Split entries Protect and safeguard capital.Vishal Baliya is Author of the book: The Happy Candles Way to wealth creation. (Available on Amazon in Paperback and Kindle version)

Split entries Protect capital and reduces losses:

Many times I get the question: What are the best friend of investors?

My answer here would be: Stop losses, trailing stop losses and Split entries.

We will talk about Stop loss and Trailing stop loss in a separate article but today we will talk about Split entries. On the onset let me clarify this is not a call of any company. The chart used below is to explain the process of Split entries in stock market. Breakouts are a great thing. Lot of people make money through breakout trading and lot of people make even more money through breakout investing. But even after selecting a stock after proper due diligence, consulting your financial advisor, reading intrinsically about the company, making charts, studying fundamentals there is a possibility that breakout still might fail. No one can be 100% sure otherwise all investors would be multi Billionaires.

This is because there is inherent risk in investment whether it is equity or any other form of investment. More so in equity as there are many macro and micro economic and factors at play. Some or most are beyond control of even the promoters of the company or mega investors. Thus when you are not 100% sure of a breakout and there are important resistances still at play, you can opt for split entries.

Now have a look at the chart below.

In the chart you can see how this stock took the support of 200 days EMA Father Line after making a bottom near 3311. Zone A to Zone B is the area where we feel that the stock has completed the process of bottom formation and is turning around. Say you want to invest Rs. 21,000 in this company. Your X here is 21000. X/2 = 10,500 and X/3 = 7000 and so on. (X being the money you want to invest in a particular company.) Instead of going all in between zone A and Zone B shown in the chart. You can go X/2 between zone A and B. Why so? Because there is an important hurdle of Mother line at 50 days EMA still to be crossed. Suppose the Mother line acts up and stops the rally and stocks turns bearish your X/2 capital is still intact. To protect remaining X/2 there is a stop loss. In case the stock turns bearish, your Rs. 10,500 is intact. Suppose you have kept stop loss at 10% of your capital deployed. 90% of your X/2 is safe plus 100% of your X/2 capital which you are yet to invest is also safe. Thus Split entry protects your capital. Now ideal scenario in my opinion would be X/2 entry between Zone A and B. Second X/2 entry between zone B and C where you got a breakout confirmation when the stock has confirmed its bullishness as the stock has given a closing above Mother line which is 50 days EMA. To know about the Mother, Father and the Small Child Theory please do read my book: The Happy Candles Way to Wealth Creation which is available on Amazon in paperback and Kindle version. Which explains in depth many such concepts which will help you as an investor.

The argument against such an investment would be: Ah! If I would invest my full capital between Zone A and B. And cruise till Zone D. I will make more money. Definitely you would. But there was a greater risk compared to split entry. Even if you take a split entry between Zone A and B and Second X/2 entry between zone B and C and cruise till Zone D, you will still make a good amount of money. The risk you would have taken in case of split entry would be much less compared to having invested all your capital in one go.

Pyramiding Split Entry Approach:

Another kind of split investment is Pyramiding. In Pyramiding you gradually increase your investment in an equity after every positive breakout. Usually at a price higher than the previous one. Like base of the pyramid is large your first investment is high and gradually decreasing the quantum of investment. I personally use split entry/pyramiding split entry approach in many of my equity related investments.

Disclaimer: There is a chance of biases including confirmation bias, information bias, halo effect and anchoring bias in this write-up. Investment in stocks, derivatives and mutual funds is subject to market risk please consult your investment advisor before taking financial decisions. The data, chart or any other information provided above is for the purpose of analysis and is purely educational in nature. They are not recommendations of any kind. We will not be responsible for Profit or loss due to descision taken based on this article. The names of the stocks or index levels mentioned if any in the article are for the purpose of education and analysis only. Purpose of this article is educational. Please do not consider this as a recommendation of any

Educational

NSE:CERA India toilet boom 🚽 get set go..Half of India couldn't access a toilet 5 years ago. Modi built 110M latrines

Incorporated in July 1998, Cera Sanitaryware Ltd is headed by Mr Vikram Somany; the company manufactures sanitaryware and faucets and outsources wellness products and tiles. The sanitaryware and faucet plants are in Kadi, Gujarat, with capacity of 36 lakh and 18.5 lakh pieces per annum, respectively.

#

The Company has been constantly launching new designs in Sanitaryware, Faucets and Tiles. The new designs are indigenously developed by in-house teams, after feedback from the market. This helps the Company to be seen a leader in product offerings. #

NSE:CERA

HOW TO BALANCE YOUR LIFE AND TRADINGHey! When we all started we passed trough some difficulties in trading.

Usually we face this problems during first year of trading. Most of people by the end of year losing all of money and quit trading forever.

Basically this caused by overtrading and having no idea what to do. Like many business in our lives trading require some abilities and technics which you can study and apply to get good results. But when you are novice trade you probably don't even know where to start.

So on the pic you see basic problems and solutions to start from:

PROBLEMS:

- Worried about trades all day and night

This point distracts from important things and giving huge depression in your live.

- Losses affecting personality and mood

When you starting to losing too much, it often hard to get money back, moreover trying to recoup will give even more loss.

- Mindset confusion

Like every depression in our lives it confuses our abilities to think clear.

- Rushing for new trades

Overtrading is common mistake, causing huge losses from impatient traders/investors.

- Trading assets for all of your money

I f you ever tried trading for 100% of your money — write me a comment!

This problem causing new traders losing too much, and trading become gambling.

SOLUTION:

- Plan your trades

Focus on the future trades, plan your entries, take profits, stop loss. Like every business it should be planned and if something not working you have to fix it and try again.

- Take small trades

In trading Small is BIG, start with small trades, don't give rush, if you will not be rich till the end of year it is okay. But first learn how to trade and make sure you learned from mistakes and wins.

- Focus on affordable risk

Yeah, just 10% from traders have profits every month, rest of traders struggling somewhere in the middle. To make sure you will be in 10% winners, try to understand your risks before opening new trades.

