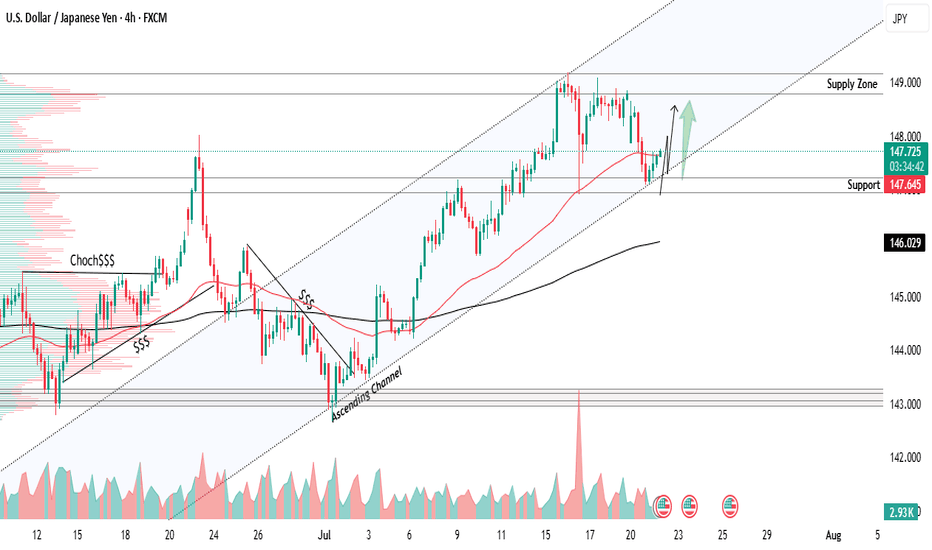

USDJPY Ascending channel bullish strong from support 📊USDJPY Analysis – 4H Timeframe

USDJPY is giving full respect to the bullish ascending channel, maintaining higher highs and higher lows with clean structure

📍 Key Support Zone:

Strong buying interest seen near 147.200 — potential long opportunity from this zone

Watching for bullish confirmation or entry setups at this level

🎯 Next Target / Supply Zone:

🔹149.000 – marked as the next resistance / supply zone where price may react or slow down

Bullish Order Block (OB) sits deeper at 143.000 – a strong area of interest if price pulls back further

🧠Stay patient and let price action lead — clean structure, smart levels, and risk-managed entries

What’s your take on USDJPY right now? Drop your thoughts

#usdjpy

Exponential Moving Average (EMA)

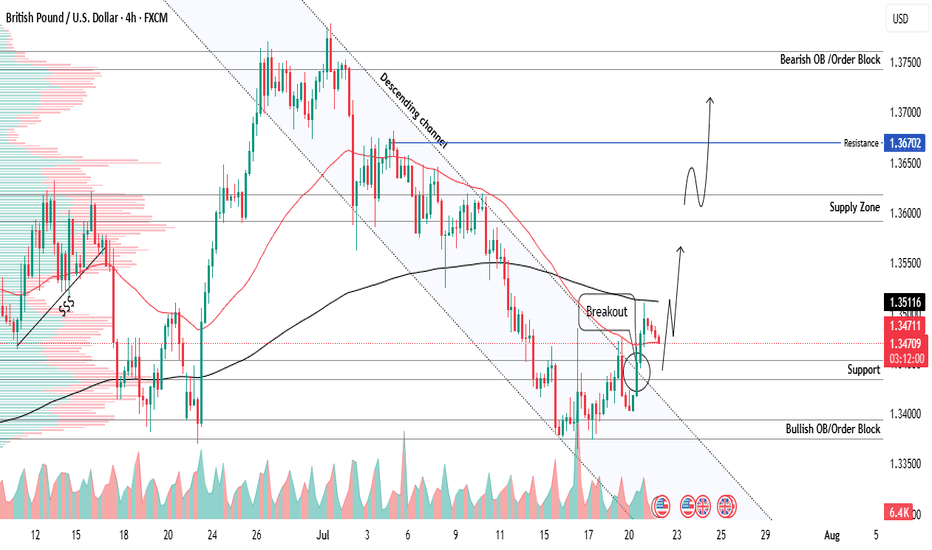

GBPUSD new breakout from descending channel bullish strong 📊GBPUSD Analysis – 4H Timeframe

