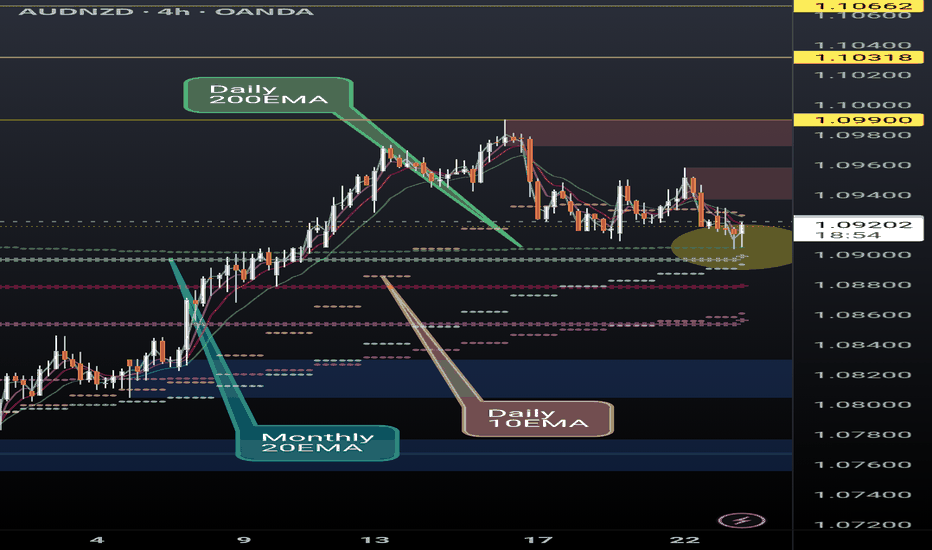

AUDNZD finding support on critical EMAsAUDNZD is finding support at the daily 200EMA (overlayed on 4H chart) and, more significantly, above the monthly 20EMA (overlayed). Break and hold the daily 10EMA (overlayed) will be key.

If the momentum continues we could see a continuation of the ongoing rally however recent AUD monetary policy meeting minutes seemed to lean dovish.

I'm a cat not a financial advisor.

EMAS

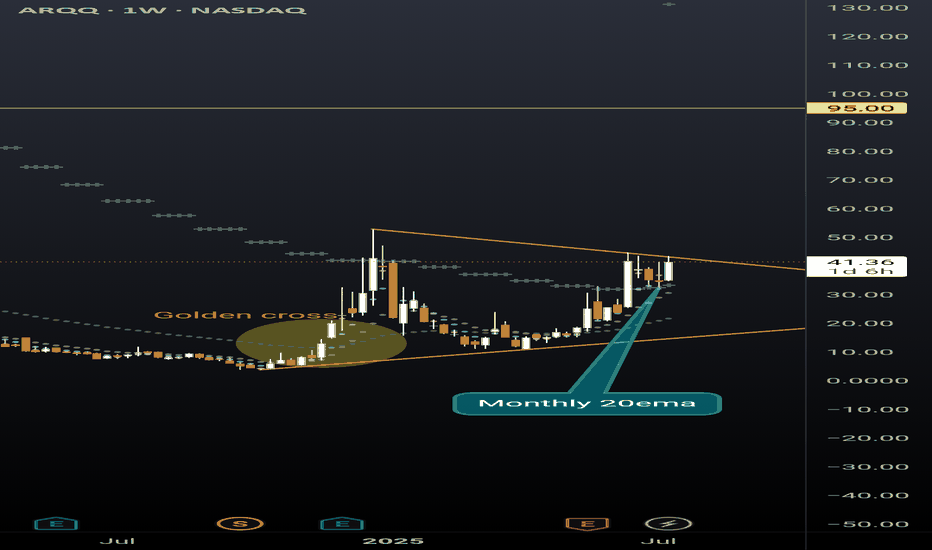

ARQQ weekly pennantBeautiful weekly pennant on ARQQ weekly timeframe. This chart is coiling nicely for a continuation. Still early in the process of reaching breakout but given the recent momentum in this sector a premature break to the upside can happen at any moment.

