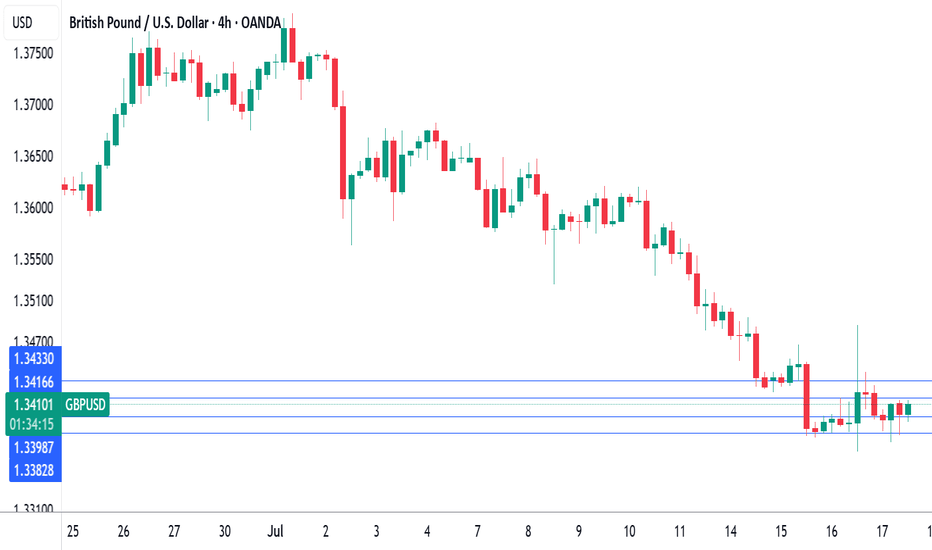

UK employment,wage growth falls, US retail sales shineThe British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day.

Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly revised from 109 thousand, easing concerns of a significant deterioration in the labor market.

Wage growth (excluding bonuses) dropped to 5.0% from a revised 5.3%, above the market estimate of 4.9%. The unemployment rate ticked up to 4.7%, up from 4.6% and above the market estimate of 4.6%. This is the highest jobless level since the three months to July 2021.

The latest job data will ease the pressure on the Bank of England to lower rates, as the sharp revision to the May payroll employees means the labor market has not deteriorated as much as had been feared. Still, the employment picture remains weak and the markets are expecting an August rate cut, even though UK inflation was hotter than expected in June.

US retail sales bounced back in June after back-to-back declines. Consumers reacted with a thumbs-down to President Trump's tariffs, which took effect in April and made imported goods more expensive.

The markets had anticipated a marginal gain of just 0.1% m/m in June but retail sales came in at an impressive 0.6%, with most sub-categories recording stronger activity in June. This follows a sharp 0.9% decline in May.

The US tariffs seem to have had a significant impact on retail sales, as consumers continue to time their purchases to minimize the effect of tariffs.

Consumers increased spending before the tariffs took effect and cut back once the tariffs were in place. With a truce in place between the US and China which has slashed tariff rates, consumers have opened their wallets and are spending more on big-ticket items such as motor vehicles, which jumped 1.2% in June.

Employment

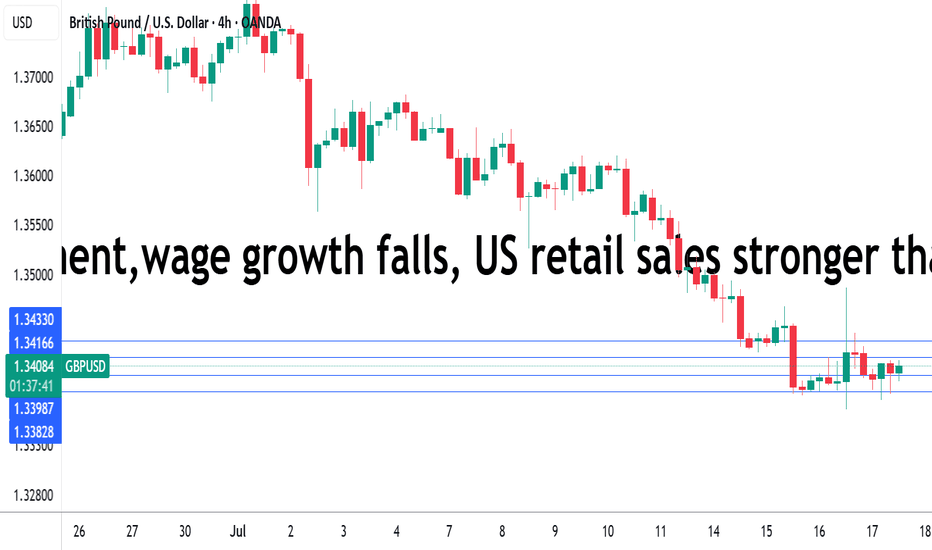

UK employment,wage growth falls, US retail sales shineThe British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day.

Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly revised from 109 thousand, easing concerns of a significant deterioration in the labor market.