GBPUSD has broken out of the descending channel with a strong bullish candle, signaling a potential shift in structure and bullish momentum

📍 Key Support Zone:

✅ Buy activated from 1.34400 – now acting as a solid demand area after breakout

🛑 Stop Loss:

Set below at 1.33800, aligned with the bullish order block for added protection

🎯 Next Resistance Levels / Profit Zones:

🔹 1.36000 – first supply zone

🔹 1.36700 – short-term resistance

🔹 1.37500 – major bullish OB target zone

🧠Trade with structure, manage risk, and follow your plan – no emotions, just execution

Share your view on GBPUSD below

#gbpusd

$AMD Swing Trade – Put Debit Spread Setup🔻 NASDAQ:AMD Swing Trade – Put Debit Spread Setup (Jul 18 Exp)

📅 Trade Opened: July 3, 2025

🛠 Strategy: Buy to Open (BTO) Put Debit Spread

📉 Strikes: $31 / $30 (Jul 18 Expiration)

💵 Cost (Premium Paid): $0.21

🎯 Trade Thesis

This setup aims to capture short-term downside in NASDAQ:AMD via a low-cost, defined-risk spread. The trade fits within my broader portfolio of OTM spreads under $0.25.

Key Drivers:

🔻 Semi sector under pressure – NASDAQ:AMD showing relative weakness.

📉 Breakdown below key support near $31 and rejection at VWAP.

🧾 Weak momentum – MACD trending down, RSI near 44.

🔄 Trade enters into earnings season volatility.

📊 Technical Setup (Daily)

EMA(4) < EMA(8) < EMA(15): Bearish structure fully intact.

VWAP: Price rejected from 30-day VWAP zone.

MACD/RSI: Momentum still fading, no signs of bullish divergence.

⏳ Strategy Notes

Max loss: $0.21

Max gain: $0.79

Risk/reward structured for a drop into or below $30

Expiration: July 18

🧠 Journal Note

Most of my trades are swing-based using OTM debit spreads with tight risk control. No same-day entries — setups must have defined technical compression and short-term catalysts.

$LYFT Swing Trade – Low-Cost Call Debit Spread Setup🚗 NASDAQ:LYFT Swing Trade – Low-Cost Call Debit Spread Setup (Jul 18 Exp)

📅 Trade Opened: July 3, 2025, 2:53 PM

🛠 Strategy: Buy to Open (BTO) Call Debit Spread

📈 Strikes: $16.5 / $17.5 (Jul 18 Expiration)

💵 Cost (Premium Paid): $0.25

🎯 Trade Thesis

This swing trade targets a short-term bullish move in NASDAQ:LYFT based on improving fundamentals and favorable technical setup. The structure uses a low-cost OTM call spread to define risk and limit exposure while capturing directional potential.

Catalysts supporting the move:

🚙 Autonomous vehicle rollout beginning this summer (Atlanta) and expanding to Dallas (2026) via Mobileye partnership.

🗳 Activist investor Engine Capital pushing for governance changes and strategic alternatives.

💵 Gross bookings at record levels, with net income and free cash flow turning positive.

📈 Analyst upgrade from TD Cowen with a $21 target (+30% upside from entry).

📊 Technical Setup (Daily Chart)

📉 EMA(4) < EMA(8) < EMA(15): Bearish alignment beginning to flatten – potential compression signal.

⚖ VWAP (30‑day): Price consolidating near long-term VWAP – watching for reclaim.

🔄 MACD: Bullish crossover emerging.

📉 RSI: ~36 – approaching oversold territory, setting up possible reversal.

