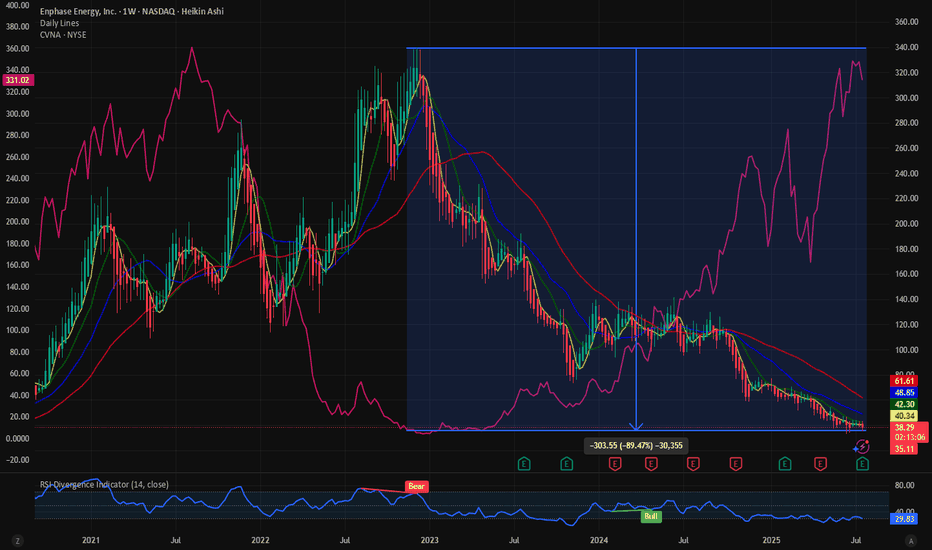

$ENPH:Clean energy stock and messy chart. Short squeeze incomingThe clean energy stocks are in a serious drawdown. NASDAQ:ENPH has a very messy stock. The stock has seen almost 88% of its value wiped out over the last 2 years. But is it the end of clean energy and stocks? With the new administration in place the clean energy stock has been in a bearish pattern.

In terms of the drawdown the stock looks the same as $CVNA. At its lowest NYSE:CVNA had 98% drawdown. NASDAQ:ENPH is down 90% and maybe it must go through a similar drawdown then the price must drop down to 10$.

Currently 21% of the NASDAQ:ENPH shares are sold short, and the short interest ratio is 3.77. These numbers indicate that there might be a danger of short squeeze with 21% of the shares sold short and it might take 4 days for the shorts to cover the positions. This is more than the current short squeeze candidate $OPEN. But is this a good time to buy?

In my opinion the price of NASDAQ:ENPH has some more room to downside. Out target is with price between 20$ - 10$ we can go long NASDAQ:ENPH

Verdict: More downside possible in $ENPH. Go long between 20$ -10 $. 21% Short interest.

ENPH

ENPH Earnings Trade Setup – JULY 22, 2025

🔋 ENPH Earnings Trade Setup – JULY 22, 2025

🌘 Enphase Energy: Oversold or More Pain Ahead? Bearish Setup in Play

⸻

📉 1. FUNDAMENTALS SNAPSHOT

📈 Revenue Growth: +35.2% (TTM) – strong, but…

❌ Recent EPS Misses: -3.17%, -15.21% → Poor execution

💥 Margins:

• Net: 10.4%

• EBITDA: 15.9% → Compression risk

⚠️ Guidance: Inconsistent + failed beat/raise trend

📉 Goldman Sachs PT: $32 (Bearish downgrade)

🧠 Fundamental Score: 5/10 – Fast growth, but fading sentiment

⸻

📉 2. OPTIONS FLOW SNAPSHOT

📍 Key Activity: Bearish flow near ATM puts

📊 Implied Volatility: Elevated → IV crush expected

📉 Put/Call Skew: Heavily skewed toward puts

📉 Sector: Solar weakness + rising rates + policy risk

📟 Options Flow Score: 6/10 – Caution dominates

⸻

📉 3. TECHNICAL SETUP

📉 Price: $39.66 (Below 20D: $40.88, 50D: $42.51)

