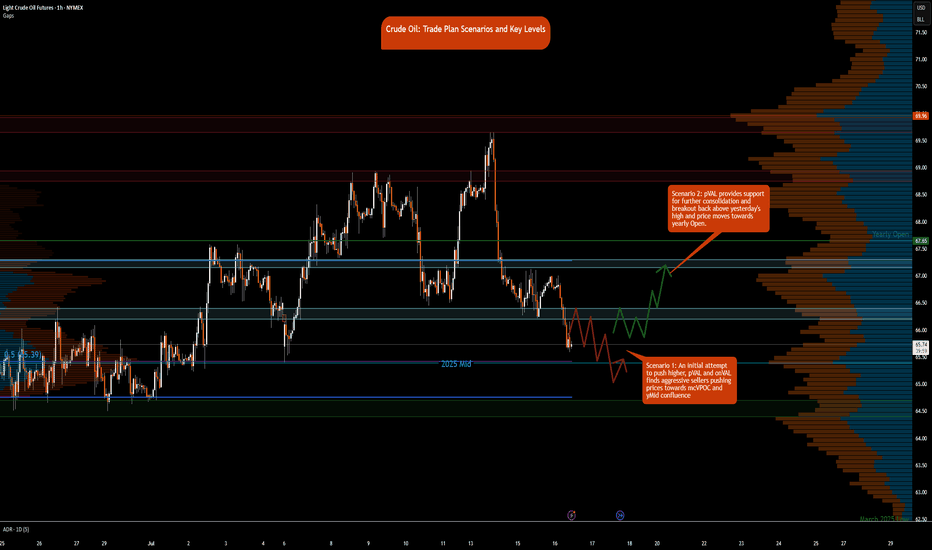

Crude Oil Trade Plan Scenarios and Key Levels

NYMEX:CL1!

It’s Wednesday today, and the DOE release is scheduled for 9:30 a.m. CT. This may provide fuel—pun intended—to push prices out of the two-day consolidation. Also, note that the August contract expires on July 22, 2025. Rollover to the September contract is expected on Thursday/Friday. You can see the pace of the roll here at CME’s pace of roll tool . The chart shows that rollover is about 70% complete, and CLU25 has higher open interest. Note, the front-month August contract is still trading at higher volume.

What has the market done?

Crude oil is in a multi-distribution profile since the peak witnessed during the Iran-Israel conflict. Crude oil formed a strong base above the 64s and traversed towards the 69s. Prices were rejected at these highs and have since reverted back towards the monthly Volume Point of Control, monthlyVPOC.

What is it trying to do?

The market is in active price discovery mode and has formed multi-distributions since June 23. The market has been consolidating after prices at highs were rejected.

How good of a job is it doing?

The market is active and is also providing setups against key levels. Patience to take trades from these higher time frame levels is what is required to trade crude oil currently. Otherwise, there is a lot of volatility and chop that can throw traders off their plan.

Key Levels:

• Yearly Open: 67.65

• Neutral zone: 67.15–67.30

• 2-Day VAL (Value Area Low): 66.40

• Neutral zone: 66.40–66.20

• 2025 Mid-Range: 65.39

• Key Support: 64.40–64.70

What is more likely to happen from here?

Scenario 1: An initial attempt to push higher, pVAL and onVAL finds aggressive sellers pushing prices towards mcVPOC and yMid confluence

Scenario 2: pVAL provides support for further consolidation and break back above yesterday's high and price moves towards yearly Open.

Glossary:

pVAL: Prior Value Area Low

onVAL: Overnight Value Area Low

yMid: 2025 Mid-Range

mcVPOC: Micro Composite Volume Point of Control

EIA

OPEC’s supply cuts pre-empt economic weaknessThe Organisation of Petroleum Exporting Countries and its partners (OPEC+) producers surprised the market with a decision on Sunday 2 April 2023 to lower production limits by more than 1mn barrels per day (bpd) from May through the end of 2023. This decision was announced ahead of the OPEC+ Joint Ministerial Monitoring Committee (JMMC) meeting scheduled on 3 April and was contrary to market expectations that the committee would keep policy unchanged. Over the prior week, OPEC+ ministers were giving public assurances that they would stick to their production targets for the entire year. This cut tells us that OPEC+ is pre-empting weaker demand into the year and was looking to shore up the market.