⏳ Strategy Notes

Position type: OTM vertical call debit spread.

Risk defined: Max loss = $0.25 per contract.

Max gain: $0.75 if LYFT closes at or above $17.5 by expiration.

Timeframe: 2-week swing through July 18, ahead of Q2 earnings (~Aug 6).

🧠 Journal Note

This position aligns with a broader strategy focused on OTM spreads priced under $0.25, using technical compressions and fundamental tailwinds. Trade was opened not on an entry signal day - this avoids front-running momentum shifts.

GBPUSD: Potential Reversal After Strong RallyThe British Pound has shown strong gains against the US Dollar, approaching a key resistance area. After such an extended move, a correction or reversal would be a logical expectation.

Technical Setup

There is a clear series of bearish divergences on the CCI (14) indicator. Price is forming a narrowing rising wedge, which often signals trend exhaustion.

Trade Plan

Sell limit orders: 1.3690 and 1.3850

Market entry: Only after confirmation — either a trendline break or a moving average crossover

Conclusion

GBPUSD shows signs of weakening at the top. I remain focused on short setups from resistance areas, waiting for confirmation to act.

AAVE (Aave): 100EMA Holding Price Down | Another Sell Incoming?Aave is seeing a good decline in price after each touch of the 100EMA, which we recently had again. We are going to look here for a decent movement to lower zones, which should give us at least 15% of market price movement; this, of course, only as long as we stay below the EMAs.

Swallow Academy

EICHERMOT (NSE) – Bullish Setup on 15min & 1H🔑 Trade Plan:

📥 Buy Above: ₹5485 (above current resistance & candle body highs)

🎯 Targets:

T1: ₹5527 (Pivot R1)

T2: ₹5555

🛡️ Stop Loss: ₹5380 (below 13 EMA & Supertrend support)

📊 Technical Signals:

RSI: 58.08 – Bullish momentum, still room to run

%B (BB): 0.77 – Close to breakout from upper band

EMA Crossover: 9 EMA > 13 EMA – Short-term bullish crossover confirmed

Supertrend: Support at ₹5322, aligning with bullish reversal

Volume: Spike during recent green candles signals strong buying interest

⚙️ Strategy Notes:

Use 15min chart for entry timing post breakout

Tighten SL to cost after T1 hits

Ideal for short-term intraday/swing traders

For Education Purposes Only

ADANI Enterprises Ltd..... Seems to hv finally broken out.ADANI Enterprises Ltd..... Seems to hv finally broken out of the 38.2 % Fib Resistance, 2 days in a row (most likely). This is the third time its trying to break out of this zone. It's crossed the 50 ema & nearing the 200.

Needs to take out 2497, the recent high on a closing basis for a smoother ride up.

Am Bullish on the stock, one more reason being its subsidiary ' KUTCH COPPER ' which is to begin production full fledged very soon. Lets See.

RSI 101: The Secret of RSI’s WMA45 Line and How to Use ItIn my trading method, I use the WMA45 line together with RSI to help spot the trend more clearly.

Today, I’ll share with you how it works and how to apply it — whether you're doing scalping or swing trading.

Why WMA45?

WMA (Weighted Moving Average) is a type of moving average where recent prices are given more importance.

WMA45 simply means it takes the average of the last 45 candles (could be 45 minutes, 45 hours, or 45 days depending on your chart).

Because it moves slower than RSI, it helps reduce the “noise” and gives you a better idea of the real trend.

This idea is not new — many traders have tested RSI strategies also use this line. I just applied and adjusted it in my own way.

👉 How to set it up on TradingView (very simple):

What WMA45 Tells You

Trending

This line shows you the overall direction of the market:

📉 If WMA45 is going down, the price is likely going down.

📈 If WMA45 is going up, the price is likely going up.

Also, the steeper the line, the stronger the trend is:

Looking at the example above, the WMA45 line starts from the same level in two different phases, but the slope is different. The steeper line shows a larger price range.

