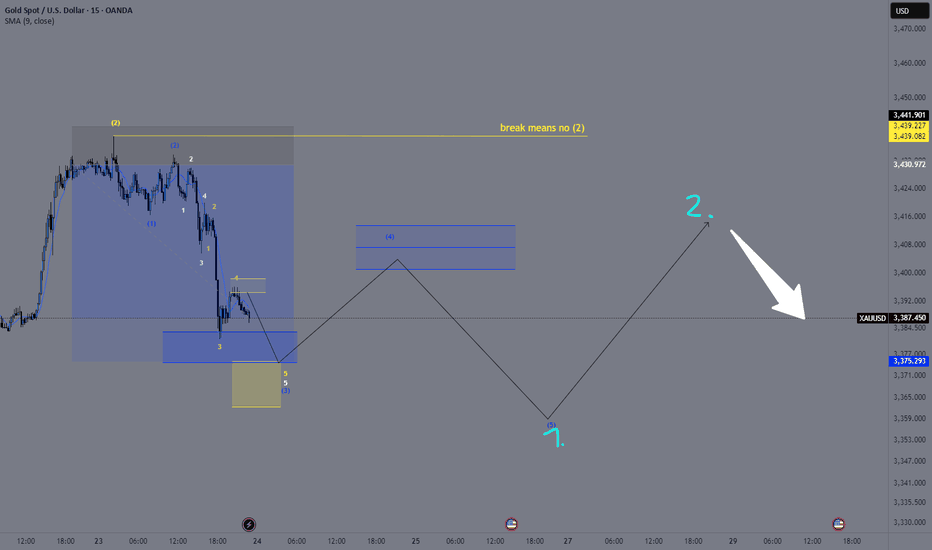

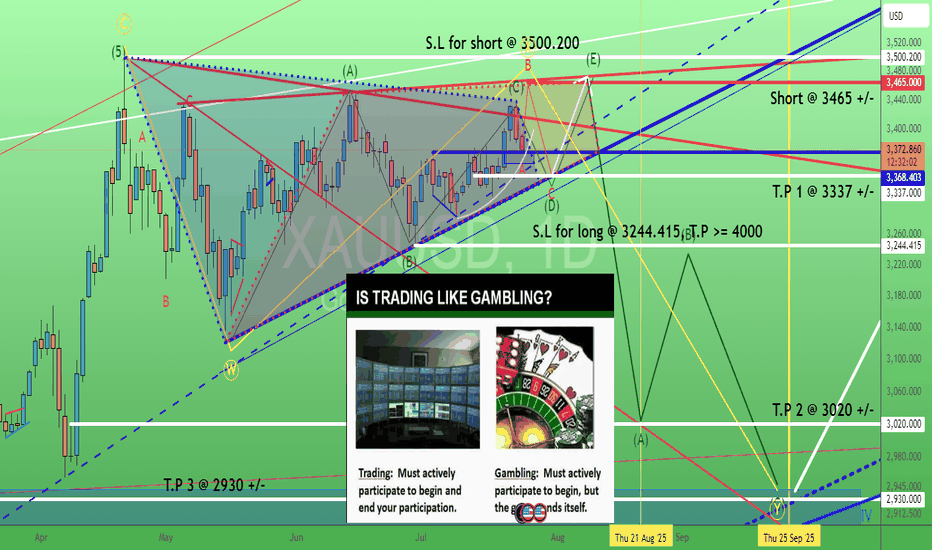

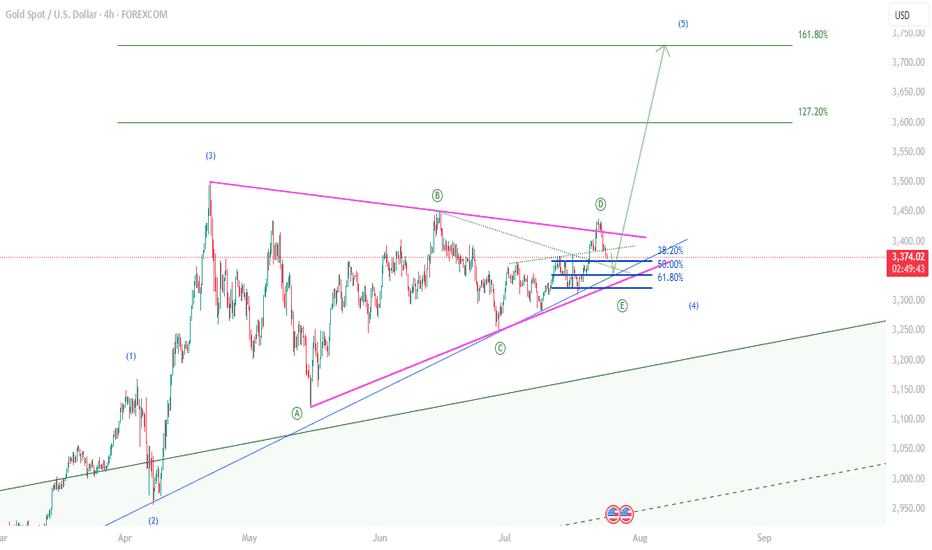

XAU/USD – Wave 2 Breakout Confirmed | Tracking the ImpulseOANDA:XAUUSD

We’ve now seen the first bullish push out of the blue (2) Fibonacci zone.

This allows us to start tracking a potential blue (1)-(2) structure, setting the stage for an impulsive move into blue (3) – although we haven't fully arrived there yet.

Within this blue wave (2) to (3), we can already identify a white 1-2-3-4 in progress, and from white 4, we're seeing a yellow 1-2-3-4-5 impulse forming.

📌 Currently, we are at yellow wave 4, right below the Take Profit zone of the Fibonacci extension projected for blue wave (3).

