"BTC Sweeps Liquidity – Eyeing 115K Reclaim?""BTC Sweeps Liquidity – Eyeing 115K Reclaim?"

🔍 Technical Analysis – BTC/USD

On the 1H chart, Bitcoin (BTC) is currently displaying a textbook smart money structure, with price action following key institutional footprints.

🔑 Key Observations:

Liquidity Grab at Weak Low

Price dipped below the local support (~112,500), sweeping sell-side liquidity and tapping into a possible reversal zone.

Rejection from Demand Zone (Support Area)

A strong reaction occurred right at the support level, suggesting buyer interest is still present.

Order Block & Fair Value Gap

A visible Fair Value Gap (FVG) sits above current price action, aligning with an Order Block near the 115,000 level — this is a key magnet for price to rebalance.

Target Zone

Immediate upside target is 115,000, where an order block lies. If price reaches that level, expect potential short-term resistance or reversal.

Break of Structure (BOS) Confirmations

Multiple BOS and CHoCHs indicate bearish-to-bullish attempts, but the current structure still needs confirmation above 113,500+ for bullish continuation.

🧠 Conclusion & Expectation:

BTC has swept liquidity to the downside and may now seek to fill the FVG and revisit the 115K order block. However, confirmation is required — watch for bullish engulfing candles, volume spikes, or a CHoCH above 113,500.

“Smart money doesn’t chase — it waits for liquidity, then repositions. BTC may be following the same script.”

Educationaltrade

Mechanical vs. Anticipation Trades: The Fine LineWhen traders talk about discipline, they often refer to following rules — sticking to a plan, being methodical, and avoiding emotional decisions. But there's a subtle and powerful difference between being rule-based and being blindly mechanical. And even more, there's a moment in every trader’s process where discipline demands adaptation.

Let’s look at a recent trade on Gold to understand this better.

On Thursday, I published an analysis on Gold stating that the recent breakdown of support had turned that zone into resistance. A short entry from that level made sense.

It was mechanical, clean, and aligned with what the chart was showing at the time.

And, at first, it worked. Price rose into the resistance area and dropped. Perfect reaction. Textbook setup. Confirmation. The kind of trade you want to see when following a rule-based system.

But then something changed.

Price came back. Quickly.(I'm talking about initial 3315-3293 drop and the quick recover)

So, the very next rally pushed straight back into the same resistance area, hmmm...too simple, is the market giving us a second chance to sell?

That was the first sign that the market might not respect the previous structure anymore.

It dipped again after, but the second drop was different: slower, weaker, choppier.

That told me one thing: the selling pressure was fading.

So I shifted. From mechanical execution to anticipatory mindset.

This is where many traders struggle — not because they don’t have a system, but because they don’t know when to let go of it. Or worse: they abandon it too quickly without cause.

In this case, the evidence was building. The failed follow-through. The loss of momentum. The compression in structure. All signs that a reversal was brewing.

Rather than continuing to blindly short, referring to a zone that no longer held the same weight, I started looking for the opposite: an upside breakout and momentum acceleration.

That transition wasn’t based on emotion. It was based on market behavior.

________________________________________

Mechanical vs. Anticipation: What’s the Real Difference?

A mechanical trade is rule-based:

• If X happens, and Y confirms, then enter.

• No need for interpretation, no second guessing.

• It can (in theory) be automated.

An anticipatory trade is different:

• It’s about reading intent in price action before confirmation.

• Higher risk usually, but higher reward if you’re right.

• Can’t be automated. It requires presence, experience, and context.

And the tricky part? Often, we lie to ourselves. We say we’re "mechanical" while actually guessing. Or we think we’re being smart and intuitive, when in fact, we’re being impulsive.

The key is awareness.

In my Gold ideas, the initial short was mechanical. But the invalidation came quickly — and I was alert enough to switch gears. That shift is not a betrayal of discipline. It’s an upgrade of it.

________________________________________

Final Thoughts:

Discipline is not doing the same thing no matter what. Discipline is doing what the market requires you to do, without emotional distortion.

And that, often, means walking the fine line between the setup you planned for, and the reality that just showed up.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

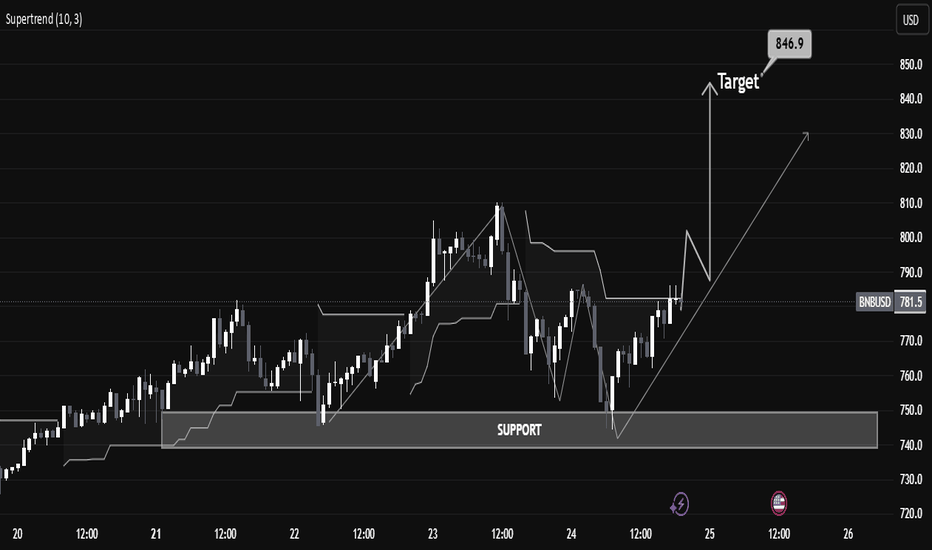

“BNBUSD Educational Breakdown – Support Rejection “BNBUSD Educational Breakdown – Support Rejection with $846 Target in Sight”

Market Structure Overview:

BNBUSD is exhibiting a bullish market structure after forming a textbook higher low at the major demand zone near $740–$750. This zone has been historically significant, offering strong rejections and triggering aggressive bullish rallies.

A new bullish wave appears to be forming after price respected the ascending trendline and reclaimed the supertrend level, now acting as dynamic support around $782.2.

⸻

🔧 Technical Confluences:

• Support Zone: Highlighted between $738–$750, serving as a demand base. Recent price rejection here confirms buyers’ dominance.

• Trendline Support: Price has respected an ascending trendline, signaling short-term trend continuation.

• Supertrend Confirmation: Trend flip has occurred—price is now trading above the Supertrend line, indicating a fresh bullish momentum phase.

• Break of Structure (BoS): Minor resistance around $784–$790 was breached, suggesting bullish continuation.

⸻

🎯 Target Projection:

Using recent swing highs and market symmetry, the next logical resistance lies at $846.9, aligning with the previous supply zone. This target also fits within the measured move from the support base to previous highs.

⸻

📈 Trade Plan (Educational Only):

• Long Bias Zone: Between $770–$780

• Invalidation Level: Below $738 (loss of support structure)

• Target: $846.9

• Risk-Reward: Roughly 1:2.5 – favorable for swing traders

⸻

📚 Educational Note:

This chart is an excellent example of:

• Structure trading (support/resistance)

• Trend confirmation using a dynamic indicator (Supertrend)

• Risk-managed entries with clearly defined stop-loss and take-profit zones.

Pending Orders Are Not Set in Stone – Context Still MattersIn a previous educational article, I explained why I almost never trade breakouts on Gold.

Too many fakeouts. Too many emotional traps.

Instead, I stick to what works:

• ✅ Buying dips

• ✅ Selling rallies

But even these entries — placed with pending orders — are not automatic.

Because in real trading, price is not just a number — it’s a narrative.

And if the story changes, so should the trade.

