Elliott Wave

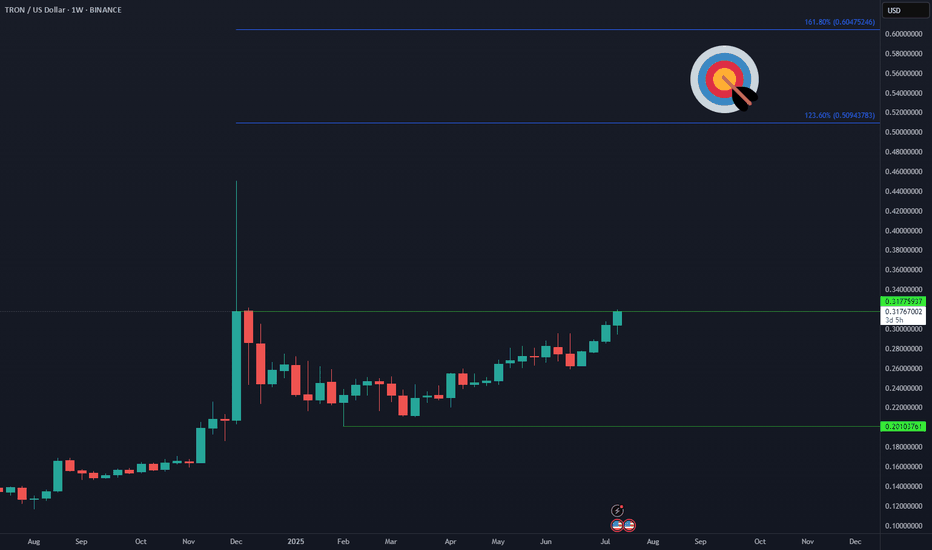

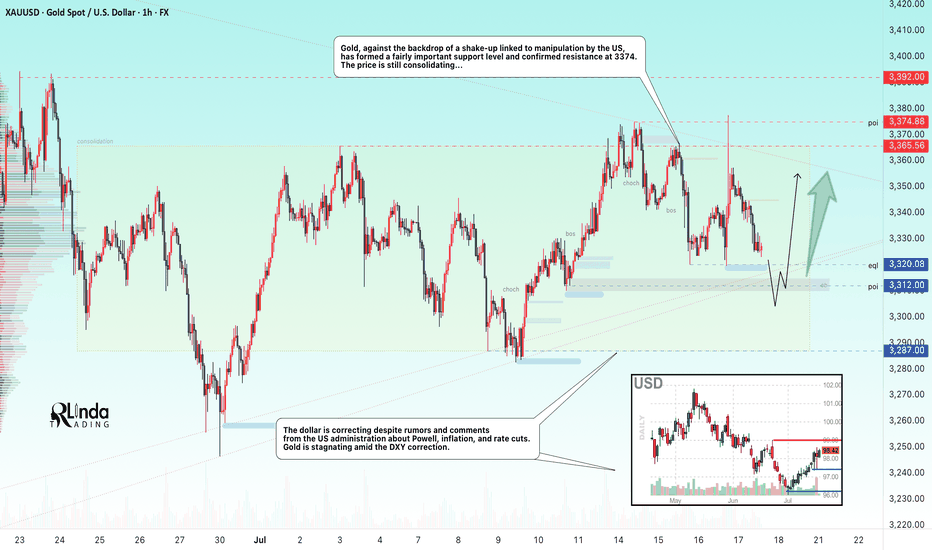

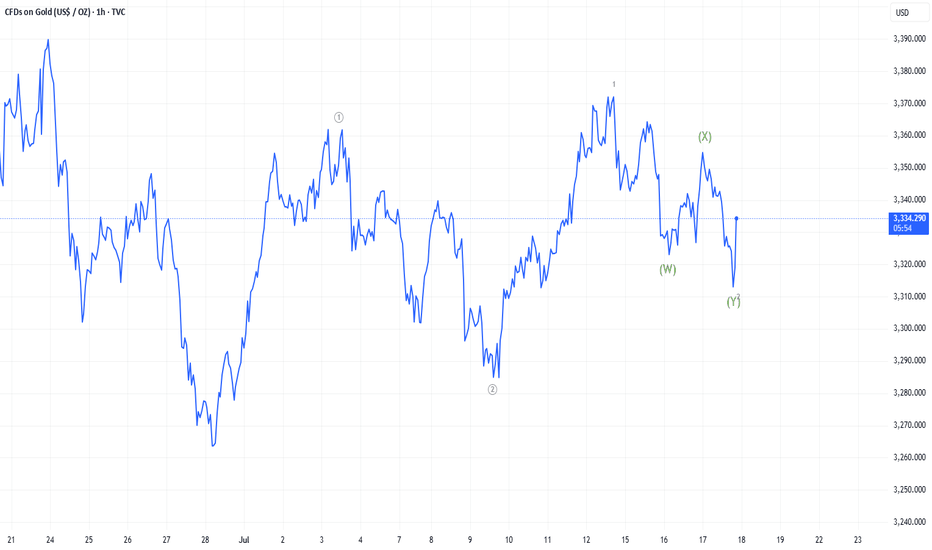

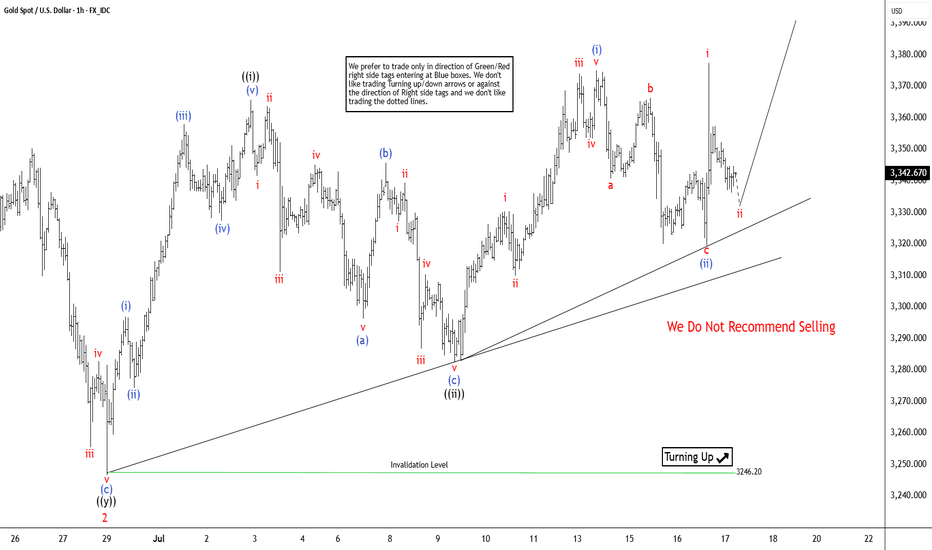

GOLD → The triangle is contracting. Retest of support...FX:XAUUSD tested a local high of 3375 but quickly returned to consolidation. The reason is manipulation by the US administration related to Powell, inflation, and interest rates...

Demand for gold has risen sharply amid global risks: Trump's aggressive tariff plans, strong inflation, and uncertainty about the Fed's actions have increased interest in defensive assets. Despite the temporary strengthening of the dollar, gold remains a popular hedging instrument. Technical analysis also points to a bullish outlook. However, growth potential is limited until the Fed clarifies its interest rate policy

Technically, on the D1 chart, it is clear that the price is consolidating, with the range continuing to narrow. Due to the bullish factors listed above, we can expect