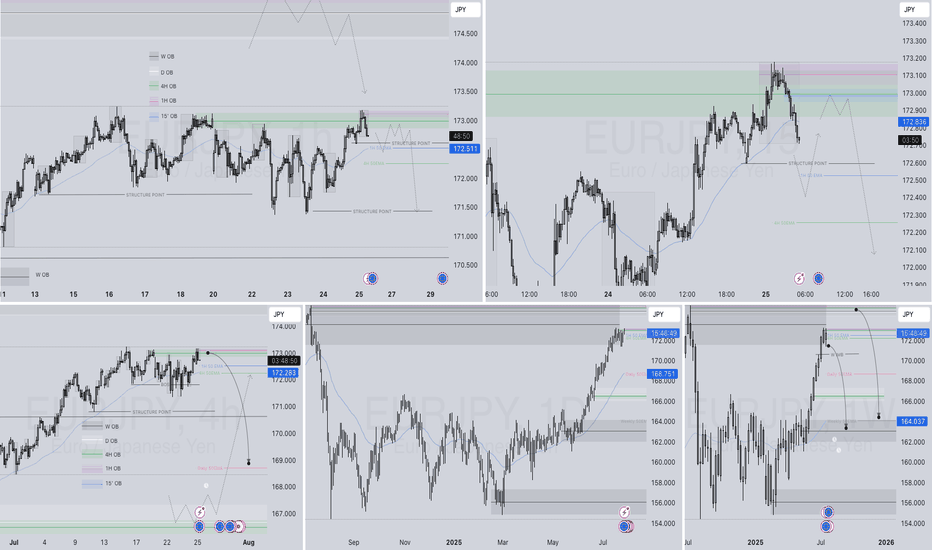

EURJPY 4Hour TF - July 27th, 2025EURJPY 7/27/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

All timeframes suggest we are bullish and after last week that is clear. We’re expecting a bit of a pullback but let’s get into two potential setups for the week ahead:

Bullish Continuation - If we are to continue with the bullish trend we would like to enter a trade at the next point of structure. In this scenario, the next point of structure would be a higher low as close to 172.250 support & our 61.8% fib level as possible.

Look to target higher toward our -27% fib level if this happens.

Bearish Reversal - For us to consider EJ bearish again we would need to see a strong break below our support at 172.250.

If we see bearish structure below this zone we can say price action will most likely fall lower, potentially down to 170.750.

EJ

EURJPY Q3 | D25 | W30 | Y25📊 EURJPY Q3 | D25 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

OANDA:EURJPY

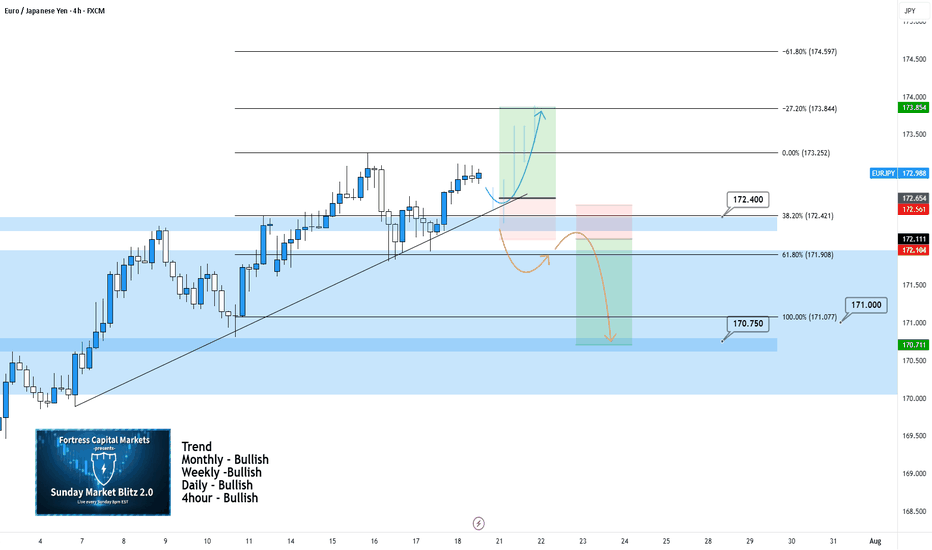

EURJPY 4Hour TF - July 20th, 2025EURJPY 7/20/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

Bullish Continuation - This is the most likely scenario for EJ this week as nothing suggests anything other than Bullish activity.

EJ could take off right at market open and start pushing up without giving us a retest to enter on. If we do get some sort of retest or pullback, look for rejection as close to 172.400 as possible before looking long.

If this does execute it looks like it will be a very small window of opportunity to enter. Trade cautiously with EJ in this bullish scenario.

Bearish Reversal - This scenario is less likely but is much more favorable in my opinion.

