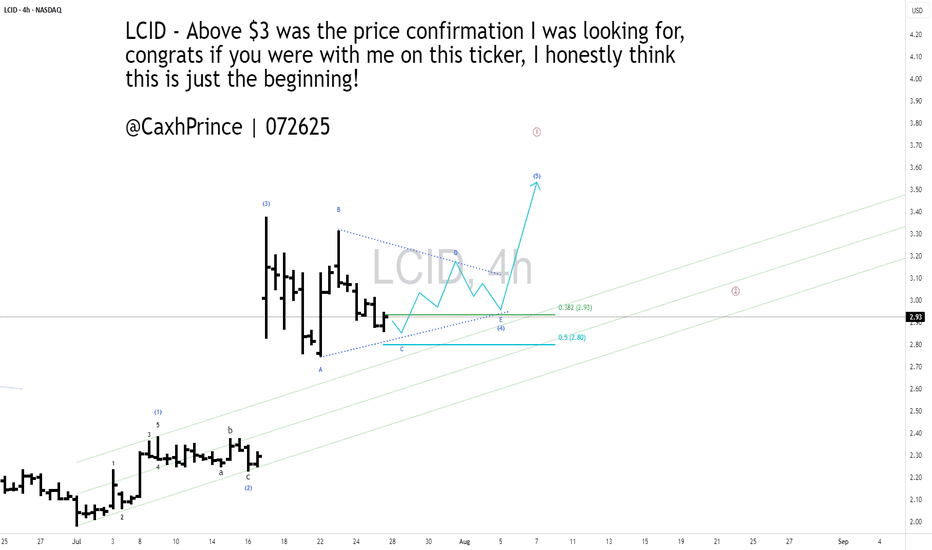

#LCID - 4HR [ A potential bullish view]Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

Elliott Wave

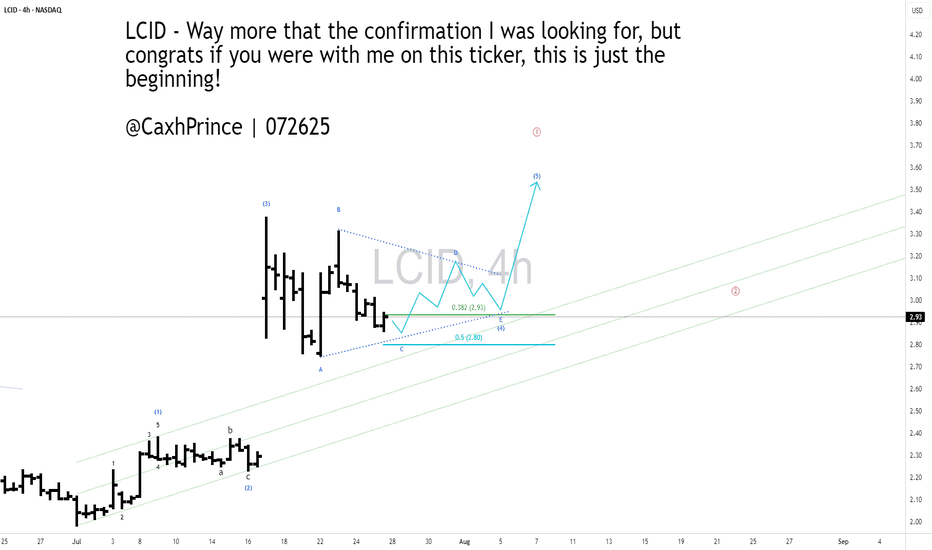

A 4HR Bullish view on #Lucid Motors ($LCID)Lucid blasted off last week with the collaboration of Uber and Robo-taxis. I think that blast infused more investors to the stock and I think it may never come back to take out its lows. If it does, I would load up more on it. I like their designs and the fact that they are now compatible with TESLA's Super Chargers make them even more attractive.

In my count here, I am sensing the current correction could form a triangular pattern for another high before one last correction for ABC down.

Go LCID, Go!!!

Check out my other chart ideas @CaxhPrince everywhere.

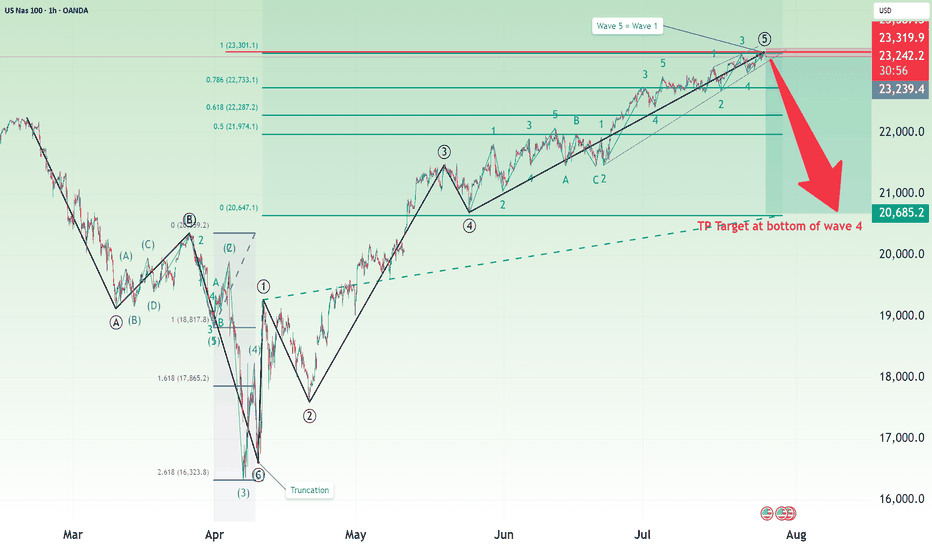

Nasdaq Short: Completion of 5 waves with wave 5=wave 1Over here, I present a short case for Nasdaq (and S&P500 by default since their correlations are high). The main reasons are:

1. Completion of 5 waves structure both on the high degree and on low degree, as shown in the chart.

2. Fibonacci measurement where wave 1 = wave 5.

The stop of this idea is to be placed slightly above the high, in this case, I placed it at around 23320. The take profit target is at the bottom of primary wave 4, around 20685.