- Use trading system

Trading system is something which suits your personality, you have to try different strategies and technics before understanding your trading criterias. But once trading system is setup, you will be fine and closing months in solid profits.

- Take breaks in trading

Make sure you have some time for other activities, try to plan your trading time and sometimes on the market is nothing to do, so take a breath and relax. Market won't go away :)

👍I appreciate your likes and comments below this post, lets discuss our problems in trading! 💬

Education: The 90-90-90 rule - Why do traders fail?" Many are called, but few are chosen ". Ever heard this proverb?

This is certainly true for trading, in fact, there is even a rule in trading about this, the 90-90-90 rule. So what does this rule say?

" 90% of traders lose 90% of their money in 90 days "

😱😱😱

That's right, statistics show that 90% of people who start trading lose the majority of their money in less than 3 months. But why is that so? In this post I will try to lay out the reasons for failure, if you are a new or struggling trader, I'm sure you'll find this useful. Let's get into it ...

🤯 EXPECTATIONS

Many start trading because they've seen or read about success stories, people becoming rich overnight, they might even have a friend who has been successful in trading and they think (to say it in Jeremy Clarckson's famous words) " How hard can it be? . With this approach, failure is imminent...

📐 NOT HAVING A PLAN

" If you fail to plan, you are planning to fail - Benjamin Franklin. Trading without a plan results almost certainly in failure. Your trading plan should include the definition of your setup, entry, stop loss, profit taking, trade management, risk management and money management.

🔄 NOT TESTING YOUR PLAN

OK, you have determined how you will trade, what defines your entries and exits, how much of your capital you will risk and how you will manage your trades. But do you know what is the expectancy of that plan? Do you know how much trades you will win on average, and how many you will lose? How much money can you expect to make?

Backtesting your plan, executing it flawlessly time after time on historical data will give you that information and the confidence to execute your plan time and time again without hesitation.

😱 EMOTIONS - THIS IS THE BIG ONE!

If did not take the time to create a trading plan and backtest it, you don't really know what you are doing and emotions will have the best of you.

Fear, greed, hope, excitement, anxiousness, boredom and frustration will drive your hard earned capital away from you.

Results of these emotions are : trading too much, letting your losers run and cutting winners short, revenge trading, overleveraging etc...

I could write an entire post about each of the emotions and how they can affect you while trading, but it would make this post too lengthy. Just know that emotions are your biggest enemy when trading, for best results you should be in a stoic state when trading.

🕺 EGO

" The market can remain irrational longer than you can remain solvent. ". If you want to prove the market that you are right, you are doomed to fail. The market is always right, no matter what happens, so you better learn to accept that your analysis or prediction of what would happen was wrong and cut your losses. Fast!

📚 LACK OF EDUCATION

It takes many years to learn a skill or a profession, trading is no different. If you think about making lots of money without putting the time in to learn and test, you pretty much guarantee yourself to fail.

You wouldn't want a lawyer without education to defend you in court, or a self-proclaimed surgeon who learned on YouTube to operate on you, would you?

💰 STARTING CAPITAL TOO LOW

If you're starting with a low capital, you will tend to try and make it grow fast, resulting in taking too many trades, too high of a risk, too high leverage. If you start with a low capital, you'll have to be OK with the fact that it will grow slowly and that it will take (a lot of) time to build up a sizeable account.

🚦 BUYING OR FOLLOWING SIGNALS

" There is no such thing as easy money. " You might think that you don't have the time to learn about trading, making and backtesting a trading plan. So why not follow signals?

Ask yourself what you know about this service? How profitable is it (and don't just go from the claims they make)? Do you know anything about the reason for a signal, why was it triggered?

Have you talked to other users who used the service, what do they think about it? Why is this person/company selling signals if they are so successful as they claim? Philanthropy ? 🤔

📉 INDICATORS OVERLOAD

Indicators can help you make decisions for trading, but too many indicators can and will lead to opposite signals or " analysis paralysis .

Most indicators are derived from price, so it makes sense to learn how to read price action and discover the story behind the candles.

🆕 THE NEXT SHINY OBJECT SYNDROME

You took the time to develop a trading plan and even tested it, but you run into a drawdown... Rather than counting on your experience and the expectancy that you know is there, you look for a new shiny method of trading, until the same thing happens again with this new method ... Rinse & repeat, never giving the chance for your original method, which you know was working when you tested it, to prove its worth ...

Alright, I think I have provided the main reasons why new or inexperienced traders fail. Knowing why they (or you) fail is one thing, doing something about it is not a small feat. But with enough dedication, persistance and the right mindset, you can prove these statistics wrong!

Feel like reasons are missing, let me know in the comments below.

" Trading is a ruthless business that does not take any hostages, better come prepared. - Nico Muselle

So what is your story?

Are you a successful trader now but recognize these reasons for failure?

Are you a new trader? Was this helpful?

What did/will you do to overcome this?

What did/do you struggle most with?

Help the TradingView community by commenting below.

"Trading is a ruthless business that does not take any hostages, so you better come prepared." - Nico Muselle

Liked this post ? "Smash that like button!" 👍 - follow for more educational posts and alerts 🔔 when a new one is published.