This level aligns perfectly with the yellow Fibonacci extension zone calculated from yellow wave 2 to 3 to 4, which gives us the expected yellow wave 5 target.

🚀 Once that move is complete, I anticipate a potential upward breakout above 3400, leading to a blue wave (5).

This blue wave (5) would then mark the blue wave 1 of a larger bearish sequence: specifically, the broader move from yellow wave (2) to (3).

Elliott Wave

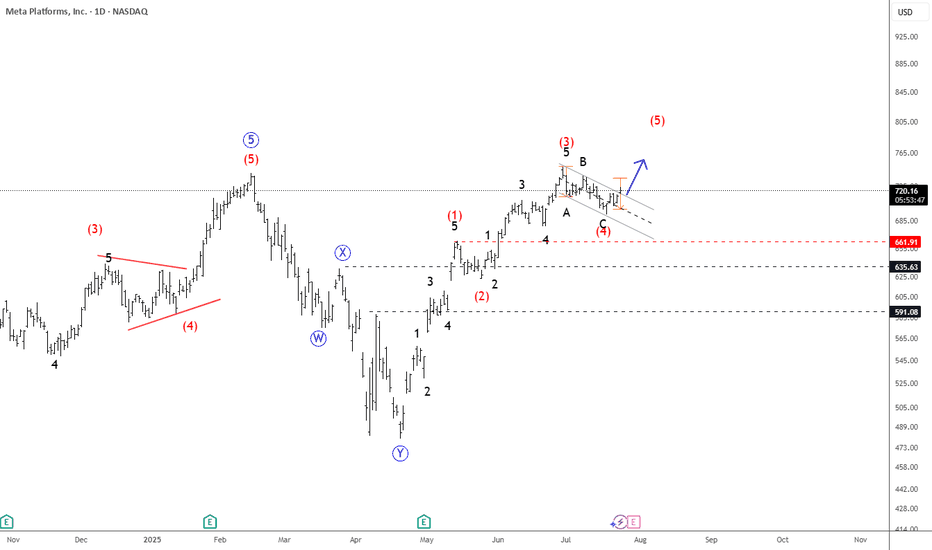

META Slows Down For A Correction Within UptrendMeta has seen a strong recovery recently, but barely retested February highs around 740, from where we can see some nice pullback, but it appears corrective, since it’s unfolding in three waves, and forming a potential bull flag — likely wave 4. A breakout above the downward channel on a daily close could signal the start of wave 5 and a push to new highs.

However, keep a close eye on the 666.1; a break below this level would invalidate the bullish view and suggest a deeper consolidation phase may follow.

Highlights:

Direction: Up (pending breakout)

Structure: Wave 4 bull flag; wave 5 possible soon

Support: 680 / 690

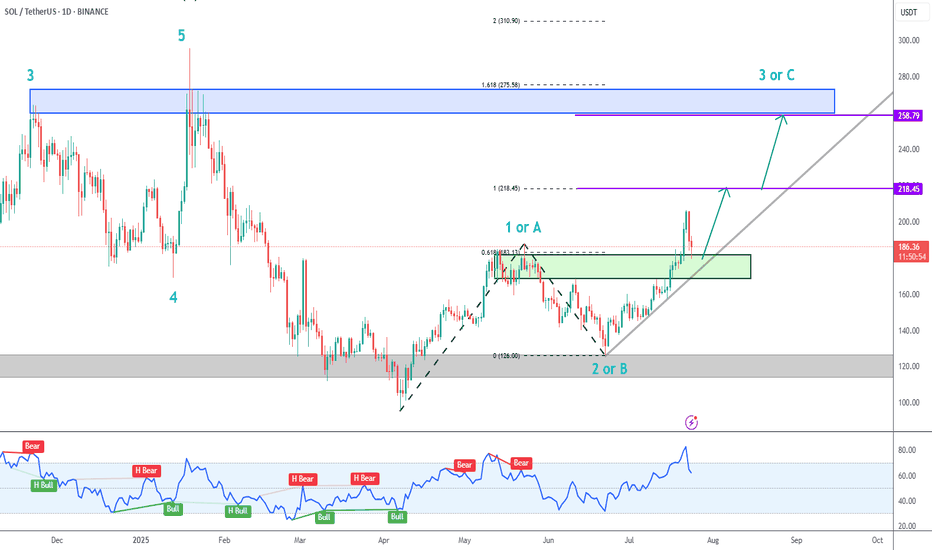

SOL Uptrend Update➡️ Solana has been correcting for the last couple of days, but the trend is clearly up.

➡️ There are 2 confluence factors that should give price support: the gray ascending trendline and the green zone.

➡️ Initial Targets (purple lines) are:

218.45 (100% extension)

258.79 (beginning of blue potential supply zone)

Building a Future for RWAs and Multichain DeFi: A Strategic OutlThe intersection of real-world assets (RWAs) and decentralized finance (DeFi) has become one of the most transformative trends in the blockchain space. As traditional financial institutions explore blockchain integration, and DeFi continues to mature, tokenized RWAs—like real estate, bonds, and commodities—are poised to redefine the global financial landscape. Combined with multichain interoperability, this evolution promises greater efficiency, transparency, and accessibility.

The Rise of Real-World Assets on Blockchain

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. For RWAs, this means that tangible assets—such as property, equities, or art—can be fractionalized and traded globally in real-time. This unlocks liquidity in previously illiquid markets, enables 24/7 trading, and reduces administrative overhead.

Use cases are rapidly emerging: real estate funds issuing tokenized shares; commodities like gold being represented on-chain; and even government bonds available on DeFi platforms. These developments democratize access to assets once limited to high-net-worth individuals and institutions.

