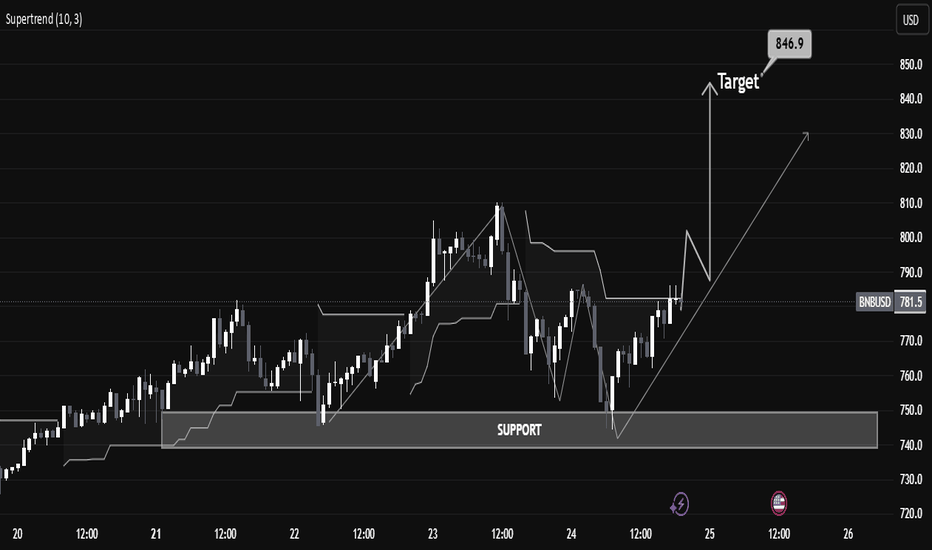

“BNBUSD Educational Breakdown – Support Rejection “BNBUSD Educational Breakdown – Support Rejection with $846 Target in Sight”

Market Structure Overview:

BNBUSD is exhibiting a bullish market structure after forming a textbook higher low at the major demand zone near $740–$750. This zone has been historically significant, offering strong rejections and triggering aggressive bullish rallies.

A new bullish wave appears to be forming after price respected the ascending trendline and reclaimed the supertrend level, now acting as dynamic support around $782.2.

⸻

🔧 Technical Confluences:

• Support Zone: Highlighted between $738–$750, serving as a demand base. Recent price rejection here confirms buyers’ dominance.

• Trendline Support: Price has respected an ascending trendline, signaling short-term trend continuation.

• Supertrend Confirmation: Trend flip has occurred—price is now trading above the Supertrend line, indicating a fresh bullish momentum phase.

• Break of Structure (BoS): Minor resistance around $784–$790 was breached, suggesting bullish continuation.

⸻

🎯 Target Projection:

Using recent swing highs and market symmetry, the next logical resistance lies at $846.9, aligning with the previous supply zone. This target also fits within the measured move from the support base to previous highs.

⸻

📈 Trade Plan (Educational Only):

• Long Bias Zone: Between $770–$780

• Invalidation Level: Below $738 (loss of support structure)

• Target: $846.9

• Risk-Reward: Roughly 1:2.5 – favorable for swing traders

⸻

📚 Educational Note:

This chart is an excellent example of:

• Structure trading (support/resistance)

• Trend confirmation using a dynamic indicator (Supertrend)

• Risk-managed entries with clearly defined stop-loss and take-profit zones.

Educationalpost

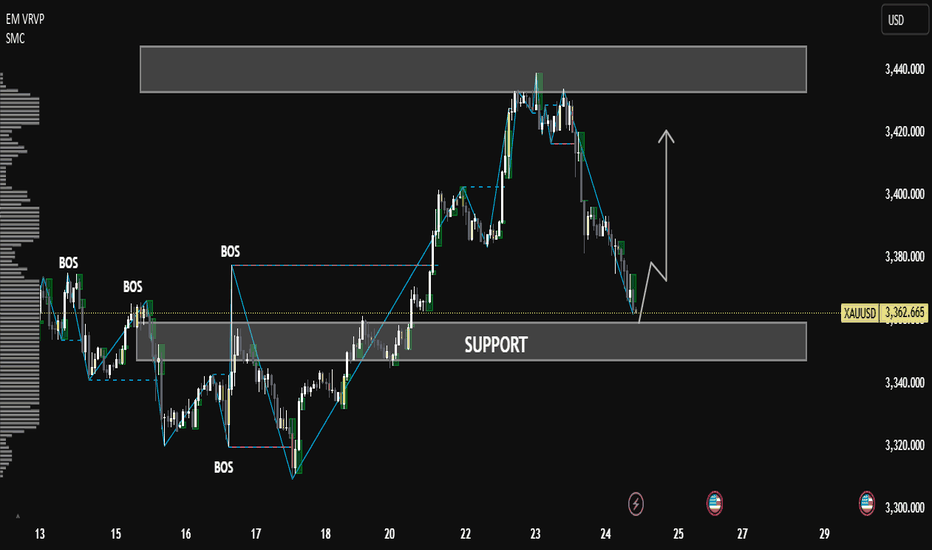

XAUUSD Price Analysis — Support Zone Reaction & Potential XAUUSD Price Analysis — Support Zone Reaction & Potential Bullish Reversal

🔍 Market Structure Overview

The chart shows a clear bullish market structure characterized by multiple Breaks of Structure (BOS) and a strong upward trend that recently corrected into a key support zone around 3360–3340.

This correction phase may be coming to an end as price reaches a high-probability demand area, with bullish reaction forming at the support level.

🧠 Smart Money Concept (SMC) Breakdown

📌 Break of Structure (BOS) confirms institutional activity and directional bias.

🔄 After a strong uptrend and BOS on July 22–23, a healthy retracement has taken place toward a major demand zone.

The support level is aligning with past consolidation and previous BOS zones, providing confluence for a bullish bounce.

📊 Technical Confluence

✅ Volume Profile (VRVP) shows strong buyer activity at current levels.

✅ The price is reacting within the support box with a small bullish candle, indicating potential accumulation.

✅ A clean liquidity sweep may have occurred just below minor lows, shaking out weak hands before a move upward.

🎯 Forecast

If price holds above the 3360 level, and bullish confirmation continues (e.g., break above minor lower highs), we can expect:

Short-term target: 3400

Major target: 3440 (marked resistance zone)

⚠️ Invalidation: A clean break and close below 3340 may lead to deeper correction or change in structure.

📘 Educational Title Suggestion

"Smart Money Reaction at Demand: XAUUSD Poised for Reversal from Key Support"

Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

Feed Your Ego or Feed Your Account- Your Choise🧭 From Rookie to Realization

I’ve been trading since 2002. That’s nearly a quarter of a century in the markets.

I’ve lived through it all:

• The early days, when the internet was slow and information was scarce

• The forums, the books, the overanalyzing

• The obsession with finding “the perfect system”

• And later… the dangerous phase: needing to be right, because I have a few years of experience and I KNOW

At one point, I thought that being a good trader meant calling the market in advance — proving I was smarter than the rest.

But the truth is: the market doesn't pay for being right. It pays for managing risk, always adapting and executing cleanly.

________________________________________

😤 The Psychological Trap Most Traders Fall Into

There’s one thing I’ve seen consistently over the last 25 years:

Most traders don’t trade to make money.

They trade to feel right.

And this need — this psychological craving to validate an opinion — is exactly what keeps them from growing.

You’ve seen it too:

• The guy who’s been screaming “altcoin season” for 2 years

• Who first called it when EGLD was at 80, TIA, and others that kept dropping

• But now that something finally moves, he says:

“See? I was right all along, altcoin season is here”

He’s not trading.

He’s rehearsing an ego story, ignoring every failed call, every drawdown, every frozen position.

He doesn’t remember the trades that didn’t work — only the one that eventually did.

This is not strategy.

It’s delusion dressed up as conviction.