The ticker is currently sitting above the monthly 20ema (overlayed on this weekly chart), and just had a strong bounce off the daily 20ema (overlayed on this weekly chart). Golden cross is also highlighted that occurred in December 2024 with the daily 50ema retracing back to the daily 200ema and then continuing the uptrend earlier this spring.

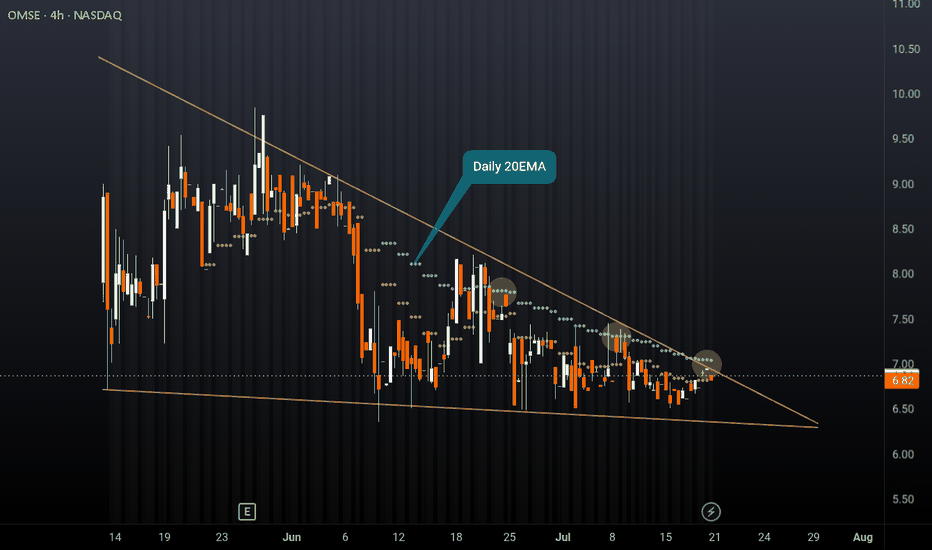

OMSE falling wedge after IPONeutral on OMSE, another relatively new ticker. Similar to my previous post on DVLT, this ticker is fundamentally strong but stuck in a falling wedge after IPO. Price is struggling to break the daily 20EMA (overlayed on this 4H chart) and has rejected multiple times. The company has strong financials, take the time to do some DD, however this pattern could break to the downside and hit new lows before we see any type of rally given the weakness in this sector at the moment. Set alerts and watch the price action play out, or don't bet your rent money on any direction if entering a position.

I'm just a cat not a financial advisor.

SWING IDEA - JK LAKSHMI CEMENT JK Lakshmi Cement , a key player in India’s cement sector under the JK Group showing strong technical confluence making this a swing-worthy setup.

Reasons are listed below :

Formation of a bullish engulfing candle on the weekly chart, indicating a potential trend reversal

Strong support from the 50-week EMA , reinforcing medium-term trend strength

Breakout from a consolidation range that lasted over a year, suggesting renewed momentum

Inverse Head & Shoulders breakout , a classic bullish pattern

Target - 1000

Stoploss - weekly close below 795

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

XAU/USD Bounces Off Strong Support Zone – Bullish MomentumGold (XAU/USD) has shown a strong bounce from the clearly defined support zone around the 3280–3290 level on the 1-hour timeframe. This zone has held multiple times in the past, confirming its significance. Additionally, the 200 EMA (red) is aligned with this horizontal support, creating a strong confluence area. Price action has respected this level, forming a bullish reversal candle setup, indicating potential for upside movement.

Based on this structure, a long (buy) trade can be considered around the 3300–3305 range, ideally after a bullish confirmation candle or price holding above the EMAs. This entry provides an opportunity to ride the next wave upward while maintaining a favorable risk-to-reward ratio.

