips .

-- Golden Tips To Continue In Market --

1-Don't Start Within 500$

2-Learn And Choose Good Strategy First

3-Traning On Demo Account For 1-3 Months With One Strategy

4-Foucs On 4-5 Pairs Only To Understand There How To Move

5-Don't Trade In High Spread

6-Don't Trade With High News

7-For Every 500$ Only USE 0.01 And Just 5 Open Trades In Same Time

8-Use Stop Lose

9-Don't Use Hedge

10-Don't Forget 1/2/3/4/5/6/7/8/9 Tips ♥

Be Safe -- Trade Safe