________________________________________

🎯 The Setup – Buy the Dip Around 3400

Let’s take a real example from yesterday.

In my analysis, I mentioned I would look to buy dips near 3400, a former resistance now acting as support.

Price dropped to 3405, just a few points above my pending buy at 3402.

We saw a clean initial bounce — confirming that short-term support was real.

But I missed the entry by 30 pips.

So far, so good.

But here’s the important part — what happened next changed everything.

________________________________________

🧠 The Rejection Shifted the Entire Story

The bounce from 3405 was immediately sold into at 3420, a newly formed short-term resistance (clearly visible on the 15-minute posted chart).

After that, price started falling again — heading back toward my pending order.

📌 At that point, I cancelled the order. Why?

Because the context had changed:

• Bulls had tried once — and failed at 3420

• Sellers were clearly active and waiting above

• A second drop into my level wouldn’t be a clean dip — it would be retest under pressure.

The market was no longer giving me a “buy the dip” setup.

It was showing me a failed recovery. That’s a very different trade.

________________________________________

💡 What If It Had Triggered?

Let’s imagine that price had hit 3402 first, triggering my order.

Then rebounded, failed at 3420, and started dropping again.

Even then, I wouldn’t hold blindly.

Once I saw the rejection at 3420, I would have understood:

The structure had shifted.

The bullish case is weakening.

Exit early — breakeven or small controlled loss.

________________________________________

🔁 Sequence > Level

This is the most important principle:

• ✅ First down, then up = healthy dip → shows buyers are still in control

• ❌ First up, then down = failed breakout → shows selling pressure is stronger

Two scenarios. Same price. Opposite meaning.

That’s why you should look for:

Not just where price goes — but how it gets there.

________________________________________

🔒 Pending Orders Are Conditional

Many traders treat pending orders like traps:

“Just let price come to my level, and I’m in.”, but you should refine a little

✅ Pending orders should be based on a conditional expectation

❌ Not a fixed belief that the zone must hold

If the market tells a different story, remove the order.

No ego. No drama. Just process.

________________________________________

📌 Final Thought

Trading isn’t just about catching a price.

It’s about understanding price behavior.

First down, then up = strength.

First up, then down = weakness.

Let the market show its hand — then decide if you want to play.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Serios Traders Trade Scenarios, Not Certaintes...If you only post on TradingView, you're lucky — moderation keeps discussions professional.

But on other platforms, especially when you say the crypto market will fall, hate often knows no limits.

Why?

Because most people still confuse trading with cheering for their favorite coins.

The truth is simple:

👉 Serious traders don't operate based on certainties. They work with living, flexible scenarios.

In today's educational post, I'll show you exactly how that mindset works — using a real trade I opened on Solana (SOL).

________________________________________

The Trading Setup:

Here’s the basic setup I’m working with:

• First sell: Solana @ 150

SL (stop-loss): 175

TP (take-profit): 100

• Second sell: Solana @ 160

SL: 175

TP: 100

I won’t detail here why I believe the crypto market hasn’t reversed yet — that was already explained in a previous analysis.

Today, the focus is how I prepare my mind for different outcomes, not sticking to a fixed idea.

________________________________________

The Main Scenarios:

Scenario 1 – The Pessimistic One

The first thing I assume when opening any position is that it could fail.

In the worst case: Solana fills the second sell at 160 and goes straight to my stop-loss at 175.

✅ This is planned for. No drama, no surprise. ( Explained in detail in yesterday's educational post )

________________________________________

Scenario 2 – Pessimistic but Manageable

Solana fills the second sell at 160, then fluctuates between my entries and around 165.

If I judge that it’s accumulation, not distribution, I will close the trade early, taking a small loss or at breakeven.

________________________________________

Scenario 3 – Mini-Optimistic

Solana doesn’t even trigger the second sell.

It starts to drop, but stalls around 120-125, an important support zone as we all saw lately.

✅ In this case, I secure the profit without waiting stubbornly for the 100 target.

Important tactical adjustment:

If Solana drops below 145 (a support level I monitor), I plan to remove the second sell and adjust the stop-loss on the initial position.

________________________________________

Scenario 4 – Moderately Optimistic

Solana doesn’t fill the second order and drops cleanly to the 100 target.

✅ Full win, perfect scenario for the first trade

________________________________________

Scenario 5 – Optimistic but Flexible

Solana fills the second sell at 160, then drops but gets stuck at 120-125(support that we spoken about) instead of reaching 100.

✅ Again, the plan is to close manually at support, taking solid profit instead of being greedy.

________________________________________

Scenario 6 – The Best Scenario

Solana fills both sell orders and cleanly hits the 100 target.

✅ Maximum reward.

________________________________________

Why This Matters:

Scenarios Keep You Rational. Certainties Make You Fragile.

In trading, it's never about being "right" or "wrong."

It's about having a clear plan for multiple outcomes.

By thinking in terms of scenarios:

• You're not emotionally attached to a single result.

• You're prepared for losses and quick to secure wins.

• You're flexible enough to adapt when new information appears.

Meanwhile, traders who operate on certainties?

They get blindsided, frustrated, and emotional every time the market doesn’t do exactly what they expected.

👉 Trading scenarios = trading professionally.

👉 Trading certainties = gambling with emotions.

Plan your scenarios, manage your risk, and stay calm. That's the trader's way. 🚀

Possible vs. Probable in Trading — Most Traders Ignore ThisOne of the biggest mistakes traders make — especially beginners — is confusing what is possible with what is probable.

This confusion leads to poor decisions, unnecessary risks, and eventually, losses that could have been easily avoided.

Possible and Probable Are NOT the Same Thing

Let's make this very clear:

• Possible means it can happen.

• Probable means it is likely to happen, based on evidence and context.

In life, many things are possible — but that doesn’t mean we should live our lives preparing for each possible (and often extreme) event.

To give you a real-life example: it’s possible that something falls from the roof top of a builing and hits you while shopping and die. Sadly, this actually happened in Romania about a month ago.

But as rare and tragic as it is, it’s not probable. And it definitely doesn’t mean that we should stop going outside, right?

Trading Is a Game of Probabilities, Not Possibilities

When trading, we are not betting on what is possible.

If we did, we would enter trades every time we imagine a price could go higher or lower — and that would be a disaster.

Instead, we are betting on what is probable — based on:

• Technical analysis

• Price action

• Market context

• Volume

• Sentiment

⚠️ Yes, it is always possible for price to go in either direction.

But our edge comes from identifying what is more likely to happen based on the data we have.

Why This Difference Is Crucial for Your Trading Success

✅ Focusing on probabilities means:

• You enter only high-probability setups.

• You manage risk properly because you accept that nothing is 100% sure.

• You avoid chasing trades just because "it’s possible" something happens.

❌ Focusing on possibilities leads to:

• Overtrading

• Emotional decisions

• Hoping instead of following a plan

• Blowing up accounts

Conclusion: Trade Like a Professional — Trade Probabilities

Remember:

"Anything is possible, but not everything is probable."

If you want to survive and thrive in the markets, focus on probabilities — not on fantasies of what could happen.

You are not trading "maybe this happens", you are trading "this is likely to happen, and I’m managing my risk if it doesn’t".

Make this shift in mindset, and you’ll already be ahead of most traders out there.

The Right Questions to Ask Before Entering a TradeEvery day, traders—especially beginners—ask the same recurring question:

❓ What do you think Gold will do today? Will it go up or down?

While this seems like a logical question, it’s actually completely wrong and one that no professional trader would ever ask in this way.

Trading is not about predicting the market like a fortune teller. Instead, it's about analyzing price action, managing risk, and executing trades strategically.

So, instead of asking, "Will Gold go up or down?" , a professional trader asks three critical questions before taking any trade.

Let's break them down.

________________________________________

Step 1: Identifying the Right Entry Point

Let’s say you’ve done your analysis, and you believe Gold will drop. That’s great—but that’s just an opinion. What really matters is execution.