Wage growth (excluding bonuses) dropped to 5.0% from a revised 5.3%, above the market estimate of 4.9%. The unemployment rate ticked up to 4.7%, up from 4.6% and above the market estimate of 4.6%. This is the highest jobless level since the three months to July 2021.

The latest job data will ease the pressure on the Bank of England to lower rates, as the sharp revision to the May payroll employees means the labor market has not deteriorated as much as had been feared. Still, the employment picture remains weak and the markets are expecting an August rate cut, even though UK inflation was hotter than expected in June.

US retail sales bounced back in June after back-to-back declines. Consumers reacted with a thumbs-down to President Trump's tariffs, which took effect in April and made imported goods more expensive.

The markets had anticipated a marginal gain of just 0.1% m/m in June but retail sales came in at an impressive 0.6%, with most sub-categories recording stronger activity in June. This follows a sharp 0.9% decline in May.

The US tariffs seem to have had a significant impact on retail sales, as consumers continue to time their purchases to minimize the effect of tariffs.

Consumers increased spending before the tariffs took effect and cut back once the tariffs were in place. With a truce in place between the US and China which has slashed tariff rates, consumers have opened their wallets and are spending more on big-ticket items such as motor vehicles, which jumped 1.2% in June.

US Unemployment Rising: How Is This NOT a Recession?The U.S. unemployment numbers are steadily climbing, as indicated by recent Bureau of Labor Statistics data. Typically, significant rises in unemployment correlate directly with recessions, which are shaded gray in historical data charts.

Currently, unemployment has reached over 7 million, significantly higher than recent lows. Historically, every similar increase has coincided with or preceded an official recession declaration. Yet, mainstream economic narratives have avoided labeling this a recession.

What does this data tell us, and is the market accurately pricing in the risk? Are we already in a recession, or is this time different?

Share your thoughts below. Let's discuss the disconnect between the unemployment reality and official recession narratives.

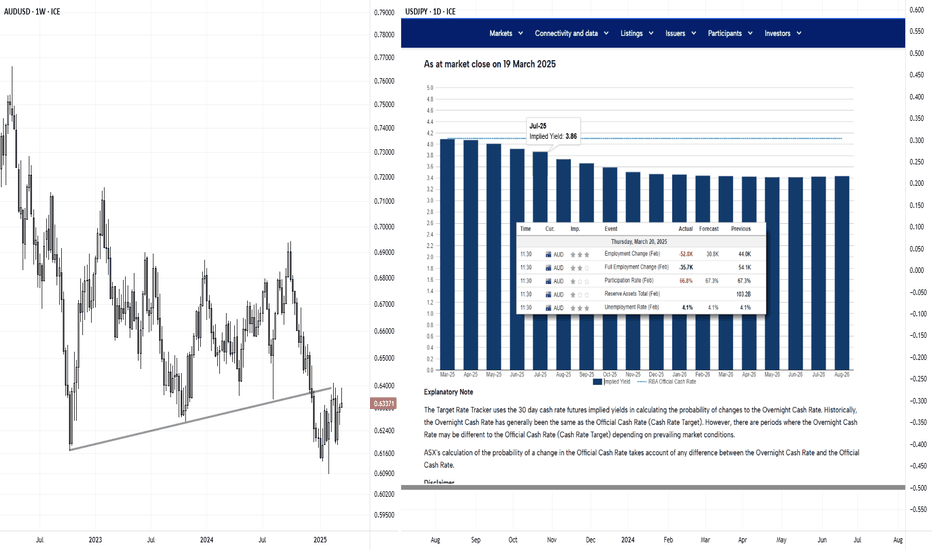

Australian dollar loses ground, jobs report nextThe Australian dollar has declined on Wednesday. In the North American session, AUD/USD is trading at 0.6441, down 0.45% on the day. This follows the Australian dollar's massive gains of 1.5% a day earlier.

Australia's wage growth accelerated in the first quarter. Annually, the Wage Price index gained 3.4%, up from 3.2% in Q4 2024 and above the market estimate of 3.2%. The gain was driven by stronger wage growth in the public sector. On a quarterly basis, wage growth rose 0.9% q/q, up from 0.7% and above the market estimate of 0.8%. This is the first time since Q2 2024 that annual wage growth has accelerated.

The higher-than-expected wage report comes before next week's Reserve Bank of Australia's rate decision. Currently, it looks like a coin toss as to whether the Reserve Bank will maintain or lower rates.

Australia releases employment data on Thursday. Employment change is expected to ease to 20 thousand in April, down from 32.2 thousand in March. The unemployment rate is expected to remain at 4.1%. The labor market has been cooling and if it continues to deteriorate, there will be pressure on the Reserve Bank to lower rates.

At last week's Federal Reserve meeting, Fed Chair Powell said that he would take a wait-and-see attitude in its rate policy. Trump's erratic tariff policy must be frustrating for the Fed, as it makes it difficult to make reliable growth and inflation forecasts.

This week's surprise announcement of a tariff deal between the US and China is a case in point at Trump's zig-zag trade policy. The two sides have been engaged in a bruising trade war and slapped massive tariffs on each other's products. Suddenly, the tariffs were slashed, leading to a sigh of relief in the financial markets. The deal is only for 90 days, and what happens then is very much up in the air.