Take note that this is a positional short, meaning the strategy is to short and hold and periodically adjust your stop loss based on unfolding on wave structure. Sizing is based on your risk tolerance.

Good luck!

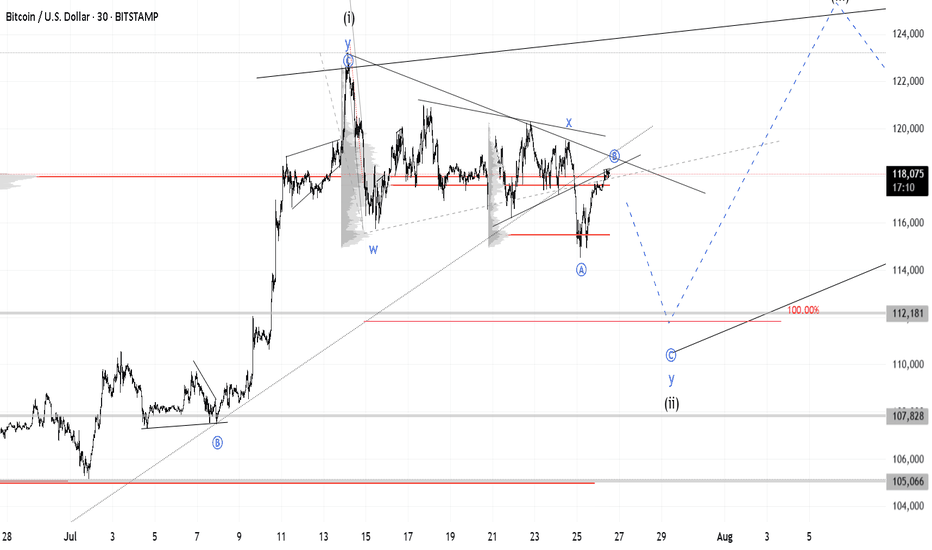

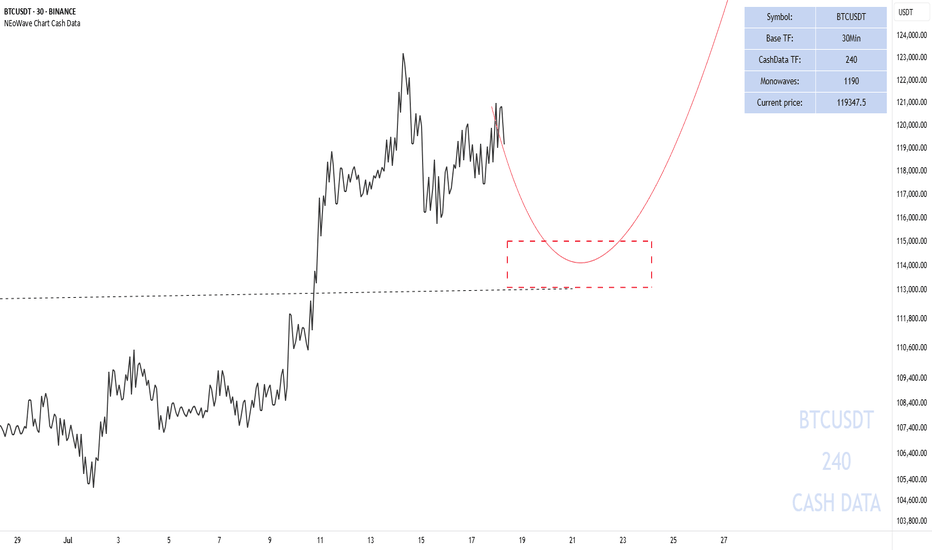

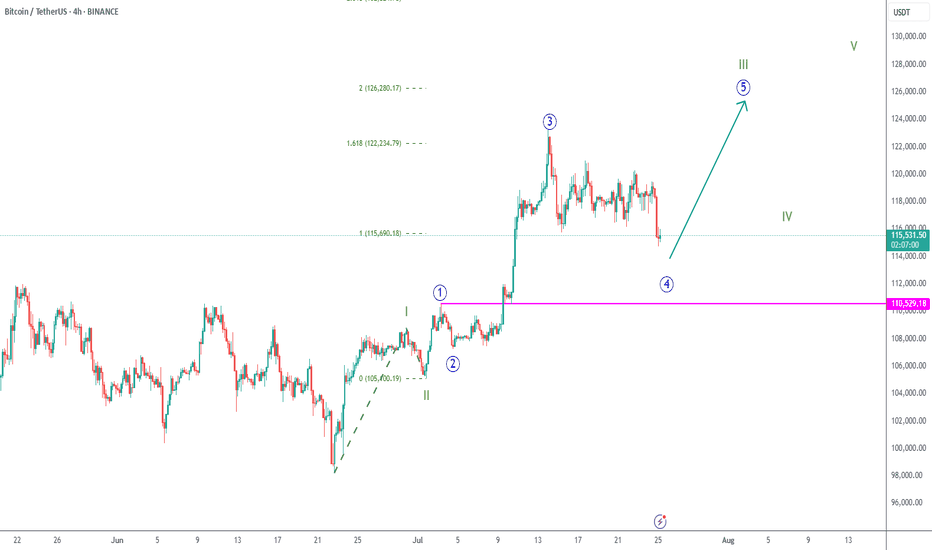

Bitcoin Long: Completion of Sub-wave 4, riding wave 5I updated the Elliott Wave counts for Bitcoin and we should have completed sub-wave 4 and is currently onto sub-wave 5. Based on my counts, sub-wave 3 has extended and is slightly more than 1.618x of wave 1, thus I expect sub-wave 5 to NOT extend. Based on Fibonacci extensions, the price target is around $124,600.