📊 Volume: 1.23x avg, mostly on red days = Selling pressure

📉 RSI: 33.9 → Weak momentum, possible breakdown

📍 Support: $39.00 📍 Resistance: $43.00

📈 Technical Score: 4/10 – Weak setup into earnings

⸻

🧭 4. MACRO & SECTOR OUTLOOK

🌞 Solar Sector: Under pressure → higher rates + uncertain subsidies

🧯 Market Sentiment: Turning defensive on growth

📉 Macro Score: 5/10 – Long-term potential, short-term pain

⸻

🎯 DIRECTIONAL BIAS:

🔻 Moderate Bearish – 75% Confidence

→ Recent analyst downgrades, bearish flow, poor guidance history, and a weak chart setup signal downside risk

⸻

🔻 TRADE IDEA

🔹 BUY $39 Put exp. 07/25 @ $1.02

🎯 Target: $3.60+ → Stock < $35.50

⚠️ Stop Loss: $0.51

📅 Entry: Pre-Earnings Close (Jul 22, AMC)

💰 RR Ratio: ~3.5:1 → High leverage, tightly controlled risk

⸻

🔐 RISK PLAN

💼 Position Size: 1 contract

📉 Max Risk: $1.02 (Premium only)

🎯 Target Gain: +250%

⏱️ Exit Window: Within 2 hrs post-earnings to avoid theta + IV crush

⸻

🧬 TRADE DETAILS (JSON Format)

{

"instrument": "ENPH",

"direction": "put",

"strike": 39.00,

"expiry": "2025-07-25",

"confidence": 75,

"profit_target": 3.60,

"stop_loss": 0.51,

"size": 1,

"entry_price": 1.02,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-07-22",

"earnings_time": "AMC",

"expected_move": -5.0,

"iv_rank": 0.75,

"signal_publish_time": "2025-07-22 14:57:55 UTC-04:00"

}

⸻

#ENPH #EarningsPlay #PutOptions #SolarStocks #OptionsTrading #ENPHBearish #VolatilitySetup #TradingViewReady

Looking long for ENPH a possible leap! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

$TAN Is This Getting Ready for a Stage 2 Breakout?Clean Energy (Solar) has been in a downtrend since January 2021! Every time it looks like it is setting up for a stage 2 breakout, it has broken down. Will this time be different?

Here is what I see on this chart.

TAN

was in a clear downtrend until mid-December 2024. Then it challenged its previous high from the beginning of December. That failed BUT, it seems to have found a bottom as here we are in early February, and it has not sunk any lower than the December lows.

I am optimistic that we may be ready to enter a Stage 2 uptrend. However, it has work to do. The first step is to get up and over the 50 DMA (red). Next it needs to break the Downtrend line. It also needs to put in a higher high and finally put in a higher low. As I said, it has work to do.

Having said all of that, I have an alert set just over the 50 DMA where I will look for a good entry where I can put in a tight stop should I decide to make the trade. IF, it is going to enter a sustained uptrend it “could” be a big winner. All TBD.

These are my ideas, if you think it makes sense for you, please make it your own trade that fits within “your” trading plan.

ENPHASE ENERGY (ENPH) Short Play: Bearish Momentum Building!Technical Analysis:

Enphase Energy (ENPH) on the 15-minute timeframe signals a solid short trade setup. The price is moving steadily below the Risological dotted trendline, showing sustained bearish pressure with room for the price to descend further.

Key Levels:

Entry: 78.13

Stop Loss (SL): 85.38

Target 1 (TP1): 69.18

Target 2 (TP2): 54.69

Target 3 (TP3): 40.20

Target 4 (TP4): 31.2

5

Observations:

The price is consolidating near the entry, showing potential to test the lower targets.

The Risological dotted trendline continues to act as overhead resistance, indicating a strong bearish outlook.

Enphase Energy is positioned for a potential decline with all targets set. Traders should watch for a breakdown below TP1 to confirm continued bearish momentum and aim for deeper targets!

Kamala Leads, Solar Stocks Shine Again?I'm closely watching the solar sector again, especially stocks like NASDAQ:FSLR , NASDAQ:ENPH , and $RUN.

After the Trump/Biden debate, solar stocks plummeted because it looked like Trump might win. But now, with Kamala Harris running, the odds have shifted her way, and I'm optimistic about the sector since she's likely to support clean energy like Biden did.

These solar stocks have been stable over the last month compared to tech.

First Solar has strong financials, Enphase has solid earnings and big potential, and Sunrun just teamed up with Tesla.

Definitely worth watching all three, in my opinion.