Thank you for your visit! 🙏

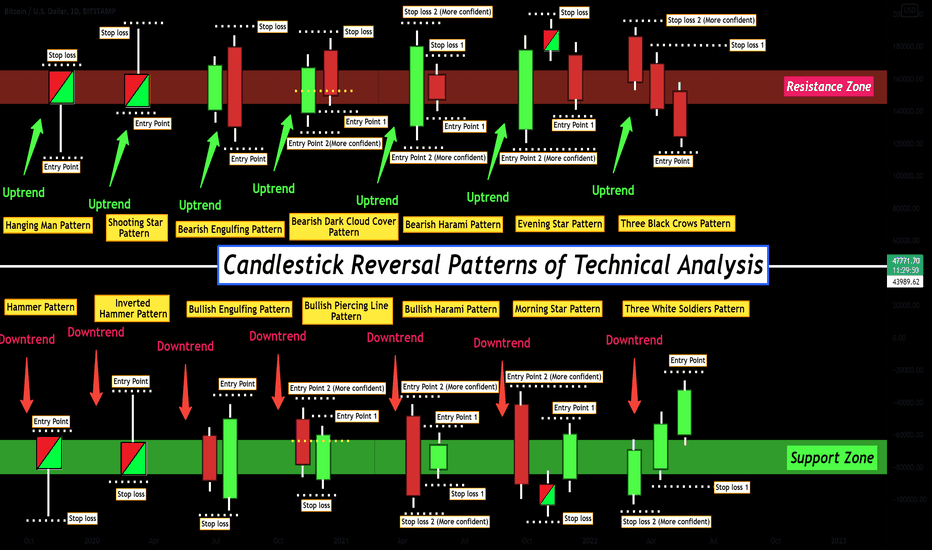

Candlestick Reversal Patterns of Technical Analysis !!!👨🏫 In this post, I tried to show you the most important Candlestick Reversal Patterns of Technical Analysis with Entry points & Stop loss points . you can use these patterns for Triggers of your traders at any timeframe ⏰ (These patterns are more valid at higher timeframes).

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends, Thanks, and Trade safe.

What Is A Candlestick ❗️❓

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and

daily momentum for hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price

(black/red if the stock closed lower, white/green if the stock closed higher).

Bullish Pattern 🌅:

🟢 Hammer Pattern : A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period.

🟢 Inverted Hammer Pattern : The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signaling a potential bullish reversal. The inverted hammer pattern gets its name from its shape – it looks like an upside-down hammer. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick, and a small body.

🟢 Bullish Engulfing Pattern : A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

🟢 Bullish Piercing Line Pattern : A piercing pattern is a two-day, candlestick price pattern that marks a potential short-term reversal from a downward trend to an upward trend. The pattern includes the first day opening near the high and closing near the low with an average or larger-sized trading range. It also includes a gap down after the first day where the second day begins trading, opening near the low and closing near the high. The close should also be a candlestick that covers at least half of the upward length of the previous day's red candlestick body.

🟢 Bullish Harami Pattern : The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

🟢 Morning Star Pattern : A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators.

🟢 Three White Soldiers Pattern : Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high. These candlesticks should not have very long shadows and ideally open within the real body of the preceding candle in the pattern.

Bearish Patterns 🌄:

🔴 Hanging Man Pattern : The hanging man is a type of candlestick pattern. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. The term "hanging man" refers to the candle's shape and what the appearance of this pattern infers. The hanging man represents a potential reversal in an uptrend. While selling an asset solely based on a hanging man pattern is a risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The strength in the uptrend is no longer there.

🔴 Shooting Star Pattern : A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near the open again. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star's body. There should be little to no shadow below the real body.

🔴 Bearish Engulfing Pattern : A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

🔴 Bearish Dark Cloud Cover Pattern : Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle (typically black or red) opens above the close of the prior up candle (typically white or green), and then closes below the midpoint of the up candle. The pattern is significant as it shows a shift in the momentum from the upside to the downside. The pattern is created by an up candle followed by a down candle. Traders look for the price to continue lower on the next (third) candle. This is called confirmation.

🔴 Bearish Harami Pattern : A bearish harami is a two-bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle. An uptrend precedes the formation of a bearish harami.

🔴 Evening Star Pattern : An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. The opposite of the evening star is the morning star pattern, which is viewed as a bullish indicator.

🔴 Three Black Crows Pattern : Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, high, low, and closing prices for a particular security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle. Often, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal.

SPX. The Certainty Trap ‘Never’ &‘always’ have no place in MKTS!Just passing this cool info written by a guy called Ben Carlson.

- Ben discusses the differences between probability and certainty:

"There are two arguments I see on a regular basis that show up as a result of data overload:

…because that’s never happened before.

…because that’s what’s always happened before.

-The problem with this line of thinking is that it can lead investors to fall into what I like to call the certainty trap. It’s this all-or-nothing line of thinking that causes so many to constantly attach extremes to every single market move or data point they see. The beginning of the recovery or the end of the world is always right around the corner. The assumption is that we’re always either at a top or a bottom when most of the time the markets are probably somewhere in the middle."

-The reason the investing certainty trap is so easy to fall for is because historical data can feel so safe and reassuring. Look here, my data says that this has never (always) happened in the past. Surely this trend will continue. I’ll just sit here and wait for my profits to start rolling in.

-‘Never’ and ‘always’ have no place in the markets because no one really knows what’s going to happen next. ‘Most of the time’ is a much more reasonable goal, because nothing works forever and always in the markets. If it did everyone would simply invest that way. I think a much more levelheaded approach is to follow the Jason Zweig 10 word investment philosophy:

-Anything is possible, and the unexpected is inevitable. Proceed accordingly.

This is exactly where ETH will bottom!!!Traders,

This is not a post to start the bears on a name calling rampage. This post is not to get validation from the bulls. This is simply my opinion based on a few different technical theories. Yes, we had another push down, now everyone is saying..... "See, I have been telling you that we are going to $14k and nobody listened, you all cussed me out and now look at you!" "$10k is on its way, just like I have said from bitcoins top at 70k, I am right always because I am the Chart God's son, Ben Liquidated.... f0ll0w me on P@treon for $9783264238976423897 a day. I have never been wrong!".

The fact of the matter is, we have had one Black Swan event after another and you can't chart that. You can do your best to apply your technical analysis which works as well as your average win/loss ratio should tell you from your trading journal.... YOU DO HAVE A TRADING JOURNAL CORRECT?? Yet, sure, you may have called the drop, or the pop and can fell vindicated when the price hits your analysis prediction but, the simple fact is we all have our good calls and our bad ones, some more good than others but, a lot of traders are just starting this journey and opposed to ridiculing them for an opinion based on the TA they know up until this point... give them some sound knowledge, send them a link to a nice educational post on here that could help them grow as a trader. Because at the end of the day, what you scream is wrong in their idea of where the price action will go could end up being right even if they got there the wrong way.

