Dow Jonas - Elliot wave📉 DJI — Elliott Wave Top in Sight?

🔍 A long-term analysis with serious implications...

I've been diving deep into the Dow Jones Industrial Average (DJI), using Elliott Wave principles — and what I see may signal the end of one of the longest bull markets in history.

Elliott was right — the massive bull cycle did arrive and extended well into the 2000s. But now, that journey looks to be nearing its final destination.

Currently, I believe we're witnessing the development of an Ending Diagonal pattern — a structure often seen at the end of a major impulse. This formation appears to be completing a set of blue sub-waves, which in turn cap off the larger green primary impulse wave.

📍 The box marks my anticipated top for the DJI. From this point, I expect a strong reversal and the beginning of a major correction.

Now here's the shocking part:

If this correction plays out in time and reaches the Fibonacci 0.382 level, that would suggest a retracement spanning up to 86 years — yes, 86 years.

This isn’t just about markets anymore — such a scenario could carry massive consequences for the global economy and society as a whole.

If, however, we see a strong breakout above the box, then the ending diagonal thesis would be invalidated, and we might instead be witnessing an extended wave 5 — complete with five internal sub-waves.

But either way — the top is coming. It’s just a matter of when, and how hard we fall.

💬 What are your thoughts? Could we really be on the edge of a generational peak?

Elliottwaveidea

PENGUUSDTA risky analysis of a popular meme coin..

Based on this analysis, we are in wave 4 and it is expected to end soon and enter wave 5..

Around 0.091 to 0.085, if the price reaches it, it will be suitable for a short swing to the target of 0.0163 and 0.0175..

Ideal time zones are also marked with low tolerance..

This analysis can be easily filled..

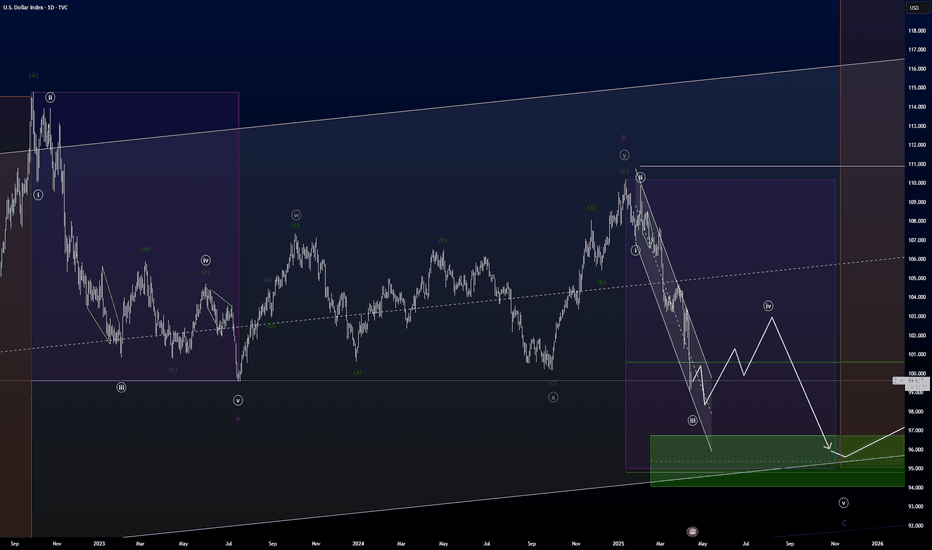

Elliott Wave Principles: A Study on US Dollar IndexHello friends, today we'll attempt to analyze the (DXY) US Dollar Index chart using Elliott Wave theory. Let's explore the possible Elliott Wave counts with wave Principles (Rules).

We've used the daily time frame chart here, which suggests that the primary cycle degree in Black weekly wave ((A)) and ((B)) waves have already occurred. Currently, wave ((C)) is in progress.

Within wave ((C)) in Black which are Weekly counts, Subdivisions are on daily time frame, showing Intermediate degree in blue wave (1) & (2) are finished and (3) is near to completion. Post wave (3), we can expect wave (4) up in Blue and then wave (5) down in Blue, marking the end of wave ((C)) in Black.