OPEC+ announcement may have caught speculators by surprise

It is evident Sunday’s decision caught the market by surprise evident from the commitment of trader’s report which showed net speculative positioning in Brent crude oil futures at -44k contracts were 146% below the 5-year average. Sentiment on the crude oil market had been weak prior to the decision.

Demand outlook remains soft amidst weaker economic backdrop

OPEC has been markedly dovish on oil demand for some time relative to other forecasters such as the Energy Information Administration (EIA). This cut helps solve the disparity that existed between OPEC and the EIA. OPEC expects oil demand to grow by around 2mn bpd in 2023. A significant portion of this growth (nearly 710,000bpd) is reliant on Chinese oil demand . Given that such a large amount of demand hinges on a single economy poses a risk to the demand outlook as the pace of China’s recovery post re-opening has not been as robust as previously anticipated. At the same time, tightening credit conditions owing to the recent banking crisis is also likely to weigh on growth forecasts in the rest of the developed world. Global Purchasing Managers Indices (PMI) indicators suggest manufacturing activity has contracted since September 2022.

Supply outlook will be driven by new OPEC+ cuts

Since Russia has been producing less than its notional limit, the reduction on actual production will be less than 1mn bpd. But with Saudi Arabia committing to voluntary reduction of 500,000bpd we would expect the overall decline in OPEC supply to be around 900,000bpd by the beginning of May 2023. Assuming OPEC production holding at the recent 28.9mn bpd for April, our balances would point to an equilibrium in Q2 and a return to a deficit in Q3 and Q4. This deficit is largely a function of OPEC+ cuts as opposed to stronger demand globally. The front end of the Brent crude oil futures curve remains in backwardation with a roll yield of +0.4%

OPEC+ producers can also cut without the fear that they will lose significant market share to non-OPEC members. Previously, OPEC+ would be reluctant to let prices rise too high, as it would incentivise a supply response from US producers. However, US producers today appear more focussed on capital discipline and maximizing shareholder returns. The US also has limited capacity to plug the shortfall created by OPEC+ cuts owing to last year’s unprecedented release from strategic US oil reserves (now at a 40-year low).

Conclusion

In the short term, OPEC production cuts are almost always supportive evident from the recent price reaction Brent crude oil prices have risen (+6.54% ). However, over the medium term, the price response to cuts have been more mixed as they do tend to signal underlying weakness in the supply/demand balance. Either OPEC countries are expecting demand to be significantly weaker or doubt oil production in Russia will decline as sharply as forecasted.

So, with speculative positioning at currently low levels alongside further inventory draws expected later in the year, the risks are titled towards the upside for crude oil prices. However, given the uncertainty in the macro environment, we expect the upside in prices to be capped at about US$90 per barrel.

NATURAL GAS – Week 19 – Pullback edging closer.As we expected in our previous analysis, Natgas started to lose some of the bullish momentum and moved sideways the whole week

For this week, we expect the price to make a pullback similar to the one we highlighted on our chart and push the price towards the support area. After this move is completed, we anticipate that this pair will make a new top.

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

🌍 Website: www.finflagship.com

👉 Youtube Channel: www.youtube.com

NG April-May contracts, EIA storage vs Price vs OI"Below 5 years average" in storage means really nothing to me.

It has been much lowerin the same past 5 years.

and price?

See by yourself

my 5 live public views available as a free TV account:

www.tradingview.com

www.tradingview.com

www.tradingview.com

www.tradingview.com

www.tradingview.com

NATURAL GAS – Week 9 – Correction almost over.In the past week, Natural Gas continued to consolidate towards the $2.70 support area that is highlighted on our chart.

Based on our analysis, we expect the price to continue the pullback towards the second support area located at $2.60 level. After the consolidation is over, we expect the price to increase and hit the $3 area, making a new top.

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

Brent crude soars on OPEC surpriseThursday's OPEC+ meeting became a market-mover event, as members announced that production cuts would be extended in April. This caught the market completely off guard, as OPEC+ was widely expected to raise output by 500,000 barrels per month. Instead, OPEC+ has opted to hold back some 9.2 million barrels from the market each day, until at least the beginning of May.