This happens because the price was more volatile, which caused the RSI to move more sharply, and that, in turn, made the WMA45 slope steeper.

In multi-timeframe analysis, when the trend on the higher timeframe is strong (shown by a steep WMA45 line), the RSI on the lower timeframe will usually move within a tighter range and react more accurately to key levels.

If you’re not sure what these key RSI levels are, check out my previous post here:

For example, in a strong downtrend on H1, RSI on M5 might not even reach 50:

✅ What does this mean for trading?

Use WMA45 on higher timeframes to define trend bias.

On lower timeframes, watch RSI responses at key zones for optimal entries.

When holding positions, WMA45 helps determine whether to stay in the trade.

Moving Sideways

Here’s something important to note: when WMA45 is flat, RSI will keep crossing back and forth over it.

Depending on where WMA45 is flat, RSI tends to move within that range and creates different sideways price patterns. Here are the main types:

Around 50 → price moves in a box: According to RSI theory, the 50 level is the balance between buyers and sellers. RSI fluctuating around this causes price to move sideways in a rectangular box range.

Above 50 → price goes up in a rising channel: Above 50 is where buyers dominate sellers. RSI operating in this zone will continually create bullish candles pushing the price upward.

Below 50 → price goes down in a falling channel: Below 50 is where sellers dominate buyers. RSI in this zone will consistently form lower highs and lower lows, pushing the price downward.

Trend Reversal of WMA45

WMA45 is calculated from the average of 45 candles, so it's almost impossible for it to reverse direction suddenly. When it's sloping (trending), it takes time for RSI to fluctuate enough to "flatten" it before it can reverse.

As shown in the example, after WMA45 slopes up, before it turns downward, RSI must cross back and forth through it to reduce the steepness => flatten it => then reverse.

Does this align with Dow Theory? It represents the phases: Trend > Sideway > Trend. Sideway is when the WMA45 line is flattened.

✅ What does this mean for trading?

After a trend forms, if you want to enter a counter-trend trade, patiently wait for WMA45 to flatten to confirm the previous trend has ended.

Dynamic Support and Resistance

In addition to being a trend indicator for RSI, WMA45 also serves as a dynamic support/resistance level for RSI.

You will often observe RSI reacting when it encounters the WMA45 line.

In an uptrend, WMA45 acts as support for RSI.

In a downtrend, WMA45 acts as resistance for RSI.

Notably, if the reactions occur at higher RSI values, the resulting price support is stronger. Conversely, if reactions happen at lower RSI values, the price is pushed down further.

In the above example, in the first reaction around RSI 60s, RSI dropped by 9.6 points and price dropped by 12 points. In the second reaction at RSI 40s, RSI dropped similarly, but the price dropped by 25 points.

✅ What does this mean for trading?

You can use WMA45 as an entry zone for your trade: Wait for reactions with WMA45 on the higher timeframe, then switch to a lower timeframe to find a trade entry.

Use WMA45 as a take-profit or stop-loss level: For a short trade near WMA45, you can stop out if RSI crosses above it.

When monitoring these reactions, pay attention to the number of reactions—more reactions require more caution in trading.

Some Trade Setups Using WMA45 and RSI

1. Intraday trading

Trend: Follow the trend on the H1 chart.

Entry zone: At WMA45 of H1.

Entry confirmation: 2 methods:

On M5: when WMA45 of RSI is already flattened, and RSI has crossed above WMA45.

On M5: when a divergence appears in RSI.

2. Scalping

With the RSI’s reaction to WMA45, even on smaller timeframes (M1, M5), you can scalp when RSI touches WMA45.

When WMA45 has a slope and RSI returns to touch it, you can enter a trade with SL behind the candle close (10–20 pips to avoid stop hunts and spread), and TP to the nearest peak.

As mentioned, the first touch gives the best reaction.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

POWERGRID – Breakout Setup with Volume Spike📍 Entry Zone: ₹310.10 – ₹311.10

🎯 Target: ₹330.00

🛑 Stoploss: ₹302.00

📈 RSI has crossed above 60, volume confirms breakout momentum (🔵 arrow), and price is supported above key EMAs.