Additionally, within blue wave (3) Intermediate degree, we should see 5 subdivisions in red of Minor degree, which is clearly showing that waves 1 & 2 are done and now we are near to completion of wave 3 in Red. followed by waves 4 and 5, which will complete blue wave (3).

Key Points to Learn:

When applying Elliott Wave theory, it's essential to follow specific rules and principles. Here are three crucial ones:

1. Wave 2 Retracement Rule: Wave two will never retrace more than 100% of wave one.

2. Wave 3 Length Rule: Wave three will never be the shortest among waves 1, 3, and 5. It may be the largest most of the time, but never the shortest.

3. Wave 4 Overlap Rule: Wave four will never enter into the territory of wave one, meaning wave four will not overlap wave one, except in cases of diagonals or triangles.

Invalidation level is a level which is decided based on these Elliott wave Principles only, Once its triggered, then counts are Invalidated so we have to reassess the chart study and other possible counts are to be plotted

The entire wave count is clearly visible on the chart, and this is just one possible scenario. Please note that Elliott Wave theory involves multiple possibilities and uncertainties.

The analysis we've presented focuses on one particular scenario that seems potentially possible. However, it's essential to keep in mind that Elliott Wave counts can have multiple possibilities.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

A Zoom of the Weekly DXY into a Daily viewI kept the colored rectangels from my weekly analysis, to keep the focus and knowledge where we are on the chart.

DXY is doing a long A-B-C before it's is going into the last impulse og the C of Y of x of the larger degree.

It's quite a lot of corrections to manage, but if you swipe from the daily to the weekly timeframe, it makes good sense. For me at least :D.

The purple B wave took some time to figure out, but this was what made most sense to me. I was trying to look at it as a triangle, but that wouldn't have a good shape, so I ended out with this white ((w))-((x))-((y)) correction.

DXY is right now performing, what I see as, a extended 5th wave in the white ((iii) wave, before it goes into the white ((iv)) correction.

The white ((iv) wave correction could be become a long shallow drawn out correction for two reasons.

We had a steep and swift white (ii) followed by an extended white ((iii) wave. This usually means we are going to spend some time correcting that white (iii) wave and the rule of alternation tells us, if we have a quick 2nd wave, we are usually going to see a slow fourth wave.

I don't believe we have completed the white (iii) yet, so we have a long time to go still until that white (iv) wave is done.

When the white (iv) wave is done, the white (v) wave is probaly going to take us down to that green box.

So relax for the next 6 months and grab yourself a cup of coffee.

WMT Walmart: Has an Important Top Formed?The price may have formed a major top in Circle Wave 3 in the white scenario, which suggests a potential move toward the $20 area as part of a larger Circle Wave 4. For now, the assumption is that a substantial top has been struck, but whether this marks the end of Wave 3 (yellow scenario) or a broader corrective phase remains to be seen.

Key Levels and Scenarios:

In the yellow scenario, the market should be moving toward the support area between $45.60 and $62.87. A strong, impulsive rally from this zone could indicate one final Wave 5 push higher before a major third-wave top is confirmed.

In the white scenario, if the rally from support turns out to be corrective, it may just be forming a white B wave, reinforcing the outlook for lower prices in a prolonged correction.

Current Focus:

The market is currently moving downward in Circle Wave A toward the orange support area.

Since A waves can unfold in either three or five waves, it is important to monitor whether this decline remains impulsive or corrective.

As long as the price remains below the March high (~$105 on smaller time frames), the focus remains on lower prices.

For now, the priority is to closely observe the microstructure as the move down develops, to determine whether the yellow or white scenario plays out.

CRVUSDT Potential for a Bullish Revers? ( EW Analysis )CRVUSDT, a popular cryptocurrency trading pair, is showing potential signs of a bullish reversal based on Elliott Wave Theory. This analysis aims to break down the current wave structure and outline possible future price movements.