growth to continue. However, it is difficult to say where and when the growth will begin due to the uncertainty factor. All attention is on the support at 3320-3312, the triangle support, as well as the consolidation support at 3287.

Resistance levels: 3365, 3375

Support levels: 3320, 3312, 3287

Since the opening of the session, the price has spent part of its daily range, so there may not be enough potential for the decline to continue. A false breakdown of support and consolidation of the price above the key zone may attract buyers, which will trigger growth towards resistance.

Best regards, R. Linda!

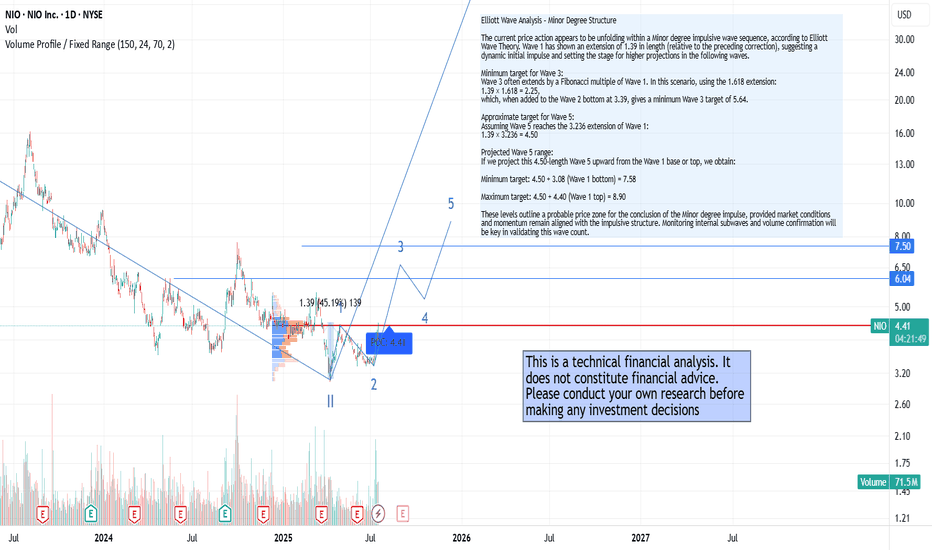

New Highs Ahead?In recent sessions, Nio Inc. has shown a price acceleration consistent with a Minor degree impulsive wave, as outlined by Elliott Wave Theory. Wave 1 has extended by a factor of 1.39, and the current price structure suggests a possible completion of Wave 3 and an early development of Wave 5, with clear technical targets already in place.

