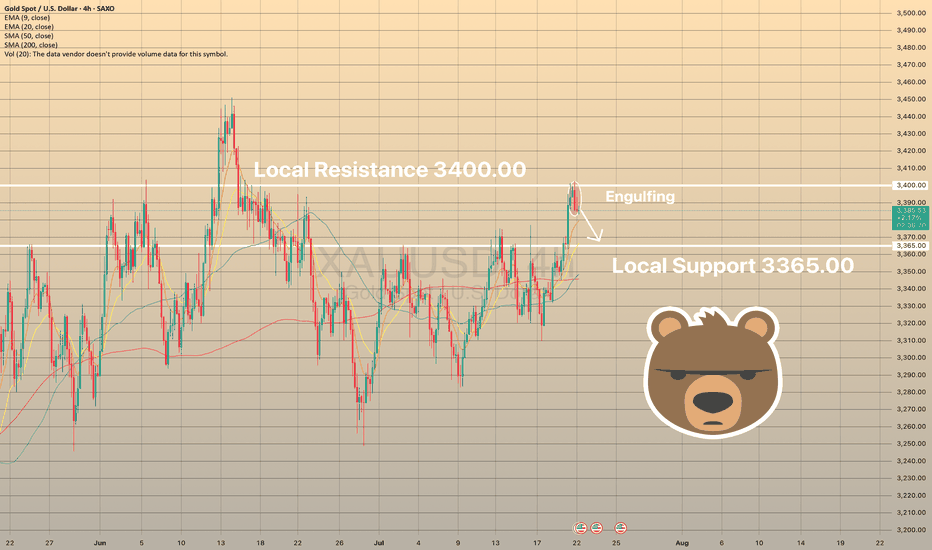

XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?

XAUUSD has been trading bullish within the last day. The price touched the resistance level of 3,400.00. As a result, the bearish engulfing pattern has formed on 4-h chart.

An engulfing pattern is a two-candle reversal pattern where a smaller candle is followed by a larger one that completely covers it, indicating a potential shift in the trend. A bullish engulfing pattern, which signals a buy signal, occurs in a downtrend when a small red candle is followed by a larger green candle. A bearish engulfing pattern, which signals a sell signal, occurs in an uptrend when a small green candle is followed by a larger red candle. To trade, identify the pattern in a clear trend with high trading volume on the engulfing candle. Enter a buy position (for a bullish engulfing pattern) or a sell/short position (for a bearish engulfing pattern) after the engulfing candle closes, confirming a rebound from support or resistance. Set a stop-loss below the low of the bullish engulfing candle or above the high of the bearish engulfing candle. Aim for the next support or resistance level or aim for a 1:2 risk-reward ratio.

So, here I expect the price to move down towards local support of 3,365.00, where supposedly, the price will start to consolidate.

Engulfingpattern

Big Week for Markets: U.S. CPI Tomorrow – What It Means for GoldThis week is packed with news, but the main focus is the U.S. CPI report dropping tomorrow.

🗓 Key Event: U.S. CPI Report

📍 July 15, 2025 | 12:30 p.m. UTC

The CPI report measures inflation and heavily influences the Fed’s rate decisions. Last month’s CPI came in at 2.4% vs. 2.5% expected, following 2.3% vs. 2.4% in April. While it seems inflation is rising, the bigger picture shows stable annual inflation in the 2.3%–3.0% range, keeping things under control—likely the reason Trump is pressuring Powell to cut rates.

Market expects June CPI to be 2.7%.

🤔 Possible Scenarios:

1️⃣ CPI > 2.7%: Bullish for DXY 📈. The stronger the print, the bigger the spike, but I see this scenario as less probable.

2️⃣ CPI < 2.7%: Bearish for DXY 📉. We may see a USD dump, though likely shallow since CPI could still be higher than previous months.

✨ What About Gold?

I don’t expect a major reaction in gold:

✅ Higher CPI? Gold often benefits as an inflation hedge.

✅ Lower CPI? Also supportive for gold as it weighs on the USD.