________________________________________

📉 The Market Doesn’t Care What You Think

Here’s the reality:

You can be right in your analysis — and still lose money.

You can be wrong — and still come out profitable.

Because the market doesn’t reward your opinion.

It rewards how well you manage risk, entries, exits, expectations, and flexibility

I’ve seen traders who were “right” on direction but blew their accounts by overleveraging.

And I’ve seen others who were wrong on their first two trades — but adjusted quickly, cut losses, and ended green overall in the end.

This is what separates pros from opinionated amateurs.

________________________________________

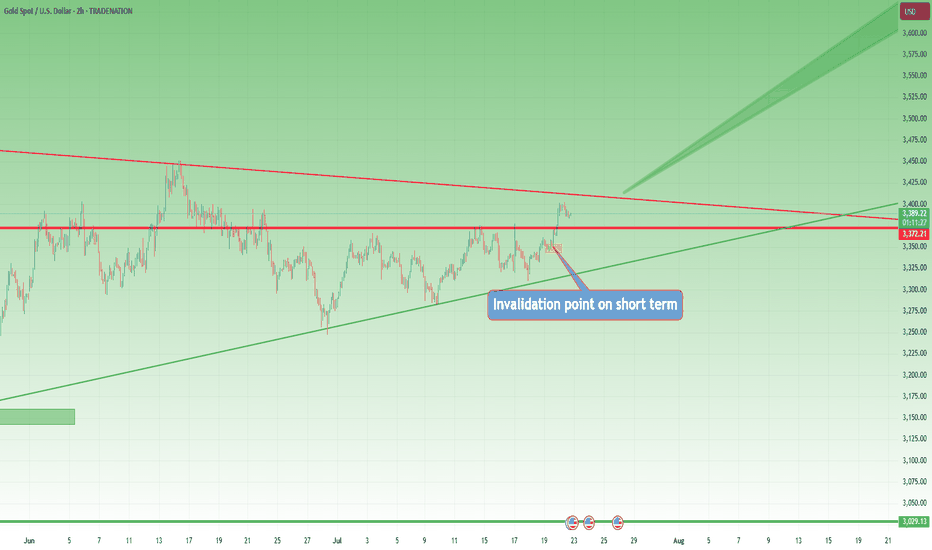

📍 A Real Example: Today’s Gold Analysis

Let’s take a real, current example — my own Gold analysis from this morning.

I said:

• Short-term, Gold could go to 3450

• Long-term, the breakout from the weekly triangle could take us to 3800

Sounds “right,” right? But let’s dissect it:

Short-term:

✅ I identified 3370 as support

If I buy there, I also have a clear invalidation level (below 3350)

If it breaks that and hits my stop?

👉 I reassess — because being “right” means nothing if the trade setup is invalidated

And no, it doesn’t help my PnL if Gold eventually reaches 3450 after taking me out.

Long-term:

✅ The weekly chart shows a symmetrical triangle

Yes — if we break above, the measured move targets 3800

But…

If Gold goes below 3300, that long-term scenario is invalidated too.

And even worse — if Gold trades sideways between 3000 and 3500 for the next 5 years and finally hits 3800 in 2030, that “correct call” is worth nothing.

You can't build a career on "eventually I was right."

You need precision, timing, risk management, and the ability to say:

“This setup is no longer valid. I’m out.”

________________________________________

💡 The Shift That Changed Everything

It took me years to realize this.

The day I stopped needing to be right was the day I started making consistent money.

I stopped arguing with the market.

I stopped holding losers out of pride.

I stopped needing to "prove" anything to anyone — especially not myself.

Now, my job is simple:

• Protect capital

• Execute with discipline

• Let the edge do its job

• And never fall in love with my opinion

________________________________________

✅ Final Thought – Let Go of Being Right

If you’re still stuck in the “I knew it” mindset — let it go.

It’s not helping you. It’s costing you.

The best traders lose small, admit mistakes fast, and stay emotionally neutral.

The worst traders hold on to “being right” while their account burns.

The market doesn’t owe you respect.

It doesn’t care if you called the top, bottom, or middle.

It pays the ones who trade objectively, flexibly, and without ego.

After almost 25 years, this is the one thing I wish I had learned sooner:

Don’t try to win an argument with the market.

Just get paid.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

The Dangers of Holding Onto Losing Positions...One of the most common — and costly — mistakes in trading is holding onto a losing position for too long. Whether it's driven by hope, ego, or fear, this behavior can damage your portfolio, drain your capital, and block future opportunities. Successful trading requires discipline, objectivity, and the willingness to accept when a trade isn’t working. Understanding the risks behind this behavior is essential to protecting your capital and evolving as a trader.

-- Why Traders Hold Onto Losing Trades --

It’s not always poor strategy or lack of experience that keeps traders locked in losing positions — it’s often psychology. Several cognitive biases are at play:

1. Loss Aversion

Loss aversion refers to our instinctive desire to avoid losses, often stronger than the desire to realize gains. Traders may hold onto a losing position simply to avoid the emotional pain of admitting the loss, hoping the market will eventually turn in their favor.

2. Overconfidence

When traders are overly confident in their analysis or trading thesis, they can become blind to changing market conditions. This conviction may cause them to ignore red flags and hold on out of sheer stubbornness or pride.

3. The Sunk Cost Fallacy

This is the belief that since you’ve already invested money, time, or effort into a trade, you need to keep going to “get your investment back.” The reality? Past investments are gone — and continuing the position often compounds the loss.

These mental traps can distort decision-making and trap traders in unproductive or damaging positions. Being aware of them is the first step toward better judgment.

-- The True Cost of Holding Losing Positions --

Holding onto a bad trade costs more than just the money it loses. It impacts your entire trading strategy and limits your growth. Here’s how:

1. Opportunity Cost

Capital tied up in a losing trade is capital that can’t be used elsewhere. If you keep $8,000 in a stock that’s fallen from $10,000 — hoping it rebounds — you're missing out on placing that money in higher-performing opportunities. Inactive capital is wasted capital.

2. Deeper Compounding Losses

A 20% loss doesn’t sound catastrophic until it becomes 30%… then 40%. The deeper the loss, the harder it becomes to break even. Holding out for a recovery often makes things worse — especially in markets with high volatility or downtrends.

3. Reduced Liquidity

Successful traders rely on flexibility. When your funds are tied up in a losing position, you limit your ability to respond to new opportunities. In fast-moving markets, this can be the difference between success and stagnation.

Recognizing these costs reframes the decision from “holding on until it turns around” to “preserving capital and maximizing potential.”

Consider this simple XAUUSD (Gold) weekly chart example. If you base a trading strategy solely on the Stochastic oscillator (or any single indicator) without backtesting and ignoring the overall trend, focusing solely on overbought signals for reversals, you'll quickly see the oscillator's frequent inaccuracies. This approach will likely lead to substantial and prolonged losses while waiting for a reversal that may never occur.

-- Signs It’s Time to Exit a Losing Trade --

The hardest part of trading isn’t opening a position — it’s closing a bad one. But if you know what to look for, you’ll know when it’s time to let go:

1. Emotional Attachment

If you find yourself feeling “married” to a trade, it’s a warning sign. Traders often assign meaning or identity to a position. But trading should be based on data and strategy, not sentiment.

2. Ignoring or Adjusting Your Stop Loss

Stop Loss orders exist for a reason: to protect your capital. If you habitually move your stop further to avoid triggering it, you’re letting hope override risk management.

3. Rationalizing Losses

Statements like “It’ll bounce back” or “This company always recovers” can signal denial. Hope is not a strategy. When you catch yourself justifying a bad position without objective reasoning, it’s time to reevaluate.

Consider also reading this article:

-- How to Cut Losses and Move Forward --

Cutting a loss isn’t a failure — it’s a skill. Here are proven techniques that help you exit with discipline and confidence:

1. Use Stop Losses — and Respect Them

Set a Stop Loss at the moment you enter a trade — and stick to it. It takes the emotion out of the exit and protects your downside. Moving the stop is the fastest path to deeper losses.