The stop loss for this idea is around $114,600.

Towards to end of the video, I zoomed out for Bitcoin and observed that Cycle level wave 1 and 3 are HUGE (red font) and the current Cycle Wave 5 looks too small. Thus, the entire 5-wave structure of what we are going through now may be just a Sub-Wave 1 of Cycle Wave 5. And that means that longer-term, Bitcoin may really go to $200,000 and beyond. But for traders, keep our foot on the ground and trade what is in front of us.

Good luck!

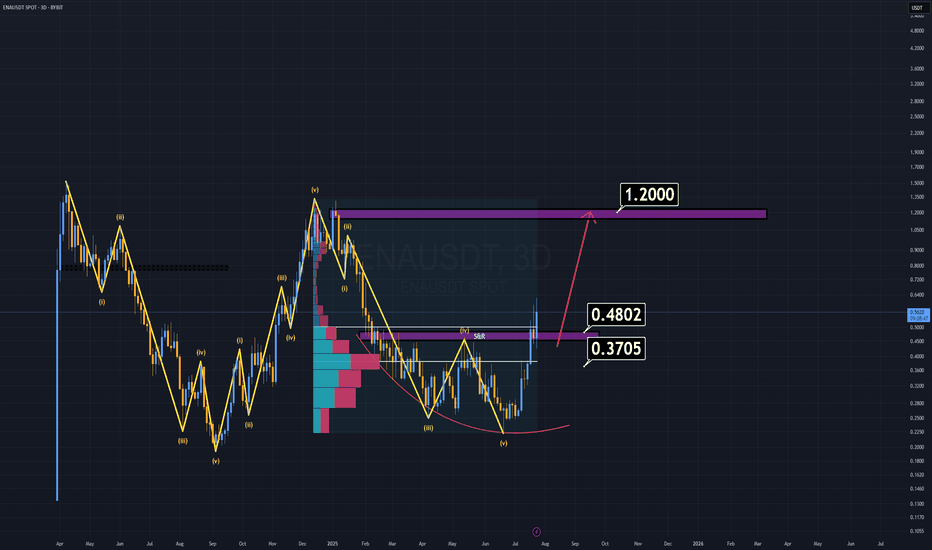

ENA Analysis (3D)ENA has been outperforming many altcoins for weeks, yet it still appears undervalued based on its fundamentals and recent investor interest.

Where to buy?

Right now, buying at current levels is extremely risky, as the ideal buy-back zones are significantly below the market price.

First major support: $0.48 — considered a "cheap" entry.

Dream entry (low probability): $0.37–$0.38 — at that point, ENA would feel almost free.

Notably, BlackRock and its partners are actively investing in ENA, which speaks volumes about its long-term credibility. That alone justifies keeping it on your radar.

Minimum target: $1.00–$1.20

Remember, that’s just the beginning. We may see even more once momentum kicks in.

Sometimes, the best trade is the one you're waiting for.

Good luck.