🔍 Strong bullish structure with clear higher lows and a clean breakout candle. Momentum shift confirmed with increasing volume.

For Education Purposes Only

Nifty - moderation of +ve momentum seen on short period charts.Nifty closed with over 1% 21 VWMA was rising, Nifty respected SD+2 resistance today.

23298, 23395 resistance levels for tomorrow.

SD+1 or 23057 acted as major support today, any breach below this and sustaining lower will signal some weakness.

23730 major pivot, as long as this is help, uptrend is intact, and Nifty is in buy on dips.

24060, 23930, 23875, 23790, 23760 major support levels.

$INJ: Preparing for a Possible Impulsive Move UpCRYPTOCAP:INJ – Setting Up for a Potential Impulsive Move

After a sharp correction, CRYPTOCAP:INJ may be preparing for a strong rebound.

In a previous idea, I forecasted a bottom at $8.5 — and it dipped even lower to $7, fully retracing last year's pump.

The price broke below the bearish flag after a clear bearish divergence at the top. It also sliced through my green buy zone and is now sitting right on a critical support level at $8.40.

🚀 Signs of recovery are starting to show:

🔹 MACD is climbing and approaching the median line — a bullish crossover could ignite an impulsive rally.

🔹 Price is stabilizing above the key $8.40 support.

🔹 RSI is low and consolidating — signaling potential upside.

🔹 Volume is quiet — often a precursor to strong moves.

The target is to re-integrate the green liquidity zone, to prepare another explosive pump.

📅 Reminder: around this time last year, CRYPTOCAP:INJ pulled off a 4x rally. While past performance doesn't guarantee future results, the setup looks promising.

🧠 DYOR | This is not financial advice.

#INJ #CryptoAnalysis #Altcoins #TechnicalAnalysis #MACD #CryptoMarket #BreakoutSetup #DYOR

$ONDO: Potential Reversal in SightLSE:ONDO : Potential Reversal in Sight

Signs suggest that LSE:ONDO may have reached the bottom of its consolidation phase, having fully retraced to its August 2024 lows. Momentum is shifting:

MACD is climbing toward the median — a breakout above could signal the start of an explosive uptrend.

RSI remains neutral, leaving room for a strong move in either direction.

Volume is near all-time lows, often a precursor to a breakout.

If the projected move plays out, the next resistance levels (based on Fibonacci ratios) are:

🔹 TP1: $0.94

🔹 TP2: $1.17

🔹 TP3: $1.35

📉 DYOR | Not financial advice.

GOLD - Day Trading with RSI 04/03/2025FX:XAUUSD

Daily Timeframe (D1): Still in a strong uptrend, with RSI and both moving averages are pointing upwards. The WMA45 is above 60.

4-Hour Timeframe (H4): RSI is positioned between the resistance created by WMA45 (current price around 3152) and the RSI 60 support level (current price around 3121).

1-Hour Timeframe (H1): The WMA45 is trending upward, supporting the bullish trend.

Trading Plan: BUY

Entry Zone:

When the RSI on the M15 timeframe is supported at the 50 or 60 levels.

Entry Confirmation:

When M5 completes a wave, or a divergence appears.

Or even when M1 shows divergence.

Stop Loss:

20–30 pips below the M5 low.

Take Profit:

100 pips or R:R ≥ 1:1.

Or when M5 completes its own uptrend.

But be careful when RSI on H4 reaches its own WMA45.

You can check out the indicators I use here: tradingview.com/u/dangtunglam14/

GOLD - Day Trading with RSI 04/02/2025

Weekly and Daily Timeframes (W & D):

GOLD is still in an uptrend, as the RSI's WMA45 is still hovering near the 70 level, and RSI remains above both of its moving averages.

H4 Timeframe:

This timeframe is currently showing a correction. However, it's not yet considered a downtrend because the WMA45 is still in the high region, close to the 70 level. But, RSI has dropped below the WMA45.

