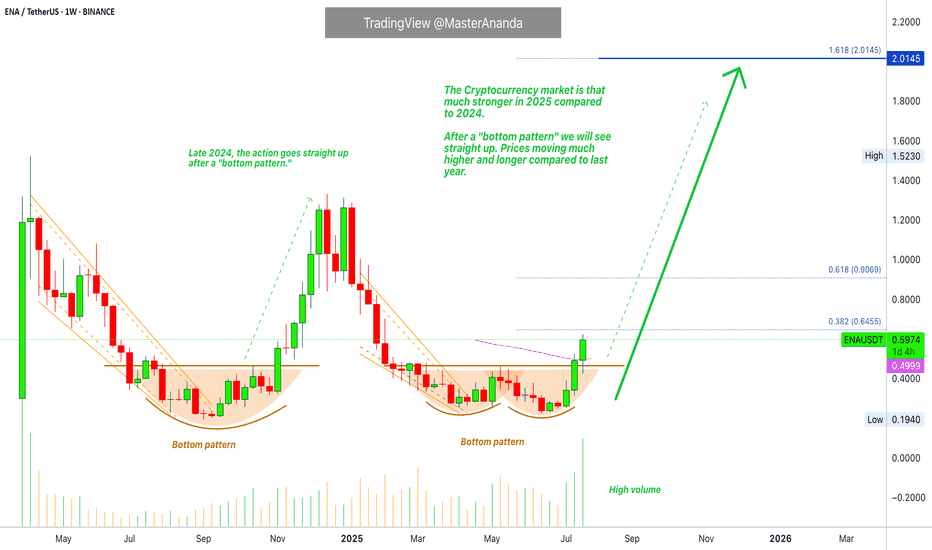

Ethena · Millions Overnight? It Can Be DoneEthena is starting its 2025 bullish cycle with three full green candles. The current week has the highest volume since the first week of trading in April 2024. Normally the first week of trading tends to produce the highest volume. ENAUSDT is matching those days now and market conditions are so much better in 2025 compared to 2024.

The entire bullish period last year lasted less than two months. That's it. This wasn't an uptrend nor a bull market, it was more like a bullish jump. A momentary event. ENAUSDT right now is entering the 2025/26 bull market. Growth can be sustained for a period of 6 months or longer. Sometimes a bull market trend can last 8 months, 12 months, or even 16 months or longer. We have many examples across the market.

This week Ethena is trading above EMA55 weekly for the first time ever. The bullish bias is confirmed.

When I saw this pair it was already moving, not the bottom catch that I like and go for and yet, I still went ahead on it because it is still early when you consider the bigger picture; practice what you preach.

We missed the bottom but it is still early, there is plenty of room available for growth. Trading is easy when the market is approached with the right mentality, with a simple working plan. Buy and hold. Watch how the market will take care of the rest.

Just deposit and continue to invest, as much as you can. Continue to add to each position you like and grow; let it grow. Check back every 3 weeks, every 1-2 months; watch your money grow. It is truly that simple. Timing is very important for this strategy and the best timing is now. Right now we are on the verge of a major advance, no need to wait. You can buy today and start earning within days.

A few months back, we had to wait for months. A few weeks back, we had to wait for weeks. Entering the market now, the wait is short but patience is key.

It will go higher than what is shown on the chart. This publication is to alert you of a great timing, be ready to wait. Make sure to do your own planning. The risk is minimum when trading spot. The worst case scenario is a long wait. If things go right; enter green, stay green and profits-capital grow.

Success can be achieved but the hard part is being around now, when prices are low. It is easy to be around when there is hype and everything is 1,000% up. But can you beat the impulse to sell when the right choice is to buy? Can you take action now and go ahead?

If you are reading this now, you are in the right track but for many people it is not that easy, they are allergic to low prices and they won't be reading this until it is too late. 90% of the people will only become aware of these opportunities that I am showing you daily when it is too late.

That's ok. We use the experience to learn. When I first started I went through the same process. The euphoria got my attention and when I became aware of the market everything was already high up. We tend to join at the market top. But then we go through the entire cycle, the market is here to stay. We get to buy the bottom, we gain experience and in the end we can always win if we never give up. Persistence and consistency, be ready to hold.

If you can hold your altcoins when prices are low, you will reap the rewards at the time of the bull run. Millions to be made overnight. Years of preparation, but it can be done.

Namaste.