However, integrating RWAs into DeFi isn't just a technical feat. It requires robust legal frameworks, clear custodianship, and standardized processes for valuation and dispute resolution. Without proper infrastructure, tokenized RWAs risk becoming speculative rather than transformative.

The Role of Multichain Ecosystems

No single blockchain can accommodate the entire spectrum of financial use cases. Multichain architecture—where assets and applications span multiple blockchains—is essential to scale RWA integration effectively.

Cross-chain interoperability enables users to leverage different blockchains for what they do best. Ethereum offers deep liquidity and composability. Algorand and Avalanche deliver scalability and low fees. Polkadot and Cosmos focus on seamless interoperability. Bridging these ecosystems creates a holistic, resilient financial infrastructure.

Protocols like Wormhole, LayerZero, and Chainlink’s CCIP are leading the charge in enabling these connections. By ensuring assets can move securely and efficiently across chains, they support a unified liquidity layer that benefits both RWA issuers and investors.

Challenges and Opportunities

Despite the promise, several hurdles remain. Regulatory compliance is fragmented across jurisdictions, making it difficult for global RWA platforms to operate consistently. Many DeFi protocols are not yet equipped to handle the complexities of asset custody, identity verification, or investor rights enforcement.

Moreover, education is a significant barrier. Institutional investors and retail users alike must understand the risks and mechanisms of DeFi to participate confidently. Projects that prioritize transparency, usability, and regulatory alignment are more likely to gain mainstream adoption.

The opportunity, however, is vast. RWAs could unlock trillions in idle capital, while multichain frameworks reduce friction in global capital markets. Combined, they offer a future where financial products are borderless, inclusive, and programmable.

Conclusion

The convergence of RWAs and multichain DeFi represents a critical shift in finance—from centralized gatekeeping to decentralized participation. It has the potential to create a more accessible and efficient global financial system. While challenges persist, technological advances and increasing institutional interest suggest that this transformation is not only possible, but inevitable. The next few years will be pivotal in shaping the architecture, governance, and standards of this emerging ecosystem.

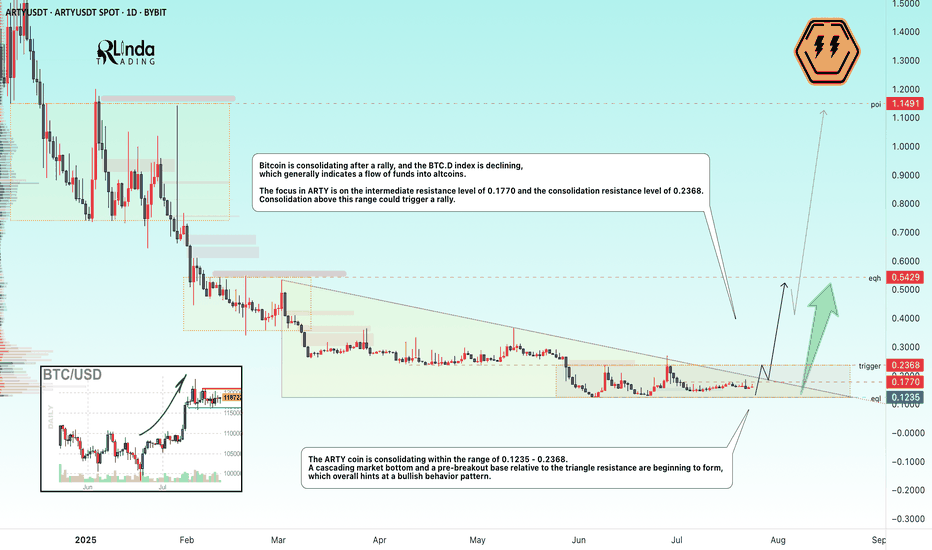

ARTYUSDT → A breakout of resistance could trigger another rallyBYBIT:ARTYUSDT is forming a cascading bottom as part of consolidation before a possible breakout of resistance. The decline in Bitcoin's market dominance gives altcoins a chance.

( (Idea from September 29, 2024!) We previously discussed this coin before its 300% rally. The root causes of its emergence from accumulation and readiness for strong growth were correctly identified).

The dump phase is coming to an end, a cascading market bottom is beginning to form, and a pre-breakout base relative to the triangle resistance is forming, which overall hints at a bullish behavior pattern.

Bitcoin is currently consolidating after the rally, and the Bitcoin dominance index is declining, which generally indicates a flow of funds into altcoins. The situation is such that the altcoin market has another chance for the season. The correction across the entire market may end in the near future, and under favorable conditions (the fundamental background is strengthening, Trump has announced another important event for cryptocurrencies), the market may return to strong movements...

The focus in ARTY is on the intermediate resistance at 0.1770 and the consolidation resistance at 0.2368. Consolidation above this range could trigger a rally.

Resistance levels: 0.2368

Support levels: 0.1235

Technically, a few days ago, the coin tested the consolidation resistance, but the decline did not continue, which generally indicates that buyers are showing interest and holding the market. Consolidation in the near term may end with a retest of 0.1770, 0.2368, a breakout, and further growth.

Best regards, R. Linda!