At present, the RSI on H4 is facing dynamic resistance from the WMA45 above and has support around the 4x level (43-48). The corresponding temporary price levels are approximately 3128 (resistance) and 3088 (support).

This end-of-uptrend correction on H4 could lead to high price volatility. GOLD may move within a 300–400 pip range (between the resistance from WMA45 and the RSI support around the 4x zone).

H1 Timeframe:

Currently in a downtrend, as RSI is moving below both of its MAs, and the WMA45 has a noticeable downward slope.

H1 also has RSI support at the 30 level (temporary price ~3086) and resistance at WMA45 above (temporary price ~3130).

Since we’re focusing on intraday trading, priority is given to the H1 trend.

Figure 1

Trading Plan: SELL

Entry Zone:

When RSI on M15 approaches upper resistance: levels 50–55 or 65–70.

Confirm Entry:

Conservative/Safe approach: when M5 ends its uptrend and reverses (see example in Figure 1 – M5 ends uptrend when RSI crosses below both MAs).

Or when bearish divergence appears on M5.

Or even earlier, when there’s divergence on M1 and M5's WMA45 flattens out.

Stoploss:

20–30 pips above M5’s recent peak.

Or if RSI on M5/M15 breaks through its previous high.

Take Profit:

100 pips or R:R >= 1:1.

Or when M5’s downtrend ends (when RSI crosses above both MAs).

You can check out the indicators I use here: www.tradingview.com

GOLD - Day Trading with RSI 04/01/2025FOREXCOM:XAUUSD

D and H4 Timeframes:

GOLD is in a strong uptrend.

RSI is operating around the 80 level, indicating that buying pressure is 4 times stronger than selling pressure.

Priority: Trade in the direction of the trend on higher timeframes.

H1 Timeframe:

GOLD is showing signs of a correction: EMA9 has crossed below WMA45, and RSI is positioned below the two MA lines.

Given the current slope of WMA45 on the H4 RSI, this correction is considered minor for now.

Intraday Trading Plan:

Entry Strategy:

If H1 continues to correct: Look for buy entries when RSI H1 reaches previous RSI lows (zones 44, 55).

If H1 breaks the current high (level 3128): Look for buy entries when RSI M15 reaches previous RSI lows (zones 30–40).

At these levels, RSI M5 should end its downward wave (e.g., forming a double-bottom pattern on RSI) or show a price-RSI divergence before entering a buy trade.

Stop Loss (SL):

Set SL 20–30 pips below the entry point's low on the M5 timeframe.

Take Profit (TP):

Follow an R:R ratio of at least 1:1.

Or, take profit when M5 ends its bullish wave:

If RSI M5 forms a double-top pattern or

If RSI M5 crosses below WMA45.

Partial profit-taking is recommended at different stages to optimize returns.

📌 Refer to my scripts for pre-configured RSI indicators. 🚀

USDJPY Setup: SHORT on 200 EMA Rejection📉 Best Risk/Reward Setup: SHORT on 200 EMA Rejection

🔻 Entry: Sell in the 148.50 - 148.80 zone after rejecting the 200 EMA (⚪)

🎯 Take-Profit (TP1): 146.50 (RRR: 5:1)

🎯 Take-Profit (TP2): 145.00 (RRR: 9:1)

🛑 Stop-Loss (SL): 149.20

📊 Market Overview & Bias

🟥 Bearish Outlook (Macro Trend - Daily & 4H)

✅ USD/JPY remains in a clear downtrend, trading below the 200 EMA (⚪).

✅ Price has consistently rejected the 100 EMA (🟡) as resistance.

✅ Lower highs and lower lows are forming on the daily & 4H charts.

✅ If 146.50 breaks, next downside targets are 145.00 and 143.50.

🟩 Short-Term Bullish Retracement (1H & 30M)

🔹 USD/JPY has found temporary support at 146.50.