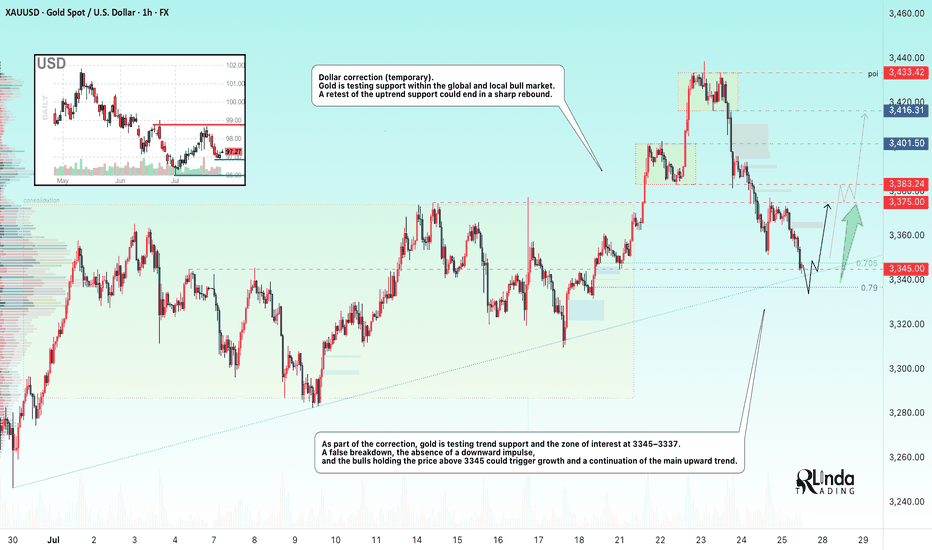

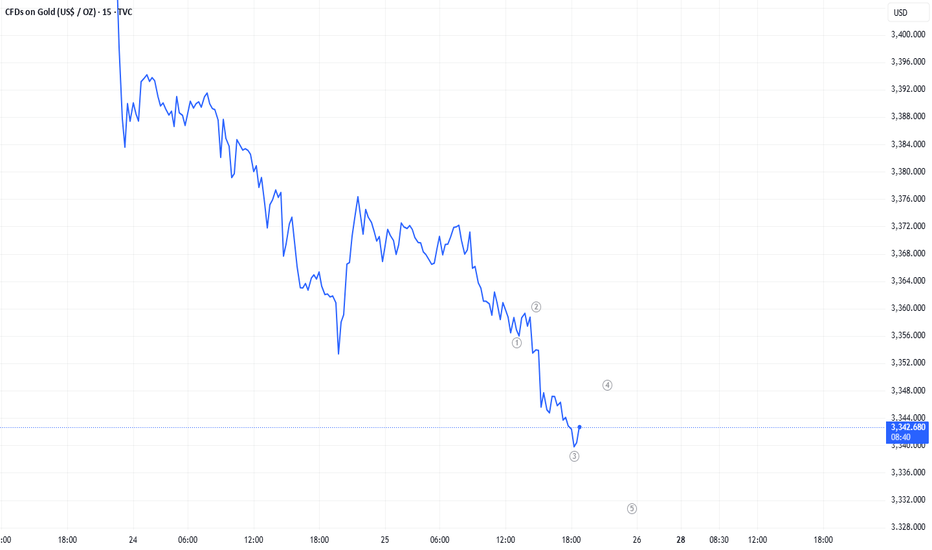

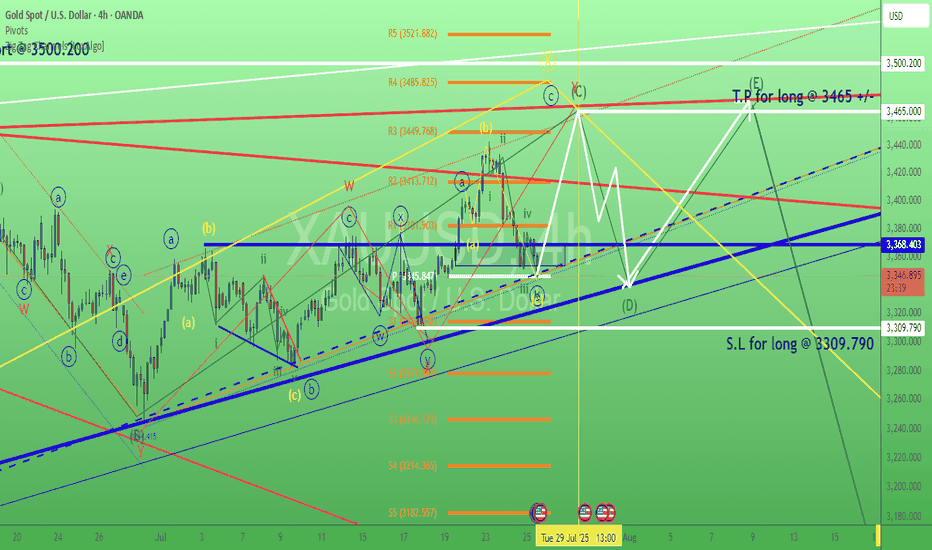

GOLD → Countertrend correction, retest of 3345 before growthFX:XAUUSD , undergoing a deep correction after a false breakout of local resistance at 3433, has reached the support of the upward trend. Will the bulls be able to maintain the trend?

Gold held below $3,400 on Friday, rebounding from $3,350, and is poised to end the week higher. Investors are watching the conflict between Thailand and Cambodia, which is boosting demand for safe-haven assets, and are also awaiting decisions from the Fed and the Bank of Japan next week. The markets received additional support from US trade deals with Asian countries and progress in negotiations with the EU, easing fears of a tariff war.

As part of the correction, gold is testing trend support and the 3345-3337 zone of interest. A false breakdown, lack of downward momentum, and bulls holding prices above 3345 could trigger growth and a continuation of the main upward trend.

Resistance levels: 3375, 3383

Support levels: 3345, 3337, 3330

Technically, the support level of 3345 plays a fairly important role in the market. If, during the correction, the bulls manage to hold their ground above this zone, the prospects for recovery will be high, especially against the backdrop of geopolitical problems.

Best regards, R. Linda!

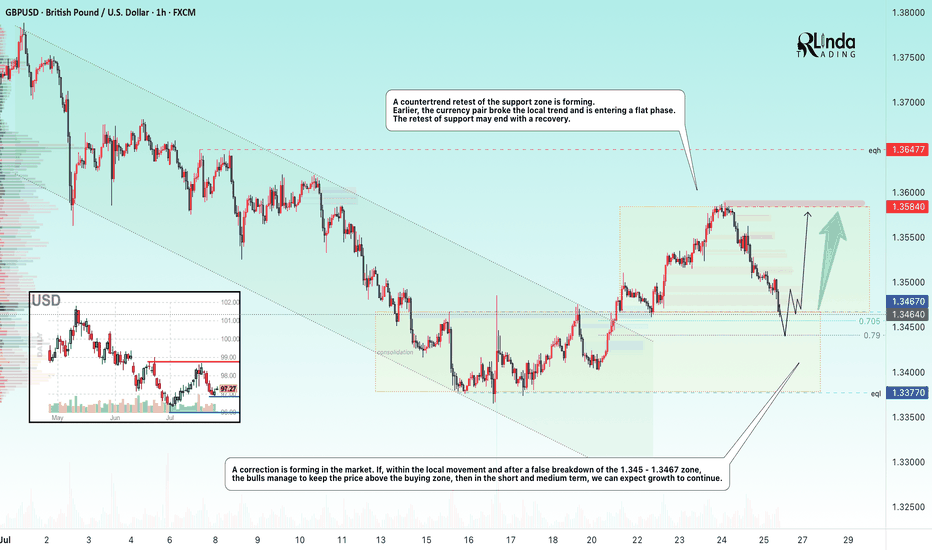

GBPUSD → Retest of previously broken resistance...FX:GBPUSD has entered a correction phase after breaking through the local downtrend. If the price remains in the 1.3450–1.346 zone, this will confirm the formation of a new trading range...

The market is entering a correction phase due to the dollar. A countertrend retest of the support zone is forming. Earlier, the currency pair broke the local trend and is entering a flat phase. The retest of support may end with a recovery. If, within the local movement and after a false breakout of the 1.345 - 1.3467 zone, the bulls keep the price above the buying zone, then in the short and medium term, we can expect growth to continue.