🔍 Technical Outlook:

Gold has been trading within a triangle since April 22, forming lower highs and higher lows. We may currently be in Wave D (Elliott Wave), aiming toward the triangle’s upper boundary slightly above $3,400 resistance. After that, Wave E may develop – but that’s a story for another post.

Below the current price, several demand zones have been marked!Gold Analysis (1H Timeframe):

On the 1-hour chart, Gold has previously formed a bearish engulfing candlestick pattern, which signaled a potential reversal and has since led to a downward move in the market. At present, another bearish engulfing pattern has formed, suggesting renewed selling pressure. If the price retraces back to this level, there is a high probability that it may continue to decline from there.

Below the current price, several demand zones have been marked. These zones correspond to areas where bullish engulfing patterns have previously formed or are likely to form. These zones have been carefully filtered for quality and relevance.

The recommended approach is to patiently wait for the price to enter these demand zones. If the market provides a valid bullish confirmation signal (such as bullish candlestick formations, divergence, or volume confirmation) within these zones, it could present a high-probability buying opportunity.

> ⚠️ Disclaimer: This analysis is for educational purposes only. Always conduct your own research (DYOR) before making any trading decisions. This is not financial advice.

Bullish Engulfing Pattern: A Strong Reversal SignalBullish Engulfing Pattern: A Strong Reversal Signal

The bullish engulfing pattern is a two-candlestick formation that suggests a possible reversal from a downtrend to an uptrend in the financial market. This particular pattern holds immense value for traders and technical analysts as it equips them with the means to discern potential buying opportunities. In this article, we will explain how traders implement this pattern in their trading strategies.

What Is a Bullish Engulfing Pattern?

The bullish engulfing is a technical analysis pattern consisting of two candles. This formation emerges when a large bearish candlestick is succeeded by a larger green one that entirely engulfs it.

What does the bullish engulfing mean? The bullish engulfing indicates a potential shift in market sentiment, suggesting that buying pressure might surpass selling pressure in the near future and highlighting a possible reversal from a downtrend to an uptrend.

Traders can find the bullish engulfing candlestick pattern across various financial instruments, including currencies, stocks, cryptocurrencies*, ETFs, and indices.

Bearish Engulfing vs Bullish Engulfing

The bullish engulfing pattern has a counterparty - bearish engulfing. The bearish engulfing pattern occurs during an uptrend, indicating a change in market sentiment and potential price reversal to the downside. It consists of two candles, where the second is larger and bearish and completely engulfs the body of the preceding candlestick.

How Can You Trade the Bullish Engulfing Pattern?

Here are some steps traders consider when trading with the bullish engulfing:

- Identification: Look for a clear bullish engulfing setup on a price chart at the end of a downtrend.

- Entry Point: Although candlestick patterns don't provide precise entry and exit points as chart patterns do, there are general rules you could use.

The entry point could be set slightly above the high of the bullish engulfing formation. In the conservative approach, traders enter the market after several candles close higher. In a risky approach, traders open a buy position after the pattern is formed.

- Exit Point: A stop-loss level could be below the low of the engulfing candle or below a nearby support level. A take-profit level could be based on a trader’s risk/reward ratio or key resistance levels.

- Risk Management: You can consider a risk management strategy to potentially limit losses. Traders focus on appropriate position sizing and risk-to-reward ratios to maintain a balanced approach to trading.

- Trade Monitoring: Once you have entered the trade, monitor price action and market conditions. Pay attention to any sign of reversal confirmation or potential obstacles that may invalidate the signal.

- Stop-Loss and Take-Profit Adjustment: As the trade progresses, you may consider adjusting your stop-loss level to protect potential returns. Similarly, you may consider adjusting your take-profit level if the price signals a strong uptrend.

Live Market Example

Let's consider an example of a bullish engulfing on the forex chart. The bullish engulfing candle in the example below is marked with 1 and 2. The trader sets the entry point above the green candle and a stop-loss level below it. The take profit is at the closest resistance level.

How Do Traders Confirm a Bullish Engulfing Candlestick Pattern?

Confirming this pattern enhances the reliability of its signals and helps traders make informed decisions. Here are key steps to confirm it:

- Volume Analysis: Traders typically look for increased buying trading volume accompanying the candle. Higher volume suggests stronger buyers’ interest and validates the reversal signal.