🔹 Where do I enter the trade?

Professional traders don’t jump into the market impulsively. They use pending orders instead of market orders to wait for the right price.

If you believe Gold will fall, you shouldn’t just sell at any price. You need to identify a key resistance level where a reversal is likely to happen.

For example:

• If Gold is trading at $2900, and strong resistance is at $2920, a professional trader will set a sell limit order at that resistance level rather than shorting randomly.

This approach ensures that you enter at a strategic point where the probability of success is higher.

________________________________________

Step 2: Setting the Stop Loss

🔹 Where do I place my stop loss?

A trade without a stop loss is just gambling. Managing risk is far more important than being right about market direction.

The key is to determine:

✅ How much risk am I willing to take?

✅ Where is the invalidation level for my trade idea?

For example:

• If you are shorting Gold at $2920, you might place your stop loss at $2935—above a recent high or key technical level.

• This way, if the price moves against you, you have a predefined maximum loss, avoiding emotional decision-making.

Professional traders never risk more than a small percentage of their account on a single trade. Risk management is everything.

________________________________________

Step 3: Setting the Take Profit Target

🔹 Where do I set my take profit, and does the trade make sense in terms of risk/reward?

Before taking any trade, you must ensure that your reward outweighs your risk.

For example:

• If you risk $15 per ounce (short at $2920, stop loss at $2935), your take profit should be at least $30 away (for a 1:2 risk/reward).

• A good target in this case could be $2890 or lower.

This means that for every dollar you risk, you aim to make two dollars—ensuring long-term profitability even if only 40-50% of your trades succeed.

If the trade doesn’t offer a good risk/reward, it’s simply not worth taking.

________________________________________

Conclusion: The “Set and Forget” Mentality

Once you’ve answered these three key questions and placed your trade, the best approach is to let the market do its thing.

✅ Set your entry, stop loss, and take profit.

✅ Follow your trading plan.

✅ Avoid emotional reactions.

Many traders lose money because they constantly interfere with their trades—moving stop losses, closing positions too early, or hesitating to take profits.

Instead, adopt a professional approach: set your trade and let it run.

📌 Final Thought:

The next time you find yourself asking, “Will Gold go up or down today?” , stop and ask yourself:

📊 Where is my entry?

📉 Where is my stop loss?

💰 Where is my take profit, and does the risk/reward make sense?

This is how professional traders think, plan, and execute—and it’s what separates them from amateurs.

👉 What’s your biggest struggle when it comes to executing trades? Let’s discuss in the comments! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

The Pygmalion Effect in Trading: Expectations Shape Your Resuls!The Pygmalion Effect is a psychological phenomenon where higher expectations lead to improved performance, while low expectations result in poor outcomes.

This concept, often explored in education and leadership, also plays a crucial role in trading psychology.

Your beliefs about your trading abilities, strategies, and the market can directly influence your results.

But how can you use this to your advantage, and when does it work against you? Let’s explore.

________________________________________

How the Pygmalion Effect Applies to Trading

At its core, the Pygmalion Effect suggests that what you expect tends to become reality—not through magic, but through subconscious behavioral shifts. In trading, this can manifest in several ways:

🔹 Confidence in Your Strategy – If you genuinely believe in your trading system, you're more likely to follow it with discipline, leading to consistent results over time.

🔹 Fear and Self-Doubt – If you constantly doubt your trades, hesitate to enter, or close positions too early out of fear, you reinforce negative expectations, leading to underperformance.

🔹 Risk-Taking Behavior – Overconfidence, another side of the Pygmalion Effect, can lead to excessive risk-taking, believing that every trade will be a winner—just as dangerous as self-doubt.

How to Use the Pygmalion Effect to Your Advantage:

✅ Develop a Strong Trading Plan – Confidence comes from preparation. A well-tested strategy gives you a clear roadmap to follow.

✅ Control Your Self-Talk – The way you talk to yourself matters. Replace " I always lose trades" with "I am improving my risk management and discipline."

✅ Focus on Process Over Outcomes – Instead of worrying about individual wins or losses, focus on executing your plan consistently.

✅ Surround Yourself with Positive Influences – Follow traders and mentors who reinforce disciplined trading habits rather than hype and emotional decision-making.

✅ Use Visualization Techniques – Imagine yourself trading successfully, making rational decisions, and following your plan—this can train your mind to align with positive expectations.

________________________________________

Applying the Pygmalion Effect – A Real Market Example:

Let’s take a real-world example to illustrate this concept:

For several days, I have been warning about a potential major correction in Gold. The reason? Looking at the daily chart, even though Gold has made all-time highs in the last 10 days, these highs are very close together, and each time the price hit a new top, it reversed sharply.

This pattern is a classic sign of a reversal.

Yesterday, Gold closed with a strong bearish engulfing candle, another indication that a correction is underway.

Now, if we look at the hourly chart (left side), we can see an aggressive drop followed by a retest of the 2930 level—a typical move before further decline.

Here’s where the Pygmalion Effect comes into play:

✅ We see the setup clearly.

✅ We trust our analysis.

✅ We execute with confidence.

Following this logic, Gold could continue its correction, breaking below 2900, possibly testing 2880 support or even lower. We put the strategy into action with conviction.

Final Thoughts:

The Pygmalion Effect in trading is powerful—your expectations can make or break your performance. By setting high but realistic expectations, reinforcing confidence, and focusing on disciplined execution, you can shape yourself into a profitable, consistent trader.

Trust what you see, believe in your strategy, and trade with conviction.

👉 What are your expectations for your trading? Let’s discuss! 🚀📊

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

The Power of a Trading Journal: Key to Consistent SuccessHave you ever pondered what distinguishes successful traders from those who struggle for consistent profits? One key tool, often underestimated, is the trading journal. Both research and practical experience demonstrate that traders who diligently track their performance and critically assess their decisions tend to enhance their trading skills and overall results over time. While financial markets can seem erratic, a well-maintained trading journal can provide clarity regarding your trading behavior and highlight areas ripe for improvement.

Understanding the Trading Journal

At its core, a trading journal serves as a comprehensive record of your trades, detailing every decision and its corresponding outcome. However, it goes beyond a mere tally of wins and losses; it acts as a robust instrument for self-reflection and growth. By keeping an organized log, traders can identify recurring patterns, refine their strategies, and cultivate greater discipline in their trading practices. In essence, a trading journal empowers you to track your performance while offering meaningful insights for informed decision-making.

What Constitutes a Trading Journal?

A trading journal is a personalized record of your trading journey designed to document every aspect of your experiences. Unlike a basic transaction log, it encompasses insights into your decisions, emotional states, and strategies, thereby providing an in-depth perspective on your trading habits and performance over time. This journal functions as a roadmap, enabling you to analyze your actions, learn from missteps, and recognize successful patterns to replicate in future trades.

Essential Components of a Trading Journal

1. Trade Details:

Log fundamental information for each trade, including the date, instrument, entry and exit points, position size, and the outcome.

2. Trade Analysis and Rationale:

Capture the reasons behind each trade, such as market analysis, utilized indicators, or significant news events influencing your decision.

3. Emotional Insights:

Document the emotions felt before, during, and after each trade, which will help you identify emotional triggers impacting your decision-making.

4. Results and Lessons Learned:

Reflect on the trade’s outcome and the insights gained. Did it align with your expectations? What could be improved next time?

By consistently maintaining these entries, your trading journal will allow for systematic performance tracking, enabling you to conduct insightful trade analysis and continuously enhance your trading methodology.

The Key Benefits of a Trading Journal

Maintaining a trading journal provides numerous benefits that can significantly elevate your trading performance over time. From honing decision-making skills to fostering emotional discipline, a trading journal is an invaluable asset for anyone committed to enhancing their trading approach.