Bottom line, yes, I do believe this is the bottom, I do have TA to back my thoughts up but, this post is to remind everyone on here that this is a community to help people grow as a trader. Not just with the tools that the Dev's have created for us but, also the community they have built and we all provide. So let this be an educational post on ethics and etiquette to be the best person you can be and be helpful. Nobody likes a keyboard warrior nor a d bag. I know that I could be wrong but, the main point of technical analysis is to give you a plan and if it doesn't work in the way you looked forward to, then you have another plan based on it not working out to protect your capital, simple as that.

With all of that said, lets discuss what you think about my bottom prediction and what you think could happen from here forward. I will post my TA in the comments after we get a discussion going.

I look forward to hearing your analysis!

Savvy

Parabolic SARHello, Let us talk about 'Parabolic SAR.'

On this chart: We will read about who developed it, how it works, and how it helps us.

Those who read the book called 'New Concepts in Technical Trading Systems' know that Parabolic SAR was developed by J. Welles Wilder Jr. and published in 1978.

Who is J. Welles Wilder?

He is the creator of several technical indicators that are currently the leading indicators in technical analysis software. These indicators include the Average True Range, the RSI, the Average Directional Index, and the Parabolic SAR.

Let us get to Parabolic SAR:

It stands for Parabolic Stop And Reverse.

In technical analysis of the stock market, Welles Wilder designed Parabolic SAR to find potential changes in the pricing of traded goods such as stocks or currency exchanges such as Forex. It is a trend-track indicator (trend or price tracker) and can be used to determine the break-even point or entry or exit points based on prices that occur during a strong trend in a parabolic curve.

In preceding research based on 17 years worth of data, the parabolic SAR showed a 95% success level.

The indicator appears as a set of points located above or below the price bars in the chart. The point below the price is considered as an uptrend. Conversely, a higher price indicates that bears are in control and likely to remain down. When the points rotate, it indicates that a potential change in price direction occurs. For example, if the points are higher than the price when they go lower, it can increase a higher price. As stock prices rise, make the points, first slowly, then rapidly, and accelerating. SAR starts to move faster as the trend progresses, and the points get priced soon.

When the position of the points moves from one side of the asset price to the other, it produces a parabolic indicator of buy or sell signals. For example, a buy signal occurs when points move from the top to below the price, while a sell signal occurs when points move from the bottom to the top of the price.

The formula of calculation:

Uptrend: PSAR = Prior PSAR + Prior AF (Prior EP - Prior PSAR)

Downtrend: PSAR = Prior PSAR - Prior AF (Prior PSAR - Prior EP)

EP: Extreme Point in a trend

AF: Acceleration Factor (with a default value of 0.02)

How accurate is it?

As we said before, the parabolic SAR showed a 95% success level.

The main advantage of this indicator is that during a strong trend, the indicator indicates that traders should maintain their position.

This indicator also shows the output when there is a move against the trend, which indicates a reverse.

The downside is that it does not provide good trading signals in the side market conditions. The indicator constantly moves up and down the price without a clear trend.

Traders should only trade in the dominant trend direction and avoid trading without a trend. Also, using other indicators such as moving average and parabolic SAR can help prevent such losses.

Suppose you are interested in using this great indicator. In that case, you can go on your TradingView chart and the dashboard, click on 'Indicators & Strategies' and search for Parabolic SAR and find the best one suited for you.

Have you ever used this indicator? What do you think the pros and cons are?

Let us know your ideas.

Good luck.

Two Types of Elliot Wave CorrectionsWhen it comes to Elliot Wave Theory, we know of two different correction patterns .

On the left you can see the classic correction, which is less common in real market situations. On the other hand, the flat correction (right) occurs more frequently in the market, since modern price action is often characterized by fakeouts . In this case, a fakeout looks like a wave B making a new high above wave A. In most cases, traders would open a trade here due to a structural break, which then runs against them (bull or bear trap).

In the following table you can see how the respective correction patterns differ from each other and what you need to pay attention to.

It is very important that you learn how to use Fibonacci tools correctly so that you can calculate the wavelength properly. Maybe I'll do a separate educational post on the proper use of those tools in future.

Thank you very much for your attention,

Your RT

The Investor Mentality: Are You a Worthy Investor?There are two types of people: people who will read through this entire post and put themselves on a life-changing path towards generational wealth by understanding the essence of investing, and people who simply won't read this post. This post may be lengthy and abstract, but I guarantee you that comprehending the concept of what it means to invest, and how to do so, can change your life forever.

This is not financial advice. This is for educational purposes only.

Capitalism is much simpler than you think. The goal of the game, as the name suggests, is accumulating as much capital as possible. Interestingly enough, there are only three ways to achieve this goal, and if anyone tells you otherwise, they're either lying or they're a crook. The method is simple - you need to own the three means of production: land, labor, and capital.

Land: Only 30% of earth's surface is covered by land. Land, contrary to common belief, is rare in the sense that it's limited. If you own land, you can have factories and houses built on your land, through which you can receive rent. This was also prevalent in the past where aristocrats allowed peasants to farm on their properties, taking a certain percentage of the crops that were harvested without even breaking a sweat.

Labor: When you own labor as a means of production, it essentially means that you run a business. What this implies might not be intuitive, but it simply means that you're paying money to buy someone's time. Time is a resource that is much more important than money. Money is infinite, and can even be printed. As for time, both Jeff Bezos and a freshman at college both get 24 hours a day. The difference between the two, is that Jeff Bezos can pay the freshman and hire him to work on whatever needs to be done. Essentially, Jeff is paying to buy the freshman's time, a limited resource.

Capital: Capital is the magic sauce that allows all of this to happen. You can buy land, buy someone else's time, and even buy companies that do all of the above on your behalf. But, capital is no good if you don't make that capital work for you. You can lend capital to someone who needs it, and receive interest payments. In this case, interest is simply understood if you think about it as the cost of borrowing money. The name of the game is to either make the capital work for you, or convert that capital to other means of production, which then bring you more capital, ultimately creating a virtuous cycle.