- Follow-Up Candlesticks: Waiting for subsequent closes can confirm the upward momentum. A series of higher closes strengthens its credibility.

- Support Levels: If it forms near a significant support level, this adds context to the reversal, as buyers are stepping in at a critical price point.

- Technical Indicators: Complementary indicators like the Relative Strength Index (RSI), Stochastic Oscillator, or a pair of moving averages can confirm the shift in sentiment.

- Market Context: Traders assess the overall market trend and news to ensure the formation aligns with broader market conditions.

Bullish Engulfing and Other Patterns

Let’s take a closer look at how this pattern compares to other chart formations, like the piercing and harami.

What Is the Difference Between a Bullish Engulfing and a Piercing Pattern?

A bullish engulfing pattern occurs when a large bearish bar is followed by a larger candlestick that completely overtakes the former's body. This indicates a strong potential reversal from a downtrend to an uptrend.

In contrast, a piercing formation also signals a potential reversal but is slightly weaker. It forms when a bearish candle is followed by a bullish candle that closes above its midpoint but doesn’t envelop it entirely.

What Is the Difference Between a Bullish Engulfing Pattern and a Bullish Harami Pattern?

The bullish harami pattern consists of a large red candle followed by a smaller green candle that is completely contained within the body of the red candle. This formation suggests a potential reversal but is generally considered less strong than the bullish engulfing candle pattern, as the latter completely envelops the previous bearish bar, showing more decisive buying pressure.

Final Thoughts

While this pattern offers valuable insights into potential trend reversals, it's essential to complement it with technical indicators and robust risk management for effective use. Also, be sure to explore other patterns as they may look very similar but provide different signals.

FAQ

What Is a Bullish Engulfing Pattern?

A bullish engulfing pattern is a two-candlestick formation in technical analysis that suggests a potential reversal from a downtrend to an uptrend. It occurs when a large bearish candlestick is followed by a larger bullish candlestick that completely engulfs the body of the preceding bearish candle.

How Reliable Is the Bullish Engulfing Pattern?

The reliability of the bullish engulfing pattern as a reversal signal depends on various factors, including the overall market context, confirmation from other technical indicators, and the timeframe being analysed. While it can be a strong indication of a potential trend reversal, it is not foolproof and should be used in conjunction with other tools and fundamental analysis.

What Is a Bullish Engulfing Candle Trading Strategy?

The bullish engulfing candle strategy involves identifying this pattern at the end of a downtrend as a signal for a potential sentiment shift. Traders typically enter a buy position slightly above the high of the closing bar, with stop-loss levels set below the low or beneath nearby support levels. Take-profit levels are determined based on risk/reward ratios or key resistance levels.

Do Wicks Matter in Engulfing Candlesticks?

Yes, wicks matter in the formation. The wicks provide insights into price rejection and volatility. For a strong confirmation, the absence of long upper wicks suggests sustained buying pressure, reinforcing its validity as a reversal signal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Mastering the Bullish Engulfing PatternHello, Traders! 👋

Finding powerful reversal signals in a downtrend can be challenging, but what if a pattern was so visually striking that it's almost impossible to miss? Enter the bullish engulfing pattern – one of technical analysis's most reliable reversal signals. Today, we'll explore everything you need to know about the bullish, engulfing candlestick pattern and how to trade it effectively.

What Is a Bullish Engulfing Candle? 🔍

The bullish, engulfing candlestick tells a compelling story of market psychology. After a downtrend, a small bearish candle appears, suggesting continued selling pressure. But then something dramatic happens—a powerful bullish candle completely “engulfs” the previous day's trading range, signaling a dramatic shift in market control.

When asking, “what is a bullish engulfing candle?” think of it as a visual representation of bulls overwhelming bears in a single, decisive battle. The engulfing bullish pattern is particularly powerful because it shows not just buyer interest but complete buyer dominance.

Identifying the Perfect Bullish Engulfing Pattern 🎯

On the left side of the chart, we can see the formation of the Bullish Engulfing pattern. This consists of a smaller red candle completely engulfed by a larger green candle that follows it. To spot a valid bullish engulfing candle pattern, look for these essential elements:

A Clear Downtrend: Like any great comeback story, the engulfing bullish formation needs context.