This technical scenario aligns with recent positive developments on the fundamental side:

🔹 Stronger delivery numbers – The latest quarterly results reveal robust year-over-year growth in vehicle deliveries, highlighting the company’s ability to scale production and meet rising demand. This performance is further enhanced by an improved product mix, with a shift toward higher-end or newer models, which contributes to stronger revenue per unit and improved brand positioning.

🔹 Battery swap network expansion – The company is steadily expanding its battery swap infrastructure. This innovative model, which allows EV drivers to swap a depleted battery for a fully charged one in just a few minutes, differentiates the company from traditional EV players. It also reduces charging time anxiety, increases convenience, and aligns with long-term goals for energy and fleet efficiency—particularly in dense urban areas and high-mileage use cases like ride-hailing or logistics.

🔹 New market entries – The company is actively pursuing international expansion, with strategic launches in Europe, including growing presence in countries like Germany, the Netherlands, and Norway. At the same time, it's establishing key partnerships in the Middle East to prepare for future entry into high-potential markets such as the UAE and Saudi Arabia. This geographic diversification not only broadens the customer base but also strengthens global brand positioning in the premium EV segment.

🔍 Key Highlights – NIO Mid-2025 Update

📈 Vehicle Deliveries

June 2025: 24,925 vehicles delivered (+17.5% YoY)

Q2 2025: 72,056 vehicles (+25.6% YoY)

1H 2025 total: 114,150 units (+30% YoY)

Cumulative deliveries: 785,714 units as of June 30, 2025

🔋 Battery Swap Network

Global footprint: Over 2,700 stations (2,400+ in China, ~60 in Europe)

China: ~2,651 stations, with 159 in Shanghai

Europe: ~60 stations, notably in Germany and Norway

Utilization: Peak stations in Shanghai exceed 100 swaps/day; global average ~30–40

💡 Takeaway

These strong operational metrics confirm accelerating growth and strategic infrastructure expansion, reinforcing NIO’s unique value proposition in the EV sector. The fundamental momentum aligns with bullish technical signals, including an unfolding Elliott Wave pattern projecting higher targets.

Based on the current Elliott Wave projection:

Minimum target for Wave 3: 5.64

Projected Wave 5 range: between 7.58 and 8.90

In summary, we’re observing a technically and fundamentally aligned scenario where price action is increasingly supported by improving financials and strategic execution on the ground.

This is not a financial advise, please do your own research.

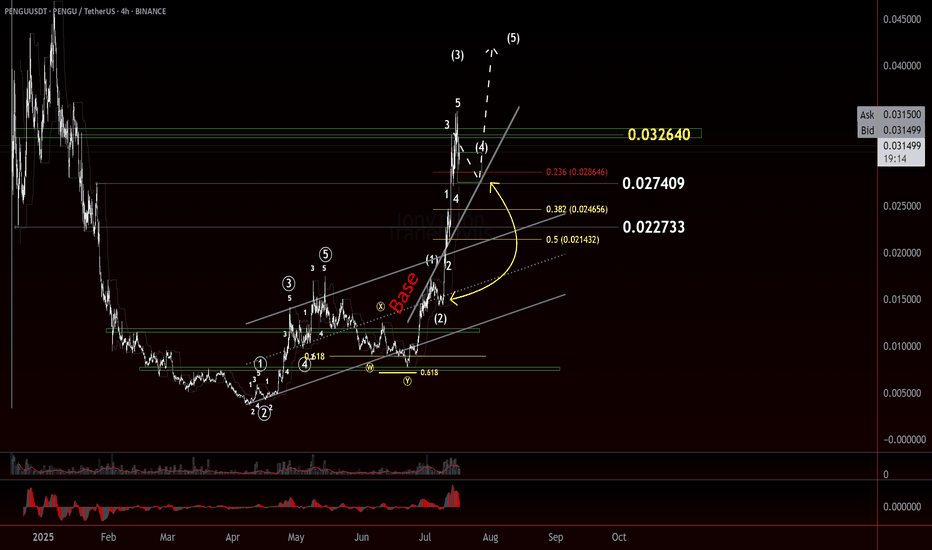

$PENGU Taking a Breather? CSECY:PENGU Taking a Breather? Wave 4 May Be Brewing

After a strong move, CSECY:PENGU looks like it might be pausing for breath. The recent action suggests we may have just wrapped up a small-degree Wave 3, with price now struggling to clear a key resistance level from earlier in the structure.