TAN - Invesco Solar ETFSimply go long, it's the future! If the USA doesn't want to increase this ETF by 20 or 30 or 40%, the world will end up on its last legs! NVDA won't save the planet!

ENPH

Enphase Energy, Inc. 10.11%

FSLR

First Solar, Inc. 8.64%

NXT

Nextracker Inc. 7.68%

RUN

Sunrun Inc. 7.10%

3800.HK

GCL Technology Holdings Limited 5.01%

0968.HK

Xinyi Solar Holdings Limited 4.45%

ECV.DE

Encavis AG 4.18%

HASI

HA Sustainable Infrastructure Capital, Inc. 3.71%

SEDG

SolarEdge Technologies, Inc. 3.47%

NEOEN.PA

Neoen S.A. 3.35%

ENPH Enphase Energy Options Ahead of EarningsIf you haven`t sold ENPH after the Double Dop:

Now analyzing the options chain and the chart patterns of ENPH Enphase Energy prior to the earnings report this week,

I would consider purchasing the 115usd strike price Calls with

an expiration date of 2024-7-26,

for a premium of approximately $3.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Long $ENPH till day after earnings report July 24.There’s is a huge lift for all battery and renewable energy companies right.

For example, META hired Evercore EVR, to the tune of $54B to build out 11 square mile solar powered data storage facilities for its push into A.I., which requires a lot of energy to run AI.So there’s a ton of money from the large cap MAG 7 companies going into this industry right now.

Based on the volume profile and the fib levels already breached, i would easily believe if ENPH just slightly beats rev & earnings, and has decent guidance.

ENPH Enphase Energy Options Ahead of EarningsIf you haven`t sold ENPH before the previous earnings:

Then analyzing the options chain and the chart patterns of ENPH Enphase Energy prior to the earnings report this week,

I would consider purchasing the 110usd strike price in the money Puts with

an expiration date of 2024-9-20,

for a premium of approximately $16.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Enphase Energy forms alliance with Octopus Energy to boost salesEnphase Energy Inc., a leading provider of solar energy solutions, has recently established a strategic partnership with Octopus Energy Group to enhance its sales. This collaboration is expected to drive significant future revenue growth for Enphase Energy by integrating its solar inverters and battery systems with Octopus's Kraken platform, which manages virtual power plants. This synergy aims to harness multiple home solar panels and batteries, integrating them into a cohesive and sustainable power generation system through smart distribution technologies.

Analysing potential trading opportunities for Enphase Energy Inc. (NASDAQ: ENPH):

On the Daily (D1) timeframe, the stock shows resistance at 114.40 USD and support at 106.00 USD, with early signs of an uptrend. A break above the current resistance level could further confirm this uptrend. If the price fails to do so and continues its downward trajectory, a potential target could be 360.50 USD.

For traders, surpassing the resistance at 114.40 USD could present a buying opportunity, with a short-term target set at 139.50 USD. Those contemplating a medium-term investment may consider holding a long position to reach up to 152.60 USD.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.88% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Solar stocks follow energy prices (crude oil).Solar stocks follow energy prices (crude oil) and AMEX:USO (oil etf) is about to break out. I read that chinese are outcompeting the west in cheaper solar products. ie NYSE:JKS

TNX is at bull market, crude oil and yields correlate (not sure which one cause the other).

I look at everything trough probabilities since nothing is ever known.

Stocks do bad when economy does good. But energy sector performs well during good economy, whilst everything else is falling (Tech). Peak tech means bottom for energy?

I think these are good hedge plays, if you believe rising oil or yields pose risk.

Recently Chinese gov asked Jack Ma to return because their financial markets did poorly. There could be a sentiment shift, where indicator will be NYSE:BABA performance. People might still have an old bias?

ENPH - ready for a take off?ENPH is quite a volatile stock. It’s been a multi-bagger since the 2020 elections.

This has been hammered lately and looks like bottomed out.

Recent uptick in volume showing signs of recovery.

Long - around 100ish

Stop loss - 85

Target #1 - 175

Target #2 - 230

So much of supply ahead, won’t be a smooth ride.

And note- this one has political risk as well.

Manage your risk and position size carefully.

SunPower to report running now Earnings Play LongSPWR is a volatile penny stock; solar energy is hot right now. ENPH is the slow and easy big cap

play. This one is high octane and can go from overdrive into reverse when the shorts catchup.

As for me, I will chase this and setup a trailing loss when the sun goes down. I have alerts

set up for death crosses on the moving averages or the mass index triggers. Bring on the heat of

the sun.