The stop loss for this trade should be placed just below the support zone—around 3275 USD. Placing the stop slightly below this area protects against fakeouts while still maintaining good risk control. This is a logical level where the setup would be invalidated if breached.

For targets, the first potential resistance and partial profit booking zone is near 3335–3340 USD. This zone acted as resistance during previous price swings. If momentum sustains, the second target zone is around 3360–3370 USD, which marks a previous swing high and a likely destination for bullish continuation. For extended upside potential, traders can aim for 3385+ USD, especially if the price action is supported by volume and broader market sentiment.

This setup offers a clean technical play with a risk-reward ratio of approximately 1:2.5 or higher. Traders can also trail their stop-loss once the price crosses above the first target to protect gains while riding further upside.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ONDO Trade Setup: EMA Break ConfirmationWe're monitoring the EMAs for a breakout, which will trigger this trade. RWA (Real-World Assets) remains a strong narrative, and if the market turns bullish, ONDO could see a significant pump.

🛠 Trade Details:

Entry: Around $0.88

Take Profit Targets:

$0.98 (First TP - Key Resistance Level)

$1.12 (Second TP - Upside Expansion Zone)

Stop Loss: Below $0.79

Waiting for EMA confirmation and market momentum shift before execution. 🚀

GBP/USD at Key Resistance: Potential Reversal or Continuation?The GBP/USD 15-minute chart indicates a strong uptrend, with price action forming a **Crab harmonic pattern**, suggesting a potential overextension. The pair has reached a key resistance zone at **1.26323**, aligning with significant Fibonacci levels, with the **Harmonic Optimal Point (HOP) at 1.26469** acting as a potential reversal area.

If a pullback occurs, the first downside targets are 1.26127 and 1.25993 , while the ** 200 EMA ** below may provide further support. A sustained break above 1.26469 could signal continued bullish momentum. Traders should monitor price action for confirmation before positioning accordingly.

Nifty's Next Move? 24,000 on the Cards!The hourly candle formed on Friday, 7th Feb looks promising! A bullish engulfing pattern, confirming RD while taking support at AVWAP, sets up an interesting long opportunity. With the low of this candle on a closing basis as SL, going long makes sense.

📈 Upside Target? 24,000 in the coming weeks!

📉 What about ATH? A new all-time high (ATH) looks unlikely unless we see a clear breakout above the heavy supply zone of 24,200 - 24,300.

🔍 Trading Idea

For now, shorting PUTs seems like a good play, aiming for 23,800 - 24,000 levels with a clear SL of closing below 23,400.

👀 What's your view? Drop your thoughts below! 🔥📊

⚠ Disclaimer: This is my personal view and not a recommendation or tip. Please do your own due diligence and study before making any trading decisions.

NSE:NIFTY

Bitcoin compression into expansion?As one of the most historic weeks in crypto history draws to a close, it feels like the next leg in the Bullrun is upon us.

The reason for this is a clear Higher low pattern going into a resistance zone @ $106,000, buyers are willing to buy up any lower timeframe dips in price at progressively higher and high levels showing strength. The 1H 200 EMA also providing clear support since being reclaimed @ $94,000 and as it gets closer and closer to the resistance level something has to give way.

After all the bullish news coming out of the USA in relation to crypto and leaving the typical January dip and going into the historically bullish Feb-March months all is looking good. A bearish scenario would be a potential beartrap that punishes euphoric late longs thinking this is a simple trade, the truth is it's overcrowded and the market tends to aim for max pain at all times, max pain here is a sell-off but until this bullish structure is broken I am not worried.

Strong attractor to $BTC price around 88kWe can see a beautiful confluence of technicals around 88k

1- Blue dotted line; multiyear (since 2021) strong resistence trend

2- Orange dashed line; recently reseted volume-weighted average price

3- Green tick line; exponential moving average from last 200 12h periods

4- Purple arrow down; target from shoulder-derivated triangle

5- Green fine line; important multiyear Fibonacci-circle level

If this important resistence made of lots of confluences doesn´t hold, we will see the CME gap closed after price plunges to the marked orange square

XLM - 1hr Chart TA by GrokAI

Given the 1-hour chart of XLM/USD, here's an in-depth technical analysis:

Price Action & Trend Analysis:

Current Price: $0.449910 USD, showing a recent test of lower levels after a peak near $0.49.