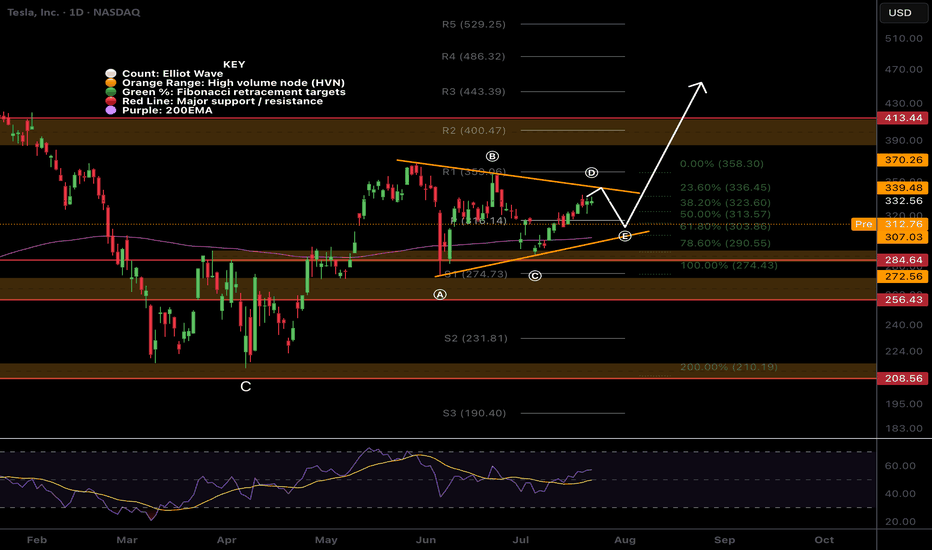

$RIOT Targets hitNASDAQ:RIOT has hit my take profit target at the High Volume Node and R3 daily pivot where it has found resistance.

Wave III appears to be complete with wave IV expected targets being the 0.382-0.5 Fibonacci retracement, also the daily pivot point and ascending daily 200EMA, $10.24.

Analysis is invalidated if we continue to the upside with a new swing high. RSI is overbought no bearish divergence.

Safe trading

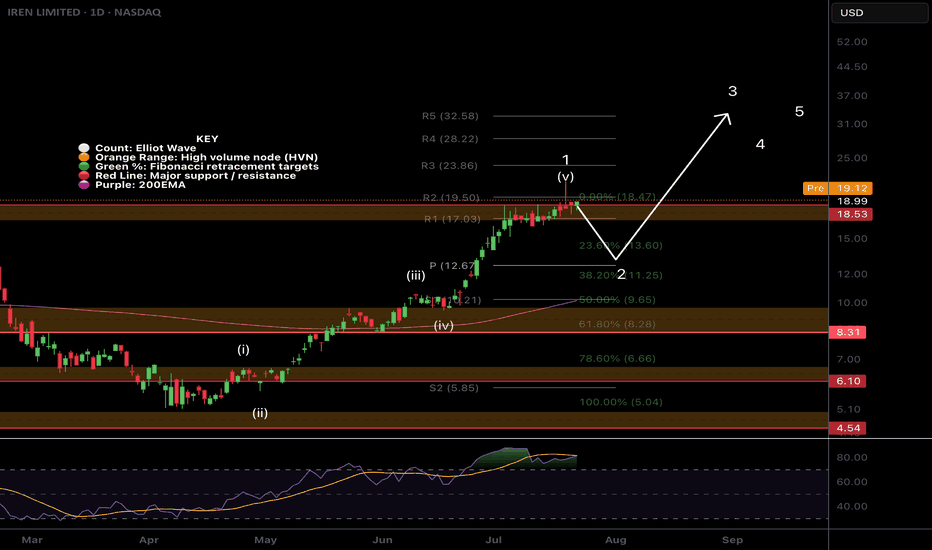

$IREN More downside after huge rally!NASDAQ:IREN is printing bearish divergence on the daily RSI at all tie high resistance.

An Elliot wave motif wave appears complete and wave looks underway with a shallow target of the daily pivot, 0.382 Fibonacci retracement and ascending daily 200EMA.

The daily red wick after printing a 20% start to the day is reminiscent of a blow off top in this asset trapping newbs with FOMO price discovery pump. Market behaviour in action!

Analysis is invalidated if price returns to all time high.

Safe trading

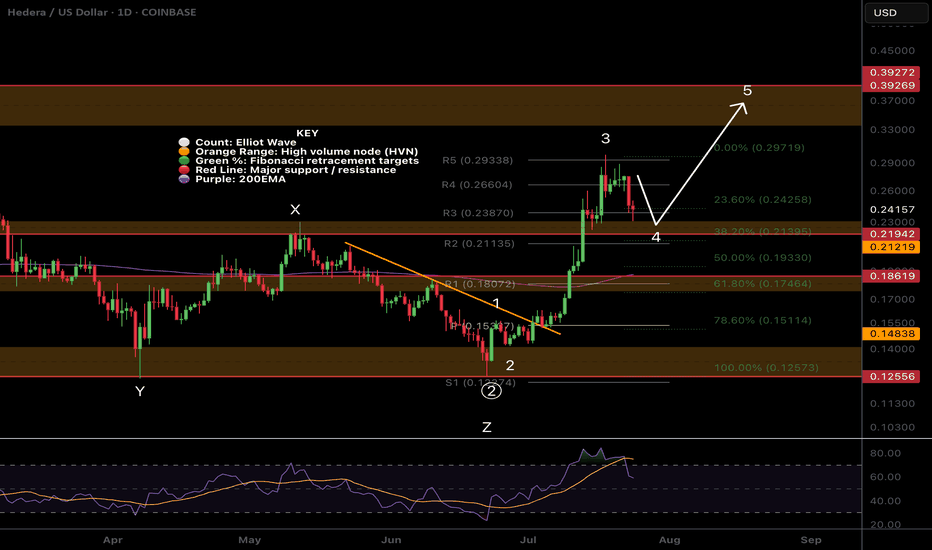

$HBAR Wave 4 finishing soon?CRYPTOCAP:HBAR Hedera appears to have completed wave 4 with the test of the High Volume Node support at the 0.382 Fibonacci retracement.