Support levels: 1.3467, 1.345

Resistance levels: 1.35, 1.3584

A false breakdown of support at 1.3467 will confirm a change in the local trend (correction). The market may return to the recovery phase of the global trend.

Best regards, R. Linda!

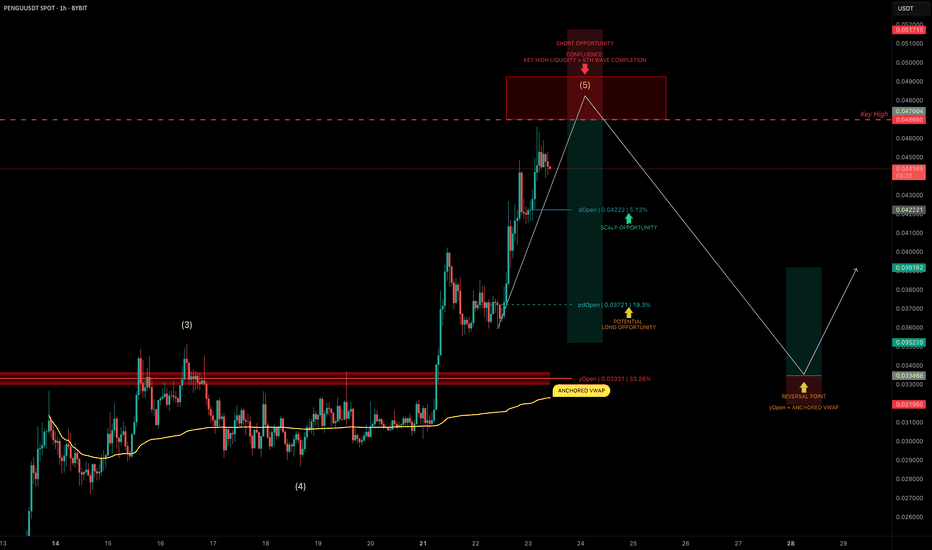

PENGU Topping Out? Targeting 30% Downside After Liquidity SweepPENGU has had an explosive run, but it now looks to be nearing completion of wave 5 of its current Elliott impulse.

We’re approaching a key high at $0.04698, a likely liquidity grab zone — and potentially a great area to position for a short trade.

🧩 Short Setup Overview

➡️ Wave 5 Completion Incoming:

Price is showing signs of exhaustion as it approaches $0.04698, where liquidity is likely stacked above the previous high.

➡️ SFP Trigger Zone:

Watch for a swing failure pattern (SFP) at $0.04698 — confirmation for a potential short entry.

➡️ Psychological Resistance:

The $0.05 level also sits just above — a classic psychological barrier that may get tapped or wicked into.

🔴 Short Trade Setup

Entry: After a confirmed SFP at $0.04698–$0.05

Target (TP): Yearly Open (yOpen) — potential move of ~30%

Stop-loss: Above post-SFP high

R:R: Excellent asymmetry if setup confirms

🛠 Indicator Note

In this analysis I'm using my own indicator called "DriftLine - Pivot Open Zones ", which I recently published.

✅ It helps highlight key open levels, support/resistance zones, and price structure shifts — all critical for confluence-based trade planning.

Feel free to check it out — you can use it for free by heading to my profile under the “Scripts” tab.

💡 Educational Insight: How to Trade Wave 5 Liquidity Sweeps

Wave 5 tops often trap late longs, especially when paired with psychological levels and key highs.

➡️ Patience is key — wait for a rejection pattern or SFP before entering.

➡️ Liquidity sweeps first — then the move.

Final Thoughts

PENGU is pushing toward $0.04698–$0.05, but this may be its final move up before correction.

With the yearly open as a logical target, and clear confluence via DriftLine, this setup offers a clean short opportunity — if confirmation comes.

Stay sharp, let price lead, and trade the reaction — not the prediction.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

XLM Explodes +132% — Is the Party Over or Just Starting?XLM has been one of the top movers, sweeping the January 2025 swing high at $0.515 before stalling and moving sideways for the past 4 days.

Is XLM gearing up for another push toward the highs, or is a correction imminent?

Let’s dive into the details.

🧩 Market Structure & Fractal Pattern

XLM skyrocketed +132% in just 13 days, mirroring the explosive move seen back in November 2024.

If we apply the November fractal, the current price action suggests we could be setting up for an ABC corrective move.

📉 Key Levels & Confluences

FVG Zone: ~$0.49–$0.50 — likely to be swept before any major move down.

Monthly Support: $0.4142

Key Level / Liquidity Pool: $0.4056 — likely cluster of stop-losses.

Anchored VWAP (from $0.2228 start of trend): currently near $0.4056, adding strong confluence.

1.0 Trend-Based Fib Extension (ABC projection): If price pushes to ~$0.49 to complete wave B, the projected 1.0 TBFE for wave C lands right on the $0.4056 key level + VWAP, creating a perfect confluence zone.

➡️ Conclusion: The $0.4142–$0.4056 zone is a critical support and liquidity area with multiple confluences lining up.

Trade Setups

🔴 Short Setup:

Entry zone: $0.48–$0.50 (ladder in)

Stop-loss: Above $0.5166 (prior high)

Take-profit: $0.4142–$0.4056 zone

R:R ≈ 1:3

🟢 Long Setup:

Entry zone: $0.4142–$0.4056 (preferably near VWAP)

Stop-loss: Below $0.395

Take-profit: $0.44

⚡ Final Thoughts

Watch for a potential final push toward $0.49–$0.50 before a corrective wave unfolds.

The confluence at the $0.4142–$0.4056 zone — including monthly/weekly levels, VWAP, liquidity pool, and the 1.0 TBFE target — makes it a key area for decision-making.

Stay patient and wait for confirmation at these levels. Will post an update as things unfold!