ENA

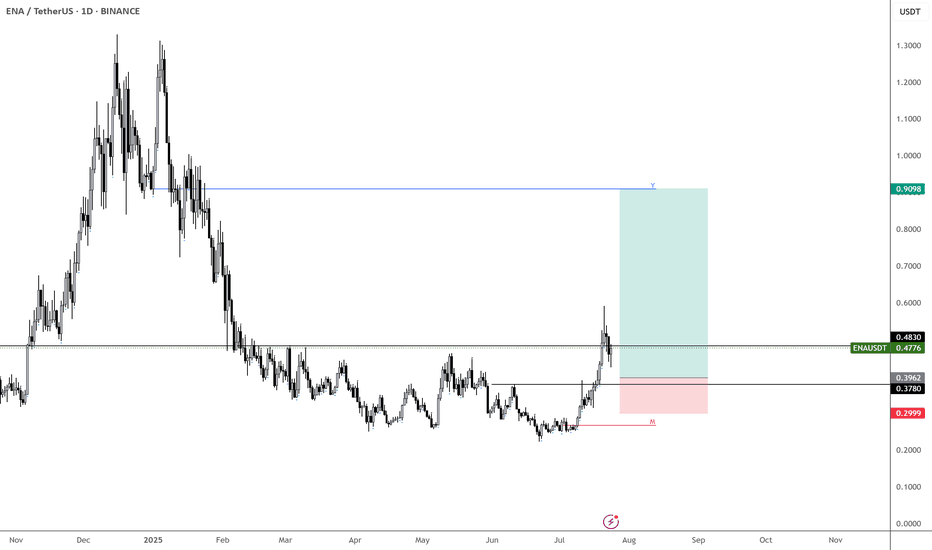

ENA – Sub-40c Would Be a Gift

If we get BINANCE:ENAUSDT below 40c, that would be an incredible opportunity.

Maybe I’m being too greedy—or maybe not. I’ll let the market decide.

Right now, ENA looks like a solid play for the coming weeks, so I’m focused on finding the best possible entry.

MARKETSCOM:ETHEREUM still looks strong overall. Even with a minor retrace, I’m expecting higher—potentially up to $7k.

So it makes sense to position in names like BINANCE:ENAUSDT , BINANCE:EIGENUSDT , BINANCE:AAVEUSDT , and others to ride the wave.

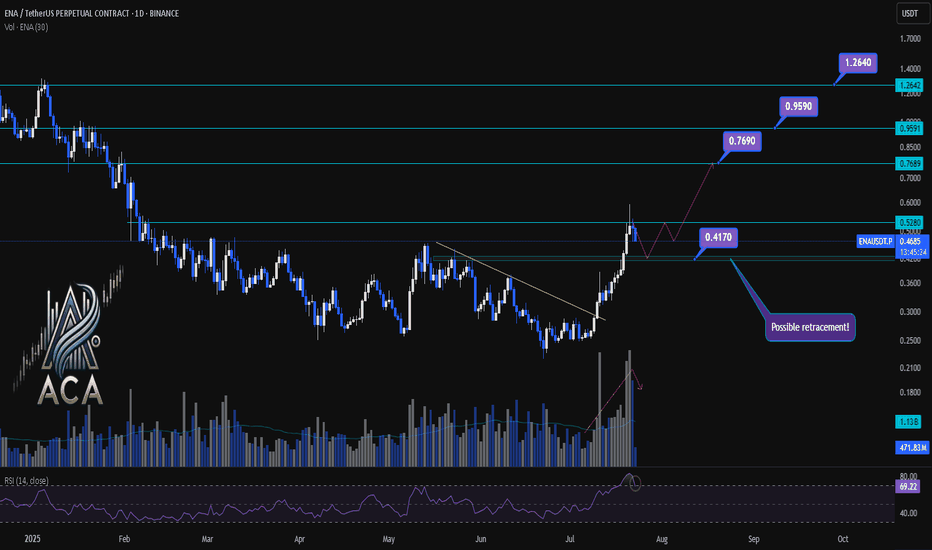

ENA/USDT Chart Analysis | Volatility Signals & Bullish TriggersENA/USDT Chart Analysis | Volatility Signals & Bullish Triggers

🔍 Let’s dive into the ENA/USDT perpetual contract and analyze recent price action, focusing on momentum shifts and key breakout scenarios.