2. Trade With a Plan

Every trade should be part of a bigger strategy that includes risk tolerance, entry/exit points, and profit targets. If a position hits your predetermined loss threshold, exit. Trust your system.

3. Apply Position Sizing and Diversification

Never risk more than a small percentage of your capital on a single trade. Keep your portfolio diversified across different instruments or sectors to avoid one position derailing your progress.

4. Review and Reflect

Post-trade analysis is vital. Review both wins and losses to learn what worked — and what didn’t. This practice sharpens your strategy and builds emotional resilience over time.

-- Why Cutting Losses Strengthens Your Portfolio --

There’s long-term power in letting go. Here’s what cutting losses early can do for you:

1. Preserve Capital

The faster you cut a losing trade, the more capital you retain — and the more opportunities you can pursue. Capital preservation is the foundation of longevity in trading.

2. Reduce Emotional Stress

Sitting in a losing trade weighs heavily on your mindset. The stress can cloud your judgment, increase risk-taking, or cause hesitation. Exiting early reduces this emotional drag and keeps you clear-headed.

3. Reallocate to Better Setups

Exiting losing trades frees up both capital and mental energy for higher-probability opportunities. This proactive approach builds momentum and reinforces the idea that it’s okay to be wrong — as long as you act decisively.

Consider also reading this article:

-- Final Thoughts: Discipline Over Denial --

Holding onto losing trades may feel like you're showing patience or commitment — but in reality, it's often denial wrapped in hope. Trading is about probabilities, not guarantees. The most successful traders aren’t the ones who win every trade — they’re the ones who manage losses with discipline.

Letting go of a bad trade is a show of strength, not weakness. It’s a deliberate choice to protect your capital, stay agile, and refocus on trades that serve your goals. The market doesn’t owe you a comeback — but with a clear head and disciplined approach, you can always find your next opportunity.

✅ Please share your thoughts about this article in the comments section below and HIT LIKE if you appreciate my post. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Japanese Candlestick Cheat Sheet – Part OneSingle-Candle Formations That Speak

Before you dream of profits, learn the one language that never lies: price.

Indicators are just subtitles — price is the voice.

Japanese candlesticks are more than just red and green bars — they reflect emotion, pressure, and intention within the market.

This series will walk you through the real psychology behind candlestick patterns — starting here, with the most essential:

🕯️ Single-candle formations — the quiet signals that often appear before big moves happen.

If you can’t read a doji, you’re not ready to understand the market’s hesitation.

If you ignore a hammer, you’ll miss the moment sentiment shifts.

Let’s start simple. Let’s start strong.

This is Part One of a five-part series designed to build your candlestick fluency from the ground up.

1. DOJI

Bias: Neutral

What is the Doji pattern?

The Doji candlestick pattern forms when a candle’s open and close prices are nearly identical, resulting in a small or nonexistent body with wicks on both sides. This pattern reflects market equilibrium, where neither buyers nor sellers dominate. Dojis often appear at trend ends, signaling potential reversals or pauses.

As a fundamental tool in technical analysis, Dojis help traders gauge the psychological battle between buyers and sellers. Proper interpretation requires context and experience, especially for spotting trend shifts.

Meaning:

Indicates market indecision or balance. Found during trends and may signal a reversal or continuation based on context.

LONG-LEGGED DOJI

Bias: Neutral

What is the Long-Legged Doji pattern?

The Long-Legged Doji captures a moment of intense uncertainty and volatility in the market. Its long wicks represent significant movement on both sides, suggesting that neither buyers nor sellers have control. This back-and-forth reflects the psychology of market participants wrestling for control, which often foreshadows a shift in sentiment. When traders see a Long-Legged Doji, it highlights the need to monitor for potential changes in direction.

They can appear within trends, at potential reversal points, or at consolidation zones. When they form at the end of an uptrend or downtrend, they often signal that the current trend may be losing momentum.

Meaning:

The prominent wicks indicate volatility. Buyers and sellers pushed prices in opposite directions throughout the session, ultimately reaching an indecisive close.

SPINNING TOP

Bias: Neutral

What is the Spinning Top pattern?

A Spinning Top is a candlestick with a small body and long upper and lower wicks, indicating that the market has fluctuated significantly but ultimately closed near its opening price. This pattern often points to a moment of indecision, where both buyers and sellers are active but neither dominates. Spinning Tops are commonly found within both uptrends and downtrends and can suggest that a trend is losing momentum.

For traders, a Spinning Top provides a valuable insight into market psychology, as it hints that the prevailing sentiment may be weakening. While Spinning Tops alone aren’t always definitive, they can serve as a precursor to larger moves if the following candles confirm a shift in sentiment.

Meaning:

Shows indecision between buyers and sellers. Common in both up and downtrends; signals potential reversal or pause.

HAMMER

Bias: Bullish

What is the Hammer pattern?

A Hammer candlestick appears at the end of a downtrend, with a small body and a long lower wick. This shape reflects a moment when sellers pushed prices lower, but buyers managed to absorb the selling pressure and drive prices back up before the close. This pattern is particularly important for spotting potential reversals, as it indicates that buyers are beginning to reassert control.

Hammers reveal the underlying psychology of a market where buying confidence is emerging, even if sellers have dominated for a while. To successfully trade this pattern, it’s essential to confirm the reversal with subsequent candles.

Meaning:

Showing rejection of lower prices. Signals potential bullish reversal, especially if followed by strong buying candles.

INVERTED HAMMER

Bias: Bullish

What is the Inverted Hammer pattern?

The Inverted Hammer forms at the bottom of a downtrend, with a small body and long upper wick. This pattern shows that buyers attempted to push prices higher, but sellers ultimately brought them back down by the close. The Inverted Hammer is an early sign of buyer interest, hinting that a trend reversal may be underway if subsequent candles confirm the shift.

Interpreting the Inverted Hammer helps traders understand where sentiment may be shifting from bearish to bullish, often marking the beginning of a recovery. Recognizing these patterns takes practice and familiarity with market conditions.

Meaning:

Showing rejection of higher prices. Can signal bullish reversal if confirmed by subsequent buying pressure.

DRAGONFLY DOJI

Bias: Bullish

What is the Dragonfly Doji pattern?

The Dragonfly Doji has a long lower wick and no upper wick, forming in downtrends to signal potential bullish reversal. This pattern reveals that sellers were initially in control, pushing prices lower, but buyers stepped in to push prices back up to the opening level. The Dragonfly Doji’s unique shape signifies that strong buying support exists at the lower price level, hinting at an impending reversal.

Recognizing the psychology behind a Dragonfly Doji can enhance a trader’s ability to anticipate trend changes, especially in markets where support levels are being tested.

Meaning:

Found in downtrends; suggests possible bullish reversal if confirmed by a strong upward move.

BULLISH MARUBOZU

Bias: Bullish

What is the Bullish Marubozu pattern?

The Bullish Marubozu is a large, solid candle with no wicks, indicating that buyers were in complete control throughout the session. This pattern appears in uptrends, where it signals strong buying momentum and often foreshadows continued upward movement. The absence of wicks reveals that prices consistently moved higher, with little resistance from sellers.

For traders, the Bullish Marubozu offers a glimpse into market psychology, highlighting moments when buyer sentiment is particularly strong. Learning to identify these periods of intense momentum is crucial for trading success.

Meaning:

Showing complete buying control. Found in uptrends or at reversal points; indicates strong buying pressure and likely continuation of the trend.

SHOOTING STAR

Bias: Bearish

What is the Shooting Star pattern?

The Shooting Star appears at the top of an uptrend, characterized by a small body and a long upper wick, indicating a potential bearish reversal. Buyers initially drove prices higher, but sellers took over, bringing prices back down near the open. This shift suggests that buyers may be losing control, and a reversal could be imminent.