When people invest in stocks, oftentimes they get too caught up and focus only on the price action, and forget the fact that buying a stock represents ownership of the company. In other words, if you own 10% of Tesla's shares, you have ownership of 10% of the company whether the company is valued at $800B or $2T. So what do you do when a company that's supposed to be worth $1T, judging by the amount of money it makes (cash flow) and the growth it's showing, drops to $800B? The most logical course of action is to buy more shares. You want to buy more ownership of the company for a cheap price, because you know that the company is going to buy other people's time (labor) and use that to generate more capital for you.

It seems so easy, but there's a reason why most people fail at investing. Our brains are biologically wired to focus on short term consequences, and we fail to look at what's best for us in the long term. Thus, we make dumb mistakes like selling perfectly good assets just because "the price dropped too much".

"A price drop is an opportunity to buy more of a good prospect at cheaper prices." - Peter Lynch

Unfortunately, most people sell when the price drops, because fear, uncertainty, and doubt take over their mind. There is a reason why billionaire hedge fund manager Bill Ackman bought over $1.1B worth of Netflix stocks when the price dropped. He saw no fundamental changes to the company, yet the price dropped due to certain people's irrational decision to sell. And I'm very positive that there's a high chance that Bill will be the last one laughing in the end.

I believe that there are only three reasons for you to sell a perfectly good asset: 1) when the narrative has changed (fundamental change in the asset), 2) when you find a better asset, and 3) when selling is inevitable to save your entire position (ex. selling to pay taxes). Unless there is a clear reason for you to sell that fits into one of these three criteria, selling is probably not the best idea. If you truly understand what it means to invest, and convince yourself on why you should be buying or selling at certain levels, you can, and will become a successful investor. Think big, be optimistic, and have patience.

If you like this educational post, please make sure to like, and follow for more quality content!

If you have any questions or comments, feel free to comment below! :)

TESLA - just an idea. It may happenTesla stock is showing some bearish signals. Is forming a double top with two big weekly reversals candles. Also shows bearish divergence against the RSI in the weekly timeframe. On the other hand, price is trading within a huge megaphone bearish pattern. The price is hanging by a thread. If it breaks the support, is going down hard. Personally, I don't think Tesla is making ATH again. That's it for Tesla. I'm not short or long in this stock, too speculative for me, but the chart doesn't look pretty for holders.

Lets talk prop firms❗Its the buzz words and hot topic of the moment! PROP FIRMS

Before I start on this topic I want confirm I am a funded trader. This post isn't to promote this style of trading or prop firms.

I am writing this post for those who may not understand what a prop firm is and to share my own experiences on the route to being a funded trader.

What is a prop firm?

Proprietary trading is where a firm trades for its own financial gain instead of earning commissions for clients.

What is a prop trader?

A prop trader is someone who uses that firms money to trade with and in exchange receives a wage or a percentage of the profits.

Now those two statements above probably ring more true for those who work for financial institutes on trading floors all around the world.

The propriety trading firms I want to talk about are the retail prop firms that usually for a subscription or a challenge fee will allow you as a trader to trade funds provided by them.

Any profits you make on that account you as the trader will receive a share of the profits. Usually 70-80%.

The business model has drawn a lot attention some good and some bad.

So this seems a good starting point to discuss what we know of the business model.

To become a funded trader with these companies you must either pay a subscription or take a challenge.

You rules and conditions of which you have to abide by in order to gain and keep funded accounts.

Subscriptions model

This route to prop funding tends to be a monthly reoccurring payment. You are then given an account to trade with stipulations attached.

For the subscription model the rules on the account tend to be very tight/strict and the fee can be quiet hefty.

Challenge model

This route to funding is where the trader pays an entry fee in to a challenge to prove their trading credentials.

The trade will be set targets to meet over one or two phases in order to secure funding.

The account will have rules and stipulations applied for example 10% overall draw down.

If funding is secured then most companies refund the entry fee and you then as a funded trader earns money of any profits made on your funded account.

So that's the options to becoming a funded trader.

The retail prop firm business model has been criticised because some of these funded accounts are demo accounts once gained.

Some say these companies only make money off failures and that's why even their funded traders who have passed are only ever trading demo accounts.

Some prop firms on completion of challenges give you real accounts. But do we truly know they are real or does it just say real?

A prop firm most definitely makes money from failed challenge attempts as part of it's business model. No one will ever know for real if they copy trade their top funded traders either.

But in my opinion they would be daft not to copy trade consistent performers that take payouts of these firms every month because they exists.

Prop trading pros and cons.

Their is pro and cons to any choice in life and prop trading is no exception.

I'll cover my personal pro and cons to the prop world below.

PROS

-For traders who are consistent and proven but only have small capital available, Prop trading is a good route to potentially larger trading pots.

-Most prop firms have scaling plans

-Prop firm gives trader the opportunity to funding most would never of got if they didn't exists. Most would never get an the opportunity to trade for a big institute. Prop firms bridge that gap.

-Given the amount of firms popping up a consistent trader could soon find themselves with a diverse portfolio of accounts giving some life changing chances and monthly profit opportunity.

-Most prop firms have favourable commissions and spreads with some having no commissions what so ever.

-Reduced personal risk . Worse case scenario for a funded trader is losing the account rather than massive personal losses.

CONS

-Even when funded you have to adhere to rules and terms of the prop firm

-You could spend big money getting traded

-The health of the prop firm you trade for is unknown and one prop firm has already dis-appeared.

-In reality the targets set are gain the funded account is quiet high at 8-10% in 30 calendar days.

-Violation of rules ends in account loss.

Summary

I can only speak of the journey I have taken myself.

For me the pros out weighed the cons when it came to seeking funding via these prop firms and the opportunities they offer.

I personally don't mind paying a fee to enter challenges as you need some emotional attachment to the challenge in order for you to play your best trading game.

If these were free to enter then everyone would just go big and all out to get funded then would do exact same if managing to get funded. That would be sustainable for no one.

That's not what trading is about it's about risk management and emotional control which helps lead to consistent trading results.