Wave Structure Overview

The chart follows a complex corrective wave pattern, which consists of WXYXZ labeling. This pattern indicates an extended correction phase that may be coming to an end. Below is a breakdown of the observed waves:

1. Wave (iii): This wave marked a strong uptrend, indicating significant bullish momentum in the past.

2. Wave WXYXZ Correction: The corrective structure suggests a prolonged retracement, leading to potential price exhaustion at the recent low near $0.40.

3. Wave (iv) and Completion of Wave Z: The labeling shows that wave (iv) is completing, forming a potential higher low on the support trendline.

4. Formation of ABCDE Structure: A possible contracting triangle (ABCDE) is forming within the final leg of wave Z, signaling an imminent breakout.

Key Support and Resistance Levels

- Support: The ascending trendline near $0.44 - $0.48 serves as a critical level for price stabilization.

- Resistance: The downward trendline resistance around $0.55 - $0.60 is the first hurdle for bullish continuation.

- Target Zone: If wave (v) initiates, potential targets lie between $1.20 - $1.50, aligning with the upper channel.

Bullish Outlook and Confirmation

To confirm the bullish scenario, CRVUSDT must break above the $0.55 resistance with strong volume. A successful breakout would validate the start of an impulsive wave (v), pushing prices higher.

Risk Factors

- A breakdown below the $0.40 invalidation level would negate this bullish outlook and extend the correction.

- Market sentiment and external factors such as Bitcoin’s price action and macroeconomic conditions may impact the projected wave structure.

Conclusion

CRVUSDT appears to be at a pivotal moment, with Elliott Wave analysis suggesting a potential bullish reversal. Traders should monitor key levels and look for breakout confirmations before making any trading decisions. If the projected wave (v) unfolds, we could see a significant rally in the upcoming sessions.

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.

NVDA - finding an Exit on LongsIn this short piece, I present some visuals of my ideas on NASDAQ:NVDA targets.

If the chart patterns play well then my intention is to exit at around $183 to $193 and then catch the wave (4) low ideally at $146 , for the final push up in this sequence in to $210 or slightly higher for a final exit.

Viewed from the perspective of a weekly or monthly chart - NASDAQ:NVDA doesn't look complete at those higher levels, however, I suspect that the end in to the wave (5) around $210 will complete a multitude of larger wave degrees, thus start a much larger degree (wave 4) correction from that point.

**NVDA may be a strong barometer for the market peak on an intermediate scale. I will certainly consider this strongly.

Riding the Wave: A Deep Dive into EURUSDElliott Wave Analysis of EURUSD

This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and individuals should consult with a financial advisor before making any investment decisions.

Current Analysis

Based on the provided Elliott Wave chart, we've identified the following:

Completed Waves: Waves (1) to (4) have been completed in blue.

Potential Ongoing Wave: Wave (5) is currently unfolding, with wave 1 completed in red.

Scenario 1: Upward Reversal

If the low of wave (4) is not breached, we can anticipate a potential upward reversal. This would indicate the completion of wave 2 in red and the beginning of wave 3 in red. This bullish scenario suggests a continuation of the uptrend.

Scenario 2: Downward Correction

If the low of wave (4) is broken, it would suggest that wave (4) is still in progress. This could lead to a further downward correction before the uptrend resumes.

Key Points

Support Level: The low of wave (4) serves as a crucial support level. A break below this level would invalidate the current bullish scenario.

Resistance Level: The high of wave (1) could act as a potential resistance level. A break above this level would strengthen the bullish outlook.

Elliott Wave Theory: This analysis is based on Elliott Wave Theory, which posits that financial markets move in predictable patterns. However, it's important to note that Elliott Wave analysis is not infallible, and other factors can influence market movements.

Conclusion

The current analysis suggests a bullish outlook for EURUSD, assuming the low of wave (4) is not breached. However, it's crucial to remain vigilant and monitor market developments closely. Always conduct thorough research and consider multiple factors before making any trading decisions.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Bullish Bat Breakout: EURNZD Trade IdeaHello traders, I hope you're all doing well. Below is my analysis of the EURNZD pair and a detailed plan on how I intend to capitalize on this trading opportunity.

