ELLITOWAVEANALYSIS

Bitcoin $60k? Weekly Watchlist 02 October [Crypto]In this video I break down my crypto watchlist for this week as well as break down my technical analysis and thoughts on $BTC. Please remember that this is not financial advice! Also if you found this helpful in any way please be sure to leave a like and follow I really appreciate it :) Good Luck!

My Watchlist:

www.tradingview.com

Bearish Scenario of $BTC, Elliott Wave theory and FibonacciThe Elliott Wave theory is a form of technical analysis that looks for recurrent long-term price patterns related to persistent changes in investor sentiment and psychology...After the nice rally that $BTC did lately, we might see a weak momentum from the bull's side and take a BC correction.

Mixing The Elliott Wave theory with Fibonacci retracement I can know approximately when we might end up with the BC correction...At The Golden zone of Fibonacci.

Reda Souhail™

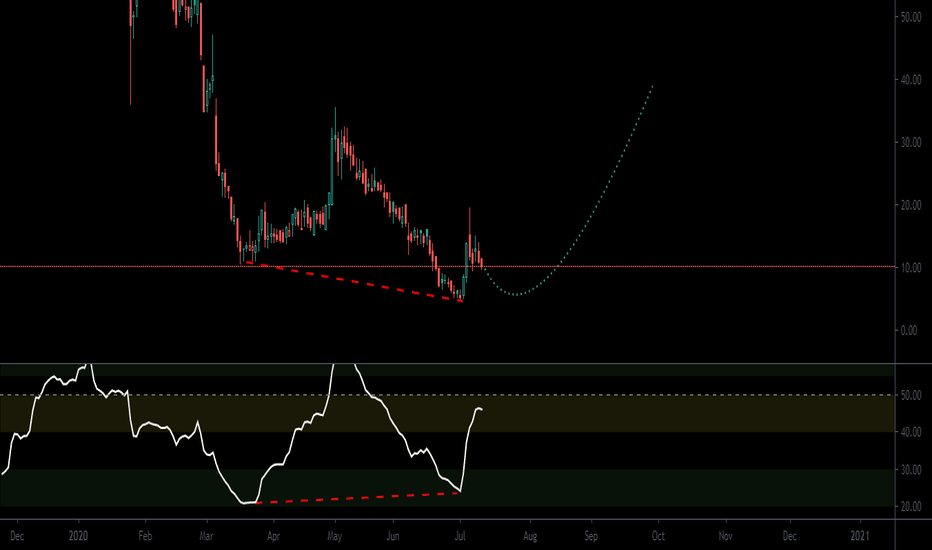

Is TEL the next 20x crypto?? Hi crypto traders!

TEL had a massive run, similar to DNT. This subwave 1 of wave 5, TEL broke first. This is a good signal for DNT as it may follow this same trend too.

Anyways, back to TEL, if you draw a fib extension from the previous highs to the all time lows, you can find the 65c fib extension as a major target. When it comes to Elliott wave count, you can see than we have finished the wave 3, a month ago and now we are in the beginning of wave 5. This will be the last wave so profit taking on the way up it will be a wise choice to make.

Stay safe!

BTC-$ 80,000Target of the uptrend In the weekly chart, the price is forming the 5th ascending wave, which can be extended up to $ 290,000 target. This is a general trend.

( Weekly Chart )

In the daily chart and by the wave count, the 3rd wave from point 5 is being completed, which can be extended up to the range of 70,000 to 80,000 dollars.

( Daily Chart )

The 240-minute chart shows the structure of the sub-waves, of which the final targets range are from $ 70,000 to $ 85,000.

BTC to make slow fall downwardIm at 4 rep! Just need a few more likes so I can chat and get some actual advice!

Looking here like we're going to have some sideways action for a few hours at least. If you believe the elliot waves (i still struggle with identifying them correctly) we have exited the 5th wave and are on the A portion of the correction. I keep seeing things like "38k" but I just don't believe it. Stochastic RSI is showing too much underbought on 4hour and 1hour charts. Possibly in for a boring morning

FACE BOOK conditional long candidateFace book spot cmp 278

Counter is trading around rising trend line support.