First Candle Characteristics: A relatively small bearish candle, showing the last gasp of selling pressure.

The Engulfing Candle: The second day's bullish candle must completely engulf the previous day's real body, which puts the “engulfing” in bullish engulfing.

Opening and Closing Prices: The engulfing bullish pattern requires the second candle to open below the previous close and close above the last open.

On the right side of the chart, we can observe the Bearish Engulfing pattern. This formation shows the opposite scenario, where a larger red candle completely engulfs the body of the previous green candle. This pattern forms after several bullish candles, suggesting a potential reversal of the upward movement.

Why Does the Bullish Engulfing Pattern Work? 📊

The power of the bullish, engulfing candlestick pattern lies in its psychology. When a downtrend is in place, sellers feel confident, but the appearance of an engulfing bullish candle represents a dramatic shift in market sentiment. This sudden change often triggers a chain reaction:

Stop Losses Trigger (short sellers rush to cover their positions)

New Buyers Enter (fresh capital flows in as traders recognize the reversal signal)

Momentum Builds (the combination creates a self-reinforcing upward cycle)

Trading the Bullish Engulfing Pattern: A Strategic Approach 💡

Successfully trading the bullish engulfing pattern requires more than just pattern recognition.

Volume Confirmation: Look for higher-than-average volume on the engulfing day, confirming strong buyer participation.

Support Levels: The pattern becomes more powerful when it forms near key support areas.

Size Matters: The larger the engulfing bullish candle, the more significant the potential reversal signal.

Overall Market Trend: The pattern carries more weight in line with larger timeframe trends.

Market Conditions: Consider volatility and trading volume when assessing pattern strength.

Bringing It All Together 🎓

The bullish engulfing pattern is one of technical analysis's most powerful reversal signals. By understanding its formation, psychology, and proper trading approach, you can add a valuable tool to your trading arsenal.

Remember: successful trading isn't about finding a perfect pattern—it's about finding and managing high-probability setups. When adequately identified and traded, the bullish, engulfing candlestick pattern offers precisely that kind of opportunity.

WHAT IS QM (SIMPLY)Quasimodo trading setup or QM is an advanced reversal pattern in which its formation signals the end of a trend, and most traders use its variants to improve trading results in the forex market.

If u don't understand it, there is high possibility for stop hunting.

u may heard HEAD AND SHOULDER pattern, yes?

QM is exactly HAD (head and shoulder) and u can trade it at: FL'S _ S&D ZONES and SR lines.

it is also a Great show for money back and u can short it at all.

What invalidates it?

only Do not ENG the first support.

4 TRADE LEVELS XAUUSD - PRECISE PRICE LEVEL THEORY After a successful sell in our community at 2719-2726 , today we are presented with a tough perspective due to the fact that now the current market price is entangled between the Supply and Demand Levels of H4 & Daily indicating a market cool off scenario entering a passive sideways.

So best strategy for today is to let the eruption of the market happen first and attempt on a reversal trade rather than seeking for a continuation trend trade.

GBPAUD at most important resistance since 2020The GBP/AUD pair shows a notable pattern on the daily chart, displaying a clear uptrend that has persisted since July 2024, characterized by rising lows but encountering resistance at the 2.000 level. Recently, the price approached 1.9967, a significant resistance level not seen since 2020. This level is pivotal, not just as a historical high, but also as a key psychological barrier near the round number of 2.000. Following this resistance testing, the price has begun to exhibit signs of weakness, indicating a potential reversal or at least a short-term correction.

Current Market Context

The bullish trend has been backed by a distinct ascending trendline connecting the key lows. However, as the price neared the 1.9967 resistance, candles with long upper shadows emerged, signaling rising selling pressure.

Potential Sell Opportunity: Close Below 1.9735

A close below 1.9735 would result in a Bearish Engulfing pattern, where a bearish candle completely covers the previous bullish one, indicating a shift in market sentiment toward sellers. In this context, closing below 1.9735 would validate this pattern and support a potential sell-off.