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

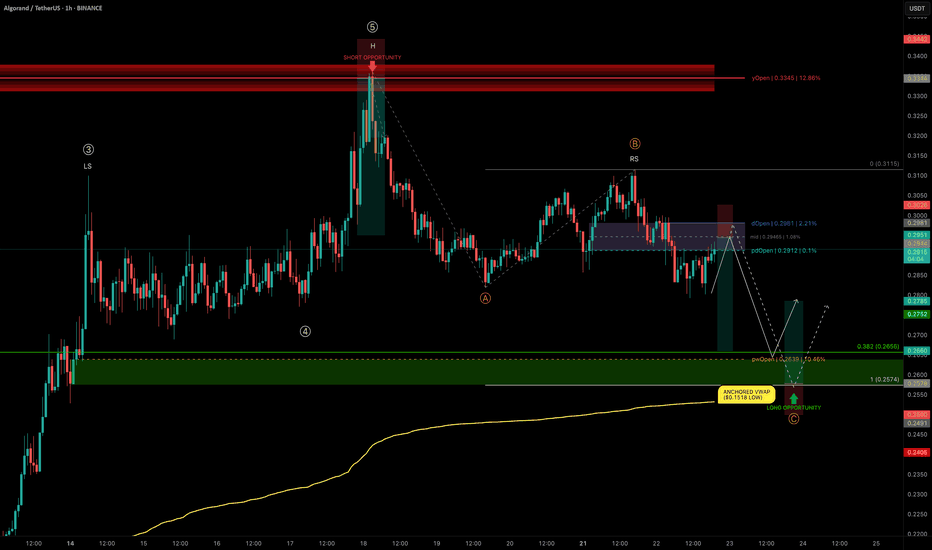

ALGO rejects at yOpen — Mapping High-Conviction Trade ZonesALGO has delivered an impressive +124% rally from $0.1518 to $0.336 in just 25 days, completing a 5-wave Elliott impulse right into the yearly open resistance.

We are now in a correction phase, and the current structure is showing a head and shoulders pattern, with the right shoulder currently forming.

Let’s break down the key levels and setups.

🧩 Technical Breakdown

➡️ ABC Corrective Structure:

Targeting wave C near the trend-based fib extension (TBFE) at $0.2574

➡️ Fib Retracement Confluence:

0.382 retracement of the entire 5-wave move → $0.2656

Previous weekly open (pwOpen) → $0.2639

Liquidity pocket likely to be swept

Anchored VWAP from the $0.1518 low (start of the bullish trend) → currently at $0.2532, acting as a major support layer

Conclusion: Long opportunity zone between $0.2656–$0.2574

Trade Setups

🔴 Short Setup:

Why? ALGO has lost dOpen and pdOpen — a bearish sign for downward continuation.

Entry Zone: Between dOpen and pdOpen

Stop-loss: Above dOpen

Target (TP): 0.382 fib retracement (~$0.2656)

R:R: ≈ 1:3.5

🟢 Long Setup:

Entry Zone: Laddered Entries between $0.2656–$0.2574

Stop-loss: Below anchored VWAP (~$0.2532)

Target (TP): ~$0.2785+

R:R: ≈ 1:2.65

🛠 Indicator Note

I’m using my own indicator called "DriftLine - Pivot Open Zones " for this analysis, which I recently published.

✅ Feel free to use it in your own analysis!

Just head over to my profile → “Scripts” tab → apply it directly to your charts.

💡 Educational Insight: Why Confluence Matters

High-probability trades aren’t based on just one tool or level — they come from confluence, where multiple signals align: fib levels, VWAP, liquidity pools, price structures , and key levels.

For example, in this ALGO setup, it’s not just the fib retracement or just the VWAP — it’s the stacking of all these elements together that creates a precise zone with a better statistical edge.

✍️ Lesson: Don’t chase trades off single signals; stack tools for confirmation.

Patience, confirmation, and confluence — as always, the keys to high-probability setups. 🚀

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

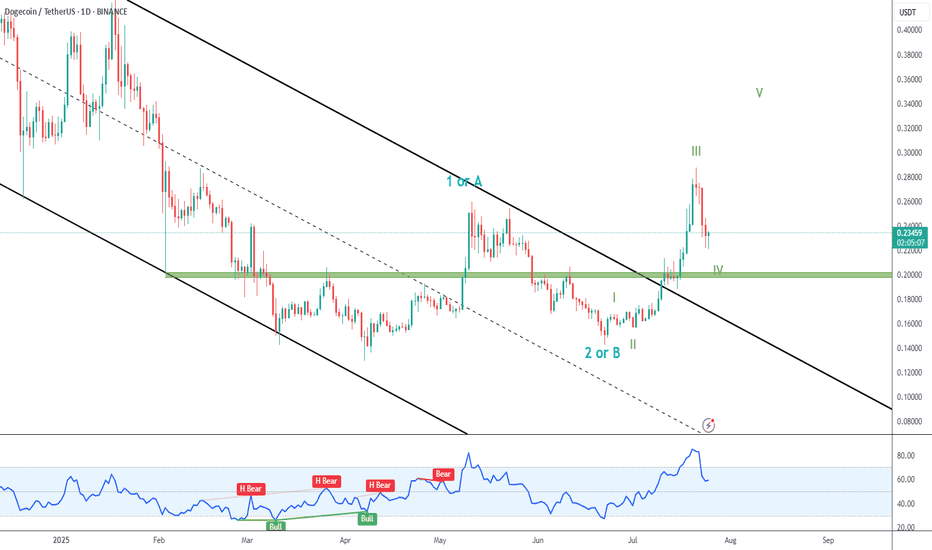

DOGE Breakout

➡️ Dogecoin blasted away from the black descending channel and past green resistance (now support).

➡️ In my primary count, we are currently in green IV correction, and expect new higher highs.