Wave 5 has an expected target of the High Volume Node resistance at $0.4 before a larger retracement in wave 2 aligning with my summer pump august / September dump view.

Analysis is invalidated below $0.1933 at the 0.5 Fib retracement and will be updated to a wave 2 instead of 4.

Safe trading

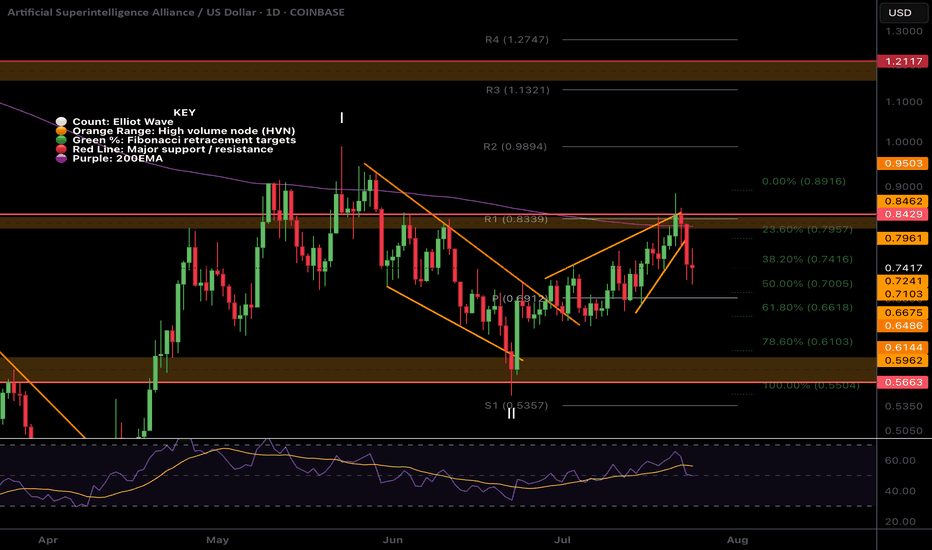

$FET local ending Diagonal and wave 2 near completion?NYSE:FET was rejected for the 4th time at the daily 200EMA! Each time the probability of a breakout increases.

I have adjusted the High Volume Nodes for accuracy.

Locally Fetch appears to have completed a motif wave up with an ending diagonal for wave 5. Wave 2 is expected to find support at the daily pivot and .618 Fibonacci retracement before attempting a breakout of the daily 200EMA once more.

A move below wave II will invalidate this analysis.

Safe trading

Gold. How to "kill" bull or bear (triangle)? 24/July/25XAUUSD. are you betting (gambling) OR trading for bull/bear triangle? With or without "active lost/cut lost"?.. No stop lost = passive (cut) lost = Let the "gambling" games end for you. Not you end the "trading" any time actively. The "happy ending" always come with good risk management with good risk/reward ratio where ONLY happened when we have T.P and S.L plans.

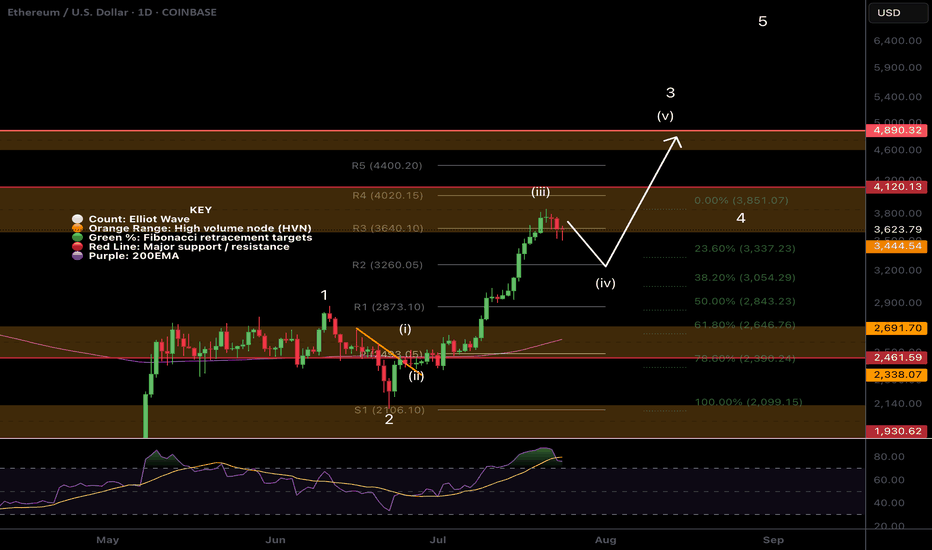

$ETH Hit Our Targets and was rejectedCRYPTOCAP:ETH hit our signal take profit target at $3820 and was rejected at the High Volume Node EQ to the penny.

That appears to have completed wave 3 of this motif wave. Wave 4 has an expected target of the R2 daily pivot and 0.236-0.382 Fibonacci retracement, $3260 before continuing to the upside in wave 5 with a target of the all time high.

This aligns with my views of a significant pullback at the end of August and September which is typical after a summer rally.

No divergences yet in daily RSI.