Characteristics of the Potential Sell Trade:

Entry Point: Approximately 1.9730 (upon a close below 1.9735).

Stop Loss: 2.0010, above the recent high, to guard against false breakouts.

First Target: 1.9350 (380 pips away), aligning with significant support from November, where the price faced strong rejection previously.

Second Target: 1.9150 (580 pips away), corresponding to an even stronger support level, reinforced by the long-term ascending trendline.

Risk-Reward Ratio:

Risk: 280 pips (from 1.9735 to the stop at 2.0010).

Reward:

First Target: 380 pips (Risk-Reward Ratio: 1.35).

Second Target: 585 pips (Risk-Reward Ratio: 1.52).

This scenario presents an attractive opportunity for traders seeking a short-term trend reversal.

Scenario: Breakout of 2.000 Resistance

Conversely, if the price breaks and closes above 2.000, this historical resistance would be invalidated, potentially allowing the uptrend to continue. In this case:

Entry: Close above 2.000.

Stop Loss: 1.9900, positioned below the broken resistance to protect against retracements.

First Target: 2.0100 (90 pips from the entry), a significant psychological level likely to attract market interest.

Second Target: 2.0250 (240 pips from the entry).

Signals Against Selling:

A breakout candle with increasing volume above 2.000.

Sustained closes above the resistance, indicating buying momentum.

In this scenario, the bullish structure would resume, with buyers regaining control.

Summary

The GBP/AUD pair is at a critical juncture. A Bearish Engulfing pattern following a close below 1.9735 could present a viable sell opportunity, supported by clear targets and a favorable risk-reward ratio. Conversely, a break above 2.000 could pave the way for new highs, sustaining the uptrend. Traders should closely observe price movements in the upcoming sessions to determine the likely outcome.

Disclaimer:

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK.

Once in a Decade Bearish Reversal on GoldThe week closed with bearish engulfing reversal indicating a drop from very high bullish level of 27 on the Thrend Strength After Reversal Indicator Such high level is reached only for the 5th time in modern gold price history.

Previous occurrences of a drop from such a high level indicate a major correction in Gold prices:

Drop from level 23 in May 2012 was followed by 23% correction

Drop from level 25 in March 2008 was followed by 23% correction

Drop from level 21 in February 2003 resulted in 9% correction

Drop from level 22 in January 1994 resulted in 28% correction

The biggest drop in history from level 42 occurred in July 1980 and resulted in 50% correction

Understanding Bullish Engulfing Candlestick PatternThe Bullish Engulfing Candlestick Pattern is a popular price action signal used by traders to identify potential trend reversals in the market. If you're keen on mastering price action trading, understanding this pattern is essential. This guide will take you from the basics of the pattern to advanced insights, with easy-to-understand explanations to help you become more confident in your trading decisions.

What is a Bullish Engulfing Candlestick?

A bullish engulfing candlestick is a two-candle pattern that signals a potential reversal in a bearish trend. The pattern consists of a smaller bearish (red) candle followed by a larger bullish (green) candle that completely engulfs the previous one. This indicates that the buying pressure has overwhelmed the sellers, suggesting a shift from a downtrend to an uptrend.

Key Features of the Bullish Engulfing Pattern

Here’s a breakdown of the key characteristics:

Number of Candles: The pattern consists of two candles.

First Candle: A bearish candle, typically red, showing a decline in price.

Second Candle: A bullish candle, typically green, that completely engulfs the previous bearish candle, including its wicks.

Prior Trend: A bearish trend must precede the pattern to validate it as a potential reversal signal.

Prediction: A potential shift from bearish to bullish trend.

The Anatomy of a Bullish Engulfing Pattern

To fully grasp this pattern, let's break down the structure:

The first candle in the pattern is a small bearish candle, indicating the continuation of a downtrend.

The second candle is a large bullish candle that opens lower than the previous close and closes higher than the previous high, completely engulfing it. This suggests a strong buying momentum.

Why Do Bullish Engulfing Patterns Work?