1. Enhanced Decision-Making:

Analyzing past trades enables you to discern patterns in your decision-making process, both successful and otherwise. You might uncover that certain strategies work better under specific market conditions or that impulsive trades frequently lead to losses. Understanding these patterns grants you valuable insights for making informed, calculated choices in future trades.

2. Improved Emotional Control:

Trading often involves a rollercoaster of emotions, with factors like fear and greed skewing decision-making. Documenting your feelings during trades can help you identify emotional triggers and develop strategies to manage them, maintaining objectivity and preventing emotions from derailing your trading plan. Over time, this fosters emotional control, which is crucial for sustained trading success.

3. Increased Consistency and Discipline:

A trading journal encourages consistency by promoting adherence to your trading plan and strategies. By recording every trade—regardless of its outcome—you cultivate a disciplined mindset that helps you avoid impulsive decisions and maintain a structured approach aligned with your objectives.

How to Establish Your Trading Journal

Creating a trading journal is quite simple; the key lies in selecting the right format and knowing what to document. Follow this guide to set up a journal that effectively tracks your trading performance and identifies growth opportunities.

Selecting Your Format:

1. Digital Applications:

Tools like Evernote, OneNote, or specialized trading journal software offer accessibility, data backup, and automation. Many apps include analytics features for streamlined performance tracking.

2. Spreadsheets:

Utilizing Excel or Google Sheets affords flexibility and customization. You can craft a spreadsheet tailored to your needs, complete with specified fields, formulas, and visualizations.

3. Paper Journals:

For those who prefer a tactile approach, a traditional notebook can suffice. While writing by hand fosters reflection, it lacks digital conveniences like searchable records.

Crucial Information to Record:

To enhance the effectiveness of your trading journal, make sure to include these key data points:

- Entry and Exit Points:

Log the precise times and prices at which trades are entered and exited.

- Position Size and Trade Details:

Note the trade size, instrument, and any pertinent details.

- Motivation for the Trade:

Document the analysis or strategy that influenced your trade decision, whether rooted in technical analysis, fundamental factors, or broader market trends.

- Emotional State:

Record your feelings throughout the trading process to better understand emotional influences.

- Trade Outcome and Lessons:

Reflect on the trade's success and any insights gained, noting what worked well or what didn’t.

Starting a trading journal requires minimal time but can significantly affect your long-term ability to track performance and improve.

Read Also:

Reviewing Your Trading Journal for Growth

A trading journal can only yield benefits if you regularly review and analyze its contents. Consistent reviews enable you to identify patterns, adjust strategies, and enhance your trading acumen.

Setting Review Periods:

Designate time—weekly, biweekly, or monthly—to review your journal. These sessions reinforce your commitment to your goals and reveal areas needing adjustment, ensuring ongoing learning from your trades.

Spotting Patterns and Mistakes:

Analyze your trades for recurring themes. Determine if you consistently act on particular signals or if emotional responses lead to poor decision-making. Acknowledging frequent mistakes marks the first step toward correcting detrimental behaviors.

Implementing Adjustments:

Leverage insights from your journal to modify your trading strategies. If a specific method isn’t yielding results, revise or replace it accordingly. If certain emotional triggers lead to losses, develop coping mechanisms to mitigate their influence.

By committing to regular reviews, you can transform your trading experiences into invaluable lessons that foster better habits and skills.

Read Also:

Maximizing the Benefits of Your Trading Journal

To fully reap the rewards of a trading journal, it's crucial to engage with it effectively. Here are tips to enhance your journaling experience:

1. Maintain Consistency:

Regularly enter details after every trade or at least daily. This practice captures relevant details while they’re recent, building a robust record for analysis.

2. Practice Honesty:

Accurately document both successes and failures. A truthful account allows for clearer insights into areas needing improvement, as self-awareness plays a vital role in progress.

3. Utilize Visuals:

Incorporate charts, graphs, or screenshots to enrich your journal. Visual aids facilitate pattern recognition and provide a more comprehensive understanding of your trading performance.

Read Also:

Conclusion: The Transformative Role of a Trading Journal

A trading journal is an essential tool for any trader pursuing consistent success. By meticulously recording trades, scrutinizing decisions, and learning from both victories and defeats, you can sharpen your skills, master your emotions, and cultivate a disciplined approach to the markets. Beyond merely documenting past trades, a trading journal offers critical insights that can profoundly influence your long-term performance. By consistently utilizing this resource, you can decipher your unique trading habits, refine strategies, and ultimately boost your confidence in decision-making.

✅ Please share your thoughts about this article in the comments section below and HIT LIKE if you appreciate my post. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Pride Comes Before the Fall: A Trading Lesson in HumilityIn trading, as in life, pride can be your undoing. The saying “Pride comes before the fall” holds a profound lesson for traders who let overconfidence cloud their judgment. While confidence is an essential trait for success, excessive pride often leads to reckless decision-making, ignored warnings, and ultimately, significant losses.

This post explores the dangers of pride in trading and how maintaining humility can safeguard your capital and enhance your decision-making process.

The Dangers of Pride in Trading

1. Overconfidence in Winning Streaks

Few things inflate a trader's ego like a winning streak. When every trade seems to go in your favor, it's tempting to believe you've mastered the market. However, markets are dynamic and unforgiving.

- Overconfidence may lead you to take larger positions, abandon risk management strategies, or ignore market signals.

- A single unexpected move can erase gains and even wipe out your account.

2. Refusal to Admit Mistakes

Pride can prevent traders from accepting when a trade idea is wrong. This often results in:

- Holding onto losing trades longer than necessary.

- Averaging down into bad positions, magnifying losses.

- Ignoring stop-loss levels because of a belief that the market will "come back."

3. Chasing "Revenge Trades"

After a loss, pride might push you to recover your losses immediately by doubling down on risk. Revenge trading is driven by emotions rather than logic, often leading to bigger losses.

4. Ignoring the Bigger Picture

Pride can blind traders to critical market realities. Instead of adapting to changing conditions, they stubbornly cling to outdated strategies or refuse to learn from others.

How to Keep Pride in Check

1. Treat Every Trade as a Probability Game

The market doesn't owe you anything, and no strategy guarantees success. Every trade involves risk, and outcomes are influenced by factors beyond your control.

- Focus on executing your strategy consistently rather than trying to "win."

- Acknowledge that losses are a natural part of trading.

2. Stick to a Risk Management Plan

Pride can tempt you to exceed your risk limits. Combat this by:

- Using fixed position sizes relative to your account balance.

- Setting stop-loss levels for every trade and respecting them.

3. Practice Continuous Learning

Markets evolve, and so should you. Humility keeps you open to learning new strategies, techniques, and perspectives.

- Analyze your trades, both wins and losses, to identify areas for improvement.

- Seek mentorship or study market history to gain broader insights.

4. Detach Emotionally from Trades

Acknowledge that a single trade doesn't define you as a trader.

- Avoid tying your self-worth to your trading results.

- Focus on the long-term process rather than short-term outcomes.

Conclusion

Pride is one of the most dangerous emotions a trader can harbor. It clouds judgment, promotes reckless behavior, and blinds you to market realities. Trading is not about proving you're right—it's about staying disciplined, managing risk, and adapting to ever-changing conditions.

Remember, humility is your greatest ally in the market. Stay grounded, respect the risks, and you'll be better equipped to navigate the ups and downs of trading without falling victim to the perils of pride.

Pro Tip: Write this on a sticky note and place it near your trading screen: "The market is always right. My job is to listen, adapt, and act accordingly."

The Top Ten Money Habits Every Trader Should EmbraceSuccess in trading is more than just making strategic entry and exit decisions; it demands a holistic approach that encompasses effective profit realization, diligent capital protection, and a nuanced understanding of the psychological challenges posed by money. Many traders, especially novices, overlook these critical aspects, which can impede their journey to achieving full potential. By cultivating robust money habits, traders can sidestep common pitfalls and enhance their trading practices from haphazard speculation driven by luck to a disciplined methodology that enhances the chances of success over time.