Enphase Energy's Strategic Moves Signal a Brighter FutureEnphase Energy (NASDAQ: NASDAQ:ENPH ) stands as a beacon of innovation and resilience. Despite facing headwinds in the form of inventory issues and shifting market dynamics, the solar inverter maker is charting a course towards a brighter future. We delve into Enphase's recent developments, strategic shifts, and the prospects that lie ahead.

Navigating Short-Term Challenges:

Enphase Energy (NASDAQ: NASDAQ:ENPH ) recently announced its anticipation of an improvement in demand in the near term, sparking a surge in its shares by nearly 13% in extended trading. The company acknowledges the hurdles it faced in Europe, with a significant sequential decrease in revenue in the fourth quarter due to inventory management issues. However, Enphase (NASDAQ: NASDAQ:ENPH ) remains optimistic, citing early signs of recovery in Europe and the potential for a rebound in non-California states.

Adapting to Market Dynamics:

Solar firms, including Enphase, have encountered obstacles such as rising inventory levels in Europe and softening demand in the U.S., attributed in part to regulatory changes like the metering reform in California. Enphase's response to these challenges involves strategic adjustments, including reducing shipments to manage inventory levels and focusing on enhancing demand and margins for its batteries and micro-inverters throughout 2024.

CEO's Vision and Guidance:

Enphase's (NASDAQ: NASDAQ:ENPH ) Chief Executive, Badri Kothandaraman, paints a picture of cautious optimism, acknowledging the slowdown in demand while expressing confidence in the company's ability to navigate through it. Kothandaraman highlights the potential turnaround, citing early signs of recovery in Europe and the expected resilience of non-California states. Despite forecasting a seasonally down sell-through demand for the first quarter, Enphase (NASDAQ: NASDAQ:ENPH ) sets its sights on a revenue range of $260 million to $300 million, indicating a proactive stance in managing expectations.

Analyst Expectations vs. Performance:

Enphase's (NASDAQ: NASDAQ:ENPH ) fourth-quarter revenue slightly fell short of analysts' expectations, standing at $302.6 million compared to the anticipated $327.9 million. The company's first-quarter revenue forecast also falls below analysts' estimates, but Enphase (NASDAQ: NASDAQ:ENPH ) remains steadfast in its strategic direction, focusing on operational excellence and seizing opportunities for growth amidst challenges.

Conclusion:

Enphase Energy's (NASDAQ: NASDAQ:ENPH ) journey exemplifies the resilience and adaptability required to thrive in today's dynamic energy landscape. Despite short-term challenges, the company's strategic maneuvers, coupled with the vision of its leadership, signal a promising trajectory ahead. As Enphase (NASDAQ: NASDAQ:ENPH ) navigates through the current headwinds, it emerges as a compelling player poised to capitalize on the opportunities that lie beyond. Investors and industry observers alike would do well to keep a keen eye on Enphase Energy as it continues to shape the future of renewable energy.

ENPH Enphase Energy Options Ahead of EarningsIf you haven`t sold ENPH before the previous earnings:

Then analyzing the options chain and the chart patterns of ENPH Enphase Energy prior to the earnings report this week,

I would consider purchasing the 102usd strike price at the money Puts with

an expiration date of 2024-2-9,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

The Invesco Solar Etf TAN based on the Global Solar Energy IndexThe Invesco Solar ETF is based on the MAC Global Solar Energy Index (Index). The Index is comprised of companies in the solar energy industry.

Wall Street investors have only short-sold the future of the planet! They have shorted all the players that could be a solution to climate change (personal opinion).

With the upcoming U.S. presidential elections, I expect that new financial promises will be put forward, and this ETF will regain strength.

TAN etf, ASSETS UNDER MANAGEMENT $1.32B

ICLN etf, ASSETS UNDER MANAGEMENT$2.54B

TAN: Enphase, First Solar, SolarEdge, Sunrun, GCL Tech, Xinyi, Hannon Armstrong, Array, ...

ICLN: First Solar, Vestas, Enphase, China Yangtze, Orste, EDP Portugal, SolarEdge, Suzlon, ...

$TAN Up 17% in 2 Days!Who says you cannot make big returns on ETF's?