⏳ Daily Overview

The daily chart shows that ENA recently reentered the overbought zone on the RSI, which can serve as a potential trigger for traders watching momentum shifts. Earlier, price action broke decisively above a long-standing descending trendline, resulting in a rapid, nearly 100% surge, a classic RR2 move off the trendline. This breakout coincided with a visible uptick in trading volume, confirming strong demand behind the move.

Now, during the ensuing rest or correction phase, trading volume is decreasing—often a constructive sign suggesting either profit-taking or a healthy pullback rather than panic selling.

🔺 Bullish Trigger & Setup:

- RSI Signal: Reentry into the RSI overbought zone is a potential long trigger, especially if confirmed by price action.

- Confirmation Level: A daily close with strong volume above $0.528 would add conviction to a bullish setup.

- Trendline Reference: The break above the recent trendline fueled the rapid advance, showing the importance of watching such key resistance levels.

📊 Key Targets (on further bullish confirmation):

- $0.769 — First upside resistance.

- $0.959 — Next bullish target.

- $1.264 — Extension target if momentum continues and broader market sentiment remains supportive.

🚨 Conclusion:

Eyes are on the $0.528 level—closing above it with volume, especially while RSI holds in the overbought zone, could provide the next strong entry signal. Current declining volume during pullbacks suggests this is likely a profit-taking phase or standard correction, not bearish capitulation. Keep monitoring RSI, volume profile, and price closes for the next actionable opportunity.

ENA/USDT Breakout Watch Signs of Reversal from a Key Demand Zone🔍 Full Technical Analysis:

ENA/USDT has been forming a Descending Triangle pattern since the December 2024 high — a structure often seen in continuation moves, but here it may act as a potential reversal pattern, especially since price is consolidating around a strong historical demand zone.

The price is hovering within a key support area between $0.1940–$0.2624, which has repeatedly held against bearish pressure. Recent candles are showing signs of accumulation, indicating possible base formation before a breakout.

✅ Bullish Scenario (Breakout Setup):

If the price successfully:

1. Breaks above the descending trendline (yellow line), and

2. Confirms with a breakout above the $0.28–$0.30 zone with strong volume,

We could see a powerful bullish reversal with the following upside targets:

📈 Target 1: $0.3720

📈 Target 2: $0.4569 – breakout structure confirmation

📈 Target 3: $0.6540 – prior resistance zone

📈 Target 4: $0.7702

📈 Target 5: $0.8928

💥 Extended Targets: $1.2512 – $1.3300 (Major High from December 2024)

🚨 A clean breakout from this setup may trigger major FOMO and offer multi-level swing trading opportunities.

❌ Bearish Scenario (Breakdown Risk):

If the downtrend continues and:

The price fails to break above the trendline, and

Breaks below $0.1940, which is the historical low support,

Then the door opens for further downside towards: 🔻 Bearish Target: $0.1600 or lower

⚠️ A confirmed breakdown below this key zone would suggest trend continuation and weakness in buyer interest.

🧠 Strategic Summary:

Strong Demand Zone + Historical Support suggest high probability of trend reversal.

Descending Triangle offers a textbook breakout opportunity with favorable risk-reward.

High RR potential makes this setup ideal for swing traders and mid-term investors.

💡 Success tip: Wait for breakout confirmation and volume spike before entering.

#ENAUSDT #CryptoBreakout #DescendingTriangle #BullishReversal #AltcoinSetup #CryptoTrading #SwingTrade #TechnicalAnalysis #ChartPatterns #SupportAndResistance

ENA : The largest token release...Hello dears

Given the long-term price decline that we have witnessed, it has now been announced that this currency is going to do a token release, which will naturally cause the price to fall, so be careful.

In case of a fall, we have identified important supports for you so that you can buy with risk and capital management.

The target has also been identified.

*Trade safely with us*

ENA SCALP & Intraday Setup Both Long & Short SetupWait for the entries to be filled first. If short entry achieved first then go for the short, if long entry achieved first then go for the long, in both cases must use SL, cause it's consolidating in a range, any side impulse move is expected from ena.

ENA About to Explode or Dump? Key Levels You Can’t Ignore!Yello Paradisers — are you positioned right for the next potential explosion in #ENA, or will you get caught on the wrong side of the move like most retail traders? After a brutal grind in a descending channel, something big is brewing... and it’s coming faster than many realize. Let's dive in.