Safe trading

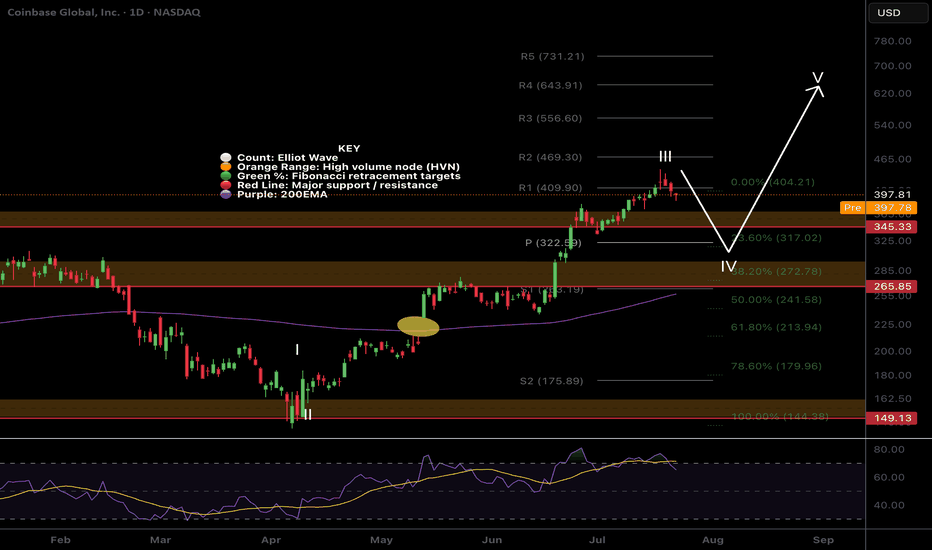

$COIN Wave 4 pullback?NASDAQ:COIN had a tremendous run, a text book Elliot wave 3 but has confirmed bearish divergence on the daily RSI.

The trend is strong so wave 4 could be shallow, only reaching the previous all time high, High Volume Node and 0.236 Fibonacci retracement and daily pivot point between $322-345

Further decline brings up the High Volume Node support at 0.382 Fib retracement and ascending daily 200EMA! Also a highly probable scenario!

Long term outlook remains around $600 target

Safe trading.

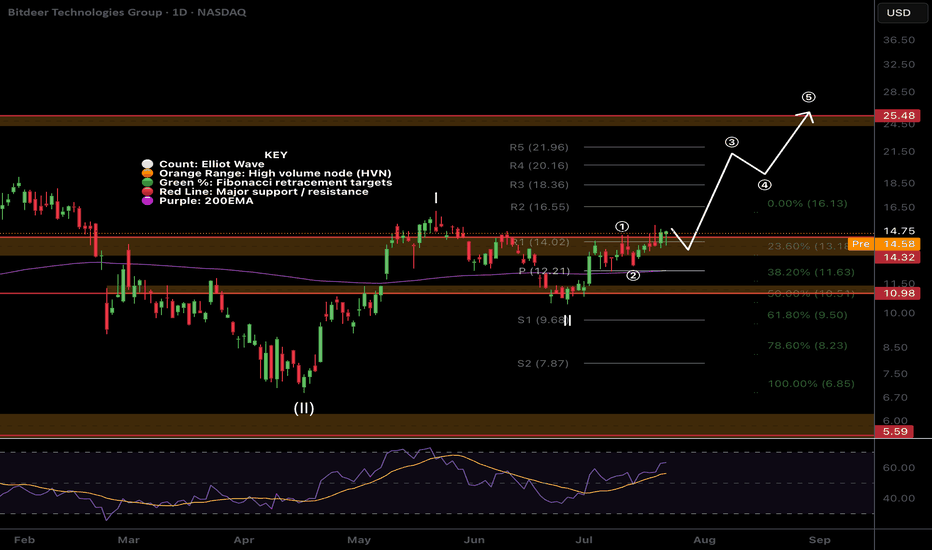

$BTDR Closed above resistance!NASDAQ:BTDR Bitdeer closed above major resistance yesterday, despite BTC and alt coins having a bearish day, triggering our long signal in the Weekly Trade signals substack.

I am looking for price to start to accelerate in wave 3 and resistance now support to hold. If BTC reverses it will add additional tailwinds with a target of the major resistance above the R5 daily pivot $24

Safe trading

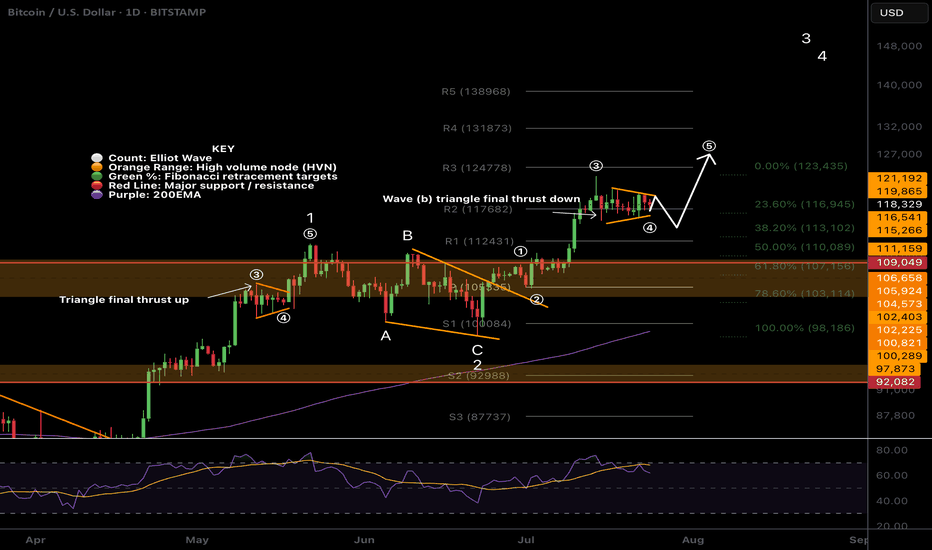

$BTC Wave (b) triangle?CRYPTOCAP:BTC Bitcoin appears to have competed wave 3 up, wave (a) down and now finishing a triangle in wave (b) which would result in a thrust down to around $113k before continuing to the upside in wave (5).