Canadian dollar shrugs after mixed employment numbersThe Canadian dollar is steady on Friday, after a two-day slid in which the loonie declined by 1%. In the North American session, USD/CAD is trading at 1.3911, down 0.09% on the day. On the data calendar, Canada released the employment report and there are no US economic releases.

The April employment report didn't show much change and the Canadian dollar has shown little reaction. The economy added 7.4 thousand jobs, rebounding from the loss of 32.6 thousand in March and above the market estimate of 2.5 thousand. At the same time, the unemployment rate climbed to 6.9%, higher than the market estimate of 6.8% and above the March reading of 6.7%. This was the highest level since Nov. 2024.

The rise in unemployment is likely a reflection of the US tariffs. Canada's exports to the US were down in March, hurting businesses that export to the US. If the tariffs remain in place, weaker demand from the US could significantly damage Canada's economy.

The Bank of Canada released its Financial Stability Report on Thursday. The BoC said that the financial system was strong but warned that a prolonged trade war between Canada and the US could lead to banks cutting back on lending, which would hurt consumers and businesses and damage the economy. The report said that the unpredictibility of US trade policy could cause further market volatility and was a risk to financial stability.

The Federal Reserve maintained rates earlier this week and Fed Chair Powell said the Fed was in a wait-and-see-stance due to the uncertainty over the US tariffs. We'll hear from seven Fed members on Friday and Saturday, who may provide some insights on where rate policy is headed. The markets have priced in a rate hike in June at only 18%, down sharply from 58% a week ago.

USD/CAD is testing resistance at 1.3928. Above, there is resistance at 1.3935

1.3922 and 1.3915 are the next support levels

New Zealand dollar steady ahead of employment dataThe New Zealand dollar is showing limited movement on Tuesday. In the European session, NZD/USD is trading at 0.5970, up 0.05% on the day. With no key events in New Zealand or the US today, we can expect a quiet day for the New Zealand dollar.

New Zealand releases the employment report for the first quarter on Wednesday. The labor market is showing signs of weakening, with employment change posting two straight declines.

The markets are projecting a slight improvement, with an estimate of 0.1% for Q1.

The unemployment rate has accelerated for seven consecutive quarters and is expected to rise to 5.3% from 5.1% in Q4 2025. This would be the highest level since Q4 2016 and would support the case for the Reserve Bank of New Zealand to lower rates for a sixth straight time at the May 28 meeting. At the April meeting, members warned that the tariffs created downside risks for growth and inflation in New Zealand.

The RBNZ would prefer to continue lowering interest rates in increments of 25-basis points in order to boost the weak economy. Inflation is comfortably within the 1-3% target band but there are upside risks to inflation, especially with global trade tensions escalating due to US tariffs.

In the US, the Federal Reserve is virtually certain to maintain interest rates at 4.25-4.5% on Wednesday. The meeting will be interesting as Fed Chair Powell is expected to push back against pressure from President Trump to lower rates. The Fed is likely to remain on the sidelines until the uncertainty over US tariffs becomes more clear. Trump's zig-zags over tariffs has triggered wild swings in the financial markets, but Trump has said some trade agreements will be announced soon.

NZD/USD is testing support at 0.5968. Below, there is support at 0.5940

There is resistance at 0.5995 and 0.6023

German inflation higher than expected, Euro dipsThe euro is calm on Wednesday. In the North American session, EUR/USD is trading at 1.1334, down 0.45% on the day.

Germany's inflation rate dropped to 2.1% y/y in April, down from 2.2% in March but above the market estimate of 2.0%. This was the lowest level in seven months, largely driven by lower energy prices.

The more significant story was that core CPI, which excludes energy and food and is a more reliable indicator of inflation trends, rose to 2.9% from 2.6%. This will be of concern to policymakers at the European Central Bank, as will the increase in services inflation. The ECB has to balance the new environment of US tariffs and counter-tariffs against the US, which will raise inflation, along with the strong rise in the euro and fiscal stimulus which will boost upward inflationary pressures.

The ECB will be keeping a close look at Friday's eurozone inflation report, which is expected to follow the German numbers. Headline CPI is projected to drop to 2.1% from 2.2%, while the core rate is expected to rise to 2.5% from 2.4%. The central bank would prefer to continue delivering gradual rate cuts in order to boost anemic growth, but this will be contingent on inflation remaining contained.

The markets were braced for soft US numbers but the data was worse than expected. ADP employment change declined to 62 thousand, down from a revised 147 thousand and below the market estimate of 115 thousand.

This was followed by first-estimate GDP for Q1, which declined by 0.3% q/q, down sharply from 2.4% in Q4 and lower than the market estimate of 0.3%. This marked the first quarterly decline in the economy since Q1 2022. The weak GDP reading was driven by a surge in imports ahead of US tariffs taking effect and a drop in consumer spending.

EUR/USD has pushed below support at 1.1362 and is testing support at 1.1338. Below, there is support at 1.1306

There is resistance at 1.1394 and 1.1418

German inflation higher than expected, Euro dipsThe euro is calm on Wednesday. In the North American session, EUR/USD is trading at 1.1334, down 0.45% on the day.