🔹 RSI shows bullish divergence, suggesting a possible short-term bounce.

🔹 If price breaks 148.00, we could see a move toward 149.00 – but this remains a counter-trend move within a larger downtrend.

📉 Why This Trade?

🔻 Major resistance at the 200 EMA (⚪) and previous swing highs.

🔻 The macro trend is bearish, so selling rallies is safer than counter-trend longs.

🔻 RSI may enter the overbought zone, signaling a sell opportunity.

🔻 If price struggles at 148.50, expect another bearish impulse.

⚠️ Trading carries a high level of risk, and past performance is not indicative of future results. Always manage your risk carefully and never trade with money you cannot afford to lose. This is for educational purposes only and not financial advice.

💬 Do you think USD/JPY will respect the 200 EMA or break through? Drop your thoughts below! 👇🔥

$AFRM $70 target into retest $80, pt. 1 chartI wish you could post multiple charts in the same size so you can see and I don't have to post twice. I looked at the D and W. This name should see it's IPO highs at some point this year, with the volatility it could be sooner than later as well. Resistance, in my opinion, looks to be $80 zone, a psyche area as well -- dating back to 3/2021, 1/2022, 2/2022, and 2/2025. Looks like $45-$50 which was once resistance now flipped to support. It touched the 200sma and riding the 200ema. & There almost seems like a huge cup and handle formed on the weekly as well... interesting. Also, look at the earnings on NASDAQ:AFRM ... lmao. Monstrous.

WSL

Bitcoin - 200 EMA is holding Strong#BTC #Analysis

Description

---------------------------------------------------------------

+ Bitcoin has successfully tested the 200 EMA line and rebounded effectively.

+ However, caution is still advised, as the price may revisit the EMA support line.

+ The strong performance of the EMA is a positive indicator, suggesting the bullish trend could persist after a few retests.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

btc finds 200 ema support, whats next?As I have been posting in these "Ideas" for the past few weeks about market direction and where the price for BTC will go. It now has come to pass where the 200 EMA has been tested and support has been found, It however has not generated any relief among buyer sentiment unable to push price above the previous days close leaving the digital asset to continue to bleed out and cause positions from all the 93k Bulls to liquidate.

Its a shame people cannot make the connection that the only way price can go higher is to go lower in a market. That Is why I am going to warn people about where we may go , I believe the 200 EMA will be tested again and if support is broken it will send is into the low 70k area where there are open orders and It is possible this may happen. The Bull market support band is the 200EMA however there may be institutional money that may drive us down to cause massive liquidations and fear and panic among those holding bags while greed causes big players to push more into the fringe of where we can maintain a recovery.

Watch for a retest of the 200EMA . which is a bit of a fuzzy zone , use the high and low to denote the area for support as well as keep an eye on the RSI and CCI , we are also watching on balance volume drop off which is not a great sign that there is market confidence however this will play out over the weekly and the weekly candle will start to materialize in the next few days.

$INDEX:BTCUSD Action Potential? End of Day decisionINDEX:BTCUSD We see BTC continue to eat people trying to long this market based on low timeframes.

BTC is currently in an uptrend on the micro but overall there is a bearish cloud that continues combatting all growth

I believe this is artificial and tonight's close below the sup/res area at 95,500 will see another test 0f the support trend line.

if that breaks and cannot set new highs above the flipped sup/res trend that should open the way for a crawl towards 200EMA

ETHENA - Identifying a trend shift using RSI, MACD, EMA and DivFirst post of 2025 to start the new year Journaling and using Basic tools Offered by Tradingview. The most Common Used by traders are RSI MACD and EMA's.

I am going use these indicators with descriptors of what I came to understand after reading the "About script" and applying them to my trade Ideas to see If I can correctly Identify Strength and Weakness in markets.

I have plotted out on the charts what the use cases are for these tools.

RSI, MACD and EMA's are momentum Indicators, They are not used to identify where a reversal will happen but over a period of time where you can see trend start to shift or continue trending based on the Information they provide.