💎#ENAUSDT currently facing a key resistance at the upper boundary of the descending channel, clearly tested multiple times and respected well by the market structure. A candle close above this channel would trigger a confirmed breakout, which opens up a clean path for continued upside movement — the next major target sits at the resistance zone between 0.446 and 0.4725.

💎There’s a high-probability alternative setup unfolding as well: ENA holding the S/R level around 0.3448 and the demand zone below, which aligns perfectly with the multi-timeframe EMA support. If this area holds strong, expect another impulse move toward our resistance zone as momentum builds.

💎Price had been forming lower highs and lower lows, respecting the downtrend But recently we observed a Clear Change of Character (ChoCH) — ENA broke market structure by forming a higher high.What usually follows? A higher low, and that’s where we are now.

💎The most probable scenario is for price to pull back to the S/R level or dip into the demand zone, and then form a higher low before making the next leg upward toward resistance.

💎Invalidation is simple and must be respected: if we see a confirmed candle close below 0.2798, then the bullish case breaks and the setup is no longer valid. This is where you must cut quickly, avoid hope-trading, and reassess the structure from scratch.

Don’t chase. Don’t panic. React with strategy, not emotion. This is how real professionals win in crypto. Stay sharp, Paradisers.

MyCryptoParadise

iFeel the success🌴

ENA - Already Over-Sold!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈ENA has been overall bearish trading within the falling channel marked in red and it is currently retesting the lower bound of the channel.

Moreover, the blue zone is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #ENA approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

#ENA/USDT#ENA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.3700.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.3911

First target: 0.4100

Second target: 0.4235

Third target: 0.4410

Sensitive supportHello friends

Considering the good growth we had, you can see that the price has corrected after reaching its ceiling and has reached a sensitive support.

Now, with the price correction, there is a good opportunity to buy in stages and with capital management and move towards the specified goals.

*Trade safely with us*

Ethena Short-Term Trade-Setup: Easy Profits 708%Ethena is now ready to produce a new advance, higher prices. The (1) shows a low before the last bullish jump. The (2) is a higher low which tends to lead to a higher high.

Looking at the Altcoins market, looking at Bitcoin and how strong it is; looking at the volume and candles, all is green.

ENAUSDT is ready to grow short-term, which means fast; the next advance is likely to start within days. The start will happen soon but the end is far away.

Look, the bottom has been forming for months. The bearish wave ended in March, then the market flush and now the recovery; prices are still low.

The thing is that once the action starts, there is no going back, it will happen so fast that by the time you look at the market, at the chart, everything will be 100% to 200% up. There will be more growth, but is better to get in early.

Thanks a lot for your continued support.

Buy and hold.

Namaste.

ENA is repeating a bullish fractal (1D)Look at the red, white, yellow, and green boxes in order, and then pay attention to the white trigger lines. You’ll notice that the previous phases | the end of the bearish trend (red box), followed by a bullish move for breakout (white box), then a pullback (yellow box), and finally the main bullish move (green box) | are now repeating.

Also, the price is currently sitting within the trading range marked by the two green lines, which is a key area. After the pullback is completed, a bullish wave is expected to begin, potentially reaching at least around the previous all-time high (ATH).

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Breakout trading possible range: 0.4140-0.4424

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(ENAUSDT 1D chart)

The key is whether it can break through the 0.4140-0.4424 range and rise.

It is expected that breakout trading will be possible if the 0.4140-0.4424 range breaks through.

However, it is judged that it is possible to lead to additional rise only if it rises above 0.5082 at once and maintains the price.

Therefore, if breakout trading was not possible, trading is possible if support is confirmed near 0.4140-0.4424.

-

If it rises above 0.5082 and is supported, there is a possibility that it will rise significantly as there is no special resistance zone.

In other words, it seems possible that it will break through 0.7907 and 1.0382.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems that it has been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

ENAUSDT - IS it still Bullish?This is for ENA - and below is the M-Profile

The 4H SVP chart of ENA/USDT displays a very strong bullish structure after a prolonged downtrend and compression phase. Price stayed compressed under $0.31 with declining volume and tight overlapping value areas—this created a base. The breakout occurred explosively on May 8, with aggressive volume and clear value area migration upward. Each subsequent 4H session shows price acceptance above prior value, with POC shifting from $0.36 to $0.38 and now to $0.41, confirming strength. The current VAH is around $0.422 and POC at $0.418, so if ENA holds above $0.41, dips into this value area are ideal for continuation longs. If it breaks above $0.422 with volume, the next breakout leg may target $0.445–$0.46. Overall, the structure suggests the uptrend is intact unless price closes back below $0.39 VAH.