Germany's inflation rate dropped to 2.1% y/y in April, down from 2.2% in March but above the market estimate of 2.0%. This was the lowest level in seven months, largely driven by lower energy prices. The more significant story was that core CPI, which excludes energy and food and is a more reliable indicator of inflation trends, rose to 2.9% from 2.6%. This will be of concern to policymakers at the European Central Bank, as will the increase in services inflation.

The ECB has to balance the new environment of US tariffs and counter-tariffs against the US, which will raise inflation, along with the strong rise in the euro and fiscal stimulus which will boost upward inflationary pressures. The ECB will be keeping a close look at Friday's eurozone inflation report, which is expected to follow the German numbers. Headline CPI is projected to drop to 2.1% from 2.2%, while the core rate is expected to rise to 2.5% from 2.4%.

The central bank would prefer to continue delivering gradual rate cuts in order to boost anemic growth, but this will be contingent on inflation remaining contained.

The markets were braced for soft US numbers but the data was worse than expected. ADP employment change declined to 62 thousand, down from a revised 147 thousand and below the market estimate of 115 thousand.

This was followed by first-estimate GDP for Q1, which declined by 0.3% q/q, down sharply from 2.4% in Q4 and lower than the market estimate of 0.3%. This marked the first quarterly decline in the economy since Q1 2022. The weak GDP reading was driven by a surge in imports ahead of US tariffs taking effect and a drop in consumer spending.

Australian core CPI falls within the RBA target, Aussie shrugsThe Australian dollar has been showing strong movement this week but is calm on Wednesday. In the European session, AUD/USD is trading at 0.6391, up 0.14% on the day.

Australia released the CPI report for the first quarter. The Australian dollar didn't show much reaction, but the data could point to another rate cut from the Reserve Bank of Australia.

Headline CPI remained unchanged at 2.4% y/y, just above the market estimate of 2.3%. The significant news was that RBA Trimmed Mean CPI, the key core inflation indicator, dropped to 2.9% y/y from a revised 3.3% gain in Q4 2024. This is the first time in three years that core CPI is back within the RBA's target band of between 1-3%.

The drop in core inflation is good news for the government, with the national election on Saturday. Australian Treasurer Jim Chalmers jumped on the news, stating that the market expects four or five rate additional rate cuts this year, which would save households with mortgages "hundreds of dollars".

The Reserve Bank is expected to lower rates at its next meeting on May 20, which would mark only the second rate cut this year. After cutting rates in February, the central bank has stayed on the sidelines as US President Trump's tariffs have escalated trade tensions and sent the financial markets on a roller-coaster ride.

In the US, the markets are bracing for some weak data later today. ADP employment is expected to slip to 108 thousand, compared to 155 thousand in the previous release. ADP is not considered a reliable gauge for Friday's nonfarm payrolls, but a weak reading will only increase the anxiety of the nervous markets. US first-estimate GDP for Q1 is expected to slide to just 0.4% q/q, after a 2.4% gain in Q3. If there is a surprise reading from GDP, we could see a strong reaction from the US dollar after the release.

AUD/USD is testing resistance at 0.6403. Above, there is resistance at 0.6431

0.6357 and 0.6329 are the next support levels

Markets eye US, Canada job reports, US dollar steadiesThe Canadian dollar has taken a break after an impressive three-day rally, in which the currency climbed about 2%. In the European session, USD/CAD is trading at 1.4148, up 0.39%. On Thursday, the Canadian dollar touched 140.26, its strongest level since December.

The hottest financial news is understandably the wave of selling in the equity markets, but there are some key economic releases today as well. The US and Canada will both release the March employment report later today.

The US releases nonfarm payrolls, with the markets projecting a gain of 135 thousand, after a gain of 151 thousand in February. This would point to the US labor market cooling at a gradual pace, which suits the Federal Reserve just fine. The Fed will also be keeping a watchful eye on wage growth, which is expected to tick lower to 3.9% y/y from 4.0%. The unemployment rate is expected to hold at 4.1%.

The employment landscape is uncertain, with the DOGE layoffs and newly-announced tariffs expected to dampen wage growth in the coming months. Canada's employment is expected to improve slightly to 12 thousand, after a negligible gain of 1.1 thousand in February. Unemployment has been stubbornly high and is expected to inch up to 6.7% from 6.6%.

US President Donald Trump's tariff bombshell on Wednesday did not impose new tariffs on Canada, but trade tensions continue to escalate between the two allies. Canada said it would mirror the US stance and impose a 25% tariff on all vehicles imported from the US that do not comply with the US-Canada-Mexico-Canada free trade deal. The US has promised to respond to any new tariffs against the US, which could mean a tit-for-tat exchange of tariffs between Canada and the US.

USD/CAD has pushed above resistance at 1.4088 and 141.26. The next resistance line is 1.4170

1.4044 and 1.4006 are the next support levels

Markets eye US, Canada job reports, US dollar steadiesThe Canadian dollar has taken a break after an impressive three-day rally, in which the currency climbed about 2%. In the European session, USD/CAD is trading at 1.4148, up 0.39%. On Thursday, the Canadian dollar touched 140.26, its strongest level since December.