Crude responded to the OPEC+ announcement with sharp gains. Brent crude jumped 4.84% on Thursday, its highest one-day gain in two weeks. With an additional gain of close to 1 percent on Friday, Brent crude punched above the USD 68 line for the first time since January 2020. Oil prices have soared since November 2020, with Brent crude jumping a staggering 76% during that time.

The key question now for investors and traders is whether the uptrend will continue, or will we see a levelling off in oil prices. The fact that the global economy is slowly recovering from Covid-19 should translate into higher demand for crude and maintain upward pressure on oil prices. At the same time, OPEC members are notorious for not abiding by production limits, which could put a curb on higher prices.

In other news on the crude oil front, the EIA Crude Oil inventories report showed a record-high surplus of 21.6 million barrels. However, this figure was distorted by the recent Texas storm, which resulted in huge stockpiles due to refiners being unable to take on crude shipments. Prior to today's EIA release, nine of the past 11 readings have shown drawdowns, and with significant pent-up demand in the US economy, this trend could well continue.

Brent crude has broken above resistance at the overnight high of 67.72 and double top, with the next resistance at 71.52, which has held since May 2019. Support is distant between USD62.03 and USD62.48.

WTI edged lower on hopes faded on stimulus, eyes on EIA dataCrude oil prices nudged lower as hopes faded for another round of U.S. fiscal stimulus before Nov election along with a strong dollar which kept pressure on price. House Speaker Nancy Pelosi rejected proposal from Senate Republican leaders for a smaller scale approach to new stimulus and

demanded a revamped offer from the White House. Prices however got some boost after Chinese customs data showed crude imports in Sept were up over 2% MoM to about 11.8 Mbpd in Sept, signaling improving demand in Asia’s biggest economy. IEA reported in its World Energy Outlook that in its central scenario vaccines could mean global economy rebounds in 2021 and energy demand recovers by 2023. But under a delayed recovery scenario, it said energy demand recovery is pushed back to 2025, while OPEC also forecast slower demand recovery in their monthly report. OPEC+ are due to hold a monitoring meeting on Monday with UAE ministers giving bearish signals at Intelligence Forum, reporting that OPEC+ is planning to ease output cuts by 2Mbpd in Jan which can further increase the glut at a time demand recovery is stalling. Markets await weekly U.S. oil

inventory data due tomorrow.

Suggestion: BUY WTI OIL FROM 40 SL BELOW 39.45 TGT 40.60/41.15

ELSE SELL BELOW 39.40 SL ABV 40.70 TGT 38.80

Oil investors await the IEA World outlook and OPEC’s report::Crude oil prices slipped, as a string of supply disruption which supported prices is subsided now, with bearish headwinds from easing supply blocks in Norway and Libya which opened up the door to potential rise in global oil production to a market facing feeble demand due to pandemic. Energy Operators have restarted their production in Gulf of Mexico after Hurricane Delta which led to shut in the most US offshore production is now downgraded to post-tropical cyclone. Concerns over rising supply were compounded by news that Libyan output was expected to initially restart 40,000bpd, before reaching its capacity of almost 3,00,000bpd in 10 days. The final blow to oil prices came from Norway, with negotiations successfully ending strike action that had crippled 8% oil production. Today, investors await the IEA World outlook followed by OPEC’s Monthly Market Report. Sentiments remain bearish as supply ease and expectation for a muted demand outlook from agencies can put additional pressure on prices as promising results are not expected from either of the report.

Suggestion: BUY WTI OIL FROM 39.80 SL BELOW 38.80 TGT 41 ELSE SELL BELOW 38.80 TGT 38.20/37.60 SL ABV 39.80

WTI rose on support from output shutdowns ahead of storm in USCrude prices edged higher, touching levels of $43 on support from output shutdowns ahead of a storm in the U.S. Gulf of Mexico and prospect of supply losses in Norway along with hopes for some U.S. COVID relief aid supported prices. Prices got supported after reports of Saudi Arabia considering reversing course over OPEC’s planned production increase early next year which is definitely a positive for the markets.