This is the doodle you can long for, a small little bit more of an upmove before it makes a fall below owing btc move' though expecting more higher a bit of a move!

TradeCityPro | ENA: Expansion Pattern Near Critical Break Levels👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ENA coin for you. The Ethena project is one of the DeFi projects in crypto that has attracted a lot of hype in this category.

💥 ENA coin, with a market cap of $1.7 billion, ranks 50th on CoinMarketCap.

📅 Daily Timeframe

As you can see on the daily chart, there is an Expanding Triangle, and the price is fluctuating within this pattern.

📚 One key characteristic of an Expanding Triangle is that while the price is within the triangle, it tends not to respect static levels such as supports and resistances. Currently, the price is within the triangle and, as you can see, it doesn’t respond significantly to static zones.

📈 For this coin to become bullish, the triangle must break to the upside and the triangle trigger at 0.37 should be activated. In that case, the price can move upward and begin a bullish trend. Full confirmation of the bullish reversal will come with price stabilization above 0.4746.

✔️ For continued downward movement, the first trigger is the break of 0.2694. If you already hold this coin, you can use this level as a stop-loss — and once the price closes below it, you can trigger your stop-loss.

📊 For short positions, the break of 0.2694 is a valid trigger, but the issue is that it activates before the triangle breaks, and I personally prefer not to open a position within an Expanding Triangle — I’d rather wait and enter after it breaks.

🔽 Another trigger for a bearish move is the break of 0.2054. This is the main support for ENA, and if it breaks, the price will register a new All-Time Low.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ENA is standing at a classic “make-or-break base-build” juncture

🕞 60-Second Read

Trend on the 1-D chart is still structurally bearish , yet price (spot 0.350 USDT) just printed a higher-low off the April wick and reclaimed the mid-channel line. Two large upside voids are now in play.

Hot-Zone #1 – 0.292 (15 m imbalance): fresh demand, 17 % under spot.

Hot-Zone #2 – 0.496 (3 MP-High retest): range cap & first breaker, 42 % above.

Hot-Zone #3 – 0.836 → 0.892 (Feb pivot ↔ Yearly EC): macro supply shelf.

🎲 Probability Dashboard

HTF Trend & Structure – -2

Liquidity Map (voids above) – +1

Momentum (vector flips) – +1

Derivatives (funding ≈ flat) – 0

Net Score = 0

Bear / Neutral / Bull odds ≈ 40 % / 30 % / 30 %

📈 Trade Playbook

Strategy 1

1. Layered Limit Grid – Aggressive Counter-Trend Long

Entry layers (size %):

0.300 – 25 % of your allocated ENAUSDT size

0.280 – 35 %

0.260 – 25 %

0.240 – 15 %

SL = 0.215

TP ladder:

0.350 – 20 % off-load

0.496 – 25 %

0.836 – 30 %

1.040 – 25 %

Weighted R:R ≈ 7.3

Strategy 2

2. Layered Limit Grid – Conservative Breakout Long

Trigger: daily close > 0.496, then place grid orders.

Entry layers (size %):

0.510 – 40 %

0.570 – 30 %

0.650 – 20 %

0.836 – 10 %

SL = 0.440

TP ladder:

0.836 – 30 %

1.040 – 30 %

1.516 – 25 %

1.550 – 15 %

Weighted R:R ≈ 4.8

Setup Logic

Price reclaimed mid-channel but remains inside a 69 % upside void to 0.836.

Stacked un-retested highs (0.496 / 0.836 / 1.040) act as magnetic targets.

Yearly S1 (0.220) converges with vector zone support – ideal invalidation.

Risk Radar

Perp OI up 18 % WoW – a funding spike could squeeze late longs.

Two token unlocks (2 & 5 May) add ≥ 200 M ENA supply.

Macro: FOMC (1 May) & BTC flow volatility may spill into alts.

ENA must flip 0.496 to sprint through the 0.84-1.04 air-pocket; fail that and liquidity magnets at 0.30 → 0.22 take the wheel. Trade the grid – not the hopium.

(Not financial advice – always do your own research.)

#ENA/USDT#ENA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.2800.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2935

First target: 0.3020

Second target: 0.3100

Third target: 0.3200

ENA/USDT Breakout Pattern (18.04.2025)The ENA/USDT pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.3015

2nd Resistance – 0.3217

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.