Trend: The price has been in a downward trend but seems to be finding support around the $0.45 level. This could be a pivot point for either a bounce back or a breakdown.

Moving Averages:

200-period SMA (Simple Moving Average): The price is trading below this long-term average, indicating a bearish sentiment over a longer time frame.

50-period SMA: The price has also dipped below this shorter-term average, reinforcing the bearish outlook in the short term.

Volume:

The volume appears subdued, suggesting a lack of strong buying or selling pressure. This might indicate consolidation or a wait for a market catalyst.

Fibonacci Retracement:

The chart shows Fibonacci retracement levels from a recent swing low to high. Key levels to watch:

0.382 at $0.41841100: This could be a strong support level if the price continues to decline.

0.5 at $0.43855500: A test of this level could indicate further resistance or support, depending on price action.

Indicators:

Stochastic RSI: Positioned below 50, indicating a potential bearish phase or preparation for a bounce if it turns upwards.

MACD: While not visible in the provided image, typically, if the MACD line were below the signal line, it would suggest bearish momentum. Conversely, a crossover above the signal line would be bullish.

RSI (Relative Strength Index): At 45.57, it's neutral but shows a bearish divergence (price makes higher highs while RSI makes lower highs), which could precede a price drop if support doesn't hold.

Support and Resistance:

Support: Around $0.418 (0.382 Fib level). If broken, the next support could be lower, around previous lows or psychological levels.

Resistance: Near current price levels and above at $0.462 (0.5 Fib level).

Strategy:

For Sellers: Consider entering on a confirmed break below $0.418 with stops just above this level to manage risk.

For Buyers: Look for bullish signals or a clear reversal pattern forming near the $0.418 support, with stops below this level.

Market Sentiment:

Given the bearish signals from moving averages and RSI divergence, the market might be leaning towards further downside unless supported by volume increase or positive news.

Final Thoughts:

Always watch for volume spikes which could confirm the current trend or indicate a reversal.

Keep an eye on global crypto market sentiment, as XLM often correlates with broader market movements.

Use additional tools like trend lines, chart patterns, or other indicators for confirmation before making trading decisions.

This analysis provides a snapshot based on the given chart. Always combine technical analysis with fundamental analysis and risk management for the best trading outcomes.

BNB 15M Reversal PlayLook how the market reversed and the day's sentiment shifted. 📉📈 You can see this in the charts, of course, but I now track sentiment with numbers.

The scores "UP and DOWN" before the ">" reflect the start of the day, while those after the ">" show the current sentiment. This shift means I’ll focus on searching for shorts instead of longs (for now)- which make this day a potential ''reversal play'' for me. All intraday.

But also, this is typical End OF Year chop, for example watch DOGE 15M trend, reversed 4 times which make this very bad to trade on for me with a 15M system.

BNB Numbers, factual structure:

- Structure: 1D: UP | 4H: UP | 1H: UP | 15M: DOWN > UP |

- First 2H (15M): UP

- 15M Sentiment: EMA's: UP > DOWN > UP | ATR: UP > DOWN > UP

- Up score 4/7 > 7/7"

SWING IDEA - CAPLIN POINT LABORATORIESCaplin Point Laboratories , a leading pharmaceutical company known for its strong presence in regulated and emerging markets, presents a promising swing trade opportunity based on the following technical factors:

Reasons are listed below :

2100 Resistance Break : The stock has decisively broken the 2100 resistance level, signaling strength and potential for further upside.

Head and Shoulder Pattern Breakout : A classic bullish reversal pattern, indicating a continuation of the uptrend.

Bullish Marubozu Candle : A strong bullish candle on the daily timeframe showcases significant buying interest and momentum.