Interpreting the Shooting Star gives traders valuable insights into moments when optimism begins to fade, providing clues about a potential trend shift.

Meaning:

Indicating rejection of higher prices. Signals a potential bearish reversal if followed by selling pressure.

HANGING MAN

Bias: Bearish

W hat is the Hanging Man pattern?

The Hanging Man candle forms at the top of an uptrend, with a small body and long lower wick. This pattern suggests that sellers attempted to drive prices down, but buyers regained control. However, the presence of a long lower shadow hints that sellers may be gaining strength, potentially signaling a bearish reversal.

The Hanging Man pattern reflects market psychology where buyers might be overextended, making it a valuable tool for identifying potential tops in trends.

Meaning:

Signals potential bearish reversal if confirmed by selling candles afterward.

GRAVESTONE DOJI

Bias: Bearish

What is the Gravestone Doji pattern?

With a long upper wick and no lower wick, the Gravestone Doji reveals that buyers pushed prices up, but sellers eventually regained control. Found in uptrends, it suggests that a bearish reversal could be near, as the upper shadow indicates buyer exhaustion. The Gravestone Doji often appears at market tops, making it a valuable indicator for those looking to anticipate shifts.

Understanding the psychology behind this pattern helps traders make informed decisions, especially in markets prone to overbought conditions.

Meaning:

Showing rejection of higher prices. Found in uptrends; signals potential bearish reversal if followed by selling activity.

BEARISH MARUBOZU

Bias: Bearish

What is the Bearish Marubozu pattern?

The Bearish Marubozu is a large, solid bearish candle without wicks, showing that sellers held control throughout the session. Found in downtrends, it signals strong bearish sentiment and suggests that the trend is likely to continue. The lack of wicks reflects consistent downward momentum without significant buyer support.

This pattern speaks about market psychology, offering traders insights into moments of intense selling pressure. Recognizing the Bearish Marubozu can help you align with prevailing trends and avoid buying into weakening markets

Meaning:

Showing strong selling pressure. Found in downtrends; signals continuation of the bearish trend or an intensifying sell-off.

👉 Up next: Double-candle formations – where price meets reaction.

Why Swing Trading and Scalping Are Opposite Worlds"It's not about the strategy. It's about who you are when the market puts pressure on you."

Most traders fail not because they don’t learn “strategies” — but because they pick a style that doesn't match their temperament.

And nothing creates more damage than confusing swing trading with scalping/intraday trading.

Let’s break them down. For real...

________________________________________

🔵 1. Swing Trader – Chasing Direction, Not Noise

A swing trader does not touch choppy markets.

He’s not here for the sideways grind. He wants momentum.

If there’s no clear trend, he doesn’t trade.

He shifts between assets depending on where real movement is.

• USD weakens → he buys EUR/USD and waits

• Gold breaks → he enters and lets the move develop

Swing trading means positioning with the macro flow, not chasing bottoms and tops.

✅ He trades based on H4/Daily or even Weekly charts

✅ He holds for hundreds of pips.

✅ He accepts contrarian candles in the process.

________________________________________

🔴 2. Scalper/Intraday Trader – The Asset Specialist

A true scalper doesn’t chase trends.

He hunts inefficiencies — quick spikes, fakeouts, liquidity grabs.

✅ Loves range conditions

✅ Lives inside M5–M15

✅ Often trades only one asset he knows like the back of his hand

He doesn’t care what EUR/USD will do this week.

He cares what it does in the next 30 minutes after a breakout.

Scalping is not chaos. It's cold execution with a sniper mindset.

📡 He reacts to news in real time.

He doesn’t predict — he exploits.

________________________________________

🧾 Key Differences – Swing Trader vs. Scalper

________________________________________

🎯 Primary Objective

• Swing Trader: Captures large directional moves over several days.

• Scalper/Intraday: Exploits short-term volatility, aiming for quick, small gains.

________________________________________

🧭 Market Conditions Preference

• Swing Trader: Needs clean, trending markets with clear momentum.

• Scalper/Intraday: Feels comfortable in ranging markets with liquidity spikes and noise.

________________________________________

🔍 Number of Instruments Traded

• Swing Trader: Monitors and rotates through multiple assets (e.g. XAUUSD, EURUSD, indices, BTC, he's going where the money is).

• Scalper/Intraday: Specializes in 1–2 instruments only, knows their behavior in every session.

________________________________________

⏰ Time Spent in Front of the Charts

• Swing Trader: Waits for clean setups, may hold positions for days or weeks.

• Scalper/Intraday: Constant screen time, executes and manages trades actively.

________________________________________

📰 Reaction to News

• Swing Trader: Interprets the macro/fundamental impact and positions accordingly.

• Scalper/Intraday: Reacts live to data releases, wicks, and intraday volatility.

________________________________________

📉 When They Struggle

• Swing Trader: Fails in choppy or directionless markets.

• Scalper/Intraday: Loses edge when the market trends explosively.

________________________________________

🧠 Psychological Requirements

• Swing Trader: Needs patience, confidence in the big picture, and acceptance of drawdown.

• Scalper/Intraday: Needs absolute discipline, emotional detachment, and razor-sharp focus.

________________________________________

✅ Bottom line: They are two different games.

Don’t try to play both on the same chart with the same mindset.

________________________________________

✅ Final Thoughts – Your Edge Is in Alignment, Not Imitation

You don’t pick a trading style because it “sounds cool.”

You pick it because it aligns with:

• Your schedule

• Your attention span

• Your tolerance for uncertainty

If you hate watching candles all day – go swing.

If you hate waiting for days – go intraday.

If you keep switching between both – go journal your pain and come back later.

P.S. Recent Example:

I'm a swing trader. And this week, Gold has been stuck in a range.

What do I do? I wait. No rush, no overtrading. Just patience.

Once the range breaks, I’m ready — in either direction.

But I don’t close after a quick 50–100 pip move. That’s not my game.

I aim for 700+ pips whether it breaks up or down,because on both sides we have major support and resistance levels that matter.

That’s swing trading:

📍 Enter with structure, hold with confidence, exit at significance.

Not every move is worth trading — but the big ones are worth waiting for.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

In trading, the long way is the shortcut⚠️ The Shortcut Is an Illusion — And It Will Cost You

In trading, everyone wants to arrive without traveling.

They want the profits, the freedom, and the Instagram lifestyle — even if it’s fake.

What they don’t want is the process that actually gets you there.

So they chase shortcuts:

• Copy signals without understanding the reason behind them

• Over-leverage on “the perfect setup”

• Buy indicators they don’t know how to use

• Skip journaling and backtesting

• Trade real money without trading psychology

And then they wonder…

Why is my account bleeding?

Why does this feel like a cycle I can't break?

Because:

Every shortcut in trading is just a fast track to disaster.

You will lose. You will restart. And it will take even longer than if you just did it right the first time.

🤡 The TikTok Fantasy: “1-Minute Strategy That Will Make You Millions in 2025”

This is the new wave:

A 60-second video showing you a magical indicator combo.

No context. No testing. No risk management.

Just fake PnL screenshots and promises of millionaire status before next summer.

“This 1-minute scalping strategy made me $12,000 today!”

And people fall for it… because it’s easier to believe in shortcuts than to accept that real trading is boring, repetitive, and hard-earned.

If it fits in a TikTok video, it’s not a strategy. It’s clickbait.

________________________________________

❓ Looking for a System Without Knowing the Basics

Here’s the paradox:

Most people are desperate to find a “profitable strategy” — but they haven’t even mastered the basic math of trading.

• They don’t know how pip value is calculated

• They don’t understand how leverage works

• They confuse margin with risk

• They size positions emotionally, not based on their account

• They can’t define what 1% risk per trade actually means in dollars

But they’re out here, loading indicators, watching YouTube “hacks,” and flipping accounts with 1:500 leverage.