For a 100k challenge most prop firms charge between £400-£500 that is still a fair amount of money for anyone and you should be treating it as a serious venture if your not then you are simply gambling.

Funded accounts being a demo account hasn't bothered me. I get paid when I'm in profit and that's all that matters.

Spreading accounts over different prop firms lowers risk and exposure to losing all your funded accounts.

One well known firm has gone and thankfully I wasn't with them but aiming for a few accounts with different firms lowers risk of finding yourself funded one minute then not the next.

Are they a scam? In ever growing market place bad apples will be operating in the sector.

As traders you have to do own research but plenty have been round for a while now with good reviews to boot.

Trading in general is hard and gaining 8-10% in one month to pass then doing 5% the following is no easy feat.

Get a game plan and strategy together, back test and forward test the live out of it and when consistency is there only then is it worth attempting funding challenges.

Love them or hate them prop firms are here and making some noise.

They offer opportunity a plenty but they do come with mystique attached.

You as a trader and an individual have to judge if they are for you or not.

Simple way I looked at the opportunity

1 Funded 200k account

3% profit per month = $6000

80% profit split= $4800

GBP= £3478

Approx equivalent to 57k GBP a year!

Freedom can be closer than you think.

Thanks for taking time to read my idea

Darren.

Make Always Bears And Bulls Your Friends ( Take You From A : Z An Overview of Bull and Bear Markets

The terms are simple but their causes are incredibly complex

In the investing world, the terms "bull" and "bear" are frequently used to refer to market conditions. These terms describe how stock markets are doing in general—that is, whether they are appreciating or depreciating in value. And as an investor, the direction of the market is a major force that has a huge impact on your portfolio. So, it's important to understand how each of these market conditions may impact your investments.

KEY TAKEAWAYS

A bull market is a market that is on the rise and where the economy is sound; while a bear market exists in an economy that is receding, where most stocks are declining in value.

Although some investors can be "bearish," the majority of investors are typically "bullish." The stock market, as a whole, has tended to post positive returns over long time horizons.

A bear market can be more dangerous to invest in, as many equities lose value and prices become volatile.

Since it is hard to time a market bottom, investors may withdraw their money from a bear market and sit on cash until the trend reverses, further sending prices lower.

Bull Market vs. Bear Market

A bull market is a market that is on the rise and where the conditions of the economy are generally favorable. A bear market exists in an economy that is receding and where most stocks are declining in value. Because the financial markets are greatly influenced by investors' attitudes, these terms also denote how investors feel about the market and the ensuing economic trends.

A bull market is typified by a sustained increase in prices . In the case of equity markets, a bull market denotes a rise in the prices of companies' shares. In such times, investors often have faith that the uptrend will continue over the long term. In this scenario, the country's economy is typically strong and employment levels are high.

By contrast, a bear market is one that is in decline. A market is usually not considered a true bear market unless it has fallen 20% or more from recent highs. In a bear market, share prices are continuously dropping.

This results in a downward trend that investors believe will continue this belief, in turn,

Characteristics of Bull and Bear Markets

Although a bull market or a bear market condition is marked by the direction of stock prices, there are some accompanying characteristics that investors should be aware of.

Supply and Demand for Securities

In a bull market, there is strong demand and weak supply for securities. In other words, many investors wish to buy securities but few are willing to sell them. As a result, share prices will rise as investors compete to obtain available equity.

n a bear market, the opposite is true: more people are looking to sell than buy.

The demand is significantly lower than supply and as a result share prices drop

Investor Psychology

Because the market's behavior is impacted and determined by how individuals perceive and react to its behavior, investor psychology and sentiment affect whether the market will rise or fall. Stock market performance and investor psychology are mutually dependent. In a bull market, investors willingly participate in the hope of obtaining a profit.

During a bear market, market sentiment is negative; investors begin to move their money out of equities and into fixed-income securities as they wait for a positive move in the stock market. In sum, the decline in stock market prices shakes investor confidence. This causes investors to keep their money out of the market, which, in turn, causes a general price decline as outflow increases.

Change in Economic Activity

Because the businesses whose stocks are trading on the exchanges are participants in the greater economy, the stock market and the economy are strongly linked.

A bear market is associated with a weak economy. Most businesses are unable to record huge profits because consumers are not spending nearly enough. This decline in profits directly affects the way the market values stocks.

In a bull market, the reverse occurs. People have more money to spend and are willing to spend it. This drives and strengthens the economy.

Gauging Market Changes

The key determinant of whether the market is bull or bear is not just the market's knee-jerk reaction to a particular event, but how it's performing over the long term. Small movements only represent a short-term trend or a market correction. Whether or not there is going to be a bull market or a bear market can only be determined over a longer time period.

However, not all long movements in the market can be characterized as bull or bear. Sometimes a market may go through a period of stagnation as it tries to find direction. In this case, a series of upward and downward movements would actually cancel-out gains and losses resulting in a flat market trend.

Perfectly timing the market is almost impossible.

What to Do in Each Market

In a bull market, the ideal thing for an investor to do is to take advantage of rising prices by buying stocks early in the trend (if possible) and then selling them when they have reached their peak.

During the bull market, any losses should be minor and temporary; an investor can typically actively and confidently invest in more equity with a higher probability of making a return.

In a bear market, however, the chance of losses is greater because prices are continually losing value and the end is often not in sight. Even if you do decide to invest with the hope of an upturn, you are likely to take a loss before any turnaround occurs. Thus, most of the profitability can be found in short selling or safer investments, such as fixed-income securities.

An investor may also turn to defensive stocks, whose performance is only minimally impacted by changing trends in the market. Therefore, defensive stocks are stable in both economic gloom and boom cycles. These are industries such as utilities, which are often owned by the government. They are necessities that people buy regardless of economic conditions.

In addition, investors may benefit from taking a short position in a bear market and profiting from falling prices. There are several ways to achieve this including short selling, buying inverse exchange-traded funds (ETFs), or buying put options.