Positive money habits function like the gears in a well-oiled machine. They help traders manage stress and maintain focus in the face of market volatility, enabling them to adhere to their strategies rather than succumbing to impulsive actions. In this article, we explore ten key money habits that successful traders embrace.

1. Conservatively Allocate Your Net Worth to Trading

In the realm of retail trading, the importance of a cautious approach to capital allocation cannot be overstated. New traders should consider investing only a small percentage of their total net worth into their trading accounts. This strategy serves several purposes, the foremost being financial preservation. When stakes are relatively low, the emotional impact of inevitable losses diminishes, allowing for greater objectivity and composure. This approach helps traders manage their mental resources, which are just as critical as financial capital, by minimizing the emotional stress associated with fluctuating account balances.

2. Limit Per-Trade Risk

The 1% rule is a cornerstone of sound risk management, advising traders to commit no more than 1% of their total capital to a single trade. Adhering to this guideline is essential for maintaining stability and consistency within one’s trading operations. Small, manageable losses preserve trading capital and serve as a buffer against the emotional turmoil that larger losses can cause. By keeping losses minimal, traders can maintain emotional balance and avoid engaging in destructive behaviors such as overtrading or deviating from their established strategies.

3. Implement Stop-Loss Orders

Stop-loss orders are a vital risk management tool that dictates a pre-established exit point for trades that begin to lose value. When conditions turn unfavorable, these orders automatically limit losses, transforming small setbacks into manageable situations, which prevents catastrophic financial consequences. By setting stop-loss orders, traders can detach from the emotional weight of each trade, reducing the temptation to react impulsively. Much like a life jacket keeps you afloat in turbulent waters, stop-loss orders protect traders from significant loss during market storms.

Read Also:

4. Know When to Stop Trading

Establishing a clear boundary for when to cease trading is essential to maintaining emotional health and discipline. Whether it’s after two consecutive losses or reaching a predetermined percentage of capital loss, these self-imposed limits serve as crucial safeguards against emotional decision-making and impulsive reactions to market shifts. Avoiding the trap of "chasing losses" is vital for long-term survival, as relentless attempts to recover lost funds can lead to reckless trading behavior.

Read Also:

5. Maintain Accurate Records to Understand Your Performance

Successful traders often keep a detailed trading journal to track their history of trades and analyze performance metrics. Regularly assessing key statistics—such as win/loss ratios, average trade sizes, and recurring mistakes—enables traders to identify patterns and areas for improvement. This diligent record-keeping allows for data-driven decision-making and objective assessments, facilitating strategic adjustments based on performance rather than emotion. In essence, a trading journal becomes more than a record; it transforms into an essential tool for growth and competitive advantage.

Read Also:

6. Keep Trading Capital Separate from Personal Finances

A fundamental principle for serious traders is to maintain a clear separation between trading funds and personal finances. This involves designating a specific amount of capital exclusively for trading, shielding everyday finances from the volatility that can arise in the markets. Treating trading as a business with its own financial structure fosters discipline and enables traders to navigate market fluctuations without compromising essential personal expenses, such as rent or family obligations.

7. Develop Emotional Control

Successful trading is deeply rooted in emotional discipline. This trait differentiates a professional trader from an amateur gambler. Those capable of regulating their emotions can execute their trading plans with confidence, resisting the lure of impulsive, fear-driven decisions. Regular self-evaluation and mindfulness techniques contribute to emotional resilience, fostering a mindset that prioritizes strategic processes over short-term returns. Practicing emotional control enhances consistency and ultimately serves as a pillar of long-term success.

Read Also:

8. Cultivate Patience for Sustainable Capital Growth

Patience is a valuable asset in the trading world. Success is often achieved incrementally, necessitating a disciplined and sustained approach to trading rather than a frantic dash for immediate profits. By adhering to risk management principles and avoiding over-leverage, traders can gradually build their accounts, acknowledging that success is a marathon, not a sprint. Impatience can lead to hasty decisions that undermine a trader’s strategy, while a patient, methodical approach allows for the powerful compounding of gains over time.

9. Maintain Balance Beyond Trading

It’s crucial for traders to remember that their self-worth should not solely depend on their trading outcomes. An inherent risk exists when traders overly identify with their trading performance, potentially clouding judgment and fueling emotional volatility. Fostering a balanced lifestyle that includes varied interests helps mitigate the effects of trading fluctuations on overall well-being. This broader perspective can help traders remain level-headed, ensuring that their mood and decision-making processes are not solely influenced by trading results.

10. Establish an Emergency Fund for Financial Security

Finally, traders should prioritize building an emergency fund covering several months’ worth of living expenses. This safety net provides mental clarity and reduces the pressure that arises from needing consistent trading income. The unpredictable nature of trading can lead to significant financial stress, making it essential to separate one’s day-to-day financial needs from trading outcomes. With an emergency fund in place, traders can focus on making rational decisions without the looming pressure of immediate financial obligations.

Conclusion

In summary, successful trading transcends the mechanics of market entry and exit; it encompasses a comprehensive approach to profit realization, capital protection, and psychological resilience. By adopting sound money habits, whether you are an experienced trader or just starting, you can enhance your trading methodology and significantly improve your chances for long-term success. These strategies, from prudent capital allocation to emotional discipline, form the backbone of a resilient trading practice. Ultimately, cultivating these habits transforms trading from a game of chance into a systematic, strategic endeavor, paving the way for consistent profitability over time.

✅ Please share your thoughts about this educational post in the comments section below and HIT LIKE if you appreciate! Don't forget to FOLLOW ME; you will help us a lot with this small contribution

Sort of confluence I look 4. Not setup*# lazy, messy GBPUSD long

Be wary of any tipster subscription service that is too lazy or too inept to give you some reasons for taking the trade. Look at the mess of GBPUSD now. Fools who thought the USD would not continue to rally this week, either because they don't have a clue or are too arrogant and lazy to pull the USDX chart apart. Mute them and move on.

This is a chart of a Crypto DSHUSD. The first thing that stood out to me was the incredible volume today. That promoted me to take a closer look. You don't need the BS of in intraday price-action theorist plotting their confusing charts to throw you off.

Firstly the Daily chart. Long term downwards wedge patterns have their ways of turning bullish, one of the reasons would be the oversold nature of the instrument. You will see exactly that here in this daily chart.

This is what you need to see multiple areas of confluence on bigger timeframes. Most price-action intraday traders hiding behind concepts they probably don't understand, the so called experts don't have a clue imo.

Avoid Financial Disaster: Master Portfolio Protection.Safeguarding your portfolio is as critical as the pursuit of growth. While the excitement of asset appreciation draws many into the investing world, the reality is that market fluctuations can pose significant threats to even the most meticulously devised plans. Portfolio protection strategies exist to shield your assets against the inevitable risks inherent in financial markets, allowing you to endure turbulent economic seasons without incurring substantial losses. Whether you're an experienced investor or a newcomer, the significance of effective risk management cannot be overstated.

Markets are known for their volatility, often reflecting shifts in economic conditions, political events, and societal sentiments. A downturn can erase years of gains in a matter of moments if protective measures are lacking. Therefore, constructing a robust portfolio demanding attention to diversification, risk management techniques, and strategic asset allocation is paramount. The aim of these strategies is not the complete avoidance of risk but rather the mitigation of its potential impact, ensuring that your investment trajectory remains stable over time.

The Importance of Portfolio Protection for Lasting Success

In today’s fast-paced investment landscape, prioritizing long-term protection strategies is crucial for sustained financial success. While opportunities abound, they often come hand-in-hand with unexpected downturns, economic turmoil, or global crises that could significantly hinder wealth accumulation. During distressing market conditions, stock prices may experience extreme volatility, leading to potentially disastrous outcomes for investors who lack robust protective measures.