Trading Above Key Moving Averages : The price is comfortably above the 50 and 200 EMAs on the daily timeframe, reinforcing the bullish sentiment.

Target - 2390 // 2600

Stoploss - daily close below 2060

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

KIRLOSBROS - Cup & Handle patternAll details are given on chart. If you like the analyses please do share it with your friends, like and follow me for more such interesting charts.

Disc - Am not a SEBI registered analyst. Please do your own analyses before taking position. Analysis provided on chart is only for educational purposes and not a trading recommendation.

Gold (XAUUSD) ShortThis is not an financial advice. This is just my observation.

1. Gold is obviously bearish and the price is on its correction way.

2. Based on Elliot, the A and B wave has been completed and we are now in the wave C. In the wave C, the first and second waves are almost done and we are going to enter wave 3. The 2/C is reached to 50% correction. However, I have to admit that On Friday I expected that price should reach 2670 (on of the strangest price resistance level). On 4H time frame, yesterday price crossed down the EMA 200 which can be considered as an entry signal.

3. For long term (I think until next Fed reserve rate announcement, unless other news interrupt) price should meet about 2470, although more bearish is also possible. After 2470, I suppose we should look for a bullish signal. Until then, we have some minor SR levels, expectedly on about 2568, 2515.

I am looking forward for your comments.

Bests,

Minor Structure + Momentum: Part OneWhen analyzing momentum, the most important question to consider is: Where should I focus my analysis of momentum?

Many traders often find themselves confused by the concept of "momentum" as they try to derive meaning from every single candlestick movement.

The straightforward answer is: Analyze momentum when the price is at key levels or is getting close to them! In particular, for minor structures (trends), you should pay close attention to momentum near the 13 and 20 EMAs, as we do in ARZ Trading System.

Keynotes: a minor trend is still valid, if these two key points are continuously happening:

1. We always expect a loss of momentum for price when approaching the key levels, and gaining momentum when it's moving away from them, in the direction of the trend.

2. A very important sign of gaining momentum is crossing and closing the whole previous candle(s).

Let's analyze this chart:

- It is obvious that candles #1 to #3 are showing a loss of momentum, but they are far from key levels and it just might mean a retracement, which happened. But again it might not retrace at all!

- from #3 to #4, we see price is gaining momentum, which is not good! so both key levels could easily break, which happened. But again in #5 and #6, we see the price losing momentum in the opposite direction of the previous downtrend, and gaining it in the direction of the minor downtrend. so everything is good.

- Again #7 confirms the momentum in the direction of minor downtrend.

- In retracement up until #8, the price is gaining momentum upward, which is not good. But candles #9 through #10 again are in our favour.

- the correction to #11 is not looking good for a downtrend, and in the next candles, to #13 we are not convinced that sellers are stronger. So, we are cautious here. And the price finally gains momentum upward and we reach #14.

- From #15 to #16, momentum is the same for both buyers and sellers. It is a tight range and can do nothing until we see a clear sign of gaining momentum (or losing) in one direction. And the sign came in the shape of candle #17. If this tight range were to continue, it should have been a bullish strong candle.

Last Time XRPUSD Will Be Under $1! Raise the "Flags"!BITSTAMP:XRPUSD - Bull Flag Prediction

Based on lack of Volume and price falling into a Descending Channel.

The suspected Flagpole from the Low @ .4860 before the Rally to the current High @ 1.26541, suggest a potential 160% increase in price once a Bullish Break confirms the Bull Flag!

First, Price will make a Retracement to the 38.2% Fibonacci Level, testing the July 2023 Highs and the Support of the Descending Channel around .94 - .92 cents.

Added confluence is the Retracement would also be testing the 200 EMA since the appearance of Golden Cross across all Timeframes!

This could be the Last Time BITSTAMP:XRPUSD sees below $1!!

Rallies come in waves, if you missed the first, don't miss this one!!

How to Use Exponential Moving Averages?The Exponential Moving Average (EMA) is one of the most popular technical indicators for traders, known for its sensitivity to recent price changes and ability to reveal trends in real-time. This is certainly not a 100% grail or a super indicator! But I would recommend not to ignore EMA during backtests

What is the Exponential Moving Average (EMA)?

