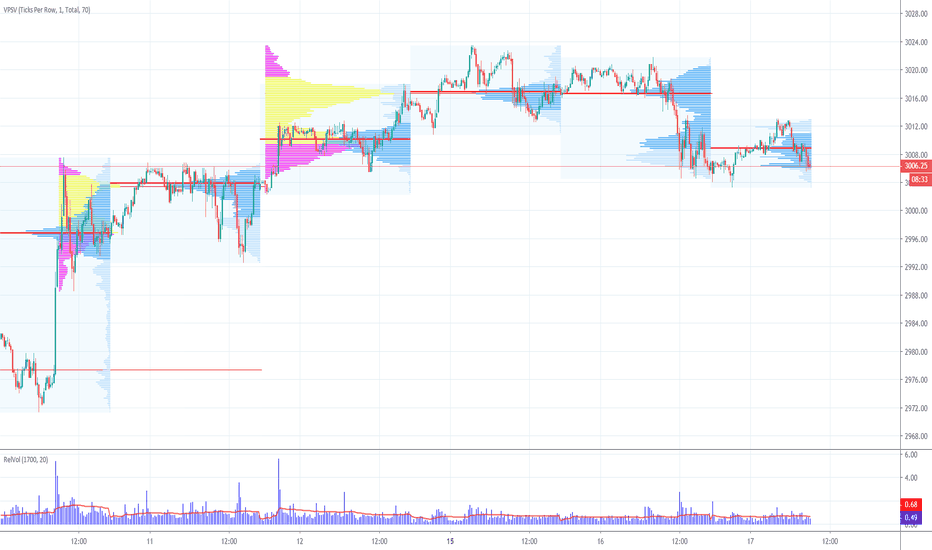

July 22 2019 E-Mini/E-MIcro SP500 Morning IdeasWas wrong about the bounce on Friday...

Well not completely wrong, but I didn't capitalize on the uptrend early in the day.

Capped off a poor trading week for me as I was trying to will the market higher.

New week, and expect it to be noisy. 2993-2960 seems to be the area of interest this week. I think the line in the sand for the bears is the high from Friday.

After that, I would be expecting all time highs again.

Eminis

Morning Ideas July 19 2019 E-Mini/E-Micro SP500Hey traders,

I got shaken out of my long briefly yesterday, only to re-enter (at a worse price). The position is in the green and will continue to add to it because I want to get paid if the hypothesis is correct.

Volume is good overnight and a ledge at the top, indicating we are not done going higher yet.

Look forward to seeing you guys in class at 930.

Morning Ideas July 15, 2019. Emini Sp500/E-Micro SP500Sounding like a broken record but we continue to accept value higher. That means I will continue to be long and continue to follow the value.

2992 is the line in the sand below where I think we pull back into the next distribution below, as shown on the video.

ES Update - Breaks 61.8%!Following from my last, I mentioned that the full half way back would be an area of interest for shorts if lower time-frames confirmed. I am still not in any swing positions because no confirmation was given. In fact, the full half way back 61.8% has failed suggesting from my way of framing the markets that price is due to head higher.

This recent move up in a V shape has taken out previous highs thus far, so I will be looking for a pull back to the respective 50% level. Currently this stands at 2808. However, I would require a confirmation on the lower-time frames before entering into any positions. Price is quite far from the area of interest, and who knows, it could continue higher without giving any opportunities. If price is to continue moving higher, I will just trace my fibonacci levels accordingly to get my next pull-back levels of interest.

Although there is support levels visually around 2729 which may be a reason for the reversal to the upside on ES, I don't consider myself with the subjective nature of support and resistance. One can say my approach of Fibonacci analysis is subjective too. The only difference is that I have used this approach for a long enough time that I am able to objectively identify my levels in a consistent way. Anyway, if price is to continue higher, the larger long setups from the beginning of the year have not hit target yet at 3110 region. So, if price is to continue higher in "waves" (term used loosely - not Elliott waves), this is the target I would be looking at to begin with because there has been no confirmation of longs failing YET.

Some comments I would like to summarize with:

1. I am looking for long opportunities. Currently area of interest is at 2808.00. However, this could change with price movement so I will be looking at continuing to trace the ES in real time too.

2. The long setup from the beginning of the year has not failed yet.

3. I am not going to remain biased though. If there is evidence using my approach to suggest long opportunities fail, I will consider short opportunities.

4. If you also day trade like me, you can capitalize on short-term opportunities in either direction.

5. Patience is key and confirmation is required before entering into any setup.

6. Always trade whichever setup trades first. If you are in a situation where you are between a long and short opportunity, trade the setup that trades first.

E-Mini 500 BullishA very interesting week last week for the ES! (E-Mini S&P 500)

What with the tweets, corporate earnings and the continued trade war!

Uncertainty still prevails. This should be another interesting week. A lot of opportunity and I am expecting a considerable amount of volatility.

There is much in the way of scheduled news events.

Sunday open could be either be a gap down or an inside or a bounce to the upside.