That hesitation could mark the early stages of a Wave 4 correction...Conservatively.

Here’s the zone I’m watching for a potential W4 pullback:

- .236 to 50% retracement of Wave 3, measured from the Wave 2 low

- Most Likely Target (MLT) sits right around the .382 fib

- Keep an eye on time symmetry—Wave 4 may offset the time duration of Wave 2

- Price could react off the base channel as a support guide

If this is a W4, it could give us a clean continuation setup into Wave 5—provided it holds structure and doesn’t overlap the Wave 1 territory. Stalking the pullback as it plays out, and am ready to react if we see support step in at the expected fib levels or the base channel.

Trade Safe!

Trade Clarity!

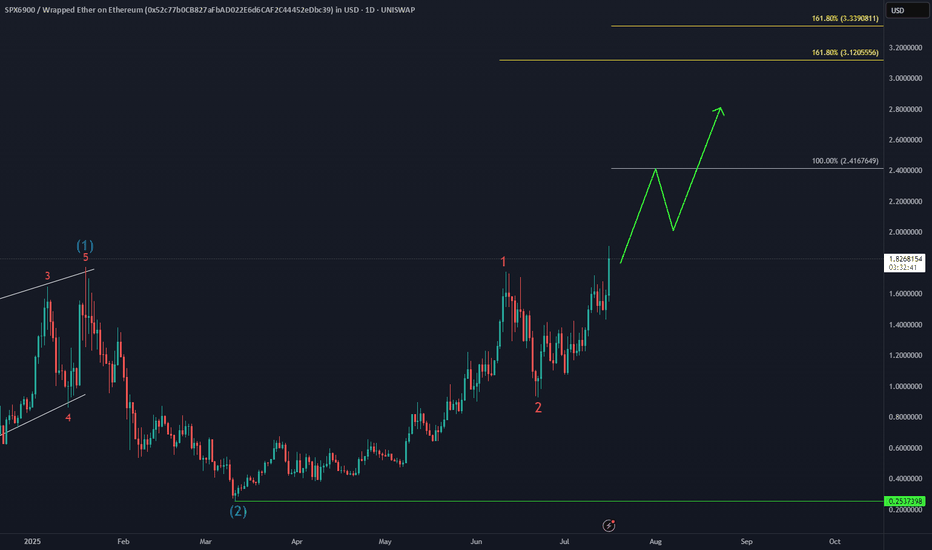

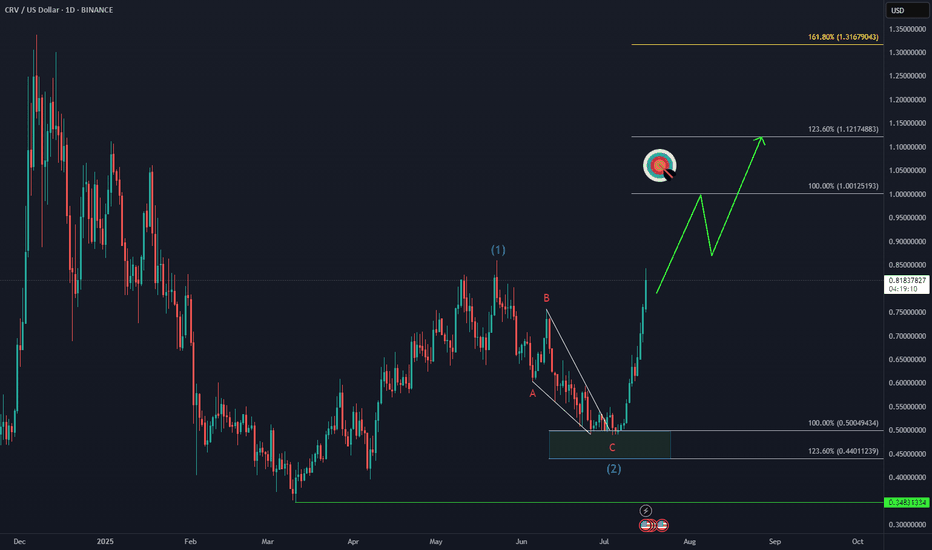

C98USDT – Potential Impulse Wave 3 in Progress? | Elliott WaveHello traders! 🚀

Sharing a fresh Elliott Wave setup I'm currently monitoring on C98USDT (4H TF). The price structure is unfolding clearly and may be in the early phase of a classic 5-wave impulse.