The hottest financial news is understandably the wave of selling in the equity markets, but there are some key economic releases today as well. The US and Canada will both release the March employment report later today.

The US releases nonfarm payrolls, with the markets projecting a gain of 135 thousand, after a gain of 151 thousand in February. This would point to the US labor market cooling at a gradual pace, which suits the Federal Reserve just fine. The Fed will also be keeping a watchful eye on wage growth, which is expected to tick lower to 3.9% y/y from 4.0%. The unemployment rate is expected to hold at 4.1%.

The employment landscape is uncertain, with the DOGE layoffs and newly-announced tariffs expected to dampen wage growth in the coming months.

Canada's employment is expected to improve slightly to 12 thousand, after a negligible gain of 1.1 thousand in February. Unemployment has been stubbornly high and is expected to inch up to 6.7% from 6.6%.

US President Donald Trump's tariff bombshell on Wednesday did not impose new tariffs on Canada, but trade tensions continue to escalate between the two allies. Canada said it would mirror the US stance and impose a 25% tariff on all vehicles imported from the US that do not comply with the US-Canada-Mexico-Canada free trade deal. The US has promised to respond to any new tariffs against the US, which could mean a tit-for-tat exchange of tariffs between Canada and the US.

USD/CAD has pushed above resistance at 1.4088 and 141.26. The next resistance line is 1.4170

1.4044 and 1.4006 are the next support levels

Why the Weak AU Jobs Report Might Not Force the RBA's HandAustralia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given.

Matt Simpson, Market Analyst at City Index and Forex.com

Does a strong ADP number lead to a decent NFP print? Given the decent ADP report just delivered ahead of Friday's NFP figures, I'm curious to see whether the direction of ADP can be an indicator of what to expect on the headline Nonfarm growth figure. Armed with another spreadsheet, I take a look.

Matt Simpson, Market Analyst at City Index and Forex.com

AUD/USD stabilizes after post-NFP slideThe Australian dollar has started the week quietly. In the North American session, AUD/USD is trading at 0.6151, up 0.07% at the time of writing. Earlier, the Australian dollar fell as low as 0.6130, its lowest level since April 2020.

It was another rough week for the Australian dollar, which declined 1.7% last week. The Aussie can't find its footing and has plunged 10.4% in the past three months.

Strong US nonfarm payrolls sends Aussie tumbling

The week ended with a surprisingly strong US jobs report. In December, the economy added 256 thousand jobs, the most since March 2024. This followed a downwardly revised 212 thousand in November and easily beat the market estimate of 160 thousand. The unemployment rate eased to 4.1%, down from 4.2% in November. Wage growth also ticked lower, from 4% y/y to 3.9% and from 0.4% to 0.3% monthly.

The upshot of the jobs report is that the US labor market remains solid and is cooling slowly. For the Federal Reserve, this means there isn't much pressure to lower interest rates in the next few months. That will suit Fed policy makers just fine as it awaits Donald Trump, who has pledged tariffs against US trading partners and mass deportations of illegal immigrants. Either of those policies could increase inflation and the Fed will try to get a read of the Trump administration before cutting rates again. The latest Fed forecast calls for only two rate cuts in 2025 but that could change, depending on inflation and the strength of the labor market.

The strong employment numbers boosted the US dollar against most of the majors on Friday and the Australian dollar took it on the chin, falling 0.8%, its worst one-day showing in three weeks. With interest rates likely on hold in the near-term and and high tensions in the Middle East, the safe-haven US dollar should remain attractive to investors in the coming months.

AUD/USD tested resistance at 0.6163 earlier. Above, there is resistance at 0.6188

0.6121 and 0.6096 are providing support

XAUUSD - The NFP indicator will determine the direction of gold!Gold is above the EMA200 and EMA50 in the 4-hour timeframe and is in its ascending channel. In case of weakness in the data of the employment market and increase in the unemployment rate, you can look for opportunities to buy gold.

A lower-than-expected unemployment rate release and a strong NFP headline will lead to a breakout of the bullish and bearish channel in gold.

While most major economies are expected to pursue expansionary monetary policies this year, the pace of these measures will likely slow. According to Bloomberg’s forecast, the overall interest rate index in advanced economies is projected to decrease by only 72 basis points in 2025, which is lower than the rate of decline in 2024.

Donald Trump, with his electoral promises and economic policies, has become a source of concern for central banks worldwide.If Trump enforces his threats to impose trade tariffs, these policies could harm economic growth and, in the case of retaliatory measures, drive up consumer prices.

Analysts at Bank of America (BofA) highlighted the “complex” impacts of Trump’s proposed tariffs on metal prices in a recent note. The proposed 25% tariffs on imports from Mexico and Canada—two of the main suppliers of metals to the U.S.—are expected to have both direct and indirect effects on the market.