Imagine trying to perform surgery before learning anatomy.

That’s what trying to trade a strategy without knowing pip cost looks like.

________________________________________

🛠️ The Long Way Is the Fastest Way

You want the real shortcut?

Here it is:

• Learn price structure deeply

• Backtest like a scientist

• Journal like a professional

• Risk small while you're learning

• Stay on demo until your edge is proven

• Master basic math: leverage, margin, pip value, position sizing

This is the long way.

But it’s the only way that doesn’t end in regret.

________________________________________

⏳ Most Traders Waste 2–5 Years Looking for a Shortcut

And in the end?

They crawl back to the long path.

Broke, humbled, and wishing they had just started there from the beginning.

The shortcut is a scam.

The long way is the only path that leads to consistency.

You either take it now… or take it later — after your account pays the price.

________________________________________

✅ Final Thought

Don’t ask how fast you can get profitable.

Ask how solid you can build your foundation.

Because in trading:

❌ The shortcut costs you everything

✅ The long way gives you everything

And the longer you avoid it, the longer it takes.

The Unicorn Model: : Guide to ICT’s Best Standalone setup🦄 The ICT Unicorn: The Most Powerful Setup in ICT

Among all the concepts of ICT, the Unicorn setup stands out as the ultimate precision entry model, it’s confluence perfected. Why? Because it merges two of the most potent ideas in ICT theory: Breaker Blocks and Fair Value Gaps into a single zone.

This combination creates the most high-probability, sniper-level setup in the entire ICT playbook.

Why It’s the Best you think?

Most ICT setups (like simple FVGs, order blocks, or liquidity sweeps) offer high-probability trades on their own, but the Unicorn setup stacks the odds in your favor by combining multiple layers of confirmation. This makes it the most disciplined and rewarding entry model for traders who rely on market structure.

Core Concepts Explained

A breaker block is a former order block that gets invalidated when price breaks structure, then acts as support or resistance upon a retest. It’s a sign of a shift in market intent, from bullish to bearish or vice versa.

A fair value gap (FVG) is a three-candle pattern where a sudden price move creates an imbalance, a "gap" between the wicks of the first and third candle. Price often retraces into that gap before continuing its trend.

When these two concepts overlap, a breaker block and a fair value gap in the same zone, it forms the “unicorn” setup. It suggests a strong level where liquidity has been taken and institutions may re-enter.

How the Setup Work s

First, you identify a market structure shift, like a break in a previous high or low. Then look for the breaker block left behind by that move. Within that block, check if there’s a fair value gap (the imbalance zone). When price retraces back into that confluence zone, wait for a reaction, often a strong reversal or continuation.

Entry is usually taken when price shows rejection within the zone on a lower timeframe. Your stop-loss goes just beyond the breaker block, and your target can be the next high/low or a logical liquidity pool.

Example of a bearish Unicorn Model:

Best Conditions to Use It

This setup works best when used in line with the higher timeframe trend. Many traders analyze structure on the 1-hour or 4-hour chart, then drop to 5-minute or 15-minute charts to enter. It’s commonly used in forex and indices but also works well in crypto or commodities.

Avoid using it during news events though. Like all ICT concepts, it requires patience and practice to identify clean setups and avoid forcing trades.

Example spotted on a Gold setup:

ICT Unicorn Model was first introduced in 2022, primarily applied to the Nasdaq 100 (NQ) and S&P 500 (ES). What stood out immediately was its precision, the kind of clean structure and consistency you don’t often find in most strategies.

As it was tested further, it was clear this wasn’t just for indices. The model transitioned beautifully into forex, especially on major pairs like GBP/USD and EUR/USD, delivering sharp entries as well.

I also tested it on metals like gold (XAU/USD) and silver (XAG/USD), as well as the Dollar Index (DXY), and the results spoke for themselves. Even in crypto, where volatility is the norm, the Unicorn setup held its ground.

It’s rare to find a trading model that adapts across markets this well.

Final Thoughts

The ICT Unicorn is all about confluence and precision. You’re not trading every breaker or every FVG, only the ones that align, especially with a clean shift in structure. When used with proper risk management, it can be a high-probability setup in your playbook.

Most Traders React to Markets. The Best Anticipate Them.Most Traders React to Markets. The Best Anticipate Them.

Hard truth:

You're always one step behind because you trade reactively.

You can’t win a race if you're always responding to moves already made.

Here's how reactive trading burns your edge:

- You chase breakouts after they've happened, entering at the peak.

- You panic-sell into downturns because you didn't anticipate.

- You miss major moves because you're looking backward, not forward.

🎯 The fix?

Develop anticipatory trading habits. Identify scenarios in advance, set clear triggers, and act decisively when probabilities align - not after the market confirms.

TrendGo provides structure for anticipation - not reaction.

🔍 Stop responding, start anticipating. Your account will thank you.

Tensions in the Middle East. (Levels to watch, things to do). Iran and Israel situation is tense. Lot of investors have lot of questions in mind. I am trying to provide my opinion for the same in the video. I am trying to give my Technical and Political commentary on the situation in this educational video. The political commentary is based on my 15+ years of experience in the Middle East and is my personal opinion. I hope this will answer a lot of questions for you. I have also tried to give Techincal support and resistance levels for Nifty. In the 10 minute I have tried to cover as many points as I can. Along with the list of things to do as an investor. I hope this will help many of you.

As it was expected there was a deep fall in the market due to Israel Vs Iran tensions. US is also a direct or indirect party to the situation and if there is further escalation other global powers will mostly get involved. Due to the this situation market opened gap down at 24473. What we saw post that is Indian market recovered smartly from that situation to close at 24718. That is a huge 245 point recovery to end the day. This is why colour of the candles throughout the day (As this is an hourly chart are green despite we ended in red. (That is a classic Technical lesson for understanding candle sticks analytics). The closing is above the father line support of 24674 which is a good sign as this will be our support (Strong support for Monday.) I have spent more than 15 years in the Middle East and happen to know a little bit out of my personal experience, having interacted with a lot of locals. Thus I am trying to answer a few questions that might be coming in the minds of may investors including myself.

Q&A

The Question now are we out of danger?

Answer: Not yet.

Question 2: Why we are not out of danger?

Ans: The geo-political situation is very tense. The scale of Israeli attack was massive and there are clear and present chances of Iran counter attack which has already begun. Israel will respond again and Trump has already said that the next attacks by Israel will be even more fierce. No Iran is no palestine and there would be many countries that might support Iran. Specially China has already hinted support. Russia another ally is busy with Ukraine but you never know.

Question 3: How it goes for the other Middle Eastern countries?

Ans: There are lot of countries with US and Western bases on them. If Iran attacks them there are chances of other Western countries getting into the act too. In addition to some Middle Eastern countries getting into the act for the purpose of self defence. Thus over the weekend the things can get either very tense.

Question 4: What happens to India and Indian markets?

Ans: Today Indian markets have shown a lot of resilience. Global meltdown can affect us to for sure. But as we are neutral (As of now as it seems). The damage to our market hopefully will be minimal. Moreover recovery will be swift once the situation becomes less tense.

Question 5: What should investors do?

Ans: Long term investors can hold on to their long term positions in blue chip stocks. Keep stop losses and trailing stop losses in place for the mid-cap and small cap stocks. If some stop losses are hit or trailing stop losses are hit, you can always buy again as market is not going anywhere. The dip that we might potentially see can be an opportunity for long term investors for bottom fishing again and recalibrating their portfolios. (You can use the current situation to realign your portfolio for buying the trending stocks which have giving good results this quarter or have been giving good results since last few quarters.) Get rid of the stocks that have been dragging your portfolio down. Market has provided another opportunity for a fresh start.

Things you can do:

1) Gold and Silver are always a great option when it comes to uncertain times.

2) Do not give a knee jerk reaction in selling off your winners.