A bullish engulfing pattern is significant because it reflects a shift in market sentiment. Here’s why:

Seller Exhaustion: The first candle shows a bearish trend, indicating seller dominance. When the second candle engulfs it, it suggests that sellers are losing control.

Buyer Strength: The second candle’s larger body signals strong buying interest, indicating a shift in market control from sellers to buyers.

Market Psychology: A bullish engulfing pattern indicates that traders are willing to buy at higher prices, leading to increased bullish momentum.

Why a Pin Bar Can Be an Engulfing Pattern

A common observation among experienced traders is that a pin bar on a higher timeframe can appear as a bullish engulfing pattern on a lower timeframe. This happens because:

A pin bar shows a strong rejection of lower prices, which on a lower timeframe looks like a large bullish candle engulfing smaller bearish candles.

This highlights the importance of multi-timeframe analysis. Understanding how patterns form on different timeframes gives a more holistic view of market dynamics.

Brent crude: Buying into the stormAny trade you take in oil right now is probably going to make you a quick win or loss .

Oil has easily been the most volatile market this week - it's pretty obvious why

1) Hurricanes in the US disrupting supply

2) War in the Middle East

For us, the trend is higher since breaking through $76 / bbl. And the latest fractal forming a higher low helped confirm this idea.

This uptrend has not been properly established with 2 higher highs, which offers bigger possible upside but also a greater chance of never getting going.

You can see the price is trapped between the 50 SMA and 200 SMA.

We see a chance for a favourable 2:1 risk reward by trading the pullback from yesterday's bullish engulfing candlestick up to this week's high around 81.50.

What do you think? Please share your ideas in a comment

Top 3 Must-Know Candlestick Patterns for BeginnersGet your cup of coffee or tea ready we are doing a crash course on Candlesticks today

I’m walking you through three candlestick patterns every beginner trader should know—Doji, Engulfing Candles, and Hammers (including the Inverted Hammer). These patterns are super helpful when you’re trying to spot market reversals or continuations. I’ll show you how to easily recognize them and use them in your own trades. Let’s keep it simple and effective.

Key Takeaways:

Doji: Indicates indecision, potential reversals.

Engulfing Candles: Bullish or bearish reversal signals.

Hammer & Inverted Hammer: Bullish reversal after a downtrend.

Trade what you see and let’s get started!

Mindbloome Trader

EURUSD Daily Technical AnalysisHi Traders!

If we look closely at Daily Chart, the @eurusd pair could form a very interesting Reversal Pattern in the short term. From a technical point of view an Engulfing Pattern could appear with a minimum Target around 1.087 area (see chart below), but if this will work correctly as a “reversal” the projection could be even more interesting.

That said, if we have Engulfing Pattern in the daily close, it might be interesting to try to take short position on the pullback with stop loss below the previous low or failure of the Pattern. Traders who have followed our previous analyses on our Blog can handle the long position taken on the Harmonic Structure (ABC Pattern) on 1H chart.

The dollar slipped on Friday as investors fretted U.S. payrolls data could be weak after an unexpected slump in U.S. manufacturing raised concerns about a slowdown in the world's largest economy and lifted traditional safe-haven currencies.

In conclusion, next week we have interesting macro events as well as follow the geo-political dynamics (Iran-Israel) and from the technical point of view we have a potential Reversal Pattern to follow today, let's see what will happen in the coming hours.

The monthly on btcusd.The price confirms that it has reversed the bear market of 2022. We already knew this thanks to the analyzes of the lower time frames. With the engulfing bear not yet confirmed, the price draws a new price structure above the previous ath on a monthly timeframe, I know this is something we have already seen, but now we have the full picture and it is not something to be underestimated after we have seen on What resistance levels there was the first significant profit taking. Btc could catch its breath a bit before starting to run again, because with this confirmation which sees the sequence of highs and lows rising and the number of monthly sessions greater than the previous bear, it is only a matter of time, the price will take the direction of the rise and it will do so forcefully, when we cannot know, we have the long-term trend on our side, this would be enough even if we cannot predict the future.

RECOGNIZING ENGULFING CANDLESTICK Hello traders!

- I want to present the engulfing candlestick pattern and will try to explain why it is important to recognize this pattern formation.