The bank identified two main concerns. First, the potential negative impact on global growth and the fundamentals of the metals market, particularly if the tariffs escalate into a full-blown trade war. However, BofA predicts that a more “measured approach to trade barriers is likely to prevail,” which would mitigate the overall damage. Second, regional metal prices will need to adjust to the potential tariffs.

Bank of America warned that tariffs could strengthen the dollar, increase inflation, and lead to higher interest rates—all of which could pose challenges for the U.S. economy. Nevertheless, they concluded that metal prices are likely to stabilize after the initial volatility subsides, especially if the tariffs are targeted and investments in energy transition continue.

Jerome Powell, the Federal Reserve Chair, downplayed expectations of continued monetary easing in 2025 during his December 18, 2024, press conference. Cleveland Fed President Loretta Mester’s dissenting vote against a rate cut was surprising, but the major shock to markets came from the Fed members’ projections (dot plot).

The Fed members forecast only two rate cuts for 2025, signaling that the monetary easing cycle, which began in September 2024, will slow significantly in the coming year.

Powell also admitted that inflation forecasts for the end of the year had been overly optimistic, suggesting that inflation is not yet fully under control. The Fed is increasingly concerned about Trump’s policies, as tools like tariffs could raise import prices and, subsequently, inflation.

Forecasts for Friday’s NFP data:

• Average estimate: 165K

• Lowest estimate: 120K

• Highest estimate: 190K

The importance of the labor market for monetary policy has slightly diminished following Powell’s December 18 press conference. This indicates that the Fed has some confidence in easing price pressures stemming from the labor market. However, recent data suggests that the labor market has not fully cooled. The upcoming NFP report is expected to show a 160,000 increase in nonfarm payrolls, while the unemployment rate and hourly wage growth are likely to remain steady at 4.2% and 4%, respectively.

If these expectations are unmet, especially with job growth below 50,000, the likelihood of a Fed rate cut in Q1 2025 will increase. Currently, markets anticipate a 25-basis-point rate cut by June 2025, but this move could occur sooner if labor market data remains weak.

USD/CAD in holding pattern ahead of US, Cdn. jobs dataThe Canadian dollar started the week with strong gains but has shown little movement since then. In the European session, USD/CAD is trading at 1.4411, up 0.12% at the time of writing. We could see stronger movement from the Canadian dollar in the North American session, with the release of Canadian and US employment reports.

Canada's economy may not be in great shape but the labor market remains strong. The economy added an impressive 50.5 thousand jobs in November and is expected to add another 24.9 thousand in December. Still, the unemployment rate has been steadily increasing and is expected to tick up to 6.9% in December from 6.8% a month earlier. A year ago, the unemployment rate stood at 5.8%. This disconnect between increased employment and a rising unemployment rate is due to a rapidly growing labor market which has been boosted by high immigration levels.

Another sign that the labor market is in solid shape is strong wage growth. Average hourly wages have exceeded inflation and this complicates the picture for the Bank of Canada as it charts its rate path for early 2025. The BoC has been aggressive, delivering back-to-back half point interest rate cuts in October and December 2024. Inflation is largely under control as headline CPI dipped to 1.9% in November from 2% in October. However, core inflation is trending around 2.6%, well above the BoC's target of 2%. The central bank is likely to take a more gradual path in its easing, which likely means that upcoming rate cuts will be in increments of 25 basis points. The BoC meets next on Jan. 29.

In the US, all eyes are on today's nonfarm payrolls report. The market estimate stands at 160 thousand for December, compared to 227 thousand in November. The US labor market has been cooling slowly and the Federal Reserve would like that trend to continue as it charts its rate cut path for the coming months. An unexpected reading could have a strong impact on the direction of the US dollar in today's North American session.

USD/CAD is testing resistance at 1.4411. Above, there is resistance at 1.4427

1.4388 and 1.4372 are the next support levels

Euro stabilizes as Spain posts strong job dataThe euro has stabilized on Friday. In the European session, EUR/USD is currently trading at 1.0296, up 0.3% on the day. The euro fell as much as 1.2% a day earlier and fell below the 1.03 line for the first time since Nov. 2022.

The eurozone economy wasn't exactly on fire in 2024. The Ukraine-Russia war led to increases in gas and oil prices, millions of war refugees have strained the economy and many eurozone countries have boosted their defense budget as relations with Moscow have chilled. In addition, global demand has been weak and the incoming Trump administration could spell tariffs and even a trade war.

Germany, which for decades was the locomotive of Europe, hasn't recovered since the corona pandemic. Competition from China has hurt the key automotive industry and the government coalition has collapsed, resulting in political instability. France and Italy, the second and third largest economies in the eurozone, are also struggling.

The bright light is this gloomy picture has been Spain, the fourth-largest economy in the eurozone. "Sunny Spain" isn't just a catchy phrase for winter-weary tourists, but also reflects a resilient economy. According to the European Commission, Spain's economy is expected to have expanded by an impressive 3% in 2024. In contrast, Germany's GDP is projected to have contrasted by -0.1%.

Spain's manufacturing and services sectors are expanding, in contrast to the eurozone's three largest economies which are showing contraction. The labor market remains solid and the number of unemployed fell by 25.3 thousand in December, the lowest figure since December 2007.