The Bottom Line

Both bear and bull markets will have a large influence on your investments, so it's a good idea to take some time to determine what the market is doing when making an investment decision. Remember that over the long term, the stock market has always posted a positive return.

----------

FOREX Trading Tips To Upgrade your level ( Check it out )

The best traders hone their skills through practice and discipline. They also perform self-analysis to see what drives their trades and learn how to keep fear and greed out of the equation. These are the skills any forex trader should practice.

KEY TAKEAWAYS

Trading forex can be a great way to diversify a broader portfolio or to profit from specific FX strategies.

Beginners and experienced forex traders alike must keep in mind that practice, knowledge, and discipline are key to getting and staying ahead.

Here we bring up 9 tips to keep in mind when thinking about trading currencies.

8 Tricks Of The Successful Forex Trader

Define Goals and Trading Style

Before you set out on any journey, it is imperative to have some idea of your destination and how you will get there. Consequently, it is imperative to have clear goals in mind, then ensure your trading method is capable of achieving these goals. Each trading style has a different risk profile, which requires a certain attitude and approach to trade successfully.

For example, if you cannot stomach going to sleep with an open position in the market, then you might consider day trading. On the other hand, if you have funds you think will benefit from the appreciation of a trade over a period of some months, you may be more of a position trader. Just be sure your personality fits the style of trading you undertake. A personality mismatch will lead to stress and certain losses.

The Broker and Trading Platform

Choosing a reputable broker is of paramount importance, and spending time researching the differences between brokers will be very helpful. You must know each broker's policies and how they go about making a market. For example, trading in the over-the-counter market or spot market is different from trading the exchange-driven markets.

Also, make sure your broker's trading platform is suitable for the analysis you want to do. For example, if you like to trade off Fibonacci numbers, be sure the broker's platform can draw Fibonacci lines. A good broker with a poor platform, or a good platform with a poor broker, can be a problem. Make sure you get the best of both.

A Consistent Methodology

Before you enter any market as a trader, you need to know how you will make decisions to execute your trades. You must understand what information you will need to make the appropriate decision on entering or exiting a trade. Some traders choose to monitor the economy's underlying fundamentals and charts to determine the best time to execute the trade. Others use only technical analysis .

Whichever methodology you choose, be consistent and be sure your methodology is adaptive. Your system should keep up with the changing dynamics of a market.

Determine Entry and Exit Points

Many traders get confused by conflicting information that occurs when looking at charts in different timeframes. What shows up as a buying opportunity on a weekly chart could show up as a sell signal on an intraday chart.

Therefore, if you are taking your basic trading direction from a weekly chart and using a daily chart to time entry, be sure to synchronize the two. In other words, if the weekly chart is giving you a buy signal, wait until the daily chart also confirms a buy signal. Keep your timing in sync.

Calculate Your Expectancy

Expectancy is the formula you use to determine how reliable your system is. You should go back in time and measure all your trades that were winners versus losers, then determine how profitable your winning trades were versus how much your losing trades lost.

Take a look at your last ten trades. If you haven't made actual trades yet, go back on your chart to where your system would have indicated that you should enter and exit a trade. Determine if you would have made a profit or a loss. Write these results down.

Although there are a few ways to calculate the percentage profit earned to gauge a successful trading plan, there is no guarantee that you'll earn that amount each day you trade since market conditions can change. However, here's an example of how to calculate expectancy:

Formula for Expectancy

Expectancy = (% Won * Average Win) - (% Loss * Average Loss)

Example of Expectancy

If you made ten trades, six of which were winning trades and four of which were losing trades, your percentage win ratio would be 6/10 or 60%.

If your six trades made $2,400, then your average win would be $400 ($2,400/6).

If your losses were $1,200, then your average loss would be $300 ($1,200/4).

Expectancy = (% Won * Average Win) - (% Loss * Average Loss)

Expectancy: (.60 * $400) - (. 40 * $300) = $120

In other words, on average, a trader could expect to earn $120 per trade.

Risk:Reward Ratio

Before trading, it's important to determine the level of risk that you're comfortable taking on each trade and how much can realistically be earned. A risk-reward ratio helps traders identify whether they have a chance to earn a profit over the long term.

For example, if the potential loss per trade is $200 and the potential profit per trade equals $600, the risk-reward ratio would equal 1:2.

If ten trades were placed and a profit was earned on just four of the ten trades, the total profit would equal $2,400 ($600*4).

As a result, six of the ten trades would've lost money at $200 each, which equals $1,200 in total losses ($200*6).

In other words, a trader would earn a profit on the ten trades, despite being correct only 40% of the time.

Stop-Loss Orders

Risk can be mitigated through stop-loss orders, which exit the position at a specific exchange rate. Stop-loss orders are an essential forex risk management tool since they can help traders cap their risk per trade, preventing significant losses.

Using the example above, imagine the trader had a very wide stop-loss order for each trade, meaning they were willing to risk losing $1,200 per trade but still made $600 per winning trade. One loss could wipe out two winning trades. If the trader experienced a series of losses due to being stopped out from adverse market moves, a far higher and unrealistic winning percentage would be needed to make up for the losses.

Although it's important to have a winning trading strategy on a percentage basis, managing risk and the potential losses are also critical so that they don't wipe out your brokerage account.

Focus and Small Losses

Once you have funded your account, the most important thing to remember is your money is at risk. Therefore, your money should not be needed for regular living expenses. Think of your trading money like vacation money. Once the vacation is over, your money is spent. Have the same attitude toward trading. This will psychologically prepare you to accept small losses, which is key to managing your risk. By focusing on your trades and accepting small losses rather than constantly counting your equity, you will be much more successful.

Positive Feedback Loops

A positive feedback loop is created as a result of a well-executed trade in accordance with your plan. When you plan a trade and execute it well, you form a positive feedback pattern. Success breeds success, which in turn breeds confidence, especially if the trade is profitable. Even if you take a small loss but do so in accordance with a planned trade, then you will be building a positive feedback loop.