For us to consider EJ bearish we would need to see a clear break below 172.400 with a lower high below. This would give us enough confidence to consider short scenarios and start looking lower toward major support levels like 170.750.

EURJPY – WEEKLY FORECAST Q3 | W30 | Y25📊 EURJPY – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

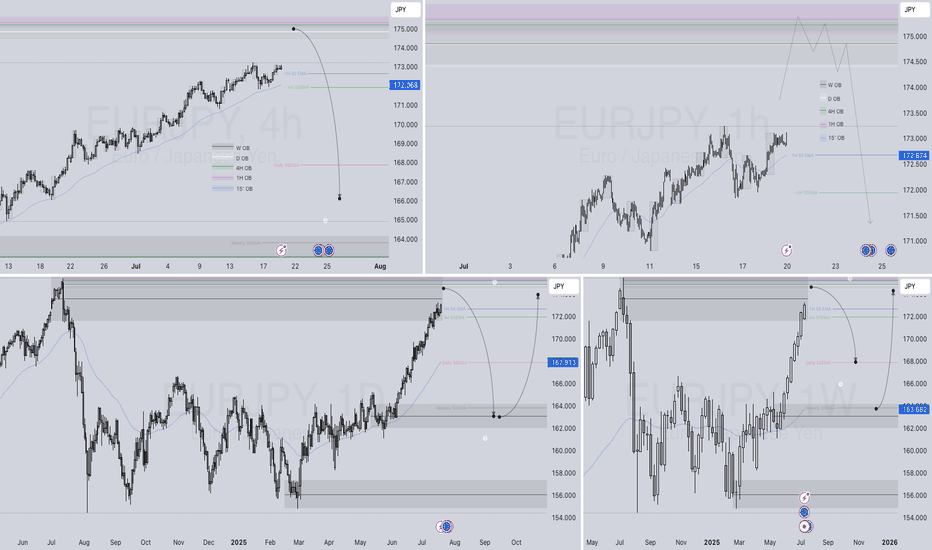

EURJPY SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 EURJPY SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURJPY is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Strong reaction and early signs of distribution.

Previous bullish momentum is losing steam; structure is flattening with rejection wicks forming.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

1H structure shift bearish

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

EURJPY SHORT DAILY FORECAST Q3 D10 W28 Y25EURJPY SHORT DAILY FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY SHORT DAILY FORECAST Q3 D1 W27 Y25EURJPY SHORT DAILY FORECAST Q3 D1 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY LONG FORECAST Q2 W25 D19 Y25EURJPY LONG FORECAST Q2 W25 D19 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅15' Order block identification

✅Daily Order block rejection

✅4H order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY LONG FORECAST Q2 W25 D16 Y25EURJPY LONG FORECAST Q2 W25 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅15' Order block identification

✅Daily Order block rejection

✅4H order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY WEEKLY HTF FORECAST Q2 W25 Y25EURJPY WEEKLY HTF FORECAST Q2 W25 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25WHO LOVES A STRONG JPY ( YEN )BASKET FORECAST Q2 W22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

✅The JPY Basket tracks the overall strength of the JPY against a weighted average of other currencies.

✅It can be used as an indicator of YEN strength which can be a tool for analysing and potentially hedging for or against the Index.

✅ Pairs to watch - GBPJPY, USDJPY EURJPY, CADJPY, AUDJPY

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EJ, bound for a massive upside reversal in the next few seasons!EJ has corrected with so much weight after going parabolic on Q2 of 2024 (June 2024) -- peaking at an ATH of 175.0. There after a massive correction was warranted that has lingered for months ahead.

Now based on recent long term metrics. EJ is now heavily showing some basing behavior from the current range at 157 zone. This is conveying already of a shifting structure on its price.

It has created a triple bottom formation that spans 2 years!

From this scenario alone you can sense the contextual direction it is about to undertake. Reverse to the UPSIDE.

Based on its historical price movements - it has undergone what I called a transitional shift to new ascending channel. You can check the chart above for reference. We are now at that period.

Expect some fresh series of price growth attempts from here on -- aiming to reclaim new high metrics.

Best seeding season is NOW.

Spotted at 157.0

TAYOR.

Trade safely.

EURJPY - buy to sell setup?There is some glitch and previous 2 posts shall be deleted as soon as possible. Okay, onto the EJ - As price finally dropped down to the daily buy zone, while breaking the structures with a big drop and creating it's own ITR, I am bearish on EJ but before that I am looking for buys prior to sells. That would make sense, knowing that liquidity can come into the market from higher buy/sell zones and price is increasing from the daily buy zone. Lets's watch it closely as the setup seems great!

EURJPY ANALYSIS [W/B 10/06] Long term Swing Short EJ has been heavily, bearish within - not just - the last few hours, but days. Sells have most definitely taken over and have resulted in continuous breaks of structures downwards.