After an impulsive move up completing Wave (1), the market corrected in a textbook ABC pattern down into a key demand zone, finishing Wave (2). We’re now seeing strong bullish momentum suggesting the beginning of Wave (3) – the longest and most aggressive wave in Elliott theory. ⚡

Trade Setup:

🟢 Entry Zone: 0.043 – 0.046

🔴 Stop Loss: 0.03913

🎯 Target Price: 0.05955

💡 Note: Always manage your risk and confirm with your own analysis before entering any trade.

Let me know your thoughts and wave count below! 👇

Happy trading! 🚀

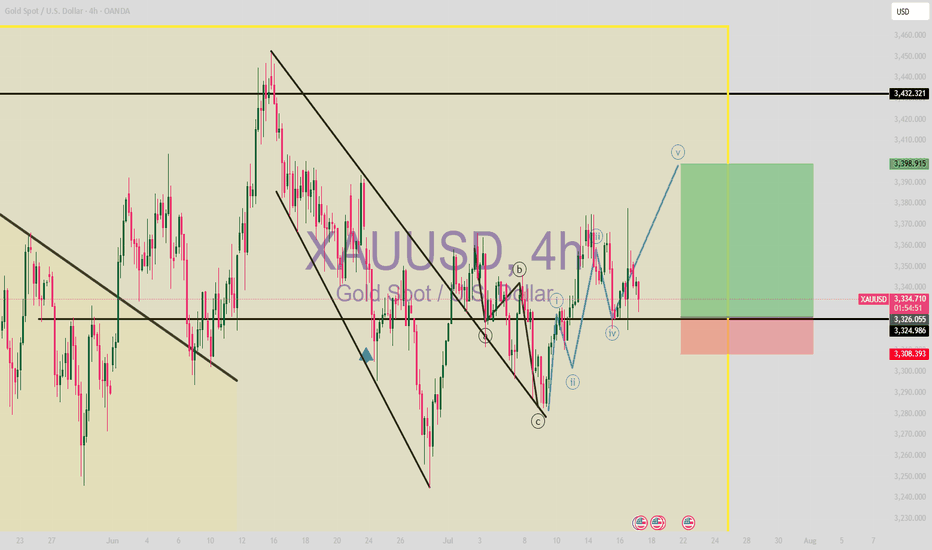

Gold (XAU/USD) - Elliott Wave Suggests Wave 5 Upside Starting!📊 Current Wave Count:

Wave 1 (Complete): Rally from to .

Wave 2 (Corrective): Pullback to (held 50%/61.8% Fib).

Wave 3 (Extended): Strong impulse to .

Wave 4 (Corrective): ABC pattern ending near (e.g., 38.2% Fib of Wave 3).

🎯 Wave 5 Projection:

Target: Typical 0.618–1.0 extension of Wave 1-3 → $ .

Invalidation: Break below Wave 4 low ($ ).

📈 Why Now?

Wave 4 completed as a shallow correction (flat/triangle).

MACD/RSI shows bullish divergence on lower timeframes.

Fundamental drivers (e.g., Fed dovishness, inflation) align.

⚡ Trading Plan:

Entry: Near current pullback (~$ ).

Stop Loss: Below Wave 4 low.

Take Profit: Scale out at 0.618 and 1.0 extensions.

Gold (XAU/USD) - Elliott Wave Suggests Wave 5 Upside Starting!📊 Current Wave Count:

Wave 1 (Complete): Rally from to .

Wave 2 (Corrective): Pullback to (held 50%/61.8% Fib).

Wave 3 (Extended): Strong impulse to .

Wave 4 (Corrective): ABC pattern ending near (e.g., 38.2% Fib of Wave 3).

🎯 Wave 5 Projection:

Target: Typical 0.618–1.0 extension of Wave 1-3 → $ .

Invalidation: Break below Wave 4 low ($ ).

📈 Why Now?

Wave 4 completed as a shallow correction (flat/triangle).

MACD/RSI shows bullish divergence on lower timeframes.

Fundamental drivers (e.g., Fed dovishness, inflation) align.

⚡ Trading Plan:

Entry: Near current pullback (~$ ).

Stop Loss: Below Wave 4 low.

Take Profit: Scale out at 0.618 and 1.0 extensions.