Price action and closed is signalling an upside. However, there is chance that price will want to test Friday low and naked POC at 2814.25 before a move up.

Also of note is that price touched 2827.00 a 0.786 Fib

A confirmation for a bullish day we should see:

1. Price take out Friday’s high

2. Price closing above VWAP

3. Value area must remain in upper area of Friday’s VA or more

4. POC must be equal or above Friday’s

E-Mini S&PToday I believe it’s going to be a balanced profile day as market awaits Sino-US trade talks outcome.

Overnight price traded within yesterday’s value area. I believe price will come down to test yesterday’s lows before going up to test overnight VPOC or try to take out overnight high before falling back within the range -baring any unexpected news of course.

E-Mini S&P 500Yesterday’s price action was a bit unexpected due to earnings outcome. However, while price went up, it was not very convincing, due to the pace and low volume. Divergence remains.

Overnight session remained within the value area low of the previous session. Towards market open, price pierced yesterday’s POC and pulled back to the bottom of value area high.

Based on the pullback, the price is likely to test overnight lows or retrace to overnight POC before resuming higher to retest yesterday’s high.

Lack of convincing price movement backed by volume leads me to suspect something else is happening. (Today there are a few things on the economic calendar). Therefore, wait for the initial balance to be established before entry.

E-Mini S&PAnother day of earnings and uncertainty. Nasdaq made higher highs after earnings reports after market close. Dow lost some of the gains made on Tuesday. This has left S&P a bit flustered. There is no clear directional bias on intra-day. Overnight price action, particularly during London, held in a very narrow range. Maybe those in the know, know something retail doesn’t.

However, I maintain a upside bias, as I believe the market is taking a breather before it takes out the recent highs before coming down to fill imbalances created earlier this weak. The price went up on very thin volume on Tuesday. I think the bears are waiting around the 44-mark.

The big guns are accummulating!

SP500 ES Emini Futures-Possible Ending Diagonal Could be totally wrong here but to me it seems like the SP500 is shaping up with an ending diagonal formation to end a massive run since 2009. You could also count it as An ABCDE triangle wave IV and now a new impulse wave 5 starting, but the end result is the same; a jaw dropping end to a multi decade bull run.

If this is correct, we will see the most severe depression we have ever seen. Maybe even worse than our grandparents went through. A massive deleveraging of the total 200 trillion dollar debt bubble the world economies have created in order to keep the show going

I took profits and remain neutral while I'm waiting for a possible pull back to the trendline or previous wave 4 of one lesser degree to re-evaluate the market and possibly enter a long for the final run

This may coincide with a massive blow off top in BTC and other cryptocurrencies to seal the deal and bring massive gains. Again, nobody knows what will happen, but i thought i would share this to warn everyone of the possibilities.

Hope everyone is well

Fibonacci Buy For The September E-mini S&P 500July has been a good month for U.S. equities, featuring bull runs in both the DJIA and the S&P 500. A simple look at the September E-mini S&P 500 futures daily chart illustrates this point. If we see some weakness in the S&Ps as the trading week develops, then a long from the 38% Fibonacci retracement of the current daily wave may come into play.

As long as the Swing High (2818.25) remains the recent top on the daily chart, I will have buys queued up from 2771.00. With an initial stop at 2764.75, this trade yields 25 ticks using a standard 1:1 risk vs reward scenario.

S&P 500 emini futures day trade ideas for Monday, May 16Although I do not have access to a Market Profile indicator on TradingView , I've shaded in the areas (on a 30 minute bar chart) where I see two separate distributions from Friday's double distribution trend day selloff.

If the market opens Monday in the lower distribution, I would look to enter a day trade short if price rallies to the high of this balance and fails, re-entering the lower distribution below 2047.75 with a stop above 2049.25 (back inside the upper distribution). There is also a single print at 2051.25 and may be a more attractive spec short, as that level could be considered the "spike base" from Friday's earlier 3rd period low.

Short targets would initially be Friday's low, and possibly to test last week's low at 2033.75. If that weekly low fails it opens up the possibility of trading down to 2026.00, which below that would stop the one time-framing higher on the monthly bar.

If price opens Monday in Friday's upper distribution ideally I would look for a long entry if price trades down to 2047.75 with a small stop just back into that lower distribution, with initial profit target of 2058.75 - where mechanically two 30 minute periods sold off from (mechanical because it was Thursday's close).

With declining NYSE volume Friday of 3.5 billion, Friday's selloff could be attributed more to weekly options expiration, and the market could be very short. With any trade monitor for continuation, and look out for a possible short covering rally.

today in ES April 5th 2016today, looking at 2047 as the point buyers must get serious, and if they do will look for 2052 and 2056, failing buyers showing up and sellers continue to take over then will look for 2035, 2025, 2015. i think we open with a pop up and then see continued down, this is my first idea and will be monitoring 2047 for that short possibility

as you notice these post are not coming everyday anymore just not enough interest.

For updates on numbers and some trade ideas during the day come find me in my chat room at www.inthefutures.com