3) Watch the global updates and keep stop losses and trailing stop losses accordingly.

4) Re-calibrate your portfolio

5) If you are sitting on cash use the dip for investing in stocks with long term perspective.

The support for Nifty Remain at: 24674 (Father line support), 24640 (Mid-channel support), 24492 (Trend line support), 24382, 24208 and finally 24077 (Channel Bottom Support). a closing below 24077 will enable and empower bears to Pull Nifty further down.

Resistances for Nifty remain at: 24752, 24818, 24906 (Mother line Resistance), 25043, 25138 and finally 25223 (Channel top Resistnace). Above 25223 Bulls will potentially take over the market.

To know more about Mother Father and Small Child theory, Parallel Channel, Technical and Fundamental analysis and to learn it to master it. Read my book. The Happy Candles Way To Wealth Creation available on Amazon in Paperback and Kindle version. The book is one of the highest rated books in the category and many readers consider it as a Hand Book for Equity investment.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. The political commentary is based on personal views and analysis. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Guide: How to Read the Smart Farmer SystemDear Reader , Thank you for tuning in to my first video publication.

This video explains the 3-step signal validation process—helping you quickly and precisely anticipate market intent and liquidity dynamics before taking action.

We do not react to noise; we respond with structured execution because we understand the market’s true game.

Listen to the market— this guide is here to sharpen your journey.

Correction Notice (16:58 timestamp): A slight clarification on the statement regarding signal validation :

SELL signals: The trading price must close BELOW the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

BUY signals: The trading price must close ABOVE the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

Multiple signals indicate liquidity games are actively unfolding, including accumulation, control, distribution, and offloading.

Trading Without an Edge Is Like Gambling Without the FunAt least in Vegas, you get free drinks.

Let’s cut the fluff.

You want to make money trading.

But here’s the problem no one wants to admit:

Most traders don’t have an edge. And they trade anyway.

Which means they’re not traders.

They’re just expensive gamblers in denial.

🎰 W elcome to the Casino Called “Charts”

In Vegas, the odds are clearly displayed.

You know the house has the advantage.

But in trading? You convince yourself you are the house.

You say things like:

-“This setup worked for someone on YouTube.”

- “Price is oversold, so it has to bounce.”

- “I just have a feeling it’ll go up.”

That’s not a strategy. That’s astrology.

If you can’t define your edge in one sentence, you don’t have one.

And if your edge isn’t tested over at least 100 trades — it’s fantasy.

🧠 What Is an Edge, Anyway?

An edge is not a pattern. It’s not always your gut.

It’s a repeatable, testable advantage in the market.

It could be:

- A statistical tendency in price behavior

- A setup with positive risk-to-reward over time

- A timing structure that aligns with volume or volatility

- Even psychological edge (you stay calm when others panic)

But here’s the key:

An edge is something that works often enough, with controlled risk, and consistent execution.

☠️ What Happens When You Don’t Have One

Let’s break it down.

Trading without an edge leads to:

- Random outcomes that feel emotional

- Overtrading because you’re chasing the next “feel good” moment

- Misplaced confidence after a few lucky wins

- Explosive losses when luck runs out

And worst of all?

You think you’re improving…

But in reality, you’re just getting better at losing slower.

🍹 At Least Vegas Gives You Something Back

Here’s the irony:

In Vegas, the drinks are free.

You get a show. You laugh. You know it’s a gamble.

In trading?

- You pay for your losses

- You pay for your education

- You pay for your psychology coach

- And nobody even gives you a free mojito.

If you're going to lose money without an edge, you might as well enjoy the music.

🎯 So How Do You Actually Get an Edge?

1. Backtest.

Find a setup that repeats. Track it. Chart it. Obsess over it.

2. Track your stats.

Your win rate, average R, time in trade. Know thyself.

3. Simplify.

An edge isn’t 12 indicators. It’s one thing done well.

4. Survive first, thrive later.

If you’re not around after 100 trades, your edge won’t matter anyway.

5. Learn from pain, not just profit.

Your losers have more to teach than your winners.

🧘 Final Thought – Stop Playing Pretend

If you wouldn’t go to a casino and bet $1000 on 25 without knowing the odds…

Why are you doing that in the markets?

Don’t call it trading if it’s actually coping.

Don’t call it strategy if it’s actually guessing.

Most Traders Want Certainty. The Best Ones Want Probability.Hard truth:

You’re trying to trade like an engineer in a casino.

You want certainty in an environment that only rewards probabilistic thinking.

Here’s how that kills your edge:

You wait for “confirmation” — and enter too late.

By the time it feels safe, the market has moved.

You fear losses — but they’re the cost of data.

Good traders don’t fear being wrong. They fear not knowing why.

You need to think in bets, not absolutes.

Outcomes don’t equal decisions. Losing on a great setup is still a good trade.

🎯 Fix it with better framing.

That’s exactly what we designed TrendGo f or — to help you see trend strength and structure without delusions of certainty.

Not perfect calls. Just cleaner probabilities.

🔍 Train your brain for the game you’re playing — or you’ll keep losing by default.

In Theory, You’re a Great Trader — In Practice, You’re Human🧠 10 Ways Trading Theory Falls Apart in Real Practice

Because in theory, you're rich. In practice, you panic-sold at support.

“In theory, there is no difference between theory and practice. In practice, there is.”

— Yogi Berra

Welcome to trading — where you read about patience and discipline, and then blow up your account chasing a breakout at 3AM.

Let’s explore the top 10 ways trading theory gets wrecked by real-world execution, complete with painful honesty and maybe a laugh or two (because crying is for after market close).

________________________________________

1. 🎯 In theory: You always follow your trading plan.

In practice:

You make a new plan after every trade.

That loss wasn’t part of “the plan,” so obviously the plan was wrong. Let’s fix it — during the trade — in real-time — while it bleeds. Genius.

________________________________________

2. 🧘♂️ In theory: You manage risk carefully.

In practice:

"Let me just move the stop... just this once... just 10 more pips..."

Before you know it, your stop loss is in the next timezone, and your trade is now a long-term investment.

________________________________________

3. 📊 In theory: Backtesting proves the strategy works.

I n practice:

Backtest = you, alone, with no emotions, clicking replay in TradingView.

Live trading = markets screaming, Twitter panicking, and you entering on the 1-minute chart because “it felt right.”

________________________________________

4. 💻 In theory: You’ll be objective.

In practice:

You saw one green candle and whispered:

“This is it. The reversal. I feel it.”

You weren’t objective. You were in a situationship with your trade.

________________________________________

5. 💰 In theory: R:R 2:1 minimum.

In practice:

You close at +0.3R “just to be safe” — and then it hits target 10 minutes later while you re-enter worse, and get stopped.

________________________________________

6. 🕒 In theory: You wait for confirmation.

In practice:

You anticipate confirmation. You hope for confirmation.

Spoiler: hope is not a strategy. But hey, at least you learned… again.

________________________________________

7. 🤖 In theory: You’re a rules-based, emotionless trader.

In practice:

You meditate, breathe deeply, journal, and then buy Gold after CPI with no stop loss and max leverage.

So much for being the Terminator.

________________________________________

8. 📚 In theory: More knowledge = better performance.

I n practice:

You read five books, memorized all candlestick names, and still entered long into resistance because it “looked bullish.”

Trading isn’t trivia night. It’s controlled decision-making under fire.

________________________________________

9. 😤 In theory: You’ll accept losses calmly.

In practice:

First you rage-quit. Then you revenge trade. Then you open ChatGPT and ask:

“Should I hedge this 80% drawdown?”

________________________________________

10. 📆 In theory: You’ll be consistent.

In practice:

You traded London Open on Monday, Asian Session on Tuesday, and New York close on Friday.

Consistency? You don’t even use the same time frame twice in a row.

________________________________________

🚧 So… how do you bridge the gap?