Perform Weekend Analysis

On the weekend, when the markets are closed, study weekly charts to look for patterns or news that could affect your trade. Perhaps a pattern is making a double top , and the pundits and the news are suggesting a market reversal. This is a kind of reflexivity where the pattern could be prompting the pundits, who then reinforce the pattern. In the cool light of objectivity, you will make your best plans. Wait for your setups and learn to be patient.

Keep a Printed Record

A printed record is a great learning tool. Print out a chart and list all the reasons for the trade, including the fundamentals that sway your decisions. Mark the chart with your entry and your exit points. Make any relevant comments on the chart, including emotional reasons for taking action. Did you panic? Were you too greedy? Were you full of anxiety? It is only when you can objectify your trades that you will develop the mental control and discipline to execute according to your system instead of your habits or emotions.

The Bottom Line

The steps above will lead you to a structured approach to trading and should help you become a more refined trader. Trading is an art, and the only way to become increasingly proficient is through consistent and disciplined practice.

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our FREE Stock Simulator. Compete with thousands of traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money. Practice trading strategies so that when you're ready to enter the real market, you've had the practice you need.

My 5 Year Forex Journey so FarIf there is one thing to remember, it's that life is precious.

What may appear to be a setback is really a stepping stone towards

a better tomorrow. That's the one thing that really separates us from the

animals. They are not aware of the the Future. They have instincts built into their

complex physiology. This is also what makes them innocent. But awareness of the future

is a key distinction. If you you observe criminal psychology, criminals are quite impulsive.

They may cut corners to achieve their goals (Short-Sighted) and this lands them in custody of the more civilized and organized

humans. It is in our nature to pursue goals, because this is how we experience positive emotion. Setting goals has turned my life around, please here this, digest it.

I was on a devastating treacherous descent into the underworld. Immature, Impulsive, Addicted, Lost, Disgusted, these words describe a mindset, an attitude.

The underworld, let me tell you, was quite the experience. I feared for my life, and the health of my loved ones. "How?" I asked myself repeatedly.

Is this what I wanted for myself?

This is what I manifested, really?

Dear God. Help my soul.

Help me Take this 1 day at a time

Help me take it 1 minute at a time if that's what is necessary

Help me restore my dignity

Not from Society

Not From Others

Not even from God

I need to believe that I am worth it

I am worthwhile

I am a good person

I am just a man

I am am an imperfect man

I am an Ignorant Man

I am an Incomplete Man

I am a partially Broken Man

I am vulnerable Man

I am a tough man

But most importantly I am an unstoppable man. And to be quite honest, it doesn't matter what you think.

Because I can manifest anything my heart desires.

USDCAD Multi-TimeFrame Analysis // February 22Weekly

Daily

4hr Analysis

NFP week so this could get wild

Bias remains bullish on USDCAD,

due to USD strength, and not anticipating crude oil to take CAD with it to the

moon. Here we can see market structure on 3 different Timeframes.

Plz Like for more breakdowns like this

Weekly -

Daily TF -

How to Choose Which Pairs to Trade With - The Ultimate Guide!Everyone always asks when they start out "which pairs should I choose to trade with" as there is a long list of currencies. So let's break it down:

1. The currency market is the most liquid market place in the world, but that's not the case with ALL currencies. In fact, the US Dollar is involved in around 90% of all trades that occur in the market and therefore it's what we call the most "liquid". Liquidity refers to how easy it is to exchange assets into cash or vice versa. For example, the US Dollar has upwards of a trillion dollars a day in volume which translates to an unimaginable number of traders ready to buy or sell at any given price at any given time, so it's very easy to fill a trade at the amount and price you want. For a less liquid market, such as an altcoin in cryptocurrencies, the liquidity is a lot thinner which means it's not as easy to fill a trade at any given price. Trades are filled when your broker matches your buy order to a sell order(s) of equal amount. When the market orders to buy exceed the limit orders to sell at any given price, the broker will quote a higher price to attract sellers. If the market is liquid like the dollar, the price will move up a tick or so, but if the price is illiquid like an altcoin, it can run up several pips which is why crypto fluctuates so much. So what does this mean for me when I choose a currency pair? It means that the more exotic you get in your choice such as the USDZAR vs EURUSD, the more volatility, unpredictable and volatile trading conditions you will get. Since we use leverage in the currency markets, we want very liquid pairs and very predictable, stable market conditions which brings our currency pool to EUR, USD, GBP, JPY, AUD and Gold is good too.

2. You should not be trading every single variation of the currency list provided above. There is 0 point having both EURUSD AND GBPUSD or USDJPY, EURJPY AND GBPJPY on your list because of correlation. Correlation means these currencies will move together because in the real world currencies aren't exchanged in pairs, they are singular. When I want to make an investment in the U.S. or if I go an visit New York, I'm not going to the exchange counter asking can I sell my EURUSD currency... no, I sell my Euros and I buy USD in return. So since we know the USD is responsible for 90% of currency trades, if EURUSD is moving up it's a result of the USD being weak unless the Euro has had a signficant news event. In that case, GBPUSD will also move up with it. If you ever find yourself buying EU and selling GU at the same time, you'll lose that more often than not. The exact same happens with the Yen pairs.

3. AUD, CAD are commodity currencies whereby their value comes from the investment purposes their economies are pegged to. AUD is commodity rich in a lot of things so analysing conditions in the commodity markets will give you an idea of it's strength. CAD is based off oil and when oil is up, CAD will be up. So there's no point having Oil and Gold and all these other commodities open along with USDCAD, XAUUSD and XTIUSD.

Based on the above, we can wittle about 20 different signifcant currency options down to a handful of choices which are as follows

1. EURUSD or GBPUSD

2. USDJPY or EURJPY or GBPJPY

3. EURAUD or GBPAUD or AUDUSD

AND

4. USDCAD or EURCAD or GBPCAD

OR

5. XAUUSD and XTIUSD (oil)

You shouldn't really have more than 4 to 5 pairs that you know inside out being traded at any given time. If you are looking for more opportunities, branch out into indices such as the S&P or maybe BTC, both are correlated.