➡️ A retest of green support would be nice, but it is probable that price won´t go that far.

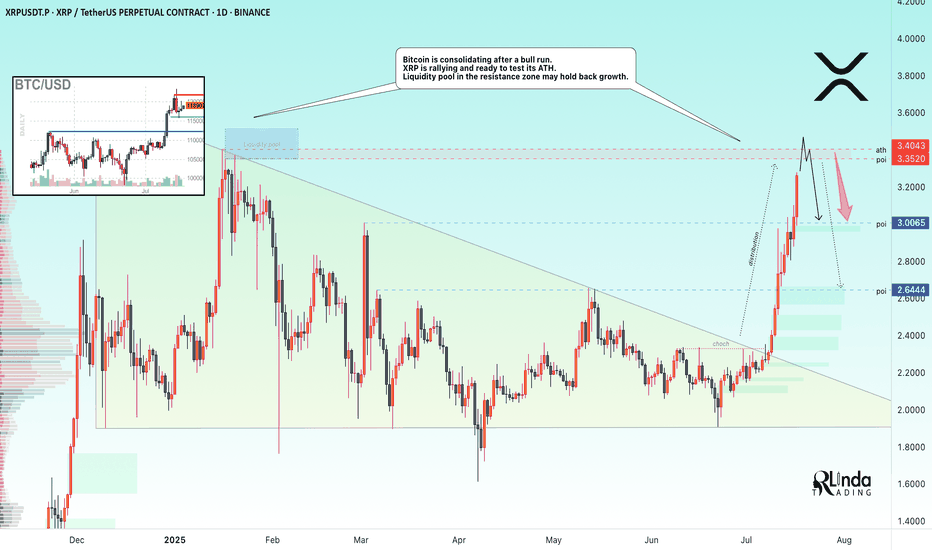

XRP → ATH retest. Reversal or continued growth?BINANCE:XRPUSDT.P is rallying and ready to test the resistance zone - ATH. Against this backdrop, Bitcoin is consolidating after a bull run. The liquidity pool may hold back growth.

Fundamentally, there is excitement across the entire cryptocurrency market. Altcoins are rallying after Bitcoin hit a new high and entered consolidation. The BTC.D index is declining, which generally provides a good opportunity for altcoins to grow. However, the index is approaching technical support, which may affect market sentiment overall...

As for XRP, there is a fairly strong liquidity pool ahead — the ATH resistance zone. The price is in a distribution phase after a change in character and a breakout of the downtrend resistance in the 2.33 zone. The momentum may exhaust its potential to break through the 3.35-3.34 zone, and growth may be halted for correction or reversal (in correlation with Bitcoin's dominance in the market).

Resistance levels: 3.35-3.40

Support levels: 3.0, 2.64

A breakout of resistance without the possibility of further growth, a return of the price below the level (i.e., inside the global flat) will confirm the fact of a false breakout of resistance, which may trigger a correction or even a reversal.

Best regards, R. Linda!

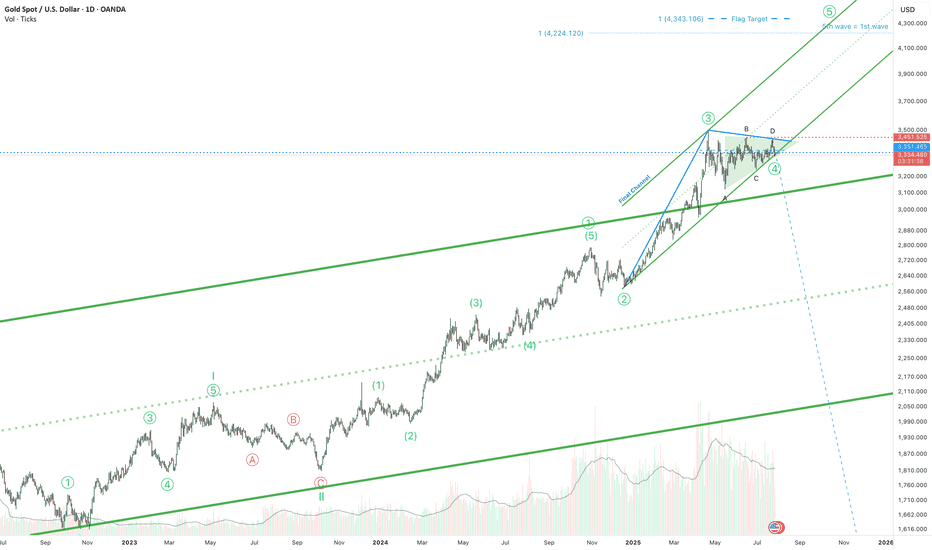

Gold is ready for the 5th wave!Hello! If you're following gold, here's some exciting news. The triangle correction phase that began in April is almost over. It's been a long journey, but we're almost there.

And guess what? The final phase is expected to reach around $4,300. But wait, there's more! The price is holding above the top of a long-term channel. This isn't just a random move; it could be a strong signal that the price could rise even higher than the $4,300 mark.

So, if you're following the gold market, keep your eyes peeled. Big moves could be just around the corner!