The consequences of failing to implement adequate protection can be catastrophic. Severe market corrections can rapidly erase gains, forcing investors to either sell at a loss or make hasty, emotional decisions. This knee-jerk reaction can create a cycle of mismanagement, further amplifying losses and jeopardizing long-term financial objectives. In stark contrast, those who incorporate strategies designed to protect against market downturns can maintain composure during turmoil, effectively safeguarding their investments while positioning themselves for recovery as conditions improve.

Preserving capital during unpredictable phases is not merely about avoiding losses; it is about fostering resilience. By minimizing risk exposure, investors enhance their ability to bounce back from setbacks and continue on their path toward growth. Techniques such as diversification, strategic asset allocation, and hedging help create a safety net during tumultuous times. For example, a diversified portfolio that encompasses bonds, commodities, and international assets offers a buffer against losses when one sector falters.

Key Strategies for Portfolio Protection

For an investment portfolio to withstand the inevitable ups and downs of the market, implementing a suite of protection strategies is essential. Here are several methods that can help minimize risks and optimize long-term growth potential:

1. Diversification Across Asset Classes

At its core, diversification is a fundamental strategy for risk management. By allocating investments across various asset classes—such as stocks, bonds, real estate, and commodities—investors can mitigate overall risk. The rationale behind this approach is straightforward: when one asset class struggles, others may thrive, balancing the portfolio's performance.

For instance, in a bearish equity market, bonds or real estate may exhibit stability or even appreciate, cushioning the blow from declining stocks. A well-crafted diversification strategy not only fortifies against losses but also creates opportunities for steady returns. An effectively diversified portfolio reduces vulnerability by distributing risk across a spectrum of investments, a critical aspect of portfolio protection.

2. Hedging with Derivatives

Hedging is a powerful technique that allows investors to guard against financial market volatility using derivatives like options and futures. For example, purchasing put options on a stock provides a safety net, giving investors the right to sell at a specified price and limiting potential losses.

While hedging does not obliterate risk, it functions as insurance, softening the impact of adverse market movements. This strategic approach requires a deep understanding of financial instruments, but when applied correctly, it can significantly bolster portfolio resilience.

3. Incorporating Defensive Investments

During economic instability and market downturns, defensive investments or safe-haven assets come into play. These assets typically retain their value, providing stability in the face of broader market declines. Sectors such as healthcare, utilities, and consumer staples represent defensive stocks that generate consistent revenue regardless of economic conditions.

Furthermore, assets like gold and government bonds are renowned for their stability during turbulent times. Gold often appreciates as stock markets decline, serving as a hedge against inflation and currency depreciation. Government bonds offer a reliable income stream, making them low-risk investments during periods of uncertainty. Incorporating these defensive strategies enhances an investor's ability to manage risk effectively.

4. Regular Portfolio Review and Rebalancing

Maintaining an optimal risk level requires regular portfolio assessments and adjustments aligned with financial goals. As market dynamics evolve, certain assets may outperform or underperform, disrupting the initial asset allocation and potentially amplifying risk.

To counter this, investors should conduct routine rebalancing—selling portions of outperforming assets and reallocating proceeds into underperforming or lower-risk investments. This process helps restore the intended asset mix and ensures adherence to overall financial objectives, promoting stability within the portfolio.

Advanced Portfolio Protection Techniques

For seasoned investors, advanced protection tactics can provide deeper layers of security against market fluctuations. These strategies extend beyond conventional diversification, utilizing sophisticated financial instruments and techniques tailored for effective risk management.

1 - Portfolio Insurance

This technique merges equities with protective puts to limit potential losses. By holding onto stocks while acquiring put options, investors cap their downside risk while still allowing for participation in market gains.

2 - Volatility-Based Strategies

Adjusting exposure based on market volatility indicators can also serve as a proactive approach to risk management. For instance, heightened volatility might necessitate reducing equity exposure in favor of low-volatility assets, thereby maintaining manageable risk levels.

3 - Utilizing Swaps and Collars

Swaps can facilitate the exchange of investment risks, providing flexibility for managing exposure to market fluctuations. A collar strategy, conversely, combines purchasing a put with selling a call option, creating a protective range that limits both potential losses and profit. These advanced tactics suit investors seeking tailored risk solutions.

Common Pitfalls in Portfolio Protection

Despite the necessity of safety strategies, several missteps can undermine their efficacy. Recognizing these errors is crucial for maintaining a resilient portfolio.

1 - Over-Diversification

While diversification is vital, over-diversifying can dilute returns and complicate portfolio management. An unmanageable number of small investments may also escalate fees and expenses unnecessarily.

2 - Neglecting Market Conditions

Failing to adjust portfolios in response to fluctuating economic or geopolitical climates can expose investors to heightened risks. Consistent reevaluation is essential to keep portfolios aligned with prevailing market trends and personal objectives.

3 - Overtraditional Reliance on One Strategy

Dependence on a singular protective measure—be it Stop Loss orders or a single hedge—can be detrimental. Instead, employing a multifaceted approach that integrates various strategies enhances systemic resilience to market volatility.

4 - Ignoring Changes in Risk Tolerance

Personal circumstances and market conditions can shift your risk profile, especially as significant life milestones approach. Neglecting to recalibrate asset allocation in light of these extrinsic factors can lead to increased vulnerability during downturns.

Being aware of these common pitfalls will enhance your ability to protect your investments and pursue long-term financial goals with confidence.

Conclusion

Establishing a resilient portfolio necessitates a strategic approach to safeguarding your investments. In a world filled with uncertainties, deploying effective portfolio protection strategies remains essential for navigating market volatility. Techniques from diversification to hedging to the utilization of advanced instruments serve to fortify your investments against sudden declines while ensuring the potential for sustainable growth.

The journey toward financial success thrives on a commitment to ongoing investment monitoring and a willingness to adapt as conditions change. By implementing a blend of protective strategies—regular rebalancing, investment in safe havens, and employing sophisticated tools—you can cultivate a durable portfolio equipped to weather economic fluctuations. Remember, protecting your investment portfolio is not simply a reactive task, but an evolving commitment aligned with your financial aspirations and the inherent uncertainties of the marketplace.

Trump 2.0: What to Expect If Donald Trump Returns to the W.HouseWith Donald Trump once again campaigning for president, his economic policies and views on international trade are resurfacing. Known for his aggressive protectionism, deregulation, and tax cuts, his economic approach has been dubbed the “Trump 2.0” by the media.

But what does the Trump Trade really mean for investors? During his first term, Trump’s policies produced mixed results. While sectors like finance and energy thrived, the federal budget deficit widened, healthcare coverage decreased, and income inequality grew. Now, with the prospect of Trump returning to the White House, we could witness "Trump 2.0." What impacts might this have on the economy, and how should investors prepare?

Key Points

-The Trump Trade emphasizes lower taxes, deregulation, increased tariffs, and reduced immigration to stimulate U.S. growth.

-Trump’s policies benefited sectors like finance and energy but also increased the federal deficit and triggered trade wars.

If re-elected, Trump’s economic agenda could boost the stock market and select industries but also bring risks like higher inflation and global retaliatory tariffs.

Understanding the Trump 2.0

The "Trump 2.0" represents Donald Trump’s economic strategy, which centers on stimulating growth through deregulation, tax cuts, higher tariffs, and reduced immigration. While this approach benefited specific sectors, it also led to rising federal deficits and global trade conflicts.

Highlights of Donald Trump (2016-2020)

1. A Strong Economy Under Trump, the U.S. economy remained robust, with low inflation and consistent job growth until the COVID-19 pandemic struck. However, the economic momentum seen during Trump’s presidency was largely a continuation of the post-Great Recession recovery initiated by the Obama administration.