Symmetrical triangle formation support around 270 levels.

Elliot wave :- counter is currently trading in corrective wave 4 of impulse phase, if impulse wave 5 unfold we can see sharp rally in counter..

good support around 260-270 levels, view gets violated below 246 levels on closing basis..

upside breakout above 286 levels will confirm bullish stance for counter,, from where we can see levels of 303-319-33 levels

Gold likely drops to the range of USD1650The wave III is ended around the range of USD 2075, we are currently in Wave IV which is a corrective movement of this uptrend.

In wave IV and in b wave, the Triangle pattern is formed, and by the price crossing the USD 1906 range, which is the end of wave d of this pattern, the hope for a further downtrend exists. It should be in the form of 5 descending waves (according to the wave A which has a structure of 5 waves)

The first wave ended in the range of USD 1848 and we currently are in wave iii.

Generally, the downtrend in wave IV, depending on the Fibonacci percentages and according to the descending ratio in wave A, can be extended to the targets of USD 1679 to USD 1630.

However, we have several scenarios for gold, currently, this is the most likely scenario.

GBPCAD, daily timeframe, 5th wave of Elliott WaveHello my friends,

Today i noticed some good setup from GBPCAD. Previously this pair make an inverted shoulders head pattern and then push straight to the upside for 700 pips in 2 weeks.

I tried to fit some fibonacci tools into it and count the waves according to Elliot Waves principle. Surprisingly, it looks like this pair just finished with the 4th Wave.

Wave-4 is the shortest wave and usually it stopped at 38.2 fibonacci retracement.

We could possibly see wave-5 from this point onwards and usually it ends at 127% fibonacci retracement of Wave-4

Wave-4 could never touch the area of Wave-1 so we could use stop loss a little below Wave-1. In this case, my stop loss is at 1.7200

Buy GBPCAD 1.7395

Stop loss 1.7200

Take profit 1 @1.7675

Take profit 2 @1.7870

S&P500 all Possible ElliotWave counts for next weekMany people asked me what will happen if the invalidation level gets broken!

3 thing might happen next week:

1- the invalidation level never gets hit and we will have a crazy down trend (left chart)

2- the invalidation level will get broken. In that case we will assume that wave 3 is extended and you can see the scenario in the right chart. the price will go up to the invalidation level and then reverse.

3- the price will climb up until the triangle gets invalidated the we will have a bullish count.

I hope I could help to give you a clear picture of what might happen next week from a scientific point of view (not a personal point of view) based on the ElliotWave theory.

--------------------------------------------------------

response why I think the mark has to crash:

I always confirm my wave count with fibo and RSI or DPO.

This is the daily chart:

RSI confirms the wave count and also you can see a clear divergence , suggesting end of wave 5

wave 5 looks like a proper ending diagonal as well. That is why I am still on the bearish side.

I will not Update this post as it is just educational post not a live trading one. Live wave count will be available under my previous post

hope it helped

AUDUSD, 4hr tf, ABC corrective waveAfter a 3 month 1500-pips bull run by AUDUSD from 0.5500 area to 0.7070, price start to exhaust and has been moving in a sideways direction for 1 month since 10 June 2020 to 10 July 2020.

In my opinion we could see some correction from AUD now as there is also a fundamental issue regarding COVID-19 second wave.

There is a triangle pattern forming, and price already broken below the support. By assuming this is an ABC correction after the 5th wave movement of Elliott wave, we could see price go down to area around 0.6720-0.6700

I am selling AUDUSD 0.6950

Stop loss 0.7015

Take profit 1 @0.6860

Take profit 2 @0.6800

Take profit 3 @0.6720

Good luck

EUR/USD BUY SIGNALHey tradomaniacs,

welcome to another free trade-plan .

Important: This is meant to be a preparation for you. As always we will have to wait for a confirmation.

EUR/USD: Day-Swingtrade-Preparation

Market-Buy: 1,09930

Stop-Loss: 1,09320

Target 1: 1,10510

Target 2: 1,11000

Target 3: 1,11450

Stop-Loss: 61 pips

Risk: 1%

Risk-Reward: 2,5

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)