There is slight bullish divergence on daily RSI and wave (4) meets the Fibonacci retracement rules of between 0.236 - 0.382 adding confluence.

Previous all time high is expected to be tested as support on a larger correction, perhaps when the ascending daily 200EMA creeps up to the same level after we blow off.

Safe trading

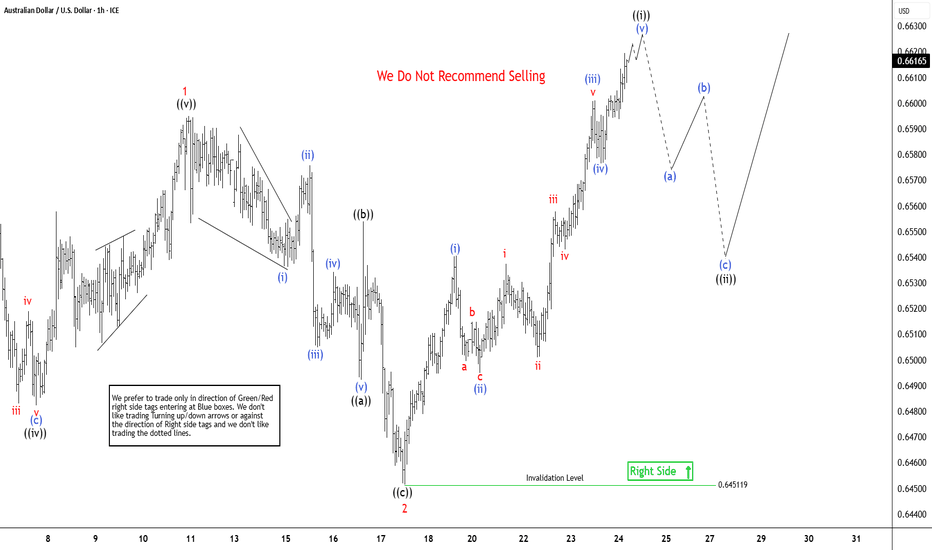

AUDUSD Elliott Wave Outlook: Impulse Pattern Approaching To EndThe AUDUSD pair is showing higher high from 4.09.2025 low, expecting rally to continue from 5.12.2025 low. It favors zigzag corrective bounce from April-2025 low & should continue rally against 0.6451 low. In daily, it started corrective bounce from 4.09.2025 low & may extend towards 0.6720 – 0.6955 area in next few weeks. Above 4.09.2025 low, it ended (A) at 0.6515 high of 5.06.2025, (B) at 0.6354 low of 5.12.2025 & favors upside in (C). Ideally, (C) can extend towards 0.6955 or higher levels, while pullback holds above 5.12.2025 low. Within (C), it placed 1 at 0.6595 high, 2 at 0.6451 low in corrective pullback & favors upside in 3. Within 1, it ended ((i)) at 0.6552 high, ((ii)) at 0.6369 low, ((iii)) at 0.6590 high, ((iv)) at 0.6451 low & ((v)) at 0.6595 high in overlapping diagonal. Below 1 high, it ended 2 in zigzag correction at extreme area before resume rally in 3.

It placed ((a)) of 2 at 0.6492 low in 5 swings, ((b)) at 0.6554 high & ((c)) at 0.6451 low in 5 swings. Wave 2 pullback ended at 0.618 Fibonacci retracement of 1. Within 3, it favors impulse in ((i)) started from 7.17.2025 low. It placed (i) of ((i)) at 0.6540 high, (ii) at 0.6495 low, (iii) at 0.6601 high, (iv) at 0.6576 low & favor upside in (v) targeting in to 0.6606 – 0.6637 area to finish it. It already reached minimum area, but can see more upside above 0.6593 low. Alternatively, the current move even can be (iii) of ((i)) followed by small pullback in (iv) & higher in (v). Later, it expects ((ii)) to correct in 3, 7 or 11 swings against 7.17.2025 low & find support from extreme area to continue rally. Wave 3 should extend in to 0.6692 – 0.6841 area in 5 swings before correcting in 4 of (C). We like to buy the pullback in 3, 7 or 11 swings at extreme area against 7.17.2025 low.