AMEX:TAN the Solar Sector ETF Is on fire. It looks like rotation back into the beaten-up sector. Names Like NASDAQ:FSLR and NASDAQ:ENPH up even more. Rather than take the risk on an individual name I have opened a ¼ sized position in this ETF. I will be looking to bring this up to a full-sized position on any consolidation.

This ETF has institutional accumulation volume going back over a month. It has regained all MAs except for the 40 Week MA in white. All shorter-term MA’s, including the 50 Day Moving Averages are turning up. My stop is set below yesterday’s low and the horizontal line of support / resistance.

Ideas not investing / trading advice. Comments always welcome. Thanks for looking.

ENPH Short In Progress*Posting this a couple months late since I've been more preoccupied with Crypto

Saw a lot of people calling for $400s in August since price looked to be finding a bottom around $150, but felt the rate environment and overall outlook for S&P would make this nearly impossible to happen. Took a contrary position due to believing price should be around pre-covid levels, and it has been working quite effectively.

Potential bounce soon back to $96, from where I can see price revisiting $33 or $18 worst-case.

Let me know how you feel about ENPH.

Enphase EnergyThis is a chart of Enphase Energy (ENPH). For those who are not familiar with the company, Enphase Energy develops and manufactures microinverter systems for the solar photovoltaic industry. They are one of the preeminent companies in solar power. Recently, price gapped up on the daily chart following news that Congress would pass legislation to fund sustainable infrastructure projects.

In the above chart, each candlestick represents a 6-month period. Analyzing higher timeframes can often help us determine trend reversals long before they happen. This higher timeframe chart reveals a very peculiar candlestick pattern: the sneaky bearish tri-star pattern. This pattern occurs when three Doji candlesticks form after a bull run. This pattern can warn that a major reversal is coming. See below image.

A bearish tri-star pattern is an insidious topping pattern that Wall Street smart money would love for you to not know about. In short, it appears because Wyckoff distribution is occurring underneath the surface.

While I cannot describe the entirety of Wyckoff distribution in this post, I can say that, in short, Wyckoff distribution is when smart money gradually distributes or sells their shares near the top. The gradual nature of the selloff traps the unsuspecting "weak hands" (mostly small retail traders) who buy while unaware that the bull run is in its final phase. Sometimes, since smart money is especially manipulative, they manufacture a sudden upthrust in price near the end of the Wyckoff distribution, which may be what's happening right now.

This sudden upthrust (UT or UTAD) is a price move above resistance that quickly reverses and closes lower. The upthrust is a test of the remaining demand. It is also a bull trap: It appears to signal the resumption of the bull run but in reality, is intended to trick uninformed breakout traders. A UT or UTAD allows Wall Street smart money to mislead the public about the future trend direction and, subsequently, sell additional shares at elevated prices to breakout traders before the markdown begins. In addition, a UTAD may induce smaller traders in short positions to cover and surrender their shares to the larger interests who have engineered this move.

In my years of trading experience I have seen the above chart many times before, and the result is almost always the same. This chart is in the phase that some of us traders call a "fake out". A fake out occurs when price appears to be breaking out when actually it is just forming an upper wick. This occurs when price has been moving within an ascending wedge and after bearish divergence has occurred on the RSI. The final phase is when the RSI breaks out after bearish divergence and while in overbought territory. Price then pulls back down strongly and a long upper wick forms on the candlestick. In essence, this is just another way of visualizing the upthrust phase of Wyckoff distribution. The final RSI breakout is the UTAD of Wyckoff distribution.

Here's another Trading View user who is apparently seeing the same thing as I am, though this post is from before the current upthrust:

Also worth mentioning is that it is interesting that corporate insiders have been only selling their positions and there has been no reported insider buying for nearly a year (see below). This is not usually predictive of future price action, but it can give a general sense of sentiment among insiders at a company.

So it's worth watching to see if ENPH will reverse downward. Perhaps it will blast through this level and my analysis prove wrong. As a trader, you must always be willing to accept when you're wrong because your money is more important than your ego. With that said, just remember this is a long-term chart and price may continue moving up before reversing down. Some related charts, including the charts of ETFs that hold ENPH and the ENPH/SPY relative chart, suggest that ENPH does have the momentum necessary to break out to the upside. It's just looking very suspicious right now.

This post is not making a short call on ENPH, it is just an observation. It is not financial advice. Although I may choose to open a position, at the time of writing this, I have neither a long nor a short position open on ENPH. This is an objective, non-biased analysis.

I'll be keeping an investigative eye on this chart.