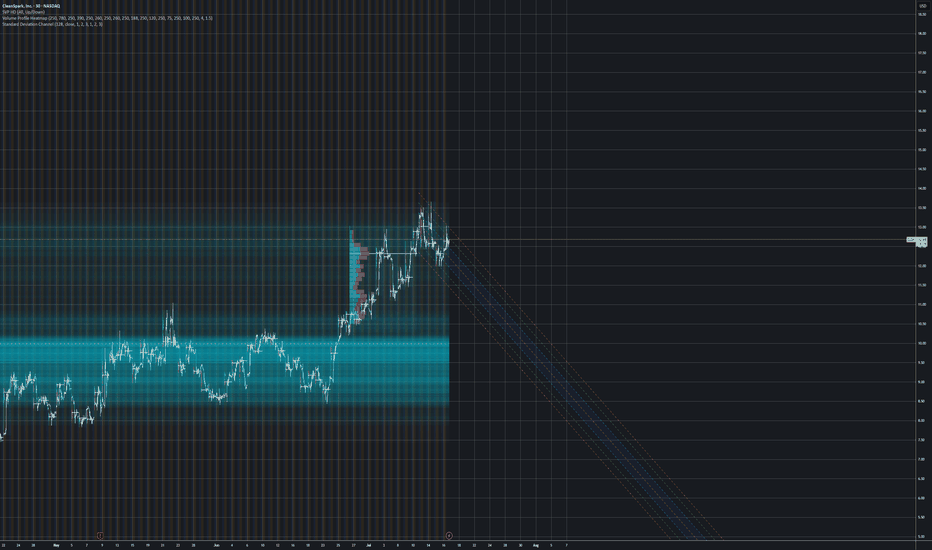

Short WISE as leading diagonal has been completedWISE can be shorted with the first target at the lower edge of the diagonal and then, at around 800 pence (start of wave 5), if move lower confirmed.

Clear RSI divergence shows trend reversal in the short-term at least (until touching lower band of the diagonal). So the lowest upside is around 14-16% here.

SL can be set to 1230 pence.

MARA Is Waking Up And Looks Promising For The Crypto MarketMARA Is Waking Up And Looks Promising For The Crypto Market, as it can send the price even higher this year from a technical and Elliott wave perspective.

Marathon Digital Holdings with ticker MARA nicely and sharply recovered away from the strong support after a completed projected higher degree abc correction in wave B/2. So, similar as Crypto market, even MARA can be forming a bullish setup with waves »i« and »ii« that can soon extend the rally within wave »iii« of a five-wave bullish cycle within higher degree wave C or 3, especially if breaks above 21 first bullish evidence level. It could be easily supportive for the Crypto market if we consider a positive correlation.

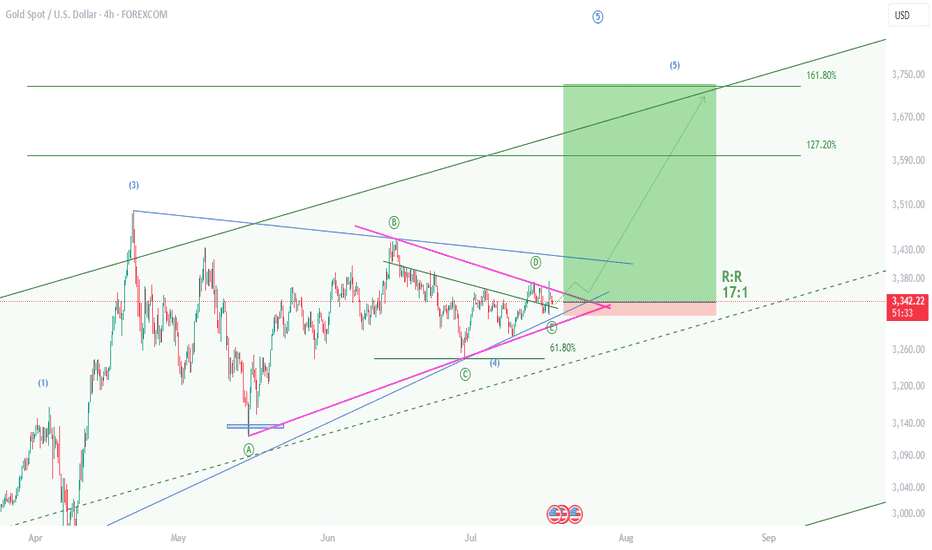

XAUUSD , Bullish Setup , R:R 17Hello friends

I am back after a long time and I want to share the results of my efforts of several years with you.

Gold is starting a 5th wave of bullishness and yesterday it gave us the necessary confirmations by rejecting the previous ceiling. I have identified the best buying position for you now. With a reward to risk 17

Take advantage of this opportunity.

If you are interested in Elliott waves or work in this field at a professional level, contact me and share your analysis with me.

I hope we will all be profitable together.

Elliott Wave View: XAUUSD (Gold) Should Continue RallyElliott Wave sequence in XAUUSD (GOLD) suggest bullish view against September-2022 low in weekly. In daily, it should remain supported in 3, 7 or 11 swings to continue rally to extend higher. In daily, it ended ((4)) correction in 7 swings sequence at 3120.20 low in 5.15.2025 low against April-2025 peak. Above May-2025 low, it should continue rally targeting 3589 or higher levels, while pullback stays above 3246.55 low. In 4-hour, it placed 1 at 3452.5 low in proposed diagonal sequence. Within 1, it ended ((i)) at 3252.05 high, ((ii)) at 3245.20 low, ((iii)) at 3365.93 high, ((iv)) at 3245.20 low & finally ((v)) ended at 3452.50 high. It ended 2 in 7 swings correction at 3246.55 low in 6.29.2025. Within 2 pullback, it ended ((w)) at 3340.18 low, ((x)) at 3398.35 high & ((y)) at 3246.55 low in extreme area. It provided short term buying opportunity in extreme area, corrected 0.618 Fibonacci retracement of 1.