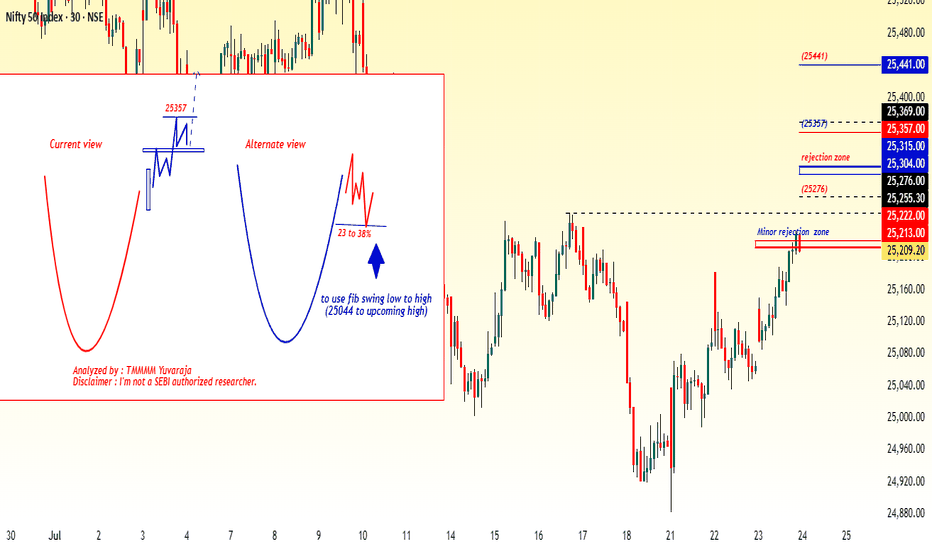

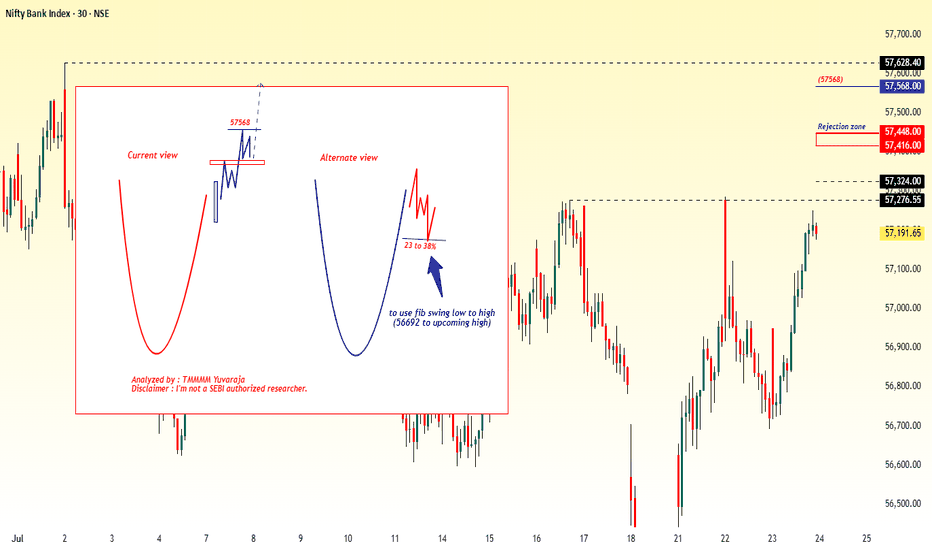

#nifty directions and levels for July 24Good morning, friends! 🌞

Here are the market directions and levels for July 24th:

The global market is showing a moderately bullish sentiment.

Meanwhile, the local market is also exhibiting a moderately bullish tone.

Today, Gift Nifty indicates a gap-up opening of around 60 points.

What can we expect today?

In the previous session, both Nifty and Bank Nifty took a solid pullback.

At the same time, the open interest also shifted to the bullish side.

So, if the gap-up sustains, we can expect the pullback continuation.

Also, as it’s a new moon day(for south), some volatility can be expected.

Let’s look at the charts:

Current View:

The current view suggests that, as mentioned above,

if the gap-up sustains, we can expect a rally continuation with some consolidation.

In this case, the parameters are showing slight strength,

so the rejection zone may act just around the minor resistance.

Alternate View:

The alternate view suggests that

if the gap-up does not sustain or if the market rejects near immediate resistance with a solid reversal,

then we can expect a minor correction of around 23% to 38%.

However, unless the market breaks below the 38% level,

we cannot confirm a reversal into a bearish trend.

#Banknifty directions and levels for July 24Current View:

The current view suggests that, as mentioned above,

if the gap-up sustains, we can expect a rally continuation with some consolidation.

In this case, the parameters are showing slight strength,

so the rejection zone may act just around the minor resistance.

Alternate View:

The alternate view suggests that

if the gap-up does not sustain or if the market rejects near immediate resistance with a solid reversal,

then we can expect a minor correction of around 23% to 38%.

However, unless the market breaks below the 38% level,

we cannot confirm a reversal into a bearish trend.

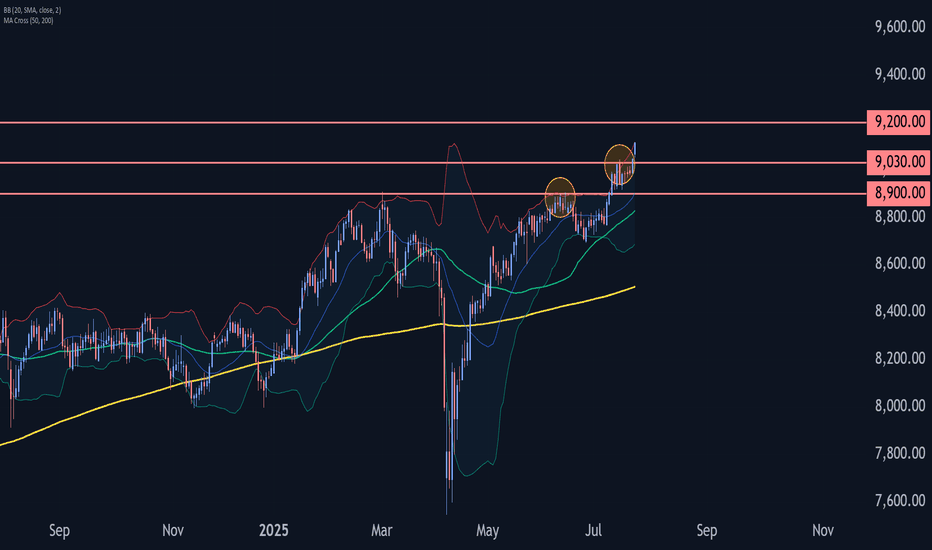

FTSE 100 Wave Analysis – 23 July 2025- FTSE 100 broke resistance level 9030.00

- Likely to rise to resistance level 9200.00

FTSE 100 Index recently broke above the resistance level 9030.00, which stopped the previous minor impulse wave 1 at the start of July.

The breakout of the resistance level 9030.00 continues the active minor impulse wave 3 – which belongs to the intermediate impulse wave (3) from the end of July.

Given the clear daily uptrend, FTSE 100 Index can be expected to rise to the next resistance level 9200.00 (target price for the completion of the active impulse wave 3).