1. Journal your trades — honestly. Especially the emotional mess-ups.

2. Create rules you can actually follow — not Instagram-quote rules.

3. Simulate real conditions — including drawdowns, boredom, and fakeouts.

4. Accept that mistakes are part of the job — and build for resilience, not perfection.

5. Trade small enough that you don’t care much — so you can learn while surviving.

________________________________________

🎯 Final word:

Trading theory is like a clean whiteboard.

But the market? It’s a chaotic toddler with crayons and no rules.

If you can operate inside that chaos — with clarity and emotional control — that’s when the theory starts working.

AUDJPY 240 MINS TIME FRAME - MY VIEWThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

We do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy KG

Trading Gold? Know the Difference Between XAU/USD and Futures🔎 Let’s address a question I get very often:

“Should I trade spot gold (XAU/USD) or Gold futures?”

It might sound like a technical decision, but it’s actually about how you approach the market, your risk profile, and your experience level.

So let’s break it down 👇

________________________________________

🟡 Two ways to trade the same asset

Both spot and futures allow you to speculate on the price of Gold. But they’re two very different beasts when it comes to execution, capital, and strategy.

________________________________________

1️⃣ Spot gold (XAU/USD)

• Traded mostly via Forex brokers or CFD platforms

• No expiration — you can hold the position as long as you want

• Often used by retail traders for day trading or swing setups

• You can open small trades (even 0.01 lots)

• Costs include spread, swap fees if you hold overnight

• Leverage is usually high — up to 1:100 or more

• Margin is required, but typically lower than in futures

💡 Spot is flexible and accessible, but you pay the price through overnight holding costs, wider spreads during volatility, and slippage. On some brokers, especially during high-impact news, your platform might even freeze or delay execution — and that’s a serious risk if you’re not prepared.

________________________________________

2️⃣ Gold futures (GC)

• Traded on major futures exchanges like CME

• Contracts have a fixed size (usually 100 oz)

• They expire monthly, so you need to manage rollovers

• Common among hedge funds and experienced traders

• You pay commissions and exchange fees, but no swaps

• Margin is required here too — but it's much higher

💡 Futures are structured and professional — but they demand more capital, stricter execution discipline, and higher margin requirements. Just like in spot trading, margin is a collateral deposit, not a cost — but with futures, the bar is set higher.

________________________________________

⚖️ So, which one is for you?

If you're using MetaTrader or any platform offered by a Forex/CFD broker, and you're a scalper, intraday, or swing trader working with flexible position sizes...

→ You're probably better off with spot gold (XAU/USD).

If you're trading big volume, managing diversified portfolios, or involved in hedging large exposure...

→ You should consider futures — but expect to level up your game, capital requirements, and discipline.

________________________________________

🧠 Mindset:

Don’t confuse accessibility with simplicity.

Just because spot Gold is easier to open doesn’t mean it’s always the best choice.

Just because futures look “pro-level” doesn’t mean they’re always worth it for a retail trader.

Understand your tools. Pick the one that aligns with your structure. That’s how you stay in the game. 🎯

________________________________________

📚 Hope this cleared it up. If you want me to cover execution setups for each one, let me know in the comments.

Educational Video: Nifty Outlook-How Technical analysis is done.We have tried to draw a parallel channel on Nifty hourly chart. The chart indicates that we are just below the mid channel line. The mid channel line will act as a resistance if the price is below the same and will act as a support if the price is above it. Right now it is acting as a resistance. Top of the channel always acts as a resistance and bottom of the channel always acts as a support. Additionally there are historic resistances and supports which indicate the other levels which may act as support or resistance. There are also Mother and Father lines (50 and 200 EMA)(EMA = Exponential Moving Average).

To understand in detail how parallel channel works or how supports and resistance are derived or what is Mother, Father and Small Child theory. I would recommend you my book The Happy Candles Way to Wealth creation. By reading this book you can understand all these concepts with ease. You can additionally understand what is fundamental and technical analysis and how to do it. You will also get to understand the dos and the don'ts of investment in equity by reading various chapters on Behavioural Finance. Overall it is a value for money book available on Amazon in Paperback and Kindle version. The book is also available on Google play book and other E-book stores. You can also contact us for getting the copy of it. The Happy Candles way is one of the highest rated books in the category and you can go through the reviews of the book on Amazon before purchasing it.

Based on Parallel Channel, Supports and Resistances, Mother Father and Small child theory resistances and supports of Nifty remain at.

Nifty Resistances Remain at: 24815, 24909, 24977, 25045 and 25116. The channel top resistance for the current parallel channel is around 25372.

Nifty Supports Remain at: 24780 (Mother Line Support), 24679 and 24537. The Channel Bottom support is currently around 24396. 24247 is the most important Father line support.

Shadow of the candles currently is neutral. Indicating Nifty can still go in any direction. A pennant like structure (Triangle is also formed). This indicates that Breakout or Breakdown of this triangle or pennant can take Nifty a long way on either side. Nifty is currently squeezing in the pennant with limited space. Usually when the space is limited a Breakout can happen in either direction.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Buy Fear, Not Euphoria: The Trader's EdgeWhen you look back at the greatest trading opportunities in history, they all seem to share a common element: fear. Yet, when you're in the moment, it feels almost impossible to pull the trigger. Why? Because fear paralyzes, while euphoria seduces. If you want to truly evolve as a trader, you need to master this fundamental shift: buy fear, not euphoria.

Let's break it down together.

________________________________________

What Fear and Euphoria Really Mean in Markets

In simple terms, fear shows up when prices are falling sharply, when bad news dominates the headlines, and when people around you are saying "it's all over."

Euphoria, on the other hand, is everywhere when prices are skyrocketing, when everyone on social media is celebrating, and when it feels like "this can only go higher."

In those moments:

• Fear tells you to run away.

• Euphoria tells you to throw caution to the wind.

Both emotions are signals. But they are inverted signals. When fear is extreme, value appears. When euphoria is extreme, danger hides.

________________________________________

Why Buying Fear Works

Markets are pricing machines. They constantly adjust prices based on emotions, news, and expectations. When fear hits, selling pressure often goes beyond what is rational. People dump assets for emotional reasons, not fundamental ones.

Here’s why buying fear works:

• Overreaction: Bad news usually causes exaggerated moves.

• Liquidity Vacuums: Everyone sells, no one buys, creating sharp discounts.

• Reversion to Mean: Extreme moves tend to revert once emotions stabilize.

Buying into fear is not about being reckless. It’s about recognizing that the best deals are available when others are too scared to see them.

________________________________________

Why Chasing Euphoria Fails

At the peak of euphoria, risks are often invisible to the crowd. Valuations are stretched. Expectations are unrealistic. Everyone "knows" it's going higher — which ironically means there's no one left to buy.

Chasing euphoria often leads to:

• Buying high, selling low.

• Getting trapped at tops.

• Emotional regret and revenge trading.

You’re not just buying an asset — you're buying into a mass illusion.

________________________________________

How to Train Yourself to Buy Fear

It's not enough to "know" this. In the heat of the moment, you will still feel the fear. Here's how you build the right habit:

1. Pre-plan your entries: Before panic strikes, have a plan. Know where you want to buy.

2. Focus on strong assets: Not everything that falls is worth buying. Choose assets with strong fundamentals or clear technical setups.

3. Scale in: Don’t try to catch the bottom perfectly. Build positions gradually as fear peaks.

4. Use alerts, not emotions: Set price alerts. When they trigger, act mechanically.

5. Remember past patterns: Study previous fear-driven crashes. See how they recovered over time.

Trading is a game of memory. The more you internalize past patterns, the easier it is to act when everyone else panics.

________________________________________

A Recent Example: April 2025 Tariff Panic

Very recently, at the start of April, Trump’s new tariff announcements sent shockwaves through the market. Panic took over. Headlines screamed. Social media was flooded with fear.

But if you looked beyond the noise, charts like SP500 and US30 told a different story: the drops took price right into strong support zones.