Above 2 low, it is showing nest in 1-hour sequence expecting further rally. It needs to break above 6.15.2025 high of 3452.5 to confirm the upside to extend daily sequence. Short term, it placed ((i)) of 3 at 3365.70 high, ((ii)) at 3282.43 low, (i) of ((iii)) at 3374.96 high & (ii) of ((iii)) at 3319.50 low. It is showing higher high since 2 low in 5 swings, which can be nest or a diagonal sequence, if breaks below 7.09.2025 low before rally higher above 6.29.2025 low. In (i), it ended i at 3330.32 high, ii at 3309.91 low, iii at 3374.02 high, iv at 3353.43 low & v at 3374.96 high. In (ii) pullback, it placed a at 3340.76 low, b at 3366.38 high & c as diagonal at 3319.50 low. It already broke above (i) high, confirmed upside can be possible as long as it stays above 3319.50 low.

Currently, it favors pullback in ii of (iii), while placed i at 3377.48 high. It expects pullback in 3 swings to hold above 3319.50 low before rally continue in iii of (iii). The further upside confirms when it breaks above 3452.50 high. Five swings rally from 6.29.2025 low, suggests more upside should be unfold. The next leg higher expects to erase the momentum divergence in 1-hour to be (iii) of ((iii)). Alternatively, if it breaks below 7.09.2025 low, it can be pullback against 6.29.2025 low, while ended ((i)) in diagonal at 3377.48 high. Gold is choppy after April-2025 peak. It can even do double correction, if breaks below 6.29.2025 low, correcting against May-2025 low before rally continue. We like to buy the pullback in 3, 7, or 11 swings pullback as it is bullish in weekly sequence.

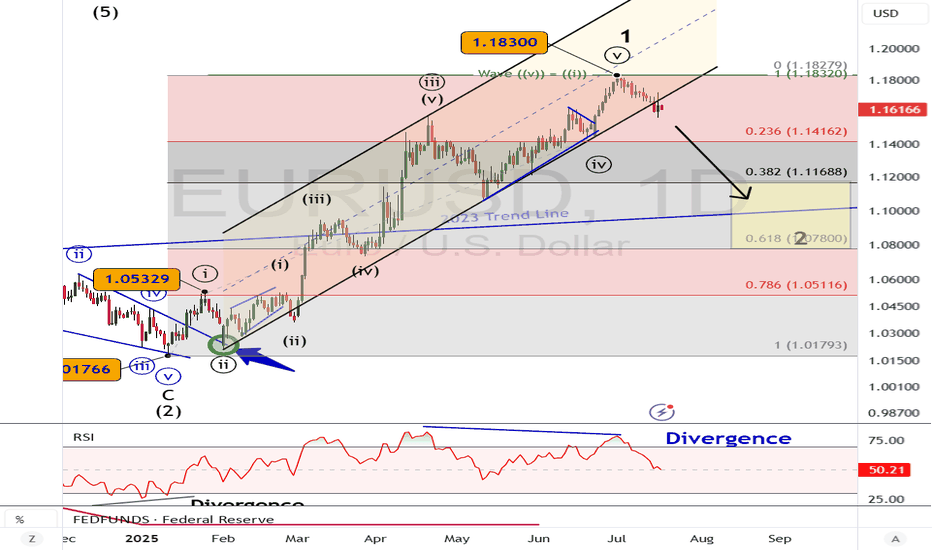

EURUSD Elliott Wave: Top in PlaceExecutive Summary

Wave 1 rally from January 2025 to July 2025 appears complete

Decline to 1.1170 and possibly 1.08 in wave 2.

The support shelf near 1.1170 may contain the decline.

We now have enough evidence in place to consider a medium-term (or longer) top in place for EURUSD.

The weekly chart above shows a rally from the January 2025 low that reached the upper parallel at the July high. This rally appears to be complete and a sideways to lower consolidation is likely underway.

On January 24, we forecasted a rally with a second target of 1.18. EURUSD reached the target topping at 1.1830.

Now, it’s time to flip the scrip as a correction is likely underway to correct that strong rally.

The 6-month rally in EURUSD appears to have ended this month and a correction is likely underway to 1.1170 and possibly lower levels.

The top of EURUSD on July 1 is labeled as wave 1. The decline underway appears incomplete and would be wave 2.