- The engulfing candlestick is a crucial tool in technical analysis for traders in financial markets. It serves as a powerful indicator of potential trend reversals or continuation, providing valuable insights into market sentiment and potential future price movements.

- Recognizing and interpreting these patterns can enhance the ability to spot potential trend reversals, confirm existing trends, and make informed trading decisions. However, like any technical analysis tool, it is important to use engulfing patterns in conjunction with other indicators and risk management techniques for a comprehensive approach to trading.

Follow, like, and comment to see the daily/weekly content:

www.tradingview.com

#EURGBP selling opportunityEURGBP exhibits a valid bearish market structure in the 1-hour timeframe, as illustrated in the chart. This structure begins after the price tested an important daily resistance and was subsequently rejected.

With this ongoing bearish move, we are inclined to take sell positions in this pair as long as the current structure persists.

Upon closer examination, the price tested the bearish trendline and formed a 1-hour engulfing candlestick pattern . When combined with the preceding candles, it resulted in an evening star candlestick pattern.

The occurrence of this pattern within a resistance area enhances the likelihood of its significance.

The formation of this pattern leaves us with a clean-break area, which serves as an important supply zone where traders may consider selling this pair.

Additional bearish confluences include the price testing the 1-hour and 30-minute 200 EMA.

For selling this pair, the optimal area to place your stop-loss would be above the previous high. If the price reaches that point, it indicates the end of the bearish trend, and we would then be dealing with a bullish trend.

If you've found this analysis helpful, please take a moment to like, comment, or share your thoughts with me.

#Nikkei buying opportunitHello, traders and friends. I hope you all doing well.

Let's delve into NIKKEI chart and explore why we believe there may be a potential Buying opportunity.

The three-wave bearish corrective nature of this downward leg, following a bullish impulsive wave we observed on the chart, suggests the possibility of another bullish move, potentially testing at least the upper boundary of our longer-term bearish trendline channel.

Supportive confluences that we have observed include the inner trendline, which has acted as both resistance and support multiple times, indicating traders' awareness of its significance. Additionally, the price has reached a static support line and a demand area from above, both of which serve as important support levels. Furthermore, the price retraced around 50% of the Fibonacci level of the last bullish move.

Additionally, we've observed the formation of a 4-hour bullish engulfing candle, which can be seen as a trigger for this potential buying setup.

If you have found this analysis helpful, please take a moment to leave a like and a comment or share your idea with me.

Bitcoin:Monthly chart ViewHi guys.

Hope you have had perfect trades.

In this idea i will share you some TA perspectives about

Bitcoin Longterm reactions according to historical datas.

As you can see each time the price reached the MA50 , made a

trough below it and then come back above.

Now we can se in Monthly chart that after price shaped

a Bottom under MA50 , it tries to come back above with a

Bullish Engulfing pattern.

after that we surpass MA50 with another white candle and now ,

Unfortunately we have some frauds in market.

(China Evergrande Group bankruptcy and Tesla sold

millions of BTC).

So in my opinion after a few weeks , Bitcoin start to continue

its smoothed run and go towards 36000.

its the level we will see at the end of 2023.

after that...

Lets see what will happen and dont predict far futures :)

If you like my opinion please tell me yours in comment.

Thank you all my friends

AUDUSD - 15M - SELL IDEA- Entry 0.66633 📉

- Entered on the 15m.

- 15M Engulfing Candle/Supply was retested.

- 15M Engulfing inside of 4HR engulfing .

💡 Idea: Price potentially falling to the 1HR Engulfing/Demand on the 1HR at 0.66304.

*This is not financial advice. These posts are just my opinion on the market.

Bitcoin Scalping PlanHello friends.

According to following reasons i personally go LONG for BTC/USD :

1 - Reach the Higher Timeframe Valid trendline.

2- shape an Bullish Engulfing pattern on this line.

3-Reach the 27000 support level.

4-Bullish divergence Between Price and RSI.

5-Long distance from 50 , 100 and 200 EMA

So for these reasons i think we can go up till drawn trendline and

price 28200.

Trade R/R is 1:2 and after that we should look after price for next analysis.

Thanks for your supports.