At the time, I even posted this : support zones were being tested under emotional pressure.

If you had price alerts set and reacted mechanically, not emotionally , you could have bought into that fear — and potentially benefited from the rebound that followed just days later.

This is the essence of buying fear.

________________________________________

Final Thoughts

In trading, you are paid for doing the hard things. Buying when it feels terrible. Selling when it feels amazing.

Remember:

Fear offers you discounts. Euphoria offers you traps.

The next time the market feels like it's crashing, ask yourself:

• Is this fear real, or exaggerated?

• Is this an opportunity hiding under an emotional fog?

If you can answer that with clarity, you're already ahead of 90% of traders.

Stay rational. Stay prepared. And above all: buy fear, not euphoria.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Trading Psychology Trap: The Dark Side of Hedging a Bad Trade⚡ Important Clarification Before We Begin

In professional trading, real hedging involves sophisticated strategies using derivatives like options, futures, or other financial instruments.

Banks, funds, and major institutions hedge to manage portfolio risk, based on calculated models and complex scenarios.

This article is not about that.

We are talking about the kind of "hedging" retail traders do — opening an opposite position at the broker to "protect" a losing trade.

It may feel smart in the moment, but psychologically, it can be a hidden trap that damages your trading discipline.

Let’s dive into why emotional hedging rarely works for independent traders.

________________________________________

In trading, there’s a moment of panic that every trader has faced:

"My short position is in the red… maybe I’ll just open a long to balance it out."

It feels logical. You’re hedging. Protecting yourself. But in reality, you might be stepping into one of the most deceptive psychological traps in trading.

Let’s unpack why emotional hedging is rarely a good idea—and how it quietly sabotages your progress.

________________________________________

🧠 1. Emotional Relief ≠ Strategic Thinking

Hedging often arises not from a solid strategy, but from emotional discomfort.

You don’t hedge because you’ve analyzed the market. You hedge because you can’t stand the pain of a losing position.

This is not trading.

This is emotional anesthesia.

You’re trying to feel better—not trade better.

________________________________________

🎭 2. The Illusion of Control

Opening a hedge feels like taking back control.

In reality, you’re multiplying complexity without clarity.

You now have:

• Two opposing positions

• No clear directional bias

• An unclear exit strategy

You’ve replaced one problem (a loss) with two: mental conflict and strategic confusion.

________________________________________

🎢 3. Emotional Volatility Rises Sharply

With two positions open in opposite directions:

• You root for both sides at once.

• You feel relief when one wins, and stress when the other loses.

• Your mind becomes a battleground, not a trading desk.

This emotional volatility leads to irrational decisions, fatigue, and trading paralysis.

________________________________________

🔄 4. You Delay the Inevitable

When you hedge a losing position, you don’t fix the mistake.

You prolong it.

Eventually, you’ll have to:

• Close one side

• Add to one side

• Or exit both at the wrong moment

Hedging here is just postponed decision-making—and it gets harder the longer you wait.

________________________________________

🧪 5. You Build a Dangerous Habit

Hedging out of fear creates a reflex:

"Every time I’m losing, I’ll hedge."

You’re not learning to cut losses or reassess your strategy.

You’re learning to panic-protect.

And over time, you start to rely on hedging as a crutch—rather than developing real confidence and discipline.

________________________________________

✅ The Healthier Alternative

What should you do instead?

• Cut the loss.

• Review the trade.

• Wait for a fresh setup that aligns with your plan.

Accepting a losing trade is hard. But it’s a sign of maturity, not weakness.

Hedging may feel clever in the moment, but long-term consistency comes from clarity, not complication.

________________________________________

🎯 Final Thought

Emotional hedging isn’t about strategy.

It’s about fear.

The best traders don’t hedge to escape a loss.

They manage risk before the trade starts —and have the courage to close what’s not working.

Don’t fall into the illusion of safety.

Master the art of decisive action. That’s where real edge lives. 🚀

Why I Deal With Losses Before They Even Appear📉 Mastering the mindset that most traders avoid

There’s a moment that happens in every trader’s journey — not during a win, but during a loss.

A frozen moment where your mind screams, “It shouldn’t have gone this way!”

You look at the screen, your stop is hit, your equity drops, and your brain starts the negotiation:

“What if I held a bit longer?”

“Maybe the stop was too tight.”

“I need to make this back. Now.”

But the problem didn’t start with that loss.

It started long before you placed the trade.

________________________________________

💡 The Biggest Lie in Trading: “I’ll Deal With It When It Happens”

Too many traders operate from a place of reactivity.

They focus on the chart, the breakout, the “R:R,” the indicator... but they forget the only thing that actually matters:

❗️ What if this trade fails — and how will I handle it?

That’s not a pessimistic question.

It’s the most professional one you can ask.

If you only accept the possibility of a loss after the loss happens, it’s too late.

You’ve already sabotaged yourself emotionally — and probably financially, too.

So here's the core principle I apply every single day:

________________________________________

🔒 I Accept the Loss Before I Enter

Before I click "Buy" or "Sell," I already know:

✅ What my stop is.

✅ How much that stop means in money.

✅ That I am 100% okay losing that amount.

If any of those don’t align, the trade is dead before it begins.

This is not negotiable.

________________________________________

🚫 Don’t Touch the Stop. Touch the Volume.

One of the biggest mistakes I see — and I’ve done it too, early on — is this:

You find a clean technical setup. Let’s say the proper stop is 120 pips away.

You feel it’s too wide. You want to tighten it to 40. Why?

Not because the market structure says so — but because your ego can’t handle the potential loss.

❌ That’s not trading. That’s emotional budgeting.

Instead, keep the stop where it technically makes sense.

Then reduce the volume until the potential loss — in money, not pips — is emotionally tolerable.

We trade capital, not distance.

________________________________________

🧠 This Is the Only Risk Model That Makes Sense

Your strategy doesn’t need to win every time.

It just needs to keep you in the game long enough to let the edge play out.

If your risk is too big for your mental tolerance, it’s not sustainable.

And if it’s not sustainable, it’s not professional trading.

The goal isn’t to be right. The goal is to survive long enough to be consistent.

________________________________________

📋 My Framework: How I Deal with Losses Before They Show Up

Here’s my mental checklist for every trade:

1. Accept the loss before entering.

If I’m not okay losing X, I reduce the volume or skip the trade.

2. Set the stop based on structure, not comfort.

If the setup needs a 150-pip stop, so be it. It’s not about feelings.

3. Adjust volume to match my comfort zone.

I never trade “big” just because a setup looks “great.” Ego has no place here.

4. View trades as part of a series.

I expect losses. I expect drawdowns. One trade means nothing.

5. Be willing to exit early if the story changes.

If price invalidates the idea before the stop is hit (or the target), I’m gone.

________________________________________

🧘♂️ If You Can’t Sleep With the Trade, You’re Doing It Wrong

Peace of mind is underrated.

If a trade is making you anxious — not because it’s near SL, but because it’s threatening your sense of control — something is off.

And that something is usually your risk size.

Professional trading isn’t built on adrenaline.

It’s built on calm decisions, repeated for years.

________________________________________

🏁 Final Thoughts: Profit is Optional. Loss Management is Mandatory.

If you want to become consistent, start every trade with a simple, brutally honest question:

“Can I lose this money and still feel calm, focused, and in control?”

If the answer is no, you’re not ready for the trade — no matter how good the chart looks.

Profit is a possibility.

Loss is a certainty.

Master the certainty. The rest will follow.

🚀 Keep learning, keep growing.

Best of luck!

Mihai Iacob

Why All You Need Is the Chart: Let the Market Speak FirstYou missed the news? Doesn’t matter. The chart already heard it for you.

________________________________________

1. The Myth of Being “Informed”

Modern traders feel pressured to be constantly plugged in:

• Twitter alerts

• Trump’s latest outburst

• CNBC headlines