Within the wave 1, wave ((v)) measures equal to wave ((i)) at 1.1832, just a couple of pips within the actual high. Additionally, there is RSI divergence within the wave ((v)) and wave ((iii)) highs. This is a common pattern within a fifth wave of an Elliott wave impulse pattern.

The next trend (lower) will likely carry to below 1.1170.

Near this level is the 38% Fibonacci retracement level of the 6-month rally. Additionally, there is a support shelf of broken resistance and congestion appearing between 1.1033 - 1.1275.

At the lower end of that price zone is a broken trend line dating back to 2023. Therefore, this price zone will offer up a strong level of support that may launch the next rally or at least a small bounce.

BOTTOM LINE

The Elliott wave impulse pattern from January to July 2025 appears over. A downward correction appears to have begun and may visit 1.1170 and possibly lower levels.

As the downward trend takes hold, we’ll review its structure to determine where we are at within the larger wave sequence.

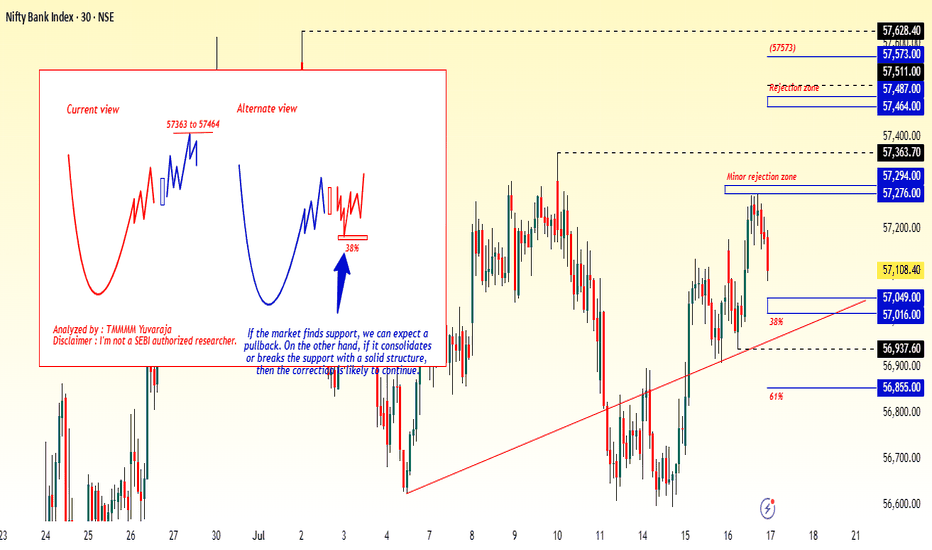

#Banknifty directions and levels for July 17thIn the previous session, both Nifty and Bank Nifty moved with ups and downs. Structurally, the sentiment still remains the same.

Even if the market opens with a gap-up, we can expect some rejection near immediate resistance.

So, my expectation is that the market may behave similarly to the previous session.

If it starts with a pullback, we may see rejection afterward.

On the other hand, if it starts with a decline, we can expect a pullback later.

The key point to note is that clear directional moves are likely only if a strong candle forms after consolidation.

#Nifty directions and levels for July 17thGood morning, Friends! 🌞

Here are the market directions and levels for July 17th:

There have been no major changes in the global market; it continues to maintain a moderately bearish sentiment.

Meanwhile, our local market is showing a moderately bullish tone on the lower time frame. Today, Gift Nifty is indicating a neutral to slightly gap-up start.

So, what can we expect today?

In the previous session, both Nifty and Bank Nifty moved with ups and downs. Structurally, the sentiment still remains the same.

Even if the market opens with a gap-up, we can expect some rejection near immediate resistance.

So, my expectation is that the market may behave similarly to the previous session.

If it starts with a pullback, we may see rejection afterward.

On the other hand, if it starts with a decline, we can expect a pullback later.

The key point to note is that clear directional moves are likely only if a strong candle forms after consolidation.

[$CLSK] CleanSpark Inc. - Farming [$BTC] LongNASDAQ:CLSK

no finanical advice

📑market outlook

+ Fed rate cut priced in --> short term risk-on environment

+ total FIAT-debasement in motion --> Precious &Crypto are poomping

- geo-political risk can drag down the 'weaker ANTI-Fiat' risk-on positions

💡idea

we want to farm BTC indirectly by selling covered-calls /placing cash secured puts

🧪approach

derivatives options with i.e. 0.1 BTC ~ 10,000 USD

🏁target

get 2% yield per month

⚠️ caution

Only weekly options: --> Crypto Cycle could take hits of -50% which would basically demolish your position

--> check weekly volume/sentiment on BTC

Don't forget:

⏳ Theta is our alley. Always have been!