The EMA is a moving average that gives more weight to recent prices, allowing it to react faster to price changes compared to the SMA. This quality makes EMA especially valuable in volatile markets like cryptocurrencies, forex, and stocks. Typically, traders use the EMA to smooth price data, making it easier to spot trends and reversals.

Key EMA Timeframes:

Short-Term: 10-20 EMA (for quick trades and scalping)

Medium-Term: 50 EMA (commonly used to gauge trend direction)

Long-Term: 100-200 EMA (used to assess overall market sentiment)

Why Use EMA in Trading?

The EMA helps traders identify the trend direction, evaluate market momentum, and recognize possible reversal points. Because the EMA adjusts quickly to price changes, it is effective for day trading, intraday trading, and even longer-term investing. Its responsiveness is particularly useful for:

Trend Confirmation: The EMA helps traders confirm if a trend is upward or downward. Multiple EMAs used in combination can highlight potential crossovers that signal trend shifts.

Entry and Exit Signals: EMA crossovers and support/resistance levels can serve as effective entry and exit points.

Momentum Assessment: Short-term EMAs provide insight into current momentum, while longer-term EMAs reveal broader market sentiment.

Pros and Cons of Using EMA in Trading

Pros:

Reactiveness: EMA adjusts quickly to new price movements, helping identify trends sooner than SMA.

Versatility: Suitable for various timeframes, from scalping to swing trading.

Clear Signals: Effective in trending markets for capturing entry and exit points.

Cons:

Sensitivity to Noise: EMA is more susceptible to market “noise” or erratic price swings, leading to potential false signals in choppy markets.

Not Ideal for Ranging Markets: EMA is less effective in sideways or consolidating markets.

Tips for Trading with EMA

Use EMA in Trending Markets: EMA performs best when there is a clear trend. In ranging markets, signals are less reliable.

Combine EMA with Other Indicators: Use indicators like RSI or MACD to confirm EMA signals and reduce the chances of false breakouts.

Stick to Risk Management Rules: EMAs, while effective, are not foolproof. Always set stop-loss levels and use proper position sizing to manage risk effectively.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

$BA 1D Idea🚨 Boeing (BA) Analysis 🚨

🔻 Falling Wedge: BA is in a falling wedge pattern, signaling a potential reversal soon.

📊 Key Levels:

Support: $146

Resistance: $165-$170

Current Price: $152.35 (-25.88%)

🟢 Oscillator: Currently oversold in the green zone, suggesting a possible bounce.

📈 Watch for a breakout above the wedge for a move toward $165. Failure to hold $146 could lead to further downside.

Copper Pulls Back as China Optimism FadesCopper extended the August rebound into autumn and reached three-month highs, helped by the Fed’s jumbo rate cut and massive stimulus from Chinese authorities aiming to prop the economy and the property sector. However the measures do little to address the structural problems and the real estate market is unlikely to return to its former glory, while the lack of follow through on the fiscal front this week caused prior optimism to subside. Furthermore, the Fed has struck a more cautious approach towards further easing and Friday’s strong jobs report supported the reserved commentary. Markets have now priced out previous aggressive bets for 75 bps of cuts this year, aligning with the Fed’s 50 bps projections.

Copper pulls back as a result, threatening the EMA200 (black line) and the 50% Fibonacci of the recent recovery. A breach would pause the upside bias, send the non-ferrous metal into the daily Ichimoku Cloud and expose it to the ascending trend line from the August lows. Deeper correction however does not look easy under the current technical and fundamental backdrop.

There are still hopes for additional Chinese stimulus (potentially within the weekend), while prospects of US soft-landing and easier monetary policies in major economies can support higher prices. So do the AI boom and the green energy transition. Copper tries to defend the EMA200 that maintains its recovery momentum. This will allow it to push again towards 4.791, but we are cautious around further strength at this stage.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”) (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.