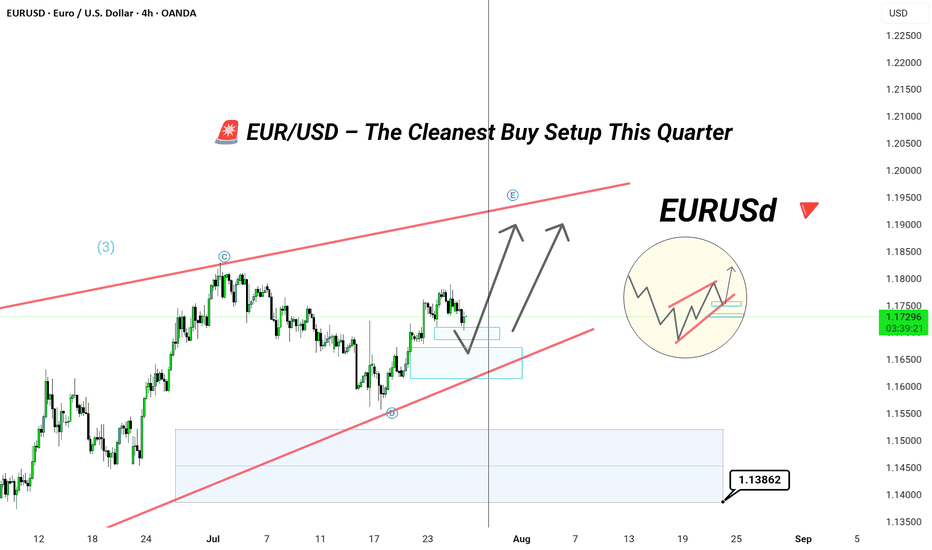

EUR/USD – The Cleanest Buy Setup EUR/USD – The Cleanest Buy Setup This Quarter (Wave E Targeting New Highs)

---

📄 TradingView explanation

📊 EUR/USD 4H Chart Analysis

The pair has beautifully respected the corrective channel from Wave C to D and is now preparing for the final leg — Wave E.

🟦 Key Highlights:

🔹 Price bouncing off demand zone

🔹 Tight consolidation near mid-channel = accumulation

🔹 Next targets: 1.1900 / 1.2050

🔹 Bullish continuation expected after liquidity sweep

🎯 The cleanest and most technically sound buy opportunity this quarter — align your longs with the trend before the breakout happens.

💬 Let them call it a bubble — we call it precision and patience. 🧠💸

#ElliottWave #EURUSD #ForexSetups #SmartMoneyMoves

?

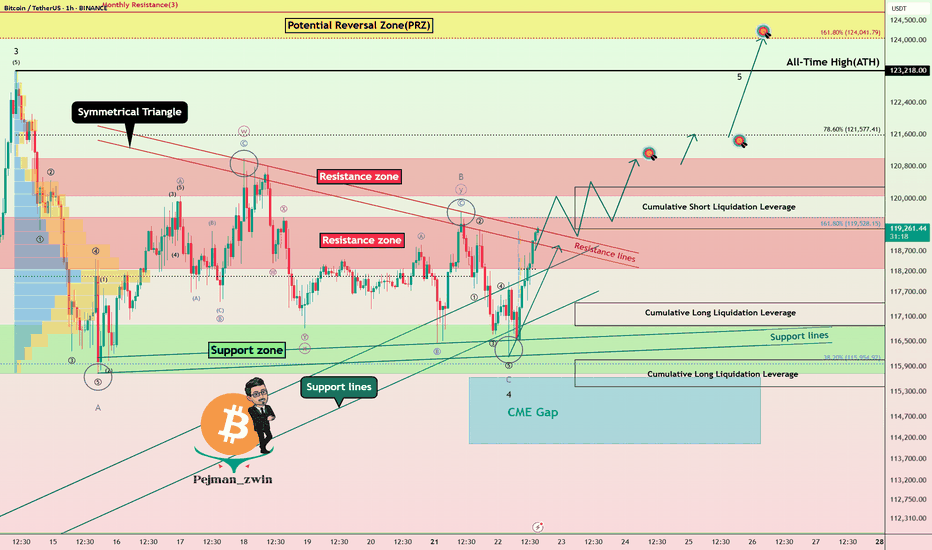

Powell’s Comments Could Decide BTC’s Fate: New ATH or Rejection!Bitcoin ( BINANCE:BTCUSDT ) has attacked the Support zone($116,900-$115,730) several times over the past week but failed to break through, meaning that buyers are still hoping for a BTC increase or even a new All-Time High(ATH) .

Bitcoin has reached a Resistance zone($119,530-$118,270) again and is trying to break the upper lines of the Symmetrical Triangle Pattern . The Cumulative Short Liquidation Leverage($117,255-$116,675) is important and includes high sell orders , so if Bitcoin can break the Resistance zone($119,530-$118,270) and the Resistance lines with high momentum , we can hope for a continuation of the upward trend.

Whether or not the Resistance zone($119,530-$118,270) and the Resistance lines break could depend on the tone of Jerome Powell’s speech today .

Jerome Powell will speak at the opening of the “ Integrated Review of the Capital Framework for Large Banks ” — the final major appearance before the Federal Reserve enters its pre-meeting blackout period.

Market Expectations:

The speech is officially about regulatory frameworks (like Basel III), but traders are watching closely for any hints regarding interest rate policy. Even indirect comments could move risk assets like BTC.

Rate Cut Signals?

With political pressure mounting (including criticism from Trump ) and markets pricing in a potential cut later this year, Powell may adopt a cautious, data-dependent tone emphasizing flexibility in decision-making.

--------------------

In terms of Elliott Wave theory , it seems that the wave structure of the main wave 4 correction is over. The main wave 4 has a Zigzag Correction(ABC/5-3-5) , so that the microwave B of the main wave 4 has a Double Three Correction(WXY) . Of course, the breakdown of the Resistance zone($119,530-$118,270) and Resistance lines can confirm the end of the main wave 4 .

Also, there is a possibility that the 5th wave will be a truncated wave because the momentum of the main wave 3 is high , and Bitcoin may NOT create a new ATH and the main wave 5 will complete below the main wave 3.

I expect Bitcoin to rise to at least the Resistance zone($121,000-$120,070) AFTER breaking the Resistance zone($119,530-$118,270) and Resistance lines .

Second Target: $121,620

Third Target: $123,820

Note: Stop Loss(SL)= $117,450

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,429-$116,878

Cumulative Long Liquidation Leverage: $116,053-$115,411

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.