The European Central Bank entered an easing phase in June and has lowered rates at the past three straight meetings. The central bank is keeping an eye on inflation but is expected to continue lowering rates in order to boost the weak economy. The ECB meets next on January 30.

EUR/USD is testing resistance at 1.0289. Above, there is resistance at 1.0353

There is support at 1.0203 and 1.0139

Pound steady after hot UK wage growth, CPI nextThe Canadian dollar continues to lose ground. In the North American session, USD/CAD is trading at 1.4315, up 0.48% at the time of writing. The Canadian dollar has declined 2.2% in December and is trading at its lowest level since mid-March.

Canada's inflation eased to 1.9% in November, down from 2% in October and shy of the market expectations of 2%. However, the trimmed-mean core rate remained unchanged at 2.7%, higher than the market estimate of 2.5%. This is above the Bank of Canada's target of 2% and will complicate plans to continue to lower interest rates.

The BoC has been the leader among major central banks in lowering rates, with five rate cuts since June for a total of 175 basis points. The central bank chopped the benchmark rate by 50 basis points to 3.25% last week but indicated in the rate statement that it expected a "more gradual approach to monetary policy", which means we can expect 25-bp increments in rate cuts if there are no surprises in inflation or employment data.

US retail sales sparkled, another sign that the US economy remains robust. Retail sales jumped 3.8% y/y in November, following an upwardly revised 2.9% in October. This was the highest annual gain since last December. Monthly, retail sales rose 0.7%, above the upwardly revised 0.5% gain in October and the market estimate of 0.5%.

US consumers have opened their wallets for the holiday season and motor vehicles and online sales helped drive the gain. The strong retail sales report didn't change expectations for a rate cut on Wednesday, which stand at 99%, according to the CME's FedWatch.

US PMIs on Monday pointed to a mixed bag. The Services PMI rose in December to 58.5 from 56.1 in November and above the forecast of 55.7. This was the highest level in over three years as the services economy is showing impressive expansion. The manufacturing sector is in dreadful shape and weakened to 48.3, down from 49.7 in November and below the market estimate of 49.8. Output and new orders are down as the demand for exports remains weak.

USD/CAD is testing resistance at 1.4289. Above, there is resistance at 1.4343

1.4191 and 1.4137 are the next support levels

Pound higher as Services PMI rises, job report nextThe British pound has moved higher on Monday, after declining 1% last week. In the European session, GBP/USD is trading at 1.2747, up 0.30% on the day.

The UK Services PMI rose to 51.4 in December, up from 50.8 in November, which was a 13-month low. This beat the market estimate of 51.0, but points to weak business activity as demand for UK exports has been weak and confidence among services providers remains subdued.

UK manufacturing is mired in a depression, and the PMI fell to 47.3 in December, down from 48.0 in November and shy of the market estimate of 48.2. This marked the lowest level in eleven months, as production and new orders showed an accelerated decrease.

The weak PMI data followed Friday's GDP report, which showed a 0.1% decline for a second straight month in October. This missed the market estimate of 0.1%. GDP rose just 0.1% in the three months to October.

The UK releases employment and wage growth numbers on Tuesday. The economy is projected to have lost 12 thousand jobs in the three months to October, after a sparking 200 thousand gain in the previous report. Wages including bonuses is expected to climb to 5% from 4.8%.

The Bank of England meets on Thursday and is expected to hold the cash rate at 4.75% after cutting rates by 25 basis points in November. The economy could use another rate cut but inflation remains a risk to upside, with CPI climbing in October to 2.3% from 1.7%. The BoE will be keeping a close eye on wage growth, which has been a driver of inflation.

The US releases PMIs later today. Manufacturing remained in contraction territory in November at an upwardly revised 49.7 and there is optimism that the new Trump administration's protectionist stance could benefit US manufacturers.

The services sector is in good shape and improved in November to 56.1, up from 55.0 in October. The uncertainty ahead of the US election is over and lower interest rates have contributed to stronger expansion in services.

GBP/USD is testing resistance at 1.2638. The next resistance line is 1.2668

1.2592 and 1.2562 are the next support levels

GBPAUD - Employment in Australia is at good levels!The GBPAUD currency pair is above the EMA200 and EMA50 in the 4H timeframe and is moving in its upward channel. In case of failure of this channel, we can see the demand zone and buy within that zone with appropriate risk reward. Continuing to move in the channel will pave the way for this currency pair to rise to the supply zone. Within the supply zone can look for GBPAUD sell positions.

1. Renewable Energy in the UK:

British ministers are preparing for the largest renewable energy subsidy auction in the country’s history to achieve the challenging goal of generating clean electricity by 2030. Ed Miliband, the Energy Secretary, is set to launch the “2030 Clean Electricity Action Plan” today, aiming to decarbonize the power system by the end of the decade. A recent auction secured funding for 131 clean energy projects, guaranteeing 9.6 gigawatts of energy capacity, enough to power 11 million homes. Government officials plan to hold the largest auction to date by 2025 to meet the 2030 target of at least 95% low-carbon electricity.