The last BOS on the far right - once it happens (Seeing as lows just keep being attacked, with liquidity continuously being left behind) - will confirm the overall sell into demand that was once created at the beginning of May.

N.B. It would be worth having a look at other JPY pairs too for this trend.

Narrative Analysis and Market Insights | EU & EJ - 09 June, 2024Join me as I dive into my daily analysis routine, conducted every evening before the market opens. I'll show you how I decide whether to trade or stay out of the market the following day. My strategy revolves around trading just two currency pairs, and I'm excited to share my insights with you. Stay tuned for regular updates and trading tips.

EURJPY ANALYSIS (RECENT WEEKS + FUTURE)A lot of the JPY pairs have been recently moving similarly (not surprising due to their obvious relationship). I’ve been keeping an eye on UJ, GJ and my personal favourite EJ - for me to notice their recent similarities.

Anyway, price successfully reached the supply zone and instantly began to dump, successfully shown by the initial displacement. This signalled weakening in the price and that price was ready to go to demand. This idea was further strengthened by the initial sweep and immediate BOS on the 4H chart to the downside giving me a potential entry point (on the 4H which I’m not a big fan of) and a new POI to work from.

POI formed - and another nice BOS- with an order block. However this wasn’t clear enough for me to confidently trade from.

Price broke ONCE more - fully confirming the bearish bias and it gave me two points to decide to work from either off of the 15min or the 1h OB’s created.

I’ll be seeking to TP at 168.485 and then 167.665.

EURJPY Analysis (31st May 2024)

EURJPY Analysis(1HR TF)

Price is at 1 hour Bearish OB Key level.

BUY/SELL SCENARIOS:

🟢BUYS: Price breaks above the 169.979 level with a body candle close. If this happens. A retest of the Failed 1 hour OB to Buy to target 170.251 first before targeting 170.800.

🔴SELLS: Price Dumps below the 169.734 level with a body candle close. This creates a bearish Pattern to continue to look for sells targeting the 169.400 level.

TRADE SIGNAL - BUY EURJPYWeekly and daily price bars has not moved bullish at all (no top wick), and price seats currently on psychological level 170.000. There are chances that price has found support at that level. If so, then expect a bullish swing up to 171.000 in the coming hours or days.

Confluences (A.K.A checklists) to look out for:

✅Price at psychological level?

❌Has there been a recent intraday range?

❌Do you see 30 mins or 1 hr price bar closure outside recent range?

❌Will position be in the direction of 4hr and Daily trend ?

✅Has nearby wicks to the left-hand-side been identified and marked as potential problem area/TPx?

Go long only when you tick out this checklist!!!

Trade parameters:

Buy @ 169.982 - 169.781

Flex SL 169.449

Final TP 171.002

Warning:

1. trading derivative could result to loss of your capital, kindly apply caution and use only the money you can afford to lose.

2. Previous performance is not a guarantee that my signals will profit you. Accept and implement this idea at your own risk.

3. You are advised to apply proper risk management while trading derivatives...!!!

BR,

Kings

Learn how to trade. See my signature below or visit my profile for more details

TRADE SIGNAL: EURJPY LONG 21 May 2024Factoring in some learning from my previous 2 trade signals, i have strong conviction that EJ might pullback to immediate past resistance(now support) to gather some liquidity before pushing up. Hence i'd recommend long positions for the pair. See details below

Position Parameters;

Entry BUY @ 169.500 - 169.223

Flex SL 169.060

Final TP 170.496

Note: i'd share updated confluences from next post.

Warning:

1. trading derivative could result to loss of your capital, kindly apply caution and use only the money you can afford to lose.

2. Previous performance is not a guarantee that my signals will profit you. Accept and implement this idea at your own risk.

3. You are advised to apply proper risk management while trading derivatives...!!!

BR,

Kings

Learn how to trade. See my signature below or visit my profile for more details

SIGNAL BUY EURJPY - ENTRY BELOWFind my confluences below;

✅Price at psychological level?

✅Has there been a recent intraday range?

❌Do you see 30 mins or 1 hr price bar closure outside recent range?

✅Will position be in the direction of 4hr and Daily trend ?

✅Has nearby wicks to the lefthand side been identified and marked as potential problem area/TPx?

Go long the moment the pending condition is met;

Position details

Flexible Entry 169.526

Flexible SL 169.309

Target 170.001 area

Warning:

1. trading derivative could result to loss of your capital, kindly apply caution and use only the money you can afford to lose.

2. Previous performance is not a guarantee that my signals will profit you. Accept and implement this idea at your own risk.

3. You are advised to apply proper risk management while trading derivatives...!!!

BR,

Kings

Learn how to trade. See my signature below or visit my profile for more details