1. Pattern : Bullish Bat on EURNZD.

2. Completion : The pattern reaches completion at point D, which is approximately at 1.81178 on the chart.

3. PRZ Zone : The potential reversal zone for considering long positions, in anticipation of a bullish reversal, spans about 100 pips, ranging from 1.8185 to 1.80758.

4. Target Levels : Post-reversal, the targeted levels are T1 at 1.83131, T2 at 1.84192, T3 at 1.84952, and the extended target T4 at 1.86495.

5. Entry : I am looking to confirm a breakout above the 1.81849 price region upward, with solid market support for going long before entering the trade.

6. Invalidation : Should there be a break and a close below 1.80758, this would invalidate the pattern and the associated trade idea.

This idea is potentially a 4RR trade idea if it goes as planned.

I will appreciate your thoughts on this idea.

Note: This is not a financial advice.

Cheers and happy trading!

FETUSDT Elliot Wawe theoryExcuse me!

An interesting picture has been drawing in front of me for days.

According to my theory and analysis, an elliot wave may be true for FETUSDT.

As part of this, we may now be in a correction.

I am attaching pictures of the details below.

First picture

$0.60 resistance

Second picture

Liquidation image

Third and fourth picture

Elliot wave in more detail on the hourly view.

R3ncso

USD/CAD: Short Term "Buy the Dip" strategy!From a technical point of view,, the FX:USDCAD pair is bearish in short term, but at the same time, we think a corrective structure "must" be triggered. With this in mind, the strategy is simple: "Buy the Dip" on the intraday chart (1H time frame).

On chart I have shown some potential targets that could be reached, but to understand which of these to look at, we need to follow the swing that will form (3 or 5 waves), so it will be necessary to follow and update this analysis (levels) along the way.

Trade with care!

Like 🚀 if my analysis is useful.

Cheers!

Render's Rally ending? Trading Insights & Retrace AspectsThe rally in Render appears to be reaching its conclusion. Over the past few months, Render has been an intriguing trading token, outperforming BTC by surging from 0.9 to its monthly resistance level of 2.93 (Bybit).

Based on my wave count analysis, it seems that we are approaching the end of the rally at this resistance point. I observe a potential ending diagonal pattern, consisting of a fifth wave within a fifth wave within a fifth wave, characterized by declining volume. A final upward push towards the monthly resistance, accompanied by RSI divergence, could serve as a short trigger. Alternatively, a more cautious approach would be to wait for the breach of the extreme point of wave 3 within the ending diagonal.

If a retracement occurs, the target could be a return to the previous fourth wave of a lower degree. This area coincides with a monthly resistance level, Fibonacci 0.618 retracement level, and the fixed range point of control for wave 4 according to my highest count degree.

In conclusion, the success of this swing trade will depend on the extent of the upward movement before encountering divergences or a reversal. If realized, this trade has the potential for a risk-to-reward ratio of approximately 3.85.

I will closely monitor Render for further signs of weakness, which could present a short-selling opportunity, or to observe if it breaks through the monthly support level accompanied by notable volume

BNBUSDT BEARISH, Bulls be careful!This analysis is on BNBUSDT however, it relates to the market as a whole as all major crypto coins usually trend in the same direction.

This (A)(B)(C) Elliott Wave pattern indicates weakness from the bulls.

Wave (C) formed an "ending wave diagonal" where wave 3 is shorter than 1 and 5 is shorted than 3. This usually indicates exhaustion from the bulls and a reversal to the downside.

The red box indicates an area that would be good to enter a short position.

The green box is where previous support was found due to high levels of volume being recorded. The green box is also where (D) would equal 0.618 (the golden ratio) of (B). This is a common ratio for wave (D) if an ABCDE triangle was to form. In order to reach this level, the price would need to break below the upward sloping trend line.

I hope this helps you with your trading and as always, good luck!

Disclaimer: Not financial advice, intended for educational purposes only