2. Job Creation and Wage Growth Prior to the pandemic, job creation and wage growth continued their upward trend, with unemployment hitting a 50-year low of 3.5% in 2019. Wages increased steadily in 2018 and 2019.

3. Tax Cuts The Tax Cuts and Jobs Act of 2017, Trump’s most significant policy, represented the largest tax overhaul in 30 years, reducing the corporate tax rate from 35% to 21%. The tax cuts spurred consumer spending and increased private sector investment, but also added significantly to the federal deficit.

4. Booming Stock Market The stock market thrived under Trump’s administration, with the S&P 500 setting new records until 2022. The Dow Jones Industrial Average rose by 57% during his tenure, fueled by high employment, wage growth, and tax incentives.

S&P500 During Trumph Election

5. Widening Federal Deficit Trump’s tax cuts and increased defense spending expanded the federal deficit. In 2018, the annual deficit hit $779 billion, escalating to over $1 trillion by 2020.

6. Trade Tariffs Trump imposed tariffs on steel, aluminum, solar panels, and Chinese imports, triggering a “trade war” with China and other trading partners like Canada, Mexico, and the European Union. While intended to protect U.S. industries, these tariffs led to global retaliations, impacting American consumers and workers negatively.

What to Expect If Trump Returns to Power

If Trump returns to the White House, his economic policies could have significant implications for various sectors:

1. Impact on the Stock Market

Historically, the stock market performs positively during election periods, regardless of the candidate. If Trump wins, expect market gains due to extended tax cuts, increased oil and gas production, and deregulation. While Trump’s policies could boost corporate investment, stock market performance will ultimately depend on broader economic fundamentals.

2. Impact on Bond Yields

Trump's pro-business agenda, combined with increased spending, could drive inflation upwards. If inflation rises, the Federal Reserve may maintain higher interest rates, which could increase bond yields but reduce bond prices. This would likely result in a more muted bond market under a Trump administration.

3. Impact on Dollar Strength

A strong economy under Trump could bolster the U.S. Dollar. External factors, such as economic weakness in Europe and Asia, may further support dollar strength. However, a stronger dollar could hurt U.S. exporters, making their goods more expensive abroad and reducing their competitiveness.

4. Impact on Specific Sectors

-Financial Services: The sector could benefit from deregulation, enabling banks to expand operations and increase profitability.

-Technology: Tech companies may gain from extended corporate tax cuts, leading to higher investments, stock buybacks, and dividends.

-Energy: Trump’s “drill, baby, drill” policy aims to expand domestic oil and gas production, supporting the energy sector and boosting U.S. exports.

-Manufacturing: While a strong dollar could reduce export competitiveness, Trump’s emphasis on domestic production (e.g., the CHIPS and Science Act) could support U.S. manufacturers.

-Infrastructure: Trump's support for infrastructure projects could benefit construction and civil engineering companies, building on the existing Infrastructure Act passed by Biden.

Global Implications of Trump 2.0

-Universal Tariffs: Trump’s proposed universal tariffs could trigger significant global retaliation, leading to reduced trade, disrupted supply chains, and higher global inflation.

-Renewed Trade War with China: Trump has hinted at increasing tariffs on Chinese imports to as high as 60%, which could hinder China’s economic recovery and create broader global economic uncertainty.

Preparing for Trump 2.0

Investors should keep a close eye on sectors likely to benefit from Trump’s policies, such as finance, technology, energy, and infrastructure. At the same time, be prepared for volatility in the bond market and potential retaliatory tariffs impacting global trade dynamics.

Diversifying portfolios, hedging against potential inflation, and maintaining a long-term investment outlook can help manage the uncertainties associated with a potential Trump return to the White House.

Conclusion

Trump 2.0 could have a significant impact on the U.S. economy and global markets. While certain sectors may experience growth under Trump’s policies, the risks of higher inflation, trade conflicts, and federal deficits remain. Investors should approach a potential Trump presidency with cautious optimism, focusing on sectors that align with his agenda while being prepared for increased volatility. By staying informed and adaptable, investors can capitalize on the opportunities and navigate the risks posed by a possible Trump comeback.

✅ Please share your thoughts about this article in the comments section below and HIT LIKE if you appreciate my post. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

BUY EURUSD. Not on interest rate holds but Indicator Signals.

EURO zone held their interest rates on hold yesterday despite expectations of a rate cut for the zone.

On the charts and there are 3; weekly, daily, 4hr.

Weekly is a 38.2 fib price retracement to a buy zone and the continuation of higher prices.

Daily chart is a recent bounce from a Buy order block triggering long bets for EURUSD.

The 4HR chart is getting bullish reversal oversold signals on Stochastic's and RSI, which tend to be very reliable on 4HR charts and higher.

Contrarian Approach: Going Against the Grain for Long-Term GainsContrarian investing is a distinct and often rewarding approach to financial markets that revolves around going against prevailing market trends. The strategy is based on the belief that herd behavior among investors frequently leads to significant market mispricings. When most investors are buying, contrarians sell, and when others are selling, contrarians buy. By defying conventional wisdom, contrarian investors seek opportunities where others see risk or insignificance.

The fundamental principle of contrarian investing is simple: buy when others are fearful and sell when others are greedy. This strategy leverages the cyclical nature of markets and investor sentiment, which tends to swing between extremes. Contrarian investors actively look for undervalued assets that have been negatively impacted by market sentiment, betting on a correction that will realign the asset's price with its true value.

While this approach can yield significant benefits—such as acquiring assets at a lower price and achieving substantial returns when markets correct—it is not without its risks. Contrarian investors often face prolonged periods of market disagreement, during which their positions may lose value before the anticipated correction occurs. Additionally, distinguishing between true contrarian opportunities and value traps—assets that are cheap for valid reasons—requires skill and patience.

What Is Contrarian Investing?

At its core, contrarian investing involves making investment choices that go against the crowd. Rather than following popular trends or chasing the latest fads, contrarian investors look for opportunities where collective sentiment has led to market distortions. They thrive on the idea that the market often overreacts to news and events, creating ideal conditions to buy undervalued assets and sell those that have become overhyped.

Contrarian investors stand out due to their mindset, which includes:

1- Independence: The ability to think and act independently of market sentiment.

2- Patience: The discipline to wait for the market to correct and recognize mispricings.

3- Skepticism: A critical approach to popular views and current market trends.

This strategy contrasts with momentum investing, which focuses on assets with recent strong performance, and growth investing, which targets companies poised for future earnings. Contrarian investors focus on understanding market psychology and behavioral finance to spot opportunities others might miss.

Key Principles of Contrarian Investing

Several foundational principles guide contrarian investors in recognizing and leveraging market inefficiencies:

-Market Sentiment Analysis: Contrarian investors thrive on identifying periods of extreme market sentiment, whether it's excessive optimism or pessimism. They prepare to sell during moments of widespread market enthusiasm and buy during times of fear and uncertainty.

-Overbought and Oversold Conditions: Recognizing when an asset is overbought (trading above its intrinsic value) or oversold (trading below its true worth) is essential. Contrarians capitalize on these conditions, making strategic decisions based on market extremes.

-Value Investing Component: Contrarian investing is closely tied to value investing, as both involve seeking out undervalued assets with strong fundamentals. Contrarians conduct thorough research to find stocks that are temporarily out of favor but fundamentally sound.

-Patience and Long-Term Perspective: Success in contrarian investing requires a long-term outlook and the ability to withstand short-term losses while waiting for the market to realign with the asset’s true value.

Identifying Contrarian Opportunities

Identifying contrarian opportunities involves a combination of fundamental and technical analysis, along with a keen understanding of market anomalies.

-Fundamental Analysis: Contrarian investors dig deep into a company’s financial statements, management quality, and growth potential to determine whether an asset is undervalued. Metrics like price-to-earnings (P/E) and price-to-book (P/B) ratios are key indicators of undervaluation.

