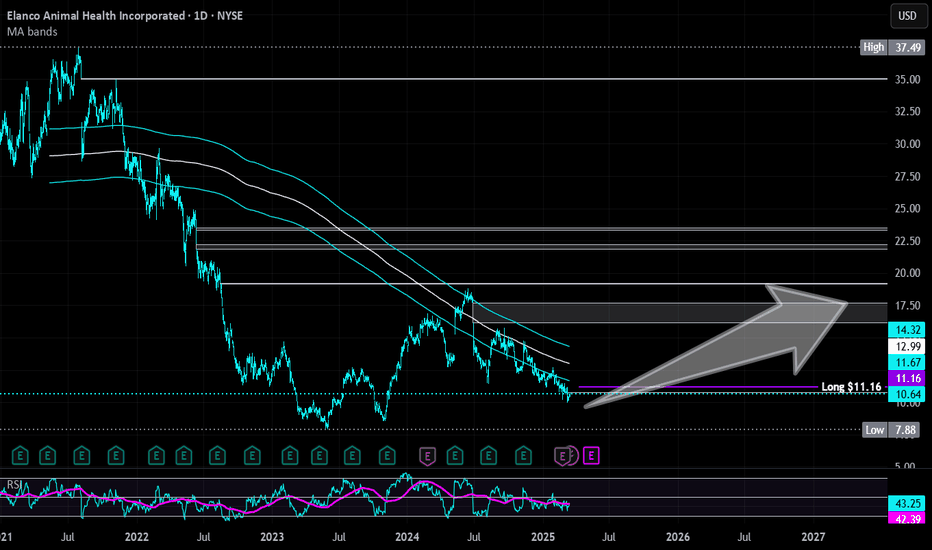

Elanco Animal Health Inc | ELAN | Long at $11.16Elanco Animal Health NYSE:ELAN is riding my historical simple moving average and likely to make a move up soon. Insiders have recently been awarded options and bought $483,000+ worth of shares. Became profitable this year, low debt, P/E = 15x.

Long at $11.16

Targets:

$12.50

$14.50

$16.00

$17.50

ELAN

DOGECOINhello friends

Considering the drop we are having, we have obtained resistance ranges for you, and you can see that after hitting each range, there are more buyers, so it can be imagined that buyers will raise the price in this area or specified support areas...

So we can buy step by step and move with it until the specified goals.

*Trade safely with us*

THE BIG DOGE...Hello friends

As you know, DOGE experienced a good growth during this period and then enters the channel and takes a break. By breaking it from above and maintaining its trend, it can move up to the specified resistance range.

Don't forget capital management, friends.

be successful and profitable

Elanco Animal Health (ELAN) AnalysisMarket Position:

Elanco Animal Health NYSE:ELAN focuses on innovating and marketing products for pets and farm animals. CEO Jeff Simmons credits the company's growth to "accelerating contribution from innovation, stabilizing core volumes, price growth, and improved market conditions in Europe."

Sector Growth:

Animal health is a promising sector for growth investors, driven by increasing pet ownership, with 70% of U.S. households now owning a pet, up from 56% in 1988. As a major player, Elanco stands to benefit significantly from this trend.

Regulatory Approvals:

Elanco recently received continued approval from the EPA and support from the FDA for its Seresto flea and tick collar for dogs and cats. This development opens a significant new revenue stream and is likely to drive the stock price higher.

Investment Outlook:

Bullish Outlook: We are bullish on ELAN above the $14.50-$15.00 range.

Upside Potential: With a target set at $22.00-$23.00, investors should monitor Elanco’s innovations and market expansions, particularly with products like Seresto, to capitalize on the growing demand in animal healthcare.

📊🐾 Stay updated on Elanco Animal Health for promising investment opportunities! #ELAN #AnimalHealth 📈🔍

ELAN reverse to mean tradeDespite negative analyst reviews, ELAN managed to beat EPS and Revenue expectations and prove again that it will fight for market share.

Demand in the stock picked up for the last 2 weeks and a return of the stock price to its 200ma has a high probability to happen.

Do your homework and watch your risk.