2. Trump’s Proposed Tariffs:

According to a Reuters survey, most economists believe that Trump’s proposed tariffs would have minimal impact on the UK economy. The survey revealed that the Bank of England is likely to cut interest rates by 100 basis points by 2025, with reductions probably occurring quarterly at 25 basis points each. Additionally, all 71 economists surveyed predicted that the central bank would hold the interest rate steady at 4.75% during its December 19 meeting.

3. Challenges in AI Oversight:

The UK is facing challenges in its efforts to expand global oversight of artificial intelligence. The country aims to strengthen its “Artificial Intelligence Safety Institute” (AISI) and solidify its position as a leading institution in researching AI risks. However, plans to open a new office in San Francisco have been delayed due to elections in the US and the UK, as well as hiring challenges.

4. London’s IPO Market Decline:

The London Stock Exchange, once a leading and prestigious center for initial public offerings (IPOs), has now fallen to 20th place among global markets, recording none of the top 100 IPOs in 2024. Markets like Oman, Malaysia, and Luxembourg have outperformed London in attracting IPO capital. The outflow of companies from the London Stock Exchange has also risen, exacerbated by 41 consecutive months of capital outflow from UK equity funds, increasing pressure on market brokers to merge or sell.

5. Australia’s Unemployment Rate:

Australia’s unemployment rate in November dropped to its lowest level in eight months, while employment continued its strong growth trend. This surprising strength led markets to reassess the likelihood of a rate cut in February, following the Reserve Bank of Australia’s unexpected dovish shift that hinted at potential monetary easing. Data from the Australian Bureau of Statistics showed that the unemployment rate fell from 4.1% in October to 3.9% in November, the lowest since March. Analysts had expected unemployment to rise to 4.2%. The participation rate declined from 67.1% to 67.0%. Net employment in November increased by 35,600 compared to a revised figure of 12,200 in October, exceeding market expectations of a 25,000-job gain, driven largely by full-time employment growth.

GBP/USD falls ahead of UK employment reportThe British pound is lower on Monday. In the North American session, GBP/USD is trading at 1.2870, down 0.33% on the day. The pound is coming of a sixth straight losing week, declining 3.5% during that time. It’s a quiet day on the data calendar, with no US events and only one minor UK release.

The UK releases the employment report for the three months to September on Tuesday. Job growth soared by 373 thousand in the prior report, crushing the market estimate of 250 thousand. The labor market is expected to reverse directions, with a market estimate of -50 thousand. As well, the unemployment rate is projected to inch up to 4.1%, up from 4%.

Wage growth excluding bonuses is expected to fall to 4.7% in the three months to September, down from 4.9% in the previous report. Wage growth has been easing but is still high and BoE policymakers are concerned about the possibility of a wage-price spiral. The strong growth in wages has contributed to high inflation in the services sector.

The BoE holds its final policy meeting in December and Tuesday’s jobs report could impact market expectations. The BoE reduced rates by 25 basis points last week to 4.75% but with inflation falling to 1.7% in September, more rate cuts are likely on the way.

A host of Federal Reserve members will deliver remarks on Tuesday and investors will be looking for clues about future rate moves. The Fed lowered rates by 25 basis points last week, a move that was well-telegraphed in advance. What will the Fed do at the December meeting? That is much less clear, as the markets have priced in a pause at 23%, a 25-basis cut at 2.9%, and a 50-basis cut at 22%, according to the CME’s FedWatch.

GBP/USD is testing support at 1.2870. Below, there is support at 1.2822

There is resistance at 1.2933 and 1.2981

New Zealand dollar higher despite pessimistic RBNZThe New Zealand dollar has moved higher on Tuesday. In the North American session, NZD/USD is trading at 0.5998, up 0.46% on the day.

The Reserve Bank of New Zealand released its semi-annual Financial Stability Report and the financial system received a favorable grade. That was it for the good news, as the report pointed to weak economic conditions that were hampering households and businesses.

The report noted that rising unemployment was causing “acute” financial difficulties for some households and that businesses had been impacted by weak demand and high cost pressures. This had caused households to reduce spending and businesses to freeze investing. Although inflation and interest rates had fallen, “significant further weakening in the economy remains a risk.”

The negative tone of the report could mean that the central bank will remain aggressive in its rate-cutting cycle. The RBNZ slashed rates by 50 basis points in October, lowering the cash rate to 4.75%. The final meeting of the year is on Nov. 27 and another 50-bp is likely, with a supersize 75-bp cut an outside possibility.

The RBNZ will be keeping a close eye on Wednesday’s third-quarter employment report. Employment change is expected to decline by 0.4% after a 0.4% gain in the second quarter. As well, the unemployment rate is projected to jump to 5%, from 4.6% in the second quarter. With inflation easing, the RBNZ is keeping a closer eye on the labor market and if the deterioration in employment is worse than expected in Q3, the calls for a 75-bp cut at the next meeting will get louder.

NZD/USD has pushed above resistance at 0.5987 and is testing resistance at 0.6002

There is support at 0.5957 and 0.5942