-Technical Analysis: While fundamentals highlight a company’s intrinsic value, technical indicators like moving averages and the Relative Strength Index (RSI) help pinpoint ideal entry and exit points for contrarian trades.

-Market Anomalies: Contrarians exploit anomalies such as market overreactions to news, seasonal trends, and behavioral biases like herd behavior, creating opportunities to buy low and sell high.

Risk Management for Contrarian Investors

Risk management is essential for contrarian investors, especially since their strategy often involves going against prevailing trends. Key risk management techniques include:

-Stop Loss Orders: Setting predetermined levels where a trade will automatically close helps cap potential losses and protect against market downturns.

-Position Sizing: Proper position sizing ensures that no single investment can significantly impact the portfolio, reducing the risk of overexposure.

-Diversification: Building a diversified portfolio of assets across different sectors and asset classes helps mitigate risk and balance returns.

Conclusion: The Power of the Contrarian Mindset

Contrarian investing is a unique approach to navigating financial markets, capitalizing on the emotional reactions and inefficiencies created by the crowd. By applying key principles such as market sentiment analysis, identifying overbought and oversold conditions, and maintaining a value-oriented perspective, contrarians uncover opportunities that others may overlook.

With discipline, patience, and careful risk management, contrarian investing offers the potential for substantial long-term gains. Embracing the contrarian mindset allows investors to navigate market noise, remain patient during market downturns, and act decisively when opportunities arise. In a world where following the crowd can lead to mediocrity, contrarians stand out by daring to go against the grain.

Trading a Single Forex Pair: Choosing the Right One for SuccessNavigating the complexities of forex trading begins with choosing the right currency pair. Each currency pairing represents a unique relationship between two currencies, and mastering the dynamics of a single pair can offer traders a sharper edge. By understanding how a particular pair moves, traders can craft more effective strategies and reduce exposure to unnecessary risks.

Understanding Currency Pairs

In forex trading, a currency pair represents the value of one currency against another. For example, in the EUR/USD pair, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. The exchange rate tells traders how much of the quote currency is needed to purchase one unit of the base currency. This core understanding is essential for crafting strategies based on price movement, market news, and economic indicators.

Base Currency vs. Quote Currency:

The base currency is the first currency listed in the pair and is the one being bought or sold. In EUR/USD, the base currency is EUR.

The quote currency is the second currency, showing how much of it is required to buy one unit of the base currency.

Types of Currency Pairs

-Major Pairs: These are the most traded pairs globally, including the US Dollar (USD) and other major currencies such as the Euro (EUR), Japanese Yen (JPY), and British Pound (GBP). Examples include EUR/USD and USD/JPY. Major pairs are typically more liquid, offering tighter spreads and more predictable price movements.

-Minor Pairs: These exclude the USD but involve other major currencies, such as EUR/GBP and GBP/JPY. While still liquid, minor pairs may have slightly wider spreads compared to majors.

-Exotic Pairs: These involve a major currency paired with a currency from a smaller or emerging market, such as USD/TRY (US Dollar/Turkish Lira). Exotic pairs tend to be less liquid and more volatile, with wider spreads and higher risk.

Key Factors for Choosing a Currency Pair

When selecting a currency pair, consider several critical factors to optimize profitability and minimize risk:

-Liquidity: High liquidity means you can easily buy or sell a currency without causing large price swings. Pairs like EUR/USD and USD/JPY are highly liquid, resulting in narrower spreads and lower transaction costs.

-Volatility: Volatile pairs experience more dramatic price swings. While this can present opportunities for larger gains, it also brings higher risk. Traders should balance their appetite for risk with volatility when selecting a pair.

-Market Hours: The forex market operates 24/5, with different trading sessions in various time zones. High liquidity occurs when major sessions, such as London and New York, overlap. Understanding which sessions affect the pair you’re trading helps optimize timing.

-Economic Indicators: Macroeconomic data—such as GDP growth, inflation, and employment reports—play a significant role in currency fluctuations. Monitoring these indicators for the currency pairs you trade will help you make informed decisions.

-Correlations: Some currency pairs are correlated with other markets, such as commodities or stocks. For instance, the Australian Dollar (AUD) is closely tied to commodity prices, while the Japanese Yen (JPY) is seen as a safe-haven currency. Recognizing these correlations can give you an edge when anticipating price movements.

-Spread and Transaction Costs: The spread is the difference between the buy and sell prices. Major pairs like EUR/USD generally have lower spreads, reducing trading costs and improving profitability.

Popular Currency Pairs and Their Characteristics

-EUR/USD: Known for its high liquidity and stable trading conditions, EUR/USD is the most traded currency pair. Its price movements are influenced by economic data from the Eurozone and the United States, making it a favorite among traders seeking reliable trends.

-GBP/USD (Cable): This pair is more volatile than EUR/USD, offering larger price swings, especially during the London session. It is sensitive to UK economic data and geopolitical events like Brexit, making it ideal for traders who prefer volatility.

-USD/JPY: This pair is less volatile than others and is influenced by US and Japanese economic data. The Japanese Yen (JPY) is also seen as a safe-haven currency, attracting traders during times of global economic uncertainty.

-AUD/USD: The Australian Dollar (AUD) is heavily influenced by commodity prices and economic data from Australia and China. It’s a great option for traders who want to capitalize on global commodity trends.

-USD/CHF: The Swiss Franc (CHF) is another safe-haven currency, meaning this pair is often less volatile and attracts traders during periods of global instability.

Developing a Strategy for Trading a Single Pair

Choosing to trade a single pair allows you to focus and specialize, giving you a deep understanding of the pair’s movements, news impacts, and market conditions. Here's how to develop a successful strategy for trading one currency pair:

-Monitor Economic News: For major pairs like EUR/USD, keep a close eye on economic data releases such as interest rates, employment reports, and inflation figures from the Eurozone and the US. News-driven trading strategies often work well with high-liquidity pairs like this.

-Leverage Volatility: If you choose a more volatile pair like GBP/USD, focus on breakout strategies or trend-following approaches. These pairs can offer large price swings, but effective risk management is crucial.

-Risk Management: Always employ Stop Loss orders to protect your capital, especially with more volatile pairs. Proper position sizing and diversification are also key to managing risk.

-Analyze Correlations: If you trade a pair like AUD/USD, understanding its relationship with commodity prices or China's economy can enhance your decision-making process.

Conclusion: Focus on One Pair for Mastery

For traders looking to specialize, trading a single forex pair can be a strategic advantage. It allows you to concentrate on the nuances of one pair, build expertise, and reduce the risks associated with juggling multiple assets. Whether you choose the highly liquid EUR/USD or the volatile GBP/USD, mastering one pair simplifies decision-making and enhances your ability to react swiftly to market movements.

In the world of futures or CFDs, focusing on a major pair like EUR/USD provides access to deep liquidity and tight spreads. With a strong strategy and the discipline to specialize, traders can avoid unnecessary distractions, manage risks more effectively, and enhance long-term success in the dynamic forex market.

✅ Please share your thoughts about this article in the comments section below and HIT LIKE if you appreciate my post. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

> Trader's Checklist for Successful Trading <Trading in financial markets involves the buying and selling of various financial instruments, such as stocks, currencies, commodities, and derivatives, with the primary goal of generating profits. This dynamic activity spans across global exchanges, driven by factors like economic data, geopolitical events, and investor sentiment. Whether you're a seasoned investor or a novice trader, navigating these markets requires careful planning, strategic decision-making, and a disciplined approach.

One essential tool for achieving success in trading is the trader’s checklist. A checklist serves as a structured roadmap, ensuring that traders stay organized, disciplined, and consistent in their approach. It helps maintain focus on critical aspects such as market analysis, risk management, and execution strategies. By integrating a comprehensive checklist into your trading routine, you can make more informed decisions, minimize risks, and optimize your trading outcomes.

Setting Up Your Trading Environment