Optimism over additional fiscal support in U.S. resurfaced, but the back and forth between policymakers could see volatility linger for a while yet. For Norway, Oil firms and labor officials might meet with a state-appointed mediator today in an attempt both sides hope will bring an end to a

strike that threatens to cut Norway’s output by some 25%. On Hurricane front, Oil workers have withdrawn from U.S. Gulf production facilities as Hurricane Delta was forecast to intensify into a powerful, Category 3 storm. Nearly 1.5 Mbpd of daily output was halted and forecast indicates that

markets can lose almost 5MB in this storm, supporting prices. The crude oil supply events along with positive talks for Stimulus will keep prices supported for coming session.

Suggestion: BUY WTI OIL FROM 40.55-60 SL BELOW 40 TGT 42 ELSE SELL BELOW 39.50 TGT 38.70 SL ABV 40.60

Crude firm as EIA showed that fuel demand improvedWTI Crude prices dipped over 1.7 percent to close at $40.2 per barrel as surge in U.S. Crude inventory levels clouded the demand outlook for Crude; however, lingering supply worries limited the fall. As per reports from the Energy Information Administration, U.S. Crude inventory levels rose marginally by 501,000 barrels in the week ending on 2 nd October’20. However, the losses were limited as Hurricane delta rapidly approached

the U.S. Gulf coast forcing the energy companies to shut around 17% of total U.S. crude output in an attempt to avoid any damage. Failed wage talks between the union and the Norwegian Oil and Gas Association (NOG) triggered a strike leading to the closure of Six Norwegian offshore oil and gas fields. More number of workers going on strike over the wage issue risked an output of 330,000 barrels of oil per day alos supported Oil prices.

Suggestion: BUY USOIL FROM 40 SL BELOW 39.40 TGT 40.50/40.90 ELSE SELL BELOW 39.40 TGT 38.80/60 SL ABV 40.20

CRUDE OIL SELL SET UP (1H)I am seeing an Ending Diagonal develop in the Crude oil chart for an upcoming Sell opportunity. This seems to line up with this week's EIA data indicating an oversupply. If this plays out, we should be hearing more about over supply over the next week or more. I will look for a sell when we get to the end of the 5th leg of the ED as indicated by my Sell zone box.

EIA Crude Stock Continues + Gasoline & Distillate Stock DropsHeadlines:

• EIA Crude Inventory See Stockpiles Continues Whilst Gasoline & Distillate Stock Drops

• Surging Indexes Spurred on by Stimulus Measures with S&P500 +4.22%

• Coronavirus Cases Slow Down in China Whilst See Rises in Italy & Iran

EIA Crude Inventories Show Build of 452,000 barrels for WeekHeadlines:

• Kuwait Allows Oil Tankers Grace Amidst Ban on Foreign Ships Due to Coronavirus Fears

• Caltex Australia Releases Half-Yearly Results Posting Cut in Profit

• EIA Continues Another Week of Crude Inventories Up with Build of 452,000 barrels

Oil Pushes Higher During Asian Session Despite API Crude BuildHeadlines:

- Oil prices surged during the Asian session up +1.4% despite build in API Crude data

- WHO officially names disease as COVID-19

- EIA Inventories to be released during afternoon session

- Asian Equities higher with Australia seeing Earning’s releases

Oil Prices Hit Hurdle as Future OPEC Talks FadeHeadlines:

- Oil Futures drops as OPEC Hits Hurdle

- Natural Gas prices continue to fall as NG1 Futures down -4.5%

- United Nations releases numbers showing close to 700,000 people displaced in recent conflicts

- US Equities finish the session higher with NASDAQ up +1.13%

ORBEX: Gold & Oil Sensitive to Trade Deal Text!Gold’s recent muted performance has been owed to missing trade deal details!

With the text likely to surface some time today or overnight following the official sign-off, market participants will see exactly what’s been agreed and whether this makes a good case for a buy or a sell.

Oil’s decline, however, has been owed to inventories build! Will the EIA save the day? Or are we going to see trade details taking charge of this market too?

Timestamps

XAUUSD 4H 02:20

WTI 4H 05:00

Trade safe

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice